Navigating the Dallas real estate market requires a sharp strategy, and it all starts with securing the right financing. Choosing a mortgage lender is one of the most critical decisions in the home-buying process, directly impacting your interest rate, closing costs, and overall experience. This guide cuts through the noise, offering a detailed look at the best mortgage lenders in Dallas, Texas. We’ll explore a mix of local powerhouses, innovative online platforms, and specialized programs to help you identify the ideal financial partner for your property goals in dynamic Dallas neighborhoods, from Preston Hollow to East Dallas.

This is not a list of vague recommendations. We provide a comprehensive roundup of the top platforms and direct lenders, each with a detailed breakdown of its strengths, potential drawbacks, and ideal customer profile. You will find actionable insights into their specialties, whether you’re a first-time buyer needing down payment assistance or a professional securing a jumbo loan for a luxury property.

Each profile includes direct links to their websites, allowing you to start your research immediately. Our goal is to equip you with the specific information needed to compare rates, understand loan products, and confidently select a financial partner. This resource simplifies the complex task of finding the right mortgage, enabling you to focus on securing your next Dallas property.

1. Zillow – Mortgage Lender Marketplace and Directory

Zillow’s primary strength isn’t being a direct lender but rather a powerful marketplace and directory. For anyone starting their search for the best mortgage lenders in Dallas, Texas, it serves as an excellent initial research tool. Instead of cold-calling banks, you can use its platform to get a broad overview of the Dallas-area lending landscape from one central hub.

The user experience is straightforward. You input details about your desired property in Dallas, your financial situation, and your credit profile. Zillow then presents a list of lenders willing to work with your scenario, complete with estimated rates and APRs. This feature is particularly useful for homebuyers in competitive Dallas neighborhoods like Uptown or Preston Hollow, where securing pre-approval quickly is a significant advantage.

Why It Stands Out

What makes Zillow unique is its transparency and breadth. Each lender profile in its directory includes crucial information like their NMLS number, physical address (if local to Dallas), and, most importantly, unfiltered customer reviews. This allows you to vet potential lenders before ever speaking to them. You can filter specifically for lenders based in the DFW area, ensuring you connect with professionals who understand the nuances of the local market.

Pro Tip: Don’t just look at the star rating. Read the detailed reviews on Zillow to understand a loan officer’s communication style, responsiveness, and ability to handle complex transactions, which is common in the Dallas luxury market.

How to Use It Effectively

- Compare Anonymously: Use the marketplace to compare initial rate quotes without having to provide your contact information to multiple lenders at once.

- Verify Credentials: Before committing, use the provided NMLS number to look up a lender’s history and licensing status on the official NMLS Consumer Access website.

- Understand the Model: Remember that lenders pay to be featured on Zillow’s platform. While it’s a great starting point, consider it a discovery tool rather than a definitive list of the absolute best options.

| Feature | Description |

|---|---|

| Access | Free for consumers to use and browse. |

| Lender Type | Marketplace featuring both national banks and local Dallas brokers. |

| Key Benefit | Quickly compare multiple lender quotes and reviews in one place. |

| Potential Drawback | Your information may be shared with lenders, leading to follow-up calls. |

Zillow is an indispensable first step for Dallas homebuyers who want to efficiently survey their options and gather competitive intelligence before committing to a lender.

