Thinking about buying a house in Texas? It’s a huge milestone, and if you’re setting your sights on the Dallas area, you’re jumping into a fast-moving, competitive market. Knowing what to expect isn’t just helpful—it’s your biggest advantage.

The whole thing isn’t just one big transaction. It’s better to think of it as a project with clear phases, from sorting out your finances to finally getting those keys on closing day.

Navigating The Dallas Real Estate Market

Welcome to your no-nonsense guide for buying a home in Dallas. This isn’t generic advice you could find anywhere; it’s a boots-on-the-ground look at what it really takes to succeed in this specific, dynamic market.

To get a feel for the journey ahead, it helps to look at the complete home buying process timeline. Having a map of the entire process, from start to finish, gives you a solid framework for what’s coming and when.

Current Dallas Market Conditions

First things first: you need to understand the climate of the market you’re walking into. Is it a buyer’s market where you have the upper hand, or a seller’s market where you need to be ready for a fight? After years of intense growth, the Texas housing market, including Dallas, has started to cool off a bit.

This shift brings both challenges and opportunities for Dallas buyers. Statewide, the median home price recently hovered around $350,400, marking a small 1.7% decrease from the previous year. More importantly for you, the number of homes for sale shot up by 19.3%. That’s a big jump in inventory. While the Dallas market is still very active, you might find a bit more breathing room and negotiating power than buyers had a year or two ago.

Key Takeaway: With more homes on the market across Texas, Dallas buyers have more choices. This doesn’t mean it’s easy, but it does mean you might avoid the frantic bidding wars that defined the recent past.

A Quick Look at the Milestones

To give you a clear picture of the road ahead, here’s a quick summary of the key phases you’ll navigate in the Dallas home buying process.

| Phase | Key Objective | Estimated Timeline |

|---|---|---|

| Financial Prep & Pre-Approval | Get your finances in order and secure a mortgage pre-approval to know your true budget. | 1-2 Weeks |

| Agent Selection & Home Search | Partner with a local expert and begin actively touring homes that fit your criteria. | 2-8 Weeks |

| Offer, Negotiation & Contract | Find “the one,” submit a competitive offer, and navigate negotiations to get under contract. | 1-5 Days |

| Option Period & Inspections | Use your option period to conduct thorough inspections and negotiate any necessary repairs. | 7-10 Days |

| Appraisal & Final Loan Approval | The lender orders an appraisal to confirm the home’s value while you finalize mortgage paperwork. | 2-3 Weeks |

| Closing | Sign the final documents with the title company, pay closing costs, and get the keys to your new home. | 1-3 Days |

Each stage builds on the last, moving you steadily toward your goal of owning a home in Dallas.

Breaking Down The Major Phases

Let’s dig into what each of those milestones really involves.

-

Financial Preparation: This is where it all starts. Before you even peek at a listing, you need to get a handle on your budget, check your credit, and get pre-approved for a mortgage. This step is non-negotiable.

-

Assembling Your Team: You can’t do this alone. You’ll need a sharp real estate agent who knows Dallas inside and out, plus a responsive mortgage lender who can close on time. This is your core team.

-

The Home Search: Now for the fun part! With your pre-approval letter ready, you can start the hunt. Whether you’re drawn to the leafy streets of Lakewood or the creative energy of the Bishop Arts District, your agent will help you zero in on the right listings.

-

Offer and Closing: Found the perfect spot? It’s time to make an offer, negotiate the terms, and enter the option period for inspections. From there, you’ll work with your lender and a title company to bring the deal across the finish line.

Get Your Financial Ducks in a Row Before House Hunting in Dallas

Before you even think about scrolling through listings in coveted Dallas neighborhoods like Uptown or the Bishop Arts District, your first real move happens at your own kitchen table. You have to get your finances in order. This isn’t just about what you make; it’s about having a crystal-clear picture of your financial health and what that means for your buying power in the Dallas market.

Lots of folks jump the gun and plug numbers into an online mortgage calculator. They’re fine for a ballpark figure, but they don’t paint the full picture. To really know what you can afford, you have to go deeper. The single most important thing you can do is start with mastering budgeting. This ensures you can handle not just the mortgage, but all the other costs that come with owning a home in Dallas.

