When you start looking for your first home in Dallas, you’ll hear a lot about credit scores. So, what’s the magic number? Generally, the first time homebuyer credit score requirements begin at a minimum of 580 for an FHA loan and 620 for a Conventional loan.

Think of those numbers as your ticket to get in the door. Hitting those minimums is the first step, but a higher score will almost always unlock better interest rates and more favorable terms, which can save you a ton of money in a competitive market like Dallas.

Your Credit Score: The Key to Your First Dallas Home

Imagine your credit score is like your financial handshake with a Dallas mortgage lender. It’s a simple three-digit number, usually between 300 and 850, that gives them a quick read on how reliable you are with money. A strong score tells them you manage debt well, while a lower score can signal a higher risk.

This one number plays an outsized role in your homebuying journey in Dallas. It doesn’t just determine whether you get approved; it directly impacts how much your mortgage will cost you over the next 15 or 30 years. There isn’t a single score that guarantees a loan, because the number you need really depends on the type of mortgage you’re aiming for.

Different Loans, Different Requirements

For first-time buyers in Dallas, most options fall into a few main categories, and each one has its own credit score expectations. Figuring out which loan fits your financial picture is a crucial first step.

- FHA Loans: These are government-backed loans that are often a fantastic starting point for people with less-than-perfect credit or a smaller down payment.

- Conventional Loans: This is the most common mortgage out there. Dallas lenders typically look for a stronger credit history for these.

- VA Loans: An incredible benefit for veterans and active-duty service members in Texas, these loans offer great terms and are often more flexible on credit scores.

The table below gives you a quick snapshot of the general minimum credit scores needed for the most common mortgages available to first-time buyers in Dallas.

Typical Credit Score Minimums for Dallas Home Loans

| Loan Type | Typical Minimum Score | Best For Buyers Who… |

|---|---|---|

| FHA Loan | 580+ | Have lower credit scores or need a smaller down payment. |

| Conventional Loan | 620+ | Have a solid credit history and a larger down payment. |

| VA Loan | No official minimum (lenders often set their own, around 620) | Are veterans, active-duty military, or eligible spouses. |

Remember, these are just starting points. The higher your score, the better your chances and the lower your interest rate will be.

It’s also worth noting that these standards aren’t set in stone. Lending criteria tightened significantly after the 2007 housing crisis, making a good credit score more important than ever. Being prepared is your best defense.

Your credit score is more than just a number—it’s a direct reflection of your financial habits. For Dallas lenders, it’s the primary tool they use to gauge your ability to handle a mortgage responsibly.

A strong credit score is vital, but it’s just one piece of the puzzle. For a more complete picture, check out these comprehensive financial tips for buying a home. Knowing where you stand financially helps you approach the Dallas real estate market with a clear, confident plan.

Choosing the Right Mortgage for Your Credit Profile

Okay, so you know your credit score. That’s step one. Now for the important part: matching that score to the right home loan. For a first-time homebuyer in Dallas, this decision is a big deal. It can completely change your buying power and what you’ll pay over the long haul, whether you’re looking in Bishop Arts or up in Lake Highlands.

It’s not just about getting a “yes” from a lender; it’s about finding the smartest financial path to homeownership.

Think of it this way: mortgage options are like different tools in a toolbox. An FHA loan is your trusty multi-tool—super versatile and great for a lot of situations, especially if your credit has a few dings. A Conventional loan, on the other hand, is more like a high-powered precision drill. It demands a bit more from you upfront, but if you qualify, its performance and efficiency are top-notch.