Website: https://www.zillow.com/mortgages/

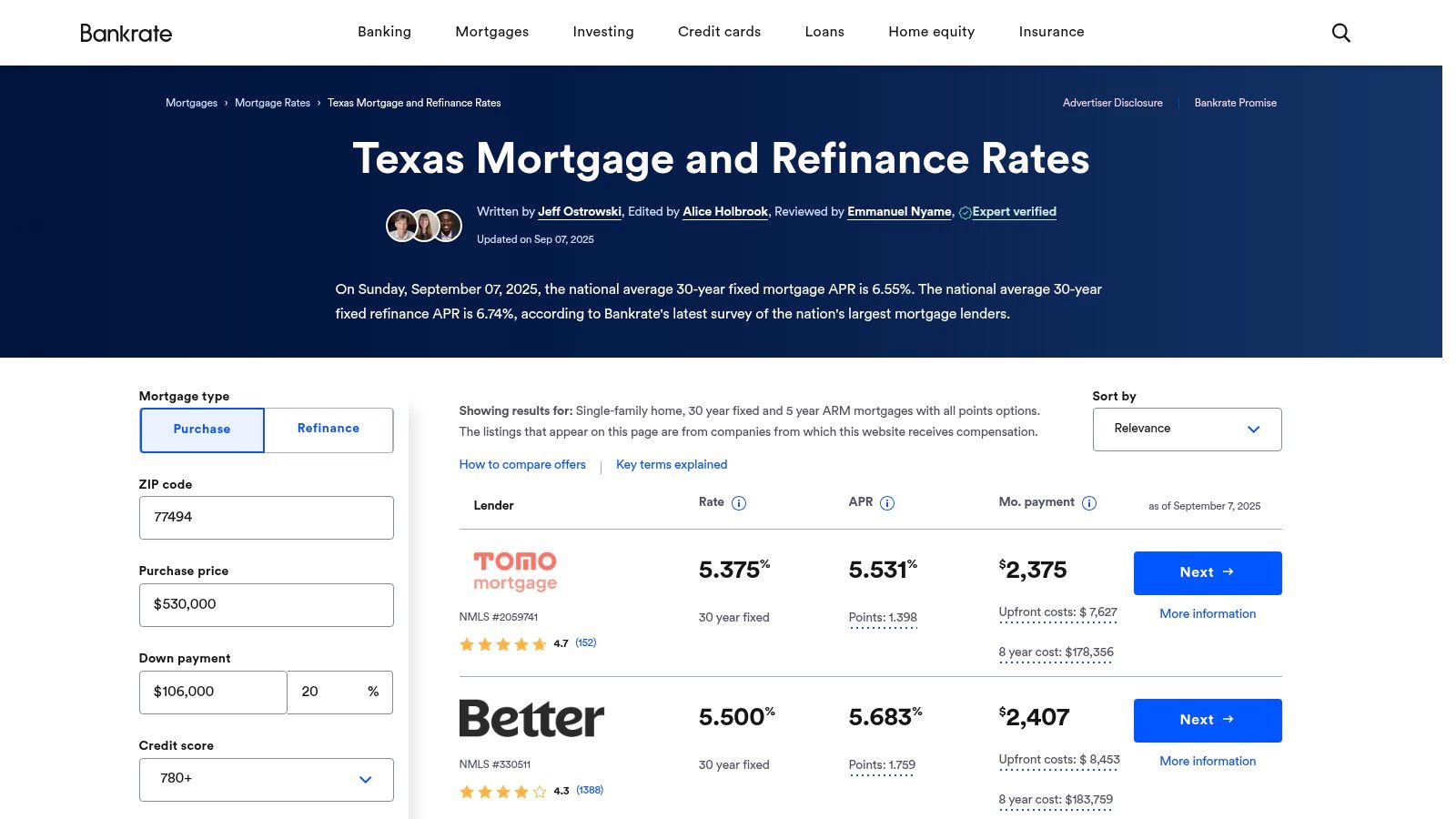

2. Bankrate – Texas Mortgage Rates and Lender Comparison

Bankrate operates as a powerful financial research and comparison tool, offering valuable insights for anyone seeking the best mortgage lenders in Dallas, Texas. It provides a high-level view of current, state-specific mortgage rates, which serves as an essential benchmark before you start engaging directly with loan officers. For Dallas homebuyers, this means you can gauge the market climate and understand what a competitive rate looks like before ever filling out an application.

The platform excels at distilling complex financial information into easy-to-understand formats. You can quickly view average rates for 30-year fixed, 15-year fixed, and 5/1 ARM loans specifically for Texas. This data is invaluable for buyers analyzing their potential monthly payments for properties in desirable Dallas areas, from the Arts District to Highland Park.

Why It Stands Out

What sets Bankrate apart is its strong editorial curation combined with real-time rate data. Beyond just a list of lenders, Bankrate provides curated “Best Of” lists that detail each lender’s specialties, such as loan types offered and minimum credit score requirements. This is particularly useful for Dallas-based professionals who may need specific loan products like jumbo loans for luxury properties.

The platform’s guides are another key differentiator. They offer practical advice on navigating the mortgage process, comparing different types of home loans, and understanding special programs that could be beneficial. For those new to the competitive Dallas market, these resources can demystify the process significantly. Learn more about the different home loans available in Dallas to see which might fit your situation.

Pro Tip: Use Bankrate’s “mortgage points” and “closing costs” calculators to get a more realistic picture of your upfront expenses. A low interest rate is attractive, but high closing costs in Dallas can significantly impact your total cash-to-close.

How to Use It Effectively

- Establish a Baseline: Check Bankrate’s Texas mortgage rates page to get a daily snapshot of the market. This gives you a strong negotiating position when you speak with lenders.

- Research Lender Profiles: Dive into their reviews and rankings. Look for lenders who have a strong presence in Texas and positive feedback on handling complex DFW-area transactions.

- Filter by Need: Use their tools to filter for lenders based on your specific requirements, such as a lower down payment option or a jumbo loan for a high-value Dallas property.

| Feature | Description |

|---|---|

| Access | Free for consumers to browse rates and read guides. |

| Lender Type | A mix of national banks, online lenders, and credit unions. |

| Key Benefit | Strong editorial reviews and real-time Texas rate snapshots for benchmarking. |

| Potential Drawback | Published rates are averages; your actual quote will depend on your financial profile. |

Bankrate is an essential resource for Dallas homebuyers who want to educate themselves on market conditions and vet potential lenders based on expert analysis before diving into the application process.

