Figuring out your property tax bill in Dallas isn’t as complicated as it might seem. At the end of the day, it really just comes down to a simple formula: your property’s taxable value multiplied by the total local tax rate.

The trick is knowing what those two numbers actually are and where to find them. Your property’s taxable value isn’t just what it’s worth; it’s the appraised value after you subtract any exemptions you qualify for. The tax rate isn’t one single number, either. It’s a combined rate from different local entities, like the city and the county. Once you get a handle on how these pieces fit together, the whole process becomes much clearer.

The Dallas Property Tax Formula Explained

You don’t need to be a math whiz to calculate your property taxes, but you do need to know who the key players are and where they keep the information you need. The whole system in Dallas is a dance between your property’s valuation and the tax rates set by local governments.

Here’s a quick rundown of who’s involved:

- Dallas Central Appraisal District (DCAD): These are the folks who determine the official market value for every single property in Dallas County. Their appraisal is the starting point for everything.

- Taxing Entities: Your final tax rate is a mashup of several different rates. Think of it as a team effort from the City of Dallas, Dallas County, your local school district (like Dallas ISD), Dallas College, and Parkland Hospital. Each one takes a slice.

- Your Exemptions: This is where you can save some serious money. Exemptions are deductions that lower your property’s appraised value, which directly reduces how much you owe. The homestead exemption is the most common one in Dallas, but there are others for seniors and disabled individuals that are absolutely worth looking into.

The Core Components of Your Bill

Before we dive into the numbers, it helps to understand a few key concepts. You’ll often hear about the nominal tax rate, which is the percentage set by each jurisdiction in Dallas, usually expressed as an amount per $100 of assessed value. This is the rate applied to your property’s value before any exemptions. If you want to get really granular on how these rates are structured, the Lincoln Institute of Land Policy has some fascinating research on the topic.

Your first stop for finding your property’s value is always the Dallas Central Appraisal District’s website.

That search bar highlighted on their homepage is your gateway. It’s where you’ll find the official valuation for your Dallas property, which is the first critical piece of the puzzle. The impact of these taxes can be significant, so getting a firm grasp on the numbers is crucial. To see how it all fits into the bigger picture, you can learn more about Dallas property tax costs and their effect on living expenses in our detailed guide.

To make things even easier, here’s a quick summary of the main components you’ll be working with.

Key Elements of Your Dallas Property Tax Bill

Understanding these three pillars is the foundation for accurately estimating your annual property tax bill in Dallas.

| Component | What It Means for You | Where to Find the Information |

|---|---|---|

| Appraised Value | This is the official market value of your property as determined by DCAD. It’s the starting point for your tax calculation. | On the Dallas Central Appraisal District (DCAD) website by searching for your property. |

| Exemptions | These are valuable deductions (like the homestead exemption) that lower your appraised value, reducing your overall tax burden. | Your current exemptions are listed on your DCAD property record. You can apply for them through the DCAD website. |

| Tax Rates | This is the combined rate from all local entities (city, county, school, etc.) that is applied to your taxable value. | Tax rates are published by each taxing unit and are often summarized on your property’s detail page on the DCAD site. |

Once you have these three pieces of information, you’re well on your way to understanding exactly how your Dallas property tax bill is calculated and what you can expect to pay.

Finding Your Property’s Appraised Value

Everything in the world of Dallas property taxes kicks off with one key number: your property’s official value. This figure, set by the Dallas Central Appraisal District (DCAD), is the absolute foundation of your tax calculation. Honestly, getting this number is the most critical first step.

You can find this information pretty easily by heading over to the DCAD website. Their property search tool is simple to use—just pop in your address or name. The value you see there is the starting line for your entire tax bill.

Market Value vs. Appraised Value

When you pull up your property record on the DCAD site, you’ll probably spot two different numbers that sound alike but mean very different things: market value and appraised value.

It’s a crucial distinction for Dallas homeowners, so let’s break it down.

- Market Value: This is what DCAD estimates your property would sell for on the open market as of January 1st of that tax year. Think of it as a snapshot of the real estate climate in your specific Dallas neighborhood.

- Appraised Value: This is the magic number used for your actual tax bill. For properties with a homestead exemption, Texas law limits how much this value can jump each year, which is why it’s often lower than the market value.

The one that directly hits your wallet is the “appraised value,” not the higher market value.

A common myth I hear all the time in Dallas is that a soaring market value automatically means a proportionally soaring tax bill. Thanks to the 10% annual cap on appraised value increases for homestead properties in Texas, your taxable value is shielded from the full brunt of rapid market appreciation.

The Notice of Appraised Value Explained

Every spring, Dallas property owners get a “Notice of Appraised Value” in the mail from DCAD. This is not a bill. Let me repeat: it’s not a bill. It’s an official heads-up about the values they’ve assigned to your property for the coming tax year.

