Let’s get right to the point. If you’re looking to buy an investment property in Dallas, you should plan on putting down at least 20% to 25%. That’s a pretty significant jump from what you’d expect for a primary home, and it’s simply the cost of entry into the competitive Dallas real estate world.

What Dallas Investors Need for a Down Payment

Securing a loan for an investment property is a completely different ballgame than buying the home you’re going to live in. Lenders look at these deals through a much stricter lens of risk. They need to see that you have serious “skin in the game,” and a hefty down payment is the clearest way to show you’re committed.

This higher requirement isn’t just some arbitrary number. It acts as a critical buffer for the lender. In a dynamic market like Dallas—from the bustling streets of Uptown to the quieter suburbs of Richardson—property values can and do shift. A larger down payment creates an instant equity cushion, which protects the lender’s capital if the market takes a dip.

The Baseline Requirements for Dallas Investors

Think of the down payment as the foundation of your entire investment. While 20-25% is the standard benchmark, lenders are going to look at your whole financial story before giving you the green light. This means they’ll scrutinize more than just your cash on hand; they’ll also dig into your creditworthiness and your ability to cover unexpected costs.

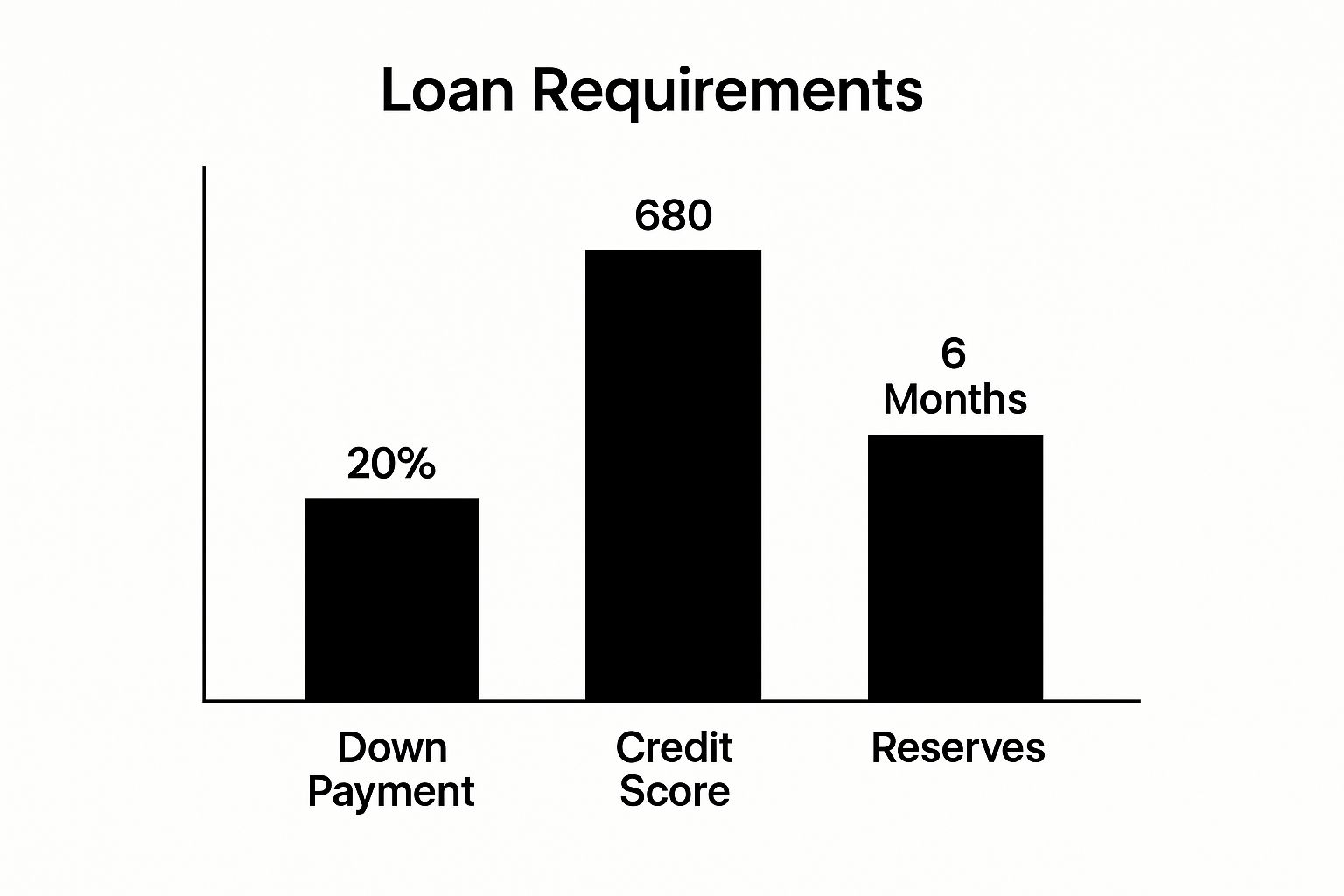

This image really breaks down the three core pillars that lenders will focus on for a typical Dallas investment property loan.

These numbers are the starting point for almost any financing conversation you’ll have in the Dallas-Fort Worth area.

To give you a quick cheat sheet, here’s a breakdown of what you can generally expect for different types of investment loans available in Dallas.

Typical Investment Property Down Payments in Dallas by Loan Type

| Loan Type | Typical Down Payment Range | Best For |

|---|---|---|

| Conventional Loan | 20-25% | Investors with strong credit and financials looking for traditional financing. |

| DSCR Loan | 20-30% | Investors whose primary focus is the property’s income-generating potential. |

| Hard Money Loan | 25-35% | Short-term investors and flippers who need to close quickly. |

| FHA Multi-Unit | 3.5% (Owner-occupied) | First-time investors willing to live in one of the units of a 2-4 unit property. |

Remember, these are just general guidelines. Your specific situation and the lender you work with will determine the final numbers.

A Look at National Trends

