Thinking about buying a house with a friend? It’s a savvy way to get your foot in the door of the competitive Dallas real estate market, turning a dream of living in a place like Bishop Arts or Lower Greenville into a reality. But let’s be clear: this is about more than just splitting a down payment. You’re essentially forming a business partnership, and a successful one is built on a rock-solid legal and financial framework before you even think about Zillow.

Your Blueprint for Co-Buying a Dallas Home

Let’s face it, with home prices soaring across the Dallas-Fort Worth metroplex, buying a home solo can feel impossible. Teaming up with a friend doubles your financial muscle, suddenly making those homes in desirable Dallas neighborhoods feel much more attainable. You’re not just sharing a mortgage; you’re building equity together instead of throwing money away on rent separately.

But this isn’t something you jump into with just a handshake. It requires some serious, upfront conversations and a legally sound plan. Think of it less like moving in with a roommate and more like launching a startup. Before you get swept up in the excitement of open houses in Lakewood or Uptown, you and your co-buyer need to sit down and tackle the big questions head-on.

Aligning Your Goals and Expectations

The absolute first thing you must do is get on the same page. Seriously. I’ve seen these arrangements go south, and it’s almost always because of mismatched expectations from the get-go.

Here’s what you need to hammer out:

- The Timeline: How long do you both see yourselves living here? Is this a 3-year plan or a 10-year investment? Agreeing on a minimum timeframe, say five years, gives you a shared goal to work toward.

- The Lifestyle: What’s the vibe of the house going to be? Are we talking quiet weeknights and a home office, or is this the go-to spot for weekend get-togethers? Talking about guests, noise, and how you’ll use shared spaces now prevents major headaches later.

- The Financial Picture: Time for total transparency. This means sharing everything—credit scores, student loans, car payments, savings. You have to know your combined financial reality to figure out what you can truly afford in Dallas.

