Before you even dream of touring homes in Bishop Arts or Uptown, the journey to buying your first place in Dallas begins with a hard look at your finances. This isn’t the glamorous part, I know, but getting this right sets the stage for a smooth, successful home-buying experience. It’s all about building a solid financial foundation.

Preparing Your Finances for the Dallas Market

The Dallas-Fort Worth housing market is in a fascinating place right now, and it’s creating real opportunities for buyers who are prepared. We’ve seen a massive 53% jump in housing inventory, pushing our local supply to 20-year highs. That means more choices for you in the Dallas area.

What’s even more telling? As of early 2025, a whopping 66% of homes sold for less than their original asking price. This is a significant shift. For the first time in years, Dallas buyers have some genuine negotiating power. This market climate makes your financial prep work more critical than ever—it’s what allows you to pounce on a great deal when you see one.

Assess Your Savings and Down Payment

First things first: take stock of your savings. The down payment is the big one, but it’s not the only check you’ll be writing. You’ll also need cash for closing costs, which usually land somewhere between 2-5% of the home’s final sale price, plus funds for the actual move.

As you build up that nest egg, you need a safe place to keep it. This isn’t the time for risky investments. You can explore various safe short-term investments for your down payment savings to make sure your money is secure and accessible when you need it.

And please, don’t let the old “20% down” myth scare you off. That’s simply not the reality for many buyers, especially first-timers in Dallas. Plenty of loan programs exist with much lower down payment requirements.

Key Insight: Dallas has some fantastic local programs to help bridge the financial gap. The Federal Home Loan Bank of Dallas (FHLB Dallas), for instance, offers a Homebuyer Equity Leverage Partnership (HELP) grant. This can provide up to $25,000 toward your down payment and closing costs—a true game-changer for many Texas buyers.

Understand Your Credit Score’s Impact

That three-digit number—your credit score—is incredibly powerful in the DFW lending world. It’s the primary factor lenders use to decide what interest rate you’ll get, which can translate into saving (or spending) tens of thousands of dollars over the life of your loan.

Here’s a quick breakdown of what scores mean to Dallas lenders:

- 740 or higher: You’re in the top tier. Expect to be offered the best interest rates on the market.

- 680-739: Still a strong score. You’ll have no trouble securing a competitive rate from most lenders.

- Below 680: You might face higher interest rates, but don’t count yourself out. Options like FHA loans are designed specifically for buyers in this range.

Calculate Your True Home-Buying Budget

Finally, it’s time to figure out what you can truly afford. Your budget is more than just the mortgage principal and interest. In Dallas, you absolutely must account for property taxes (which can vary wildly from one neighborhood to the next) and homeowner’s insurance.

These two costs are typically bundled with your mortgage into an escrow account, creating your total monthly housing payment, often called PITI (Principal, Interest, Taxes, and Insurance). Getting a clear handle on this all-in number ensures there are no surprises after you get the keys.

To help you stay on track, here’s a quick checklist of the financial milestones you should aim for before diving into your Dallas home search.

Dallas First-Time Buyer Financial Checklist

| Financial Goal | Target Metric | Why It Matters in Dallas |

|---|---|---|

| Credit Score | 740+ (Ideal), 680+ (Good) | A higher score unlocks lower interest rates, saving you thousands on a Dallas home loan. |

| Down Payment Savings | 3-20% of Target Home Price | While 20% isn’t required, a larger down payment strengthens your offer and reduces your monthly payment. |

| Closing Cost Fund | 2-5% of Home Price | This separate fund is crucial for covering fees like appraisal, title, and lender charges. |

| Emergency Fund | 3-6 Months of Living Expenses | Provides a safety net for unexpected repairs or job changes after you buy your Dallas home. |

| Assistance Program | Check Eligibility for HELP Grant | Up to $25,000 in assistance can dramatically reduce your upfront cash needs. |

Getting these financial ducks in a row isn’t just a box to check—it’s the single most empowering thing you can do to position yourself for success in the current Dallas market.

Securing Your Mortgage Pre-Approval in Dallas

Now that you have your financial ducks in a row, it’s time to get a mortgage pre-approval. In the competitive Dallas real estate market, this letter isn’t just a nice-to-have; it’s your golden ticket. Think of it as proof to sellers that you’re a serious, qualified buyer who has already done the heavy lifting with a lender.

