If you’ve ever wondered about buying a foreclosed home in Dallas, you’ve stumbled upon a unique corner of the real estate world—one that can offer incredible value if you know how to navigate it. A foreclosure is simply a property that a lender has taken back after the owner couldn’t keep up with mortgage payments. This guide is designed to cut through the complexity and give you a practical roadmap for finding and buying these properties in Dallas.

Understanding The Dallas Foreclosure Market

Dipping your toes into the foreclosure market in Dallas feels a bit like finding a secret entrance to the world of real estate. The process is entirely different from a typical home purchase. You’re not just buying a house; you’re buying a property with a complicated backstory, sold under specific legal circumstances that create both huge opportunities and potential pitfalls.

For the right buyer, whether you’re a first-timer or a seasoned investor, this can be a direct path to scoring a great deal in the Dallas area.

Why Dallas Presents Unique Opportunities

Dallas is a city that’s constantly on the move, and its real estate market is no different. This vibrant, ever-changing landscape means there’s a consistent inventory of distressed properties hitting the market. For those who are prepared, this creates a chance to buy into fantastic Dallas neighborhoods at a price that might otherwise be impossible.

But finding a foreclosure listing is just the first step. To succeed, you have to be ready for the nuances. This means getting a handle on:

- Texas Foreclosure Laws: The state has one of the fastest non-judicial foreclosure processes in the nation. For buyers in Dallas, this means you have to be ready to act quickly.

- Property Condition: Foreclosures are almost always sold “as-is.” What you see is what you get, and you’re on the hook for any and all repairs.

- Market Dynamics: You need a solid understanding of current Dallas real estate market trends to know if you’re truly getting a good deal.

- Financial Nuances: A smart investor always understands the full picture. Consulting a comprehensive guide to taxes on investment property is a non-negotiable step to grasp the financial side of things.

What is a foreclosure? It’s the legal process where a lender repossesses a property because the homeowner has defaulted on their mortgage. This creates a supply of distressed homes that savvy buyers and investors can purchase, often below market value.

Your Path To Success

This guide will break down the entire journey for you, from explaining the different kinds of foreclosures you’ll encounter in Dallas to walking you through the Texas legal timeline. The goal is to give you the confidence and know-how to spot a good opportunity and act on it. With the right information, the world of Dallas foreclosures isn’t intimidating—it’s an open door.