The steep down payment for investment properties isn’t just a Dallas thing, though our hot market certainly adds to the pressure. It’s a national trend that reflects a growing sense of caution among lenders. The average down payment for investment properties recently hit 27.4%, which is nearly double the 14.4% average for primary homes.

That gap really highlights the fundamental difference in how lenders view the risk between a personal home and an investment property. If you want to dive deeper into the numbers, you can find more on these investment property statistics on Bankrate.com.

Key Takeaway: That 20-25% down payment isn’t just a hurdle to clear; it’s a strategic requirement. It proves your financial stability and signals to lenders that you’re a serious Dallas real estate investor. Think of it as the first major step toward building a successful property portfolio in this incredible Texas market.

Why Lenders Want More Skin in the Game from Dallas Investors

Ever wonder why lenders get so particular about investment property down payment requirements in Dallas? It boils down to one simple word: risk.

From a lender’s perspective, your primary home is a sanctuary you’ll do almost anything to keep. An investment property, on the other hand, is a business. If that business starts to lose money, it’s much easier to walk away.

In a dynamic market like Dallas-Fort Worth, lenders know there’s a higher chance an investor might default on a rental in Plano during a market dip than on their own home in Preston Hollow. That perception of higher risk is precisely what shapes their stricter lending rules.

It’s All About a Financial Safety Net

Think of a bigger down payment as the lender’s financial cushion. When you put down 20-25%, you’re not just handing over cash; you’re showing you have serious skin in the game. It proves you’re financially committed to making the venture a success.

That significant down payment immediately gives you equity in the property. This equity is a powerful motivator to keep up with your mortgage, even if the rental market gets a little soft for a few months.

For the lender, that equity buffer is critical. If the worst happens and you default, the foreclosure sale is far more likely to cover the outstanding loan balance, protecting them from a loss.

For a lender, a higher down payment is the clearest signal of a borrower’s seriousness and financial stability. It transforms the loan from a speculative bet into a well-collateralized business transaction, which is essential in a competitive market like Dallas.