Website: https://www.bankrate.com/mortgages/mortgage-rates/texas/

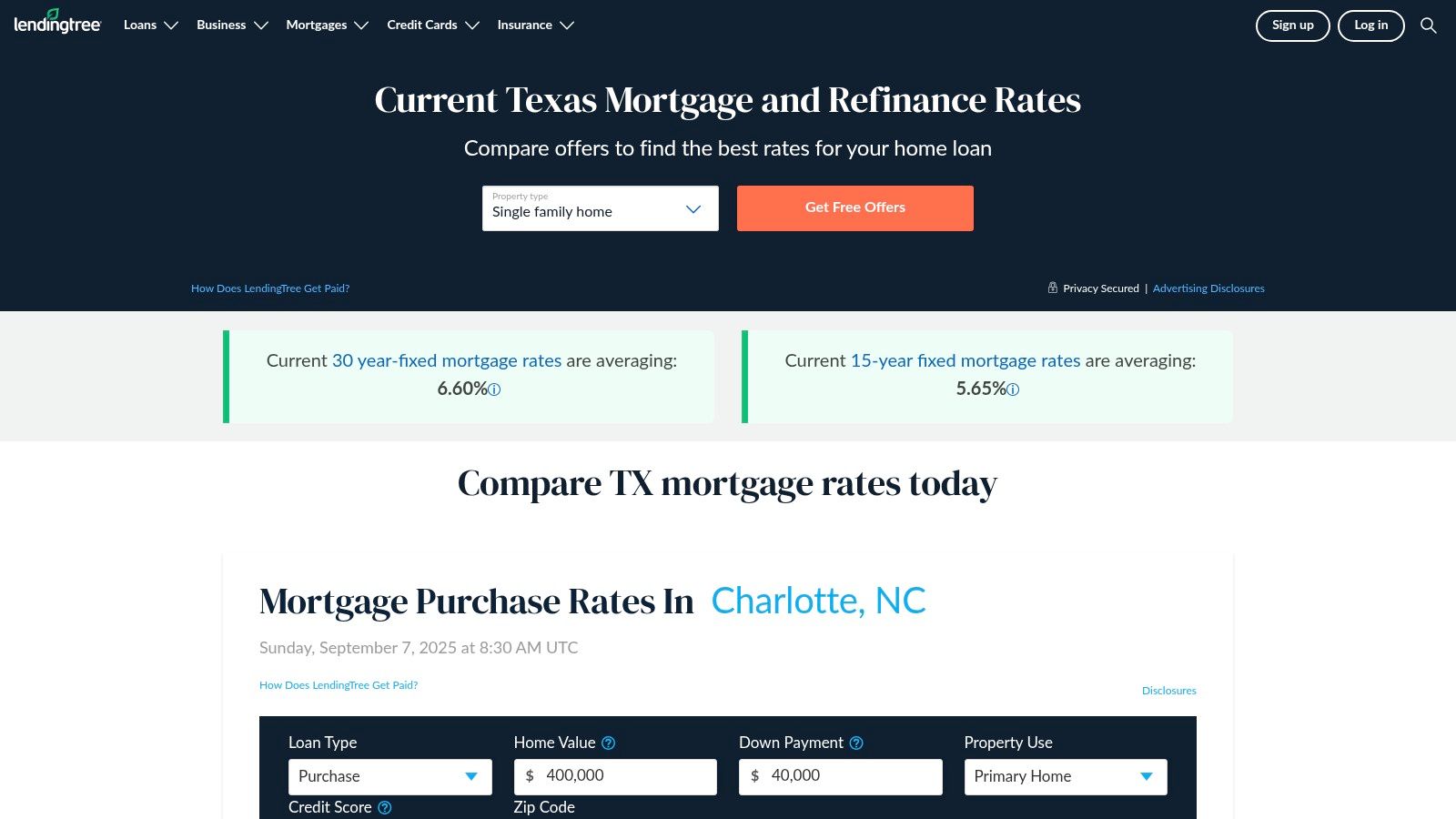

3. LendingTree – Multi‑Lender Quotes (Dallas coverage)

LendingTree operates as a massive online loan marketplace, making it a powerhouse for comparison shopping when seeking the best mortgage lenders in Dallas, Texas. Instead of applying to individual banks or credit unions one by one, you submit a single, secure form. The platform then matches you with multiple lenders from its network who are ready to offer you a mortgage for a property in the Dallas area.

This process can save a significant amount of time, a critical factor in Dallas’s fast-moving real estate market, from the Arts District to the suburbs of Plano. Receiving several quotes quickly empowers you to negotiate from a position of strength, armed with real data on prevailing rates and fees.

