Stepping into the Dallas real estate market for the first time can feel like a huge undertaking, but getting a handle on your mortgage options is the first real step toward making it happen. For most first-time buyers in Dallas, the choices boil down to two main buckets: government-backed loans (like FHA, VA, and USDA) and conventional loans. On top of that, some fantastic local Texas and Dallas programs can give you an extra leg up.

Ultimately, your own financial picture and the Dallas-area location of the home you want will point you toward the right loan.

Navigating Your First Home Purchase in Dallas

Buying your first home in Dallas is a major life moment, but let’s be honest—the road to getting the keys is filled with big financial decisions. The sheer number of mortgage options for first-time buyers can feel overwhelming.

Think of this guide as your personal roadmap. It’s designed to cut through the noise of interest rates, down payments, and program requirements you’ll encounter right here in the Dallas-Fort Worth area. We’re going to break down each option piece by piece, turning what feels like a confusing process into a confident first move.

Why This Matters in the Current Dallas Market

The dream of owning a home in Dallas is as strong as ever, but recent shifts in the market have thrown a few curveballs. While the homeownership rate has climbed over the last decade, the percentage of first-time buyers has actually dipped lately in competitive markets like North Texas.

This isn’t surprising when you consider the affordability hurdles—higher mortgage rates and home prices that just keep climbing. For anyone trying to get their foot in the door in Dallas, knowing every single financial tool at your disposal is more critical than ever.

Securing the right mortgage isn’t just about getting a “yes” from the lender. It’s about setting yourself up for financial health for years to come in your new Dallas home. The loan you pick today shapes your monthly budget for the long haul.

Your Path Forward

This guide will walk you through everything, starting with the basic mortgage types and then diving into local Dallas programs that can give you a real competitive edge.

We’ll cover:

- Government-Backed Loans: These are designed specifically to make homeownership more accessible.

- Conventional Loans: Great, flexible options for buyers who have a solid credit history.

- Local Dallas Programs: Special assistance that can dramatically reduce your upfront costs.

Before we get into the loan details, the absolute first step is figuring out what you can realistically afford. Getting pre-approved is non-negotiable. If you’re ready to take that first step, our guide on how to get pre-approved for a mortgage will help you start the process with confidence.

Understanding Government-Backed Mortgage Programs

Think of government-backed loans not as a handout, but as a helping hand. The government isn’t lending you the money directly. Instead, a federal agency essentially co-signs your loan, providing insurance to a private lender. This simple act dramatically reduces the lender’s risk, which in turn gives them the confidence to offer you much better terms.

These programs are lifelines for many first-time buyers in Dallas, especially those who don’t quite fit the rigid mold required for a conventional loan. They often come with lower down payments and more flexible credit score requirements, making them powerful first time buyer mortgage options. For so many people trying to break into a competitive market like Dallas, these loans are the key that finally unlocks the door to homeownership.

FHA Loans: The Popular Choice for Flexibility

If there’s one loan program first-time buyers in Dallas know by name, it’s the FHA loan. Backed by the Federal Housing Administration, this loan is the go-to option for a reason: accessibility. It’s designed to welcome more people into the market, often allowing you to qualify with a credit score as low as 580 and put down just 3.5%.

This approach is clearly working. The first quarter of 2025 saw a record number of first-time buyers jumping into the market, and the resurgence of FHA loans was a huge part of that story. The latest ICE Mortgage Monitor report dives into how these more forgiving standards are opening doors for new homeowners across the country, including in Texas.

Now, there is a trade-off. FHA loans require you to pay for mortgage insurance (MIP) to protect the lender. This comes in two parts: one fee upfront and another small amount paid with your monthly mortgage. To get the full picture, check out our detailed guide on FHA loan requirements in Texas—it breaks down everything you need to know.

Let’s take a look at how these government-backed loans stack up side-by-side.

