Think of a property tax exemption as a legally sanctioned discount on your annual tax bill here in Texas. It doesn’t change what your home is worth on the open market, but it does reduce the taxable value of your property, which is the number that really matters when your bill gets calculated.

Less taxable value means less tax owed. It’s that simple.

How Your Dallas Property Tax Bill Works

To really appreciate what an exemption does for you, it helps to first understand how Dallas County calculates your property taxes in the first place. The whole process boils down to a basic formula: your property’s value, multiplied by the local tax rates, equals the bill you have to pay.

Two main groups are involved in this here in Dallas.

First, you have the Dallas Central Appraisal District (DCAD). Their one job is to figure out the market value of every single property in the county. This valuation becomes the starting point—the entire “pie” that can potentially be taxed.

Then you have the local taxing units. These are the government bodies that actually provide services and, well, tax you for them. This includes:

- Dallas County

- The City of Dallas

- Dallas Independent School District (ISD)

- Dallas College (formerly Dallas County Community College District)

Each of these entities sets its own tax rate based on what it needs to operate for the year. Your final tax bill is just the sum of what you owe to each of them. For a more detailed breakdown, check out our guide on property taxes in Dallas, Texas.

So, Where Do Exemptions Come In?

This is where it gets good. An exemption literally shrinks that taxable pie before the tax rates are applied.

Let’s say DCAD values your Dallas home at $400,000. If you have a $100,000 homestead exemption for school district taxes, Dallas ISD can only tax you on $300,000 of that value, not the full $400,000.

That reduction is the whole point. By lowering the value that gets taxed, you directly lower the final check you have to write. It’s one of the most effective tools Dallas homeowners have to manage their property tax burden, and every eligible owner should be taking advantage of it.

Key Property Tax Terminology for Dallas Owners

Navigating your tax documents can feel like learning a new language. This quick reference table breaks down the essential terms you’ll encounter on your Dallas County property tax statements.

| Term | Simple Definition | Why It Matters to You |

|---|---|---|

| Appraised Value | The market value of your property as determined by the Dallas Central Appraisal District (DCAD). | This is the starting number for all tax calculations. A higher value means a potentially higher tax bill. |

| Taxable Value | The appraised value minus any exemptions you qualify for. | This is the actual amount your tax rates are applied to. Your goal is to get this number as low as possible. |

| Tax Rate | The percentage set by each local taxing unit (city, county, school district) to fund its budget. | Each entity has its own rate. Your total tax rate is the sum of all of them combined. |

| Taxing Unit | A government entity with the authority to levy property taxes (e.g., City of Dallas, Dallas ISD). | You pay taxes to multiple units, and your bill shows a breakdown of how much goes to each. |

Understanding these four terms is the foundation for making sense of your property tax bill and identifying opportunities, like exemptions, to lower what you owe.

What Is a Property Tax Exemption?

Let’s break down exactly what a property tax exemption is. Think of it as a special discount on your home’s value, authorized by Texas law, that directly lowers your annual tax bill. It’s not cash in your pocket, but it certainly keeps more of it there.

Here’s how it works: instead of sending you a check, an exemption shaves a specific dollar amount off your home’s appraised value. This lower figure, known as the taxable value, is what the Dallas Central Appraisal District (DCAD) and your local school district actually use to calculate what you owe.

Imagine your Dallas home is valued at $500,000. If you qualify for the $100,000 school district homestead exemption, you’ll only be taxed on $400,000 of your home’s value for school taxes. That simple reduction makes a huge difference year after year.

The Purpose Behind Tax Exemptions

So, why do these exemptions exist in the first place? They are a legal tool designed to provide financial relief and encourage certain outcomes, like stable homeownership. This approach has long been a key part of making housing more affordable and balancing local government funding in Dallas. If you want to dive deeper, you can read more about how tax assessments work to see the full picture.

Ultimately, these programs aim to make owning a home in Dallas more manageable. They offer real, targeted support to specific groups—including seniors, veterans, and individuals with disabilities—helping them remain in their homes without being overwhelmed by rising property values.

In essence, an exemption is the state’s way of saying that certain homeowners shouldn’t have to carry the full tax burden on their primary residence. It’s direct, meaningful financial relief written into the law.

