Saving for your first home in Dallas boils down to a few core actions: set a specific goal tied to real North Texas home prices, build a budget that actually fits your lifestyle, and then find ways to put that savings plan on steroids. With a clear strategy, that dream of owning a home in the DFW metroplex is much closer than it seems.

Your Realistic Path to Dallas Homeownership

Buying a home in Dallas can feel like a massive undertaking, but it’s absolutely doable when you have a plan built for this market. Let’s ditch the generic advice you find everywhere else. This guide gets into the nitty-gritty of what it really takes to buy in North Texas.

This isn’t just about stashing cash away. It’s about building a solid financial launchpad so you can jump into the competitive Dallas real estate scene with confidence. We’ll walk through how to figure out your true savings target, create a budget you can stick with, and even find local programs designed to help you.

Setting the Stage for Success

Your journey to a Dallas home starts with a crystal-clear vision. Knowing how to set effective financial goals is the first, most critical step. It’s what turns a fuzzy “I want to buy a house someday” into a concrete target with a real deadline.

Think about it: a well-defined goal gives you a roadmap. Instead of just “saving for a house,” you’ll be saving for a specific down payment on a home in a neighborhood you love, whether that’s in Richardson or Oak Cliff. This focus makes every spending decision that much simpler.

Laying the Financial Foundation

Before you can start building up your savings, you need a rock-solid foundation. This means getting an honest look at your current financial health and prepping for what lenders want to see. Your credit score and debt-to-income ratio are the two big players here.

Start by getting these ducks in a row:

- Check your credit: Pull your credit report and make sure there are no errors. A higher score can unlock better loan terms and lower interest rates, saving you a ton of money.

- Calculate your debt-to-income (DTI) ratio: Lenders use this to see how much of your monthly income is already spoken for by debt. A lower DTI makes you a much stronger applicant.

- Get pre-approved: In a market as hot as Dallas, this isn’t optional—it’s essential. To get the full picture, check out our guide on how to get pre-approved for a mortgage. It breaks down exactly what lenders are looking for.

Tackling these foundational steps before you start saving aggressively ensures your efforts aren’t wasted. A strong financial profile makes you a more attractive borrower and can save you thousands over the life of your loan.

Figuring Out Your Dallas Down Payment Goal

Before you can really start saving for a home, you need a number—a real, tangible goal to work toward. Just saying “I’ll save more money” is too vague to get you from renter to homeowner, especially in a competitive market like Dallas. Your target has to be specific and realistic, rooted in what homes actually cost right here in North Texas.

Think about it: the price of a home can swing wildly from one Dallas neighborhood to the next. A starter home in a quiet suburb like Richardson is going to have a very different price tag than a condo in Uptown. The first, most critical step is to start looking at median home prices in the areas you’re actually interested in. This turns a fuzzy dream into a concrete financial goal.

Let’s Talk About That 20 Percent Myth

You’ve probably heard it a million times: you need a 20% down payment to buy a house. While that’s great advice for avoiding Private Mortgage Insurance (PMI), it’s not the only way to get your foot in the door. For most aspiring Dallas homeowners, saving up 20% could take years—years you could be building equity instead.

Fortunately, there are several loan options that make homeownership much more attainable.

- Conventional Loans: Many lenders now offer conventional loans with down payments as low as 3% to 5% for qualified buyers. On a $400,000 home, that’s a down payment of $12,000 to $20,000, not a whopping $80,000.

- FHA Loans: Backed by the government, FHA loans are a go-to for many first-time buyers. They often require just 3.5% down, which can dramatically shorten the time it takes you to save up.

It’s smart to get familiar with the different requirements and benefits. We break it all down in our guide on the essentials of a first-time buyer down payment to help you figure out which path makes the most sense for you.

Looking Beyond the Down Payment

Your down payment is the big one, but it’s not the only check you’ll be writing. Forgetting to budget for other expenses is a classic rookie mistake that can really throw a wrench in your plans. Here in Texas, closing costs are a significant expense you absolutely must plan for.

Typically, closing costs run between 2% to 5% of the home’s purchase price. This bucket of fees covers everything from loan origination and appraisals to title insurance. For that same $400,000 Dallas home, you should have an extra $8,000 to $20,000 set aside just for these costs.

And there’s more. You’ll also need cash on hand for:

- Home Inspection: This is non-negotiable. A thorough inspection will cost a few hundred dollars but can save you thousands.

- Appraisal Fee: Your lender will require an appraisal to confirm the home’s value, and that fee comes out of your pocket.

- Initial Escrow Payment: You’ll likely need to pre-pay a few months of property taxes and homeowner’s insurance at closing.