Government-Backed Loan Options For Dallas Buyers

| Loan Type | Minimum Down Payment | Typical Credit Score Range | Key Advantage for Dallas Buyers |

|---|---|---|---|

| FHA Loan | 3.5% | 580+ | Low credit and down payment hurdles make it ideal for competitive urban markets. |

| VA Loan | 0% | 620+ (varies by lender) | The zero-down benefit is a massive financial advantage for eligible service members. |

| USDA Loan | 0% | 640+ (varies by lender) | Great for buying in growing suburbs just outside Dallas city limits with no down payment. |

As you can see, each loan is built for a specific type of buyer, offering unique advantages that can make all the difference in achieving your homeownership goals in the Dallas area.

VA Loans: A Premier Benefit for Veterans

For our active-duty military, veterans, and their eligible spouses in the Dallas area, the VA loan is more than just a mortgage program—it’s an incredible, hard-earned benefit. Guaranteed by the U.S. Department of Veterans Affairs, it comes with two unbeatable perks.

The most significant benefit of a VA loan is the potential for 100% financing. This means qualified borrowers can often purchase a home in Dallas with no down payment whatsoever, a game-changer when saving a large sum for a down payment is a major hurdle.

On top of that, VA loans don’t require private mortgage insurance (PMI). This alone can save you hundreds of dollars on your monthly payment compared to other options. While lenders will still have their own standards for credit and income, the entire program is structured to thank you for your service by making buying a home easier.

USDA Loans: For Properties on the Outskirts

The USDA loan is another zero-down-payment powerhouse, but with a twist. Backed by the U.S. Department of Agriculture, it’s specifically designed to encourage growth in less-populated suburban and rural communities.

You won’t find a USDA-eligible home in downtown Dallas, but you’d be surprised how many thriving communities just outside the city limits qualify. Think about growing areas like Forney, Celina, or parts of Kaufman County. This makes the USDA loan a fantastic choice for buyers who want a little more space without being too far from the action of the city.

To qualify for a USDA loan, you need to meet two main criteria:

- Location: The home must be located in a USDA-eligible area. You can check any address instantly on the USDA’s official eligibility map.

- Income Limits: Your total household income can’t be higher than the local limit set by the USDA for the Dallas area.

This program is a hidden gem for buyers willing to look just beyond the Dallas city lines. Each of these government-backed loans opens a different door, but they all lead to the same destination: making your dream of owning a home in the Dallas area a reality.

Exploring Conventional Loans For Your First Home

When Dallas first-time buyers hear “conventional loan,” many immediately think of a massive, out-of-reach 20% down payment. Let’s clear the air right now: that’s one of the biggest myths in real estate. While putting down 20% certainly has its perks, it’s absolutely not a requirement to get into your first home with a conventional loan.

So, what are they? Conventional loans are simply mortgages that aren’t backed by a government agency like the FHA or VA. They come from private lenders like banks and credit unions, and they usually follow guidelines set by Fannie Mae and Freddie Mac. For Dallas buyers with a solid credit history, these loans offer incredible flexibility and are a top-tier first time buyer mortgage option.

In a hot Dallas market, like trying to buy in Richardson or Plano, a conventional loan can make your offer look much stronger to a seller. It sends a signal that you’re financially solid and that the deal is more likely to close without a hitch.

Debunking The 20 Percent Down Payment Rule

The whole “you must have 20% down” idea is a relic of the past. Lenders know that in markets like Dallas, it can take years to save up that kind of cash. In response, they’ve created programs specifically for creditworthy buyers who just haven’t had time to build a massive nest egg.

One of the most popular game-changers is the Conventional 97 loan. The name says it all: it lets you finance up to 97% of the home’s price, which means you only need a 3% down payment.

Think about it this way: for a $350,000 home in a Dallas suburb, a 3% down payment is $10,500. That’s a world away from the $70,000 you’d need for a 20% down payment, putting homeownership on the table much, much sooner.

This program makes conventional loans a direct competitor to FHA loans, and for buyers with good credit, it’s often the better choice. It opens up a whole new pathway to getting those keys in your hand.