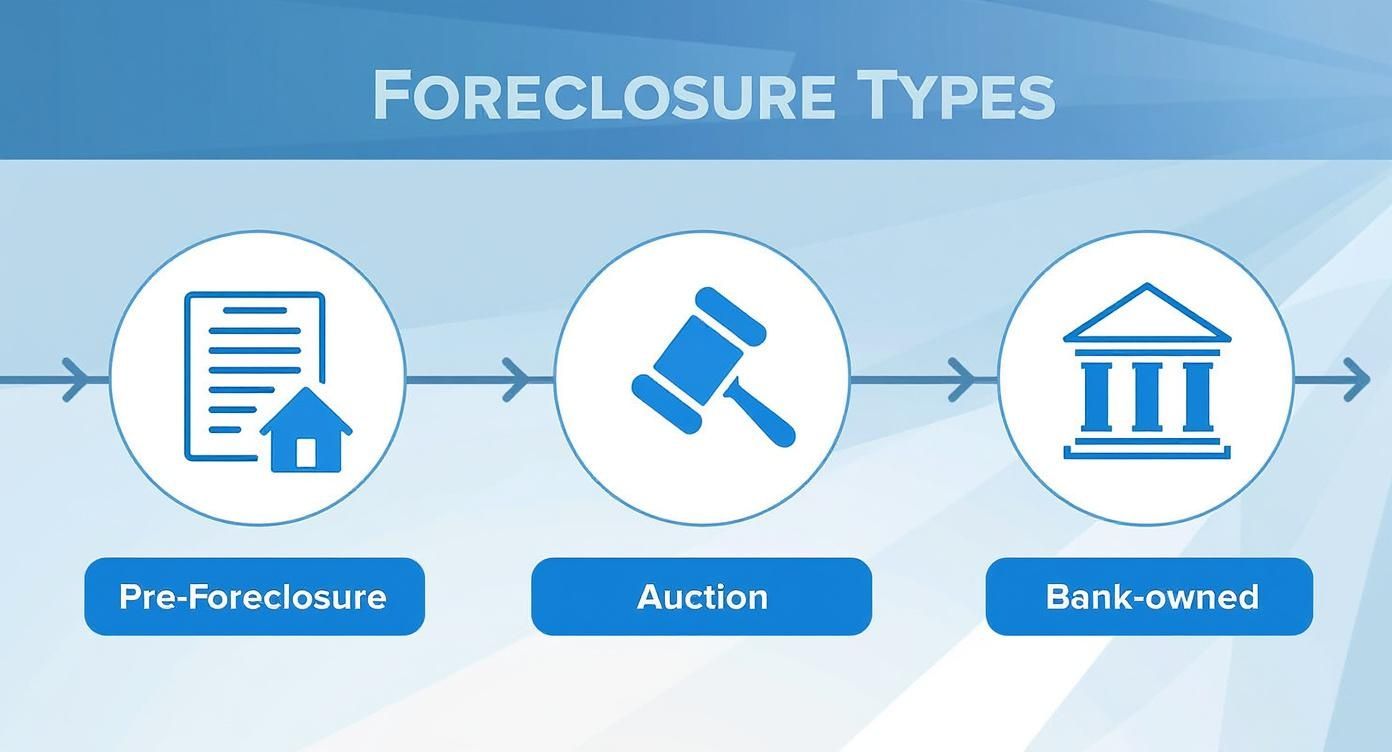

The Three Main Types of Dallas Foreclosure Properties

When you start digging into foreclosures in Dallas, you’ll quickly see that the term covers a few different situations. It’s not a one-size-fits-all deal. Each type represents a specific point in the foreclosure timeline, and knowing the difference is crucial because the rules, risks, and potential rewards change dramatically at each stage.

Think of it like buying a car. You could buy it from the original owner before they trade it in, bid on it at a fast-paced auction, or purchase it from the dealership after they’ve cleaned it up. Each path has its own pros and cons.

H3: Pre-Foreclosures and Short Sales: The Early Stage

This is your first chance to step in. A homeowner has fallen behind on their mortgage payments, but the bank hasn’t taken the house back yet. In this scenario, you’re negotiating directly with the owner, who is highly motivated to sell and avoid the credit hit of a full foreclosure.

This is also where you’ll find short sales. That’s when the bank agrees to let the owner sell the house for less than what they still owe on the mortgage.

The big win here? It often feels more like a normal home purchase. You can usually get a proper inspection and appraisal, which takes a lot of the guesswork out of the equation. The downside, however, can be the timeline. Getting a short sale approved by both the seller and their lender can be a slow, drawn-out process that sometimes takes months.

H3: Trustee Sales: The Courthouse Auction

If a homeowner can’t sell their property in time, it heads to a trustee sale—the classic foreclosure auction on the courthouse steps. Here in Dallas County, this all goes down on the first Tuesday of every month. This is the most intense, high-stakes part of the foreclosure world.

You’re bidding live against other buyers and seasoned investors. Highest bid wins, and you have to pay right then and there with cash or a cashier’s check. Forget about getting a traditional mortgage for this.

A trustee sale is the ultimate “as-is, where-is” deal. You buy the property without ever stepping inside for an inspection and with no guarantees about the title. It’s a high-risk, high-reward game best left to experienced investors who have cash on hand and can stomach the uncertainty.

You can land an incredible deal this way, but you’re truly buying blind. You won’t know if the foundation is cracked or if there are other liens on the property until after it’s already yours.

H3: REO (Real Estate Owned): The Bank-Owned Property

What happens when a house doesn’t sell at the auction? The bank takes ownership. At that point, it becomes an REO, or Real Estate Owned, property. The bank’s goal is to get the property off its books, so it will hire a local real estate agent to list it on the open market.

For most buyers, this is the safest and simplest way to buy a foreclosure. The entire process is much closer to a standard home sale.

- Financing is Welcome: You can almost always use a traditional mortgage.

- Inspections are Standard: The bank expects you to do your due diligence, including a full inspection and appraisal.

- The Title is Clear: The lender will handle clearing any liens to ensure you get a clean title at closing.

Because the bank has removed most of the risk, the discounts on REO homes usually aren’t as steep as what you might find at the auction. Still, for the peace of mind and predictability it offers, an REO is often the best entry point into the foreclosure market for the average homebuyer in Dallas.

Comparing Dallas Foreclosure Property Types

To make the right choice, it helps to see the key differences side-by-side. This table breaks down what you can expect from each type of foreclosure property.

| Characteristic | Pre-Foreclosure / Short Sale | Trustee Sale (Auction) | REO (Bank-Owned) |

|---|---|---|---|

| Seller | Homeowner (with bank approval) | Trustee (on behalf of the bank) | The bank or lender |

| Financing | Traditional financing is possible | All-cash or cashier’s check only | Traditional financing is standard |

| Inspections | Usually allowed | Not allowed before purchase | Allowed and recommended |

| Price | Potential for a good discount | Highest potential for a deep discount | Moderate discount, closer to market value |

| Risk Level | Moderate (long timeline) | Very High (no inspections, title risk) | Low (clear title, inspection period) |

Ultimately, the best path depends on your budget, experience, and how much risk you’re comfortable taking on.

