When you’re ready to contest your property tax assessment in Dallas, the first crucial step is filing a formal protest with the Dallas Central Appraisal District (DCAD). Make sure you get this done before the deadline, which is usually May 15th.

Your appeal needs a solid foundation. You’ll argue either that the market value is wrong or that your appraisal is unequal compared to your neighbors. To win, you’ll need compelling evidence like recent sales data of similar properties or clear photos showing property damage or defects. The whole process is about presenting a convincing case to DCAD, which can lead to a lower valuation and, ultimately, some serious tax savings.

Challenging Your Dallas Property Tax Assessment

Opening that Notice of Appraised Value from the Dallas Central Appraisal District (DCAD) can be a shock, especially when the number seems way out of line with reality. But that initial valuation isn’t set in stone. Every property owner in Dallas has the right to challenge their assessment, and honestly, it’s often a smart financial move.

This guide will walk you through the Dallas County property tax appeal process, step by step. This isn’t just about voicing frustration over high taxes; it’s a formal process where you present hard evidence to argue for a more accurate, lower valuation.

The Key Players in a Dallas Tax Appeal

First things first, you need to know who you’re dealing with. The two main players in this game are:

- Dallas Central Appraisal District (DCAD): This is the government agency that appraises every single property in Dallas County for tax purposes. They’re your first point of contact and the people you’ll negotiate with during an informal settlement discussion.

- Appraisal Review Board (ARB): The ARB is an independent panel of local citizens. Their job is to hear disputes that property owners and DCAD couldn’t resolve. If you and the DCAD appraiser can’t agree, the ARB steps in to listen to both sides and make the final call on your property’s value for the year.

The entire process boils down to one thing: proving that DCAD’s number is wrong. You can approach this from two main angles.

The first is a market value appeal, where your argument is simple: my property would not sell for the amount they’ve appraised it for. The second is an unequal appraisal appeal, where you demonstrate that your property is valued higher than other, similar properties in your area.

Challenging your assessment is more common—and often more successful—than you might think. While national estimates suggest a high percentage of properties are over-assessed, the key is that a significant number of property tax appeals in jurisdictions like Dallas lead to a reduced valuation for the property owner.

Having this foundational knowledge is key. When you understand the players and the valid grounds for a protest, you can look at your notice with a critical eye and decide if filing an appeal is the right move for you. For a closer look at the local tax system, I highly recommend our guide on property taxes in Dallas, Texas.

To help you keep track of everything, here’s a quick look at the typical timeline you’ll be working with.

Key Deadlines and Stages in the Dallas Property Tax Appeal Process

| Stage | Typical Deadline/Timing | Key Action Required |

|---|---|---|

| Receive Appraisal Notice | Late April to Early May | Review your property’s proposed value. Check for errors. |

| File Notice of Protest | May 15th (or 30 days after notice) | Submit your formal protest online, by mail, or in person. |

| Informal Settlement Conference | Late May through July | Negotiate with a DCAD appraiser, presenting your initial evidence. |

| Formal ARB Hearing | June through August | Present your full case to the independent Appraisal Review Board. |

| Receive Final Order | July through September | The ARB issues its final determination of your property’s value. |

| File Lawsuit (Optional) | Within 60 days of ARB order | If you disagree with the ARB’s decision, you can escalate the case. |

Remember, these dates can shift slightly from year to year, so always confirm the current year’s deadlines directly with DCAD. Missing a deadline, especially the initial May 15th protest filing, can mean losing your right to appeal for the entire year.

How to Build an Evidence-Based Appeal

When you walk into a hearing with the Dallas Central Appraisal District (DCAD), your opinion on your property value means very little. A successful appeal is never about emotion; it’s about cold, hard facts. You need to build a logical, well-documented case that leaves the appraiser with no other choice but to grant a reduction.

Your argument can’t simply be “my taxes are too high.” Instead, you have to prove why the county’s number is wrong using specific, verifiable evidence. The two strongest pillars you can build your case on are market value data and the true condition of your property.

Finding Powerful Comparable Sales

The single most effective tool in your arsenal is data on comparable sales, or “comps.” These are recent sales of properties in your immediate neighborhood that are genuinely similar to yours but sold for less than your appraised value. This is the same data DCAD uses, so beating them at their own game is a fantastic strategy.