Why It Stands Out

The primary advantage of LendingTree is the competitive environment it creates. When lenders know they are competing for your business, they are more likely to offer their most attractive terms. This pits national giants against regional players who serve the DFW metroplex, all vying to fund your purchase. The platform also provides valuable educational resources, including a dedicated Texas mortgage rates page that covers topics like local down payment assistance programs.

The “myLendingTree” app offers an additional layer of control, allowing you to manage your matches and financial profile directly. This is especially useful for understanding the mortgage pre-approval requirements before you even start the process.

Pro Tip: When you receive offers, create a simple spreadsheet to compare not just the interest rate but also the APR, lender fees, closing costs, and any potential points. A lower rate from one lender might be offset by higher fees, making another offer a better deal overall.

How to Use It Effectively

- Be Ready for Contact: Once you submit your form, matched lenders will reach out quickly. Have your basic financial documents and questions ready to make these conversations productive.

- Leverage the Quotes: Use the Loan Estimates you receive from LendingTree as leverage when speaking with other lenders, including local Dallas-based institutions that may not be on the platform.

- Check Local Options: Remember that not every great Dallas lender participates in the marketplace. Use LendingTree as a powerful tool to set a competitive baseline, but don’t let it be your only source of quotes.

| Feature | Description |

|---|---|

| Access | Free for consumers; requires submitting a loan request form. |

| Lender Type | Marketplace featuring a wide network of national and regional lenders. |

| Key Benefit | Fosters direct lender competition, leading to potentially lower rates and fees. |

| Potential Drawback | Your contact information is shared, resulting in multiple calls and emails. |

For the Dallas homebuyer focused on securing the most competitive rate through comparison, LendingTree is an incredibly efficient and powerful platform to have in your toolkit.