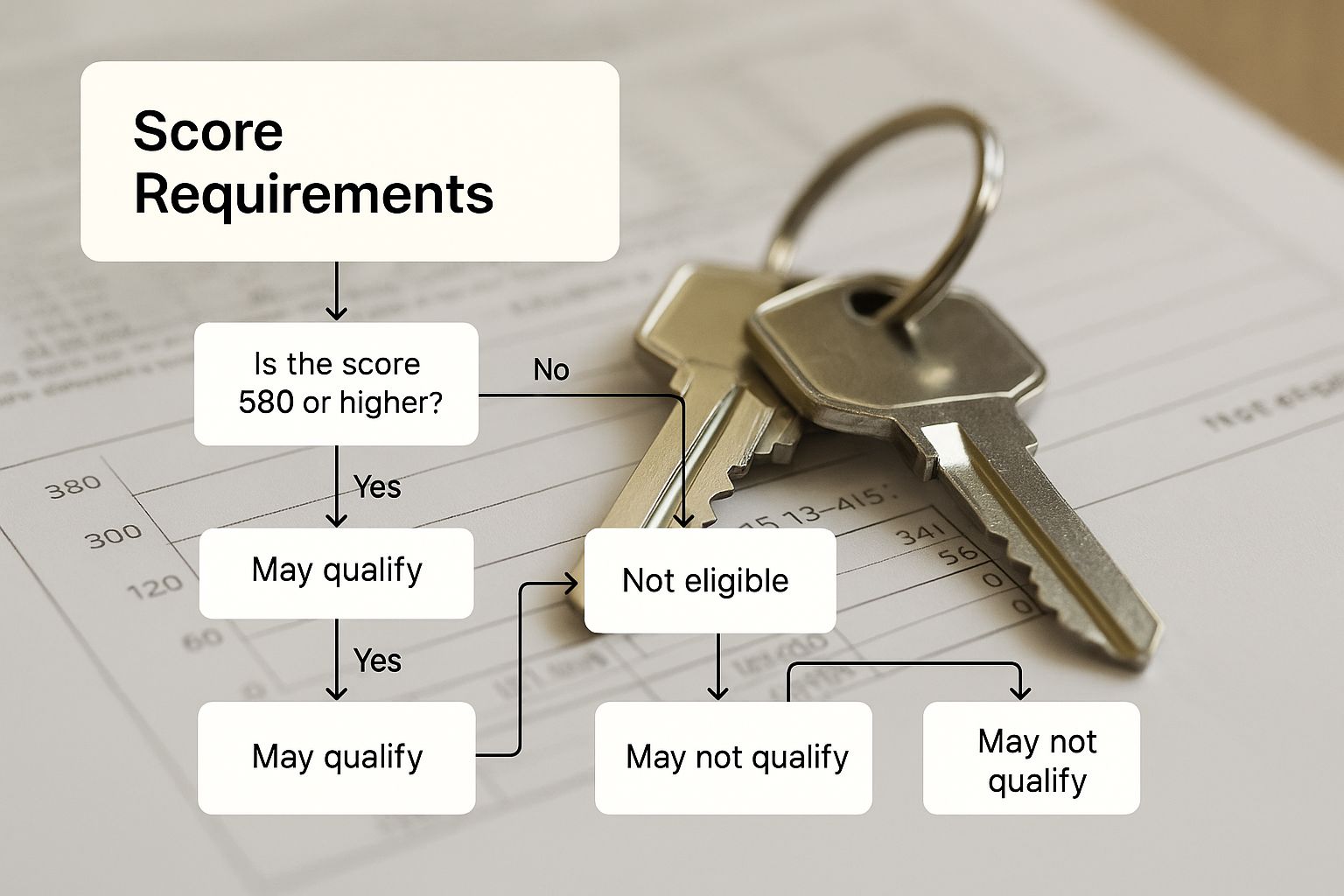

This handy guide gives you a quick visual on which path might be right for you based on your credit score.

As you can see, your credit score is really the fork in the road. It’s what will point you toward either a government-backed loan or a more traditional conventional mortgage.

FHA Loans: The Accessible Path

For a lot of first-time buyers in Dallas, an FHA loan is the perfect on-ramp to owning a home. These loans are backed by the Federal Housing Administration, and their entire purpose is to make homeownership more achievable. Their biggest selling point? The credit score requirements are much more forgiving.

You can often qualify for an FHA loan with a credit score as low as 580, and you’d only need a 3.5% down payment. This is a game-changer for people who are good with their money but just haven’t had the time to build a perfect, lengthy credit history.

The catch? There’s always a trade-off. FHA loans come with a Mortgage Insurance Premium (MIP). This is an insurance policy that protects the lender, not you, and for most FHA borrowers, it sticks around for the entire life of the loan. That means it’s a permanent extra cost baked into your monthly payment.

Conventional Loans: The Preferred Route for Strong Credit

Once your credit score hits 620 or higher, the world of Conventional loans opens up, and this is where things get interesting. These loans aren’t backed by the government, which means lenders in Dallas are going to look much more closely at your financial standing. The first time homebuyer credit score requirements are definitely stricter here.