Looking Beyond the Mortgage Payment

A realistic Dallas home budget is much more than just the principal and interest on your loan. There are several other recurring costs that sneak up on people and can seriously impact what you can comfortably afford each month.

Make sure your budget has room for:

- Property Taxes: Dallas County property taxes are no joke. A $450,000 home, for instance, could easily come with an annual tax bill over $9,000. That’s an extra $750 tacked onto your monthly payment.

- Homeowners Insurance: This is Texas, so your insurance has to account for some unpredictable weather. Your annual premium is a significant cost, and it’s usually paid through your mortgage escrow account.

- HOA Fees: From high-rise condos in Victory Park to master-planned communities in Plano, many of the most desirable Dallas-area homes are in an HOA. Fees can run anywhere from $50 to over $500 a month, and you absolutely have to factor them in.

The Power of Mortgage Pre-Approval

Once you’ve got a solid handle on your budget, it’s time to get pre-approved for a mortgage. This isn’t the same as a pre-qualification, which is just a rough estimate. A pre-approval is a lender’s formal commitment to loan you a certain amount of money. In Dallas, it’s not optional—it’s essential.

Imagine a seller looking at two offers. One is from a buyer who thinks they can get a loan. The other has a pre-approval letter in hand. Which one looks more serious? The pre-approval signals you’re a ready and capable buyer, giving you a massive advantage when it’s time to negotiate in the Dallas market.

A pre-approval letter transforms you from a window shopper into a legitimate buyer. In a fast-paced market like Dallas, it’s the ticket you need to even get in the game.

Choosing the Right Loan for Your Dallas Home

Texas buyers have a few different loan types to choose from, and each has its own rules and perks. The best one for you hinges on your personal finances, credit score, and what kind of home you’re trying to buy in Dallas.

Here’s a quick look at the most common options:

- Conventional Loans: These are the standard, non-government-backed mortgages. You’ll typically need a decent credit score (think 620 or higher) and a down payment of at least 3-5%. If you can put down 20%, you get to avoid paying Private Mortgage Insurance (PMI). They’re a great fit for buyers with strong credit and some cash saved up.

- FHA Loans: Backed by the Federal Housing Administration, these loans are a fantastic option for buyers with lower credit scores or less cash for a down payment. It’s possible to qualify with a score as low as 580 and put down just 3.5%. They are incredibly popular with first-time homebuyers across the Dallas area.

- VA Loans: If you’re a veteran, an active-duty service member, or a qualifying military spouse, a VA loan is an incredible benefit. They often require $0 down payment, have no PMI, and feature some of the most competitive interest rates available. They make homeownership much more attainable in the Dallas area for those who have served.

The best way to figure out which path is right for you is to sit down with a local Dallas mortgage lender. They live and breathe this stuff. They can look at your specific situation and recommend the loan program that will put you in the strongest position to buy your Texas home.

Assembling Your Dallas Real-Estate Team

Trying to buy a house in a market as fast-paced and competitive as Dallas is not a solo sport. To navigate it successfully, you’ll want a team of seasoned professionals in your corner. These experts are your strategists, your advocates, and your sounding board, helping you make smart decisions from the first tour to the closing table.

Your two most critical allies will be your real estate agent and your mortgage lender. Think of them as your core team. A fantastic agent brings irreplaceable local knowledge, while a skilled lender makes sure your financing is solid and ready to go when you are. Getting these two roles right is one of the most important moves you’ll make in the Dallas market.

Choosing a Top-Tier Dallas Real Estate Agent

Let’s be clear: a great real estate agent does far more than just unlock doors. A true pro offers insights into Dallas neighborhoods you simply can’t find online. They know the subtle differences between Lakewood and Richardson, or what gives the M Streets their unique character compared to Preston Hollow.

When you’re interviewing potential agents, drill down on their specific experience in the Dallas market. You want someone who has a proven track record of closing deals in the exact neighborhoods you’re considering. That expertise becomes your competitive edge. You can learn more about why you should use a buyer’s agent to represent your best interests.

Here are a few questions you should definitely ask any agent you’re considering for your Dallas home search:

- How many deals have you closed in my target neighborhoods this year?

- What’s your strategy for finding off-market or “coming soon” listings in Dallas?

- In a multiple-offer scenario, how do you make an offer stand out?

- Can you share references from recent clients who bought homes in this area?

