Purchasing your first home in Dallas is a significant milestone, a major financial undertaking that requires careful planning and strategic execution. The competitive Dallas-Fort Worth real estate market demands that buyers be prepared, organized, and informed. This is where a detailed first time homebuyer checklist becomes an indispensable tool, transforming a potentially overwhelming process into a structured, manageable journey. Skipping crucial steps can lead to financial strain, missed opportunities, or unexpected complications down the line.

This guide is designed to provide that structure. We will move beyond generic advice and offer a comprehensive, step-by-step roadmap tailored specifically for navigating the Dallas property landscape. From the initial stages of financial preparation to the final moments of closing day, each item on this checklist is a critical building block toward successful homeownership. You will gain actionable insights into strengthening your financial profile, securing the right financing, and assembling a team of local experts who understand the nuances of Dallas neighborhoods like Uptown, Preston Hollow, or the Bishop Arts District.

Think of this checklist not as a mere list of tasks, but as a strategic framework. It will help you anticipate challenges, make informed decisions, and approach the buying process with confidence. We will cover everything from assessing your credit and getting pre-approved for a mortgage to understanding the total cost of ownership in North Texas and preparing for life after you get the keys. By following these steps, you will be well-equipped to secure a property that aligns with your financial goals and lifestyle, ensuring your entry into Dallas homeownership is a smooth and successful one.

1. Check and Improve Your Credit Score

Before you even start browsing listings in sought-after Dallas neighborhoods like Uptown or the M-Streets, your first step in any first-time homebuyer checklist should be a deep dive into your credit score. This three-digit number, typically ranging from 300 to 850, is the primary metric lenders use to gauge your financial reliability. A strong score demonstrates a history of responsible borrowing, which directly translates into better mortgage options and significant savings.

In the competitive Dallas real estate market, a higher credit score can be your most powerful negotiating tool. It unlocks lower interest rates, which can save you tens of thousands of dollars over the life of your loan. For instance, on a typical Dallas-area home loan of $400,000, a buyer with a 760 score might secure a 6.5% interest rate, while a buyer with a 640 score could be offered 7.5%. This 1% difference amounts to an extra $254 per month, or over $91,000 over a 30-year mortgage.

How to Boost Your Score for a Dallas Home Purchase

Start the credit improvement process at least six to twelve months before you plan to apply for a mortgage. This timeframe allows your positive financial habits to be reflected in your score.

Actionable Credit Improvement Tips:

- Reduce Your Credit Utilization: Pay down credit card balances to below 30% of your total available credit. For a more significant impact, aim for under 10%. This is one of the fastest ways to see a score increase.

- Maintain a Clean Payment History: Late payments can severely damage your score. Set up automatic payments for all your bills to ensure you never miss a due date.

- Review Your Credit Reports: Use a free service like AnnualCreditReport.com to pull your full reports from all three major bureaus (Experian, Equifax, TransUnion). Scrutinize them for errors and dispute any inaccuracies immediately.

- Avoid New Debt: Refrain from opening new credit cards, financing a car, or taking out personal loans in the months leading up to your mortgage application. Each new inquiry can temporarily lower your score.

- Preserve Credit History: Do not close old credit accounts, even if you don’t use them. The length of your credit history is a key component of your score, and older accounts demonstrate long-term stability.

2. Determine Your Budget and Get Pre-Approved

With a healthy credit score in hand, the next critical step on your first-time homebuyer checklist is to establish a realistic budget and secure a mortgage pre-approval. A pre-approval is a formal commitment from a lender to loan you a specific amount, based on a rigorous review of your finances. This differs from a simple pre-qualification; it shows Dallas sellers and their agents that you are a serious, financially vetted buyer ready to make a competitive offer.

In a fast-moving market like Dallas, where desirable properties in areas like Bishop Arts or Lower Greenville can receive multiple offers, a pre-approval letter gives your bid significant weight. A seller might even accept a pre-approved buyer’s offer over a slightly higher one that lacks solid financing, simply because it guarantees a quicker and more certain closing. This document defines your purchasing power, allowing you to confidently shop for homes you know you can afford.