Understanding Private Mortgage Insurance

Now, there is a trade-off for that smaller down payment. If you put down less than 20% on a conventional loan, your lender will require Private Mortgage Insurance (PMI). Don’t let the term scare you; it’s just an insurance policy that protects the lender if you default on the loan. It’s their safety net for taking on the higher risk.

PMI is typically rolled into your monthly mortgage payment. The exact cost depends on a few things:

- Your Credit Score: The better your score, the lower your PMI premium will be.

- Your Down Payment: A 10% down payment will have cheaper PMI than a 3% down payment.

- Loan Type: The specific terms of your mortgage can also play a role.

While nobody loves an extra monthly fee, PMI is the very thing that makes these low-down-payment loans possible. And here’s the best part—it has a huge advantage over the mortgage insurance on an FHA loan.

The Big Advantage: Canceling Your PMI

This is the crucial difference that can save you thousands of dollars. You can get rid of conventional PMI. Unlike FHA mortgage insurance, which is often stuck with you for the life of the loan, PMI is designed to be temporary.

Once you build 20% equity in your Dallas home—either by paying down your mortgage or because your property value has increased—you can call your lender and ask them to remove it. Even better, by law, they have to automatically cancel PMI once your loan balance drops to 78% of the home’s original purchase price.

The ability to ditch that extra monthly cost is a massive long-term financial win. To see exactly how the numbers stack up for your situation, digging into a detailed comparison of conventional loans vs. FHA is a smart next step.

Unlocking Local Dallas and Texas Homebuyer Programs

Federal programs like FHA and VA are great starting points, but knowing the local landscape is how you really get a leg up in the competitive Dallas market. Both the state of Texas and the city of Dallas have rolled out some powerful programs specifically designed to help first-time buyers clear the biggest hurdle: the upfront cash needed to buy a home.

These aren’t separate, standalone loans. Think of them as a booster shot for your main mortgage. They provide the funds you need for the down payment and closing costs, making your homeownership dream a reality much faster than you might expect. Honestly, they are some of the most effective first time buyer mortgage options you’ll find anywhere.

My First Texas Home Program: A Statewide Boost

The Texas Department of Housing and Community Affairs (TDHCA) runs a fantastic program called My First Texas Home. This is way more than just a small grant; it’s a full-blown package that pairs a 30-year, fixed-rate mortgage (which can be FHA, VA, USDA, or conventional) with a serious dose of financial help.

That help comes in the form of a second, “silent” loan used for your down payment and closing costs. For many buyers, this can cover the entire down payment, which drastically cuts how much cash you need to bring to the table.

To get in on this, you’ll need to tick a few boxes:

- First-Time Buyer Status: You generally can’t have owned a home within the last three years.

- Income and Purchase Price Limits: Your income and the home’s price have to be within the program’s limits for that specific Dallas-area county.

- Credit Score Requirements: You’ll typically need a minimum credit score of around 620.

- Homebuyer Education: You must complete a homebuyer education course. This is non-negotiable, as they want to make sure you’re ready for the responsibilities ahead.

This program can completely change the game, turning the monumental task of saving for a down payment into something you can actually achieve.

Dallas Homebuyer Assistance Program: Going Hyperlocal

If you’re buying within the Dallas city limits, the help gets even more targeted. The Dallas Homebuyer Assistance Program (DHAP) is run by the city to give direct financial aid to low- and moderate-income buyers.

This program offers a forgivable loan that you can use for your down payment, closing costs, and even to lower the principal balance of your main mortgage. The assistance can be massive—often up to $60,000, depending on your qualifications. It’s meant to be used alongside a primary mortgage like an FHA or conventional loan, making homes in many Dallas neighborhoods far more accessible.

The best part about DHAP is that the loan can be forgiven. If you live in the home for a certain period—usually five to fifteen years—some or all of that assistance money is completely forgiven. It essentially becomes a grant.

Getting approved for DHAP depends on things like your income and the home’s location within Dallas. These local programs are designed to build stronger communities by helping people put down permanent roots.