Building Your Personal Savings Target

Okay, let’s put all the pieces together. To create your personalized savings goal, you need to add up your target down payment, estimated closing costs, and a little extra for those initial move-in expenses.

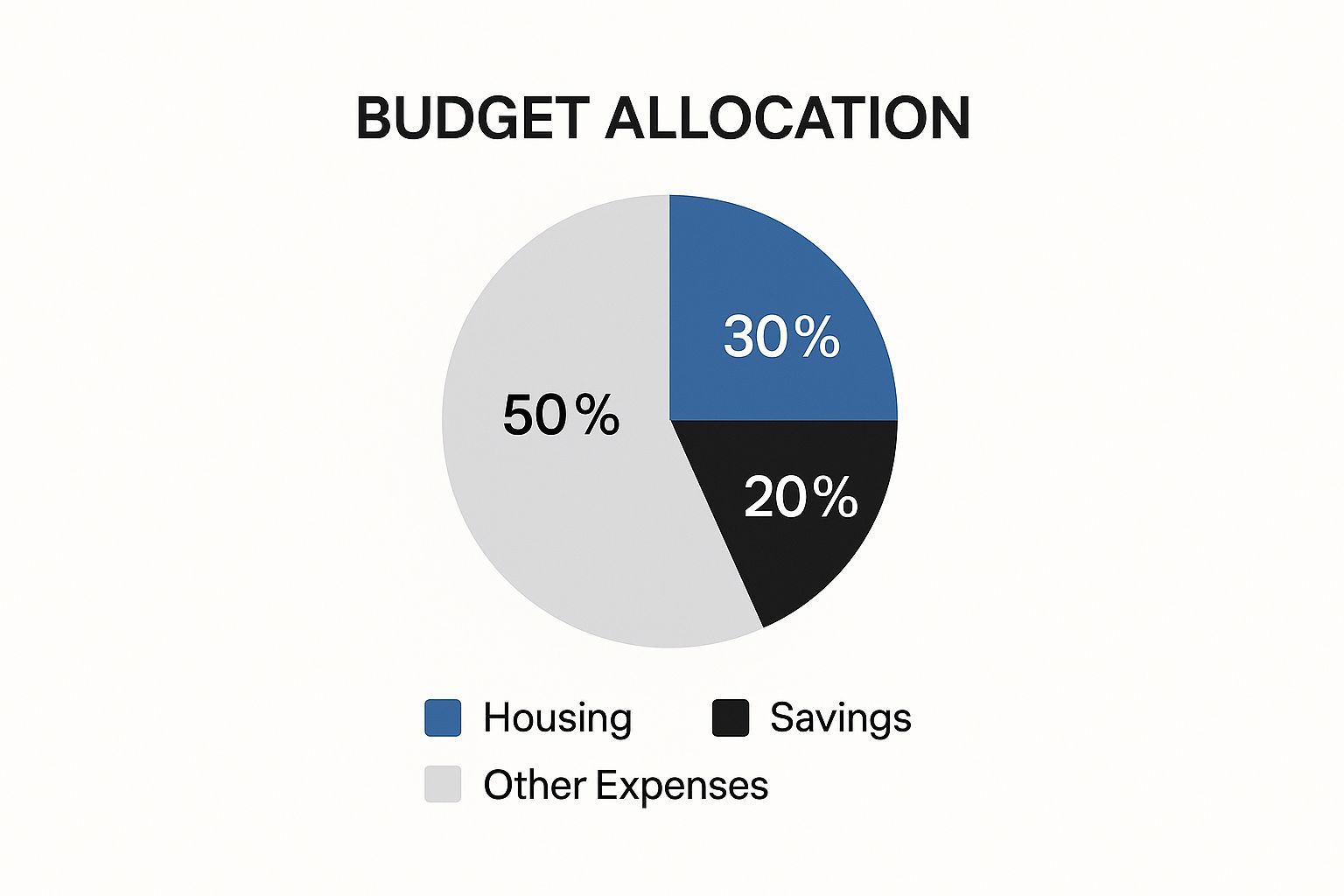

A great way to get there is to make saving a non-negotiable part of your budget. This visual shows a simple but powerful framework.

This model dedicates a full 20% of your income directly to savings. When you have a massive goal like a down payment, an aggressive strategy like this can make all the difference.

Real-World Savings Goal Calculation

Let’s imagine you’re looking at homes in a Dallas neighborhood where the median price is around $425,000.

- Down Payment (5% Conventional): $21,250

- Closing Costs (3% Estimate): $12,750

- Initial Expenses (Inspections, etc.): $1,500

- Your Total Savings Goal: $35,500

That number—$35,500—is what you’re aiming for. It’s specific, it’s actionable, and it’s based on real-world Dallas figures. With a clear target like this, you can finally build a budget and savings plan that will actually get you there.