When you connect these exemptions back to the tax calculation process, it becomes clear just how powerful they are. They shrink your taxable footprint before any tax rates are even applied. For any Dallas homeowner looking to get a handle on housing costs, understanding and claiming every exemption you’re entitled to is one of the smartest financial moves you can make.

Key Exemptions for Dallas Homeowners

Now that we’ve got a handle on what a property tax exemption is, let’s get into the good stuff: the specific options available to you as a Dallas homeowner. Texas law offers some powerful ways to cut down your annual tax bill. Figuring out which ones you qualify for is the secret to unlocking some serious savings.

The most common and impactful one by far is the General Residence Homestead Exemption. It’s pretty straightforward: if the home you own in Dallas is your primary residence on January 1st of the tax year, you’re eligible. This isn’t a minor perk—it knocks a mandatory $100,000 off your home’s taxable value for school district taxes. That’s a huge saving that every single qualifying homeowner in Dallas should be taking advantage of. For a deeper dive, check out our guide explaining what a homestead exemption is and how it really works.

Additional Savings For Specific Homeowners

On top of the general homestead exemption, Texas provides extra relief for certain homeowners.

One of the most valuable is the Over-65 Exemption. Just like it sounds, Dallas homeowners can apply for this in the year they turn 65. This grants an additional $10,000 reduction from your home’s value for school taxes, which stacks right on top of the general homestead amount.

Even better, many local taxing bodies—like the City of Dallas and Dallas County itself—often offer their own optional over-65 exemptions, pushing your savings even higher.

In the same vein, a Disability Exemption is available for homeowners who meet the federal criteria for disability. This offers the same $10,000 school tax reduction as the over-65 exemption. Just keep in mind, you can claim either the over-65 exemption or the disability exemption, but not both.