An agent’s answers will quickly reveal the depth of their market knowledge and their hustle. Vague responses or a lack of specific, recent examples are red flags you shouldn’t ignore.

Selecting a Responsive Mortgage Lender

Just as crucial as your agent is your mortgage lender. The right lender is communicative, efficient, and deeply familiar with the nuances of Texas real estate transactions. In Dallas, where a great house can be under contract in a matter of days, a slow or disorganized lender can torpedo your entire deal.

Often, your agent can recommend lenders they trust and have a strong working relationship with. This is a great place to start, as these lenders are typically vetted for their reliability and ability to close on time. Even so, it’s smart to chat with at least two or three different lenders to compare rates, fees, and their overall communication style.

Pro Tip: Ask lenders about their average closing times specifically in the Dallas market. A sharp, local lender should be able to give you a clear timeline and explain exactly how they avoid the common delays that can derail a purchase here.

The Dallas market has its own unique rhythm. For instance, recent reports painted a complex picture for the region. A lender who understands these kinds of local fluctuations can give you much better advice on navigating your purchase.

Your Team for Due Diligence

Once you’re under contract on a Dallas property, you’ll assemble a temporary team for the critical option period. This is when you do your homework on the property itself.

- Home Inspector: This professional performs a top-to-bottom review of the property’s condition, from the foundation to the shingles on the roof. Your agent will have a list of trusted inspectors they’ve worked with before in the Dallas area.

- Specialized Inspectors: Depending on the house, you might need a specialist. This could mean calling in a foundation expert for a pier and beam home, a roofer to check an older roof, or a pest control company to look for termites.

Your agent is your quarterback here, helping you schedule these inspections and make sense of the reports. The findings are your leverage for negotiating repairs or, in some cases, your ticket to walk away from a bad deal. Having a strong team makes this entire process feel less overwhelming and gives you the confidence to move forward.

Alright, with your financing lined up and your A-team ready to go, we get to the fun part: the actual hunt for your new home. This is where the dream starts to feel real as you begin exploring what the Dallas-Fort Worth metroplex has to offer. A successful search isn’t just about scrolling through apps; it’s a smart blend of modern tech and old-school, on-the-ground expertise.

The market is always in motion, but recent trends have been a breath of fresh air for buyers in Texas. Statewide, we’ve seen a welcome increase in the number of homes for sale and more stable pricing. This directly impacts the Dallas market. The median sales price hovered around $331,000, up just 0.3% from the year before, while the number of active listings jumped by a massive 30.7%. For you, that translates to a lot more choices. Homes also sat on the market for an average of 72 days, giving Dallas buyers a bit more breathing room. You can dig into these statewide housing market trends to get the bigger picture.

Defining Your Search Criteria

Before you even think about stepping inside a single house, you need to sit down and separate your absolute must-haves from your nice-to-haves. I can’t stress this enough—this simple exercise will save you a ton of time and keep you from getting sidetracked by a pretty kitchen in a house that just won’t work for you.

Think about the non-negotiables for your day-to-day life. This list is your filter.

- Your Must-Haves: These are the true deal-breakers. Things like being zoned for a specific school district, needing at least three bedrooms on one level, or having a commute under 30 minutes to your downtown Dallas office.

- Your Nice-to-Haves: These are the features you’d love but could live without for the right home. A swimming pool is a classic example, or maybe a dedicated home office or a big yard with mature trees.

Getting this clarity from the start helps your agent laser-focus on the properties that are actually viable, preventing you from wasting weekends on homes that were never the right fit.

A well-defined list of priorities is the most powerful tool in your home search. It keeps you focused on what truly matters and helps you evaluate each property objectively, especially when emotions run high.

Searching Smarter in the Dallas Market

While online portals are a great place to start your search, they never tell the whole story. In competitive Dallas neighborhoods, the best homes are often spoken for before they ever show up on Zillow. This is where your agent’s network becomes your unfair advantage.

A well-connected Dallas agent has a direct line to off-market properties and “coming soon” listings that the public simply doesn’t see. They’ve built relationships with other top agents who give them a heads-up about homes getting ready to list. This insider access can get you in the door first, letting you make an offer before there’s a line of other buyers out the door.

