Trying to buy a home in the fast-paced Dallas market can feel like a race, and it often comes down to one crucial step: getting pre-approved for a mortgage. This isn’t just a friendly suggestion; it’s the single most powerful tool you can have in your corner. The core mortgage pre approval requirements are all about a lender taking a deep dive into your finances—your income, assets, credit, and existing debts—to figure out exactly how much they’re willing to lend you.

Your Strategic Advantage in the Dallas Housing Market

In a competitive real estate landscape like Dallas, being prepared is everything. Too many buyers start by falling in love with homes online, but the truly savvy ones begin by getting their financing locked down first. Think of a mortgage pre-approval not as a frustrating hurdle, but as your ticket to being taken seriously.

When you walk in with a pre-approval letter, you’re telling sellers one thing loud and clear: you’re a real, motivated buyer whose money is good to go. It instantly separates you from the crowd of lookers who might only be pre-qualified or, worse, haven’t even talked to a lender yet.

Why Pre-Approval Matters in Dallas

The Dallas-Fort Worth metroplex is legendary for its hot market. Great homes in desirable neighborhoods like Lakewood or Preston Hollow can get snapped up in days, often with multiple offers on the table. A pre-approval gives you the agility you need to jump on the perfect home the moment you see it.

A pre-approval letter is more than just a piece of paper; it’s a conditional commitment from a lender. This demonstrates to sellers that your offer is backed by real borrowing power, significantly strengthening your negotiating position.

Without one, you’re just window shopping. You risk finding your dream home only to lose it to a more prepared buyer while you’re left scrambling to get your financial ducks in a row.

It’s a game-changer. Combining that pre-approval with a solid understanding of the market is your best bet. You can get up to speed by checking out a current Dallas real estate trends analysis. This knowledge, paired with a solid pre-approval, makes for a powerful combination.

What This Guide Will Cover

Figuring out the mortgage pre approval requirements might seem complicated, but it’s completely doable when you know what to expect. This guide is your roadmap. We’ll break down every piece of the puzzle, with a special focus on how it all works right here in the Dallas market. We will cover:

- The Core Financial Pillars: A deep dive into what lenders look for in your credit score, debt-to-income ratio, and down payment funds.

- Essential Documentation: A straightforward checklist of every piece of paper you’ll need to gather.

- Income Verification: How to prove your earnings, whether you’re a salaried employee, self-employed, or working in the gig economy in Dallas.

By the end of this, you’ll have a clear picture of the whole process. You’ll be able to walk into any Dallas lender’s office with confidence and secure the strategic advantage you need.

The Financial Pillars of a Dallas Mortgage Pre-Approval

Think of getting pre-approved for a mortgage like building a foundation for your new home. For that foundation to be solid enough for the competitive Dallas market, it needs to rest on three strong financial pillars: your credit score, your debt-to-income ratio, and your down payment. Lenders scrutinize these numbers to get a clear picture of your financial health and figure out how much they’re comfortable lending you.

Each piece tells a different part of your financial story. A good credit score shows you have a track record of paying your bills on time. A low DTI ratio proves you aren’t juggling too much debt. And a down payment shows you’re a serious buyer who knows how to save.

Decoding Your Credit Score

Your credit score is one of the very first things a Dallas lender will pull. It’s basically a report card on how you’ve handled debt in the past. You don’t need a perfect score, but a higher number can open a lot of doors and save you a significant amount of money.

For most conventional loans here in Texas, lenders are generally looking for a minimum credit score of 620. But aiming higher is where you really start to see the benefits. A score of 740 or above is the sweet spot—it usually unlocks the best interest rates available. That small difference in rate can mean saving hundreds on your monthly payment and tens of thousands over the life of the loan, a huge advantage in a market like Dallas.

Understanding Your Debt-to-Income Ratio

Next up is your Debt-to-Income (DTI) ratio. It sounds a bit technical, but the idea is simple. It’s the percentage of your gross monthly income that goes toward paying off your recurring monthly debts. Lenders use it to see how much of your paycheck is already spoken for.

To calculate your DTI, a lender adds up all your monthly debt payments—think car loans, student loans, and minimum credit card payments—and divides that sum by your gross monthly income. For example, if you bring in $8,000 a month before taxes and your total debt payments are $1,600, your DTI is 20% ($1,600 / $8,000). A lower number tells a lender you have plenty of room in your budget for a mortgage payment.

In general, lenders prefer a DTI ratio that stays below 43%. Keeping your DTI low signals that you’re a less risky borrower, which makes your application much stronger.