This document is your chance to review DCAD’s work. It will clearly lay out:

- The proposed market value for your property.

- The appraised value after any assessment caps are applied.

- A list of any exemptions you currently have.

Pay very close attention to this notice. If you look at that market value and think, “No way my house is worth that much,” this is your cue to start the protest process. An inflated valuation directly leads to a higher tax bill, so checking these numbers is your first line of defense in managing what you owe each year in Dallas.

Understanding Dallas County Tax Rates

Once you’ve got your property’s appraised value, the next big piece of the puzzle is the tax rate. A common mistake people in Dallas make is looking for a single “Dallas tax rate.” The truth is, your total tax rate is a composite figure, built by stacking several individual rates from all the local government bodies that serve your specific address.

This layering is what makes figuring out how to calculate property taxes seem a little tricky at first. It’s not just one entity sending you a bill, but a collection of them. For most property owners in Dallas, this group includes some combination of the following:

- The City of Dallas

- Dallas County

- Dallas Independent School District (ISD) (or another local district)

- Dallas College (what used to be the Dallas County Community College District)

- Parkland Hospital District

Each one of these Dallas-area groups sets its own budget and tax rate every year to fund its operations—everything from public schools to county roads and healthcare services.

Finding and Combining the Rates

To find the official, current rates, your best bet is always the Dallas County Tax Office website. They keep a full list of tax rates for every single jurisdiction in the county. Seriously, this is the only place you should get your numbers if you want them to be accurate.

These rates are almost always shown as an amount per $100 of taxable property value. So, if you see a rate of $0.75, it means you’ll owe $0.75 for every $100 of your property’s value. To get your total combined rate, you just have to add up the individual rates for every entity that taxes your specific property in Dallas.

Here’s a quick, simplified example of what this could look like for a hypothetical home in Dallas:

| Taxing Entity | Sample Tax Rate (per $100) |

|---|---|

| City of Dallas | $0.7458 |

| Dallas County | $0.2175 |

| Dallas ISD | $1.0463 |

| Dallas College | $0.1116 |

| Parkland Hospital | $0.2245 |

| Total Combined Rate | $2.3457 |

This combined rate—$2.3457 in our example—is the final number you’ll multiply against your taxable value to get your tax bill.

It’s absolutely critical to use the correct, current-year rates for your specific address in Dallas. A property just a few streets over might be in a different school district or fall outside the city limits, leading to a completely different total tax rate. Always double-check your taxing jurisdictions on the Dallas County Tax Office site.

This kind of jurisdictional complexity isn’t unique to Dallas, by the way. How property taxes are calculated varies wildly across the country based on local rules for setting rates and assessing value. This just goes to show why it’s so important for property owners in Dallas to understand the specific local rules that apply to them. You can learn more about these different approaches in this overview of property tax systems. Getting a handle on this structure is the key to accurately forecasting your annual tax obligation.

Using Exemptions to Lower Your Taxable Value

Alright, you’ve figured out your home’s appraised value and the local tax rates. Now comes the part where you can actually take control: exemptions. This is hands-down your most powerful tool for saving money on property taxes in Dallas.

Exemptions work by chopping a piece off your property’s taxable value, meaning the tax rates get applied to a smaller number. It’s a crucial distinction—exemptions don’t lower the rate; they shrink the value that gets taxed in the first place.

For Dallas homeowners, the homestead exemption is the one everyone talks about, but it’s really just the starting point. Dallas County offers a few other major exemptions that can lead to huge savings, yet so many eligible people don’t even know they qualify. Claiming every single exemption you’re entitled to is one of the smartest financial moves a Dallas property owner can make.

Major Exemptions in Dallas County

Beyond the standard homestead exemption, you really need to look into the others. The savings can add up quickly, so it’s absolutely worth taking a few minutes to check the eligibility requirements for each one.

Here are the heavy hitters you should know about in Dallas:

- Over-65 Exemption: The moment you turn 65, you can apply for an additional exemption on top of your homestead. This not only lowers your taxable value but, more importantly, it freezes the school tax portion of your bill. This “tax ceiling” means your school taxes won’t go up, even if your home value skyrockets.

- Disability Exemption: If you meet the federal definition of disabled, you can qualify for an exemption that works much like the over-65 benefit, including that incredibly valuable school tax ceiling. You don’t have to be 65 to get this one.

- Disabled Veteran Exemption: Texas provides a substantial exemption for veterans with a disability rating from the VA. The amount you save is tied to your disability percentage, and veterans with a 100% rating often qualify for a complete exemption from property taxes on their primary residence.