How to Secure Your Pre-Approval for a Dallas Home

Begin the pre-approval process by gathering your financial documents, as this will streamline the lender’s review. Remember, the pre-approved amount is a ceiling, not a target. It’s wise to determine a comfortable monthly payment for your lifestyle before letting the bank tell you what you can borrow. To learn more about this crucial stage, you can explore this detailed guide on how to get pre-approved for a mortgage.

Actionable Pre-Approval Tips:

- Calculate Your True Budget: Before speaking to lenders, use the 28/36 rule. Your housing costs (mortgage, insurance, property taxes, HOA fees) should not exceed 28% of your gross monthly income, and your total debt should not exceed 36%. This ensures you can still enjoy the Dallas lifestyle without being house-poor.

- Gather Your Documents: Have these items ready: at least two years of tax returns, two recent pay stubs, and two to three months of bank statements. This preparation accelerates the process significantly.

- Shop for Lenders: Compare offers from multiple lenders (banks, credit unions, mortgage brokers) within a 14 to 45-day window. All credit inquiries within this period will be treated as a single event, minimizing the impact on your credit score.

- Maintain Financial Stability: Once pre-approved, do not make any large purchases, open new lines of credit, or change jobs. Any major financial shift could invalidate your approval and jeopardize your home purchase.

- Inquire About Loan Programs: Ask your lender about different options that might be available to you, such as conventional, FHA, or VA loans, to see which best fits your financial situation.

3. Save for Down Payment and Closing Costs

Beyond a strong credit score, the most significant financial hurdle in any first time homebuyer checklist is accumulating the necessary cash for upfront costs. Many aspiring homeowners in Dallas focus solely on the down payment, but you must simultaneously save for closing costs, a separate set of fees required to finalize the transaction. Failing to account for both can derail your purchase of a home in desirable areas like Lakewood or Preston Hollow.

These two expenses combined represent a substantial sum. For a $450,000 home in North Dallas, a buyer might need a 5% down payment ($22,500) plus an estimated 3% for closing costs ($13,500), totaling $36,000 in cash. Putting down 20% ($90,000) would eliminate the need for Private Mortgage Insurance (PMI), potentially saving hundreds each month. Understanding this total figure is crucial for setting a realistic savings goal and timeline.

How to Strategize Your Savings for a Dallas Home

A disciplined savings strategy is non-negotiable. Begin by calculating your total target amount based on your desired home price range and start implementing a plan to reach it efficiently.

Actionable Savings Tips:

- Automate and Separate: Open a dedicated high-yield savings account for your home fund. Set up automatic transfers from each paycheck, treating it like any other mandatory bill. This “pay yourself first” method ensures consistent progress.

- Explore Assistance Programs: Don’t assume you have to save every dollar yourself. Numerous down payment and closing cost assistance programs exist for Dallas buyers. A first-time buyer might combine $20,000 in personal savings with a $15,000 grant to meet the requirements for a conventional loan. You can explore more about closing cost assistance programs on dustinpitts.com to see what you may qualify for.

- Leverage Gift Funds: If you receive financial help from a relative, ensure it is properly documented with a “gift letter.” Lenders require this to confirm the money is a true gift and not a loan that needs to be repaid.

- Negotiate Seller Concessions: In your offer, you can ask the seller to contribute a percentage of the purchase price (typically up to 3-6%) towards your closing costs. This can significantly reduce your out-of-pocket expenses on closing day.

- Preserve Your Emergency Fund: It is critical not to drain all your savings. After covering the down payment and closing costs, you should still have an emergency fund with three to six months of living expenses remaining.

4. Research and Choose the Right Loan Type

Once you’ve saved for a down payment and secured pre-approval, the next critical step in your first-time homebuyer checklist is selecting the right type of mortgage. This decision is far from one-size-fits-all; the loan you choose will dictate your down payment, monthly costs, and overall financial burden for years to come. Understanding the nuances between loan types is essential for finding an affordable path to owning a home in desirable Dallas areas like Richardson or Plano.