This pre-approval letter clearly states the maximum loan amount a lender is willing to give you, based on a solid look at your finances. When you find a house you can’t live without, having this letter means you can pounce on it immediately—a massive advantage in hot Dallas neighborhoods where homes get snapped up quickly.

What Dallas Lenders Will Ask For

Getting pre-approved means giving a lender a snapshot of your financial life. Lenders in the DFW area are thorough and will ask for a standard set of documents. My advice? Gather everything before you even talk to a lender. It makes the whole process faster and less stressful.

Here’s a quick checklist of what they’ll typically need:

- Proof of Income: Your most recent pay stubs (usually from the last 30 days) and W-2 forms from the past two years.

- Tax Returns: Lenders will want to see your federal tax returns for the last two years.

- Bank Statements: You’ll need to provide statements for your checking and savings accounts for the past two or three months.

- Credit History: The lender will run your credit report to check your score and see how you’ve handled debt in the past.

- Identification: A copy of your driver’s license or another government-issued ID is always required.

To get ahead of the game, you can dive deeper into what lenders look for. Check out our detailed guide on mortgage pre-approval requirements in Dallas to make sure you have every single document ready to go.

Choosing the Right Loan Type

Not all mortgages are built the same, and the best one for you hinges entirely on your personal financial picture. For a Dallas first time home buyer, the choice usually boils down to two main loan types: FHA and Conventional.

Expert Tip: I always recommend partnering with a local Dallas lender. They get the nuances of the DFW market, have relationships with local appraisers, and can often work much faster than the big national banks. That speed can be the critical edge you need to win a bidding war.

A FHA loan is backed by the government and is a fantastic option for buyers with lower credit scores or a smaller down payment (as low as 3.5%). On the flip side, a Conventional loan isn’t government-insured. It generally requires a higher credit score and a larger down payment, but it often comes with fewer long-term fees and restrictions.

Sit down with your lender and have them run the numbers for both. Compare the interest rates, closing costs, and private mortgage insurance (PMI) to see which loan makes the most financial sense for your first home purchase in Dallas.

Finding The Right Dallas Neighborhood For You

Choosing the right house is only half the battle. Picking the right Dallas neighborhood is where you truly find your new home. Dallas isn’t a single entity but a vibrant collection of unique communities, each with a distinct personality, lifestyle, and price tag.

The neighborhood you select will shape your daily life—from your morning commute to your weekend plans. It’s a decision just as weighty as the home’s layout or square footage, so giving it the attention it deserves is crucial for your long-term happiness.

Define Your Ideal Lifestyle

Before you even start scrolling through listings, grab a notepad and think about what really matters to you. Are you someone who craves the ability to walk to coffee shops and local boutiques, or do you prefer the quiet and space of a more classic residential area?

This self-assessment will be your compass. It helps narrow down the vast map of Dallas to a few key areas that genuinely match how you want to live.

Consider these factors:

- Commute Time: How much of your day are you willing to spend in traffic? Map the drive to your office from potential neighborhoods like Lake Highlands or Oak Cliff. A shorter commute can dramatically improve your quality of life.

- Local Amenities: Do you need parks for jogging, a buzzing nightlife scene, or quiet, tree-lined streets? Areas like Lower Greenville offer incredible walkability and entertainment, while others provide a more peaceful, suburban feel.

- Community Vibe: Are you looking for a historic feel with craftsman homes, a modern and sleek environment, or something in between? Every pocket of Dallas has its own unique character.

Research And Explore

Once you have a shortlist of potential neighborhoods, it’s time for some on-the-ground research. Don’t just rely on online photos or virtual tours. You need to spend a weekend driving, walking, and exploring these areas at different times of the day.

Pro Tip: Visit a neighborhood on a Tuesday morning and then again on a Saturday night. This gives you a much more realistic picture of the area’s traffic, noise levels, and overall atmosphere than a single visit ever could.

This hands-on approach helps you feel the true rhythm of a place. Grab a coffee, check out the local grocery store, and see if the community actually feels like a place you could call home. Many first-time buyers I work with find this step either confirms their decision or helps them pivot to an area that’s an even better fit.

For those focusing on affordability, you can find a helpful breakdown in our North Dallas affordable homes guide for first-time buyers.