Assembling Your Down Payment

The final pillar is your down payment—the cash you pay upfront for a portion of the home’s price. There’s a persistent myth that you absolutely must have 20% down. While putting 20% down is a great goal because it helps you avoid Private Mortgage Insurance (PMI), it’s definitely not a deal-breaker for getting a loan in Dallas.

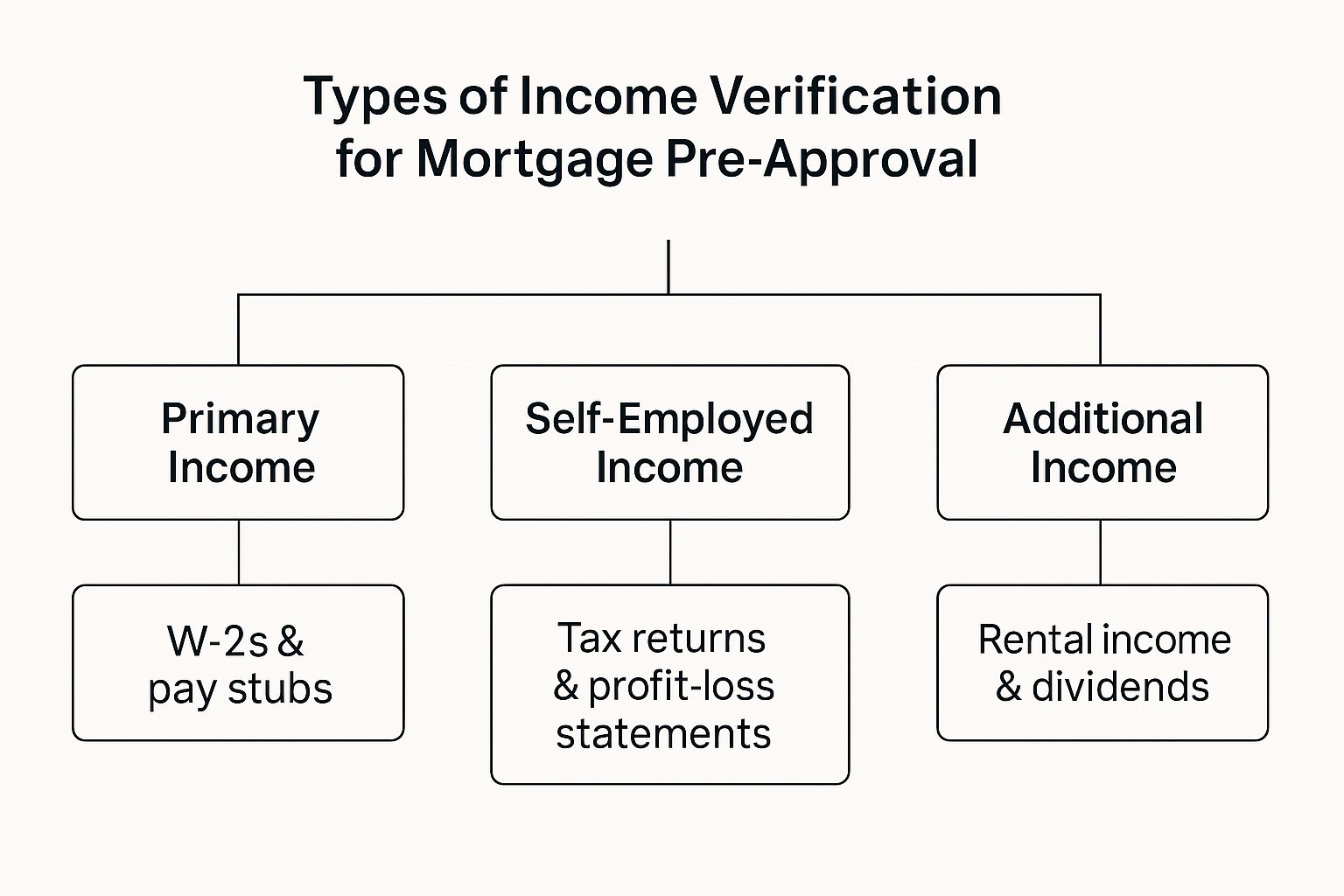

In fact, many of the most popular loan programs are designed to make homeownership more accessible. Government-backed FHA loans, for instance, can sometimes work with scores around 580 and only require a 3.5% down payment. This infographic shows how lenders verify the income needed to support your application.

As you can see, the documents you’ll need depend on how you earn a living, ranging from simple W-2s for salaried employees to more detailed profit-and-loss statements if you’re self-employed.