This is the fundamental reason the rules are so different for investment properties versus primary homes. A lender looks at them through two completely different lenses: one is personal shelter, the other is a commercial enterprise.

The Lender’s Perspective in Dallas

Lenders in the Dallas market aren’t just following a generic rulebook; they’re reacting to local conditions. A larger down payment helps them manage several Dallas-specific factors that can increase their risk.

- Market Volatility: While the Dallas real estate market has been on a tear, it isn’t bulletproof. No market is. A larger down payment protects the loan if property values temporarily stagnate or dip.

- Tenant Risk: Every landlord knows that vacancies happen. Lenders are keenly aware that an empty rental in a popular spot like Oak Lawn or Bishop Arts means zero income to cover the mortgage, which naturally increases the risk of default.

- Investor Commitment: Lenders often work under the assumption that an investor, particularly a new one, has less emotional attachment to a rental property. The financial stake created by a large down payment helps ensure the investor stays dedicated through thick and thin.

Ultimately, the higher investment property down payment requirements are a standardized, logical way for lenders to manage these risks across the board. By seeing it from their side of the table, you can walk into financing discussions prepared to show you’re a reliable and serious Dallas investor, which can make all the difference in getting your loan approved.

Choosing the Right Loan for Your Dallas Property

Jumping into the world of investment loans in Dallas can feel like a lot to take in. But getting a handle on your options is the very first step to landing the right financing for your goals. Not all loans are created equal; each one is designed for a different kind of investor and comes with its own **investment property down payment requirements**. Picking the right one can make a huge difference in your upfront costs and your long-term profit.

Ultimately, the financing path you choose will come down to your personal financial situation and the specific property you’re looking to buy. Let’s walk through the most common routes Dallas investors take.

Conventional Loans The Standard Choice

For most Dallas investors who have their financial ducks in a row, a conventional loan is the go-to. Think of it as the workhorse of the investment world, offered by nearly every bank and mortgage lender out there. The requirements are pretty straightforward: a good credit score (usually 700 or higher), income you can verify, and a down payment of at least 20-25%.

A conventional loan is the most direct route to financing. If you’re looking to buy a single-unit condo in Richardson and have a solid financial track record, this loan offers competitive interest rates and standard terms. It’s reliable and predictable, which is why so many investors love it.

DSCR Loans A Focus on Property Performance

But what if your personal income doesn’t paint the full picture, yet the property you’re eyeing is a cash-flow machine? This is exactly where a Debt Service Coverage Ratio (DSCR) loan becomes a total game-changer for Dallas investors. Instead of poring over your personal tax returns, lenders focus on one thing: the property’s ability to generate enough income to cover its own mortgage payments.

A DSCR loan evaluates the property, not the person. If a duplex in East Dallas can generate enough rent to easily cover its mortgage, taxes, and insurance, lenders may approve the loan based on that potential alone.

This loan is perfect for seasoned investors or self-employed individuals. The down payment is often a bit higher, typically starting at 20% and climbing to 30%, but it opens up a world of opportunity for investors whose strategy is built on strong property performance, not W-2 income. For a more detailed look into this strategy, you might find our Dallas real estate investment guide particularly helpful.

Portfolio Loans Local Flexibility

Local Dallas credit unions and community banks often have another tool in their belt: Portfolio Loans. These are loans the bank decides to keep on its own books instead of selling them off. That simple decision gives them way more flexibility with their lending criteria.

- Customized Terms: They can sometimes offer more flexible down payment options or work with investors who have a unique financial situation.

- Relationship-Based: These loans are often built on an established banking relationship, rewarding loyal customers.

Portfolio loans are a fantastic option for investors building a larger collection of Dallas properties who need a financing partner that truly gets the local market. Before you commit to any property, it’s a smart move to run through a comprehensive mortgage pre-approval checklist to know your true borrowing power. This step is crucial no matter which loan you choose, as it clarifies exactly what you can afford and puts you in a much stronger position as a buyer.