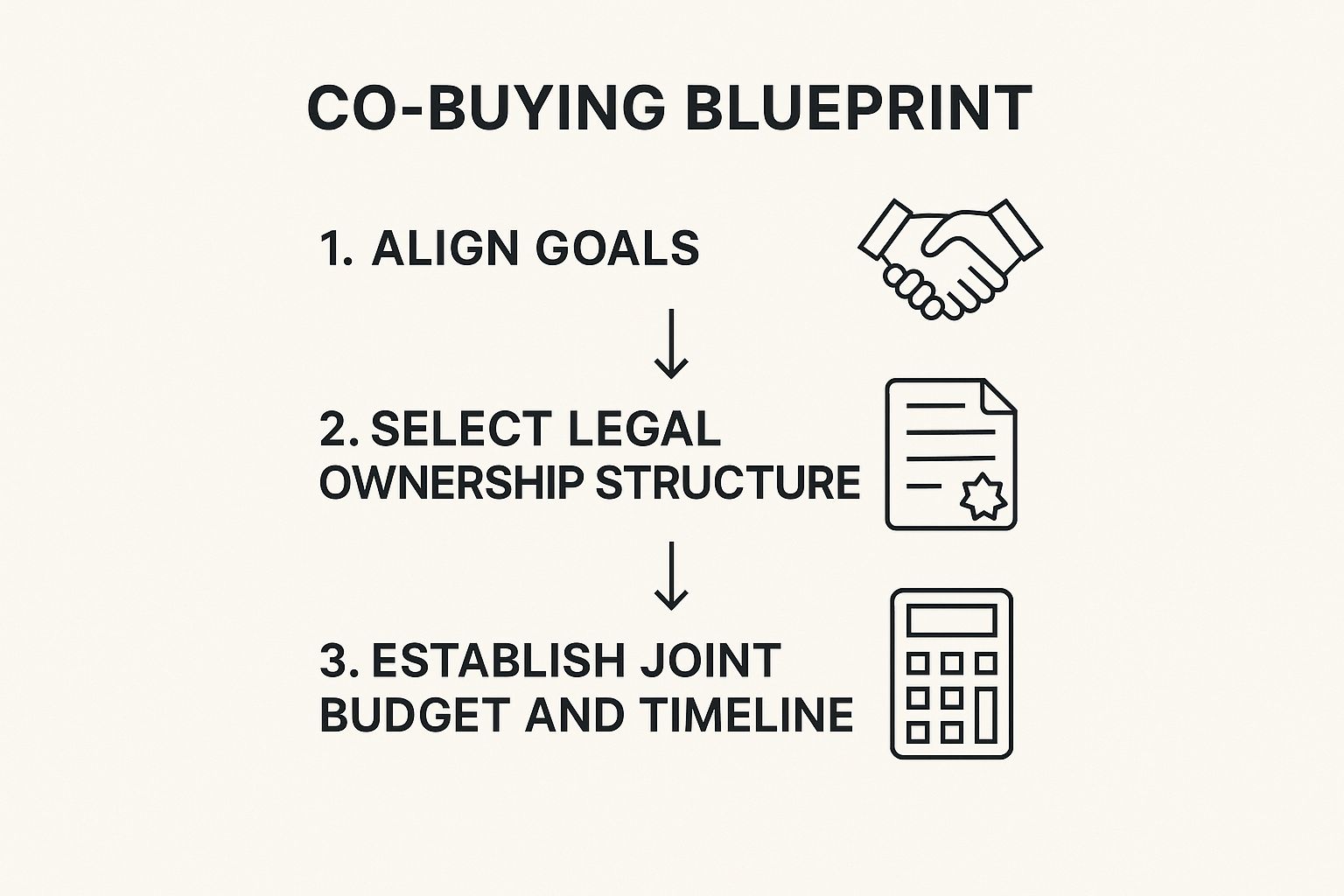

This infographic really breaks down the essential steps to get you started on the right foot here in Dallas.

As you can see, the foundation is all about aligning your goals and getting the legal stuff sorted out—the house hunt comes much later.

Before we move on, let’s summarize the key decision points you’ll need to agree on. These are the non-negotiables for anyone considering this path in the Dallas market.

Key Co-Ownership Decision Points for Dallas Buyers

| Decision Area | Key Considerations for Dallas | Why It Matters |

|---|---|---|

| Ownership Structure | Will you be Joint Tenants with Right of Survivorship or Tenants in Common? This is a huge legal distinction in Texas. | It dictates what happens to a person’s share of the property if they pass away and how the property can be sold or transferred. |

| Financial Contributions | How will you split the down payment, mortgage, taxes, insurance, and HOA fees? Will it be 50/50, or proportional to income? | Dallas property taxes aren’t cheap. Having this in writing prevents resentment and financial strain down the road. |

| Maintenance & Repairs | Who pays for a new roof or a broken water heater? Do you create a joint savings account for these expenses? | Unexpected repairs are a guarantee. A pre-funded repair account can be a lifesaver and avoids arguments over big-ticket items. |

| Exit Strategy | What happens if one person wants to sell? How is the buyout price determined? What’s the timeline? | Life happens. A clear, legally-binding exit plan protects both of you and your investment from a messy “breakup.” |

Thinking through these scenarios now provides a safety net for your friendship and your finances. It’s the most critical part of the process.

A critical takeaway is this: Your co-ownership agreement is the most important document you will create. It’s the constitution for your shared investment and the roadmap that will guide you through any unexpected events.

Ultimately, buying a house with a friend can be an incredibly smart move in a hot market like Dallas. When you take the time to methodically work through these initial steps, you’re not just buying a property—you’re building a foundation for a successful and profitable partnership.

For a deeper look into the specifics of our local market, be sure to check out our detailed guide on buying a house in Dallas for even more local insights.

Crafting Your Co-Ownership Agreement

Before you even start scrolling through listings for that charming Craftsman in East Dallas or a sleek townhome in North Dallas, you need to make the single most important investment of this whole process: a rock-solid co-ownership agreement.

Let’s be clear. This isn’t a handshake deal you make over a beer in Deep Ellum. When you’ve got hundreds of thousands of dollars and a valuable friendship on the line, that just won’t cut it. This legal document is the constitution for your shared property, and it’s about clarity, not mistrust. It’s a roadmap that anticipates every possible scenario, so you both have an enforceable plan to follow when life happens.