So, what makes a good comp? You’re looking for properties that mirror yours in a few key ways:

- Location, Location, Location: Stick to your specific Dallas neighborhood. A sale in Preston Hollow is irrelevant if you live in Oak Cliff. The closer, the better.

- Recent Sale Date: The sale should have happened as close as possible to the January 1st assessment date for the tax year you’re protesting.

- Similar Specs: The square footage, bedroom/bathroom count, and year built should all be in the same ballpark as your property.

- Condition Matters: A completely flipped and renovated house is not a fair comparison for a property still rocking its original 1980s kitchen.

You can hunt for this data on real estate websites, but your best bet is often a REALTOR® with access to the Multiple Listing Service (MLS). The DCAD website is also a decent resource. It really helps to have a basic grasp of the real estate appraisal process to understand how these values are determined in the first place.

The DCAD public search portal, shown above, is your starting point for researching both your own property details and those of potential comps in your area.

Documenting Your Property’s True Condition

The county’s assessed value assumes your property is in average shape for its age. If it isn’t, you need to show them why. This is your chance to document every flaw that would make a potential buyer think twice.

Grab your phone and walk through your property with a critical eye. Take clear, well-lit photos of any significant issues—we’re not talking about minor scuffs on the wall. Focus on the expensive stuff.

- Cracks in the foundation or signs of shifting

- An old roof with curling shingles

- Outdated plumbing or electrical systems

- Water damage, past or present

- A kitchen or bathroom that’s a time capsule from another decade

Photos are good, but repair estimates from licensed contractors are golden. An estimate to fix a foundation for $15,000 or replace a roof for $12,000 turns a subjective complaint into a hard number the appraiser can’t ignore. It’s tangible proof that directly chips away at the district’s assumed value.

Leveraging the Unequal Appraisal Argument

Sometimes, DCAD’s value for your property might seem reasonable—maybe even a bit low—but it’s still unfair. This is where the unequal appraisal argument comes into play. You’re not arguing about the market value; you’re arguing that your property is assessed at a higher percentage of its value than your neighbors’ are.

This strategy shifts the conversation from “What is my property worth?” to “Is my property being taxed fairly compared to everyone else?” It’s a potent angle because you use DCAD’s own data to poke holes in their consistency.

To build this case, you’ll dive back into the DCAD website to find the assessed values of several comparable properties. Then, do some simple math: calculate the assessed value per square foot for your property and for the others.

If your property is assessed at $250 per square foot while three similar properties down the street are all sitting at $220 per square foot, you’ve just laid the foundation for a very compelling unequal appraisal claim.

Filing Your Protest With The DCAD

Once you’ve put together a solid case with all your evidence, it’s time to make it official. This is where you formally file your protest with the Dallas Central Appraisal District (DCAD), and paying attention to the details here is non-negotiable. A simple mistake can get your whole appeal thrown out before it even begins.

You have two main ways to get this done.

By far the easiest and most efficient route is to use the DCAD’s uFile online portal. I always recommend this method to property owners. It’s quick, straightforward, and gives you an instant confirmation that they’ve received your protest. No stressing about whether your paperwork got lost in the mail.

If you’re more comfortable with a paper trail, you can always fill out and mail in the Notice of Protest form that came with your appraisal notice. Just make sure you fill it out completely and clearly before you drop it in the mail.

Navigating The Official Protest Form

Whether you’re filing online or by mail, this form is the legal backbone of your appeal. How you fill it out really matters. The form will ask you to specify why you are protesting, and your answer needs to line up perfectly with the evidence you’ve gathered.

The two most common reasons you’ll see are:

- Value is over market value: This is your argument. You’re saying the county’s valuation is higher than what your property would have realistically sold for on January 1st.

- Value is unequal compared with other properties: This is the equity argument. You’re stating that your property is valued higher than similar, comparable properties in your area.

Picking the right box is critical. If you check the wrong one, you might not be allowed to present certain evidence or arguments at your hearing. Be precise.

Avoiding Common Filing Mistakes

If you remember one thing from this section, make it this: Do not miss the deadline.

In Dallas County, your protest must typically be filed by May 15th or 30 days after your notice was mailed, whichever date is later. This deadline is absolute. Miss it, and you’ve likely lost your chance to appeal for the entire year.

