So, how do you actually figure out the return on an investment property in Dallas? At its core, you’re combining the annual net income the property generates with any appreciation in its value. Then, you divide that total by what you initially paid to acquire the asset.

This simple calculation gives you a clear percentage, showing you exactly how hard your money is working for you in the competitive Dallas market.

Your Quick Guide to Dallas Property ROI

If you’re going to invest in Dallas real estate, knowing how to calculate the return on investment is the single most critical skill you can develop. It’s what separates a high-performing asset from a financial drain disguised as a charming duplex in Oak Cliff.

Many new Dallas investors make the mistake of just looking at the monthly rent versus the mortgage payment. That’s a tiny piece of the puzzle. A true ROI calculation gives you a complete financial health report on your investment, forcing you to account for all the details—from Dallas County property taxes to the value added by that kitchen renovation you just completed.

Understanding the Core Formulas

To get a precise picture of your investment’s performance, you really need to look at it from a few different angles. The primary ROI formula is the best place to start because it looks at the big picture: both the cash flow and the property’s growth in value.

Let’s walk through a real-world Dallas example. Imagine you bought a rental in the Bishop Arts District:

- Total Investment Cost: $400,000 (this includes the purchase price plus all your closing costs)

- Annual Rental Income: $36,000 (or $3,000 per month)

- Annual Expenses: $12,000 (covering taxes, insurance, maintenance, etc.)

- Annual Appreciation: $20,000 (a reasonable estimate for value increase in a hot Dallas area)

Here’s how the formula works: ([$36,000 – $12,000] + $20,000) / $400,000.

Your total ROI comes out to 11%. That single number is a powerful benchmark you can use to compare this deal against any other investment opportunity in Dallas. For a deeper dive into how real estate stacks up against other asset classes, you can find a great comparison of real estate and stock returns on Sarwa’s blog.

By mastering a few key calculations, you can quickly analyze a Dallas property’s potential and make data-driven decisions. This removes emotion from the equation and focuses your efforts on assets that will actually build wealth.

While the total ROI is crucial for a long-term view, other metrics are essential for understanding the here and now. Things like cash-on-cash return and cap rate give you a lens into the day-to-day operational health of your investment.

To make things easier, here are the most important formulas you’ll need in your Dallas investor toolkit.

Key ROI Formulas at a Glance

This table breaks down the essential calculations for any Dallas investor. Each one tells a slightly different part of your property’s financial story.

| Formula Name | Calculation | What It Measures |

|---|---|---|

| Total ROI | (Net Income + Appreciation) / Total Investment Cost | The overall annual return, including both cash flow and equity growth. |

| Cap Rate | Net Operating Income / Property Market Value | The property’s unleveraged rate of return, used to compare similar Dallas properties. |

| Cash-on-Cash Return | Annual Pre-Tax Cash Flow / Total Cash Invested | The return on the actual cash you have in the deal, crucial for financed properties. |

Think of these formulas not as homework, but as tools. The more comfortable you get with them, the faster you’ll be able to spot a winning Dallas deal and pass on a loser.

Getting Real About Dallas Income and Expenses

If you want to get an accurate ROI for an investment property, you have to dig into the numbers specific to Dallas. Your calculations are only as good as the data you use, and this is where a great investment is separated from a money pit.

We need to build a realistic financial picture based on the local Dallas market. That means identifying every dollar coming in and, just as importantly, every dollar going out.

Finding All Your Income Sources

The monthly rent is just the beginning. A smart Dallas investor looks for other ways to generate income from a property. In many Dallas neighborhoods—think Uptown or Victory Park—there are plenty of opportunities for this kind of ancillary income.

Don’t leave money on the table. Consider adding these to your income projections:

- Pet Fees and Rent: Dallas is a pet-friendly city. Offering your rental to tenants with pets can be a huge advantage. You can often charge a non-refundable pet fee upfront and tack on a monthly pet rent. It adds up.

- Parking Fees: In crowded areas like the Arts District or anywhere parking is tight, charging a monthly fee for a dedicated spot is common and can be a nice little income booster.

