When you own a home in Dallas, you’re not just paying for a place to live—you’re actively building your personal net worth. Every single mortgage payment you make transforms into a powerful financial asset.

So, what is home equity? In the simplest terms, it’s the slice of your property you actually own. It’s the difference between what your home is worth on the Dallas market today and what you still owe on your mortgage. For a homeowner in Dallas, this isn’t just some abstract number; it’s a real, tangible stake in one of America’s most dynamic real estate markets.

Your Guide to Understanding Home Equity in Dallas

Before you can focus on growing your equity, you need to get a solid handle on the concept itself. The easiest way to think about it is like a high-yield savings account. Each mortgage payment you make is a deposit, while a hot Dallas market can generate “interest” in the form of your home’s value going up.

It all starts with that initial investment. Knowing how to calculate your down payment is the first step, because the more you put down upfront, the more equity you have from day one. From there, your ownership stake gets a boost from two primary forces.

The Two Engines of Equity Growth

The first method is one you have complete control over: paying down your mortgage principal. A chunk of every monthly payment goes toward chipping away at that loan balance, which directly increases the percentage of the home you own.

The second is market appreciation. This is driven by things outside your direct control, like the booming Dallas economy, local job growth, and strong housing demand in specific neighborhoods from Uptown to Preston Hollow. These factors can send your property’s value soaring over time.

This powerful combination of your deliberate payments and favorable market winds creates an incredible wealth-building tool. Getting the basics down is the first step toward making it work for you. For a deeper dive, check out our guide on what is equity in real estate.

Before we move on, let’s quickly summarize the fundamental ways Dallas homeowners can build their equity.

Table: Core Methods for Building Home Equity

| Method | How It Works | Control Level |

|---|---|---|

| Mortgage Payments | Consistently paying down the loan principal directly increases your ownership stake. | High |

| Home Appreciation | The market value of your home increases due to demand, inflation, and local Dallas economic factors. | Low |

| Home Improvements | Strategic renovations and upgrades can increase your property’s market value. | High |

| Larger Down Payment | Putting more money down at purchase immediately establishes a larger equity position. | High |

Ultimately, a mix of these strategies provides the most effective path to substantial equity growth for Dallas property owners.

Tappable Equity: A Key Metric

It’s also crucial to understand the term “tappable equity.” This is the amount you can borrow against while still keeping a healthy ownership stake in your home—lenders typically require you to maintain at least 20% equity. It’s the portion you can actually put to work for other financial goals.

The potential locked within Dallas homes is immense. While national figures show homeowners sitting on trillions in equity, this trend is especially strong in Texas. This shows just how much financial power is available to homeowners who manage their equity wisely in a robust market like DFW.

For those of us here in Dallas, this isn’t just some far-off statistic. With a significant number of U.S. homeowners having access to this kind of equity, the average amount available per individual with a mortgage is substantial. That’s a serious resource you could be building right now in your Dallas property.

Accelerate Equity with Smarter Mortgage Payments

The surest way to build equity in your Dallas home is to get aggressive with your mortgage principal. While the hot Dallas market certainly helps, your own payments are the one thing you have total control over. And the best part? You don’t have to make huge financial sacrifices to see a real difference.

Even small, consistent tweaks to how you pay your mortgage can shave years off your loan and save you thousands in interest. The secret is making sure any extra cash you send goes directly toward the principal balance. That’s how every extra dollar starts working for you, increasing your ownership stake.

Shift Your Payment Schedule

One of the simplest tricks in the book is switching to a bi-weekly payment plan. Instead of one monthly payment, you make a half-payment every two weeks. Since there are 26 two-week periods in a year, you end up making 26 half-payments.

Do the math—that’s the same as 13 full monthly payments.

That one extra payment a year, which you’ll barely feel in your cash flow, goes straight to knocking down the principal. On a typical Dallas mortgage, this small change can easily trim several years off your loan term.

Make Principal-Only Payments

Another direct approach is to just tack a little extra onto your monthly payment. It’s amazing how much impact even a modest amount can have over the long haul.

