Before you start scrolling through listings in Lakewood or envisioning your life in Knox-Henderson, we need to talk numbers. It’s easy to get swept up in the excitement, but the first—and most important—step is figuring out your actual purchasing power here in Dallas.

There’s a classic rule of thumb that lenders use: your total housing costs shouldn’t eat up more than 28% to 31% of your gross monthly income. Think of that as your starting line. From there, we can dial in a realistic budget that truly fits the Dallas market.

Beyond the Online Calculator: Your Real Dallas Home Budget

Those quick-and-easy online affordability calculators? They’re a decent starting point, but they don’t know Dallas. They have no idea about Dallas County’s property tax rates or how much homeowners insurance costs in a place that gets its fair share of hailstorms. They give you a generic number, not a Dallas-specific one.

This is about getting an honest look at what really goes into your monthly payment. To do that, we need to break down the key pieces lenders focus on. Nailing these down now will keep you from getting in over your head later.

Key Financial Pillars of Home Affordability in Dallas

- Debt-to-Income (DTI) Ratio: This is the big one. Lenders look at your DTI more than almost anything else. It’s a simple comparison of how much you owe each month (think car payments, student loans, credit card bills) versus how much you earn before taxes.

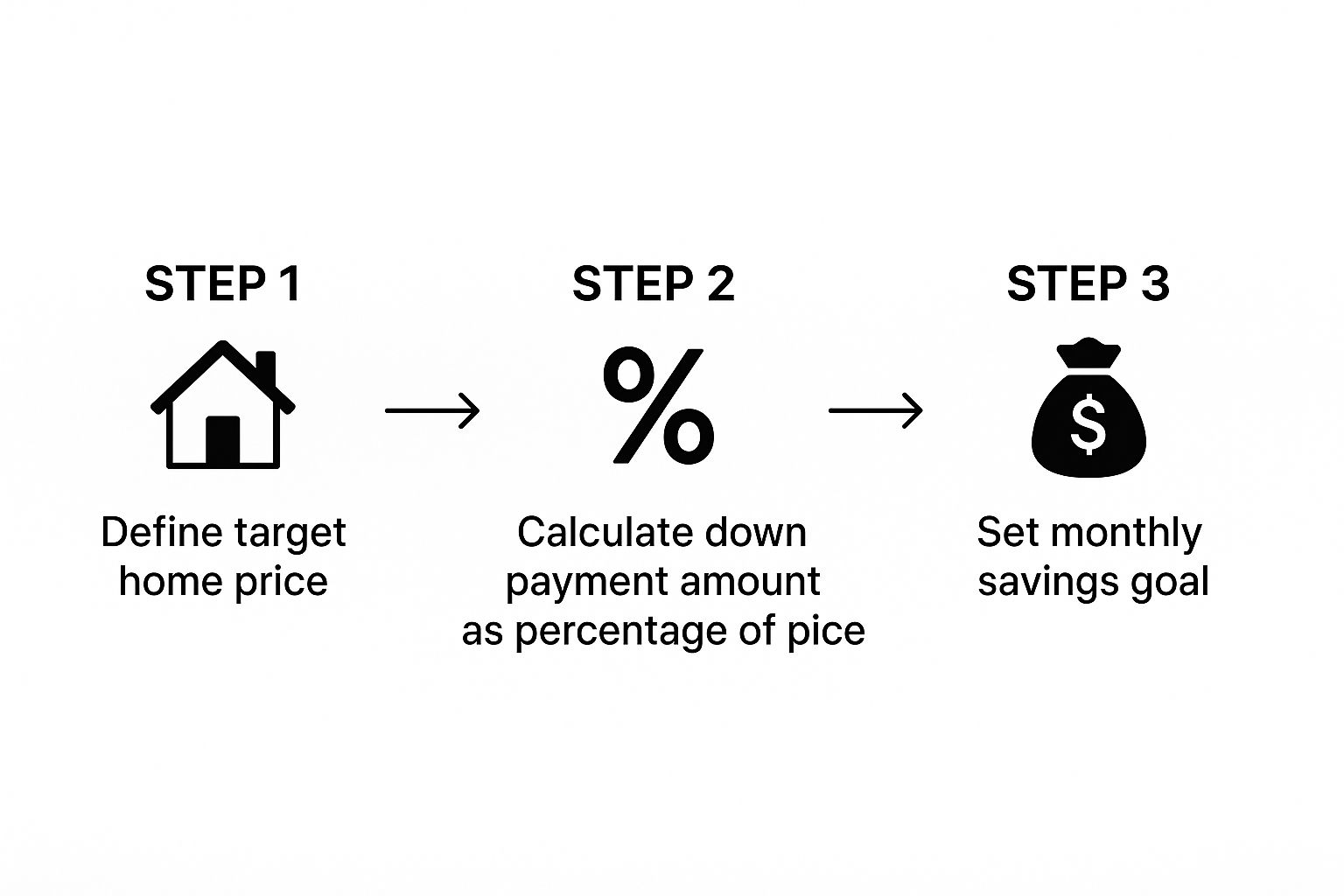

- Down Payment: How much cash you can put down is a huge factor. A bigger down payment means a smaller loan, which usually translates to a lower monthly payment and a better interest rate. It shows the lender you have skin in the game and can save you a fortune over the long haul.

- Local Dallas Costs: This is where that generic calculator really fails. Your budget has to account for North Texas specifics like our higher-than-average property taxes, homeowners insurance, and any HOA fees, which are common in many of the best Dallas neighborhoods.

Before we dive deeper, here’s a quick cheat sheet to keep in mind. These are the core metrics that will shape your budget from the very beginning.

Quick Affordability Snapshot for Dallas Homebuyers

| Affordability Metric | What It Means for a Dallas Buyer | Target Range |

|---|---|---|

| Housing Expense Ratio | The percentage of your pre-tax income that should go to your mortgage, taxes, and insurance. | < 28% |

| Debt-to-Income (DTI) Ratio | All your monthly debts (including the new house payment) compared to your pre-tax income. | < 36% |