- Utility Reimbursements: For multi-unit properties, you can sometimes bill tenants back for a portion of utilities like water or trash. This is often done using a Ratio Utility Billing System (RUBS).

- Late Fees: You never want tenants to pay late, but it happens. Make sure your lease clearly spells out late fees. When you collect them, they count as income.

Building Your Dallas-Specific Expense List

This is the part where so many new Dallas investors get it wrong. The mortgage is obvious, but the other expenses—especially the ones unique to our area—can eat into your profits if you’re not prepared.

Your expense worksheet absolutely must include these:

- Property Taxes: This is a big one. Texas has some of the highest property tax rates in the country. A classic rookie mistake is to use the seller’s old tax bill. Don’t do it. Your taxes will be reassessed based on your purchase price. To get a handle on this, you can learn how to calculate property taxes in our detailed article.

- Homeowners Insurance: Here in North Texas, our insurance rates factor in the risk of severe weather like hail and tornadoes. You need to get actual quotes to budget properly.

- HOA Dues: Buying a condo in a Victory Park high-rise or a townhome in a planned Dallas community? Those HOA fees are a significant, non-negotiable monthly expense.

- Property Management: If you’re not managing the property yourself, you need to budget for a pro. The going rate in Dallas is typically 8-10% of the monthly rent.

I always tell new investors: Vacancy will happen. You need to plan for it. A good rule of thumb in the Dallas market is to set aside 5-8% of your gross annual rent to cover periods when the property is empty.

Finally, you have to account for repairs and major replacements. These are not “if” but “when” expenses. I recommend budgeting 1% of the property’s value each year for routine maintenance and another 1% for big-ticket items—what we call Capital Expenditures (CapEx)—like a new roof or an HVAC system.

This level of detail is what makes your ROI calculations reliable. It’s how you prepare for the real costs of owning property in Dallas and invest with confidence.

Using Cash On Cash Return For Financed Properties

When you finance a property—and let’s be honest, most investors in Dallas do—the single most important metric you’ll look at is cash on cash return. While other numbers look at the property’s total value, this one gets right to the point. It focuses purely on the return you’re getting from the actual cash you pulled out of your own pocket.

It answers the most critical question an investor can ask: “For every dollar I put into this deal, how many cents am I getting back each year?” This simple, direct focus makes it the perfect tool for comparing different opportunities across the DFW metroplex to see where your money is working the hardest.

The Breakdown Of A Dallas Deal

Let’s walk through a realistic Dallas scenario. Imagine you’re eyeing a duplex in a hot, up-and-coming area like East Dallas. It needs a little TLC, but the potential is there. Your initial cash investment isn’t just the down payment—that’s a common mistake.

You have to account for everything you pay upfront:

- Down Payment: The big chunk of cash you pay to secure the loan.

- Closing Costs: All those fees for the lender, title company, and other services. Here in Texas, you can expect these to run 2-3% of the loan amount.

- Initial Renovation Budget: The money you’ve earmarked for immediate repairs and upgrades to get the units rent-ready and attractive to Dallas tenants.

The total of these three—your down payment, closing costs, and rehab budget—is your Total Cash Invested. This is the bottom number in your cash on cash return formula. It’s the true measure of your skin in the game.