Here are a few popular low-down-payment options available to Dallas home buyers:

- FHA Loans: Backed by the government, these loans often require as little as 3.5% down, making them a fantastic option for many first-time buyers in Dallas.

- Conventional 97 Loans: These conventional loan products allow for a 3% down payment, putting them in direct competition with FHA loans for buyers who have solid credit.

- VA Loans: For eligible veterans and active-duty service members in the Dallas area, these loans offer an incredible benefit: 0% down.

To get a better handle on these requirements, it helps to see how they stack up against each other for different loan types.

Key Financial Requirements for Dallas Mortgages

Here’s a quick summary of the key metrics lenders in Dallas look at during the pre-approval process, broken down by common loan programs.

| Requirement | Conventional Loan (Typical) | FHA Loan (Typical) | Dallas Market Insight |

|---|---|---|---|

| Credit Score | 620+ (740+ for best rates) | 580+ | A higher score is crucial for competing on conventional offers in DFW. |

| DTI Ratio | Under 43% | Under 43% (can be higher with compensating factors) | Keeping DTI low gives you more purchasing power in a market with rising prices. |

| Down Payment | 3% – 20% | 3.5% minimum | Low down payment options are popular, but a larger down payment strengthens your offer. |

This table gives you a great starting point, but remember that every Dallas lender has slightly different guidelines. It’s always best to speak with a mortgage professional who can review your specific situation.

Getting a handle on these financial pillars is the first and most important step. When you understand and start working on the essential financial planning steps, you’re not just preparing an application—you’re building a rock-solid foundation for your entire homeownership journey in Dallas.

Assembling Your Winning Document Portfolio

Think of getting pre-approved by a Dallas lender like you’re making a high-stakes business pitch. Your pile of documents is the proof, the hard evidence that you’re a reliable bet. If you walk in prepared from the get-go, you avoid that last-minute scramble for paperwork and signal to the lender that you’re a serious, organized buyer. This is your game plan for presenting a clean, compelling financial story that checks all the mortgage pre approval requirements.

Every document you hand over tells a piece of your financial story. Lenders in Dallas aren’t just going down a checklist; they’re piecing together a complete picture of your income, your assets, and your overall stability. A smooth, well-documented file can seriously speed up your pre-approval, which is a massive advantage in the fast-paced Dallas housing market.

The Core Paperwork Checklist

While every Dallas lender has their own little quirks, a standard set of documents is pretty much always on the list. Getting these together early will make the whole process feel less like a mad dash. For a deep dive into exactly what you’ll need to make your application a breeze, this essential mortgage document checklist is an incredibly helpful resource.

Here’s what you should start gathering now:

- Proof of Income: This usually means your W-2 forms from the last two years, plus your most recent pay stubs covering a 30-day period. This is how you prove your current salary and show you’ve got a stable job.

- Federal Tax Returns: Lenders will want to see your complete personal federal tax returns for the past two years. It gives them a wider lens on your financial history.

- Bank and Asset Statements: You’ll need to provide statements for all your accounts—checking, savings, and any investments—for the last two to three months. This shows you have the cash on hand for the down payment and closing costs.

- Identification: Simple enough—a copy of your driver’s license and Social Security card are standard for verifying who you are.

This list covers the basics, but don’t be surprised if your specific situation, especially in a competitive market like Dallas, calls for a few extra pieces of paper.

Navigating Dallas-Specific Income Scenarios

The Dallas-Fort Worth economy is a real mix, home to a massive tech scene and a ton of freelancers and entrepreneurs. This means plenty of home buyers have income that doesn’t fit neatly into a traditional W-2 box. If that’s you, be prepared to provide more documentation.

For instance, if you’re a freelance graphic designer working out of the Design District or a tech consultant based in Plano, your income isn’t a fixed number every month. Lenders need more than just a few bank statements to get comfortable with that.

Lenders need to see a consistent and reliable income history. For self-employed individuals in Dallas, this means providing at least two years of business tax returns and a year-to-date profit-and-loss statement to demonstrate stable earnings.

This detailed proof is absolutely non-negotiable. It’s how you demonstrate that even though your income fluctuates, it’s dependable enough to handle a mortgage payment.

Sourcing Your Down Payment Correctly

Another hurdle that often pops up for Dallas buyers is properly documenting a large cash gift for a down payment. It’s an amazing gesture from a relative, but lenders have to be sure it’s not a secret loan that would mess with your DTI ratio. If a relative is helping you out with funds, you will absolutely need a formal gift letter.