| Typical Down Payment | While less is possible, this is a strong target to reduce costs and be more competitive. | 10% – 20% |

| Emergency Savings | Money set aside for unexpected repairs after your down payment and closing costs. | 3-6 months of expenses |

Getting a handle on these numbers is what gives you clarity and confidence.

A great guideline lenders often lean on is the “28/36 rule.” It suggests your housing costs shouldn’t be more than 28% of your gross income, and your total debt (housing included) shouldn’t top 36%. If you can get your numbers in line with this rule, you’re in a fantastic position.

Once you have a solid grasp of these factors, you’re ready for the next move. The logical next step is understanding how to get pre-approved for a mortgage. A pre-approval letter doesn’t just solidify your budget; it turns you into a serious, competitive buyer in this market. Getting this foundation right from the start ensures your new Dallas home is a blessing, not a source of financial stress.

Getting Real About Your Monthly Income and Debts in Dallas

Before you can figure out how much house you can afford in Dallas, you have to look at your finances exactly how a lender will. It all starts with a brutally honest calculation of your Gross Monthly Income (GMI)—that’s every single dollar you make before taxes and other deductions come out. Nailing this number is the bedrock of your entire home-buying journey.

You’ll need to add up all your income streams to get a stable, provable monthly figure. This goes way beyond just your base salary; lenders need the full story.

Tallying Up Your Gross Monthly Income

If you’ve got a standard W-2 job with a steady paycheck, this part is pretty simple. But for a lot of folks in Dallas, income isn’t so cut and dried. You need to account for everything.

- Salaried or Hourly Wages: Your primary, consistent earnings before any taxes are withheld.

- Commission or Bonuses: Got a solid two-year track record of earning these? Lenders will typically average them out and add that amount to your GMI.

- Freelance or Side-Gig Income: That consistent money from contract work or your side hustle absolutely counts, as long as you can back it up with tax returns.

Once you have your bank statements together, using tools like Excel bank statement templates can make organizing all this information a lot less painful. It’s a great way to double-check your own numbers for accuracy before a lender ever sees them.