A key thing to remember: your eligibility is based on your status as of January 1st of the tax year. If you turned 65 or got your disability rating on January 2nd, you have to wait until next year to apply. Timing is everything here, so plan ahead.

The Dallas Central Appraisal District (DCAD) handles the application process for all of these. You’ll need to fill out a form and provide proof of eligibility, like a driver’s license to verify your age or paperwork from the Social Security Administration or VA for disability status.

The Impact of Economic Factors on Taxes

While exemptions are your direct line to managing your tax bill, it’s also smart to understand the bigger economic forces at play. On a global scale, things like economic growth and population booms tend to expand the taxable property base, which can influence how much revenue Dallas-area governments collect. Research into fiscal policies shows how these dynamics constantly shape property tax systems.

Understanding this bigger picture helps clarify why being proactive about your local tax burden through exemptions is so critical. These broader economic trends also feed into the overall financial landscape for anyone living in Dallas. For a complete breakdown, check out our guide on the Dallas cost of living in 2024.

A Real Dallas Property Tax Calculation Example

Okay, let’s put all this theory into practice. It’s one thing to talk about millage rates and assessment ratios, but seeing the numbers come together in a real-world scenario is what really makes it click.

We’ll walk through a hypothetical property tax calculation for a home right here in Dallas. I’ll use realistic numbers and the actual tax rates from a recent year to show you exactly how the formula plays out. You can use this as a model to get a solid estimate for your own tax bill.

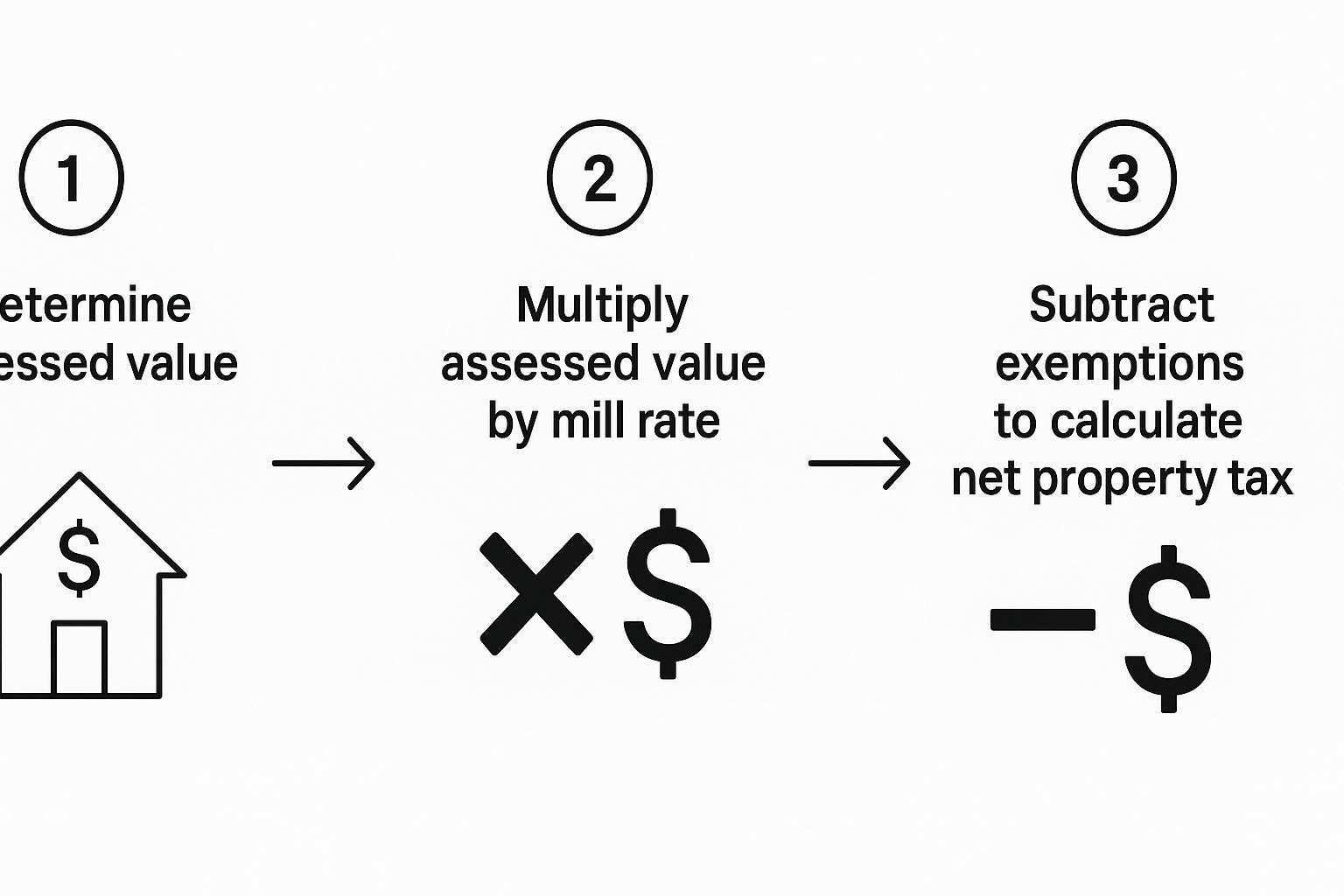

This simple graphic breaks down the core steps.