Navigating the Texas Foreclosure Timeline

When it comes to real estate, Texas definitely marches to the beat of its own drum—and foreclosures are no different. The state uses a non-judicial foreclosure system, which is a fancy way of saying it’s fast. Way faster than in most other states. If you’re looking at foreclosures in Dallas, getting a handle on this accelerated timeline isn’t just good advice; it’s absolutely critical.

Everything is designed for speed, so you have to be ready to move just as quickly. If you miss a key date or misunderstand a notice, a great deal can vanish before you even get a chance to make your move.

This timeline below gives you a bird’s-eye view of a property’s journey, from the first signs of trouble all the way to a potential auction and becoming bank-owned.

As you can see, every stage is a different ballgame. The risk, the potential reward, and the strategy all shift as the property moves down the line.

The Initial Steps: Notice of Default and Intent to Accelerate

It all starts when a homeowner falls behind on their mortgage. The lender’s first formal step is sending a Notice of Default and Intent to Accelerate. Think of this as the final warning shot. The homeowner gets a chance to make things right—usually within 20 days—by paying what they owe.

If they can’t catch up in time, the lender “accelerates” the loan, demanding the entire remaining balance immediately. This is the official starting gun for the foreclosure sale. For buyers, this pre-foreclosure window is often the last real opportunity to work out a deal directly with the homeowner.

The Critical 21-Day Notice Period

With the loan accelerated, the process goes public. The lender’s trustee must post a Notice of Sale at the Dallas County courthouse and file it with the county clerk. Here’s the most important part: this has to be done at least 21 days before the auction.

This 21-day period is the final countdown. It’s when investors and buyers scramble to do their homework—running title searches, driving by to assess the property’s condition, and lining up their cash for the big day.

Key Takeaway: The Texas foreclosure timeline is swift and unforgiving. From the initial 20-day cure period to the final 21-day notice of sale, the process can conclude in just over a month, demanding vigilance and preparation from anyone interested in buying at auction.

This rapid pace is a huge driver in the local real estate market. In 2023, Texas saw a major uptick in foreclosure activity, with 28,533 homes facing forced sale. The Dallas-Fort Worth metroplex was right at the center of it all.

The First Tuesday Auction at the Dallas County Courthouse

Texas has a unique real estate tradition: all foreclosure auctions happen on the first Tuesday of every month. In Dallas, the action unfolds on the courthouse steps. Bidders gather, the auctioneer calls out properties, and the highest bidder who can pay right then and there with certified funds wins. It’s crucial for interested parties to understand generally how long the foreclosure process typically takes from start to finish.

This isn’t your typical home purchase. There are no negotiations, no inspections, and no backing out. It’s a true “as-is, where-is” transaction.

Understanding the Right of Redemption in Texas

One last thing to get straight is the Right of Redemption. After a typical mortgage foreclosure in Texas, there is no right of redemption. Once the property is sold at auction, it’s a done deal. The house belongs to the new owner, period.

But there’s a big exception: properties foreclosed for unpaid property taxes or some HOA dues. In those specific cases, the former owner gets a redemption period to buy back the property from the winning bidder by paying the auction price plus other costs. It’s a critical detail that can completely change an investor’s game plan.

How to Find Foreclosure Listings in Dallas

Finding a great deal on a foreclosure isn’t as simple as scrolling through Zillow. These properties—while often a source of incredible value—live in a different world than the traditional real estate market. They aren’t always advertised in the same places, so uncovering the best foreclosures in Dallas means knowing exactly where to look.

Success here isn’t about luck. It’s about having a strategic, multi-channel approach. You need a mix of online tools, public records, and old-fashioned networking to get a true picture of the inventory available across Dallas County.

The MLS for REO and Short Sale Properties

If you’re looking for the least risky entry point into foreclosures, the Multiple Listing Service (MLS) is your best bet. This is the central database every real estate agent uses, and it’s where you’ll find almost every bank-owned (REO) and short sale property.

The huge advantage here is that these listings are handled much like a standard home sale. You’ll get photos, property details, and the chance to schedule viewings and perform inspections before you make an offer. A savvy agent can even set up automated alerts for you, flagging properties with REO or short sale keywords the moment they hit the market.