What Must Be Included

You absolutely need a Texas real estate attorney to draft this for you; it’s not the place to download a generic template. Your agreement has to be tailored to your specific situation. Here are the non-negotiables you’ve got to cover when buying a house with a friend in Dallas.

- Ownership Percentages: How are you splitting this? If one of you is putting in 60% of the down payment and the other is contributing 40%, the agreement needs to spell that out. In Texas, you can do this by holding the title as “Tenants in Common,” which legally allows for unequal ownership shares.

- Financial Responsibilities: Get granular. The agreement must detail exactly how you’ll divvy up all the costs—the mortgage, Dallas’s notoriously high property taxes, homeowners insurance, and any HOA fees you’ll find in neighborhoods like Preston Hollow.

- Maintenance and Repairs: You need a plan for everything from routine lawn care to a catastrophic failure. What happens when the AC unit dies in the middle of a brutal Dallas August? Or when you find foundation issues, a common headache with Texas’s clay soil? Your agreement has to specify how you approve and pay for these things.

Planning for Dallas-Specific Scenarios

Let’s talk real-world for a second. Imagine a massive hailstorm hammers your new Oak Cliff home and you need a new roof. Your agreement should already have a plan for how to pay the insurance deductible and how you’ll agree on a contractor. Without it, you could have one person wanting the cheapest fix while the other insists on a premium, long-lasting solution—instant conflict.

Or what if one of you loses a job and can’t make your half of the mortgage for a few months? The agreement should include a clause that lays out the game plan. Maybe the other owner covers the payments for a short period in exchange for a temporary bump in their equity stake.

Your co-ownership agreement is your first line of defense against future disputes. It transforms “what if” scenarios from potential friendship-ending arguments into manageable, pre-planned business decisions.

Legal Protections and Exit Clauses

This document is also where you build in crucial legal protections. As you draft your agreement, it’s a good idea to understand things like what an indemnification clause is, which can shield one of you from financial harm caused by the other’s actions.

Most importantly, you need a crystal-clear exit strategy. Life changes. What happens when one of you gets a dream job offer in Austin and has to move? The agreement should detail the entire buyout process.

This process must include:

- A Method for Valuation: How will you figure out the home’s current market value? Agree now. Will you hire one certified Dallas appraiser, or take the average from two or three?

- A Buyout Timeline: Once you have a price, how long does the remaining owner have to secure the financing for the buyout? Is it 60 days? 90 days?

- The “Forced Sale” Clause: What if a buyout just isn’t financially possible? The agreement has to state that if a buyout falls through, the property will be put on the market.

All this detail might feel tedious right now, but it will give you incredible peace of mind later. It ensures that no matter what life throws at you, you have a fair, legally binding process to fall back on, protecting both your investment and your friendship.

Securing a Joint Mortgage in Dallas

With your co-ownership agreement signed and sealed, it’s time to tackle the next big step: getting the mortgage. Applying for a home loan with a friend is a completely different animal than doing it solo. Dallas lenders are going to look at you and your friend as a single financial entity, which can be a massive plus, but it also means you need to be prepared.

This kind of partnership is becoming more and more common as people get creative about breaking into the Dallas housing market. This is reflective of a broader trend, but very applicable here. For context, in most developed countries, including the U.S., individuals with mortgages make up a significant portion of homeowners. You can dig into the global housing tenure statistics from the OECD if you’re curious, but the takeaway for Dallas buyers is that joint financial obligations are a standard part of real estate.

How Lenders Will See Your Joint Application

When you apply for a joint mortgage, Dallas lenders put both of you under the microscope. They’ll combine your incomes, which is the big advantage—it can seriously boost your borrowing power and might be the ticket to affording a home in a sought-after area like the M Streets or Preston Hollow.

But here’s the other side of that coin: they also combine your debts. Lenders will calculate your debt-to-income (DTI) ratio as a single figure. So, if one of you has a hefty student loan or a big car payment, that’s going to affect the whole application.