Taking Stock of Your Monthly Debt Payments

Next up, let’s flip the coin and look at your recurring monthly debts. A lender is going to pull your credit report and see all of this anyway, so it’s smart to get ahead of it and make your own accurate list. We’re talking about any fixed payment that shows up on your credit history.

A key thing to remember: lenders only care about the minimum required payment for each debt, not the extra you might be paying to knock it down faster. Every dollar of required debt directly reduces how much you can borrow, so precision here is crucial.

Your list of monthly debts needs to include every single obligation that a lender will see.

- Car Loans: The required monthly payment for any vehicle you’re financing.

- Student Loans: Your official monthly payment, even if your loans are currently in deferment or forbearance.

- Credit Card Bills: The minimum monthly payment due on every single one of your credit cards.

- Personal Loans: Any installment loans you’re in the middle of paying off.

- Other Obligations: Don’t forget things like alimony, child support, or any other court-ordered payments.

With your GMI in one hand and your total monthly debts in the other, you’ve got the two most important pieces of the puzzle. These numbers are what we’ll use for the next critical step: calculating your debt-to-income ratio. That single metric is the biggest factor in determining your real home-buying budget in the fast-paced Dallas market.

How Dallas Lenders See Your Debt-to-Income Ratio

Alright, you’ve gathered your income and debt numbers. Now it’s time to put on a lender’s hat and see your finances the way they do. The single most important number they’ll look at is your debt-to-income (DTI) ratio. It’s a simple percentage that shows how much of your monthly gross income is already committed to paying off existing debts.

In a fast-moving market like Dallas, your DTI is the gatekeeper. It directly influences how much a bank is willing to lend you, making it a critical piece of the home affordability puzzle.

The Two Sides of DTI: Front-End vs. Back-End

Lenders don’t just look at one number; they evaluate DTI from two different angles to get the full story of your financial situation.

- Front-End Ratio: This is purely about your potential housing payment. It calculates the percentage of your gross monthly income that would go toward your mortgage principal, interest, property taxes, and homeowners insurance (often called PITI).

- Back-End Ratio: This is the big one. The back-end ratio takes your potential PITI and adds all your other monthly debt payments on top of it. Think car loans, student debt, credit card minimums—everything.

While the front-end ratio is a useful data point, the back-end ratio is what truly matters to underwriters. It gives them a clear picture of the total financial load you’d be carrying each month. If you want to get into the nitty-gritty, you can learn more about what a debt-to-income ratio is and why it’s so foundational to getting a mortgage.

A Real-World Dallas DTI Example

Let’s put this into practice. Imagine a professional moving to Dallas who earns an annual salary of $95,000. That breaks down to a gross monthly income of about $7,917.

Now, let’s factor in some common monthly debts for someone in the DFW area:

- Car Payment: $500

- Student Loan Payment: $400

- Credit Card Minimums: $150

- Total Monthly Debts (Before Housing): $1,050

Before even thinking about a mortgage, this person’s DTI is already 13% ($1,050 divided by $7,917).

Lenders here in Dallas really want to see a total, or back-end, DTI of 43% or lower. This is the magic number for most conventional loans. For our homebuyer, this means they have about 30% of their monthly income—or around $2,375—available for their total PITI payment to stay within that key lending guideline.

This calculation is a perfect illustration of why managing your existing debt is so crucial before you even start house hunting. Keeping your DTI low doesn’t just help you qualify for a larger loan; it also makes you a less risky borrower in the eyes of the lender. That often translates into better interest rates and more favorable loan terms, which can save you a small fortune over the life of your mortgage.

When you zoom out from your personal finances, you can see these affordability pressures on a larger scale. Reports often use a “median multiple” (median home price divided by median income) to gauge affordability in metro areas. In a city like Dallas, where housing costs can be high relative to local incomes, understanding your personal DTI gives you a powerful, lender-approved roadmap to follow.

Getting Real About Dallas-Specific Housing Expenses

When a lender pre-approves you for a mortgage, they hand you a big, exciting number. But hold on—that number only covers the Principal and Interest (P&I) on the loan itself. To figure out what you can actually afford to pay each month in Dallas, you have to get familiar with a little acronym: PITI.