Public Records and the Courthouse Steps

For those willing to shoulder more risk for a potentially bigger reward, the Dallas County courthouse is ground zero for foreclosure activity. This is where you get direct, unfiltered information about upcoming trustee sales.

- Notice of Trustee Sale: Texas law requires these notices to be publicly posted at the courthouse at least 21 days before the auction. They list crucial details like the property address, original loan amount, and the trustee’s contact info.

- County Clerk’s Office: These same notices are also filed with the Dallas County Clerk, which means you can search for them online or in person. This public record is the official source for every property slated for that first-Tuesday auction.

Going this route is definitely more hands-on. You’ll be doing all the research yourself, but it’s a direct-to-the-source strategy that serious investors use to find opportunities before they hit the mainstream market.

In the Dallas foreclosure game, information is your ultimate advantage. When you combine MLS alerts, public record searches, and professional insights, you build a powerful system for spotting deals that everyone else misses.

Specialized Auction Websites and Bank Portals

Beyond the courthouse, many lenders and government-backed entities like Fannie Mae and Freddie Mac list their REO properties on their own dedicated websites. Think of these as online storefronts built specifically for selling distressed assets.

On top of that, several third-party auction sites aggregate foreclosure listings from all over the Dallas area. These platforms often provide more data than you’d find in public records—sometimes including photos or preliminary title reports—which makes them a fantastic tool for doing your homework. Many banks also maintain their own REO portals where they directly list the homes they’ve taken back.

The Power of a Specialist Agent

While anyone can access the resources above, nothing beats the edge you get from working with a real estate agent who specializes in foreclosures in Dallas. An experienced expert provides access and insight you simply can’t find on your own.

They have connections with bank asset managers and often hear about new REO properties before they’re even listed on the MLS. More importantly, their expertise helps you analyze a deal, accurately estimate repair costs, and navigate the maze of paperwork. This professional partnership is often what separates a successful purchase from a costly mistake.

Distressed properties are a constant in real estate, even when the market shifts. For example, in the 12 months leading up to May 2014, Dallas saw 6,728 foreclosures, ranking it 10th among major U.S. cities at the time. Yet, the market was improving, as that number represented a 30 percent drop from the year before. You can learn more about Dallas’s historical foreclosure metrics and see how the market has evolved.

Conducting Due Diligence on Foreclosed Properties

In the Dallas real estate world, chasing a low price tag without doing your homework is a recipe for disaster. This is especially true with foreclosures. The thrill of a potential bargain can vanish pretty quickly when you discover hidden liens, a mountain of unexpected repairs, or an occupant who won’t leave.

Vetting a distressed property is a whole different ballgame than a standard home purchase. It’s the one step that separates a smart investment from a money pit. You have to shift your mindset from simply ‘finding a deal’ to ‘making a sound investment,’ and that requires a methodical, almost forensic, approach.

Your Essential Due Diligence Checklist

A fantastic price means absolutely nothing if the house comes with thousands in hidden debt or needs a new foundation. Think of this checklist as your defense against the unknown.

- Title Search: This is non-negotiable. A professional title search is the only way to uncover liens, judgments, or other claims clouding the title. While the foreclosure itself wipes out many junior liens, some—like property tax debt—can stick with the property and become your problem.

- Property Inspection: This gets tricky. If you’re buying at auction, you won’t get to go inside. You’ll have to rely on a thorough “drive-by” inspection, looking for obvious red flags with the roof, foundation, windows, and the general condition of the neighborhood. For a bank-owned REO, you can (and should) conduct a full inspection just like a traditional sale.

- Occupancy Verification: Is anyone living there? You have to find out if the property is vacant, still occupied by the former owner, or has tenants. Discovering you have to navigate a formal eviction after closing can add significant time, stress, and cost to your investment.

This level of scrutiny is critical in a market like ours. Recent data shows Texas led the nation with 17,680 foreclosure starts in the first six months of 2025 and also had the highest number of bank-owned properties. You can read more about foreclosure activity trends across the state to get a sense of the competition and inventory.

Estimating Costs and Values Accurately

Remember, “as-is” means exactly that. You inherit every single problem, big or small. Underestimating repair costs is the fastest way to turn a great deal into a bad one.

Your financial analysis has to be grounded in reality. Start by getting rough quotes from local Dallas contractors for the big-ticket items—HVAC, roofing, foundation repair. Even if you can’t get inside, you can create a best-case, worst-case, and most-likely repair budget to guide your offer.

