At its core, a home warranty is a service contract. It’s designed to cover the costs of repairing or replacing your home’s major systems and appliances when they break down from normal, everyday use.

For any Dallas homeowner, this is a huge deal. Think about it: a sudden air conditioner failure during a brutal Texas August, or your dishwasher giving up the ghost right after you’ve moved in. A home warranty acts as a financial safety net for these exact moments. It’s important not to confuse it with homeowner’s insurance, which is for catastrophic events like fires or storms.

Understanding the Basics of a Home Warranty

The easiest way to think of a home warranty is as a specialized protection plan for all the working parts of your house. When you buy a home in Dallas, you’re not just investing in the structure; you’re also buying all the complex systems inside it. Homeowner’s insurance protects the structure itself from disasters, but a home warranty protects your budget from the inevitable breakdown of the equipment you use daily.

This distinction is absolutely crucial. If a hailstorm blows through and damages your roof, your insurance policy is your go-to. But it won’t lift a finger if your water heater just decides to stop working from old age. That’s precisely where the home warranty steps in. It’s built for those high-cost, out-of-the-blue repairs that can put a serious strain on anyone’s finances.

The Core Concept of Coverage

A home warranty is built on a simple premise: you pay an annual fee, and in return, the warranty provider agrees to arrange for and cover a big chunk of the service costs for the items listed in your contract. This effectively turns an unpredictable, potentially four-figure repair bill into a predictable, much more manageable expense.

Here are the key takeaways:

- It’s a Service Contract: This is an agreement for service, not an insurance policy that pays out after a major loss.

- Focus on Wear and Tear: The coverage is specifically for failures that happen through normal, everyday use over time.

- Budget Protection: Its main job is to shield you from the full financial hit of a major system or appliance failure.

Think of a home warranty like a subscription service for your home’s repairs. Instead of getting slammed with a surprise $1,200 bill for a new water heater, you pay a predictable annual premium and a small service fee when something goes wrong.

To really get a solid handle on this, it’s helpful to understand the general concept of a warranty and how it works. This background knowledge helps clarify what the provider is obligated to do and what protections you have under the agreement, which is key to setting the right expectations from day one for anyone managing a property in the Dallas area.

What a Dallas Home Warranty Typically Covers

When you buy a home warranty in Dallas, you’re essentially getting a financial safety net for unexpected repairs on specific items. The contract spells out exactly which systems and appliances are included.

Think of it like a pre-set menu of covered items. It’s designed to shield you from the sticker shock of fixing the most essential—and expensive—parts of your home when they break down from normal wear and tear.

This kind of coverage is a game-changer in Texas, where some home systems are pushed to their limits. A typical policy is built around the two categories that give homeowners the biggest headaches: major systems and key appliances.

Core Systems Protected in Your Dallas Home

The major systems are the operational backbone of your house. These are often complex and costly to fix, making them the primary reason most people even consider a home warranty in the first place.

- HVAC System: Here in Dallas, your AC isn’t just a comfort—it’s a lifeline. Standard warranties almost always cover your heating, ventilation, and air conditioning, including furnaces and central AC units.

- Plumbing System: This coverage typically handles leaks and breaks in your water lines, stubborn drain clogs, and problems with toilets or the water heater.

- Electrical System: A warranty will generally cover interior wiring, faulty circuit breaker panels, and outlets that stop working.

Of course, keeping your HVAC system in good shape can prevent a lot of those costly repairs. While your warranty covers unexpected breakdowns, it’s always smart to understand proper upkeep. For more on this, you can check out these HVAC maintenance best practices. This knowledge helps keep your system running efficiently and could even extend its life, preventing issues that might fall outside your warranty’s scope.

Major Appliances Under Warranty

Beyond those core systems, home warranties cover the workhorse appliances you depend on day in and day out. Protecting these items is a huge focus for homeowners, and the global market reflects that. Appliance warranties make up a large slice of the pie in the entire home warranty market. This shows just how much people prioritize protecting these essentials.