Your strategy should really be two-pronged:

- Leverage Technology: Use the search tools your agent provides to review listings that match your must-haves. Make sure to “favorite” the ones you like and share feedback on the ones you don’t.

- Tap the Network: This is crucial. Stay in close contact with your agent and ask them what they’re hearing about off-market deals. Your dream home in a sought-after area like the M Streets or Lower Greenville might come from a private connection, not a public website.

Making the Most of Showings

Once you begin touring homes in person, you need to look past the surface-level charm. It’s easy to fall for fresh paint and staged furniture, but the things that really impact your wallet and your lifestyle are the ones you can’t easily change.

Pay close attention to the home’s bones. Look for red flags that could signal deferred maintenance—things like water stains on the ceiling, cracks in the foundation, or an ancient-looking HVAC unit. Ask about the age of the roof and check the condition of the windows. These big-ticket items can quickly turn a seemingly good deal into a money pit.

Beyond that, think about the home’s flow and how it fits your daily life. Can you picture yourself moving through the space? Notice the amount of natural light, check out the storage (or lack thereof), and try to get a feel for the neighborhood at different times of the day. A truly successful search is about finding a property that fits your life, not just one that looks great in the photos.

Making an Offer and Navigating to Closing

You’ve toured countless homes, weighed your options, and finally found the one. This is where the real work begins. The Texas home-buying process now shifts from searching to securing, and in a competitive market like Dallas, this next phase is everything. Crafting a winning offer and navigating the intricate path to closing is what turns a dream home into your home.

Your offer is so much more than just a number. It’s a strategic package meant to catch a seller’s eye and assure them you’re the right buyer. I’ll be your guide here, drafting the formal offer using the Texas Real Estate Commission (TREC) promulgated “One to Four Residential Contract (Resale).” It’s a standardized document, which is great because it ensures every critical term is covered clearly.

The Key Components of Your Offer

A strong offer in the Dallas market needs to be confident and well-structured. And believe it or not, it isn’t always about the highest price. Often, the most attractive offer is the one that presents the most reliable and straightforward terms to the seller.

Several key elements make up your offer:

- Offer Price: This is the big one, obviously. I’ll run a comparative market analysis (CMA) on the property to see what similar homes in the neighborhood have recently sold for. This data helps us land on a price that’s both competitive and fair.

- Earnest Money: Think of this as your “skin in the game” deposit. In the Dallas market, it’s typically 1% of the purchase price. When we go under contract, this money is held in escrow to show the seller you’re serious.

- Option Fee & Period: This is a uniquely Texan tool and, frankly, your secret weapon. For a small fee, often $100-$500, you buy the unrestricted right to terminate the contract for a negotiated number of days (usually 7-10). This is your critical window for due diligence.

