When you invest in Dallas real estate, you’re doing more than just buying property—you’re stepping into a powerful financial strategy. The smartest investors know that the real magic happens with the tax code. We’re talking about crucial real estate investment tax benefits that let you write off expenses, postpone taxes on your gains, and even get deductions for the natural aging of your building.

These aren’t just minor perks; they are fundamental tools for building serious wealth right here in the competitive Dallas market.

Your Guide To Dallas Real Estate Tax Advantages

Seasoned investors will tell you that a property’s real worth goes way beyond its market price. In a booming area like Dallas, mastering the tax code is just as vital as picking the perfect neighborhood. The U.S. tax system is designed with specific advantages for property owners that can slash your annual tax bill and put your portfolio growth into overdrive.

Think of these benefits less as passive bonuses and more as active financial instruments in your toolkit. When you learn how to apply these rules strategically, you keep more of your hard-earned rental income, shield your capital when it’s time to sell, and lay the groundwork for a much stronger financial future. If you’re just getting started, the first step is to really understand the ins and outs of Dallas real estate investing.

Core Tax Benefits For Dallas Investors

At the end of the day, the goal is simple: lower your taxable income. Every single dollar you save on taxes is another dollar you can put toward your next Dallas property or use to upgrade a current one.

Here are the foundational benefits we’ll break down:

- Powerful Deductions: You can subtract a whole host of operating costs from your rental income, from mortgage interest all the way to the hefty property taxes we see in Dallas County.

- Depreciation: This is the big one. It’s a non-cash deduction that lets you write off the value of your building’s “wear and tear” over its useful life—even while the property’s market value is going up.

- Capital Gains Deferral: Tools like the 1031 exchange are game-changers. They allow you to sell a Dallas property, take all the profits, and roll them directly into a new investment without paying immediate taxes on the gain.

Here’s a quick overview of how these benefits work together to supercharge your investment returns.

Table: Key Tax Benefits for Dallas Real Estate Investors

| Tax Benefit | How It Works for Dallas Investors | Primary Impact |

|---|---|---|

| Expense Deductions | Subtracting operating costs like property taxes, mortgage interest, insurance, and repairs from rental income. | Lowers your annual taxable income, increasing your net cash flow. |

| Depreciation | A non-cash “paper loss” deduction for the wear and tear on the property’s structure over 27.5 years. | Reduces taxable income significantly, often creating a tax loss even when the property is cash-flow positive. |

| 1031 Exchange | Deferring capital gains taxes by reinvesting the proceeds from a sold Dallas property into a similar one. | Allows you to grow your Dallas portfolio faster by keeping your capital fully invested, rather than losing a chunk to taxes. |

These are the pillars of a smart Dallas investment plan.

While this guide is laser-focused on turning your Dallas properties into highly efficient wealth-building engines, it’s always wise to see the bigger picture. Understanding a range of tax-efficient investment strategies can provide valuable context for your entire financial portfolio.

Depreciation: Your Silent Partner in Building Wealth

What if I told you there’s a way to get a hefty tax deduction for an expense you never actually paid? That’s depreciation in a nutshell, and it’s arguably the most powerful tax benefit in a Dallas real estate investor’s toolkit. It’s a “paper” deduction that lets you write off the cost of your Dallas property over its useful life, accounting for its theoretical wear and tear.

Here’s the beautiful part: you get to take this deduction even while your property in a booming Dallas neighborhood is going up in value. The IRS sees your rental building as a long-term asset that eventually wears out. Every year, you get to deduct a small piece of its value as it “ages,” and that deduction directly lowers your taxable rental income.

This is a core concept for building wealth in Dallas. While you’re collecting rent and your property value is climbing, depreciation is quietly working behind the scenes, creating a “paper loss” that can shield your real cash flow from taxes.