And this is a big one: when it comes to credit scores, lenders almost always use the lower of the two scores to set your interest rate and determine if you even qualify. If one of you has a 640 and the other is sitting pretty with a 780, the bank is going to base its decision on that 640. This is exactly why you have to talk openly about credit history before you even think about applying.

Taking Title in Texas

During the mortgage process, you’ll have to decide how you’ll legally hold the title to the property. This isn’t just paperwork; it has huge implications for your ownership, what happens if one of you passes away, and your eventual exit strategy. In Texas, you’ve got a couple of main options:

- Tenancy in Common: This is the go-to for friends buying a house together in Dallas. It’s flexible and allows you to own unequal shares (say, 60/40) that reflect how much each of you put into the down payment. If one owner dies, their share goes to their heirs, not automatically to the other co-owner.

- Joint Tenancy with Right of Survivorship: With this setup, you both own equal shares. The key difference is the “right of survivorship”—if one owner passes away, their share automatically transfers to the surviving owner, skipping probate court entirely. This is less common for friends unless there’s a specific estate planning goal in mind.

This is a legal decision, not just a financial one. I can’t stress this enough: talk to your real estate attorney to make sure the title structure you choose perfectly matches what you both agreed to in your co-ownership agreement.

The Financial Nuts and Bolts for Success

To keep things smooth and avoid any drama down the line, you need to set up your shared finances properly from day one. This is non-negotiable.

First up, open a joint bank account just for the house. This is where you’ll pay everything from—the mortgage, property taxes, insurance, and utilities. Each month, you’ll both transfer your agreed-upon share into this account. It creates a clean paper trail and keeps your shared investment totally separate from your personal spending.

Next, build a detailed shared budget that covers more than just the mortgage. Think about utilities, potential HOA fees, and, most importantly, a monthly contribution to a “house fund” for maintenance. Having a dedicated savings account for unexpected repairs—like a busted AC in the middle of a Dallas summer—turns a potential crisis into a manageable problem. This financial prep is a crucial part of the mortgage process in Dallas.

A Team Approach to the Dallas House Hunt

Once the legal paperwork is signed and the budget is set, the fun really begins: finding your new home. But when you’re buying a house with a friend, this is more than just a house hunt—it’s a team project. To succeed, especially in a market like Dallas, you’ll need a shared game plan and crystal-clear communication every step of the way.

It’s time to get specific. The Dallas-Fort Worth metroplex is huge, offering everything from sleek Uptown condos to charming bungalows with big yards in Plano. You and your friend have to be on the exact same page to avoid spinning your wheels.

Creating Your Shared Wish List

Before you even think about calling a real estate agent, you need to sit down together and hammer out a master list of what you’re looking for. The trick here is to separate your absolute must-haves from your nice-to-haves. This simple step prevents one person’s dream feature from derailing the search for what you both truly need.

First, lock down your non-negotiables for a Dallas home. These are the deal-breakers.

- Location and Commute: Get granular. Does the property have to be inside the Loop 635? Is a commute to downtown Dallas under 30 minutes the top priority? Or is being within walking distance of a DART rail station the most important thing?

- Property Type and Size: Are you picturing a single-story house with a yard for a dog? Or would a low-maintenance townhome with an HOA be a better fit for your lifestyle? Settle on a minimum number of bedrooms and bathrooms.

- Core Features: Do you both need dedicated home office spaces? Is a garage a must-have? Are you looking for a modern, move-in-ready kitchen, or are you both up for a fixer-upper?

With those settled, you can list your “nice-to-haves.” These are the bonus features. Maybe you’d love a pool to survive the Texas heat, or your friend really wants to be close enough to jog the Katy Trail. Knowing these helps you break a tie when you find two great properties.

Working with Your Dallas Real Estate Agent

With your wish list in hand, it’s time to bring in a pro. When you meet with a Dallas real estate agent, present yourselves as a single unit. Give them your list and make it clear that you’ll be making all decisions together. A good agent will get it immediately and know to keep both of you in the loop on everything.

Pro Tip: Set up a dedicated group text or a shared email folder right away. This ensures that when your agent sends a hot new listing or needs a fast answer, nobody misses the message.