Website: https://www.lendingtree.com/home/mortgage/rates/texas/

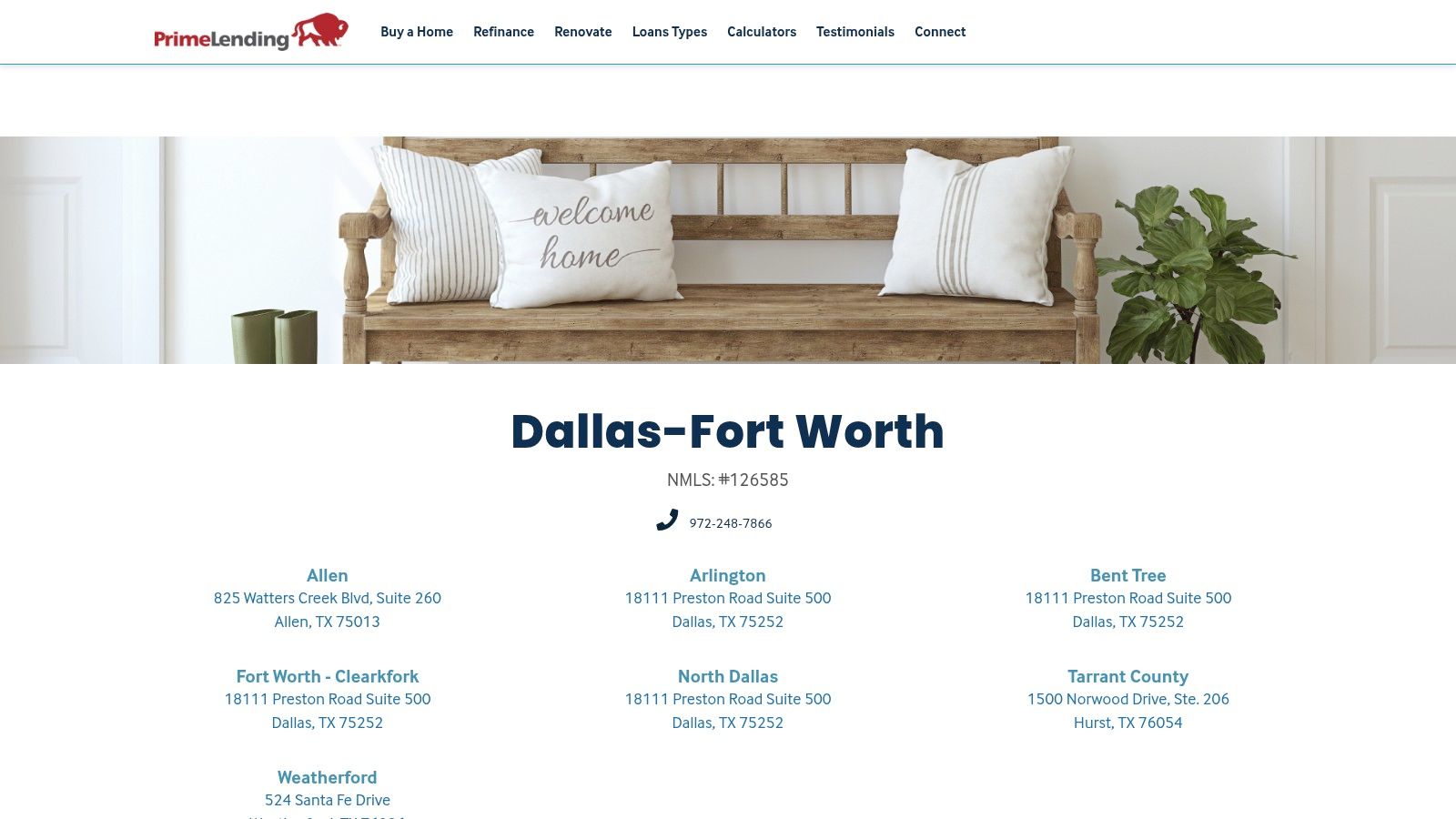

4. PrimeLending (A PlainsCapital Company) – Dallas/Fort Worth Branch Network

As a Dallas-headquartered national lender, PrimeLending offers a powerful combination of robust local presence and extensive lending capabilities. For individuals seeking one of the best mortgage lenders in Dallas, Texas, this institution provides the stability of a large company with the on-the-ground expertise of local loan officers who understand the DFW market intimately. Their dedicated Dallas-Fort Worth page serves as a direct portal to their local teams and services.

This hybrid model is particularly advantageous for homebuyers navigating Dallas’s diverse real estate scene, from a first-time purchase in Richardson to securing a jumbo loan for a home in Highland Park. The process begins with a modern digital application, but it is supported by a network of accessible, local professionals who can provide personalized guidance, a significant comfort in a complex transaction.

Why It Stands Out

PrimeLending’s deep Dallas roots are its key differentiator. With its corporate headquarters in North Dallas and a major production hub in Plano, the company is deeply invested in the local community. This translates to an intrinsic understanding of regional appraisal challenges, property types, and market velocity. Their vast menu of over 400 loan products ensures they have a solution for nearly every scenario, including specialized renovation loans for updating older homes in neighborhoods like Lakewood.

Pro Tip: When working with PrimeLending in Dallas, ask your loan officer about their experience with properties similar to the one you’re targeting. An officer who has closed multiple deals in your desired zip code will be better equipped to anticipate and resolve local-specific hurdles.

How to Use It Effectively

- Connect Locally: Use their DFW-specific website to find a loan officer based in an office near you. A local connection can make the document submission and closing process smoother.

- Explore Niche Products: If you need a jumbo loan or are considering a renovation project, leverage their extensive product catalog. Discuss these specific needs early to ensure you are matched with a specialist.

- Request a Second Opinion: Given their competitive position in Dallas, use PrimeLending to get a comparative Loan Estimate, even if you’ve already started an application with another lender.

| Feature | Description |

|---|---|

| Access | Free to apply online; branch appointments are available. |

| Lender Type | Direct lender with a national presence and strong local DFW branches. |

| Key Benefit | Combines a streamlined digital platform with personalized local expert support. |

| Potential Drawback | The experience can vary between different loan officers and branch teams. |

For Dallas homebuyers who value both digital convenience and the assurance of a local, physical presence, PrimeLending presents a well-balanced and compelling option.

Website: https://lo.primelending.com/dfw/

5. Supreme Lending – Dallas Specialty Team

As a Dallas-headquartered direct lender, Supreme Lending offers a distinct advantage for local homebuyers: deep institutional knowledge of the DFW real estate market. Their platform is geared toward individuals who value a direct relationship with a local team, offering a streamlined process from application to closing, which is particularly beneficial in fast-moving Dallas neighborhoods like Bishop Arts or the M-Streets.

The website provides clear pathways to connect with a loan officer, either through direct phone support or an online inquiry form. This immediate access to local expertise makes them a strong contender for anyone seeking one of the best mortgage lenders in Dallas, Texas, especially those who prefer personalized service over a digital-only experience. They also feature a wide array of loan products, from conventional and FHA to jumbo loans for high-value properties in areas like Highland Park.

Why It Stands Out

Supreme Lending’s primary differentiator is its commitment to speed and local processing. Their marketing heavily emphasizes a quick closing timeline, often touting a “Close in 20 days” goal. While not a guarantee, this focus on efficiency is a significant asset in Dallas’s competitive housing market, where delays can jeopardize a purchase contract. Their “Lock & Look” program is another unique offering, allowing pre-approved buyers to lock in an interest rate while they shop for a property.

Pro Tip: When discussing a fast closing with a Supreme Lending loan officer, ask for specific details on their underwriting process. Inquire if they have in-house underwriters and what documentation you can provide upfront to expedite the timeline for your Dallas property purchase.

How to Use It Effectively

- Leverage Local Teams: Use the website to find a Dallas-based loan officer. A local professional will have established relationships with Dallas-area real estate agents and title companies, which can smooth out the closing process.

- Explore Niche Programs: If you are considering a property outside city limits in areas like Collin or Denton County, ask about their USDA loan options. For high-cost homes, dive into the specifics of their jumbo loan requirements.