How Dallas Market Conditions Shape Your Down Payment

The down payment for a Dallas investment property isn’t some static figure you can just look up in a book. It’s a living number, one that breathes with the pulse of the local market. Lenders are constantly gauging the economic climate, which means the cash you need to bring to the table can shift depending on what’s happening across the Dallas-Fort Worth metroplex.

Think of it like this: when the market gets hot and good properties are flying off the shelves, lenders get a little more nervous. The loans they’re underwriting feel riskier. To protect themselves, they often ask for larger down payments to build a bigger equity cushion right from the start.

Supply, Demand, and Your Down Payment

In Dallas, things like high construction costs or a shortage of skilled labor can really put a damper on the supply of new homes. When inventory gets tight—especially in high-demand suburbs like Frisco or McKinney—you can bet bidding wars are right around the corner. That kind of intense competition drives up prices, and lenders absolutely take notice.

In a seller’s market, where multiple offers are the norm, a lender’s risk shoots up. They might tighten their investment property down payment requirements, asking for 25% or even more to make sure their loan is well-protected against an inflated purchase price.

This back-and-forth between supply and demand is a huge signal for investors. A tightening market is your cue that you’ll likely need to bring more cash to the closing, not just to win the property but also to keep your lender happy.

Broader Economic Signals Affecting Dallas

It’s not just about local housing inventory, either. Big-picture economic trends can trickle down and impact your down payment. For example, national projections are showing a huge drop in new office and industrial space completions—industrial space is expected to fall by a staggering 56%.

When commercial assets become scarce, well-located residential rentals in cities like Dallas look even more attractive to big-money investors, which further tightens the market for everyone. Staying informed with valuable Dallas market insights can help you keep a finger on the pulse of what’s happening locally.

Knowing the market dynamics is your best defense. When you can spot the signs of a competitive market, you can anticipate what lenders might ask for and adjust your financial strategy before you even make an offer.

It also helps to know which specific areas are heating up. For a closer look, check out our guide on the top Dallas neighborhoods for high ROI. Learning to read these signals will put you in a much stronger position to secure your next Dallas investment property.

The Personal Factors That Define Your Down Payment

While Dallas market trends set the general stage, it’s your personal financial profile that truly directs the show. Lenders quickly shift their focus from the big picture to your individual numbers, digging into the details to size up their risk. This is where it gets personal, and a strong financial standing can unlock much better loan terms.

Think of it as your financial report card. Lenders look at three main subjects: your credit score, your debt-to-income (DTI) ratio, and the size of your current property portfolio. A higher grade in these areas signals to them that you’re a lower-risk borrower, which can directly affect how much cash you need to bring to closing.

Your Credit Score and Debt-to-Income Ratio

The first number any lender will look at is your credit score. You might be able to find a loan with a score somewhere in the high 600s, but hitting the 740 threshold is a real game-changer. It tells lenders you have an exceptional credit history, often opening the door to lower down payment requirements and better interest rates.

Just as crucial is your Debt-to-Income (DTI) ratio. This simple calculation compares your total monthly debt payments against your gross monthly income. In Dallas, lenders generally want to see a DTI of 43% or less. A higher DTI suggests you might be financially overextended, making you a riskier bet. When you’re tallying up your debts, remember to include everything; even things like the impact of personal loans on mortgage applications are factored into this critical calculation.

Cash Reserves and Your Existing Portfolio

Beyond your income and debts, Dallas lenders want to see you have a safety net. This is where cash reserves come into play. They need proof you can cover the new property’s mortgage, taxes, and insurance—typically for at least six months—even if you have zero rental income. This gives them confidence that one tenant moving out won’t send you straight into default.

What you already own also matters. The more financed properties you have, the more cautiously a lender will approach your application. If you’re lining up financing for your fifth Dallas rental, expect a lender to ask for a larger down payment and more substantial cash reserves than they did for your first one.