It’s crucial to understand that property tax appeals, like other legal actions, are subject to strict filing periods. While the California Statute of Limitations applies to a different state and legal context, it illustrates the universal importance of meeting official deadlines in legal proceedings.

Beyond that critical date, a few other common slip-ups can cause major headaches or even get your protest rejected outright.

- Incomplete Information: Don’t leave any required fields blank. Triple-check that your name, address, and especially your property account number are correct.

- Vague Reasoning: Just writing “my taxes are too high” isn’t a valid reason. You have to formally state that the value is excessive or unequal.

- Forgetting to Sign: An unsigned form is an invalid form. If you’re mailing it in, make absolutely sure you’ve signed and dated it.

Taking a few extra minutes to file everything correctly and on time is one of the smartest things you can do. It ensures your case proceeds smoothly and sets the stage for a successful negotiation or hearing.

What To Expect at Your Informal and Formal Hearings

Once you’ve filed your protest with the Dallas Central Appraisal District (DCAD), you’ve officially kicked off the appeal process. This journey can go one of two ways: an informal chat with a staff appraiser or a more structured formal hearing in front of the Appraisal Review Board (ARB). Knowing how to handle both is the key to successfully lowering your property taxes.

For almost everyone in Dallas, the first stop is the informal settlement conference. This is your chance to sit down, one-on-one, with a DCAD appraiser and talk things out. The goal is straightforward: present your evidence and see if you can agree on a new, lower value without needing to go any further. It’s far less intimidating than a formal hearing and, frankly, a very efficient way to get the job done.

Here’s a quick look at what the informal process offers.