- Compare Loan Estimates: While their speed is appealing, ensure you get a standardized Loan Estimate (LE) from them and at least one other lender. This allows you to make an apples-to-apples comparison of interest rates, APRs, and closing costs.

| Feature | Description |

|---|---|

| Access | Free to apply online or connect with a local loan officer. |

| Lender Type | Direct Lender with a strong Dallas, Texas headquarters. |

| Key Benefit | Focus on fast closings and a wide range of loan products. |

| Potential Drawback | The “Close in 20 days” claim is a goal, not a guarantee; timelines vary. |

Supreme Lending is an excellent choice for Dallas homebuyers who prioritize a fast, locally-managed mortgage process and want access to a diverse portfolio of loan options.

Website: https://supremelendingdallas.com/

6. TexasLending.com – Dallas‑Based Direct Lender

As a Dallas-headquartered direct lender, TexasLending.com offers an authentic local experience that many national chains cannot replicate. Their deep understanding of Texas real estate regulations, title processes, and closing customs makes them a strong contender for anyone seeking one of the best mortgage lenders in Dallas, Texas. The platform combines a convenient online application with direct phone support from Dallas-based loan officers.

This model is particularly beneficial for homebuyers in fast-moving Dallas neighborhoods like the Bishop Arts District or Richardson, where having a lender familiar with local nuances can prevent closing delays. Their large volume of business across the state has resulted in a significant footprint of customer reviews, providing a wealth of information for prospective borrowers.

Why It Stands Out

TexasLending.com’s primary advantage is its identity as a true Texas-based, consumer-direct lender. Unlike marketplaces that connect you with third parties, you work directly with them from application to closing. This streamlined, single-point-of-contact approach can simplify the mortgage process significantly. Their team’s expertise in the DFW market means they are well-versed in handling transactions specific to North Texas properties, from suburban homes in Plano to high-rise condos in Victory Park.

Pro Tip: While their online tools are efficient, don’t hesitate to call your assigned loan officer directly. A Dallas-based expert can provide valuable insights on local appraisal trends and closing timelines that a national call center might miss.

How to Use It Effectively

- Start Online, Finish Local: Begin your application on their website to get the process moving, but follow up with a phone call to establish a personal connection with your loan officer.

- Explore Their Blog: The platform features an educational blog with content specifically aimed at Texas homebuyers, covering topics from first-time purchases to refinancing strategies.

- Request a Closing Cost Estimate: Since they are a direct lender, ask for a detailed Loan Estimate early in the process to clearly understand all associated fees for your Dallas property purchase.

| Feature | Description |

|---|---|

| Access | Free to apply online or via phone. |

| Lender Type | Dallas-based direct-to-consumer lender. |

| Key Benefit | Deep knowledge of Texas closing practices and a streamlined process. |

| Potential Drawback | The experience can be highly dependent on the assigned loan officer. |

For Dallas homebuyers who value local expertise and a direct lending relationship, TexasLending.com provides a focused and knowledgeable option rooted right in the DFW metroplex.