A key takeaway for Dallas homeowners: Your warranty is designed to address the failure of a covered item, not to pay for upgrades or fix problems caused by neglect. Clear expectations are crucial.

Here are the appliances commonly included:

- Refrigerator

- Oven, range, and cooktop

- Dishwasher

- Built-in microwave

- Washer and dryer

- Garbage disposal

Understanding Common Exclusions

Knowing what isn’t covered is just as important as knowing what is. You absolutely have to read the fine print—it’s non-negotiable.

Here’s what’s usually left out:

- Pre-existing Conditions: If a problem was known about before your warranty coverage kicked in, it’s typically not covered.

- Improper Maintenance: If a system fails because of neglect or a botched installation, the claim will almost certainly be denied.

- Cosmetic Defects: Dents, scratches, or rust spots that don’t actually stop the item from working are not included.

- Structural Items: Things like your windows, doors, and walls are the domain of homeowner’s insurance, not a home warranty.

Breaking Down Home Warranty Costs in the DFW Area

So, what’s the actual investment for this kind of peace of mind? In the Dallas-Fort Worth area, the cost structure for a home warranty is refreshingly straightforward. It really boils down to two key expenses, which helps you budget without any nasty surprises when a big-ticket item suddenly fails.

First up is the annual premium. You can think of this like a yearly subscription fee you pay to keep your coverage active. This ensures you have a network of qualified professionals on standby, ready to jump in when something goes wrong.

The second piece of the puzzle is the service call fee, sometimes called a trade call fee. This is a flat rate you pay directly to the technician when they come to your door to diagnose the issue. It’s essentially your co-pay for each repair visit.

Typical Cost Ranges in Dallas

For a typical home in the DFW metroplex, you can expect the annual premium to land somewhere between $450 and $600. Broken down, that’s a pretty manageable monthly payment of around $40 to $60.

When you actually need to file a claim, the service call fee in the Dallas area generally runs from $75 to $150 per visit. The great thing is this fee stays the same whether the repair takes an hour or the whole afternoon, or even if the tech has to come back to finish the job.

By combining a modest annual premium with a predictable service fee, a home warranty transforms a potentially devastating $3,000 HVAC repair into a much more palatable expense. It’s about converting financial uncertainty into manageable, planned costs.

What Influences Your Final Price

Of course, not all home warranties are created equal, and your final price tag will depend on a few key factors tied to your property and the level of coverage you want. Getting a handle on these variables is crucial, especially for anyone keeping an eye on the dynamic Dallas real estate market trends.

Here’s what really drives the cost:

- Home Size: It makes sense that a larger home, say in Preston Hollow, might have more complex systems or even multiple HVAC units. More to cover often means a slightly higher premium.

- Coverage Level: You can choose a basic plan that sticks to the essential systems, or you can opt for a premium tier that includes a wider range of appliances and extra protections.

- Optional Add-Ons: Many Dallas homeowners choose to add coverage for items that aren’t standard in a base plan. These popular extras will naturally adjust your total price.

Some of the most common add-ons we see for DFW properties include:

- Swimming pools and built-in spas

- Well pumps or sump pumps

- A second refrigerator or a stand-alone freezer

At the end of the day, you have the flexibility to customize your coverage. You can find that perfect sweet spot between comprehensive protection and a price that fits comfortably within your budget, building a warranty that makes perfect sense for your specific Dallas home.

How to Navigate the Home Warranty Claims Process

Imagine your air conditioner gives out in the middle of a sweltering Dallas August. The last thing you want is a confusing, drawn-out ordeal to get it fixed. Thankfully, the home warranty claims process is designed to be pretty straightforward.

Understanding the steps ahead of time takes the anxiety out of the equation. It empowers you to act fast and with confidence the moment a covered system or appliance decides to call it quits.

The whole thing boils down to a simple sequence: spot the problem, call your provider, and let them handle the logistics. This structured approach is what makes a home warranty so valuable—it swaps the frantic search for a reliable contractor with a clear, predictable plan. A lot of homeowners clearly appreciate this simplified repair model.