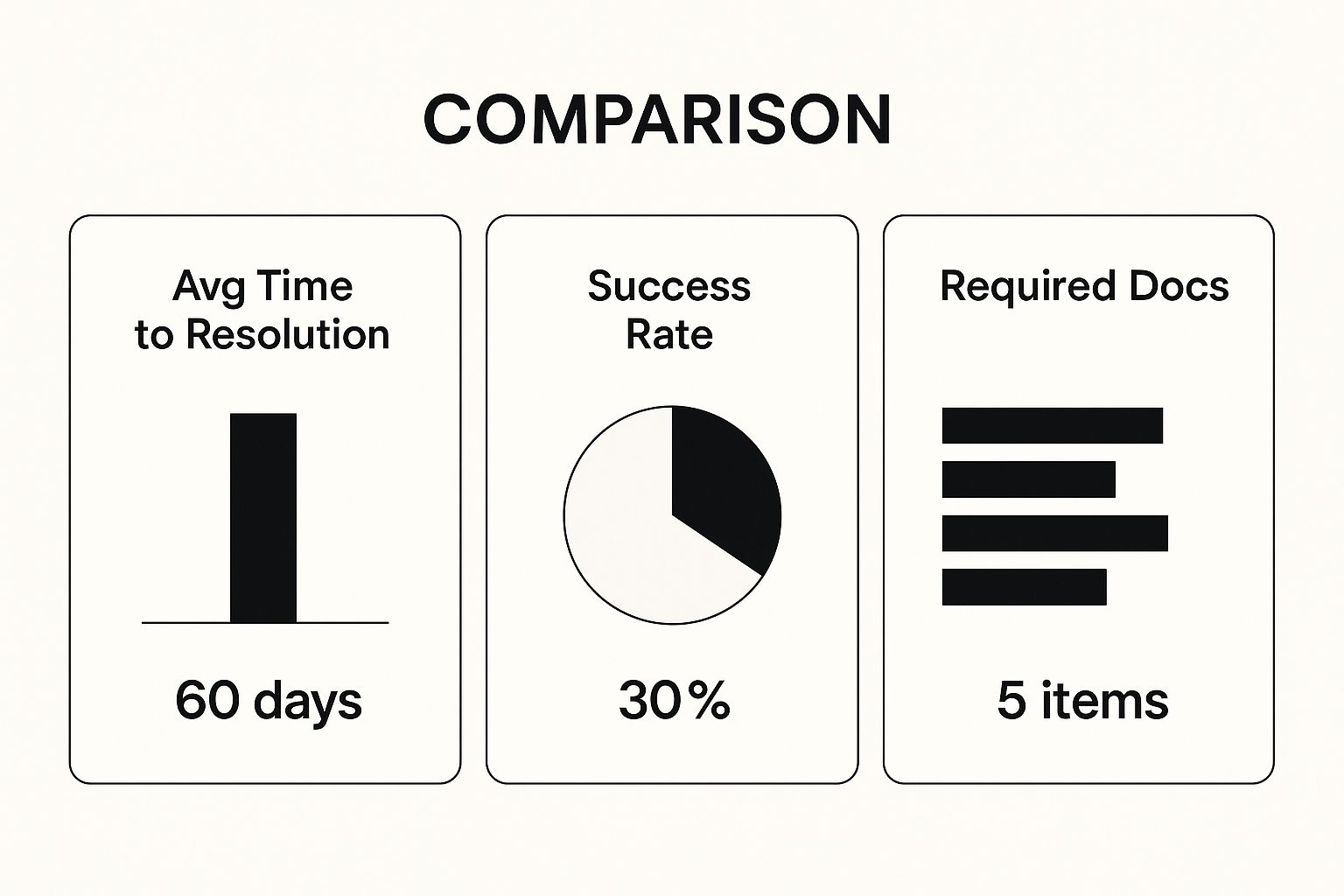

As you can see, the informal route is quick, but you need to come prepared to make it count.

Mastering the Informal Settlement Conference

You need to walk into the informal conference thinking of it as a professional meeting, not a fight. The appraiser is just a person doing their job. Your goal is to make their job easier by giving them a clear, logical, and evidence-based reason to lower your valuation. You won’t have a lot of time, so being prepared is non-negotiable.

Show up with all your evidence neatly organized and ready to hand over. A winning presentation usually includes:

- A Simple Summary Sheet: Start with a one-page summary. It should clearly list your property info, DCAD’s value, the value you’re asking for, and a quick list of your best comparable sales.

- Solid Comps: Hand the appraiser your list of comparable properties that sold for less than what they think your property is worth. Be ready to point out the similarities in location, size, and age.

- Visual Proof: Don’t just tell them about problems—show them. Bring clear photos of any damage or outdated features, and back them up with professional repair estimates that put a dollar amount on the problem.

Be polite, stay professional, and get straight to the point. Explain your position calmly and stick to the facts you’ve gathered. More often than not, if your evidence is compelling and your request is reasonable, the appraiser will offer a settlement right there. If you accept their offer, your appeal is done. You’ve successfully lowered your taxes.

The heart of a successful informal negotiation is demonstrating that the appraiser’s initial number is factually incorrect. You aren’t asking for a favor; you are presenting hard evidence that justifies a correction.

Preparing for a Formal ARB Hearing

What happens if you can’t strike a deal with the DCAD appraiser? Your case automatically moves on to a formal hearing with the Appraisal Review Board (ARB). This is a more official meeting where you’ll present your case to a panel of impartial Dallas County citizens. They get the final say.

This is your moment to formally lay out your evidence and make your argument. The DCAD appraiser will also be there to defend their valuation. Be warned: each side gets a very short amount of time—often just five to ten minutes—to plead their case.

Your presentation to the ARB needs to be even more concise and impactful than your informal chat. I recommend structuring your argument like this:

- Quick Intro: State your name, the property address, and the value you are requesting.

- Market Value Case: Jump right into your best three or four comparable sales. Explain exactly why they are the best comparisons for your property.

- Property Condition: If your property has issues, now is the time to show your photos and repair estimates. Explain how these problems drag down the market value.

- Unequal Appraisal Argument: If you’re arguing that your assessment is unfair, show the board the data. Present the numbers that prove your property is valued at a higher price per square foot than similar properties.

- Clear Conclusion: Wrap it up by restating the value you believe is fair and correct, based on everything you’ve just shown them.

Remember, the ARB members aren’t real estate pros. Avoid jargon and present your case in a simple, easy-to-follow way. A great tactic is to bring enough copies of your evidence packet for each board member to have one.