PITI stands for Principal, Interest, Taxes, and Insurance. Those last two are the real wildcards here in North Texas, and they can dramatically inflate your monthly payment. These aren’t optional; they’re a core part of your homeownership costs.

This isn’t just a Dallas issue; it’s part of a much bigger picture. The global housing affordability crisis is no secret, and as of early 2025, the average house price-to-income ratio continues to climb. We’re feeling that squeeze right here, where home prices often outpace wage growth, forcing many buyers to reset their expectations.

Cracking the Code on Dallas County Property Taxes

For anyone moving to Dallas, the property tax bill is often the biggest shock. Texas has no state income tax, which sounds great until you realize that local cities and schools make up for it with property taxes. Dallas County has some of the highest effective rates in the state, typically ranging from 2% to 2.5% of a home’s appraised value each year.

Let’s break down what that actually means for your wallet.

- Imagine a $450,000 home in a nice Plano suburb.

- With a tax rate around 2.2%, the annual tax bill comes out to $9,900.

- That adds an extra $825 to your monthly house payment.

That $825 gets tacked right onto your mortgage payment and goes into an escrow account. If you don’t budget for it, a home that seemed perfectly affordable on paper can suddenly feel like a major financial strain. For a deeper dive into this, I highly recommend reading up on understanding property tax implications to get the full picture.

What to Expect for Homeowners Insurance in North Texas

Homeowners insurance is the other big piece of your PITI puzzle. Premiums here in North Texas are often higher than the national average, and you can thank our weather for that. Insurers have to price in the risk of hailstorms, tornadoes, and severe thunderstorms, which pushes our costs up.

The final premium really depends on the home’s age, what it’s made of (brick is usually cheaper to insure than siding), and its exact location. A typical single-person home in Richardson might run you anywhere from $2,500 to $4,000 a year. That’s another $200 to $330 added to your monthly housing budget.

The Overlooked Cost: HOA Dues

Last but not least, never, ever forget about Homeowners Association (HOA) fees. They are practically everywhere in Dallas, from the shiny high-rises in Uptown to the sprawling master-planned communities in suburbs like Frisco and McKinney. These fees pay for shared amenities like pools, fitness centers, landscaping, and security.

HOA dues can be as low as $50 a month in some neighborhoods or soar past $1,000 a month in luxury condo buildings. It’s a separate payment made on top of your PITI, and your lender absolutely will count it against your debt-to-income ratio. These are just a few of the costs to be aware of, and for a complete rundown, you’ll want to check out our guide on how to calculate closing costs.

Putting It All Together: A Dallas Home Affordability Example

Theory is great, but let’s get our hands dirty with some real numbers. Seeing how these rules and local costs play out in a practical Dallas scenario is where it all starts to make sense.

We’ll walk through the exact process for a hypothetical buyer so you can see how to figure out your own budget.

Meet Our Buyer: A Relocating Tech Professional

Let’s imagine someone moving to Richardson for a job in the Telecom Corridor. Here’s a snapshot of their finances:

- Gross Annual Income: $120,000 (that’s $10,000 a month before taxes)

- Existing Monthly Debts: A $550 car payment and a $350 student loan payment, totaling $900.

- Savings: A solid $70,000 ready for a down payment and closing costs.

Based on their $10,000 gross monthly income, a lender will likely use the 43% DTI rule. This means their total monthly debt obligations, including their future mortgage, can’t top $4,300.

We subtract their existing $900 in debt from that $4,300 ceiling, which leaves them with a maximum of $3,400 for their total monthly housing payment (PITI).

Factoring in Real Dallas Costs

Now for the crucial part: estimating the “Taxes” and “Insurance” portion of PITI right here in the DFW area. These aren’t optional, and they have a huge impact on what you can actually afford.

- Property Taxes: Let’s say they’re looking at a home appraised around $475,000. In Dallas County, a conservative tax rate is about 2.2%, which comes out to $10,450 a year. That adds a hefty $871 to the monthly payment.

- Homeowners Insurance: For a home at this price point in North Texas, a good estimate is around $3,000 annually. That’s another $250 per month.

- HOA Dues: We’ll assume the neighborhoods they like have a modest HOA fee of $50 per month.