Choosing the right loan can dramatically alter your home-buying journey. For instance, a well-qualified buyer in Dallas might opt for a conventional loan with 5% down on a $450,000 home, potentially saving $200 per month on mortgage insurance compared to an FHA loan. Conversely, a buyer with a 660 credit score might find an FHA loan with a 3.5% down payment to be their only viable option, making homeownership accessible when conventional loans are not.

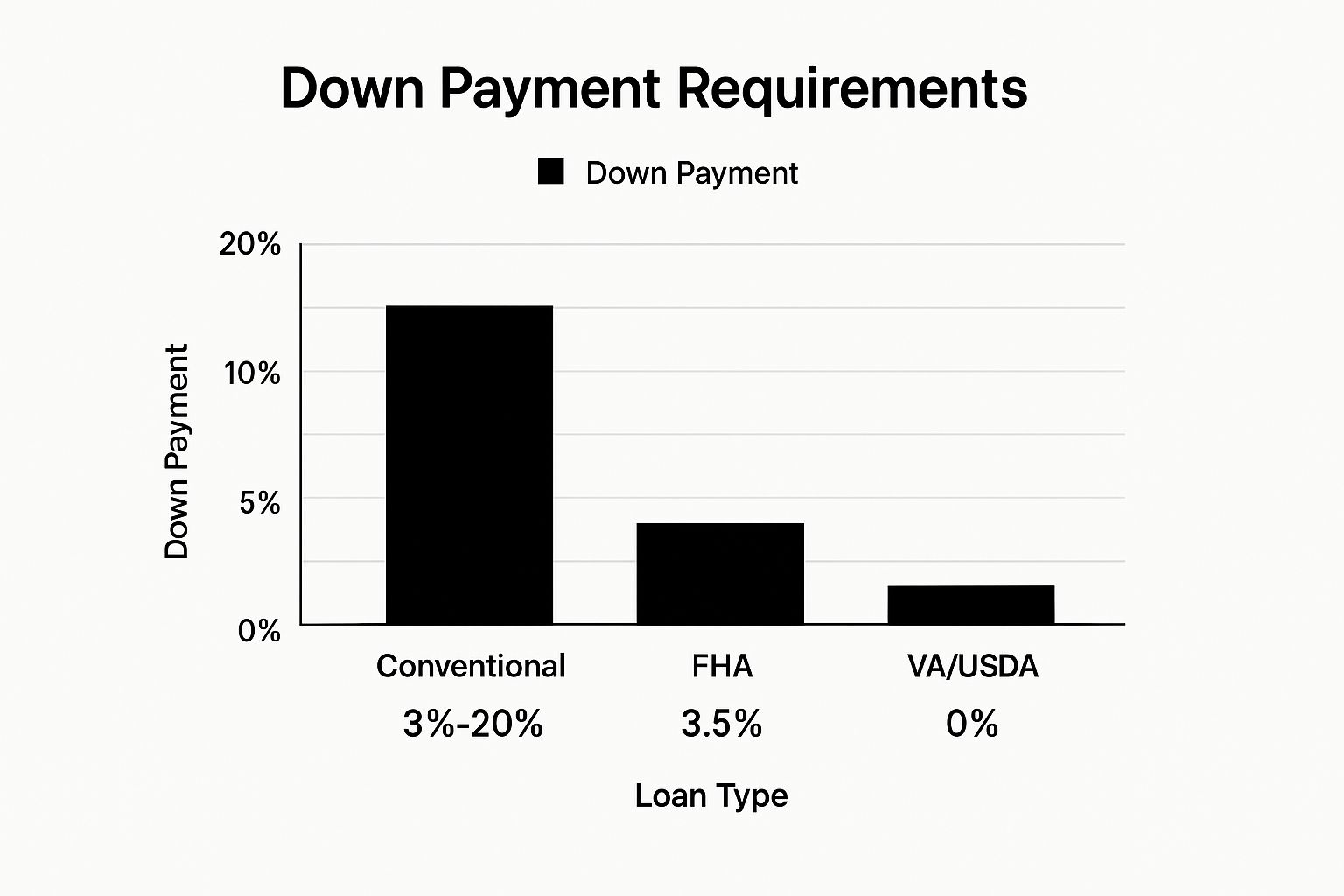

The bar chart below clearly illustrates the minimum down payment requirements for the most common loan types available to Dallas buyers.

