This is your guide to figuring out the real estate appraisal process, a step you’ll almost certainly encounter in any Dallas property transaction. Whether you’re refinancing a sleek downtown condo or selling a sprawling suburban home, the appraisal gives you an impartial, third-party opinion on what your property is truly worth on the market.

Navigating The Dallas Real Estate Appraisal Process

The appraisal is a foundational piece of the larger real estate housing industry puzzle, serving as a critical checkpoint for almost all financial decisions in Dallas. Think of it as a structured, data-driven analysis that provides an objective opinion of a property’s value. Its main purpose is to protect everyone involved—buyers, sellers, and especially lenders—from a bad deal based on an overvalued asset.

This isn’t just about confirming a price. In a market as dynamic as Dallas, where property values can vary wildly from one neighborhood to the next—say, between Preston Hollow and the Bishop Arts District—an appraisal sets a credible, factual benchmark. It ensures the loan amount a lender is willing to provide actually aligns with the property’s real-world worth.

Why The Appraisal Is So Essential

When a mortgage is involved in a Dallas property purchase, an appraisal is almost always non-negotiable. Lenders absolutely require it to make sure their investment (your loan) is backed by a property of at least equal value. Without this crucial step, the financial risk is simply too great for them to take on.

Here’s why the appraisal is so indispensable:

- It protects the buyer. An appraisal keeps a buyer from getting locked into a contract for a home that’s priced far above what it’s actually worth.

- It secures the lender. This is the big one. It confirms the property is sufficient collateral for the mortgage.

- It validates the price. During negotiations, an unbiased, professional opinion of value can be the deciding factor that moves a deal forward.

I always tell my clients to think of an appraiser as a neutral financial detective. Their job isn’t to make the contract price work. It’s to figure out the most probable price a property would sell for on the open market, using hard data and proven methods specific to the Dallas area.

The Appraiser’s Role in a Dallas Transaction

An appraiser’s role is to be completely impartial. They are independent professionals licensed by the state of Texas, and their primary duty is to the lender who hired them—not the buyer or the seller. This strict independence is what makes their final report so credible and respected.

Their work involves much more than a quick walkthrough. A good appraiser digs deep into the Dallas market. They investigate recent sales of similar homes (“comps”), carefully assess the property’s current condition, document any unique or standout features, and factor in the latest market trends for that specific corner of the Dallas-Fort Worth area.

This guide will pull back the curtain on their methods, showing you exactly what to expect and how you can prepare your Dallas home to put its best foot forward.

How Appraisers Determine a Home’s Value in Dallas

When an appraiser starts the real estate appraisal process for a Dallas home, they aren’t just pulling a number out of thin air. It’s a disciplined, data-driven analysis. To really understand the final figure on your report, it helps to know which valuation methods they use and why.

For virtually every single-residence home in Dallas, from a historic gem in the M Streets to a sprawling new build in Frisco, appraisers lean heavily on one primary technique: the Sales Comparison Approach. It’s the gold standard for figuring out what a home is truly worth in the current Dallas market.

A Closer Look at The Sales Comparison Approach

At its core, this approach works on a simple, intuitive principle: a home’s value is directly tied to what similar, nearby homes have recently sold for. The appraiser’s real work is finding the best “comparables” (or “comps”) and then making meticulous, dollar-for-dollar adjustments to account for any differences.

Let’s imagine an appraiser is valuing a home in Preston Hollow. The home they’re looking at—the “subject property”—has a brand-new, completely remodeled kitchen with top-of-the-line appliances. They find a great comp that sold just last month on an adjacent street, but it has a kitchen straight out of the 1990s.

They don’t just throw their hands up. Instead, the appraiser digs into market data to figure out exactly how much value a modern kitchen adds in that specific part of Dallas. They’ll then adjust the comp’s sale price upward to accurately reflect the superior features of the subject property. This same process is repeated for dozens of variables.

An appraisal is fundamentally a structured analysis, not a subjective opinion. Every adjustment, whether for a swimming pool, an extra garage bay, or a superior location, is backed by market data and evidence from your specific Dallas neighborhood.