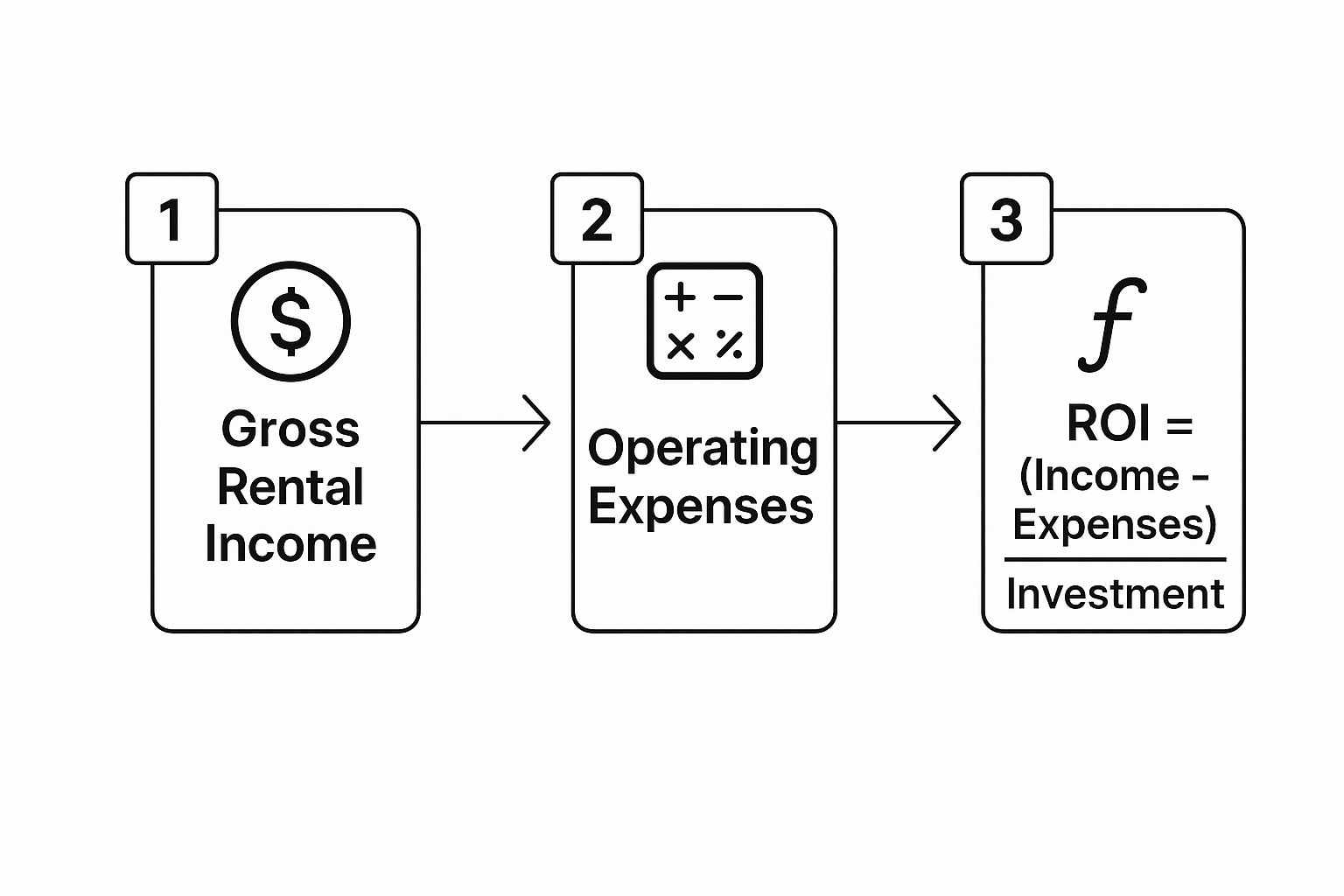

This infographic breaks down the basic flow for figuring out how your property is performing.

As you can see, your return is what’s left after all the bills are paid, measured directly against what it cost you to get into the deal.

Calculating For A Financed Scenario

Once you know your total cash investment, you need to figure out your annual pre-tax cash flow. This is your gross rental income minus all your operating expenses plus your total mortgage payment (including both principal and interest). If you need a more detailed walkthrough, we have a guide on how to calculate cash flow on a rental property with total accuracy.

Let’s put some real numbers to our East Dallas duplex example:

- Total Cash Invested: You put down $80,000 for the down payment, paid $10,000 in closing costs, and budgeted $15,000 for initial renovations. That’s a total of $105,000 out of pocket.

- Annual Pre-Tax Cash Flow: After collecting all the rent and paying for taxes, insurance, maintenance, and the mortgage, you’re left with $12,600 in cash for the year.

The formula itself is straightforward: Annual Pre-Tax Cash Flow / Total Cash Invested.

For our example: $12,600 / $105,000 = 0.12.