When you add those up, the Dallas-specific costs come to $1,171 per month.

After subtracting these local necessities from their max housing budget ($3,400 – $1,171), our buyer is left with $2,229. This is the actual amount they can spend on the mortgage principal and interest each month.

So, what does that get them? At a 6.5% interest rate on a 30-year loan, a $2,229 monthly payment supports a loan of about $352,000.

Finally, we add their down payment. They have $70,000 saved, but let’s set aside $10,000 for closing costs. This leaves $60,000 for the down payment.

Add the loan amount ($352,000) and their down payment ($60,000), and they can realistically shop for homes around the $412,000 mark. This is the exact kind of roadmap every buyer needs: defining a target price, figuring out the down payment, and knowing what you need to save.

As you can see, your savings goals are tied directly to your target home price and down payment. This kind of careful planning is more critical than ever, especially as housing demand continues to outpace supply worldwide. In fact, recent estimates show a need for about 6.5 million more housing units across major developed economies. This shortage gives buyers with a disciplined budget a real advantage. You can discover more insights about the global housing market and its trends to see the bigger picture.

Common Questions About Dallas Home Affordability

https://www.youtube.com/embed/MjS9x5b9AN8

Even after you’ve crunched the numbers, it’s completely normal to have some lingering questions. Buying a home in Dallas is a huge step, and you want to be sure you know what you can really afford before you jump in.

Over the years, I’ve heard many of the same questions from first-time buyers and folks relocating to North Texas. Getting these things cleared up is what builds the confidence you need to make a smart, strong move in this market.

How Much Down Payment Do I Really Need in Dallas?

Everyone hears the 20% rule, mostly because it helps you avoid Private Mortgage Insurance (PMI). But let’s be realistic—that’s a huge chunk of cash, and it’s definitely not the only way to buy a home here.

Plenty of buyers get into great homes with far less. For instance, FHA loans can get you in the door with as little as 3.5% down, and some conventional loan programs start at just 3-5%.

The catch? In a competitive market like Dallas, a bigger down payment speaks volumes. When a seller is looking at multiple offers, the one with more cash down often looks safer and more serious. It can genuinely be the tiebreaker. A higher down payment also means a lower monthly payment and less interest paid over time, which is a nice long-term win.

Your best strategy really depends on a mix of factors: your personal savings, the specific loan program you qualify for, and just how hot the competition is in the neighborhood you’re targeting.

Should I Get Pre-Qualified or Pre-Approved?

Let me be blunt: you absolutely need to get pre-approved. There’s a world of difference between the two, and in a fast-moving market like Dallas, it’s not optional.

Think of pre-qualification as a casual chat. It’s a rough estimate a lender gives you based on numbers you tell them, with zero verification. A pre-approval, on the other hand, is the real deal. It’s a lender’s conditional promise to loan you a specific amount of money after they’ve dug into your verified income, assets, and credit history.

When you’re up against other buyers, that pre-approval letter is your golden ticket. It proves to sellers you’re not just a window shopper; you’re a credible buyer who can actually close the deal. In fact, most agents in Dallas won’t even start showing you homes without one.

How Will My Student Loans Impact What I Can Afford?

Student loans are a big one. Lenders look at them as part of your debt-to-income (DTI) ratio, which is a critical piece of the affordability puzzle. Your required monthly student loan payment directly eats into how much money is left over for a mortgage payment.

Even if your loans are in deferment, lenders don’t just ignore them. They have to account for that future debt. They’ll typically estimate a monthly payment—often 0.5% to 1% of your total loan balance—and add that to your DTI calculation. If you’re on an income-driven repayment plan, they’ll usually use that specific payment amount.

The best way to soften the blow from student debt is to either knock down your other debts (like car loans or credit card balances) or find ways to boost your income before you start the mortgage process.

Navigating the Dallas real estate market requires local expertise and a clear financial strategy. Dustin Pitts REALTOR Dallas Real Estate Agent is dedicated to providing the guidance you need to make a confident and informed decision. If you’re ready to find a home that fits your budget and lifestyle, visit our website to start your journey today.