This is where true local expertise makes all the difference. An appraiser who intimately knows the nuances between Dallas neighborhoods—like the premium buyers place on walkability in Uptown versus the value of a large lot in Southlake—can make far more precise adjustments. For a deeper dive on what makes these areas tick, check out our guide to some of top Dallas neighborhoods.

Other Key Valuation Methods

While sales comparison is the go-to for residential properties, appraisers have other tools in their belt for specific situations.

To give you a clearer picture, here’s a quick breakdown of the three main valuation methods used in the Dallas market.

Dallas Property Valuation Methods At A Glance

| Valuation Method | Primary Use Case in Dallas | Key Factors Considered |

|---|---|---|

| Sales Comparison Approach | The standard for most residential homes (single-residence, townhomes) | Recent sales prices of similar properties, adjustments for features (SQFT, beds/baths, condition, location) |

| Cost Approach | New construction, unique/custom homes, properties with no good comps | Cost to build a new replica (labor, materials), land value, depreciation |

| Income Approach | Investment properties (duplexes, rental condos, apartment buildings) | Rental income potential, vacancy rates, operating expenses, capitalization rate |

Each method serves a distinct purpose, ensuring the valuation is grounded in the most relevant data for that property type.

- The Cost Approach: Think of this as the “what would it cost to rebuild?” method. It’s most common for one-of-a-kind properties with few or no comps, like a highly unique custom home, or for brand-new construction in Dallas. The appraiser calculates the cost to build it from the ground up (including land value) and then subtracts any depreciation.

- The Income Approach: This one is king for any property that generates revenue. If you own a duplex in Deep Ellum or a rental condo near SMU, a Dallas appraiser will absolutely use the Income Approach. It focuses entirely on the property’s ability to produce income, analyzing rents, expenses, and vacancy rates to land on a value that makes sense to an investor.

Preparing Your Dallas Property For Appraisal

When you’re getting your Dallas property ready for the real estate appraisal process, the goal is to make a solid first impression and provide clear, undeniable proof of your home’s value. There are some great strategies to add value to your home, but this isn’t about staging. An appraiser is trained to look past surface-level clutter. Instead, your energy is best spent on showcasing a well-maintained property and handing them the documents to prove it.

One of the most powerful, yet surprisingly simple, tools at your disposal is a “brag sheet.” Think of it as a one-page highlight reel for your home. It’s your opportunity to make sure every single upgrade and improvement you’ve poured money into gets noticed.

This small step can make a huge difference. An appraiser walking through dozens of Dallas homes a month might not realize your HVAC system is only a year old or that you just put on a brand-new roof. Giving them a list with dates and costs provides concrete data they can use in their final valuation.

Assemble Your Documentation

Your brag sheet is the main event, but a few other documents can help make the appraiser’s job easier and more accurate. A property survey, for instance, is the definitive word on your lot size and legal boundaries, removing any guesswork from their calculations.

Having these items ready to go shows you’re on top of things and helps the appraiser work efficiently:

- The “Brag Sheet”: A detailed list of all major upgrades with completion dates and costs. Include big-ticket items like a new roof, updated windows, kitchen or bath remodels, new appliances, or a recently installed deck.

- Property Survey: This is especially useful for homes on large or irregular lots, which you see a lot in certain Dallas suburbs.

- Homeowners Association (HOA) Documents: If you’re in a Dallas HOA, have the details on dues and a list of all the amenities they cover, like a community pool, fitness center, or maintained common areas.

An appraiser’s time on-site is limited. Presenting a clear, concise list of updates ensures they have all the facts. You’re not trying to influence their opinion; you’re providing verifiable data to support a fair and accurate valuation.

Address The Small Stuff

You don’t need to kick off a major renovation before the appraiser arrives, but fixing the small, nagging issues is a smart move. Things like a dripping faucet, a cracked tile in the foyer, or a stubborn doorknob can collectively suggest a pattern of deferred maintenance. These minor flaws might signal to an appraiser that bigger, hidden problems could be lurking.

Taking care of these items helps present your home in its best possible light. It’s not about hiding anything; it’s about showing a history of pride and proper upkeep, which is a key factor in how an appraiser rates your home’s overall condition. While it might seem minor, it all contributes to the bigger picture of your property’s value. With housing affordability being such a hot topic in Dallas, ensuring your home is appraised at its maximum value is more important than ever. You can learn more by exploring our guide to affordable housing options in Dallas.