As the chart shows, government-backed VA and USDA loans offer the incredible advantage of a 0% down payment, a game-changer for eligible buyers.

How to Select the Best Loan for Your Dallas Home

The ideal loan aligns with your financial profile, credit history, and the type of property you intend to purchase. Whether it’s a downtown condo or a house in a quieter suburb, ask your lender to prepare side-by-side comparisons of different loan scenarios.

Actionable Loan Selection Tips:

- Evaluate Government-Backed Options:

- FHA Loans: Insured by the Federal Housing Administration, these loans are popular among first-time buyers due to lenient credit score requirements and a low 3.5% down payment.

- VA Loans: An unparalleled benefit for veterans and active-duty service members, VA loans require no down payment and no private mortgage insurance (PMI).

- USDA Loans: Designed for properties in designated rural and some suburban areas, these loans also feature a $0 down payment option for eligible borrowers.

- Consider Conventional Loans: These are not government-insured and typically require a higher credit score. While you can get a conventional loan with as little as 3-5% down, you will have to pay PMI until you reach 20% equity.

- Analyze Total Costs: Look beyond the monthly payment. Compare total costs over a 5- to 7-year period, including interest, mortgage insurance, and closing costs, to understand the true financial impact.

- Check Local Loan Limits: Be aware of conforming loan limits in your target county. For 2024, most Dallas-area counties have a limit of $766,550, but it’s crucial to verify this with your lender.

- Plan Your Exit Strategy: If you choose an FHA loan, create a plan to refinance into a conventional mortgage once you build 20% equity to eliminate the costly mortgage insurance premium for the life of the loan.

5. Find the Right Real Estate Agent

Navigating the Dallas real estate market, from the historic charm of Bishop Arts to the modern developments in Frisco, requires an expert guide. A qualified real estate agent is your advocate, negotiator, and strategist throughout the entire homebuying process. For a first-time buyer, the right agent provides invaluable local market expertise, access to off-market listings, and the skill to navigate the complex paperwork inherent in Texas real estate transactions.

Choosing the right professional is a critical step in any first time homebuyer checklist, as their expertise can directly impact your financial outcome. An experienced Dallas agent might spot subtle signs of foundation issues in a Lakewood home that you might miss, saving you from a potential $30,000 repair. In another scenario, an agent’s sharp negotiation skills could persuade a seller to cover $8,000 in closing costs or reduce the list price on a North Dallas property by $15,000. They are also your key to unlocking local resources, from connecting you with down payment assistance programs to recommending a trusted inspector who uncovers major electrical issues before you commit.

How to Select an Agent for Your Dallas Home Search

Your agent is your partner in a major financial decision, so it’s essential to find someone whose expertise and communication style align with your needs. Begin your search several months before you plan to make an offer.

Actionable Tips for Choosing Your Agent:

- Interview Multiple Candidates: Schedule consultations with at least three to five agents. Ask about their experience with first-time homebuyers in your target Dallas neighborhoods, their communication frequency, and their strategy for competing in multiple-offer situations.

- Look for Specializations: Seek agents with designations like ABR (Accredited Buyer’s Representative), which indicates specialized training in representing buyers. Verify they are a full-time professional with a strong recent sales record (10+ transactions in the last year).

- Request and Check References: Ask for contact information for recent first-time buyer clients. Inquire about their experience, the agent’s responsiveness, and their overall satisfaction with the process.

- Verify Credentials: Use the Texas Real Estate Commission (TREC) website to confirm an agent’s license is active and to check for any disciplinary history. This is a non-negotiable step for due diligence.

- Discuss Representation and Communication: Before signing anything, thoroughly understand the buyer representation agreement, including its duration and terms. Clearly define your communication preferences and the agent’s expected response times to ensure you are on the same page from day one. You can learn more about how to choose a real estate agent on dustinpitts.com.

