For most Dallas homeowners, the phrase “capital gains tax on a home sale” can sound pretty daunting. But here’s the good news: the reality is usually far less complicated. Thanks to a generous tax break from the IRS, you probably won’t owe a dime on the profit you make when you sell your primary home.

The secret is knowing that you’re only taxed on the profit, not the total sale price. Let’s break down what that means for you as a Dallas property owner.

Understanding Your Dallas Home Sale and Taxes

Selling a house in the hot Dallas market often means walking away with a nice chunk of change. That profit is what the IRS calls a “capital gain.” Think of it as the difference between what you sold your home for and what you initially paid for it, plus the cost of any significant improvements you made along the way.

Because this profit is considered income, it’s technically taxable. But before you start worrying, you need to know about a homeowner’s best friend: the Section 121 exclusion. This powerful tax rule is precisely why most people in Dallas can sell their homes without writing a big check to the government. It lets you exclude a huge amount of that profit from your taxes, as long as you meet a couple of simple tests.

What Every Dallas Homeowner Should Know

- It’s About the Profit, Not the Price: You’re only looking at a potential tax on the gain you made, not the entire sale price.

- A Texas Perk: Since Texas has no state income tax, you don’t have to worry about a separate state-level capital gains tax. Your focus is entirely on the federal rules.

- The Big Exclusion: This is the game-changer. Single filers can exclude up to $250,000 of profit, and that number doubles to $500,000 for married couples filing a joint return.

- It’s for Your Main Home: This tax break is specifically designed for your primary residence—the place you live day in and day out—not for that rental property or vacation getaway.

To make these rules easier to digest, here’s a simple breakdown of the tax-free profit allowances.

Quick Overview of Tax-Free Profit Rules

| Filing Status | Maximum Tax-Free Gain | Primary Residence Requirement |

|---|---|---|

| Single | $250,000 | Must have lived in the home for at least 2 of the past 5 years. |

| Married Filing Jointly | $500,000 | Must have lived in the home for at least 2 of the past 5 years. |

As you can see, the thresholds are quite high, which is great news for the vast majority of Dallas homeowners.

Think of this guide as your personal roadmap to navigating the capital gains tax landscape in Dallas. We’ll walk through how to qualify for the exclusion, calculate your actual profit, and what to do in unique situations.

Of course, capital gains aren’t the only tax consideration when you own a home. Getting a handle on your ongoing costs is just as important. For a complete picture, check out our guide to understanding property taxes in Dallas Texas.

The Home Sale Exclusion Dallas Owners Must Know

When it comes to the capital gains tax on a home sale, there’s one rule every Dallas homeowner needs to know inside and out: the primary residence exclusion.

Think of it as the government’s way of rewarding you for being a homeowner. Officially, it’s called the Section 121 exclusion, and it’s your golden ticket to potentially pocketing hundreds of thousands of dollars in profit, completely tax-free. But like any great deal, you have to meet the qualifications first.