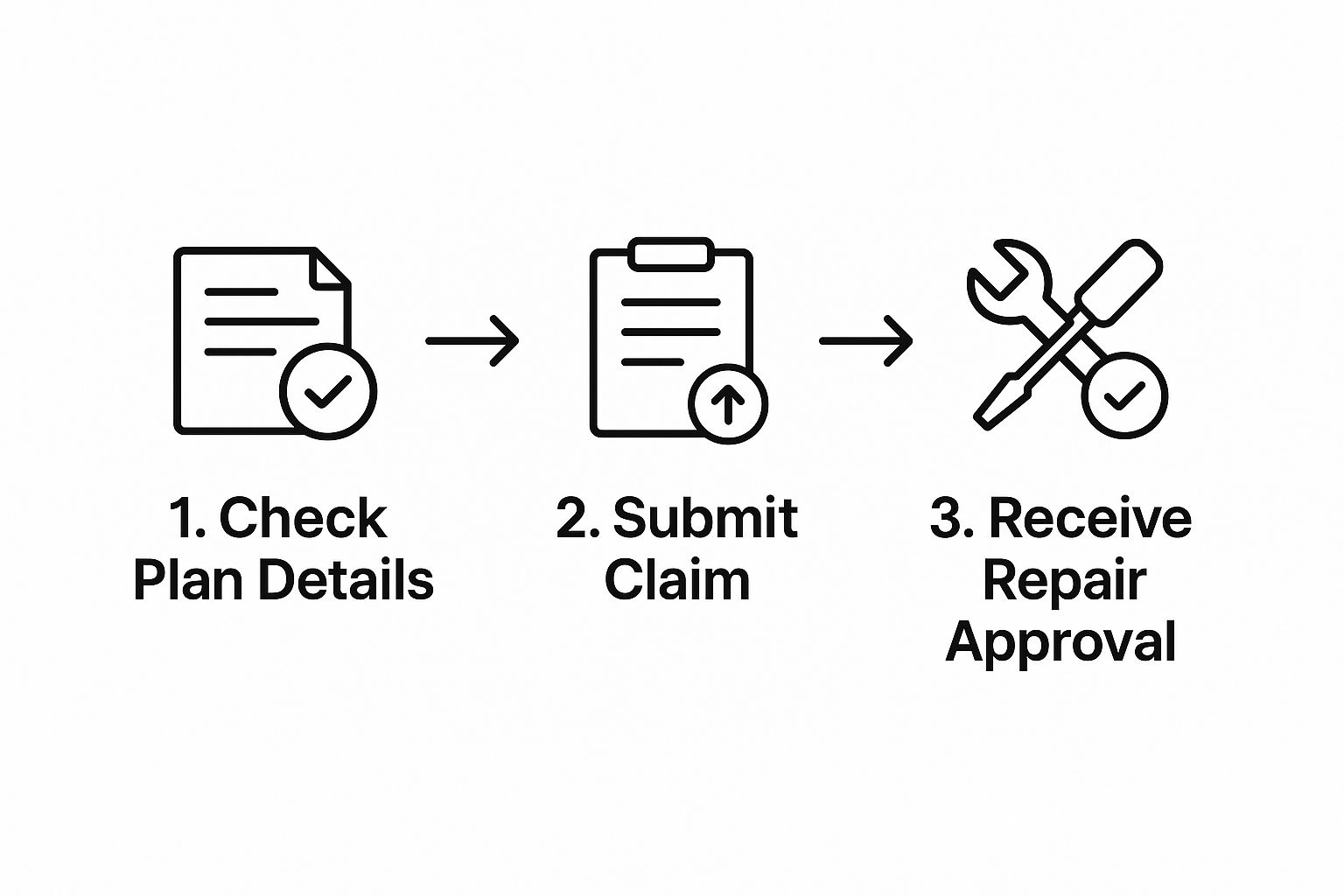

Your Step-by-Step Claims Guide

The journey from a broken appliance to a finished repair follows a clear path. This visual breaks down the core steps you’ll take.

This flow really highlights how efficient the system is, moving you from problem to solution with minimal friction.