To ease the burden even more, you can also look into various grant funding for housing initiatives that can be stacked with these mortgage options. By exploring all these resources, you can layer the benefits to make your first home purchase in Dallas surprisingly affordable.

Choosing Your Best Dallas Mortgage Option

Alright, you’ve got the rundown on the different types of mortgages. Now comes the important part: figuring out which one actually makes sense for you.

The truth is, the best first time buyer mortgage options aren’t one-size-fits-all. It really boils down to your personal financial picture and where you see yourself living in the Dallas area. Think of it like finding the right key for a lock—the perfect loan will open the door to the home you’ve been dreaming of.

Let’s move past the theory and see how these loan options work in the real world for Dallas buyers. Seeing how different people fit with specific mortgages can help you map out your own journey.

Real-World Dallas Buyer Scenarios

Let’s picture a few different homebuyers, each with a unique situation and a specific part of the DFW metroplex in mind. Their stories really show how the right loan can make all the difference.

- The Veteran in Grand Prairie: A veteran who qualifies for a VA home loan wants to buy near the new developments in Grand Prairie. Their credit is good, but they haven’t saved a lot for a down payment. A VA loan is a no-brainer here. It lets them finance 100% of the home’s price, meaning no down payment is needed, and they get to skip paying for monthly mortgage insurance.

- The Professional in Uptown: A young professional with great credit has been aggressively paying down student debt, which has limited their down payment savings. They’re looking at a cool condo in Uptown. The Conventional 97 loan is their best move. It only requires 3% down, and a huge bonus is that they can eventually cancel their private mortgage insurance (PMI), saving them a ton of money down the road.

- The Buyer in Oak Cliff: Someone with a more modest credit score has fallen in love with a renovated home in Oak Cliff. The monthly payment is manageable, but coming up with the cash for the down payment and closing costs is tough. This is where an FHA loan paired with the Dallas Homebuyer Assistance Program (DHAP) is a game-changer. The FHA loan is flexible on credit, and DHAP provides the funds to cover those big upfront expenses.