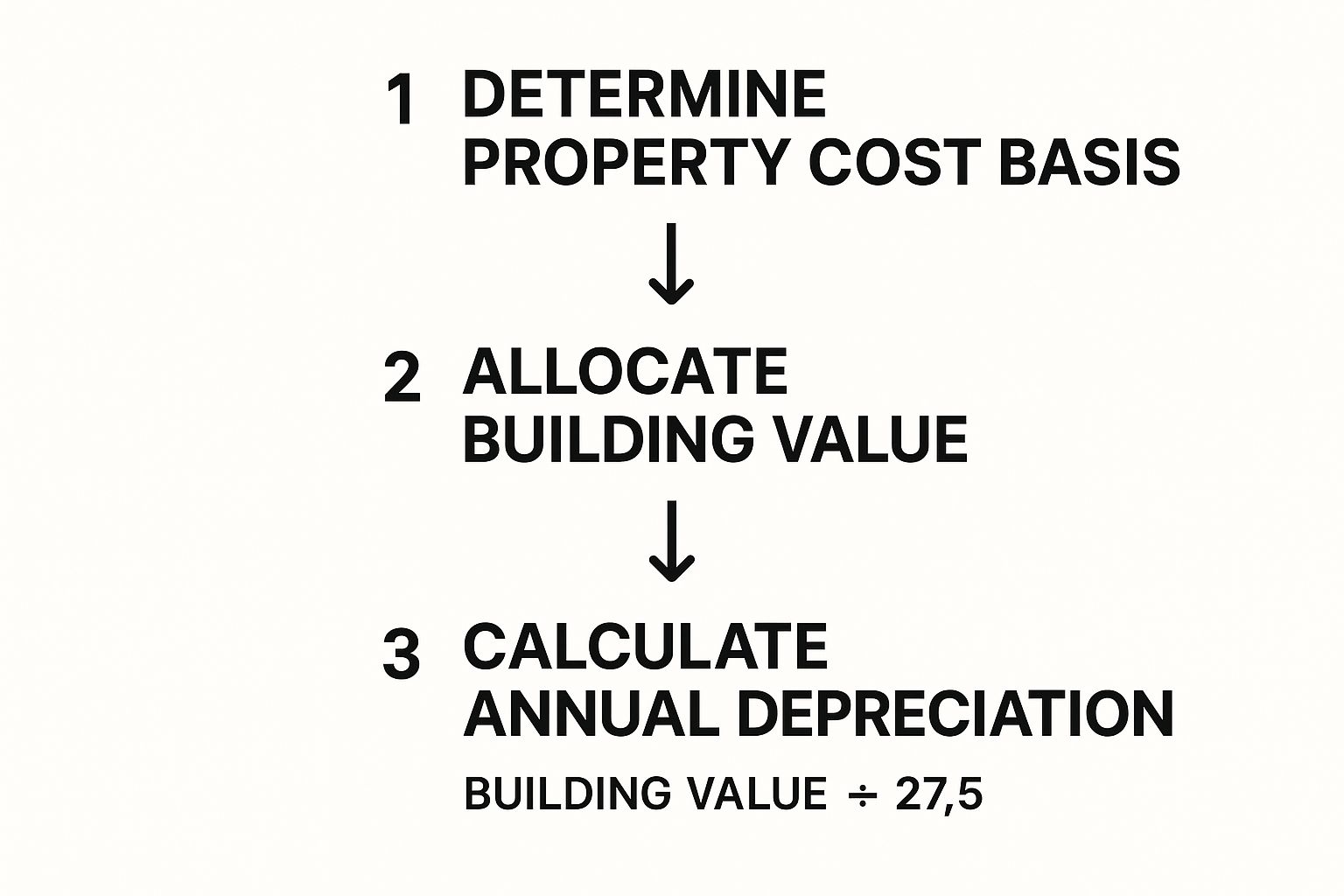

How to Calculate Depreciation on a Dallas Duplex

The IRS keeps things predictable here. For any residential rental property in Dallas, whether it’s a duplex in Bishop Arts or a condo in Uptown, the official “useful life” is 27.5 years. The math is pretty simple once you know the pieces.

First, you need your property’s cost basis. This isn’t just what you paid for it. It includes other acquisition costs like title insurance, legal fees, and transfer taxes. Think of it as your total all-in investment to get the keys to your Dallas property.