As you can see, the process is pretty logical. It starts with your property’s value, you apply the tax rate, and then you subtract any exemptions you qualify for.

The Calculation Breakdown

Let’s cook up an example. Imagine a home in Dallas with an appraised value of $500,000, as determined by the Dallas Central Appraisal District (DCAD). The owner has already applied for and received the standard homestead exemption.

First things first, we need to round up all the different tax rates that apply to this property. A single home in Dallas pays taxes to multiple entities.

Here’s what that looks like:

- City of Dallas Rate: $0.7458 per $100

- Dallas County Rate: $0.2175 per $100

- Dallas ISD Rate: $1.0463 per $100

- Dallas College Rate: $0.1116 per $100

- Parkland Hospital Rate: $0.2245 per $100

Add them all up, and you get a total combined tax rate of $2.3457 per $100 of value.

Next, we factor in that homestead exemption. For our example, let’s say the combined value of all exemptions shaves $115,000 off the top.

Appraised Value: $500,000

Less Exemptions: -$115,000

Taxable Value: $385,000

This $385,000 is the magic number—it’s what your tax bill is actually based on. It’s a lot lower than the appraised value, which is exactly why I always tell my clients to apply for every single exemption they might be eligible for. Don’t leave money on the table!

Putting It All Together

Now for the final step. We take our taxable value and apply the combined tax rate. Since the rate is quoted “per $100,” we first need to divide our taxable value by 100.

($385,000 / 100) = 3,850

Then, we just multiply that result by our combined tax rate.

3,850 x $2.3457 = $9,030.95

And there you have it. The estimated annual property tax bill for this Dallas home would be $9,030.95.

While the math itself is straightforward, it involves several precise steps. If you’re managing multiple properties or need to integrate these figures into reports, you might look into tools for automating arithmetic calculations in documents.

By following this exact model and plugging in your own property’s details from the DCAD website, you can get a surprisingly accurate picture of what you’ll owe in Dallas.

Frequently Asked Questions About Dallas Property Taxes

Navigating the world of property taxes can feel a bit overwhelming. Even once you get the hang of the basic formula, there are always unique situations and deadlines that pop up. Here are some straightforward answers to the questions I hear most often from Dallas property owners.

What Should I Do If I Disagree with My DCAD Appraisal?

It’s a common scenario: you get your annual Notice of Appraised Value from the Dallas Central Appraisal District (DCAD) and the number seems way too high. If you believe they’ve overvalued your property, you absolutely have the right to protest it.

The protest process officially kicks off once that notice arrives in your mailbox, which is usually around April or May. You’ll need to file a formal protest with DCAD by the deadline printed right on the notice. Typically, this is May 15 or 30 days after the notice was mailed, whichever is later.

To build your case, you can submit evidence like sales data from comparable homes, photos showing your property’s condition, or even repair estimates. The process might lead to an informal chat with a DCAD appraiser or a formal hearing with the Appraisal Review Board (ARB).

How Often Do Property Tax Rates Change in Dallas?

Property tax rates here in Dallas are set every single year. They aren’t static.

Each taxing entity—think the City of Dallas, Dallas County, Dallas ISD, and others—proposes a budget, holds public hearings, and then adopts a new tax rate for the coming year. This usually happens in the late summer or early fall, around August and September.

Those freshly adopted rates are what’s used to calculate the tax bills that land in your mailbox in October. Because these rates can and do change annually based on city budgets and shifting property values, you’ve got to use the most current rates to get an accurate calculation.

When Are Dallas Property Taxes Due?

In Dallas County, the official tax bills are mailed out to property owners starting in October. You then have until January 31 of the next year to pay them without any penalty or interest.

Mark that date on your calendar. If you pay on February 1 or later, the penalties and interest start piling up immediately. The penalty kicks in at 6% and climbs each month, while interest adds on at 1% per month.

If the taxes go delinquent, additional fees can be tacked on, and the taxing units could eventually take legal action to collect what’s owed. Staying on top of those deadlines is critical to avoiding a much bigger bill, whether you’re in a starter home or looking at Dallas’ high-end real estate gems.