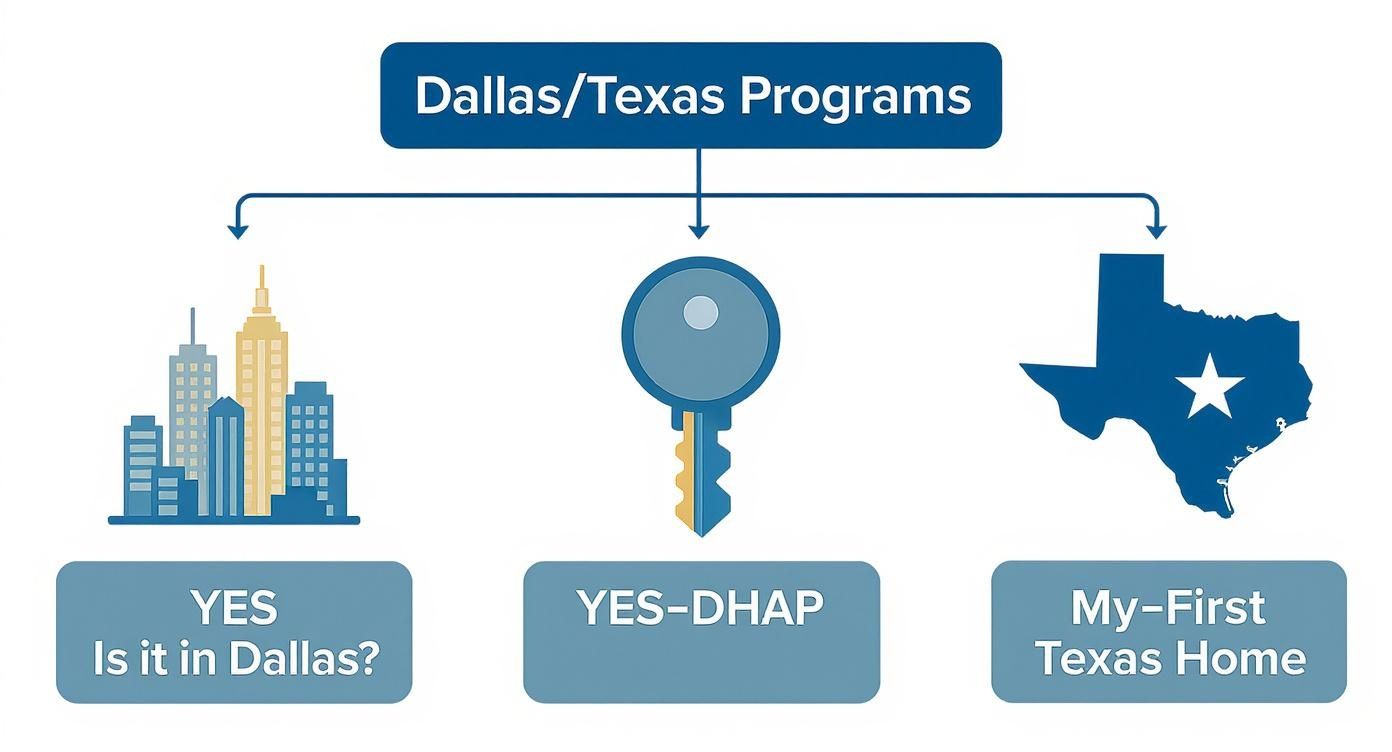

As you can see, there’s a smart financing strategy for just about every kind of buyer in Dallas. This decision tree infographic breaks down how to choose between the big local and state programs.

The visual makes it simple: if you’re buying inside the Dallas city limits, DHAP is your go-to local option. If you’re looking anywhere else in the state, My First Texas Home has you covered.

Making A Data-Driven Decision

Let’s be real—buying a home in this economy means you have to be smart about your choices. Local Dallas-Fort Worth home prices have seen significant increases. While mortgage rates have dipped a bit from their recent highs, they’re still hanging around the 6% range. For more on this, NerdWallet has some great data on home affordability.

This is exactly why low-down-payment loans and assistance programs are more crucial than ever for first-time buyers in the DFW area.

Full Mortgage Option Comparison For Dallas First-Time Buyers

To help you see everything side-by-side, this table breaks down the key differences between the loan types we’ve talked about.

| Feature | Conventional Loan | FHA Loan | VA Loan | My First Texas Home |

|---|---|---|---|---|

| Minimum Down Payment | 3% | 3.5% | 0% | Varies (provides assistance) |

| Ideal For | Buyers with good credit | Buyers with lower credit | Veterans & service members | Buyers needing DPA |

| Mortgage Insurance | PMI (cancellable) | MIP (often for life of loan) | None | Depends on base loan |

| Best Dallas Scenario | Competitive offers in Plano | Accessing DHAP in Dallas | Zero-down in Arlington | Statewide assistance |

At the end of the day, your financial profile is what guides this decision.

Key Takeaway: If you have a high credit score, a conventional loan will likely save you the most money in the long run. On the other hand, FHA and VA loans are incredible tools for getting into a home if you meet their specific criteria.

As you dig into these options, it might be worth chatting with a mortgage broker. They can shop around and often find loan products you wouldn’t see on your own. The goal is to match your financial strengths with a program that gets you into a great Dallas home with minimal upfront cost and a monthly payment you can feel good about.

Got Questions? Let’s Talk Real-World Dallas Home Buying

Alright, we’ve covered the different types of loans, but I know what you’re thinking. The real questions start popping up when you get serious about making an offer. This is where the rubber meets the road.

Let’s dive into the common “what ifs” and “how much” questions I hear from first-time buyers every day here in Dallas. We’ll get you the straightforward answers you need to move forward with confidence.

How Much Cash Do I Really Need to Buy a Home in Dallas?

Everyone focuses on the down payment, but that’s just part of the story. The real number you need to have ready is your down payment plus your closing costs.