This letter has to include:

- The donor’s name, address, and how they’re related to you.

- The exact dollar amount of the gift.

- A crystal-clear statement that the money is a gift and does not need to be repaid.

The person giving the gift will also need to show a bank statement proving they had the funds to give. Getting the sourcing of these funds right from the start helps you avoid major underwriting delays—delays that could easily cost you a house in a Dallas bidding war. When you have every piece of paper in order, you look like the ideal candidate: ready to close and get the keys.

Demonstrating Stable Income in a Dynamic Job Market

In a bustling and diverse economy like Dallas, showing you have a steady income isn’t always as simple as handing over a few recent pay stubs. Lenders need to feel absolutely confident in your ability to make payments for years to come, which means they look far beyond just your current salary. This part of the mortgage pre approval requirements is all about building a convincing story of your financial stability.

The gold standard for any lender is a consistent two-year employment history. This doesn’t mean you have to be stuck in the exact same job for two years straight. It just means they want to see a predictable, reliable pattern of earnings. At the end of the day, they’re trying to answer one crucial question: can this person reliably afford this mortgage for the long haul?

How Dallas Lenders View Job Changes

Changing jobs is a normal part of building a career, especially in the thriving Dallas-Fort Worth job market. A recent switch, however, will definitely get a lender’s attention. A promotion or moving to a higher-paying job in the same field? That’s typically seen as a huge plus.

For example, if you’re a software developer who hops from one Dallas tech firm to another for a better salary, underwriters usually see that as a smart career move. But if you were to switch from a salaried engineering role to a 100% commission-based sales position, the lender will need to see a proven track record in that new role before they can confidently count that income.

A key principle for lenders is predictability. Abrupt career changes or big swings in your income can raise red flags, making thorough documentation absolutely essential to prove your earnings are both stable and likely to continue.

It’s always a smart move to chat with your loan officer before you make any career changes. They can give you a heads-up on how it might impact your pre-approval and help you get the right paperwork ready.

Calculating Income from Different Sources

Not all income is created equal in the eyes of an underwriter. How your earnings are calculated depends entirely on how you get paid. And in a place like Dallas, where industries range from massive corporate headquarters to small creative agencies, these distinctions matter a lot.

-

Salaried Employees: This is the most straightforward scenario. Lenders will simply look at your W-2s and recent pay stubs to confirm your gross monthly income. Easy.

-

Commission or Bonus-Based Roles: If a big chunk of your pay comes from bonuses or commissions—very common in Dallas sales and corporate jobs—lenders will typically average your earnings from the past two years to establish a reliable monthly figure.

-

Self-Employed and Gig Workers: For the consultants, freelancers, or small business owners hustling in areas like Deep Ellum or the Arts District, lenders need a lot more proof. You’ll have to provide at least two years of full tax returns (both personal and business) and a current profit-and-loss statement to show your business is consistently profitable.

This deep dive is necessary because your income isn’t guaranteed by an employer; your business’s financial health is your income’s health. Lenders need to see a strong, two-year history of success. Presenting a clear, well-organized financial picture is your best strategy for a smooth approval. This level of preparation is non-negotiable when you’re meeting mortgage pre approval requirements with anything other than a simple, fixed salary.

Why Dallas Mortgage Rules Are So Thorough

If you’ve ever wondered why getting a mortgage pre-approval in Dallas feels like handing over your entire financial life story, you’re not alone. The sheer volume of paperwork can seem almost invasive. But these demanding mortgage pre approval requirements aren’t just arbitrary hoops to jump through. They are a carefully constructed safety net, built from the hard lessons of past financial crises to protect both you and the stability of the entire North Texas housing market.

When you see the process as a system designed for protection rather than a series of personal hurdles, it becomes much easier to navigate. These aren’t quirky local Dallas rules; they’re largely shaped by national regulations designed to keep the housing market on solid ground.

A Lesson from Financial History

The level of detail required today is a direct result of past economic meltdowns. Mortgage standards have ebbed and flowed over the decades, often reacting to economic cycles. Before the 2008 global financial crisis, for example, underwriting standards were sometimes alarmingly loose. Some lenders handed out loans with very little verification, leading to a house of cards that eventually collapsed.

The aftermath of that period brought about much stricter regulations. Now, agencies like the Federal Housing Finance Agency (FHFA) enforce firm capital and liquidity requirements on lenders to minimize risk. Those rules trickle down directly to the local level, resulting in the detailed, conservative lending practices you encounter in Dallas today. It’s all about verifying a borrower’s financial strength.