Here are a couple of popular strategies I see Dallas homeowners use:

- Round Up Your Payment: Is your monthly payment something awkward like $2,860? Just round it up to an even $3,000. That sends an extra $140 straight to your principal every single month.

- Add a Set Amount: Committing to an extra $100 or $200 with every payment is a fantastic way to steadily chip away at that loan balance.

One crucial tip: You have to tell your lender what to do with the extra money. Make sure you explicitly designate any extra funds as a “principal-only payment.” If you don’t, the bank might just apply it to next month’s payment, where it gets split between interest and principal like usual. That completely defeats the purpose.

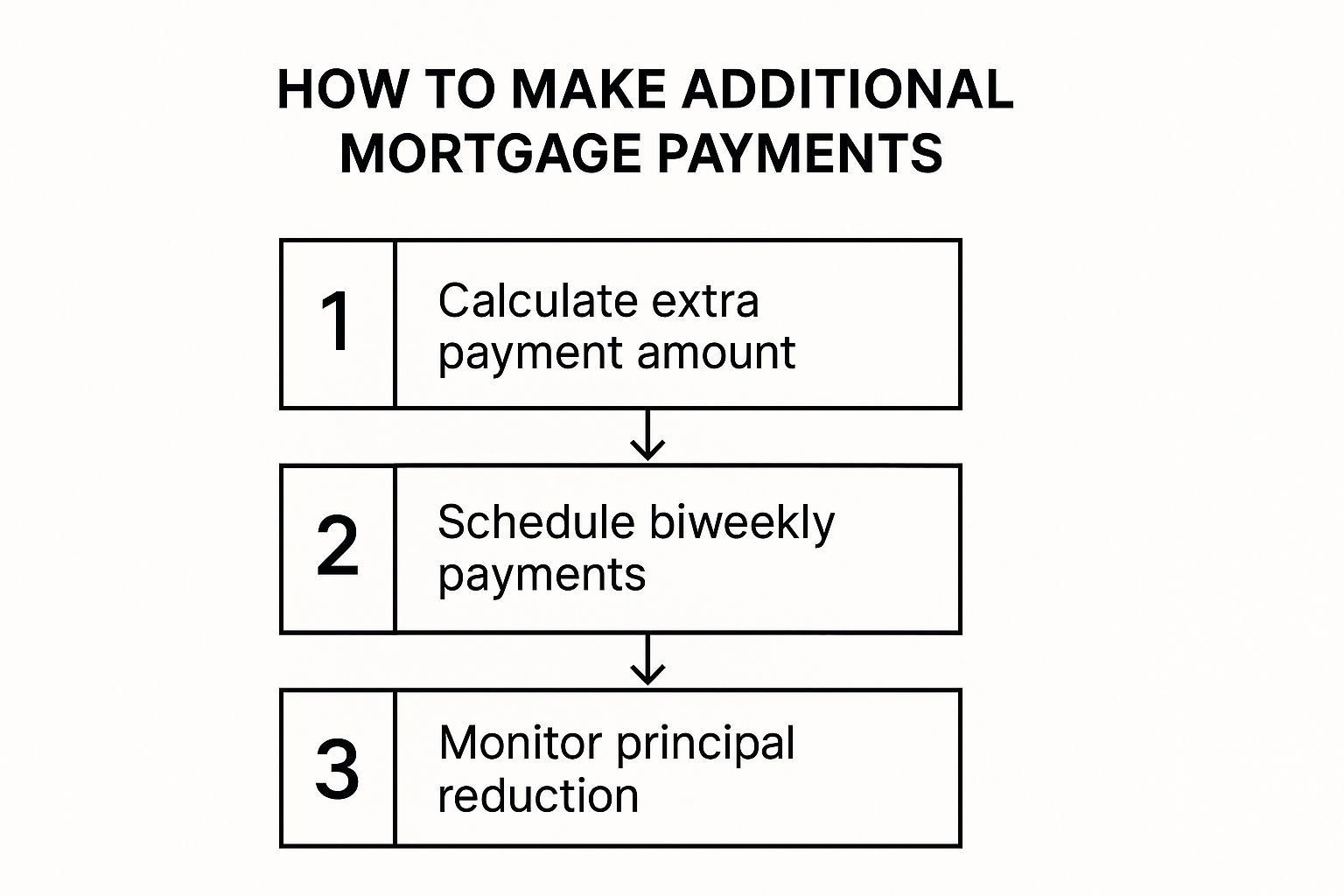

This infographic lays out the basic flow of how to make these extra payments and see the results.