6. Get a Comprehensive Home Inspection

Once your offer on a Dallas home is accepted, the next critical step in your first-time homebuyer checklist is scheduling a professional home inspection. This is not a step to be skipped. A licensed inspector conducts a thorough, non-invasive examination of the property’s condition, evaluating everything from the foundation in the clay soil to the roof that bakes under the Texas sun. This inspection provides an unbiased assessment of the home’s major systems and structural integrity, identifying existing problems and potential future expenses.

The inspection report is your single most powerful negotiation tool during the option period. Discovering a significant issue can empower you to request repairs, negotiate a price reduction, or even walk away from the deal, potentially saving you from a financial catastrophe. For example, an inspector might uncover foundation cracks common in North Texas, prompting a structural engineer evaluation that reveals $50,000 in necessary repairs, allowing you to withdraw your offer. Alternatively, finding that an HVAC system is near the end of its life could lead to a seller credit of several thousand dollars toward its eventual replacement.

How to Maximize Your Dallas Home Inspection

To ensure you get the most out of this crucial process, be proactive and strategic. Your goal is to gain a complete understanding of the property’s health before your option period expires.

Actionable Home Inspection Tips:

- Attend the Inspection: Walk through the property with the inspector. This is an invaluable opportunity to see issues firsthand and learn about the home’s maintenance needs directly from a professional.

- Hire a Qualified Inspector: Don’t choose based on the lowest price. Select an inspector certified by a reputable organization like ASHI or InterNACHI and check their reviews. Ask to see a sample report to gauge their thoroughness.

- Schedule Specialized Inspections: Depending on the Dallas property’s age and features, consider additional inspections for termites (a must in Texas), hydrostatic plumbing tests, pools, or a sewer scope.

- Focus on Major Issues: Use the report to negotiate significant defects related to structural integrity, safety, or major systems. Minor cosmetic flaws are typically not negotiation points.

- Request Repairs or Credits: If the inspection reveals critical issues like faulty wiring or an aging roof, you can ask the seller to make repairs or provide a credit at closing so you can manage the work yourself.

- Plan Your Budget: Use the final inspection report as a roadmap for future maintenance and repairs, helping you prioritize and budget for expenses in your first few years of homeownership.

7. Understand All Costs of Homeownership

Focusing solely on the monthly mortgage payment is a common pitfall for those navigating their first time homebuyer checklist. The reality of homeownership in Dallas extends far beyond that single figure. Understanding the total cost of ownership, or TCO, is crucial to prevent financial strain and ensure you can comfortably enjoy your new home in a neighborhood like Lake Highlands or Plano.

The sticker price of a home is just the starting point. Ongoing expenses like property taxes, homeowners insurance, HOA fees, utilities, and inevitable maintenance can add thousands to your annual budget. For example, a buyer pre-approved for a $450,000 home might only budget for the principal and interest. However, adding estimated Dallas County property taxes ($750/month), insurance ($250/month), HOA dues ($150/month), and a maintenance fund ($375/month) reveals a truer monthly cost that is over $1,500 higher than the mortgage alone. Ignoring these figures can quickly turn a dream home into a financial burden.

How to Calculate Your True Homeownership Costs

Before making an offer, create a detailed budget that accounts for every potential expense. This proactive step ensures you purchase a home well within your financial means, not just at the limit of your lender’s approval.

Actionable Budgeting Tips:

- Calculate PITI + More: Your baseline cost is Principal, Interest, Taxes, and Insurance (PITI). Add estimated monthly costs for utilities (electricity, water, gas, internet), HOA fees, and private mortgage insurance (PMI) if applicable.

- Budget 1-2% for Maintenance: Financial experts recommend setting aside 1-2% of the home’s purchase price annually for maintenance and repairs. For a $400,000 home in Dallas, this means saving $333 to $667 per month in a dedicated fund for eventualities like a new HVAC unit or roof repair.