Budgeting for Your Dallas Lifestyle

Okay, you’ve got a solid savings target in mind. Now comes the real work: building a budget that actually gets you there. A generic plan you find online isn’t going to cut it. We need a budget that understands what it’s really like to live in Dallas—from the daily grind on the Dallas North Tollway to a weekend brunch in Bishop Arts.

This isn’t about cutting out all the fun. It’s about being intentional. The whole point is to create a spending plan you can stick with, one that gets you closer to owning a home without making you miserable. Think of it as giving every dollar a job, and the most important job right now is building your future.

Adapting the 50/30/20 Rule for Dallas

A great place to start is the classic 50/30/20 rule, which breaks down your after-tax income. But to make it work for a future homeowner in a major city like Dallas, we need to give it a little twist.

Here’s the standard breakdown:

- 50% for Needs: This is all the non-negotiable stuff. We’re talking rent, utilities, groceries, your car payment, insurance, and yes, those lovely NTTA tolls.

- 30% for Wants: This is your lifestyle fund. Think dinner out, tickets to a show at the American Airlines Center, or a shopping trip to NorthPark.

- 20% for Savings: This bucket is for your future, and right now, your down payment is the top priority.

Ready for the pro move? Flip your “Wants” and “Savings.” By committing 30% of your income to savings and dialing back your lifestyle “Wants” to 20%, you can seriously accelerate your home-buying timeline. It’s a game-changer.

A budget isn’t a financial straitjacket; it’s a tool for freedom. By consciously directing your money toward what matters most—your future home—you take control of your financial destiny.

This shift takes discipline, no doubt. But trust me, watching that down payment account grow every single month is all the motivation you’ll need.

Pinpointing Your Dallas Spending Leaks

Every budget has leaks—those small, almost invisible expenses that bleed your account dry over time. In Dallas, these little money drains can be unique to our way of life. Find them, plug them, and you can easily free up hundreds of dollars a month for your house fund.

Look out for these common Dallas-area spending traps:

- The Convenience Habit: That daily coffee from your favorite local spot? Those few-times-a-week DoorDash orders? It feels small in the moment, but it can easily become a $200-$400 a month problem.

- Toll Road Dependency: Tolls are a fact of life here, but using them for every single trip adds up fast. Firing up Waze to find a toll-free route, even if it adds a few minutes, can save you $50 or more every month.

- Subscription Overload: How many streaming services, monthly boxes, and apps are you really using? Take 30 minutes to audit everything and be ruthless about what you cancel.

- Spontaneous Nights Out: A last-minute decision to hit Deep Ellum or Uptown can do serious damage to your budget. A little bit of planning can make a huge difference.

You don’t have to become a hermit. Just get strategic. Pack a lunch a few more days a week. Explore the amazing free things Dallas has to offer, like a walk on the Katy Trail or a picnic at Klyde Warren Park. Have friends over for a game night instead of hitting the bars. These small changes make a massive impact.

The Reality of Saving Consistently

Knowing you should save is easy. Actually doing it, month after month, is the hard part. The data backs this up. While employed Americans save an average of 23% of their pay, the median saver—the person right in the middle—only puts away about 15%. Worse, nearly two-fifths save less than 20%, and 10% aren’t saving regularly at all.

This just shows how challenging it can be to make saving a consistent habit. You can dig into these national savings trends to see the bigger picture and understand you’re not alone in this challenge.

Smart Strategies to Accelerate Your Savings

Alright, you’ve got your savings goal and a Dallas-specific budget. That’s a huge first step. Now, it’s time to stop just setting money aside and start actively making it grow.

This is where the real momentum builds. It’s about making smart, intentional moves that can shave months, or even years, off your home-buying timeline. You want your money to start working as hard as you are.

The first, non-negotiable step? Get that down payment fund out of your everyday checking account. Immediately. Open a high-yield savings account (HYSA). These are typically online accounts that pay way more interest than your brick-and-mortar bank. It’s a simple move that means your money is making more money just by sitting there. Plus, the “out of sight, out of mind” factor is real—it keeps you from accidentally spending it.

Make Your Money Work for You

Think of a high-yield savings account as your financial launchpad. It’s a safe, low-risk spot where your growing down payment can at least keep pace with inflation. Your savings are on a treadmill, not just sitting on the couch.