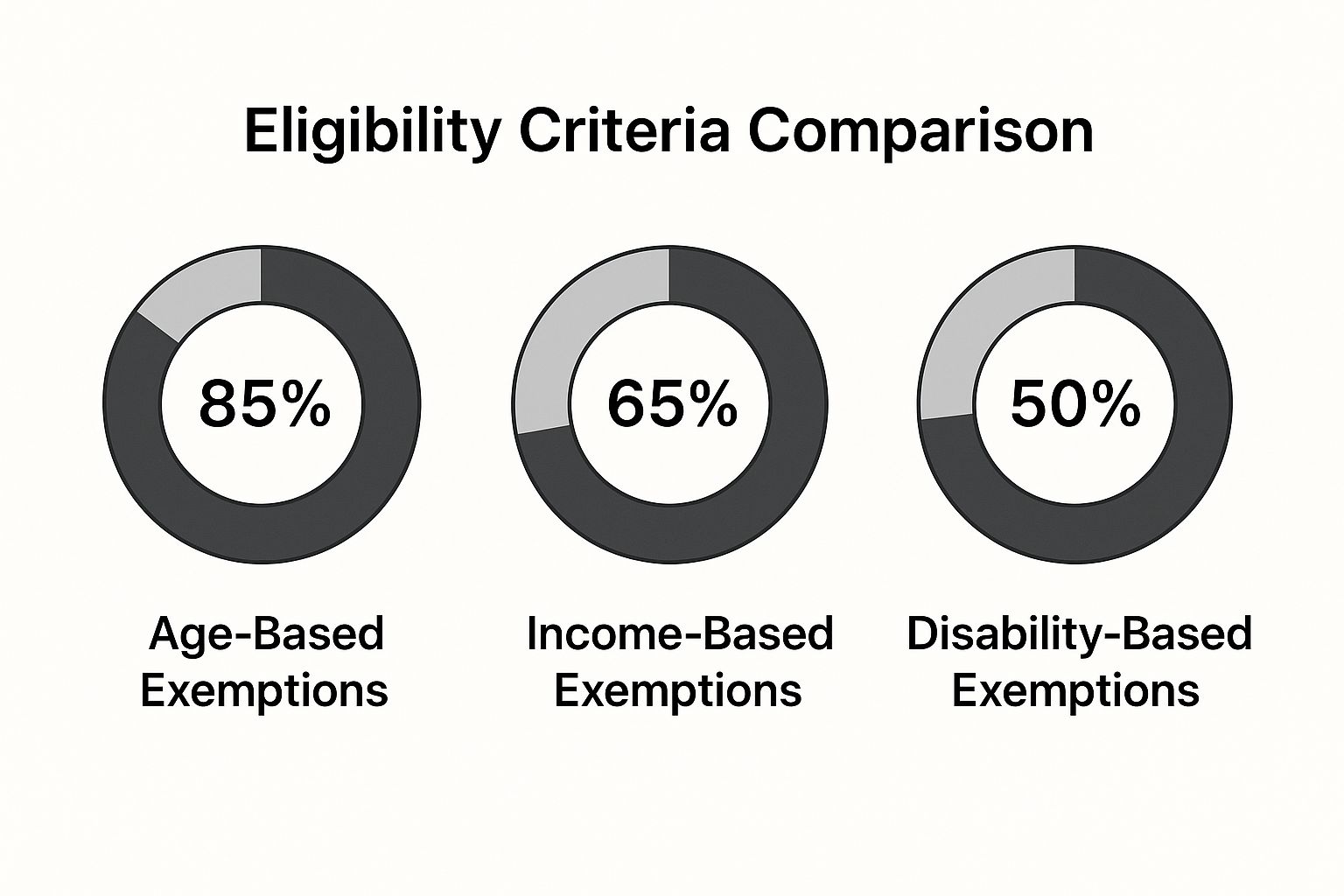

As you can see, age-based exemptions are incredibly common, but benefits for disability and income status are also widely available.

Exemptions For Disabled Veterans

Texas makes it a priority to provide significant property tax relief for disabled veterans and their surviving spouses. The amount of the exemption is directly tied to the veteran’s disability rating from the U.S. Department of Veterans Affairs.

The exemption amounts are substantial, ranging from a $5,000 reduction for a 10-29% disability rating up to a 100% property tax exemption for veterans with a 100% disability rating or those deemed individually unemployable.

Yes, you read that right. A 100% exemption means that qualifying veterans pay absolutely no property taxes on their primary residence. It’s a vital benefit for those who have served.

Common Dallas County Property Tax Exemptions at a Glance

To make this easier to digest, here’s a quick comparison of the primary exemptions available to Dallas homeowners. This table breaks down who is eligible and what the benefit looks like for different taxing authorities.

| Exemption Type | Primary Eligibility | Benefit for School Taxes | Benefit for Other Taxing Units |

|---|---|---|---|

| General Homestead | Must own and live in the property as your primary residence on Jan 1. | Mandatory $100,000 value reduction. | Optional; many offer up to 20% of the home’s value. |

| Over-65 | Must be 65 years of age or older and have a homestead exemption. | Mandatory $10,000 additional value reduction. | Varies by entity; many offer additional reductions (e.g., Dallas County offers $70,000). |

| Disability | Must meet federal disability criteria and have a homestead exemption. | Mandatory $10,000 additional value reduction. | Varies by entity; often matches the Over-65 amount. |

| Disabled Veteran | Must have a service-connected disability rating from the VA. | Based on disability rating ($5,000 to $12,000 reduction, or 100% exemption for 100% disabled). | Same as school tax benefit. |

This table shows how different benefits apply across the board, but remember to always check with the Dallas Central Appraisal District for the exact figures in your area.

Stacking Exemptions For Maximum Benefit

Here’s where it gets really powerful. One of the best parts of the Texas system is that you can “stack” multiple exemptions. This simply means combining all the different benefits you qualify for to get your taxable value as low as possible.

Let’s imagine a Dallas homeowner who is over 65 and is also a disabled veteran. They could potentially claim:

- The General Residence Homestead Exemption

- The Over-65 Exemption

- The applicable Disabled Veteran Exemption

Each one of these chips away at the property’s taxable value. The result? A much, much smaller final tax bill. The key takeaway is simple: applying for every single exemption you are entitled to is the most effective strategy for managing your property taxes in Dallas.

Securing Your Dallas Property Tax Exemptions: A How-To Guide

Okay, so you’ve figured out you qualify for a property tax exemption. That’s fantastic news, but now comes the most important part: actually claiming it. In Dallas, this all goes through the Dallas Central Appraisal District (DCAD), and getting it right means you’ll see those savings on your next tax bill.