Favorable market conditions are making this exploration even more promising. As of July 2025, the Dallas market has seen a 7.1% increase in homes for sale, bringing the total active listings to 6,342. More specifically for a Dallas first time home buyer, the inventory of smaller, more affordable homes has grown, with one-bedroom listings up 12.2% and two-bedroom homes up 7.2%. This gives you more options to choose from. You can discover more insights about the Dallas market on rocket.com.

Making a Winning Offer and Navigating Negotiations

So, you’ve explored Dallas neighborhoods, nailed down your mortgage pre-approval, and—finally—found the one. A house that actually feels like it could be home. Now for the moment of truth: making an offer.

This is where things get real, fast. It’s a mix of strategy, a surprising amount of paperwork, and a bit of a poker face. But with the right game plan, you’ll walk into it with confidence, not anxiety.

This is exactly where your real estate agent proves their worth. Together, you’ll dig into comparable sales—we call them “comps”—which are similar homes that have recently sold right there in that specific Dallas neighborhood. This isn’t about pulling a number out of thin air; it’s a data-driven reality check to land on an offer that’s both competitive and smart.

Structuring Your Offer to Win

A strong offer is about way more than just the price. Think of it as a complete package designed to make the seller say “yes” to you over everyone else.

In Texas, we use a standardized contract form. Your agent will guide you through every line item, but there are a few key components you absolutely have to understand. These are your safety nets.

- Financing Contingency: This is your “get out of jail free” card if your loan unexpectedly falls through. It says the whole deal is dependent on you actually getting the mortgage, protecting your earnest money deposit.

- Inspection Contingency (The Option Period): This is a non-negotiable for any Dallas first time home buyer. In Texas, this gives you a set number of days, usually 7-10, to bring in professional inspectors. If they find major problems, you can negotiate for repairs, ask for a price drop, or simply walk away.

- Appraisal Contingency: This one protects you if the bank’s official appraisal comes in lower than your offer price. Lenders will only loan up to the appraised value, so this clause gives you the power to renegotiate or cancel the contract if there’s a gap.

How to Negotiate in the Current Dallas Market

For the first time in a while, Dallas buyers actually have some breathing room. The frantic, “offer-anything” days are behind us, and the market has shifted significantly.

Just look at the numbers. In May 2025, Dallas County saw active inventory shoot up by 32.0% and new listings climb by 8.3% compared to last year. You can see the full DFW real estate report on republictitle.com.

Key Takeaway: With homes sitting on the market 28.6% longer, sellers are much more open to a conversation. This doesn’t mean you should throw out ridiculous lowball offers, but it absolutely means you have leverage.

This is your chance to be strategic. Don’t hesitate to ask for seller concessions, which is just a fancy term for asking the seller to pay for some of your closing costs. This can save you thousands in out-of-pocket cash.

And if that inspection turns up a leaky water heater or a faulty electrical panel? You are in a great position to request that the seller either fix it before you close or give you a credit so you can hire your own pro to handle it. The goal is to be firm but fair—you want to secure a great deal without poisoning the well with the seller.

The Critical Path From Contract To Closing Day

Once your offer is accepted, the real race begins. You’re now officially “under contract,” and a clock starts ticking on a crucial period that typically lasts 30-45 days here in Dallas. This is where the behind-the-scenes work kicks into high gear, moving you from a handshake agreement to actually getting the keys to your new home.

This entire phase is really all about due diligence. Your main job is to learn absolutely everything you can about the property before it’s legally yours. We’re talking inspections, appraisals, and a whole lot of coordination with your lender and title company to make sure the transition is seamless. Think of it as your final, in-depth investigation before you commit for good.

Schedule Your Home Inspection Immediately

The very first call you should make after your offer is accepted is to a licensed home inspector. Seriously, don’t wait. In Texas, you have what’s called an option period—usually the first 7-10 days of your contract—which is your golden window to conduct inspections and back out for any reason without losing your earnest money. You can’t afford to waste a single day.

A thorough home inspection is non-negotiable for any Dallas first time home buyer. In our area, good inspectors know exactly what to look for, paying close attention to the systems and common issues specific to North Texas homes.

They’ll meticulously check things like:

- The Foundation: Dallas’s expansive clay soil is notorious for causing foundation problems. Inspectors are trained to spot tell-tale cracks, uneven settling, and evidence of previous repairs.