Investor Insight: The smartest foreclosure buyers I know always build a “repair buffer” into their numbers. They typically add 15-20% to their initial repair estimate just to cover the surprises that inevitably pop up.

At the same time, you need a crystal-clear picture of what the property will be worth once it’s fixed up. Research recent sales of comparable homes (comps) in the same neighborhood to pin down the After Repair Value (ARV). The difference between your all-in cost (purchase price + repairs + buffer) and the ARV is where you’ll find your profit or instant equity.

For a more structured approach, our real estate due diligence checklist can help you cover all your bases and protect yourself from the unique risks of buying distressed properties in Dallas.

Partner with a Dallas Foreclosure Specialist

Trying to navigate the foreclosures in Dallas on your own is like trying to find your way through a maze blindfolded. Sure, you might have a ton of information from the internet, but without the street-level experience to apply it, you’re setting yourself up for some expensive mistakes. This is where teaming up with a specialist changes the game.

An agent who lives and breathes distressed properties brings a lot more to the table than just MLS access. They offer a seasoned eye that can turn a mountain of raw data into a clear, actionable plan.

The Advantage of Expert Guidance

A specialist just knows the difference between a genuine bargain and a money pit in disguise. They can walk through a property (or analyze a listing) and give you a realistic, no-nonsense opinion on its true market value, which is critical for avoiding the emotional trap of a bidding war.

Even more importantly, they’re experts at estimating repair costs—the single biggest area where inexperienced buyers get into trouble.

And let’s not forget their network. After years in the Dallas market, a good specialist has connections. These relationships often lead to off-market deals, giving you a shot at properties before the general public even knows they exist.

In the fast-paced Dallas foreclosure market, knowledge is powerful, but expert execution is what secures a successful purchase. A specialist helps you bridge the gap between knowing what to do and actually getting it done right.

From Information to Action

The path to buying a foreclosure is littered with complex paperwork, non-negotiable deadlines, and very specific negotiation strategies. A specialist is your guide through all of it. They make sure every ‘i’ is dotted, and every offer is structured to be as competitive as possible. They know what bank asset managers are looking for in an REO offer and how to position you for the best shot at an auction.

Choosing the right professional is easily the most important first step you’ll take. For more on what to look for, check out our guide on how to choose a real estate agent who truly gets your investment goals.

At the end of the day, their job is simple: to help you sidestep the common traps and turn your interest in Dallas foreclosures into a sound, profitable investment.

Your Top Dallas Foreclosure Questions Answered

When you start digging into the Dallas foreclosure market, you’re bound to have questions. It’s a complex world, and getting straight answers is key to feeling confident enough to make a move. Let’s tackle some of the most common questions I hear from buyers.

Can I Use a Traditional Mortgage to Buy a Home at Auction?

The short answer is no. The foreclosure auctions held on the Dallas County courthouse steps are all-cash affairs. You need to show up with certified funds, like a cashier’s check, ready to go the moment you win the bid. There’s simply no time to wait around for a traditional mortgage to get approved.

However, if a home doesn’t sell at auction and becomes bank-owned (REO), the rules change. For those properties, traditional financing is almost always an option. So, if you plan to bid at the auction, you either need cash on hand or a hard money loan lined up well in advance.

What Happens to Existing Liens on a Foreclosed Property?

This is a big one. In Texas, a foreclosure sale is designed to wipe out most junior liens. Think second mortgages or home equity lines of credit—those typically get erased.

Crucial Insight: While the foreclosure clears away junior debt, it does not touch senior liens. The most common culprits here are property tax liens and, in some cases, federal tax liens. They stick with the property, and the new owner inherits them.

This is exactly why a professional title search before you even think about bidding is non-negotiable. Skipping this step can turn what looks like a great deal into a financial nightmare overnight.

Do Former Owners Have Redemption Rights After a Sale?

For a standard mortgage foreclosure in Dallas, there is no right of redemption for the former homeowner after the sale. Once the gavel falls at the trustee’s sale, it’s a done deal. The new buyer is the owner, and the previous owner can’t come back and reclaim the house.

But there’s a major exception: foreclosures for unpaid property taxes or certain HOA dues. In these specific cases, Texas law gives the former owner a statutory “right of redemption.” For a primary residence (homestead), they get two years to pay off the debt and take back the property. For all other properties, it’s 180 days. Knowing which type of foreclosure you’re dealing with is absolutely critical.

Navigating the complexities of the Dallas foreclosure market requires deep local knowledge and expert guidance. The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the experience to help you identify sound opportunities and avoid costly pitfalls. Contact us today to start your search with a trusted partner by your side.