Here’s what that process looks like in practice:

- Submit Your Service Request: The second you discover a covered item has failed, get in touch with your warranty provider. Most companies have a 24/7 online portal or a phone number to make this step a breeze. You’ll just need to provide basic details about the problem and your policy.

- Pay the Service Call Fee: At this point, you’ll pay your predetermined service call fee. This is the flat-rate charge for each claim, no matter how simple or complex the repair ends up being. Think of it like other predictable homeownership costs—understanding things like what private mortgage insurance covers can give you a broader financial perspective.

- Schedule the Appointment: Now, your warranty company takes over. They’ll dispatch a licensed and vetted contractor from their network who serves the Dallas area. That service pro will then contact you directly to set up a convenient time to visit, diagnose the issue, and get the job done.

The best part of the whole claims process is the provider’s network. You don’t have to waste hours vetting local technicians. The warranty company has already done that legwork, connecting you with a qualified professional who knows the Dallas area.

On the off chance your claim is ever denied, it’s good to know your options. While warranties and insurance are two different things, looking into general strategies for appealing a claim denial can be a helpful starting point.

The Strategic Value for Dallas Home Buyers and Sellers

In the thick of the competitive Dallas real estate market, a home warranty isn’t just another service contract—it’s a seriously powerful strategic tool. Whether you’re on the buying or selling side of the table, it can give you a distinct advantage during negotiations and, maybe more importantly, deliver some valuable peace of mind.

For anyone selling their home, offering a one-year home warranty can be a complete game-changer. It sweetens the deal, making your listing far more attractive to buyers who might be a little nervous about the older systems in established Dallas neighborhoods like Kessler Park or Lakewood.

This simple addition builds a ton of confidence. It shows you’re being transparent and that you stand behind the home’s condition. It also acts as a protective shield for you, the seller, against any post-sale drama if a major appliance decides to give up the ghost right after closing.

A Seller’s Marketing Edge

In a market where every listing is fighting for eyeballs, a home warranty can be what sets your property apart. It directly addresses one of the biggest fears every buyer has: the dread of inheriting expensive, unforeseen problems.

- Reduces Buyer Hesitation: It smooths over concerns about the age of the HVAC unit or the water heater, making buyers feel much more comfortable putting in a strong offer.

- Provides a Competitive Advantage: When buyers are weighing two similar Dallas properties, the one that comes with a warranty often has a clear edge.

- Minimizes Post-Sale Friction: It creates a clean break. The new owner is directed to the warranty company for covered issues, not back to you.

The market for these protection plans is growing, underscoring how valuable these plans are becoming as homes get packed with more complex systems that owners want to protect.

A Buyer’s Financial Safety Net

For anyone buying a home in Dallas, a warranty is an essential financial buffer. After you’ve scraped together the down payment and paid all the closing costs, the very last thing you want is a surprise $4,000 bill for a new air conditioner. A home warranty can turn that potential budget disaster into a predictable, manageable service fee.

For a buyer, a home warranty isn’t just about repairs; it’s about financial stability in that critical first year of homeownership. It ensures the excitement of a new home isn’t crushed by the stress of an immediate, costly breakdown.

This protection lets you move in with confidence, knowing you have a plan in place for those unexpected “what if” moments. It’s a critical piece of any smart buying strategy, which you can dive into deeper in our comprehensive Dallas home buying guide.

Is a Home Warranty a Smart Move for Your Dallas Home?

Figuring out if a home warranty is right for you isn’t a simple “yes” or “no.” It’s a practical call that hinges on your specific situation, your Dallas property, and what lets you sleep at night financially. The real value of a home warranty isn’t one-size-fits-all; it shifts from one homeowner to the next.

For some, it’s an absolute financial lifesaver. For others, maybe not so much. The key is to take a hard look at your circumstances and see which side of the fence you land on.

When a Warranty Offers Maximum Value

In some cases, a home warranty just makes sense. If you find yourself nodding along to any of these scenarios, the annual premium and service fees are likely a smart investment in your financial peace of mind.