That gives you a cash on cash return of 12%. In the Dallas market, that’s a solid return and a perfect illustration of how smart financing can amplify your gains.

Many investors today are getting creative with their financing. For a deeper dive into loans designed specifically for rental properties, check out this ultimate guide to DSCR loans for real estate investors. At the end of the day, cash on cash return is the metric savvy Dallas investors use to decide which deals truly deliver the most bang for their buck.

Gauging Market Value With Capitalization Rate

While cash on cash return is all about your specific deal, the capitalization rate, or “cap rate,” is the great equalizer. It’s the metric that lets you quickly compare different investment properties in Dallas on an apples-to-apples basis.

Think of it as a property’s financial heartbeat. Cap rate strips away the unique effects of your financing and shows you the property’s raw, unleveraged income potential. This is how you can instantly tell if the asking price for a multi-unit in North Dallas is justified compared to a similar one in an up-and-coming South Dallas neighborhood. For savvy Dallas investors, it’s the go-to tool for spotting overvalued properties and uncovering genuine deals.

Demystifying The Cap Rate Formula

Calculating the cap rate is actually pretty straightforward.

The formula is: Net Operating Income (NOI) / Current Market Value.

The key here is getting a firm handle on Net Operating Income. NOI is simply all of your property’s revenue minus all of its operating expenses. The crucial part? This calculation completely excludes your mortgage payment. We’re looking at the property’s earning power independent of any loans.

Here’s a quick breakdown of what goes into NOI:

- Gross Rental Income: The total rent you could possibly collect in a year.

- Operating Expenses: This is the real-world stuff—property taxes, insurance, routine maintenance, property management fees, and a budget for vacancies.

By focusing on NOI, the cap rate gives you a pure look at a property’s operational profitability. It answers a simple question: “If I paid all cash for this property, what would my annual return be before any loan costs?”

Putting Cap Rate To Work in Dallas

Let’s run the numbers on a real-world Dallas scenario.

Imagine you’re eyeing a fourplex in the Lakewood area with a market value of $1,000,000. After doing your homework, you determine its NOI is $60,000 per year.

The calculation is simple: $60,000 (NOI) / $1,000,000 (Market Value) = 0.06.

That gives you a cap rate of 6%. Now, the real power comes from comparing this 6% to other similar properties in Lakewood or even across town in places like Plano or Frisco. If comparable properties are trading at a 5% cap rate, your potential deal looks pretty attractive. But if they’re selling at 7%, the asking price might be too high.

For a deeper dive, Keshman Property Management offers a great explanation of What Is Cap Rate In Real Estate Investing.

It’s also important to know the typical cap rates for different property types. Historically, long-term returns show distinct profiles for residential versus commercial real estate. If you want a tool to quickly run these numbers, our rental yield calculator can help. It’s this level of analysis that helps you make truly informed decisions in a competitive Dallas market.

Don’t Forget Appreciation: The Other Half of Your ROI

In a booming market like Dallas, focusing only on cash flow is a rookie mistake. It’s a huge piece of the puzzle, for sure—it keeps the lights on and pays the mortgage. But the real long-term wealth in real estate is often built quietly in the background through appreciation.

Think of it this way: ignoring appreciation is like only counting your dividends and ignoring your stock’s price growth. It’s a powerful engine for building equity, especially in a city fueled by constant population and job growth. To get a true sense of your investment’s performance, you have to factor it in.

How to Estimate a Sensible Appreciation Rate

The key here is to stay grounded in reality. You can’t just slap a 10% appreciation rate on your spreadsheet and call it a day. A good estimate is built on solid data, not wishful thinking.

Here’s my approach for pinning down a defensible appreciation number for a Dallas property:

- Go Hyper-Local with Data: Don’t just look at the average for “Dallas.” A property in Plano will appreciate very differently from one in Oak Cliff. Dig into the historical data for the specific neighborhood—or even the specific subdivision—over the last 5-10 years to find a conservative average.

- Run Fresh Comps: This is non-negotiable. I always ask my agent to pull recent comparable sales (“comps”) for similar properties in the immediate area. What have properties actually sold for in the last three to six months? This gives you a real-time pulse on where the Dallas market is headed.