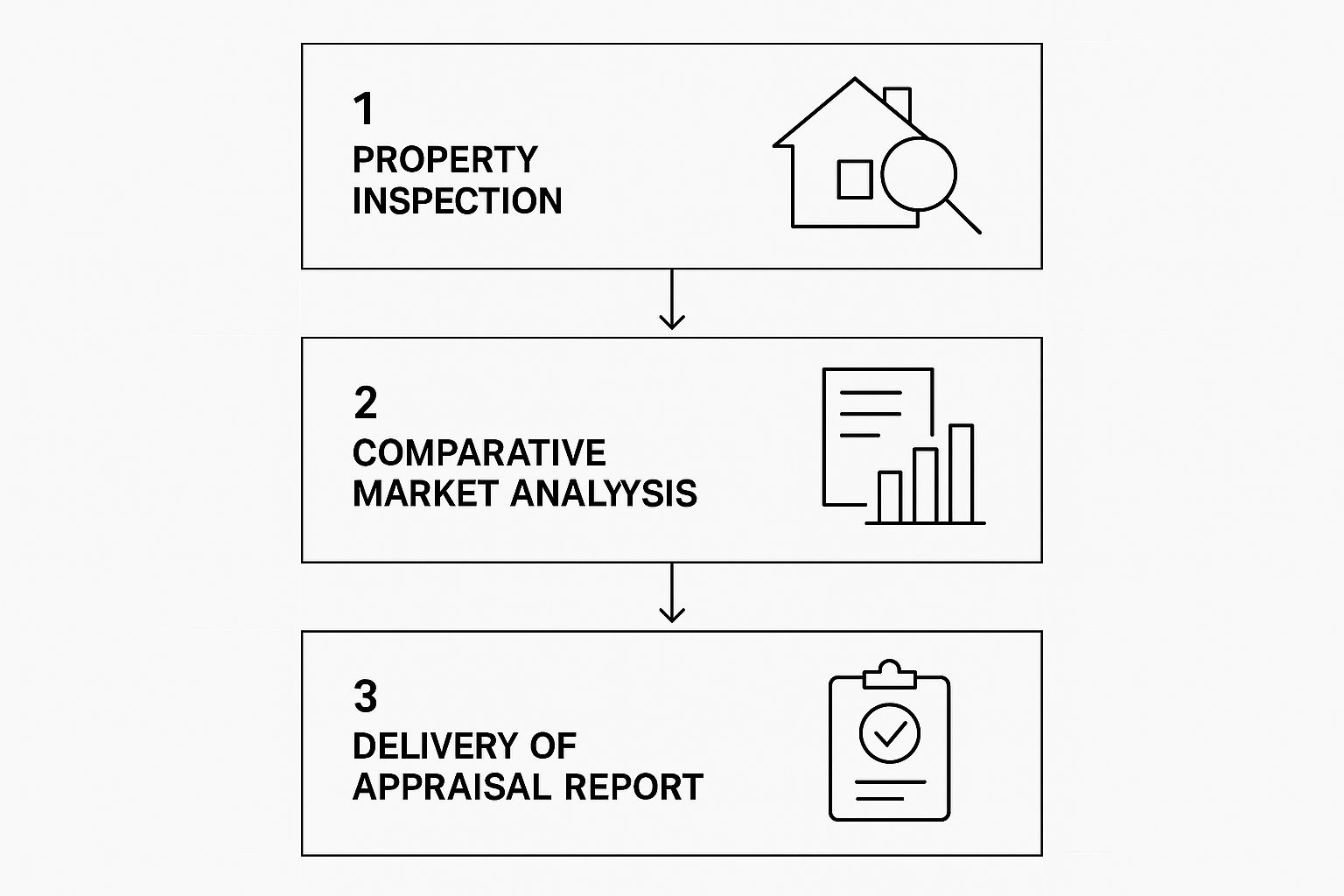

The infographic below breaks down the key phases of the appraisal process, from the on-site visit to the final report.

As you can see, the appraiser’s work is far from over when they leave your driveway. A lot of in-depth market research and analysis happens back at their office to determine the final value.

