That property tax bill in Dallas can be a real shocker. But what if there’s a straightforward way to knock that number down, legally and permanently? It’s called a homestead exemption, and it’s one of the most valuable tools Dallas homeowners have to lower their property taxes.

Your Guide to Lowering Dallas Property Taxes

With Dallas property values always on the move, getting a handle on this exemption is no longer just a good idea—it’s essential. Think of it less as a complicated tax loophole and more as a homeowner-friendly benefit built right into the state’s tax code.

This guide is designed to cut through the jargon. We’ll show you what the homestead exemption really is, how it works for you as a Dallas homeowner, and exactly how to claim it. The goal is simple: to protect a slice of your home’s value from being taxed, which translates into real, tangible savings every single year.

Simply put, a homestead exemption carves out a portion of your home’s value and makes it off-limits to property taxes. It’s designed to protect homeowners by reducing their tax bill and even offering some protection from creditors.

In essence, it acts as a financial shield for your biggest investment. If you’re looking to get more comfortable with the language of property taxes and financial planning, this a comprehensive glossary of relevant financial and estate planning terms is a great resource. Now, let’s get into how this actually works for you.

How the Homestead Exemption Really Works in Dallas

Many Dallas homeowners I talk to think the homestead exemption is some complicated secret buried deep in the tax code. But the truth is, it’s refreshingly simple. It doesn’t mess with your property tax rate at all. Instead, it just chops a piece off the top of your home’s taxable value.

That distinction is everything—it’s the whole secret to how you save money.

Think of it like getting a massive coupon from the county. If the Dallas Central Appraisal District (DCAD) says your home is worth $450,000, a $100,000 exemption means the government can only tax you on a value of $350,000. The tax rate itself doesn’t change, but your final bill gets a lot smaller because the starting number is lower.

A Few Key Ideas to Know

To really get how this works in Dallas, you only need to understand two concepts: your principal residence and your taxable value.

- Principal Residence: This is just a formal way of saying “the main house you own and actually live in.” To qualify, you must have been living there on January 1st of the tax year. You only get one, so vacation homes or rental properties don’t count.

- Taxable Value: This is the bottom-line number your tax bill is calculated from, after all your exemptions have been subtracted. The initial market value is just the starting point. If you want to dive deeper into how that initial number is set, learning more about the real estate appraisal process is a great place to start.

At its heart, the homestead exemption is a legal tool designed to give homeowners a break. It shields a chunk of your home’s value from being taxed, and in Texas, that can mean a fixed dollar amount or even a percentage.

The big takeaway is this: the exemption lowers the assessed value of your home that the government can tax. Less taxable value means a smaller property tax bill. Simple as that.

This direct reduction is why filing for your homestead exemption is one of the single most powerful things a Dallas homeowner can do to control their property taxes. It’s a benefit you’re entitled to, and now you know exactly how it works.

Do You Qualify for a Dallas Homestead Exemption?

So, now that you know what a homestead exemption is, the big question is: do you qualify? The good news for Dallas County homeowners is that the requirements are pretty simple.

For the general homestead exemption, you just need to meet two basic conditions. First, you have to own the property. Second, it must be your principal residence as of January 1st of the tax year. This just means it’s the home you actually live in, not a second home or a rental property.

Extra Exemptions for Certain Homeowners

On top of the standard exemption everyone can get, Dallas County offers some serious tax relief for specific groups of people. Think of these as extra savings you can stack right on top of the general exemption.

You might be eligible for a bigger tax break if you fall into one of these categories:

- Age 65 or Older: Once you turn 65, you can get an additional exemption that provides a significant break on your school district taxes.

- Persons with Disabilities: If you have a qualifying disability under state guidelines, you’re entitled to an extra exemption amount, much like the one for seniors.

- Disabled Veterans: Depending on their VA disability rating, disabled veterans can see their property taxes partially or even 100% waived.

To lock in these savings, you’ll need to send some paperwork over to the Dallas Central Appraisal District (DCAD). For the general exemption, a copy of your driver’s license showing the property address usually does the trick. For the others, you’ll need documentation that proves your age, disability, or veteran status. It’s well worth the effort to claim every single exemption you qualify for—it all adds up.

How to File Your Homestead Exemption in Dallas County

Ready to claim your tax savings in Dallas County? The good news is that the process is pretty straightforward. Everything runs through the Dallas Central Appraisal District (DCAD), and honestly, the little bit of paperwork is more than worth the money you’ll save.

The official form you’re looking for is the Application for Residence Homestead Exemption (Form 50-114). You can grab this directly from the DCAD website, and in most cases, you can even file it online, which is usually the quickest and easiest route.

What You Will Need

To get your application approved, you’ll have to prove the property is your main home. This is simple enough—all you need is a copy of your valid Texas driver’s license or a state-issued personal ID card.