- Research Property Tax Trends: Property taxes are not static. Investigate the tax history for the specific Dallas-area neighborhoods you’re considering to anticipate future increases.

- Get Insurance Quotes Early: Homeowners insurance rates can vary dramatically based on the home’s location (e.g., proximity to a flood zone), age, and construction type. Obtain multiple quotes during your due diligence period.

- Review HOA Documents: If considering a property in a managed community in areas like Frisco or McKinney, carefully review the HOA’s financial health, reserve funds, and any history of special assessments. A poorly managed HOA can lead to unexpected, hefty fees.

8. Plan Your Move and First-Year Homeowner Tasks

Once your offer is accepted on a home in a desirable Dallas neighborhood like Lakewood or Bishop Arts, the work isn’t over. The transition from closing to actually living in your new home involves a crucial set of tasks that are often overlooked in the excitement. This part of the first-time homebuyer checklist is about a seamless move-in and setting up your first year for success, preventing costly surprises and unnecessary stress.

Proper planning for this period ensures your home is safe, functional, and well-maintained from the moment you get the keys. For example, a new Dallas homeowner who immediately changed their locks upon moving in discovered the previous owner had shared keys with multiple contractors, preventing potential unauthorized access. Similarly, registering new appliances under warranty can be a lifesaver; one local buyer saved over $600 when their refrigerator unexpectedly failed in the eleventh month of ownership.

How to Prepare for Move-In and Your First Year

Start organizing these tasks as soon as you have a confirmed closing date. A proactive approach transforms a potentially chaotic period into a smooth and controlled process, allowing you to enjoy your new Dallas property without a hitch.

Actionable Move-In and First-Year Tips:

- Schedule a Thorough Final Walkthrough: Conduct this 24-48 hours before closing. Verify that the property’s condition matches what was agreed upon in the contract and that all negotiated repairs are complete.

- Secure Your Property Immediately: Your very first task after closing should be changing all exterior door locks and reprogramming garage door codes. You have no way of knowing who still has a copy of the old keys.

- Locate and Label Essential Shutoffs: On day one, find the main water shutoff valve, the gas shutoff, and the electrical breaker panel. Label them clearly so you can act quickly in an emergency.

- Prioritize Safety Systems: Test every smoke and carbon monoxide detector in the home. Replace all the batteries, regardless of their current status, to ensure they are reliable.

- Establish a Maintenance Schedule: Create calendar reminders for essential seasonal tasks like scheduling HVAC servicing (a must for Dallas summers), cleaning gutters, and checking for pests.

- Create a Digital Homeowner Binder: Scan and save all important documents in a cloud folder. This includes your inspection report, appraisal, appliance manuals, warranties, and even paint color codes for easy reference.

- Connect with Your New Community: Join neighborhood social media groups for areas like Preston Hollow or Lake Highlands. These are invaluable resources for finding trusted local service provider recommendations, from plumbers to landscapers.

First-Time Homebuyer Checklist Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Check and Improve Your Credit Score | Medium to High (requires months of financial behavior) | Time investment; free credit monitoring tools; financial discipline | Lower interest rates; better loan terms; increased approval chances | Buyers starting 6-12 months before house hunting | Saves tens of thousands in interest; improves lender negotiation power |

| Determine Your Budget and Get Pre-Approved | Medium (documentation intensive; involves credit check) | Gather tax returns, pay stubs, bank statements; lender time | Realistic budget; stronger offers; quicker closing | Buyers 2-3 months before active house hunting | Provides negotiating leverage; prevents wasting time on unaffordable homes |

| Save for Down Payment and Closing Costs | High (can take years; requires disciplined saving) | Large cash reserves depending on down payment percentage | Reduced monthly payments; avoids PMI; builds equity | Buyers planning 2-5 years ahead or immediately if possible | Larger down payments lower costs and loan insurance |

| Research and Choose the Right Loan Type | Medium (requires knowledge gathering and comparison) | Time for research; lender consultations; eligibility checks | Optimal loan savings; accessible homeownership | Buyers 3-6 months before shopping, finalized during pre-approval | Saves money by matching loan type to financial situation |