So, the appraiser is scheduled to visit your home. This is often the most misunderstood part of the whole real estate appraisal process. A lot of Dallas homeowners think the appraiser is there to critique their design choices or how tidy the house is. That’s not it at all.

When an appraiser walks through your property, they’re on a fact-finding mission. Think of them as a detective, but for property value. They are methodically gathering objective data about your home’s physical features. Their goal is to build a detailed, factual profile of the property, which they’ll later compare against other recent sales in your Dallas neighborhood.

The Appraiser’s Inspection Checklist

An appraiser’s walk-through is nothing if not systematic. They almost always start outside, meticulously measuring the home’s exterior. Why? To calculate the gross living area (GLA), which is one of the most critical metrics in any valuation. Even small errors in square footage can swing the final value, so getting this right is non-negotiable.

Once they come inside, the documentation continues. They’ll move through the house, noting key attributes like:

- Room Count: They’re confirming the official number of bedrooms and bathrooms. Keep in mind, that converted attic in your older East Dallas home might not count as a true bedroom if it lacks a closet or proper window egress.

- Overall Condition: This is a big one. They’re looking for signs of deferred maintenance, visible wear and tear, or any red flags. A well-kept home simply presents better and, frankly, is worth more than one showing obvious neglect.

- Quality of Construction: The appraiser takes note of the materials used throughout. What kind of flooring is it? Are the kitchen cabinets builder-grade or custom? Are those countertops laminate or quartz? These details matter.

- Major Systems: The age and condition of your HVAC, plumbing, and electrical systems are vital. These are expensive components, and their functional utility is a huge part of what makes a house livable.

The appraiser’s job is to see past your personal items and furniture to document the home’s permanent fixtures and overall state. They are focused on the ‘bones’ of the property—the core elements a new owner will inherit.

Valuing Dallas-Specific Amenities

Living in Dallas comes with its own set of desirable features, and a good appraiser knows how to identify and assign value to them. That professionally installed backyard pool and outdoor kitchen aren’t just for show; in the Texas heat, they’re a major draw and will almost certainly get a positive value adjustment compared to a similar home without them.

What else adds value in our market? Appraisers are often on the lookout for:

- Energy-Efficient Upgrades: With our scorching summers, modern, energy-efficient windows or a newer, high-SEER HVAC unit are a significant plus.

- Updated Kitchens and Baths: A tastefully renovated kitchen or a refreshed primary bathroom often delivers a strong return on investment. The appraiser will carefully document these updates.

- Lot and Location: Unique lot features, like being on a corner in a sought-after neighborhood like Lakewood or having a premium view of a local park, are absolutely factored into the final value.

At the end of the day, the appraiser is piecing together a comprehensive, data-driven puzzle of your property. They are there to observe, measure, and document—not to pass judgment on your lifestyle. Understanding their focus on the permanent, structural, and functional aspects of your home will help you set realistic expectations for the entire real estate appraisal process.

Understanding The Final Appraisal Report

Many people think the appraisal is over once the appraiser leaves their home. The truth is, the physical inspection is just the opening act. The real heavy lifting begins back at the office, where all the notes, photos, and measurements from your Dallas property meet a mountain of market data.

This is where the appraiser puts on their detective hat. They dive deep into researching “comps,” which is just industry-speak for comparable sales. They’re on the hunt for recently sold properties in your specific Dallas neighborhood that are a near-perfect match to yours in size, age, condition, and features. They then make careful, dollar-for-dollar adjustments to account for any differences, painting a clear picture of what the market is truly willing to pay for a home like yours.

Data Reconciliation And The Final Value

Once the comps are analyzed and adjusted, the appraiser moves to what’s called data reconciliation. This isn’t as simple as just averaging the prices of the comparable homes. It’s a much more nuanced process.

Think of it as a weighted analysis. The appraiser gives more significance to the comps that are most similar to your property. For instance, a home in your very own subdivision that sold last month will carry a lot more weight than a similar home in a different neighborhood that sold six months ago. It’s here that an appraiser’s professional judgment and deep knowledge of the local Dallas market are absolutely critical to pinpointing a final, defensible value.