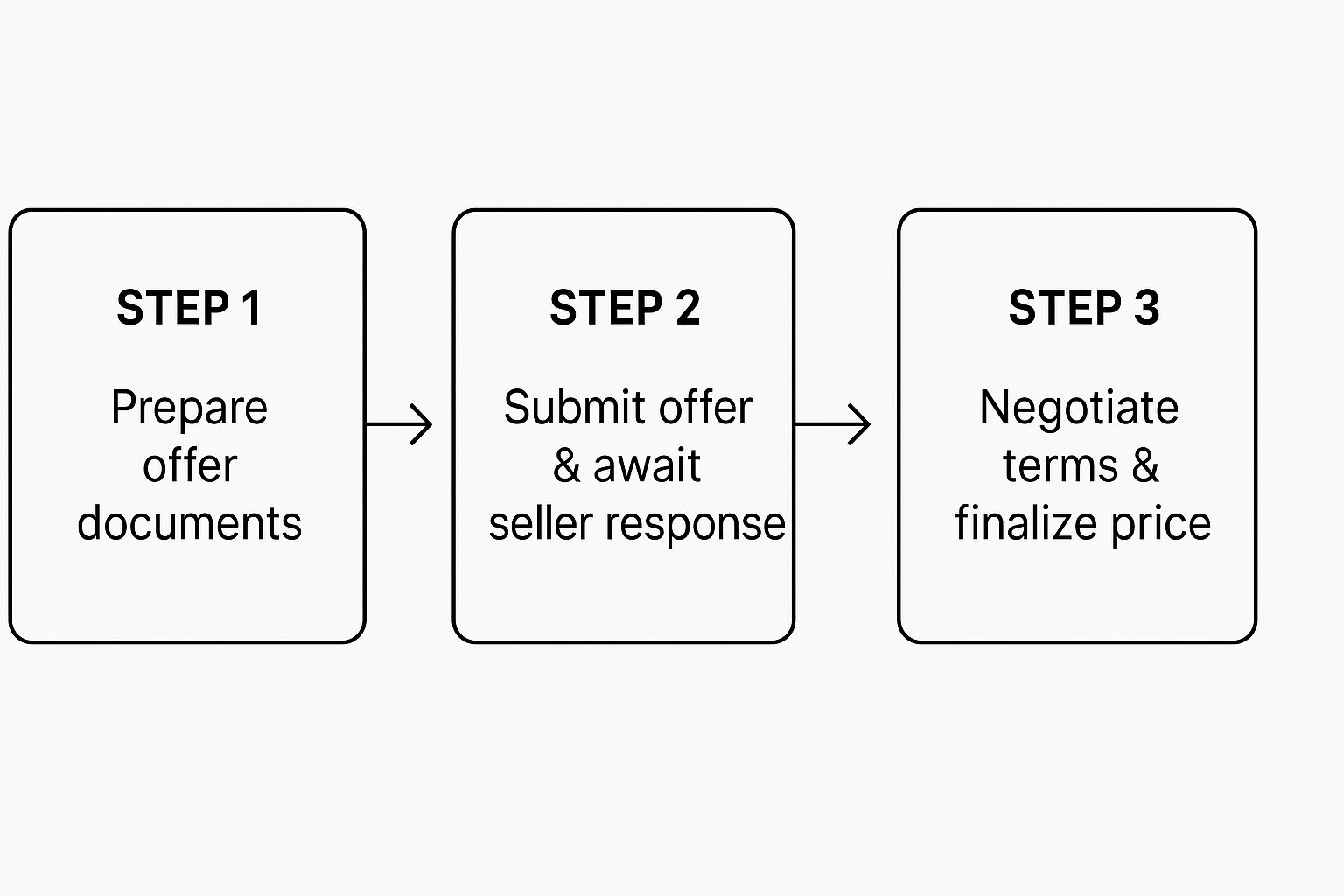

The journey from preparing your offer to getting the keys is a well-defined process. This visual gives a great high-level overview of these initial stages.

As you can see, it all starts with carefully preparing the offer documents. From there, we submit it for the seller’s review, which kicks off the negotiation phase that gets us to an agreement.

Winning the Negotiation and Using Your Option Period

Once we submit the offer, the seller has a few choices: accept it as-is, reject it, or come back with a counteroffer. This back-and-forth is where an experienced agent’s negotiation skills are absolutely vital. I’ll work with the seller’s agent to find that sweet spot on price, closing dates, or any other terms.

The moment your offer is accepted, the clock starts ticking on your option period. Now it’s time to schedule the home inspection. A licensed inspector will do a deep dive into the property’s structure, systems (like HVAC, plumbing, and electrical), and appliances to uncover any issues that aren’t visible to the naked eye.

Key Takeaway: The option period is your most powerful tool for managing risk. It gives you the leverage to renegotiate the price based on inspection findings, ask for specific repairs, or walk away from the deal with your earnest money intact if major problems are discovered.

From Contract to Keys: The Closing Process

With inspections done and any repair negotiations settled, you’re officially in the home stretch. This final period is managed by your lender and a title company, and it involves several things happening at once.

- The Appraisal: Your mortgage lender will order an appraisal to make sure the home’s value supports the price you’ve agreed to pay. It’s a crucial step that protects both their investment and yours.

- Final Mortgage Approval: While the appraisal is underway, your lender’s underwriters will perform a final review of your financial documents. This is the last hurdle before they issue your final loan approval.

- Title Search and Insurance: The title company gets to work, conducting a thorough search of the property’s history to ensure there are no hidden liens or ownership disputes. They will then issue a title insurance policy to protect you and the lender from any future claims.

Staying organized during this final phase is key to a stress-free closing. To make sure nothing slips through the cracks, it’s helpful to use a comprehensive real estate transaction checklist. For a guide tailored more to our local process, you can also explore this detailed home buying process checklist.