- HVAC System: Texas heat is no joke, and a faulty A/C is a nightmare you don’t want. The inspector will test both the heating and air conditioning systems to make sure they’re working correctly and efficiently.

- Roof and Attic: They’ll get up on the roof to assess its age and condition, searching for leaks, storm damage, or shoddy installation work.

- Plumbing and Electrical: An inspection covers the home’s core lifelines, identifying things like outdated wiring, leaky pipes, or a water heater on its last legs.

The inspector’s report isn’t a pass/fail test; it’s a detailed report card on the home’s condition. You’ll use this information to pinpoint any major safety or structural problems, which you can then negotiate with the seller to either fix or provide a credit for at closing.

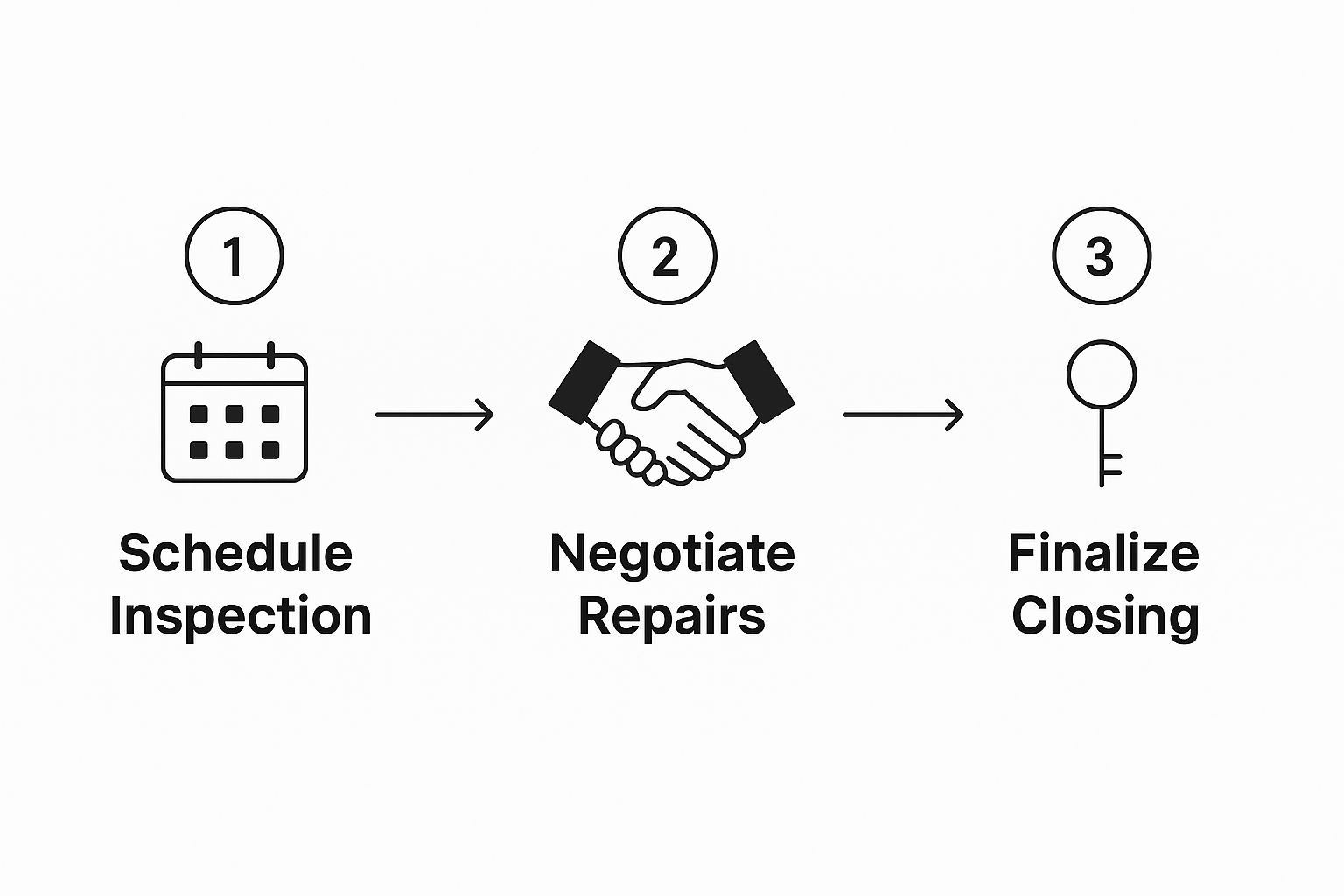

This graphic really helps visualize the key milestones you’ll hit between the inspection and closing day.