Next, you have to split the value of the land from the value of the building. Why? The IRS won’t let you depreciate land because, theoretically, it doesn’t wear out. You can only depreciate the structure itself. The easiest way to do this is often by using the land/building value ratio from your Dallas County property tax assessment.

This infographic breaks down the simple, three-step formula.

As you can see, the trick is to isolate the building’s value and then spread that cost out over the standard 27.5-year period.

A Real-World Dallas Example

Let’s make this real. Imagine you buy a duplex in the M-Streets for $600,000. You also pay $10,000 in closing costs, bringing your total cost basis to $610,000.

Here’s how the numbers play out:

- Step 1: Find the Building’s Value. Your Dallas County tax assessment says the land is worth $150,000. That leaves the building—your depreciable basis—valued at $460,000 ($610,000 – $150,000).

- Step 2: Calculate the Annual Deduction. Now, just divide the building’s value by its IRS-mandated useful life: $460,000 / 27.5 years = $16,727.

That’s $16,727 you can deduct from your rental income every year for the next 27.5 years. If your Dallas duplex brings in $50,000 a year in rent, this single deduction drops your taxable income to just $33,273—and that’s before you even account for other expenses like mortgage interest or repairs.

This non-cash deduction is a cornerstone of savvy real estate investing. It allows your Dallas property to generate positive cash flow while simultaneously showing a lower profit—or even a loss—on your tax return, dramatically reducing your tax liability.

Getting a handle on depreciation isn’t just a good idea; it’s essential for Dallas investors. It’s a massive financial advantage that separates the pros from the amateurs in a competitive market like Dallas. Mastering this one benefit can supercharge your portfolio’s growth by letting you keep more of your money working for you.

Mastering The 1031 Exchange in The Dallas Market

As your Dallas real estate portfolio grows, a “good” problem starts to emerge: your potential tax bill. Selling a profitable Dallas investment property usually means facing a capital gains tax, which can feel like a penalty for success, taking a serious chunk out of your hard-earned equity.

But what if you could put that tax bill on hold? That’s exactly what a 1031 exchange allows you to do.

Think of it as hitting the pause button on your tax obligations. This powerful part of the tax code lets you sell one Dallas investment property and roll all the proceeds directly into another “like-kind” property without paying capital gains tax right away. For investors looking to scale up in a competitive market like Dallas, this is one of the most powerful real estate investment tax benefits available.

Instead of handing over a huge slice of your profit to the IRS, you get to reinvest the entire amount. This lets you trade up for larger properties, more units, or assets in better Dallas-area locations, allowing your wealth to compound much faster over time.

Navigating The Strict Timelines

Now, here’s the catch. The immense power of a 1031 exchange comes with a set of ironclad, non-negotiable deadlines. If you miss either of them, the whole deal is off, and you’re suddenly on the hook for that big tax bill you were trying to avoid.

Every Dallas investor needs to burn these two critical timelines into their memory:

- The 45-Day Identification Period: The clock starts the moment you close on your original Dallas property (the “relinquished” property). From that day, you have exactly 45 days to officially identify your potential replacement properties in writing.

- The 180-Day Closing Period: You must close on the purchase of a new property from your identified list within 180 days of selling the first one. It’s important to remember that this 180-day window runs at the same time as the 45-day period, not after it.

These deadlines are absolute. There are no extensions for weekends, holidays, or those last-minute financing snags. In a fast-paced market like Dallas-Fort Worth, this means you need a solid plan and the ability to move decisively.

The 1031 exchange isn’t just a local advantage; it’s a key strategy that reflects global investment principles. The appeal of real estate is often boosted by tax frameworks that encourage reinvestment. While the U.S. has the 1031 exchange, investors should be aware of the broader real estate outlook on deloitte.com.

A Dallas 1031 Exchange In Action

Let’s make this real. Imagine you bought a single-unit rental in Plano years ago for $250,000. Thanks to the booming Dallas market, it’s now worth $500,000. If you sell it, you’re looking at a hefty capital gains tax on your $250,000 profit.