In Dallas, you can expect closing costs to be somewhere between 2% and 5% of the home’s final sale price. That single percentage covers a whole host of services needed to finalize the deal.

So, what are you actually paying for?

- Lender Fees: This is what the bank charges for putting your loan together, covering things like underwriting and processing.

- Third-Party Fees: This is the big one. It pays for essential services from other pros, like the home appraisal, inspection, and title search.

- Prepaid Items: You’ll have to pay for some things in advance, like your first year of homeowners insurance and a few months’ worth of property taxes to get your escrow account started.

Let’s make that real. For a $350,000 home, your closing costs could land anywhere from $7,000 to $17,500. Now you see why local programs like the Dallas Homebuyer Assistance Program (DHAP) are such a game-changer. They can provide thousands to help cover these costs, drastically reducing the cash you need to bring to the table.

Can I Get a Dallas Mortgage with a Lower Credit Score?

Yes, absolutely! This is one of the biggest myths that holds people back. While a stellar credit score will always land you the best interest rates, there are fantastic loan programs designed specifically for buyers who have a few bumps in their credit history.

The FHA loan is the classic example. Because it’s backed by the government, lenders in Dallas feel more comfortable approving buyers with scores as low as 580. In some cases, it can even be a bit lower, depending on the rest of your financial picture. This program has made homeownership possible for countless people who wouldn’t qualify for a conventional loan.

A Quick Word of Advice: Just because you can qualify now doesn’t mean you should rush in. Taking even a few months to improve your credit score can save you a ton of money. A better score means a lower interest rate, which means a lower monthly payment for the next 30 years.

Want to give your score a quick boost?

- Run a Credit Check: Pull your reports from all three bureaus and dispute any errors you find. You’d be surprised how often they pop up.

- Tackle High-Interest Debt: Focus on paying down your credit card balances. Lenders pay close attention to your “credit utilization”—how much you owe versus your available credit.

- Be Boringly Consistent: Your payment history is the single biggest factor in your score. Set up automatic payments so you never miss a due date.

Do I Need a Specific Lender for Texas Assistance Programs?

You do, and this is a critical detail to get right. You can’t just go to any big bank and ask for state assistance money. The Texas Department of Housing and Community Affairs (TDHCA), the agency behind the awesome My First Texas Home program, maintains a list of approved lenders.

These lenders are specially trained on all the rules and paperwork for TDHCA programs. They know exactly how to structure your application to make sure you check every box needed to get that down payment and closing cost assistance.

The good news? There are plenty of them. Finding an approved lender in the Dallas area is easy. The official TDHCA website has a simple search tool to help you find a qualified expert near you. Working with one of them will make the whole process much, much smoother.

How Do Dallas Property Taxes Affect My Mortgage Payment?

Property taxes are a big deal in Texas, and your mortgage payment is directly tied to them. When you get a loan, your lender will almost certainly require you to have an escrow account.

Think of an escrow account like a separate savings account that your lender manages for you. Every month, your mortgage payment will be made up of four parts, which we call PITI:

- Principal: The amount that actually pays down what you owe on the house.

- Interest: The fee you pay the lender for borrowing the money.

- Taxes: One-twelfth of your home’s estimated annual property tax bill.

- Insurance: One-twelfth of your annual homeowners insurance premium.

Your lender collects the “T” and the “I” from you each month, puts that money into your escrow account, and then pays your tax and insurance bills for you when they’re due. It’s a system designed to protect both you and the lender—it ensures you don’t get hit with a giant tax bill you can’t pay all at once.

This is why, when you’re house hunting in Dallas, you have to look at the total estimated PITI payment. That number gives you the true picture of what your monthly housing cost will be.

Figuring out the world of first time buyer mortgage options in Dallas is a journey, but you don’t have to do it alone. Having a guide who knows the local market can make all the difference. If you’re ready to see what’s possible, Dustin Pitts REALTOR Dallas Real Estate Agent is here to help you map out a plan. Reach out today and let’s get you on the path to owning your first home at https://dustinpitts.com.