Timing is everything here. The official window to file for your exemptions opens on January 1st and closes on April 30th. Filing within this period is the cleanest and fastest way to make sure your savings are applied to the current year’s taxes without a hitch.

Your Step-by-Step Application Plan

First things first, you need the right paperwork. The most common one you’ll be looking for is the Application for Residence Homestead Exemption. You can usually download this directly from the DCAD website or pick one up in person at their office.

Next, you’ll need to gather your proof. The single most critical document is a clear copy of your valid Texas driver’s license or state-issued ID.

Pro Tip: The address on your ID must be an exact match for the property address where you’re claiming the homestead exemption. DCAD is very strict about this; it’s how they confirm the home is truly your primary residence.

Once you’ve filled out the form and made a copy of your ID, it’s time to submit everything to DCAD. You can typically send it in by mail, drop it off in person, or use their online portal if one is available.

Common Pitfalls to Sidestep

Even a small mistake on your application can cause delays or an outright denial. I’ve seen it happen time and again. Here are the most common slip-ups Dallas homeowners make—make sure you avoid them.

- Leaving Blanks on the Form: Don’t rush it. Go through the form field by field and make sure everything is filled out completely and accurately. Missing info is the #1 reason applications get kicked back.

- Listing a P.O. Box: Remember, this exemption is tied to your physical home. You have to list the actual street address of your residence, not a P.O. Box.

- Forgetting the Deadline: While you technically have up to two years to file a late application, why wait? Hitting that April 30th deadline ensures you get your tax break this year, not later.

- The Dreaded Address Mismatch: I can’t stress this enough. If you’ve recently moved, update your driver’s license with the Texas DPS before you submit your exemption application. The addresses must match.

Steering clear of these simple errors will help your application get approved quickly, locking in those hard-earned tax savings. It’s interesting to note that property tax systems are handled very differently from country to country. If you’re curious about the global perspective, you can learn more about international approaches to property taxation on ImmigrantInvest.com.

Let’s Run the Numbers: A Real-World Dallas Example

It’s one thing to talk about exemptions in theory, but it’s another to see what they actually do for your wallet. Let’s put some real numbers to it.

Imagine you own a home in a vibrant Dallas neighborhood like Bishop Arts. The Dallas Central Appraisal District (DCAD) has appraised its value at $500,000. To keep things simple, we’ll use a combined property tax rate of 2.5%, which includes taxes for the city, the county, and the Dallas Independent School District (ISD).

If you want to get into the weeds of how this math works, we have a complete guide that breaks down how to calculate property taxes.

Scenario 1: No Exemptions

First, let’s look at the tax bill without any exemptions applied. It’s a straight shot. Your home’s entire appraised value is taxable.

- Appraised Value: $500,000

- Taxable Value: $500,000

- Total Tax Bill: $500,000 x 2.5% = $12,500

That’s your starting point. It’s a significant number that makes a real dent in any household budget.

Scenario 2: Adding the Basic Homestead Exemption

Now, let’s say you’ve filed for the standard residence homestead exemption. This immediately gives you a $100,000 reduction on the school district portion of your taxes. For our example, we’ll say the school district’s tax rate is 1.0% of the total 2.5%.

- Taxes for City/County (1.5% rate): $500,000 x 1.5% = $7,500

- School Taxable Value: $500,000 – $100,000 = $400,000

- School Tax Bill (1.0% rate): $400,000 x 1.0% = $4,000

- New Total Tax Bill: $7,500 + $4,000 = $11,500

Just by filling out one form, you’ve saved $1,000 a year. Not bad at all.

Scenario 3: Stacking an Over-65 Exemption

This is where the savings really start to add up. Let’s assume you’re also over 65. You now qualify for the mandatory $10,000 over-65 exemption from the school district, plus Dallas County’s extra $70,000 over-65 exemption. (We’ll assume the county’s tax rate is 0.20%).

Think of it like this: each exemption you stack on top of another chips away at your taxable value for a specific taxing authority. The more you stack, the more you save.