Instead, you opt for a 1031 exchange. Here’s how it plays out:

- Engage a Qualified Intermediary (QI): This is your first and most crucial step. Before you close on the Plano property, you hire a QI. The IRS requires this neutral third party to hold your sale proceeds to ensure you never technically “receive” the cash.

- Sell the Plano Property: You sell the rental for $500,000, and the funds go directly into an escrow account managed by your QI. Your 45-day and 180-day clocks have officially started ticking.

- Identify Replacement Properties: Within the 45-day window, you scout the Dallas market and identify a few potential properties, including a promising four-unit building in Richardson listed for $800,000. You submit this list in writing to your QI.

- Acquire the Richardson Building: You work with your agent to get the Richardson property under contract. Your QI wires the $500,000 from the first sale to the title company, and you finance the remaining $300,000 with a new loan.

- Close the Deal: You successfully close on your new building on day 120, well inside the 180-day deadline.

What’s the outcome? You’ve successfully deferred the entire capital gains tax on your $250,000 profit. Even better, you’ve leveled up from a single rental to a multi-unit property, dramatically increasing your potential cash flow and net worth—all while keeping your original investment capital working for you. This is how savvy investors accelerate their growth in the Dallas market.

Making the Most of Your Dallas Property Deductions

While depreciation is a fantastic “on-paper” tax shield, the deductions that really affect your bank account are the ones you pay for day in and day out. For Dallas investors, careful expense tracking is where the rubber meets the road. Every dollar spent operating and maintaining your Dallas rental property can be a dollar subtracted from your taxable income.

Think of it this way: you’re not just bookkeeping; you’re actively reclaiming your operating costs. From the interest on your loan to the handyman you hired for a quick fix, each expense lowers your tax bill. This ensures more of your hard-earned rental income stays exactly where you want it—in your pocket.

The Dallas Investor’s Essential Deduction Checklist

To truly maximize what you save, you have to know what you can claim. The IRS allows you to deduct costs that are both ordinary and necessary for running your rental business. The key, of course, is keeping flawless records. If the IRS ever has questions, your documentation is your best friend.

Here are the core categories every single Dallas investor needs to track:

- Mortgage Interest: For most investors, this is the big one. The interest you pay on the loan used to buy or improve your Dallas rental property is completely deductible.

- Property Taxes: Dallas County is known for its high property taxes, which can actually be a silver lining for investors. Unlike the cap on personal home deductions, you can deduct 100% of the property taxes you pay on your investment properties.

- Insurance Premiums: Your landlord insurance policy is a necessary cost of doing business, protecting you from property damage and liability. Because it’s a business expense, it’s fully deductible.

- Maintenance and Repairs: This covers all the routine work that keeps your Dallas property in good shape. We’re talking about fixing plumbing leaks, patching drywall, or calling an electrician—not major renovations.

It’s crucial to understand the difference between a repair and an improvement. A repair, like fixing a leaky faucet, is a current-year deduction. An improvement, like a full kitchen remodel, adds value and must be depreciated over several years.

Digging Deeper: The Expenses People Often Miss

Beyond those “big four,” a ton of other expenses can seriously reduce your taxable income. Overlooking these can mean leaving thousands of dollars on the table each year. A truly savvy Dallas investor knows to track everything.

Property Management and Professional Fees

Did you hire a property management company to handle your Dallas rental? Great news—their fees are 100% deductible. This same rule applies to other professional services you rely on, including:

- Legal fees for help with leases or evictions.

- Accounting and bookkeeping fees for tax prep.

- Commissions paid to a real estate agent for finding you a tenant.

Travel and Local Transportation

Do you drive from your home in Frisco to check on a rental in the Bishop Arts District? That mileage is a deduction. Any travel you do for your rental business—whether it’s meeting contractors or just going to Home Depot for supplies—is a write-off. Just be sure to keep a simple log of your mileage, the date, and the purpose of your trip.