Here’s the critical part: the address on your ID must match the address of the home you’re claiming the exemption for. This is how the appraisal district confirms it’s your principal residence, so make sure your license is updated before you file.

Mark your calendar, because the most important date to remember is April 30th. You need to have your application and all the right documents turned in to DCAD by then.

While the specifics vary by state, the core idea of giving homeowners a tax break is pretty common. For instance, you can learn more about how different states implement property tax relief, but the rules that matter for you are the ones set here in Texas.

And if you miss the deadline? Don’t panic. Texas law is pretty forgiving and lets homeowners file a late application for up to two years after the taxes would have become delinquent. So you still have a chance to claim the savings you’re entitled to.

Calculating Your Property Tax Savings in Dallas

It’s one thing to talk about homestead exemptions in theory, but it’s another to see the real money it can save you. Let’s walk through a practical example to put some real numbers behind the benefit.

Imagine you own a home in Dallas with an appraised value of $400,000. Without a homestead exemption, you’d be taxed on that full amount. But once you file, the savings kick in immediately. The biggest slice comes from the state-mandated school tax exemption, which chops a massive $100,000 right off the top of your home’s taxable value for school taxes.

Layering Dallas-Specific Exemptions

On top of the state’s mandatory exemption, Dallas County and the City of Dallas offer their own generous break. They each provide an optional 20% exemption, which shaves even more off your home’s value for their respective portions of your tax bill.

Let’s break down how these benefits stack up:

- State School Tax Exemption: A mandatory $100,000 reduction.

- Local Optional Exemptions: A 20% reduction from both Dallas County and the City of Dallas.

When you layer these exemptions, you seriously reduce the value that each taxing authority can use to calculate your bill. This directly translates into a lower property tax bill every single year.