But the reward for clearing that higher bar is huge. If you have a solid score and can put down 20%, you completely avoid paying for mortgage insurance. No PMI, period. Even if you put down less, the PMI on a Conventional loan is temporary; you can request to have it removed once you’ve built up enough equity in your home. That’s a massive difference from the FHA’s lifelong MIP and can save you thousands.

Choosing a mortgage is a balancing act between what you can get now and what’s cheapest in the long run. An FHA loan can get you the keys to a Dallas home faster, but a Conventional loan will almost always save you more money over the life of the mortgage if you qualify.

VA Loans: A Unique Benefit for Service Members

For our veterans, active-duty military, and eligible surviving spouses in the Dallas area, the VA loan is in a league of its own. Because the Department of Veterans Affairs guarantees a portion of the loan, lenders can offer terms you just won’t find anywhere else.

Believe it or not, VA loans have no official minimum credit score requirement, though most Dallas lenders will want to see a score somewhere around the 620 mark. Better yet, they typically require no down payment and have no monthly mortgage insurance. It’s easily one of the most affordable ways to buy a home and a fantastic, well-earned benefit for those who have served.

What Dallas Lenders See in Your Credit Score

When a lender in Dallas pulls your credit report, they aren’t just looking at a three-digit number. They’re reading your financial story. Think of it as a resume of your borrowing habits—every detail helps them figure out how you’d handle a mortgage payment on a new home in a neighborhood like Uptown or Lakewood.

Understanding what they’re looking for is a game-changer. It puts you in the driver’s seat. Your score isn’t just some random number; it’s a direct reflection of your financial decisions. Once you know what lenders are focusing on, you can start building a score that makes you look like a strong, low-risk applicant they’re eager to work with.

The Five Pillars of Your Credit Score

Your FICO score is built on five key factors, and each one carries a different level of importance. Dallas lenders dissect this breakdown to get a clear picture of your financial responsibility.

- Payment History (35%): This is the heavyweight champion of your credit score. It’s a straightforward log of whether you’ve paid your bills on time. A clean record of on-time payments tells lenders you’re reliable. Simple as that.

- Amounts Owed (30%): This piece looks at your total debt, but it’s really focused on your credit utilization ratio. That’s just a fancy term for how much of your available credit you’re currently using. The magic number? Lenders love to see you using less than 30% of your total limit.

- Length of Credit History (15%): Time is on your side here. A longer credit history gives lenders a bigger window into your financial behavior, which helps them feel more confident in your consistency.

- Credit Mix (10%): Lenders get a better sense of your financial savvy when they see you can successfully manage different kinds of debt—like credit cards, a car loan, and maybe a student loan.

- New Credit (10%): This factor tracks how often you’re applying for new credit. If you open a bunch of new accounts in a short time, it can look like a red flag and suggest you might be in a tight spot financially.

Why It Matters for Your Dallas Mortgage

Each of these pillars helps a lender build a profile of your creditworthiness. A spotless payment history is the best predictor that you’ll make your mortgage payments every month. Likewise, keeping your credit card balances low shows you aren’t stretched too thin and can comfortably take on a new house payment.

This is also why different loan programs have different rules. Some, like FHA loans, are known for being a bit more flexible with credit requirements. For a closer look, our guide on FHA loan requirements in Texas breaks down the specifics.

It’s important to know that lending standards aren’t static; they change with the economy. After the 2007-2008 financial crisis, for example, lenders tightened their requirements significantly. In fact, the median credit score for first-time homebuyers jumped 32 points between 2002 and 2018. You can explore more on this trend in first-time homebuyer data to see how things have evolved, especially in competitive markets like Dallas.

Ultimately, a strong credit score is your most powerful negotiating tool. It can lead to a lower interest rate, potentially saving you tens of thousands of dollars over the life of your loan on a Dallas property.

Getting Your Credit Score Mortgage-Ready

If your credit score isn’t quite where you want it to be for the Dallas housing market, don’t sweat it. Improving your score is completely achievable. Think of it like a financial fitness plan; with the right exercises, you can build the strength you need to meet the first-time homebuyer credit score requirements.

This isn’t about finding a magic bullet. It’s about making smart, strategic moves that prove to lenders you’re a responsible borrower. The ultimate goal is to craft a credit profile that makes you a top-tier applicant, whether you’re eyeing a home in Oak Cliff or Preston Hollow.

Let’s dive into the game plan.

Nail Your Payment History

The most important thing you can do—bar none—is to pay every bill on time. Your payment history is the biggest piece of your credit score puzzle, so being consistent here makes a huge difference, and fast. Even one late payment can cause a dip, so I always recommend setting up autopay for everything possible.