Utilities and HOA Dues

If you cover any utilities for your rental, like water for a duplex’s common area or the power bill while a unit is vacant, those costs are deductible. The same goes for any Homeowners’ Association (HOA) dues you’re required to pay for the property. These can be written off directly against your rental income. Understanding how these fit in with property taxes in Dallas, Texas is a critical piece of the puzzle, as these combined expenses represent a huge deduction.

Ultimately, mastering your deductions is less about knowing them and more about being organized. It’s one thing to identify a write-off, but it’s another to have the paperwork to back it up. Learning how to organize your business receipts is a fundamental skill that pays for itself every single tax season.

Navigating Capital Gains When You Sell Your Property

The moment you sell your Dallas investment property is when your strategy really comes to fruition. But the tax man is always waiting, and how you handle the sale can make a massive difference in what you actually get to keep. This is where a solid understanding of capital gains becomes your most valuable asset.

The IRS views profit from a property sale in one of two ways, and it all boils down to one simple question: how long did you own it? The answer is the key to unlocking one of the most powerful real estate investment tax benefits available to Dallas investors.

- Short-Term Capital Gains: If you buy and flip a Dallas property in one year or less, the government treats your profit just like your regular paycheck. It gets taxed as ordinary income, which means you’re paying at your highest personal rate.

- Long-Term Capital Gains: Hold onto that same Dallas property for just more than one year, and everything changes. Your profit now qualifies for the much friendlier long-term capital gains tax rates.

This isn’t just a small detail—it’s a foundational piece of building wealth through real estate, especially in a dynamic market like Dallas. A little patience goes a long, long way.

The Power of Holding On in Dallas

Simply owning your Dallas property for more than 365 days is a game-changer. It’s a strategy built on discipline, and the tax savings are the reward. As the experts at schneiderdowns.com point out, holding for the long term lets investors tap into tax rates that are significantly lower. For top earners, that could be the difference between paying a 37% tax rate on a short-term flip versus a maximum of 20% on a long-term hold.

Let’s put some real Dallas numbers to this.

Imagine you bought a rental duplex in Lower Greenville for $400,000. The neighborhood took off, and a couple of years later, you sell it for $550,000. That’s a $150,000 gain.

- The Impatient Seller (Sold in 11 months): If you’re in the 32% tax bracket and sell too soon, you’re looking at a tax bill of $48,000 ($150,000 x 0.32). Ouch.

- The Patient Investor (Sold in 13 months): By waiting just two more months, that same profit is now taxed at the 15% long-term rate. Your tax bill plummets to just $22,500 ($150,000 x 0.15).

You just pocketed an extra $25,500 by doing nothing more than waiting. That’s a down payment on your next Dallas property, funded entirely by smart tax planning. We dive even deeper into this in our full guide on the capital gains tax when you sell a home.

Tying It All Together

This is where all the pieces of the puzzle click into place. Remember all that depreciation you’ve been claiming to lower your taxable income each year? When you sell, the IRS wants to “recapture” it by taxing it. This is why you can’t just think about one tax benefit in isolation.

By understanding how depreciation, 1031 exchanges, and long-term capital gains interact, you create a seamless, end-to-end tax strategy. You use depreciation to lower your annual taxes, then roll everything into a 1031 exchange to defer both the capital gains and that depreciation recapture. It’s how you can build a Dallas portfolio for years without sending a huge check to the IRS.

This kind of big-picture thinking is what separates the pros from the amateurs. You’re not just selling a Dallas property; you’re executing a calculated move that protects your capital and sets you up for the next win.

Tax Strategies for Dallas REIT Investors

If you want a slice of the booming Dallas real estate market without the headaches of being a landlord, Real Estate Investment Trusts (REITs) are an excellent way to get in the game. Think of a REIT as a company that owns and manages a portfolio of income-producing properties. By buying a share, you’re investing in everything from high-rise office buildings in Downtown Dallas to sprawling apartment communities in the suburbs.