The Two Critical Tests for Your Dallas Home

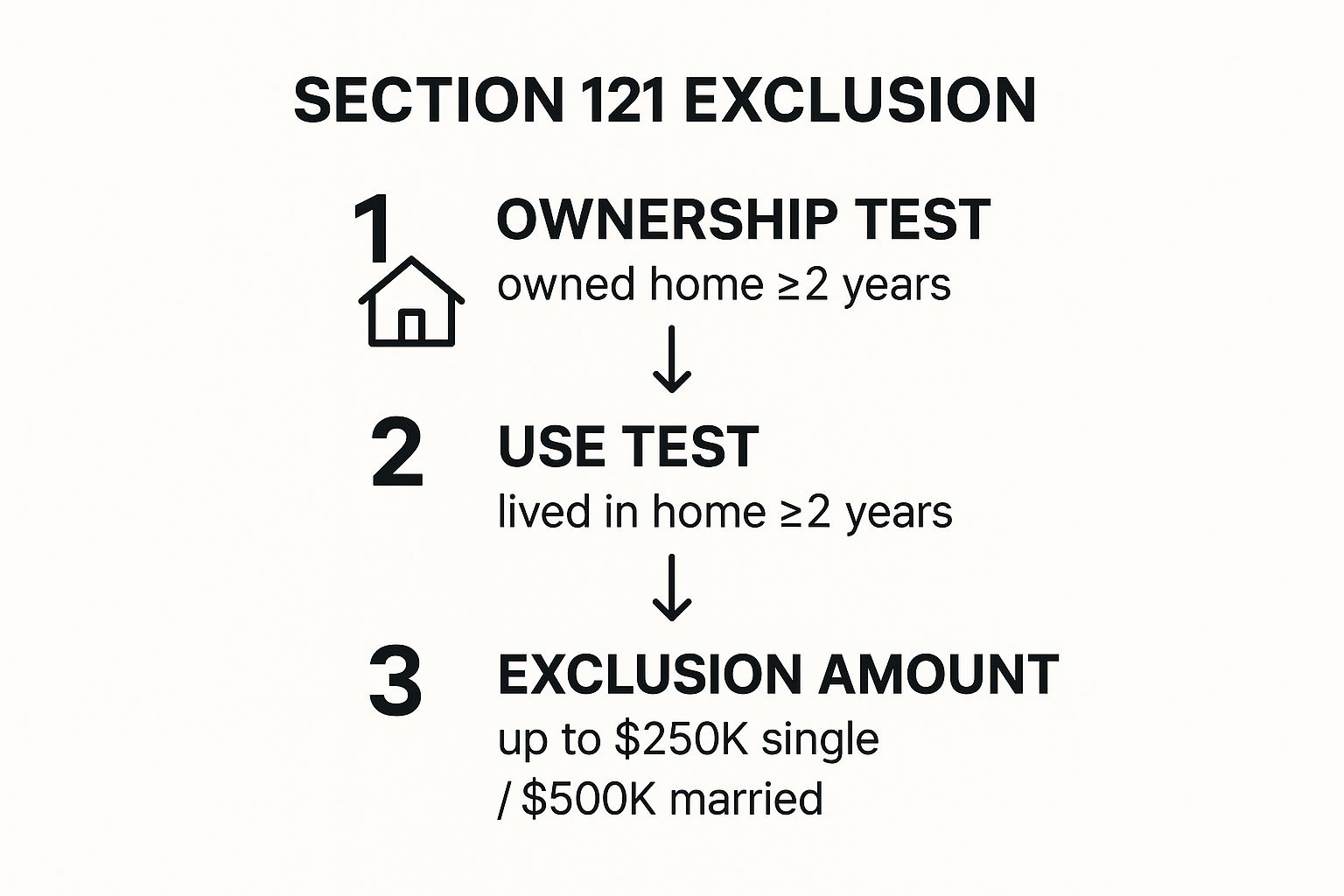

The entire exclusion hinges on a simple concept called the “2-out-of-5-years” rule. To get the tax break, you have to pass two specific tests, both of which look at the five-year period leading up to the day you sell your home.

Let’s break them down.

- The Ownership Test: Did you own the home for at least two years (a total of 730 days) during the last five years?

- The Use Test: Did you actually live in the home as your main residence for at least two years (again, 730 days) during that same five-year window?

One of the most common questions I get is whether those two years have to be back-to-back. The good news is, they don’t! The IRS gives you some flexibility here. You could live in the house for a year, rent it out for two, and then move back in for another year before selling. As long as your days living there add up to 730 within that five-year period, you’ve met the Use Test.

This visual guide really helps simplify how to check if you qualify.

As you can see, it’s a straightforward path: pass the tests, and you unlock a major tax benefit based on how you file.

Applying the Rule to a Dallas Scenario

Let’s ground this with a real-world Dallas example. Picture a young professional who bought a condo in Uptown five years ago. For the first three years, they lived there, soaking up everything the neighborhood had to offer.

Then, a great job opportunity came up in Plano. They decided to rent out their Uptown condo for the next two years while figuring out if the suburban life was for them. Now, five years after buying it, they’re ready to sell the condo and buy a house in Plano.

Does this person qualify for the exclusion? Let’s check:

- Ownership Test: They’ve owned it for the full five years. That’s an easy pass.

- Use Test: They lived there as their primary home for three consecutive years within that five-year window. Another clear pass.

Because both requirements were met, this individual gets to exclude a huge chunk of profit from taxes.

The primary residence exclusion is a cornerstone of real estate tax planning. A single person can exclude up to $250,000 of profit. For married couples filing jointly, that number doubles to a massive $500,000.

So, if our Uptown professional is single and sold the condo for a $200,000 profit, they would owe absolutely nothing in capital gains tax. If they were married and made a $450,000 profit, the result is the same—zero tax owed. This is, without a doubt, one of the biggest financial perks for homeowners across Dallas-Fort Worth.