This unified front is non-negotiable in Dallas. Homes in sought-after neighborhoods like the M Streets or Bishop Arts can get multiple offers in a matter of days. You simply won’t have time to debate your core priorities when you need to act fast.

Touring Homes and Making a Unified Offer

Viewing properties together is where your partnership can really shine. One of you might be drawn to the great natural light, while the other has a keen eye for spotting potential foundation issues—a common headache in North Texas soil. Make a point to attend open houses together and debrief after each one, always going back to your original wish list.

When you finally find “the one,” your teamwork gets its biggest test. Putting in an offer involves more than just a price. You’ll need to agree on contingencies, the amount of earnest money, and a closing date. Because you’ve already done the hard work of aligning on your goals and getting a legal agreement in place, this part will feel much less stressful.

You’ll be able to confidently tell your agent to submit a strong, unified offer, bringing you one step closer to becoming co-homeowners in Dallas.

Planning Your Exit Strategy from Day One

It might feel a little strange, even pessimistic, to talk about the end of your co-ownership before you’ve even picked out paint colors. But trust me on this: it’s the single smartest thing you can do. A rock-solid exit strategy is the foundation of a good co-ownership agreement. This isn’t about planning for failure; it’s about creating a clear, fair process for when life inevitably changes.

Think about it. What happens if your friend gets an amazing job offer and has to move to Austin? Or what if you decide you want to buy a place on your own in a few years? Answering these “what ifs” right now gives you a roadmap. It prevents emotional, panicked decisions down the line and protects both your investment and, just as importantly, your friendship.

The Buyout Clause: Your Non-Negotiable Safety Net

One of the most common ways this plays out is one friend wanting to sell their share while the other wants to stay. This scenario is exactly why you need a detailed buyout clause in your agreement. This section spells out the precise procedure for one of you to purchase the other’s equity in the home.

To make this work, you have to agree on a few key details upfront:

- How to Value the Home: How will you agree on the home’s fair market value? The cleanest way is to hire a licensed, third-party appraiser here in Dallas. You could even decide to get two appraisals and use the average price to be extra certain it’s fair.

- A Clear Timeline: Once you have a price, how long does the person staying have to secure financing for the buyout? A typical window is 60 to 90 days. This is a realistic amount of time to get their ducks in a row without leaving the selling partner hanging indefinitely.

- The “What If” Plan: What happens if the remaining owner simply can’t get a loan for the buyout? Your agreement needs to state that if financing isn’t secured within the set timeframe, the property will be listed for sale on the open market.

Having this structure in place takes the emotion out of a potentially charged situation. It transforms a potential friendship-ending fight into a straightforward business transaction.

Selling the House and Cashing Out

If a buyout isn’t in the cards or you both decide it’s time to move on, your agreement needs to outline that process, too. This should cover how you’ll choose a Dallas real estate agent, agree on a listing price, and handle the costs of any repairs or staging needed to get top dollar.

Most importantly, it has to be crystal clear on how the profits (or losses) are divided. This should be a direct reflection of your ownership percentages. If you put in 60% of the down payment and paid 60% of the mortgage, you get 60% of the net proceeds after the loan and closing costs are all paid off. Simple as that.

An exit strategy isn’t a sign of mistrust. It’s a testament to a strong partnership that respects both the shared investment and the individuals involved. Planning for every outcome is the key to a successful co-buying journey.

Learning from Other Shared Ownership Models

Buying together to tackle affordability isn’t a new idea. In England, for example, a thriving shared ownership market has helped countless people get on the property ladder, with 88% of participants being first-time homeowners. Their system allows buyers to purchase a small share of a home and gradually “staircase” up to full ownership. While not a direct system in Texas, you can learn more about these innovative shared ownership models to see how others are solving the affordability puzzle—it’s the same core idea as friends buying a house together in a hot market like Dallas.

When a buyout does happen, you’ll need to legally remove the exiting friend from the property’s title. This is typically done with a specific legal document that transfers their ownership interest. To get a handle on this part of the process ahead of time, check out our guide on what a quitclaim deed is and how it works in Texas. Understanding this now will demystify one of the final, crucial steps in your exit plan.