The real magic of REITs, though, lies in their unique tax structure. They are legally required to pay out at least 90% of their taxable income to investors in the form of dividends. Because they pass this income directly to shareholders, the REIT itself doesn’t pay corporate income tax on those profits. This setup opens the door to some powerful tax advantages for you, the Dallas investor.

The Qualified Business Income Deduction

One of the biggest perks flowing from this pass-through structure is the Qualified Business Income (QBI) deduction. This is a big deal. For most dividends you receive from a REIT, you may be able to simply deduct 20% of that income right off the top on your personal tax return.

This deduction, created under Section 199A, directly lowers how much tax you’ll owe on your REIT earnings. For a high-income earner in the 37% tax bracket, this 20% QBI deduction can effectively drop their tax rate on that dividend income down to around 29.6%. You can find a deeper dive into these tax rules on Nuveen’s REIT investor portal.

Understanding Return of Capital

Here’s another important tax concept to grasp: return of capital. Not every dollar a REIT sends your way is a taxable dividend. Part of a distribution can be classified as a return of capital, which is the REIT essentially handing back a portion of your own initial investment.

A return of capital distribution isn’t taxed as income in the year you get it. Instead, it lowers your cost basis in the REIT shares. You only pay tax on that amount later, when you decide to sell your shares.

This is a fantastic tax-deferral strategy. You get cash in your pocket now, but the tax bill is pushed down the road, boosting your after-tax returns from your Dallas-focused investments.

Common Questions About Dallas Real Estate Taxes

When you’re dealing with investment properties, especially in a market like Dallas, a lot of specific tax questions pop up. Let’s tackle some of the ones I hear most often from local investors to clear up any confusion.

How Do I Deduct Improvements To My Dallas Rental Property?

This is a great question, and the answer really comes down to one thing: Was it a repair or an improvement?

Simple repairs—like calling a plumber to fix a leaky faucet in your East Dallas duplex—are straightforward. You can deduct the full cost of that repair in the same year you paid for it. Think of these as the necessary expenses to keep the property up and running as-is.

On the other hand, major upgrades are a different story. If you’re doing a full kitchen gut and remodel or installing a brand-new HVAC system, the IRS sees that as an improvement that adds significant value or extends the life of your Dallas property. You can’t write off the whole cost at once. Instead, you’ll capitalize the expense and deduct it over 27.5 years through depreciation, just like you do with the property itself. Getting this distinction right is key to filing correctly and making the most of your tax benefits.

What Is Real Estate Professional Status in Dallas?

This is a powerful IRS designation, but it’s not for the casual investor. It’s for individuals who truly make real estate their primary business. To qualify, you have to prove you spend more than 750 hours a year and more than half of all your working hours on real estate activities.

Why jump through these hoops? Because achieving ‘Real Estate Professional’ status is a total game-changer for a Dallas investor. It unlocks the ability to deduct your rental property losses against your other income (like a salary) without the typical limitations. For an active investor juggling multiple Dallas properties, this can lead to massive tax savings. Just be warned: you’ll need to keep meticulous records of your time to back it up if the IRS ever asks.

The unlimited deduction for property taxes on investment properties is a significant advantage in Texas. While personal residences are subject to a State and Local Tax (SALT) deduction cap, this limit does not apply to your rental business expenses, offering a powerful way to offset high local tax rates for Dallas investors.

How Do Texas Property Taxes Affect My Federal Return?

It’s no secret that property taxes in the Dallas area can be hefty. But for a Dallas real estate investor, that high tax bill has a major silver lining for your federal return.

You can deduct 100% of the property taxes you pay on your rental properties as a business expense. This deduction directly reduces your taxable rental income, which in turn lowers what you owe the federal government. Since this deduction isn’t limited by the SALT cap that applies to your personal home, it becomes one of the most effective tools for turning a big local expense into a valuable federal tax break.

Whether you’re scoping out investment opportunities in Preston Hollow or getting ready to sell a luxury home in Highland Park, having an expert in your corner makes all the difference. The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the deep local market knowledge to guide you. To get started, you can find us at https://dustinpitts.com.