Let’s see how the taxable values change:

- School Taxable Value: $500,000 – $100,000 (homestead) – $10,000 (over-65) = $390,000

- County Taxable Value: $500,000 – $70,000 (over-65) = $430,000

When you run the full calculation with these new, lower taxable values, the final tax bill drops dramatically. This is exactly why it’s so critical to claim every single exemption you’re entitled to—the compounded savings can be massive.

Beyond Exemptions: Other Tax-Saving Strategies

Getting your property tax exemptions in place is a huge win, but don’t stop there. Think of it as the first step in a year-round strategy. For savvy Dallas homeowners, managing property taxes is an ongoing process, and exemptions are just one piece of the puzzle.

First things first: you have to maintain your exemptions. If you move, even just across town, you’ll need to file a new homestead application for your new primary residence. Likewise, if your situation changes—say, your eligibility for a disability exemption ends—you have to let the Dallas Central Appraisal District (DCAD) know.

Don’t Ignore Your Annual Appraisal Notice

Sometime in the spring, you’ll get a critical piece of mail from DCAD: the Notice of Appraised Value. This isn’t junk mail. It’s the document that tells you exactly what the district thinks your home is worth, and that number directly determines how big your next tax bill will be.

Don’t just glance at it and file it away. Open it immediately. Ask yourself: does this value look right? How does it compare to what similar homes in my Dallas neighborhood have recently sold for? If that number makes you do a double-take, you have every right to challenge it.

The Power of Protesting an Unfair Valuation

This leads us to your most powerful tool after exemptions: the property tax protest. If you’re convinced DCAD has overvalued your home, you can—and should—file a protest to officially dispute their number. A successful protest directly lowers your home’s taxable value, which means real, tangible savings.

Protesting isn’t just for real estate agents or lawyers. Every single Dallas property owner has the right to build a case and show why their valuation is too high. You can use sales data from comparable homes or point out issues with your property that hurt its market value.

This kind of proactive tax management isn’t just a Dallas strategy. We see similar efforts to provide relief worldwide. For instance, the city of Chongqing in China is raising its property tax exemption threshold in 2025 to ease the burden on homeowners. You can read more about these global property tax reforms and strategies on Gate.com.

It also helps to look at your property taxes through an investor’s lens. To get a bigger picture of how real estate taxation works in the Dallas market, it’s smart to explore other real estate investment tax benefits that go beyond your primary home.

When you combine your exemptions with a sharp eye on your annual notice and the confidence to protest an unfair valuation, you build a powerful defense against paying more than your fair share.

Frequently Asked Questions About Dallas Property Tax Exemptions

It’s completely normal to have a few questions when you start digging into property tax exemptions. Getting these details sorted out is the key to making sure you don’t leave any money on the table. Let’s tackle some of the most common questions Dallas homeowners ask.

Do I Have to Reapply for My Homestead Exemption Every Year in Dallas?

Good news: no, you don’t. Once the Dallas Central Appraisal District (DCAD) approves your general residence homestead exemption, it stays on your property. It automatically renews every year as long as that home remains your primary residence.

You’d only need to think about reapplying if DCAD sends you a letter asking for new information (which is rare) or if you sell your home and move into a new one.

Can I Claim More Than One Property Tax Exemption?

Yes, and you absolutely should! Texas law is set up to let homeowners “stack” different exemptions on top of each other, leading to some serious savings.

For example, a Dallas homeowner who is over 65 can claim both the general $100,000 homestead exemption and the $10,000 over-65 exemption. They combine for a much bigger dent in your home’s taxable value.

What Happens If I Miss the April 30th Application Deadline?

If the April 30th deadline flies by, don’t worry. While it’s always best to file on time, Texas law allows you to file a late application for a homestead exemption for up to two years after the taxes would have become delinquent.

This safety net ensures you can still claim the savings you’re entitled to, even if life gets in the way and you miss that initial deadline.

The most important takeaway is that these benefits are legally yours to claim. Understanding the rules, especially around deadlines and stacking, empowers you to keep your property tax bill as low as possible.

Navigating the Dallas real estate market requires local expertise, especially when it comes to maximizing financial benefits like property tax exemptions. Whether you’re buying your first home or selling a luxury property, the right guidance makes all the difference. Contact Dustin Pitts REALTOR Dallas Real Estate Agent to partner with a team that puts your financial interests first. Visit us at https://dustinpitts.com to get started.