| Find the Right Real Estate Agent | Low to Medium (time to interview/select agent) | Time for interviews; communication; local market expertise | Smooth transaction; better deals; expert guidance | Buyers 1-2 months before active house hunting | Expert negotiation and market knowledge; access to listings |

| Get a Comprehensive Home Inspection | Medium (schedule & attend inspection; requires payment) | $300-500+ cost; time for 3-5 hour inspection and review | Reveals hidden issues; negotiation leverage; peace of mind | Buyers after offer acceptance, within 5-7 days | Prevents costly surprises; educates buyers |

| Understand All Costs of Homeownership | Medium (requires thorough budgeting and research) | Time for budgeting, researching taxes, insurance, utilities | Prevents financial stress; sets realistic purchase budget | Buyers during pre-approval and before house hunting | Comprehensive financial planning; avoids surprises |

| Plan Your Move and First-Year Homeowner Tasks | Medium (many tasks, deadlines, and coordination) | Time and money for moving, setup, maintenance, emergency funds | Organized move; safe/functional home; maintenance schedule | Buyers 30 days before closing, continuing first year | Reduces moving stress; prevents safety and maintenance issues |

Final Thoughts

Embarking on the journey to homeownership in Dallas is a significant milestone, a testament to your hard work and a major step toward building your future in this dynamic city. This comprehensive first time homebuyer checklist was designed to demystify the process, transforming what can feel like an overwhelming endeavor into a series of clear, manageable steps. By now, you should have a solid framework for navigating everything from the initial financial preparations to the final signatures on closing day.

Recapping Your Path to Dallas Homeownership

Let’s quickly revisit the critical checkpoints we’ve covered. The journey begins long before you start touring homes in neighborhoods like Uptown or Bishop Arts. It starts with a meticulous review of your finances.

- Financial Foundation: Mastering your credit score, securing a mortgage pre-approval, and diligently saving for your down payment and closing costs are the non-negotiable first steps. These actions determine your purchasing power and set the stage for a smooth transaction.

- Building Your Team: The Dallas real estate market is competitive and complex. Aligning with an expert real estate agent who understands the nuances of local markets-from Preston Hollow to Lakewood-is paramount. Similarly, selecting the right loan type and a thorough home inspector are crucial decisions that protect your investment.

- Beyond the Purchase Price: True financial readiness means looking beyond the sale price. Understanding the full spectrum of homeownership costs, including property taxes, insurance, potential HOA fees, and ongoing maintenance, is essential for long-term success and peace of mind.

- The Final Stretch: The process doesn’t end at the closing table. Planning your move and anticipating first-year homeowner tasks ensures a seamless transition into your new Dallas property.

From Checklist to Keys in Hand

The ultimate value of a robust first time homebuyer checklist is not just in ticking off boxes; it’s about empowering you with knowledge and confidence. Each item on this list is a building block, creating a strong foundation that prevents costly mistakes and reduces stress. When you understand the ‘why’ behind each step, you can make informed decisions, negotiate effectively, and truly feel in control of your destiny as a homeowner. For additional insights and a detailed outline of the home buying process, be sure to consult our comprehensive First Time House Buying Checklist for a broader perspective that complements these Dallas-specific strategies.

Key Takeaway: Your journey to owning a home in Dallas is a marathon, not a sprint. Diligent preparation, strategic planning, and assembling a team of trusted professionals are the keys to crossing the finish line successfully and securing a property you’ll be proud to own.

This checklist is your roadmap. Use it to stay organized, ask the right questions, and navigate the intricate Dallas real estate landscape like a seasoned pro. Your dream of owning a piece of this vibrant city is within reach. With careful planning and the right guidance, the keys to your first Dallas home are waiting for you.

Ready to turn this checklist into action with an expert guide by your side? The team at Dustin Pitts REALTOR Dallas Real Estate Agent specializes in navigating the complexities of the Dallas market for first-time buyers, ensuring you have the strategic advantage you need. Let us help you find the perfect Dallas property that aligns with your goals and lifestyle.