Comparing Informal Settlement vs. Formal ARB Hearing

Deciding how to approach your appeal can be tough. Do you aim for a quick resolution in the informal meeting, or are you prepared to go the distance with a formal hearing? This table breaks down the key differences to help Dallas property owners figure out which path is the right one for them.

| Feature | Informal Settlement | Formal ARB Hearing |

|---|---|---|

| Setting | One-on-one meeting with a DCAD staff appraiser. | A structured hearing before a panel of ARB members. |

| Atmosphere | Casual and conversational; more of a negotiation. | Formal and procedural, similar to a courtroom but less strict. |

| Time Allotment | Typically 15-20 minutes, but can be flexible. | Very strict time limits, often just 5-10 minutes per side. |

| Decision-Maker | The DCAD appraiser can offer a settlement on the spot. | The ARB panel listens to both sides and makes a final, binding decision. |

| Evidence | Present your evidence directly to the appraiser to support your case. | You must submit all evidence to the ARB in advance and present it during the hearing. |

| Best For | Property owners with clear-cut evidence (e.g., strong comparable sales, obvious damage). | Complex cases or situations where no agreement could be reached informally. |

| Outcome | A mutually agreed-upon value. If no agreement, the case proceeds to the ARB. | The ARB’s decision is final and legally binding for the tax year. |

Ultimately, the informal settlement is the fastest and most direct route to a reduction. However, if your evidence is complex or the appraiser won’t budge on an unreasonable value, the formal ARB hearing provides an essential backstop to ensure you get a fair shake.

While every property owner hopes for a fair shake, it’s interesting to see how the system works on a larger scale. For example, a detailed study from Cook County, Illinois, showed that while appeals do lower assessments, the financial benefits often favor higher-value properties. This suggests that owners of more expensive properties tend to see more significant tax savings from the appeal process. You can dig into the data yourself in the full analysis from the University of Chicago.

What Happens After the ARB Decision?

So, you’ve presented your case to the Appraisal Review Board (ARB), and now it’s a waiting game. The board will take some time to review everything and will eventually mail you their final decision, officially called an Order Determining Protest. This single document holds the outcome of your appeal, spelling out the board’s final say on your property’s value for the year.

When that envelope arrives, it’s the moment of truth. If you’ve won, the ARB has lowered your property’s appraised value. Congratulations! This new, lower value gets passed on to your local taxing entities—like the city, county, and school district—who will then calculate your tax bill. You’ll see the payoff when the bill shows up in October, reflecting a nice reduction.

When the ARB Decision Doesn’t Go Your Way

But what if the news isn’t good? If you open the order and see the board sided with the Dallas Central Appraisal District (DCAD), it’s easy to feel like you’ve hit a dead end. But you haven’t. For Dallas property owners, this isn’t the final word; it’s just the end of the administrative part of the process.

Before you jump into the next phase, take a moment to do a quick cost-benefit analysis. The next steps can get expensive and time-consuming, so you need to be realistic about whether the potential tax savings are worth the fight.

An unfavorable ARB decision can be a gut punch, but think of it as a procedural step, not a final judgment. Your case now moves into a formal legal arena where stricter rules of evidence apply and you’re arguing before arbitrators or judges, not a review board.

You have a couple of primary paths forward if you choose to continue your appeal:

- Binding Arbitration: This is often a more practical and less expensive alternative to a full-blown lawsuit. Your case is presented to an independent, third-party arbitrator who makes a final, binding decision. You must file for arbitration within 60 days of receiving your ARB order.

- Filing a Lawsuit: This is the most formal and costly option. You can sue the appraisal district in a Dallas County district court. It almost always requires hiring an attorney and gives you a complete judicial review of your case. Just be prepared for a potentially long and complex legal battle.

Making the Right Choice for Your Appeal

Deciding between arbitration and a lawsuit really boils down to your specific circumstances. Arbitration is generally the quicker, cheaper route, making it a solid choice for many property owners. A lawsuit, on the other hand, offers a more rigorous legal process but comes with a much higher price tag and a longer timeline.

If you find yourself at this crossroads, it’s a very good idea to speak with a property tax attorney. They can review what happened at your ARB hearing, analyze the strength of your evidence, and give you an honest assessment of your chances of success. That expert guidance can make all the difference in deciding your next move.

Common Questions About Dallas Property Tax Appeals

When it comes to property tax appeals, it’s easy to feel like you’re trying to learn a new language. If you’re a Dallas property owner, you probably have some very specific questions about how the whole process works right here at home. Let’s walk through the most common concerns to give you the clarity and confidence you need to challenge your property tax assessment.