As you can see, right after the inspection comes the negotiation phase—this is your chance to address what you’ve found before moving forward.

Navigating The Appraisal And Insurance

While you’re focused on inspections, your lender will be busy ordering an appraisal. A licensed appraiser will visit the property to determine its fair market value. Their goal is to ensure the bank isn’t lending you more money than the home is actually worth. If the appraisal comes in lower than your offer, you have a few paths forward: renegotiate the price with the seller, bring cash to cover the difference, or walk away if your contract includes an appraisal contingency.

At the same time, you’ll need to secure a homeowner’s insurance policy. Lenders won’t fund your loan without proof of insurance, so it’s a must-do. It pays to shop around for quotes to find the best coverage and rate for your new Dallas home.

As you navigate this period, being methodical is key. Following a comprehensive due diligence checklist can help you meticulously track all the moving parts. Your very last step before signing stacks of paperwork is the final walkthrough. This is your last visit to the house, usually 24-48 hours before closing, to make sure it’s in the same condition you agreed to buy it in and that any negotiated repairs have been completed.

Frequently Asked Questions for Dallas First Time Home Buyers

The journey to buying your first home in Dallas is exciting, but it’s natural for questions to pop up along the way. Even with a perfect plan, you’ll hit little details and wonder what to do next. This is where we clear up some of the most common questions I get from new buyers stepping into the Dallas market.

How Much Do I Really Need for a Down Payment in Dallas?

This is, without a doubt, the question I hear most often. The good news? It’s probably less than you think. That old “20% down” rule is more of a myth than a mandate these days. Many first-time buyers in Dallas use loan programs that require much less upfront.

- FHA Loans: These government-backed loans are a game-changer for many. They are designed to open the door to homeownership and allow for a down payment as low as 3.5%.

- Conventional Loans: Don’t assume conventional loans are out of reach. Some programs are available for qualified buyers with down payments as low as 3%.

The key is to have a real conversation with a Dallas-based lender. They know the local landscape and can match your financial picture to the right loan product.

What Is the Difference Between Pre-Qualified and Pre-Approved?

These two terms sound almost identical, but to a seller, they’re worlds apart. Getting this right is absolutely crucial for any Dallas first time home buyer.

Pre-qualification is basically a ballpark estimate. You give a lender your financial info, they run some quick numbers, and tell you what you might be able to borrow. None of it is verified. Think of it as a casual first chat.

Pre-approval is the real deal. This is a formal, written commitment from a lender for a specific loan amount. It means they’ve pulled your credit and meticulously verified your income and assets. Handing over a pre-approval letter with your offer shows you’re a serious, capable buyer.

Key Insight: In a competitive market like Dallas, a pre-approval isn’t just a good idea—it’s essential. An offer without one simply won’t be taken seriously by sellers or their agents. It’s your ticket to being a contender.

Can I Get Help with My Down Payment?

Yes, absolutely! Too many buyers think they have to save up every penny themselves. There are fantastic programs designed to help with down payments and closing costs, and many Texas first-time buyers use them.

A standout program is the Homebuyer Equity Leverage Partnership (HELP) grant, offered through the Federal Home Loan Bank of Dallas. Eligible buyers in Texas can receive up to $25,000 in assistance. And here’s the best part: it’s a grant, not a loan. That’s money you don’t have to pay back, which can be a massive boost.

What Are Property Taxes Like in Dallas?

Property taxes are a significant part of your homeownership budget in Texas, and they can vary quite a bit across Dallas County. The rates are set by different local entities—the city, the county, the school district—and can range from around 2% to over 3% of your home’s assessed value each year.

When you’re running the numbers for your monthly payment, you have to look at the specific tax rate for the exact neighborhood you’re interested in. A seemingly small difference in the rate can easily add hundreds of dollars to your monthly payment, so it’s a detail you can’t afford to overlook.

For a deeper dive into these topics and a complete walkthrough of the buying process, check out our Dallas first time homebuyers guide for essential tips.