Once that’s set up, you can look at other avenues. Saving for a home is a marathon, not a sprint. Taking some time to understand what long-term investing entails can be a game-changer for building real wealth. Now, you wouldn’t dump your entire down payment fund into the stock market—that’s too risky for a short-term goal. But directing other long-term savings into investments can grow your net worth and indirectly get you to your homeownership goal faster.

Your strategy here is to create multiple streams of financial growth. Let your HYSA earn steady interest, let your budget free up cash, and let your income-boosting efforts add fuel to the fire. It’s a multi-pronged attack on your savings goal.

Boost Your Dallas Income

One of the great things about Dallas is its booming economy. There are tons of opportunities to earn more. While cutting expenses is fantastic, you can only trim so much. Your earning potential, on the other hand, is limitless.

Here are a few practical ways to bring in more cash in the DFW area:

- Negotiate a Raise: Do your homework. Find out what your role is worth in the Dallas market. Armed with that data and a list of your accomplishments, build a solid case for a salary bump and present it to your manager.

- Tap into the Gig Economy: Take advantage of flexible work. Drive for Uber or Lyft during a Cowboys game or a big concert. Deliver for DoorDash during the lunch rush. Find freelance projects on platforms like Upwork that fit your skillset.

- Monetize a Hobby: Are you a great photographer, a talented writer, or a crafty artist? Turn that passion into a side hustle. Dallas has a vibrant market for all sorts of creative services.

Tackle High-Interest Debt

High-interest debt is the anchor dragging down your savings ship. I’m talking about credit card balances. The interest you’re paying on that debt is almost certainly demolishing any gains you’re making in your HYSA. Paying it off aggressively is one of the best financial returns you can get.

Most people find success with one of two popular strategies:

- The Avalanche Method: You attack the debt with the highest interest rate first, no matter the balance. This approach saves you the most money on interest over time, plain and simple.

- The Snowball Method: You focus on paying off the smallest debt first. That quick win gives you a powerful psychological boost, and you “snowball” that payment into the next smallest debt.

Pick a method and commit to it. Doing so can free up hundreds of dollars each month that you can then redirect straight into your down payment fund. Hitting that savings goal takes this kind of focused effort. For someone aiming for a 20% down payment in Dallas, saving 10-15% of their disposable income can still take several years. This is exactly why these active growth strategies are so critical.

Using Dallas Homebuyer Assistance Programs

This is the secret weapon many first-time buyers in Dallas don’t even know they have. After all the hard work of budgeting and saving, finding out there’s money available to help can feel like you’ve found a cheat code.

Don’t let the paperwork or application process scare you off. Both the city of Dallas and the state of Texas offer some incredible programs designed specifically to help people get into their first homes. Tapping into these resources could mean thousands of dollars in your pocket—money you might be leaving on the table otherwise.

The Dallas Homebuyer Assistance Program (DHAP)

If you’re looking to buy within the city limits, your first stop should be the Dallas Homebuyer Assistance Program (DHAP). This program is a true game-changer, offering up serious funds to help you cover your down payment and closing costs.

DHAP provides this help as a forgivable loan. What does that mean? It means if you live in the home for a set amount of time (usually 5 to 15 years), the loan is completely forgiven. It essentially turns into a grant you never have to pay back. For some buyers, the assistance can be enough to cover the entire down payment on an FHA loan.

Of course, there are a few boxes you need to check to qualify:

- Income Limits: Your total household income needs to be below a certain level, which is tied to the Area Median Income (AMI) for Dallas.

- Property Location: The home must be inside the Dallas city limits.

- First-Time Homebuyer: Generally, this means you haven’t owned a home in the past three years.

- Homebuyer Education: You’ll need to complete an approved course to make sure you’re ready for homeownership.

This is a powerful tool designed to give Dallas residents a leg up.

Statewide Support from TDHCA

Your options aren’t just limited to the city. The Texas Department of Housing and Community Affairs (TDHCA) offers several statewide programs that work in Dallas and the surrounding suburbs, which gives you more flexibility.

One of the most popular is the My First Texas Home program. It offers a mortgage that comes with up to 5% of the loan amount to put toward your down payment and closing costs. This assistance comes in the form of a second loan that has no interest and no monthly payments.

Think of these programs as a partnership. The city and state are investing in your success as a homeowner because stable homeownership builds stronger communities. It’s a win-win scenario.

Another incredible resource is the Texas Mortgage Credit Certificate (MCC). This isn’t down payment assistance, but it can be just as valuable over time. An MCC is a special tax credit that lets you deduct a portion of the mortgage interest you pay each year, potentially saving you up to $2,000 annually. The best part? You can often stack an MCC with a TDHCA down payment program.

For a deeper dive into these options, check out our guide on closing cost assistance programs.