How To Figure Out Your Profit on a Dallas Home Sale

Working out the profit from your Dallas home sale feels more complicated than it actually is. It all boils down to a pretty simple equation. Once you get the hang of it, you’ll have a much clearer picture of how the capital gains tax on a home sale could affect you.

The whole thing starts with one number: your home’s basis. Just think of the basis as your total investment in the property, starting with the price you originally paid for it.

But that number isn’t set in stone. As you invest in your home over the years, your basis grows. This is where your “adjusted basis” comes in, and it’s your single best tool for shrinking your taxable profit.

Boosting Your Basis with Capital Improvements

Your adjusted basis is simply your starting basis plus the cost of any major upgrades, which the IRS calls capital improvements. These aren’t just minor fixes; they’re significant projects that add real value, extend the life of your home, or adapt it for new uses.

There’s a big difference between a repair and an improvement. A repair just keeps the house in its current condition—think fixing a leaky pipe or patching drywall. An improvement makes the house fundamentally better.

Let’s look at some real Dallas examples:

- Capital Improvement: You add a brand-new deck and outdoor kitchen to your Lakewood home. That’s a huge value-add.

- Repair: You replace a few cracked tiles on your existing patio. That’s just upkeep.

- Capital Improvement: You gut and remodel the entire kitchen in your Preston Hollow house with high-end appliances, new cabinets, and quartz countertops.

- Repair: You replace a broken handle on one of those old cabinets.

Every single dollar you pour into a true capital improvement gets added to your adjusted basis. A higher basis means a smaller profit on paper, which can directly slash your tax bill. For a deeper dive into valuation, our guide explains how to determine fair market value for your property.

The Simple Math for Calculating Your Gain

Once you’ve tallied up your adjusted basis, calculating your capital gain is surprisingly straightforward. The goal is to find your actual, take-home profit.

Your capital gain is the final sale price, minus your selling expenses, and minus your adjusted basis. It’s the real profit you’re left with, not just the big number on the closing paperwork.

Here’s how to put all the pieces together, step by step:

- Start with the Sale Price: This is the top-line number the buyer paid for your Dallas home.

- Subtract Selling Costs: These are all the legitimate expenses you paid to make the sale happen. Think real estate agent commissions, legal fees, advertising, and transfer taxes.

- Subtract Your Adjusted Basis: This is your original purchase price plus the grand total of all those capital improvements you made.

That final number is your capital gain. The good news? For most Dallas homeowners, this figure will be small enough to be completely covered by the tax-free exclusion.

It’s also worth remembering that great sales tactics can boost your final sale price, which in turn impacts your profit and potential tax. Learning about strategies to sell your home for over asking can make a real difference to your bottom line.

Navigating Special Circumstances and Partial Exclusions

The standard rules for the home sale tax exclusion are great when life goes according to plan. But let’s be honest, that’s not always the case. What happens if a fantastic job offer in Austin means you have to sell your Dallas home after only 18 months? Or what if the home you’re selling was once a rental property?

Life is full of curveballs, and thankfully, the IRS has provisions for these kinds of situations. You might not get the full tax break, but you could still be eligible to exclude a portion of your gain. This is called a partial exclusion, and it’s designed to provide some relief when you have to sell sooner than expected.

Qualifying for a Partial Tax Exclusion

A partial exclusion comes into play if you have to sell your home before hitting the two-year mark due to specific, often unforeseen, circumstances. The IRS doesn’t want to penalize you for things outside your control.

Generally, you can qualify if you sell early because of a change in:

- Place of Employment: This is a big one in a dynamic job market like North Texas. If a new job requires you to move more than 50 miles away, you likely qualify.

- Health: If you need to sell your home for a medical reason—either for yourself or a member of your household you’re caring for—that can be a qualifying event.

- Unforeseen Circumstances: This is a catch-all category for events you couldn’t have reasonably predicted. Think of a natural disaster damaging your home, a divorce, or other significant personal situations.

The core idea here is simple fairness. The tax code recognizes that you shouldn’t face a massive tax bill just because life forced you to move unexpectedly.

Instead of the full $250,000 or $500,000 exclusion, you get a prorated amount. It’s calculated based on how much of the two-year requirement you actually met. For example, say you’re a single filer who lived in your home for one year (which is 50% of the two-year rule) before a job relocation. You could potentially exclude up to $125,000 of your gain.