As you can see, building equity this way is all about being deliberate: you plan, you act, and you watch your stake in the home grow.

Let’s run the numbers for a real-world Dallas scenario. Imagine a homeowner with a $400,000, 30-year mortgage at a 6.5% interest rate. By adding just an extra $150 per month toward the principal, they could pay off their entire mortgage almost four years ahead of schedule and save over $60,000 in interest. That’s a massive win from a relatively small monthly change.

Home Improvements with the Best ROI in Dallas

Sure, paying down your mortgage is a guaranteed way to build equity. But if you want to speed things up, smart home improvements can give your home’s market value a serious boost.

The catch? Not every renovation pays off, especially in a competitive market like Dallas. You have to be strategic. The goal is to put your money where it will generate the highest return on investment (ROI), making sure your upgrades lead directly to a higher appraisal value.

Forget what you see on flashy reality TV shows. Dallas buyers aren’t looking for over-the-top remodels. They value smart, functional, and modern updates that don’t require them to tear everything out. The key is to focus on the projects that give you the most bang for your buck.

Focus on High-Impact Areas

When you’re deciding where to put your renovation budget, the kitchen and bathrooms are almost always the right answer. These are the two rooms that can make or break a buyer’s decision—and your home’s appraisal. But you don’t need to gut them down to the studs to see a great return.

Think about these high-ROI updates:

- Minor Kitchen Remodel: Instead of a massive, costly overhaul, focus on smaller, impactful changes. Refacing cabinets, swapping out old laminate for new quartz countertops, adding a modern backsplash, and upgrading to energy-efficient appliances can completely change the feel of the room for a fraction of the cost.

- Bathroom Refresh: A mid-range bathroom remodel is a consistent winner for ROI. This could be as simple as replacing an old vanity, laying down new tile, or updating the fixtures to sleek, water-saving designs.

The real goal here is to create a clean, updated, move-in-ready vibe. When a Dallas buyer walks in and can imagine life in that space—without immediately making a mental list of projects—you’ve added real value.

Don’t Underestimate Curb Appeal

First impressions are everything in real estate. What your home looks like from the street—its curb appeal—sets the tone before a buyer even walks through the door. A well-maintained and inviting exterior can tack on thousands to your appraisal.

These improvements make a world of difference:

- New Front Door: Swapping out an old door for a new steel or fiberglass one is a relatively small project that recoups a surprisingly high percentage of its cost at resale.

- Garage Door Replacement: An updated garage door isn’t just about looks; it enhances security and can dramatically modernize your home’s entire facade.

- Strategic Landscaping: You don’t need a professional landscape architect. Simple things like fresh mulch in the flowerbeds, neatly trimmed shrubs, and some seasonal flowers by the entryway make a property look cared for and welcoming.

Smart Energy-Efficient Upgrades

Today’s Dallas buyers are savvy. They’re looking for homes that won’t just look good but will also be affordable to live in long-term. This makes energy-efficient upgrades a major selling point. Things like adding attic insulation or installing new, high-efficiency windows can directly boost your home’s value.

When you’re thinking about bigger-ticket items like solar panels, a little research goes a long way. Before you commit, look into the available solar incentives in Texas, which can seriously cut down on the upfront cost. These kinds of upgrades not only help build equity but become a standout feature when it’s time to sell.

Capitalize on Dallas Market Appreciation

While you’re busy making mortgage payments and planning home improvements, there’s another force working silently to build your equity: market appreciation. It’s the powerful, passive engine driven by the Dallas economy, and it’s a huge piece of the puzzle. Understanding what makes the local market tick is the key to seeing how your net worth can grow, sometimes even while you sleep.