Have any accounts that are past due? Get them caught up right away. Lenders want to see a clean, recent track record. It shows them you’re responsible and that any past hiccups are truly in the past.

Tackle Your Credit Utilization

Next up: your credit card balances. Lenders pay very close attention to your credit utilization ratio, which is just a fancy term for how much credit you’re using compared to your total limit. Your mission is to get this number as low as you can.

A good rule of thumb is to keep your credit utilization below 30%. If you can knock it down below 10%, you’ll see an even bigger jump in your score. This signals to lenders that you aren’t living on credit and know how to manage your money well.

For instance, if you have a credit card with a $10,000 limit, you should aim to keep your balance under $3,000. Paying down cards with high balances is one of the quickest ways to give your score a boost before you apply for a mortgage.

Clean Up and Protect Your Credit Report

Mistakes on credit reports happen more often than people realize, and they can needlessly lower your score. You’re entitled to a free report from each of the three main bureaus—Equifax, Experian, and TransUnion—so pull them and go through them with a fine-tooth comb.

If you spot an account you don’t recognize or a payment that’s wrongly marked as late, dispute it immediately. Getting these errors fixed can give your score a nice, often immediate, lift. While you’re at it, be sure to avoid these common pre-application pitfalls:

- Don’t close old credit cards. The average age of your accounts helps your score. Closing an old card shortens your credit history and lowers your total available credit, which can actually increase your utilization ratio.

- Don’t open new credit lines. Applying for a new car loan or store credit card just before seeking a mortgage triggers a hard inquiry on your report. This can make you appear as a higher-risk borrower to mortgage lenders.

Getting ready for a mortgage is all about solid financial management. Creating a budget to see where your money is going is a fantastic start, and you can find some essential budgeting tips to get you on the right track. As you move forward, our https://dustinpitts.com/uncategorized/buying-a-new-house-checklist/ can be an invaluable guide to make sure you don’t miss a single step.

Buying a Dallas Home with a Less-Than-Perfect Credit Score

Seeing a credit score below 620 can feel like hitting a brick wall on your path to homeownership in Dallas. But it’s not always a dead end—think of it more like a detour that leads to some creative financing solutions.

For buyers with scores between 500 and 579, the FHA loan program can be a lifesaver, provided you can bring a larger down payment to the table, usually around 10%. This flexibility opens doors that might otherwise seem bolted shut.

Take a real-world example: A nurse I worked with was trying to buy a condo in East Dallas. Her score came in at 575, and she was ready to give up and wait another year. Instead, we highlighted her stable five-year work history at Dallas Medical Center and showed the lender six months of consistent savings. That was enough to get her FHA loan approved with a 10% down payment.

Your Best Bet: The FHA Loan

FHA loans are practically built for buyers who don’t have a perfect credit history. They are a bit more forgiving. With a score of 580 or higher, you might only need a 3.5% down payment. If your score drops below that, the requirement typically jumps to 10%.

Here’s why they work so well for many Dallas-area homebuyers:

- Lower Score Thresholds: Lenders can often work with scores as low as 500 if you have the higher down payment.

- Predictable Insurance: The mortgage insurance premiums are straightforward and based on your loan amount.

- Flexible DTI: They’re generally more lenient on your debt-to-income ratio compared to conventional loans.

Beyond the official FHA guidelines, Dallas lenders really value a steady income and a solid savings habit. These can make all the difference.

What Lenders Look for Beyond the Score

When your credit score is on the lower end, lenders look for other signs that you’re a reliable borrower. These are often called “compensating factors,” and they can truly save a deal.

Common ones include:

- A consistent employment history for at least two years.

- Enough cash in savings to cover six months of your new mortgage payments.

- A debt-to-income (DTI) ratio that’s safely under 43%.

“A solid job track and substantial savings can absolutely tip a borderline application into the approval pile. It shows stability that a three-digit number can’t always capture.” – A Dallas Mortgage Specialist

When you can present these strengths, you give lenders the confidence they need to approve your loan, sometimes even with better terms.

Practical Steps to Get Ready

If your score isn’t where you want it to be, don’t just wait—take action.

- Scrub Your Credit Report: Pull your report from all three bureaus and check it for errors. Disputing inaccuracies is one of the fastest ways to potentially boost your score.