Common Questions About Co-Buying in Dallas

Jumping into the Dallas real estate market with a friend is a huge step, and it’s natural to have a long list of questions. The legal and financial details can feel a bit overwhelming at first, so let’s tackle some of the most common concerns that pop up. Getting clear on these points from the start will give you the confidence to move forward.

Remember, this process isn’t just about combining your buying power; it’s about linking your financial histories for the loan. Understanding how Dallas lenders look at your joint application is the first hurdle.

What Happens if My Friend’s Credit Score Is Much Lower Than Mine?

This is easily one of the most common and important questions we hear. When you apply for a joint mortgage in Dallas, lenders don’t average your scores. Instead, they typically base their decision—and the interest rate they offer—on the lower of the two credit scores. A big gap between your scores could mean a much higher interest rate over the life of the loan or, in some cases, not getting approved at all.

So, what are your options?

- Work on the Score: The most straightforward path is for the friend with the lower score to focus on improving it before you apply. It might mean pushing back your house hunt for a few months, but it could save you tens of thousands of dollars in interest.

- Rethink the Loan Structure: You can’t get separate loans, but you could discuss having only the person with the stronger credit on the mortgage. This gets legally tricky, fast. The person not on the loan would have no legal obligation to the bank, but their ownership rights would need to be fiercely protected in your co-ownership agreement. This is a complex scenario that absolutely requires a Texas real estate attorney.

When buying a house with a friend, total financial transparency isn’t just a good idea—it’s a requirement. Hiding a poor credit score will only lead to bigger problems when you’re sitting in the lender’s office.

How Do We Handle Unequal Down Payment Contributions?

It’s completely normal for co-buyers to bring different amounts to the table for the down payment and closing costs. In fact, this is one of the main reasons a rock-solid legal agreement is so crucial. This is not a deal-breaker; it just needs to be documented properly to protect everyone’s investment.

In Texas, the solution is to hold the title as Tenants in Common. This legal structure is specifically designed to allow for unequal ownership shares. Your ownership percentage should directly mirror your financial contribution. For example, if the total upfront cost is $50,000 and you put in $30,000 (60%) while your friend contributes $20,000 (40%), your ownership stakes are 60% and 40%, respectively. This exact breakdown must be spelled out in your co-ownership agreement, which a Dallas real estate lawyer should draft to ensure it’s airtight.

Can We Get Separate Loans for the Same Dallas Property?

The short answer is a hard no. When you buy a single property with someone else, you apply for one joint mortgage as co-borrowers. Both of your names will be on the loan and the property title, making you both fully and equally responsible for the entire mortgage debt.

This is a legal concept called joint and several liability. In plain English, it means that if your friend can’t cover their half of the mortgage one month, the bank doesn’t just want your half—they expect the full payment from you. Not paying in full leads to default and potential foreclosure. This is precisely why having a contingency fund and a dedicated joint bank account for all house-related expenses is non-negotiable for a successful partnership.

What Are the Tax Implications of Co-Buying in Texas?

Good news! As co-homeowners, both of you can enjoy the tax benefits of homeownership, like deducting mortgage interest and property taxes. The key is how you split those deductions. The IRS lets you divide them based on the percentage each of you actually paid.

Let’s break it down with an example:

- 50/50 Split: If you split every single expense down the middle, you each claim 50% of the deductible interest and property taxes on your personal tax returns.

- Unequal Split: If your ownership is 60/40 and you pay all expenses at that same ratio, you would claim 60% of the deductions, and your friend would claim the remaining 40%.

Keeping meticulous records of who paid what is absolutely critical. Come tax time, you’ll need that paper trail. Don’t forget that when you eventually sell, any capital gains (the profit from the sale) will also be split according to your ownership percentages. Given the details involved, talking to a Dallas-based tax professional is always a smart move to make sure you’re both handling it correctly.

Navigating the complexities of buying a house with a friend in Dallas is much easier with an expert guide. At Dustin Pitts REALTOR Dallas Real Estate Agent, we have the local knowledge and experience to help you and your co-buyer find the perfect property and make a smart investment. To start your journey, visit us online and let’s build your strategy together.