Website: https://www.texaslending.com/

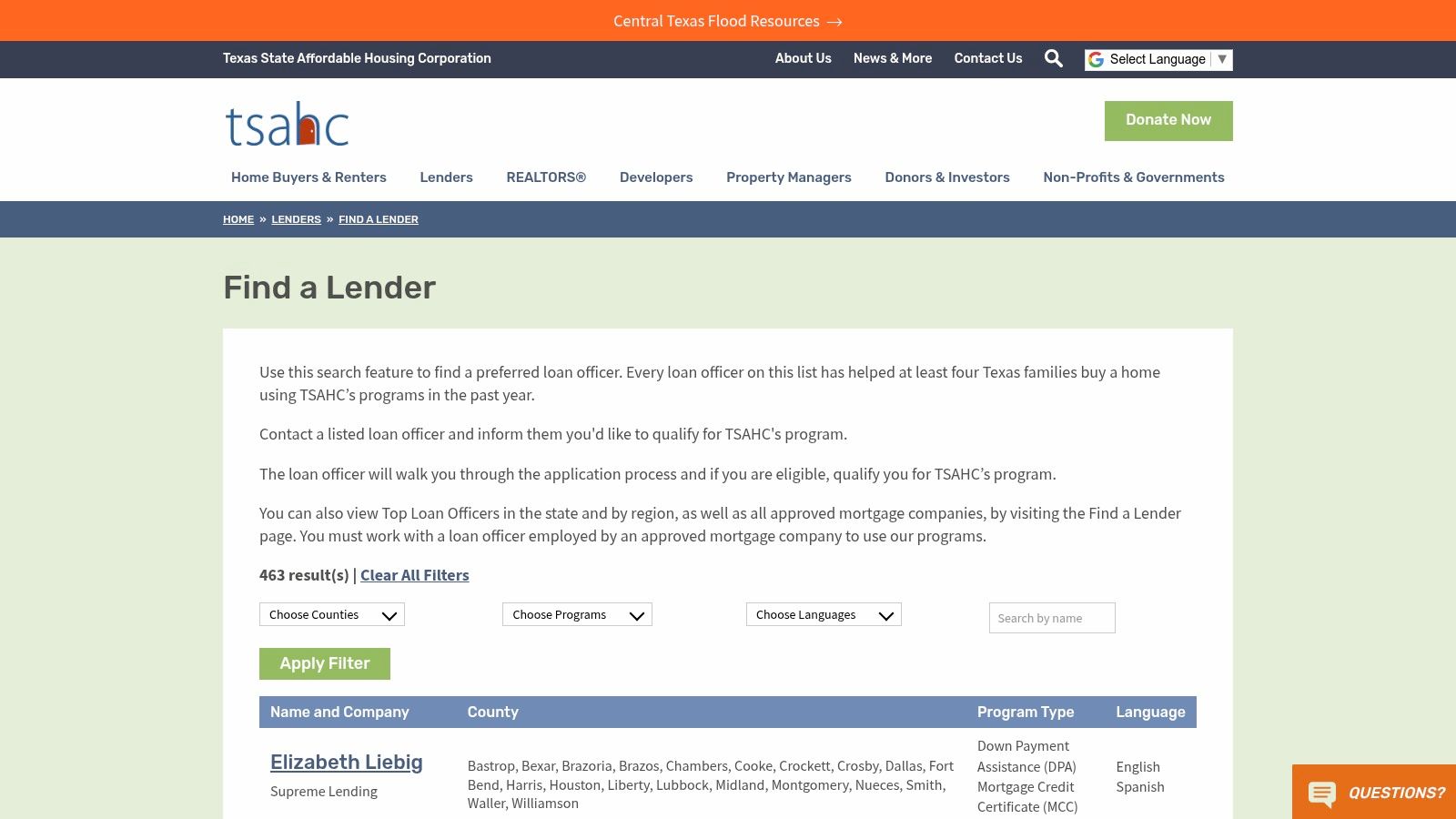

7. Texas State Affordable Housing Corporation (TSAHC) – Find a Dallas‑Area Approved Lender with Down Payment Help

The Texas State Affordable Housing Corporation (TSAHC) is not a direct lender but a vital resource for Dallas homebuyers seeking financial assistance. It’s a statewide nonprofit that provides down payment assistance grants and Mortgage Credit Certificates (MCCs). Its website features a powerful directory designed to connect you with Dallas mortgage lenders specifically approved and trained to handle these valuable programs.

For first-time or moderate-income buyers in Dallas County, navigating affordability challenges can be daunting. TSAHC’s lender search tool simplifies this process by providing a curated list of loan officers who are experts in these assistance programs. This ensures you partner with a professional who knows the specific requirements and can seamlessly integrate these benefits into your loan, whether it’s an FHA, VA, USDA, or conventional mortgage.

Why It Stands Out

TSAHC’s value lies in its specialization and vetting process. Unlike a general search, every lender in its directory is guaranteed to be experienced with Texas-specific assistance programs. This eliminates the guesswork and potential for error that can happen with a loan officer unfamiliar with TSAHC’s guidelines. The platform even highlights top-performing loan officers in Dallas County, giving you a direct path to the most knowledgeable professionals for your situation. These programs can often be combined with loans that have flexible credit requirements, making homeownership more accessible.

Pro Tip: Before choosing a lender from the list, check if you meet the basic income and purchase price limits for TSAHC programs in Dallas County. This will save you time and ensure you are pursuing a viable path from the start.

How to Use It Effectively

- Filter by County: Use the search tool to specifically pull up the list of approved lenders and loan officers operating in Dallas County.

- Target Top Performers: Look for the “Top Performing Loan Officers” designation to connect with individuals who have a proven track record of successfully closing loans with TSAHC assistance.

- Prepare Your Questions: Ask potential lenders about their experience with combining down payment assistance with your desired loan type (e.g., conventional or FHA) to gauge their expertise.

| Feature | Description |

|---|---|

| Access | Free for consumers to search and find lenders. |

| Lender Type | Directory of approved mortgage companies and loan officers in Dallas. |

| Key Benefit | Connects buyers with lenders specializing in Texas down payment aid and MCCs. |

| Potential Drawback | Income and purchase price limits apply to qualify for the programs. |

TSAHC is an essential tool for Dallas homebuyers who want to leverage state-sponsored assistance to make their home purchase more affordable, connecting them directly with the right experts for the job.