Finally, at least three business days before your closing date, you’ll receive a Closing Disclosure from your lender. This document itemizes all your closing costs, loan terms, and the exact amount of cash you’ll need to bring to the closing table. We will review it together, line by line, to make sure everything is correct.

The very last step is the closing appointment at the title company. You’ll sign the final stack of paperwork, wire your funds, and then—the best part—you’ll get the keys to your new Dallas home.

Answering Your Top Dallas Home-Buying Questions

The road to owning a home in Dallas has its own local quirks and specific steps. It’s completely normal for questions to bubble up as you go. Getting solid answers early on is the key to moving forward with confidence and making smart decisions every step of the way.

Let’s dive into some of the most common questions I hear from clients who are figuring out how to buy a house in Texas, especially right here in the DFW market.

What Exactly Is the “Option Period” in a Texas Contract?

Think of the option period as your get-out-of-jail-free card. It’s a critical, negotiated window of time—usually 7 to 10 days—that gives a buyer immense power.

To get this period, you’ll pay the seller a small, non-refundable option fee, which is typically somewhere between $100 and $500. In return for that fee, you get the unrestricted right to back out of the contract for any reason at all and still get your earnest money deposit back.

This is your prime time for due diligence. The main point is to get a professional home inspection and any other specialized evaluations you might need. If that inspection turns up a deal-breaker, you have options: you can walk away, use the report as leverage to negotiate a lower price, or ask the seller to handle the repairs.

The option period is your safety net. It’s a low-cost exit ramp if you find something about the property you just can’t live with, and it’s essential for protecting your earnest money.

How Do Dallas Property Taxes Work?

Since Texas famously has no state income tax, local property taxes play a much bigger role in homeownership costs. Your annual tax bill in Dallas County isn’t just one number; it’s a combined rate from several different entities. This includes the city, the county, the local school district (like Dallas ISD), and sometimes a community college or hospital district.

When you buy your home, the property taxes are prorated at closing. This just means you and the seller each pay your fair share for the part of the year you owned the property.

Going forward, your mortgage lender will almost certainly set up an escrow account for you. A portion of your monthly mortgage payment goes into this account, and the lender uses that money to pay your tax bill directly when it’s due. It’s absolutely vital to look at the tax history of any home you’re serious about, as this will be a big chunk of your total monthly housing expense.

What Are Typical Closing Costs for a Buyer in Dallas?

Closing costs are the collection of fees you pay to make the home officially yours. Here in Dallas, you can generally expect these costs to run between 2% and 5% of the home’s purchase price. For a buyer, these costs usually break down into a few categories:

- Lender Fees: These are charges from your mortgage company for originating and underwriting your loan.

- Third-Party Fees: This bucket covers services from other pros, like the home appraisal and your home inspection fee.

- Title Company Fees: You’ll pay for a title search (to make sure the seller truly owns the home free and clear) and for a lender’s title insurance policy, which protects your mortgage provider.

- Prepaid Items: These are costs you pay upfront, such as your first year’s homeowners insurance premium and an initial deposit to fund your property tax escrow account.

At least three business days before you sign the final papers, your lender is required to give you a Closing Disclosure. This document breaks down every single fee. Go over it with a fine-toothed comb with your agent to make sure everything looks right and there are no last-minute surprises.

Do I Need to Hire a Real Estate Attorney in Texas?

The short answer is no. Texas is a state where you are not legally required to hire an attorney to buy a house. The vast majority of standard residential deals in Dallas are handled perfectly well by experienced real estate agents and title companies using state-approved contract forms. These pros know the standard procedures inside and out.

That said, bringing in an attorney can be a very wise move in specific situations. If your purchase is anything but straightforward—maybe it has complex title issues, needs a custom contract, or involves disputes over property lines—an attorney adds a crucial layer of legal protection.

For a typical home purchase in Dallas, a great agent and a solid title company are usually all you need. Many people find that a good guide for the first-time home buyer in Dallas, TX can also help clear up a lot of common questions.

Navigating the Dallas market requires a deep understanding of its neighborhoods, pricing, and procedures. For personalized guidance and expert representation on your home buying journey, contact Dustin Pitts REALTOR Dallas Real Estate Agent. Let’s work together to find your perfect place in this dynamic city. https://dustinpitts.com