The Dallas-Fort Worth metroplex has its own unique economic currents that consistently fuel property value growth. We’re talking about major corporate relocations bringing in a steady stream of professionals, continuous job growth creating intense housing demand, and significant infrastructure projects that make neighborhoods more connected and desirable. These are the forces that can lift the entire market.

Even when you hear about shifts in the national housing conversation, Dallas often plays by its own rules. A stubbornly tight housing supply in the most sought-after neighborhoods can insulate your property’s value and even drive it upward, creating a seriously strong foundation for your investment.

Tracking the DFW Economic Engine

To be a truly savvy homeowner, it helps to keep a pulse on the local indicators that have a direct line to your property’s value. You don’t need a degree in economics, but knowing what to look for provides incredible insight into your home’s equity potential.

Here are a few key metrics I always watch in the Dallas area:

- Corporate Relocations: When a major company announces a new HQ or a big office move to DFW, that’s a huge sign of future housing demand.

- Job Growth Reports: Keep an eye on the monthly jobs report for the Dallas-Plano-Irving metro. It’s a direct reflection of the local economy’s health.

- Local Inventory Levels: The “months of supply” metric is your best friend here. A low number means it’s a seller’s market, which is fantastic for pushing prices higher.

This is especially true in hot neighborhoods where demand constantly outstrips the number of homes for sale. For a closer look at how these dynamics play out, check out our Oak Lawn real estate buyer’s guide to see how a specific neighborhood’s market can drive value.

Why a Tight Housing Supply Protects Your Equity

A limited supply of homes for sale is one of the most powerful forces propping up property values. Despite what you might hear about the national market, the overall housing supply here remains tight. Even with new home construction picking up, we’re still well below historical averages for available homes.

This simple supply-and-demand imbalance creates a price floor, which is exactly what you want for protecting and growing your equity. When more people want to buy a home in Dallas than there are homes available, values have a strong tendency to hold steady or, more often, to rise.

Think of market appreciation as your silent partner in building wealth. Your efforts in paying down the mortgage and making smart upgrades are vital, of course. But the economic strength and sheer desirability of Dallas provide a powerful tailwind that can dramatically accelerate your equity growth over time.

When Refinancing Makes Sense for Equity Growth

Refinancing can be a fantastic tool for building equity faster, but it’s a strategic play—not a one-size-fits-all solution for every Dallas homeowner. When you get it right, it can seriously accelerate how quickly you build your ownership stake. But get it wrong, and you could set yourself back with a pile of unnecessary costs.

Ultimately, the best refinancing strategies for growing equity come down to two simple goals: paying less interest over the life of the loan and knocking down your principal balance faster. It’s all about making your mortgage debt work smarter for you.

Shorten Your Loan Term

One of the most powerful moves you can make is to refinance from a standard 30-year mortgage into a 15-year term. Yes, your monthly payment will go up, but the long-term rewards are huge.

With a shorter term, a much larger slice of every payment goes directly toward the principal. This dramatically speeds up how fast you accumulate equity. This approach isn’t for everyone—the higher payment has to fit comfortably within your budget. But for homeowners in the Dallas area with stable, growing income, it’s a direct path to owning your home free and clear years ahead of schedule.

Secure a Lower Interest Rate

Another golden opportunity to refinance pops up when market interest rates drop well below your current rate. Nabbing a lower rate means less of your monthly payment gets eaten up by interest, allowing more of your hard-earned money to attack the principal balance. You build equity faster without even changing your loan’s duration.

Even what seems like a small reduction, like dropping from 6.5% to 5.5% on a typical Dallas-sized mortgage, can save you tens of thousands of dollars and help you build that ownership stake much more quickly.

The crucial calculation here is your break-even point. You have to figure out how long it will take for the monthly savings from your new, lower payment to completely cover the closing costs of the refinance. If you plan to stay in your Dallas home well beyond that point, it’s almost always a financially sound move.

Before you jump in, you have to get a clear picture of what those upfront expenses will look like. For a deeper dive, check out our guide on how to calculate closing costs to get a better handle on the numbers.