Website: https://www.tsahc.org/lenders/find-a-lender

Top 7 Dallas Mortgage Lenders Comparison

| Provider | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Zillow – Mortgage Lender Marketplace and Directory | Moderate: User questionnaire + profile browsing | Low: User submits info, lenders pay for leads | Good lender matching with reviews & licensing transparency | Users wanting quick lender comparisons in Dallas area | Free, transparent lender info, local & national lender mix |

| Bankrate – Texas Mortgage Rates and Lender Comparison | Low: Rate snapshots & editorial content | Low: Informational resource, no user data needed | Informative comparison of lender rates and programs | Rate benchmarking & learning about loan types/programs | Strong editorial standards, Texas-specific rate data |

| LendingTree – Multi‑Lender Quotes (Dallas coverage) | Moderate: Single submission with multiple lender matches | Moderate: Soft credit pull, multiple lender responses | Multiple competitive mortgage offers from different lenders | Users seeking fast, broad lender quotes in Dallas | Wide lender network, competitive pricing, app-based options |

| PrimeLending (A PlainsCapital Company) – DFW Branch Network | High: Digital applications + local branch support | High: Extensive product menu, loan officer involvement | Comprehensive loan options with local branch assistance | Buyers who want local service with diverse loan products | Strong local presence, 400+ loan products, digital process |

| Supreme Lending – Dallas Specialty Team | Moderate: Online inquiry + phone support | Moderate: Local branches with specialized programs | Fast closing focus with broad loan options | Buyers prioritizing quick closings and local support | Dedicated Dallas team, special programs like “Lock & Look” |

| TexasLending.com – Dallas‑Based Direct Lender | Moderate: Online application + phone support | Moderate: Consumer-direct, limited branches | Streamlined experience for TX home loans | Users wanting direct lender with Texas market familiarity | Large volume direct lender, strong regional support |

| Texas State Affordable Housing Corporation (TSAHC) | Low: Directory search + program info | Low: Nonprofit-supported, no direct lending | Access to down payment assistance and approved lenders | First-time/moderate-income buyers seeking assistance | Access to vetted lenders for assistance programs, nonprofit |

Making Your Final Choice and Moving Forward in Dallas

Navigating the Dallas real estate market requires a strategic approach, and securing the right mortgage is the cornerstone of a successful purchase. We’ve explored a diverse range of options, from the broad comparison power of online marketplaces like Zillow and LendingTree to the localized, hands-on service offered by Dallas-based institutions such as PrimeLending and Supreme Lending. Each tool and lender presents a unique value proposition tailored to different buyer needs.

The key takeaway is that there isn’t a single “best” option for everyone. The ideal choice depends entirely on your specific circumstances. A first-time homebuyer might find the down payment assistance programs accessed through TSAHC-approved lenders invaluable, while a seasoned investor might prioritize the speed and competitive rates found on a platform like Bankrate. Your financial profile, property type, and desire for digital convenience versus personal interaction will guide your decision.

Actionable Steps to Secure Your Dallas Mortgage

To transition from research to action, a methodical approach is essential. The goal is not just to find a lender but to find a financial partner who aligns with your goals in the competitive Dallas market.

- Select Your Top Contenders: Choose two to three lenders from this list that resonate with your situation. A strong strategy is to pick a mix: perhaps one national online platform for a broad rate comparison, one local direct lender like TexasLending.com for market-specific knowledge, and a third recommended by your real estate agent.

- Get Pre-Approved, Not Just Pre-Qualified: A pre-approval involves a detailed review of your financial documentation and carries significantly more weight than a pre-qualification. Submitting applications to your selected lenders will provide you with concrete offers and empower your negotiation position when you find the right property.

- Compare Official Loan Estimates: Once you receive pre-approvals, you will get official Loan Estimate documents from each lender. This is where you can make a true apples-to-apples comparison. Look beyond the interest rate and scrutinize the Annual Percentage Rate (APR), which includes fees. Pay close attention to origination fees, discount points, and other lender-specific charges listed in Section A of the estimate. A lower interest rate doesn’t always mean a cheaper loan if the fees are high.

Finalizing Your Decision and Preparing for What’s Next

Choosing from the best mortgage lenders in Dallas, Texas, is about finding the perfect synthesis of competitive terms, reliable service, and a seamless process. By comparing official Loan Estimates, you move beyond marketing claims and into tangible numbers, ensuring you secure the most advantageous financing for your new Dallas home.

Once your financial partner is secured and your home loan is approved, the final logistics of your move come into focus. Navigating this next phase can be made significantly smoother with an ultimate moving checklist template to ensure a seamless transition into your new residence. Having a strong financial foundation and a clear plan for the move itself sets you up for success. This preparation transforms a potentially stressful process into an exciting and well-managed journey toward homeownership in one of Texas’s most dynamic cities.

Navigating the Dallas real estate landscape requires more than just a great loan; it demands expert local guidance. For unparalleled market insights and strategic support in finding your ideal property and coordinating with the best mortgage lenders in Dallas, Texas, connect with Dustin Pitts REALTOR Dallas Real Estate Agent. Let a seasoned professional guide you through every step of your home buying journey.