Dealing with Converted Properties

Things can also get tricky when a property has worn different hats over the years. Maybe you bought a condo in Victory Park and rented it out for a few years before deciding to move in and make it your primary home. How does the IRS handle the profit when you eventually sell?

This situation involves something called non-qualified use. Any time you owned the property after 2008 but didn’t use it as your main home is considered non-qualified use. You can’t exclude the portion of your gain that’s tied to that period.

Let’s walk through an example:

- The Setup: You buy a house in Dallas and rent it out for four years.

- The Switch: You move in and live there as your primary residence for the next six years.

- The Sale: After owning the property for a total of ten years, you sell it.

In this scenario, 40% of the time you owned the home was for non-qualified use (the four years it was a rental). That means 40% of your capital gain is automatically taxable. The home sale exclusion only applies to the profit earned during the six years you actually lived there.

Tax Rules for Inherited Dallas Homes

Inheriting a property is a completely different ballgame, primarily because of a very helpful tax concept called the stepped-up basis. When you inherit a home, your cost basis isn’t what your loved one originally paid. Instead, the basis is “stepped up” to whatever the home’s fair market value was on the date of the original owner’s death.

This is a huge tax advantage. Imagine your parents bought a home in the M Streets decades ago for $50,000. By the time you inherit it, it’s worth $750,000. Your new basis is $750,000. If you turn around and sell it right away for that price, your taxable capital gain is zero. You only owe capital gains tax on any increase in value that happens after the date you inherited it.

Strategic Planning to Minimize Your Tax Bill

Knowing the rules of the capital gains tax home sale is one thing, but actually using them to your advantage is a whole different ball game. It’s about shifting from reacting to a tax bill to proactively planning for one, a move that can make a huge difference in your final payout. The key is to start thinking like a strategist long before you even think about putting a “For Sale” sign in your Dallas front yard.

This proactive mindset starts with something surprisingly simple: great record-keeping. Every dollar you pour into capital improvements can directly chip away at your taxable gain, but only if you have the receipts to prove it. This is where a little bit of organization becomes your best financial friend.

The Power of Meticulous Records

Think of your home’s financial records as the backbone of your tax strategy. When you tell the IRS you spent money on a capital improvement, they’re going to want to see proof. That new roof on your M Streets bungalow or the backyard deck you added to your East Dallas home can absolutely increase your adjusted basis, but a foggy memory of the cost just won’t cut it.

You don’t need a complicated accounting system to get this right. Start a simple digital system today.

- Create a Digital Folder: Use something like Google Drive or Dropbox to create a single place for all your home-related financial documents.

- Scan Everything: The moment you get a receipt, invoice, or contract for an improvement, scan it or snap a picture with your phone. Give it a clear name (e.g., “KitchenRemodel_Invoice_June2022.pdf”).

- Use a Spreadsheet: Keep a running list that tracks the date, who you paid, the cost, and a quick note about each improvement. This gives you a clean summary to hand over to your tax preparer.

Getting into this habit doesn’t just help with taxes; it also creates an invaluable log of your investment. A detailed list of upgrades is a powerful selling point for buyers and helps you better track how to build equity in your home.

Why Timing Your Sale Is Crucial

Beyond keeping good records, the timing of your sale is arguably the most critical factor in determining if you owe taxes at all. That “2-out-of-5-years” rule is a hard line, and crossing it at the wrong time can be an incredibly costly mistake.

Let’s say you’ve lived in your Dallas home for 22 months and a fantastic offer lands in your lap. Jumping on it immediately might feel right, but it could trigger a huge tax bill. If you simply wait another two months to hit that 24-month residency mark, you could walk away with the entire profit, tax-free.

A matter of a few months can literally be the difference between owing tens of thousands of dollars in taxes and owing nothing at all. Before accepting any offer, always check your residency timeline.

When to Call a Dallas Tax Professional

While these strategies are powerful, some situations are just too complex to DIY. It’s always a smart move to bring in a Dallas-based tax professional or CPA when your sale has a few extra moving parts.

Definitely get an expert on the phone if:

- Your Gain Exceeds the Exclusion: Your profit looks like it will blow past the $250,000 (single) or $500,000 (married) threshold.

- You Have a High-Value Property: The financial stakes are simply higher with luxury homes in areas like Preston Hollow or Highland Park.