These are the high-value situations for Dallas homeowners:

- You Own an Older Home: Think about those character-filled homes in established neighborhoods like Oak Cliff or the M Streets. Their systems might be chugging along just fine, but they’re not getting any younger. A warranty acts as a crucial safety net for when that aging HVAC unit or water heater finally decides to retire.

- You’re a First-Time Homebuyer: After pulling together a down payment and covering closing costs, most new buyers are running on fumes financially. A warranty is what keeps a sudden, thousand-dollar repair from completely wrecking your budget in that critical first year.

- You Manage Rental Properties: Landlords juggling one or more Dallas properties know the headache of unexpected repairs. A warranty simplifies everything. It gives you one number to call and predictable costs, taking the scramble to find a reliable contractor for a tenant’s broken appliance off your plate.

At its core, a home warranty is a risk management tool. It lets you swap an unknown, potentially huge repair bill for a predictable and manageable annual cost.

When It Might Be Less Essential

On the flip side, there are times when a home warranty might be overkill or just not offer much bang for your buck. It’s just as important to recognize when you’re already covered or when the odds of a major system failure are pretty low.

For example, if you just closed on a brand-new build in a booming Dallas suburb like Frisco or McKinney, your home is almost certainly protected by a builder’s warranty. This initial warranty usually covers workmanship, major systems, and structural elements for a while, making a separate home warranty redundant right out of the gate.

Likewise, if you’re a seasoned DIYer with a healthy emergency fund, you might be comfortable self-insuring. By putting aside the money you would’ve spent on the premium, you can handle repairs on your own terms, giving you total control over the contractor and the fix. By weighing these factors—your home’s age, what coverage you already have, and your personal tolerance for risk—you can make a decision that feels right for you.

Frequently Asked Questions About Dallas Home Warranties

Home warranties can seem a bit murky, especially if you’re new to the Dallas real estate scene. Let’s clear up some of the most common questions we get from local buyers and sellers. Think of this as your quick-start guide to understanding what a home warranty really means for you.

Can I Choose My Own Repair Technician in Dallas?

This is a big one, and the short answer is usually no. Home warranty companies have their own network of vetted, pre-approved contractors they work with across the Dallas area. This is how they control costs and maintain a consistent standard of service.

But there’s a huge upside here. When your oven dies right before a gathering, the last thing you want to do is scramble to find a reliable repair person who can show up quickly. The warranty company takes that entire headache off your plate—they handle the vetting, the call, and the dispatch. That peace of mind is invaluable during a stressful breakdown.

Does a Home Warranty Cover My Air Conditioner?

Absolutely—and for good reason. In Dallas, reliable HVAC coverage is often the number one motivation for getting a home warranty in the first place. When the summer heat hits triple digits, a working air conditioner isn’t just a comfort, it’s a necessity.

Most standard policies are designed to cover the repair or replacement of your central AC unit when it fails from normal wear and tear. Just be sure to read the fine print in your specific contract. Look for any potential limitations based on the unit’s age, maintenance records, or pre-existing conditions.

For many Dallas homeowners, the potential cost of a single emergency AC repair during a heatwave can easily exceed the entire annual premium of a home warranty. It’s a critical financial shield against the Texas summer.

Is a Home Warranty Required to Buy a Home in Dallas?

No, you are not legally required to have a home warranty to buy or sell a house in Dallas. It is, however, an extremely common and powerful negotiating tool in real estate transactions here.

It’s a smart move for sellers to offer a one-year warranty. It makes their property stand out and gives potential buyers an extra dose of confidence. Likewise, buyers often ask for a warranty to be included in the deal, especially if they’re looking at an older home where the major systems might be approaching their golden years. It’s a simple way to create peace of mind for everyone at the closing table.

Navigating the Dallas real estate market requires local expertise and strategic planning. Dustin Pitts REALTOR Dallas Real Estate Agent provides the guidance you need to make informed decisions, whether you’re buying, selling, or relocating. Explore your options at https://dustinpitts.com and gain a competitive edge.