How Regulations Protect Your Dallas Investment

Believe it or not, these strict rules are incredibly valuable for anyone who owns property in Dallas. By forcing lenders to verify income, confirm assets, and make sure a borrower isn’t stretched too thin, the system dramatically reduces the risk of foreclosures. A lower foreclosure rate is fantastic for everyone, as it helps protect property values across entire neighborhoods, from Bishop Arts to Frisco.

Think of these regulations as the structural code for the financial side of real estate. A building code ensures your house can withstand a storm. In the same way, these underwriting rules ensure the local housing market can withstand economic shifts, protecting the value of your investment.

This framework gives you confidence that when you buy a home in Dallas, you’re not just buying a property; you’re entering a stable market. You can be reasonably sure your neighbors were also carefully vetted, which contributes to a healthy community and safeguards the long-term value of your home. For a deeper look into what makes the local market tick, our Dallas property market guide offers expert insights.

The Lender’s Perspective

Put yourself in the lender’s shoes for a moment. A mortgage is a massive financial commitment for them. They’re fronting hundreds of thousands of dollars and betting on your ability to pay it back over 15 or 30 years. The pile of documentation you provide—W-2s, bank statements, tax returns—is their only way to confirm your financial story and feel secure in that bet.

By being so thorough, they are confirming three critical things:

- Your Identity: Making sure you are who you claim to be.

- Your Capacity: Proving you have the consistent income to handle the monthly mortgage payments.

- Your Collateral: Confirming you have the necessary funds for a down payment and that the property itself is a sound investment.

Ultimately, these strict mortgage pre-approval requirements are a system of checks and balances that works for everyone. They ensure you’re truly ready for homeownership and help keep the Dallas real estate market strong and sustainable for years to come.

Answering Your Top Dallas Pre-Approval Questions

As you dive into the Dallas real estate market, you’re bound to have some urgent questions about getting pre-approved. It’s a big step, and with so much on the line, getting clear, straightforward answers is absolutely essential. Let’s tackle some of the most common things we hear from Dallas homebuyers just like you.

It’s also worth noting that the mortgage world doesn’t exist in a vacuum. It’s shaped by the broader economy. While lenders are always careful, we’re seeing an environment where many are holding steady or even slightly easing up on lending standards for some loans. This is partly due to a brighter economic outlook and fierce competition between lenders—which is great news for well-prepared Dallas buyers.

How Long Does a Pre-Approval Last in Dallas?

Think of a pre-approval letter like a ticket with an expiration date. In a fast-paced market like Dallas, that ticket is typically good for 90 days.

Why the deadline? Lenders put that timeframe in place because your financial world is always in motion—your credit score, your income, your debts. They need a recent snapshot to feel confident. If you haven’t locked down a home within that 90-day window, don’t worry. You’ll just need to “refresh” your pre-approval by sending your lender your latest financial documents.

Can My Pre-Approved Amount Change?

Absolutely, and this is a point I can’t stress enough. Your pre-approval isn’t set in stone. It’s a conditional thumbs-up based on the exact financial picture you presented at that moment. If that picture changes, so can the lender’s offer.

A mortgage pre-approval is not a blank check. It’s a dynamic assessment that can be impacted by your financial decisions. Making large purchases, changing jobs, or taking on new debt after you’re pre-approved can lower your borrowing power or even lead to a denial.

Here’s a classic example: you get pre-approved, then go out and finance a new car. That one decision just bumped up your DTI ratio, and your lender might have to reduce the loan amount they’re willing to offer. It is crucial to keep your finances as stable as possible while you’re house hunting. For a complete rundown, this mortgage pre-approval checklist is a fantastic resource to guide you through every critical step.

What Happens If I Get into a Bidding War?

Bidding wars are a reality in many sought-after Dallas neighborhoods. If you find yourself needing to offer more than your pre-approved amount to stay competitive, the very first thing you should do is call your loan officer. Immediately.

They’ll need to run the numbers again with the higher purchase price to confirm you can still qualify for the larger loan. This is exactly why it’s smart to get pre-approved for the maximum amount you’re comfortable with right from the start. It gives you that extra bit of firepower and flexibility when you need it most. For those who are new to this, our Dallas first-time homebuyers guide provides essential tips that can help you navigate these high-stakes situations.

When you’re ready to take the next step and get a powerful pre-approval that positions you to win in the Dallas market, the right guidance is key. Dustin Pitts REALTOR Dallas Real Estate Agent specializes in helping buyers like you navigate every stage of the process with confidence. Contact us today to get started.