- Your Situation is Complex: You’re dealing with an inherited property, a home that was once a rental, or a situation where you might qualify for a partial exclusion.

An expert can help you find every legal deduction and navigate the fine print. And beyond this specific sale, learning how to reduce capital gains tax in general is a valuable piece of financial knowledge. A small investment in professional advice can pay for itself many times over by making sure you keep as much of your hard-earned profit as possible.

A Dallas Home Sale in Action

Okay, let’s take these rules and see how they play out in the real world. Nothing makes tax concepts clearer than putting actual numbers to them, so we’ll walk through a realistic Dallas home sale from start to finish.

Imagine a single homeowner who bought their first house in the Bishop Arts District five years ago for $350,000. They lived there the entire time, so it was always their primary residence. During those five years, they put a lot of sweat and money into making it perfect.

First, What’s the Adjusted Basis?

To figure out the profit, we first need to calculate the home’s adjusted basis. Think of this as your total investment in the property. It starts with what you paid for it and then includes the cost of any major improvements.

Luckily, our homeowner kept detailed records of their big projects:

- Kitchen Remodel: A complete overhaul with new cabinets, quartz countertops, and high-end appliances came to $45,000.

- Backyard Renovation: They added a big deck and had the yard professionally landscaped, spending $25,000.

- New HVAC System: Replacing the old, inefficient unit cost them $10,000.

These aren’t just minor repairs; they’re capital improvements that add real value. So, we add these costs to the original purchase price.

$350,000 (Original Price) + $80,000 (Improvements) = $430,000 (Adjusted Basis)

Next, Let’s Calculate the Real Gain

Fast forward five years, and the hot Dallas market lets them sell the house for $700,000. Of course, selling a house isn’t free. Let’s say their selling costs, like agent commissions and closing fees, added up to $40,000.

Now we have all the pieces to find their actual capital gain:

$700,000 (Sale Price) – $40,000 (Selling Costs) – $430,000 (Adjusted Basis) = $230,000 (Total Capital Gain)

The number that matters for taxes isn’t the $700,000 sale price. It’s the $230,000 profit.

Here’s the best part. Since our homeowner is single, their gain is well under the $250,000 exclusion limit. The result? They owe $0 in capital gains tax. That entire $230,000 profit is theirs, completely tax-free.

It’s a great deal, and one that homeowners in many other countries would envy. In Japan, for example, similar gains could be taxed at rates up to 39.63%. In Colombia, selling a property you’ve held for less than two years could trigger a tax bill as high as 39%. On the other hand, places like Jamaica skip the capital gains tax entirely, charging a small transfer tax instead. If you’re curious, you can explore a full breakdown of international tax rates and see just how differently other countries handle this.

Got Questions? We’ve Got Answers.

When you start digging into the details of a capital gains tax home sale, a few common questions always seem to pop up. Here are some quick answers to what Dallas homeowners often ask.

Does Texas Have Its Own Capital Gains Tax?

Nope! This is one of the best parts about living in Texas. We’re one of the few states with no state income tax, which means there’s no state-level capital gains tax on your home sale either.

You only need to worry about the federal rules, which simplifies things quite a bit.

What Happens if My Profit Is Over the Limit?

This is a great question. If the profit from selling your Dallas home is more than your exclusion amount, you don’t pay tax on the whole thing—just the amount that goes over the top.

Let’s say you’re a single filer and you walk away with a $300,000 profit. You’d subtract your $250,000 exclusion, and you’d only owe federal capital gains tax on the remaining $50,000. The first $250,000 is completely tax-free.

Do I Have to Report the Sale if I Don’t Owe Any Tax?

Usually, if your gain is fully covered by the exclusion, you don’t have to report the sale. But there’s a big “if” you need to know about.

You absolutely must report the sale if you get a Form 1099-S in the mail after closing. This form is often sent by the title company and it triggers an automatic reporting requirement with the IRS. Even if you owe zero tax, getting that form means you have to file. When in doubt, it’s always smart to check with a tax pro to make sure you’re following all the IRS guidelines for your specific situation.

Getting a handle on these tax rules is a huge part of making your home sale a success. For hands-on guidance through the Dallas real estate market, reach out to Dustin Pitts REALTOR Dallas Real Estate Agent for a smooth and profitable sale. You can learn more at https://dustinpitts.com.