The final appraised value represents the appraiser’s professional opinion of what your property would most likely sell for on the open market. This figure is the culmination of all their on-site inspection, off-site research, and detailed analysis.

The broader economic climate also plays a role, adding another layer of complexity. Take the Dallas housing market in early 2025, for example. Despite some strong economic signals late last year, ongoing housing affordability issues are definitely influencing how buyers act and what they’re willing to pay in Dallas. A good appraiser has to factor in these mixed signals when landing on a final value. You can actually read more about these kinds of housing market insights for appraisers on Mckissock.com.

Timeline From Inspection To Delivery

So, how long does all this take? From the day of the inspection to the moment the final report lands on the lender’s desk, you can typically expect it to take a few days to a week. This gives the appraiser enough time to do their due diligence without rushing.

The final report itself is a hefty document, often running 20 pages or more. It meticulously details everything from your property’s specific characteristics to the comps used, the adjustments made, and, of course, the final value conclusion. Once the appraiser submits it, your lender will review it and then provide you with a copy.

Common Questions About Dallas Appraisals

Even after you get a handle on the real estate appraisal process, it’s totally normal for questions to bubble up. This is especially true when you’re dealing with a market as unique and fast-paced as Dallas. I’ve gathered some of the most common questions I hear from both sellers and buyers to give you some straightforward answers and help you get to the finish line with confidence.

What Can I Do If The Appraisal For My Dallas Property Comes In Low?

Getting a low appraisal can feel like a punch to the gut, but it doesn’t automatically kill the deal. Don’t panic. The very first thing you need to do is get a copy of the appraisal report and go through it with a fine-toothed comb with your real estate agent.

You’re looking for clear, undeniable factual errors. Did the appraiser measure the square footage incorrectly? Did they completely miss the half-bath you just added or list your brand-new roof as being 15 years old? These are objective mistakes you can absolutely challenge. Your agent can then submit a Reconsideration of Value to the lender, armed with hard evidence of the errors and even suggesting better, more relevant Dallas comparable sales the appraiser might have missed.

More often than not, a low appraisal simply opens the door for a new round of negotiations. The buyer might come up with more cash to cover the difference, or you might agree to meet somewhere in the middle on price.

How Are Comps Chosen In A Diverse Market Like Dallas?

In a sprawling, incredibly diverse city like Dallas, picking the right “comps” (comparable sales) is both a science and an art. Appraisers have to follow strict guidelines, and they’ll always prioritize properties that are:

- Geographically Close: Ideally, this means in the same subdivision or within a tight one-mile radius in the DFW area.

- Recently Sold: The market moves fast here, so they’re looking for sales within the last 90 days.

- Physically Similar: This is key. They need homes with a similar gross living area (usually within a 20% variance), age, architectural style, and overall condition.

An appraiser’s local knowledge is absolutely invaluable here. They understand the subtle—but significant—value differences between a home in the M Streets and one just down the road in Lower Greenville. Their expertise is what allows for precise adjustments for features like a backyard pool, a remodeled kitchen, or a superior lot to land on a truly accurate valuation.

Do Minor Home Improvements Impact My Dallas Appraisal Value?

I get this question all the time, and the answer isn’t a simple yes or no. A major renovation, like adding a new bedroom or finishing out a basement, will give you a clear, quantifiable bump in value. Smaller updates, however, play more of a supporting role.

Things like fresh paint, new light fixtures, or sprucing up the landscaping absolutely enhance what appraisers call “curb appeal” and boost your property’s overall condition rating. While they might not add a specific dollar amount to the final number, they are crucial for preventing negative adjustments that come from deferred maintenance.

Think of it this way: these minor touches help ensure your home appraises at the highest possible point within its potential value range because you’re presenting a clean, well-maintained property. As you get ready to move, understanding these little details is just one piece of the puzzle. For more insights, check out our guide on living in Dallas and everything you need to know.

Ultimately, these smaller improvements send a powerful signal to an appraiser that the home has been cared for, which creates a positive impression that supports a strong, fair valuation.

Navigating the Dallas real estate market requires expert guidance. The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the local knowledge and experience to help you achieve your property goals, from understanding appraisals to closing the deal. Learn how we can assist you at https://dustinpitts.com.