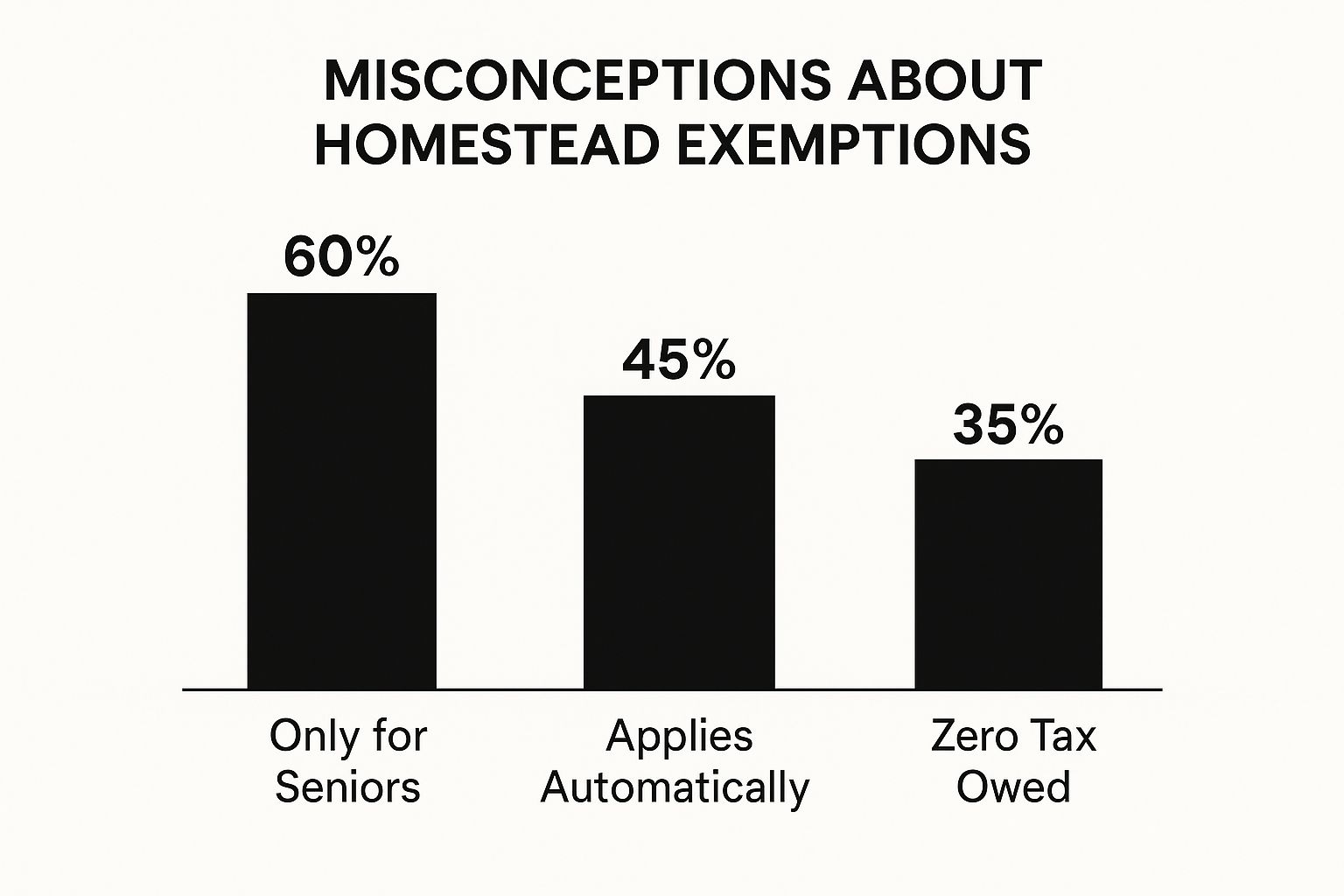

This image highlights a common problem: many homeowners think these benefits are automatic or just for seniors, which simply isn’t true. You have to file for it to get it. For a deeper dive into running the numbers yourself, check out our guide on how to calculate property taxes.

To make this crystal clear, let’s look at a side-by-side comparison. The table below shows the difference applying for the homestead exemption can make on a $400,000 Dallas home, using a sample combined tax rate.

Dallas Homestead Exemption Savings Example

| Metric | Without Homestead Exemption | With Homestead Exemption |

|---|---|---|

| Appraised Home Value | $400,000 | $400,000 |

| Taxable Value (School) | $400,000 | $300,000 |

| Taxable Value (City/County) | $400,000 | $320,000 |

| Estimated Annual Taxes | ~$10,000 | ~$7,800 |

| Estimated Annual Savings | $0 | ~$2,200 |

As you can see, the savings are substantial. Filing for the homestead exemption is easily one of the most impactful things you can do to lower your property tax burden in Dallas County. We’re talking thousands of dollars back in your pocket each year.

Your Home Is a Fortress: How the Texas Homestead Exemption Protects You from Creditors

The homestead exemption does more than just lower your annual property tax bill. It also acts as a powerful shield, providing some of the strongest asset protection in the entire country for your Dallas home. Think of it as building a financial fortress around your primary residence.

This legal safeguard is a huge deal, especially when life throws you a curveball. If you were to face something like a major lawsuit or even bankruptcy, the equity you’ve built in your home is generally untouchable for most creditors. It’s a critical layer of security that keeps your most significant asset safe.

But It’s Not a Perfect Shield

It’s crucial to know that this protection isn’t absolute. The Texas homestead exemption won’t guard your home against every single type of debt.

Certain creditors can still force a sale to collect what they’re owed. These exceptions typically involve debts directly tied to the property itself:

- The mortgage you used to buy the home in the first place.

- Unpaid property taxes owed to Dallas County or your city.

- Home equity loans or lines of credit secured by your house.

- Mechanic’s liens for unpaid home improvement work.

This protective function safeguards a homeowner’s equity from many creditors and bankruptcy proceedings. Jurisdictions like Texas offer unlimited homestead exemptions, making them particularly favorable for homeowners. Learn more about leveraging asset protection with homestead exemptions.

Beyond these built-in legal protections, many homeowners look into other financial safety nets, such as life insurance mortgage protection, to plan for unforeseen circumstances.

Got Questions About the Dallas Homestead Exemption? We’ve Got Answers.

When it comes to property taxes, a little bit of confusion is completely normal. The good news is that the rules for the Dallas homestead exemption are actually pretty simple once you get the hang of them. Let’s tackle some of the most common questions Dallas homeowners ask.

Key Exemption Details

Do I need to reapply for my homestead exemption every year in Dallas?

Nope. This is a one-and-done deal. Once the Dallas Central Appraisal District (DCAD) approves your residence homestead exemption, it stays on your property and renews automatically. You only need to think about it again if you move and it’s no longer your main home.

Can I claim a homestead exemption on more than one property in Texas?

This one is a hard no. Texas law is crystal clear: you can only claim the exemption on one property, and it absolutely must be your principal residence. Trying to claim it on a vacation home or rental property is illegal and can get you into hot water with penalties.

What happens if you miss the April 30th application deadline? Don’t panic. Texas law gives you a grace period, allowing homeowners to file a late application for up to two years after the taxes would have become delinquent.

This safety net means you still have plenty of time to claim the tax savings you’re entitled to.

Navigating the Dallas real estate market requires local expertise. Whether you’re buying, selling, or have questions about property taxes, Dustin Pitts REALTOR Dallas Real Estate Agent is here to help. Get in touch today at https://dustinpitts.com for personalized guidance.