Why This Matters for Your Savings Journey

So, how does this actually help you? A program that covers your $15,000 down payment instantly fast-forwards your timeline. The money you’ve already saved can now be put toward a larger down payment to lower your monthly mortgage, cover all your closing costs, or—and this is a big one—build a solid emergency fund.

Having that cash cushion is non-negotiable. Unexpected repairs can pop up at any time. A recent annual emergency savings report found that while about 55% of U.S. adults have enough to cover three months of expenses, a shocking 18% have less than $100 saved. Using an assistance program lets you protect your savings for when life throws you a curveball.

Answering Your Top Dallas Home Savings Questions

Even the best-laid plans come with questions, especially when you’re saving for a home in a market as dynamic as Dallas. It’s totally normal to wonder if you’re on the right track. Let’s dig into some of the most common hurdles and questions I hear from aspiring homeowners right here in North Texas.

How Much Do I Really Need for a Down Payment in Dallas?

This is usually the first question on everyone’s mind, and the answer is probably less intimidating than you think. The old 20% rule is more of a myth than a requirement these days. Sure, for a home around the $400,000 mark—a common price point in the Dallas area—a 20% down payment would be a hefty $80,000.

But that’s not the path most first-time buyers take. The reality is much more accessible.

- An FHA loan is a popular choice, often requiring just 3.5% down. On that same $400,000 house, you’re looking at $14,000.

- Many conventional loans are now available for qualified buyers putting down only 3-5%, which sets your target somewhere between $12,000 and $20,000.

The key is to remember closing costs, which typically run another 2-5% of the purchase price. The best thing you can do is talk to a lender who knows the Dallas market. They’ll help you figure out a precise, achievable savings goal based on the loans you actually qualify for.

Are Some Dallas Neighborhoods Better for First-Time Buyers?

Absolutely. It’s easy to get sticker shock when you see prices in places like Preston Hollow or Uptown, but Dallas is full of fantastic neighborhoods perfect for getting your start. You just have to know where to look.

Expanding your search a bit can make your savings goal feel much closer. I often point my clients toward areas that offer a great blend of value, community, and potential.

- East Dallas: Check out communities like Lake Highlands or Casa View. You get more of a classic suburban feel while still being well-connected to the city.

- Oak Cliff: If you venture just beyond the popular Bishop Arts District, you’ll find some incredibly charming homes at more approachable prices.

- Nearby Suburbs: Don’t sleep on cities like Mesquite, Garland, and Richardson. They consistently offer amazing value and are a go-to for first-time buyers who want a bit more space.

The right neighborhood always comes down to your personal lifestyle and commute, but casting a wider net in these areas can dramatically speed up your savings timeline.

Your dream of owning a home in Dallas shouldn’t be limited to the most expensive zip codes. The real win is finding a neighborhood that fits your budget and your life—and DFW has more of those than you think.

Should I Wipe Out All My Debt Before I Start Saving?

Not always, but you do need a smart strategy. The number lenders care most about is your debt-to-income (DTI) ratio. This is simply the percentage of your gross monthly income that goes toward paying off debt.

Your first priority should be attacking high-interest debt, like credit card balances. That kind of debt is a huge drag on your DTI and can seriously hurt your chances of getting a good interest rate. Paying it down is one of the best financial moves you can make.

However, manageable long-term debt—like a student loan or a car payment with a low interest rate—won’t automatically disqualify you. A balanced approach often works best: aggressively pay down the high-interest debt while you build up your down payment in a separate high-yield savings account.

How Big of a Deal Is My Credit Score in Dallas?

In a word: huge. Your credit score is one of the most critical pieces of the puzzle. In a competitive market like Dallas, it’s what lenders look at to decide your interest rate and which loan programs you can access. A strong score tells them you’re a low-risk borrower.

Here’s a rough idea of what lenders are looking for:

- Conventional Loans: You’ll generally need a score of 620 or higher. To get the absolute best interest rates, lenders love to see scores of 740 and up.

- FHA Loans: These offer more flexibility and can sometimes be approved with scores as low as 580, though specific lender requirements may be stricter.

Before you get too far down the road, pull your credit report. Check for errors and dispute anything that looks off. Then, lock in on two simple habits: make every single payment on time and keep your credit card balances low. Just bumping your score a few points can save you thousands over the life of your mortgage.

Ready to turn your Dallas homeownership dream into a reality? Navigating this market requires local expertise and a dedicated advocate. At Dustin Pitts REALTOR Dallas Real Estate Agent, we specialize in guiding first-time buyers through every step of the process, from refining your savings plan to closing on the perfect home. Let us help you find your place in Dallas. Visit us at https://dustinpitts.com to start your journey today.