Can I Appeal My Dallas Property Taxes Every Year?

Yes, you can—and you absolutely should think of it as part of your annual financial check-up. The Dallas Central Appraisal District (DCAD) re-evaluates properties every single year, and a successful protest one year doesn’t lock in your value for the next.

The Dallas real estate market moves fast, meaning your property’s value can change significantly in just 12 months. Getting into the habit of reviewing your assessment notice each spring is the single best way to protect yourself from getting hit with a sudden, steep tax hike.

What Is the Difference Between Market Value and Unequal Appraisal?

These are the two main arguments you can use when protesting your taxes in Dallas. Getting the distinction right is the key to building a case that actually works.

- Market Value Appeal: This one is pretty straightforward. You’re arguing that DCAD’s appraised value is higher than what your property could have realistically sold for on January 1st. Your evidence here is all about recent sales of comparable properties (comps) that sold for less than what the county thinks your property is worth.

- Unequal Appraisal Appeal: This is an argument about fairness, not just price. You’re essentially saying, “My property is assessed at a higher value per square foot than similar properties around me.” This clever approach uses DCAD’s own data to show that your property is shouldering an unfair portion of the tax burden compared to your neighbors.

One questions the accuracy of the value; the other questions its equity. In many cases, you can and should argue both points in your protest.

The heart of any successful appeal is solid evidence. A “market value” protest relies on what’s happening in the real estate market, while an “unequal appraisal” protest uses the appraisal district’s own records to point out an inconsistency. Both are powerful tools when you have the right documents to back them up.

Do I Need to Hire a Professional for My Appeal?

No, you’re not required to hire a tax consultant or an attorney. Many Dallas property owners successfully handle the appeal process themselves by doing their homework, gathering strong evidence, and presenting a logical case. DCAD’s website has made a DIY appeal more doable than ever.

That said, bringing in a pro can be a smart move in a few scenarios:

- Complex Properties: If you own a unique commercial building or a high-value, non-traditional residential property, an expert’s specialized knowledge can be invaluable.

- Time Constraints: Let’s be honest, the appeal process takes time. If your schedule is already packed, a consultant can manage the entire thing for you.

- Lack of Confidence: Feeling overwhelmed by the data or intimidated by the thought of a formal hearing? A professional can offer peace of mind and expert representation.

Just remember that most tax consultants work on a contingency fee. This means they typically take a percentage (often 30-50%) of the tax savings they get for you. You only pay if they win, but you’ll want to factor that fee into your potential savings.

What Happens If I Miss the Dallas Protest Deadline?

This is the single biggest mistake you can make. The protest deadline in Dallas County is usually May 15th or 30 days after you get your Notice of Appraised Value, whichever is later. For almost everyone, missing this date means you lose your right to appeal for the entire year.

The law does allow for a few, very specific exceptions for filing late, but they are incredibly rare and hard to prove. These usually involve situations where DCAD failed to mail you a required notice. Simply forgetting, being out of town, or being too busy won’t cut it.

Treat the protest deadline as if it’s set in stone. File your protest on time, even if you’re still pulling together all your evidence. You can always add more documentation later, but you can never get back a missed deadline.

Will Protesting My Taxes Guarantee a Lower Bill?

Filing a protest doesn’t automatically mean you’ll get a lower tax bill, but it’s the only way to even have a shot at one. A successful appeal lowers your property’s appraised value—the number used to calculate your taxes.

But remember, the final amount you owe is also based on the tax rates set by your city, county, school district, and other local entities. So, even if you win a lower valuation, your bill could still go up if those entities decide to raise their tax rates.

Even so, a lower valuation will always mean you pay less than you would have otherwise. If you want to dive deeper into the math, you can learn more about how to calculate property taxes in our detailed guide.

Think of it like this: your appraised value and the tax rates are two different levers controlling your final bill. You have direct control over the first one by protesting. It’s your chance to pull the one lever that’s available to you.

At Dustin Pitts REALTOR Dallas Real Estate Agent, we believe empowering property owners with knowledge is the first step toward making sound financial decisions. If your real estate journey involves buying or selling in Dallas, our team is here to provide the expert guidance you need. https://dustinpitts.com