- Build a Financial Cushion: Start aggressively saving. Having three to six months of housing costs socked away is a massive green flag for lenders.

- Stay Stable: Now is not the time to switch jobs or open new credit cards. Lenders want to see stability right before you apply.

These steps demonstrate financial responsibility and can significantly strengthen your application, proving you’re more than just a number.

Don’t Forget Dallas Assistance Programs

Several local programs are designed to help first-time buyers overcome the hurdles of down payments and closing costs. These can be absolute game-changers.

- Dallas Homebuyer Assistance Program: Can provide up to 6% of the home’s purchase price to help with your down payment.

- Texas State Affordable Housing Corporation (TSAHC): Offers grants for buyers who meet certain income qualifications, sometimes up to $15,000.

- Dallas County Mortgage Credit Certificate (MCC): This gives you a federal tax credit equal to 20% of the mortgage interest you pay each year.

- Nonprofit Partners: Organizations like NeighborWorks offer homebuyer counseling and access to low-interest loan options.

For a bit of perspective, as of Q2 2024, the average credit score for a mortgage borrower in the U.S. was 758—quite a bit higher than the national average FICO score of 715. You can dive deeper into these trends and borrower behavior on Experian’s blog.

If you want to explore this topic further, learn more about first-time Dallas purchase strategies in our guide on First Time Home Buyer Dallas TX.

Common Credit Questions for Dallas Homebuyers

Trying to understand credit scores can feel like decoding a secret language, especially when you’re navigating the Dallas housing market for the first time. Let’s cut through the noise and get straight to the answers you actually need. Here are some of the most frequent questions I hear from aspiring homeowners.

Can I Get a Home Loan in Dallas with a Credit Score of 600?

Believe it or not, yes. Getting a mortgage in Dallas with a 600 credit score is definitely on the table. A score in this range often points you toward a government-backed FHA loan. These are great options for first-timers, usually allowing a down payment as low as 3.5% as long as your score is at least 580.

Just be aware that some lenders in the Dallas area might have slightly higher standards, which we call “lender overlays.” With a 600 score, you should also expect a higher interest rate than someone with a score above, say, 640. A conventional loan, which typically demands a minimum score of 620, will likely be just out of reach until that number climbs a bit.

Does Checking My Own Credit Score Hurt My Mortgage Chances?

Not at all. Checking your own credit is a completely safe—and smart—move. When you pull your own score using a credit monitoring app or through your bank, it’s recorded as a “soft inquiry.” This has absolutely zero impact on your score.

A “hard inquiry” is different. That happens only when a lender formally pulls your credit as part of an official loan application. It can cause a small, temporary dip in your score, but it’s a standard part of the mortgage process.

I always tell my clients to keep a close eye on their credit long before they even think about house hunting in Dallas. It gives you the chance to spot and fix any errors or issues ahead of time, putting you in the driver’s seat when you’re ready to apply.

How Fast Can I Raise My Credit Score to Buy a House in Dallas?

That really depends on what’s holding your score down. The timeline for boosting your credit is tied directly to the specific issues on your report.

- High credit card balances? If your main problem is just high credit utilization, you could see a solid jump in your score in as little as 30-45 days. All you have to do is pay down those balances. Card issuers report to the credit bureaus monthly, so the positive change shows up pretty quickly.

- More serious issues? If you’re dealing with things like late payments or accounts in collections, you’ll need to be more patient. It can take several months, or even a year, of consistent on-time payments to really move the needle.

Without a doubt, the fastest way to a better score is to pay every single bill on time and attack your credit card debt. A good Dallas mortgage professional can look at your report and give you a personalized game plan.

Will My Student Loans Stop Me from Buying a Home in Dallas?

Student loans alone almost never stop someone from buying a home in Dallas. In fact, if you have a long history of making those payments on time, it can actually help your credit score by showing you’re a responsible borrower.

What lenders really focus on is how that student loan payment affects your debt-to-income (DTI) ratio. It’s a simple calculation: they add up all your monthly debts (like a car payment, credit cards, and student loans) and divide that by your gross monthly income. As long as your student loans don’t push your DTI over the lender’s limit—usually somewhere between 43% to 50%—you should be in good shape to qualify.

Navigating the Dallas real estate market requires local expertise and a guide you can trust. If you’re ready to take the next step toward owning your first home, the team at Dustin Pitts REALTOR Dallas Real Estate Agent is here to help you every step of the way. Start your Dallas home search today.