- Scout for Growth: Pay attention to what’s happening around your property. Is a new corporate headquarters breaking ground nearby? Are they widening the main road or building a new light rail station? These local developments are often leading indicators of future value bumps.

By digging into these local drivers, you shift from pure guesswork to making an educated projection. The goal isn’t to be a fortune teller; it’s to create a reasonable forecast you can plug into your long-term ROI calculations.

Putting It All Together: Calculating Your Total Return

Once you have a conservative annual appreciation estimate, you can finally see the big picture. You just add your projected appreciation to your net operating income to find your total gain for the year.

The formula for Total ROI looks like this:

Total ROI = (Annual Net Income + Annual Appreciation) / Total Investment Cost

Let’s run the numbers on a real-world Dallas example. Say your rental property clears $8,000 in net income for the year. After researching comps and local trends, you land on a conservative 4% annual appreciation rate for its $400,000 value. That’s $16,000 in equity growth.

If your all-in investment cost was $400,000, the math is simple:

($8,000 Net Income + $16,000 Appreciation) / $400,000 = 0.06 or 6% Total ROI

This total return metric is what lets you accurately compare a Dallas rental property against other investments, like stocks or bonds. Historically, real estate has proven to be a remarkably stable performer. A comprehensive study on historical returns from 1870–2015 found that residential real estate delivered average real returns of about 6.6% per year, even outperforming the more volatile stock market.

By combining your monthly cash flow with a data-backed appreciation forecast, you get the complete story of how your investment is working for you.

Digging Deeper: Your Dallas Property ROI Questions Answered

When you’re trying to figure out the real return on a Dallas investment property, a lot of questions pop up. It’s natural. Getting the numbers right is the difference between a great investment and a costly mistake, especially in a market as unique as North Texas.

Let’s break down some of the most common questions I hear from investors.

What’s a Good Cash on Cash Return in Dallas?

Everyone wants a benchmark, and for Dallas, most investors are looking for a cash on cash return somewhere between 8% and 12%.

But let’s be real—this isn’t a hard and fast rule. In super popular neighborhoods like Uptown or the M-Streets, you’ll likely see returns on the lower end of that scale simply because the property prices are so high. On the flip side, you might uncover opportunities for much higher returns in up-and-coming areas of Dallas.

The trick is to balance that potential return with the risk you’re taking on. A 12% return looks fantastic on paper, but you have to dig into the property, the tenants, and the neighborhood to understand why the numbers are what they are.

How Do I Handle Dallas Property Taxes in My Numbers?

This is a big one. Seriously. Texas is famous for its property taxes, and if you get this number wrong, it can absolutely wreck your ROI.

The single biggest mistake I see new Dallas investors make is using the seller’s current tax bill in their own calculations. Don’t do it. The moment you buy the property, its value gets reassessed at your purchase price, which almost always means your tax bill is going to jump.

My rule of thumb for clients? When you’re first analyzing a deal in Dallas County, plug in an estimate of 2.0% to 2.5% of the purchase price for your annual property taxes. It’s a conservative buffer that saves you from a nasty surprise later.

You can always get more specific estimates from the Dallas Central Appraisal District (DCAD) website, but starting with a safe estimate is just smart business.

Should I Factor in Appreciation When I First Analyze a Property?

When you’re deciding whether or not to buy a Dallas property, my advice is to keep it simple. Focus on the metrics that tell you how the property performs today—things like cash on cash return and cap rate. These are based on real, verifiable income and expenses, giving you a solid picture of the investment’s immediate financial health.

Appreciation is incredible for building long-term wealth, especially in a hot market like Dallas, but at the end of the day, it’s a prediction. It’s not guaranteed cash in your pocket.

Think of it this way: Calculate your total ROI with appreciation for your long-term strategy, but make your initial buying decision based on whether the property generates positive cash flow right out of the gate.

Ready to find a Dallas investment property that hits your ROI targets? The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the on-the-ground expertise to help you run the numbers and find the right opportunities. Start your search with us and let’s make a smart investment together.