Finally, as you weigh your options, it’s essential to understand the difference between refinancing versus a home equity loan. The first restructures your primary mortgage to help you build equity faster, while the second is all about tapping into the equity you’ve already built. Knowing which is which is key to making a smart financial decision for your goals.

How You Really Build Home Equity in Dallas

Building serious home equity isn’t about one single thing. It’s a powerful combination of two forces working in tandem: your own financial habits and the Dallas market itself.

Think of it this way. You’re in control of one engine, the steady, reliable one. The other is a massive turbocharger that kicks in based on the local economy. You need both firing on all cylinders to maximize your wealth.

The first engine is your principal paydown. Every single mortgage payment chips away at your loan balance. Each extra dollar you can spare and send to the bank is a direct investment in your ownership stake. This is the disciplined, methodical part of the equation, where consistency wins the race.

Riding the Wave of Market Appreciation

The second engine is market appreciation, and frankly, this is where Dallas homeowners have seen explosive growth. This is that turbocharger—it’s less predictable but incredibly powerful when it spools up.

Things like strong job growth across North Texas and relentless demand for housing can make your property’s value climb, sometimes dramatically, without you lifting a finger. It’s the closest thing to passive income in real estate.

And this isn’t just a Dallas story; it’s a nationwide wealth-builder that has been particularly strong in Texas. For instance, recent national trends saw home prices rise dramatically, which significantly increased the amount of tappable equity for homeowners. This created a huge boost in net worth for the average borrower. You can dig deeper into these home equity gains to see the full impact.

The winning strategy is simple: run both engines at full throttle. You focus on what you can control—making those extra payments, tackling smart improvements—while the strong Dallas market works in the background to amplify every move you make.

When you understand how these two forces work together, you can make smarter decisions. For example, in a hot Dallas market where values are climbing fast, a minor kitchen remodel could deliver a much higher return on investment because the rising tide is already lifting your property’s base value.

This dual-engine approach changes the game. Homeownership stops being just about having a place to live and becomes an active strategy for building real, long-term financial stability. It’s about positioning yourself to benefit from your own hard work and the powerful economic currents of the Dallas real estate market.

Got Questions About Building Equity in Dallas? We’ve Got Answers.

When you start digging into the details of building home equity, it’s natural for a few questions to pop up. Here are some of the most common ones Dallas homeowners ask, with clear, straightforward answers.

How Quickly Can I Build Equity in Dallas?

There’s no magic number here—it’s a mix of your own efforts and what the market is doing. If you get aggressive with your mortgage principal by making bi-weekly payments or just throwing a little extra at it each month, you can start to see a real difference within a few years.

But the real game-changer is market appreciation. We’ve seen homeowners in hot Dallas neighborhoods like Lakewood or the M Streets build equity at a shocking pace simply because property values were climbing. The fastest path is always a combination of your consistent payments and a strong local market.

Should I Focus on Renovations or Extra Payments?

This really comes down to your personal goals and your finances. Tackling your mortgage with extra payments offers a guaranteed, risk-free return on your investment because you’re actively cutting down your debt. On the other hand, home renovations offer the potential for a much higher return, but they come with their own set of costs and risks.

A smart play for many Dallas homeowners is to prioritize consistent extra payments while setting aside savings for a specific, high-ROI project. Think about a minor kitchen or bathroom refresh—something you can pay for without taking on new debt.

Do My Property Taxes Affect My Equity?

Property taxes don’t directly chip away at your equity. But, with property taxes on the rise in Dallas County, they definitely have an indirect impact.

A higher tax bill means a higher total monthly housing cost. This can leave you with less cash at the end of the month to make those extra principal payments. So, while taxes aren’t eating your equity, they can slow down how fast you build it yourself. Keeping a close eye on your total housing budget is the key to staying on track.

Are you ready to make a strategic move in the Dallas real estate market? Whether you’re planning to buy, sell, or simply understand your home’s potential, the right guidance is essential. Contact Dustin Pitts REALTOR Dallas Real Estate Agent today to put an expert on your side. Visit us at https://dustinpitts.com to get started.