For Dallas lenders, it boils down to a simple equation: A borrower with a high credit score, low DTI, and plenty of cash reserves is a reliable partner. This financial strength can be the difference between a 20% and a 25% down payment.

Let’s run a quick side-by-side scenario.

Investor A vs. Investor B in Oak Cliff

Imagine two investors want to buy a similar duplex in Oak Cliff for $500,000.

- Investor A: Has a 760 credit score, a 32% DTI, and eight months of cash reserves. They own one other rental. The lender sees very little risk and approves them with a 20% down payment ($100,000).

- Investor B: Has a 680 credit score, a 45% DTI, and only three months of reserves. This is their fifth rental property. The lender sees much higher risk and requires a 25% down payment ($125,000).

Even on the exact same property, Investor B has to come up with an extra $25,000 simply because of their personal financial situation. It’s a perfect illustration of how critical it is to get your financial house in order before you start shopping for investment properties in Dallas.

Dallas Investment Property Down Payment Questions

Getting into the financial weeds of buying an investment property in Dallas can stir up a lot of questions. To help you get your footing, here are some straight-up answers to the most common things Dallas investors ask about down payments and the lending process.

Can I Use Gift Funds for a Down Payment in Dallas?

When it comes to investment properties, the short answer is almost always no. This is a huge difference between buying a rental and buying your own home. Lenders in Dallas need to see that the down payment comes directly from your own, verified funds.

They’re looking for what’s called “seasoned” money—cash that has been sitting in your bank account for at least 60 days. Putting your own capital on the line is a powerful signal to the lender that you’re serious about the investment, which makes them feel a lot better about the risk. Rest assured, they will dig deep to verify the source of every dollar you bring to the closing table.

Does the Dallas Property Type Affect the Down Payment?

Yes, it absolutely does. The kind of property you’re eyeing in the DFW area will directly shape your investment property down payment requirements.

- Single-Unit Properties: A standard single-unit condo in a hot spot like Uptown or a single-unit rental out in Plano will typically fall into the standard 20-25% down payment range with a conventional loan.

- Multi-Unit Properties (2-4 Units): Trying to finance a duplex or a fourplex in a neighborhood like Grand Prairie? You’ll likely need a bigger down payment, usually starting at 25%. Lenders see these as more complicated assets to manage, so they want more skin in the game from you upfront.

And if you’re looking at buildings with more than four units, you’ve crossed over into commercial real estate territory. That’s a whole different ballgame with its own set of lending rules and even steeper down payment expectations.

Is Getting a Dallas Investment Loan with Less Than 20% Down Possible?

It’s tough—and very rare in the current lending climate. That 20% down payment is the industry standard for a reason. For one, it helps you sidestep Private Mortgage Insurance (PMI), which isn’t typically offered on investment properties anyway.

You might find some specialized private money or portfolio lenders in DFW willing to go lower, but those loans always come with serious trade-offs. We’re talking much higher interest rates, hefty fees, and shorter payback periods. For the vast majority of investors using traditional financing, planning on at least 20-25% down is the smartest and most realistic path forward. If you’re just starting out, our Dallas first-time homebuyers guide is a great resource for understanding the entire buying process.

How Do My Existing Properties Affect My Next Down Payment?

Dallas lenders are going to look at your entire real estate portfolio, no exceptions. Both Fannie Mae and Freddie Mac cap the number of financed properties you can have (usually at ten). As you build your portfolio, lenders naturally get more conservative.

Key Insight: For every new rental you add, expect lenders to tighten their requirements. They’ll often ask for a larger down payment—sometimes as high as 25-30%—and demand proof of more significant cash reserves for each property you own.

This isn’t to punish you for being successful. It’s to make sure you aren’t spread too thin and can handle the financial weight of your entire portfolio, especially if you hit a rough patch with a few vacancies at once.

Navigating the complexities of Dallas real estate requires a knowledgeable partner. If you’re ready to find the right investment property and secure the best financing, the team at Dustin Pitts REALTOR Dallas Real Estate Agent is here to guide you. Contact us today to get started at https://dustinpitts.com.