If you’re serious about boosting your credit score, the very first thing you need to do is get a crystal-clear look at where you stand right now. You can’t fix what you can’t see. This means pulling your credit reports from all three major bureaus—Equifax, Experian, and TransUnion—and going through them with a fine-tooth comb.

The whole point of this initial deep dive is to spot errors, understand what makes up your score, and see your financial history through the eyes of a Dallas mortgage lender. This isn’t just a box to check; it’s the foundation for every other step you’ll take.

Getting a Lay of the Land: Your Credit Score in the Dallas Market

Before you can even think about a game plan, you need a map. Your credit report is that map—a detailed financial history of how you’ve handled debt. Lenders in a competitive real estate market like Dallas lean heavily on this history to figure out how likely you are to make your mortgage payments on time, every time.

A higher score doesn’t just get you approved; it gets you a lower interest rate, which can save you tens of thousands of dollars over the life of your home loan. It’s a huge deal for any prospective Dallas homeowner.

Your journey starts by pulling those reports. You’re legally entitled to a free report from each of the big three bureaus once a year. I tell every Dallas client this is the non-negotiable first step.

The only place to go for this is the official, government-authorized site: AnnualCreditReport.com.

Make sure the site looks like this, so you know you haven’t landed on a lookalike trying to sell you something.

Using the official site means you get your full reports without getting roped into a paid credit monitoring service you don’t need. Once you have them in hand, your mission is simple: review every single line and look for anything that seems off.

The Five Pillars of Your Credit Score

Your credit score isn’t some random number pulled out of thin air. It’s calculated using a specific recipe, and while the exact math is a trade secret, the ingredients are well-known. When you understand these factors, you know exactly where to put your energy to see the biggest results.

Here’s a quick breakdown of what goes into your score.

The Five Pillars of Your Credit Score

| Factor | What It Means | Impact on Your Score |

|---|---|---|

| Payment History | Do you pay your bills on time? Simple as that. | 35% (The single biggest factor) |

| Credit Utilization | How much of your available credit card limit are you using? | 30% (Extremely important) |

| Length of Credit History | How long have you been responsibly using credit? | 15% (Longer is better) |

| Credit Mix | Do you have a healthy mix of credit types (e.g., credit cards, loans)? | 10% (Shows you can handle different debt) |

| New Credit | Have you opened several new accounts or had many inquiries recently? | 10% (Too much too fast is a red flag) |

Focusing on all five is important, but as you can see, two of them carry most of the weight.

Dallas lenders zoom in on payment history and credit utilization. Together, those two factors make up a massive 65% of your score. If you want to see your score move up quickly, that’s where you need to focus your attention.

Why This Is a Game-Changer for Dallas Home Buyers

In a hot market like Dallas, a solid credit score is your competitive edge. It’s not just about getting approved for a mortgage; it dictates the terms you’re offered. A score of 740 or higher is the magic number that usually unlocks the best possible interest rates. Anything lower, and you’ll likely pay more.

For anyone new to this, it’s worth getting a handle on the baseline expectations. You can learn more about the first-time homebuyer credit score requirements that lenders are looking for.

By knowing exactly where you stand today and understanding these five pillars, you’re no longer guessing. You have a clear, actionable roadmap to building the kind of credit profile that will help you win your dream home in Dallas.

Mastering Your Payment History

When a Dallas mortgage lender pulls your file, they’re really just trying to answer one big question: “Can we count on this person to pay us back every month?” Your payment history is the clearest answer you can give them, and it’s no exaggeration to say it’s the cornerstone of your credit score. In fact, it accounts for a massive 35% of your total score.

You can’t overstate how important this is. Every on-time payment you make is like casting a vote for your own reliability. On the flip side, just one payment that’s more than 30 days late can torpedo your score and linger on your report for up to seven years. For anyone serious about buying a home in Dallas, a rock-solid payment history is simply non-negotiable.

Automate Everything You Can

Let’s be honest, life in Dallas gets busy. The easiest way to let a due date slip by is simply by forgetting it. The fix? Take human error out of the equation. Set up automatic payments for every single recurring bill.

I’m not just talking about your credit cards, either. Go through all your regular Dallas-area expenses and put them on autopilot:

- Rent or Current Mortgage: Check your landlord’s or lender’s online portal for auto-debit options.

- Utilities: This means your Oncor electric, Atmos Energy gas, and Dallas Water Utilities bills. Set them and forget them.

- Car Payment: Have your auto lender pull the payment a day or two after you get paid.

- Student Loans: Don’t let these crucial payments fall through the cracks.

Automating your payments ensures your most critical bills are always paid on time. It’s the simplest and most effective way to build that positive history lenders are looking for.

How to Handle Past-Due Accounts

What if you’ve already got a few late payments on your record? It’s not the end of the world. First things first: get current on that account immediately and commit to staying that way. The negative impact of a late payment lessens over time, and a long string of on-time payments that follow it shows lenders you’ve turned things around.

If an account has gone to collections, you absolutely have to deal with it. Ignoring it is the worst thing you can do for your credit. Your best bet is often to contact the collection agency and try to negotiate a settlement. You might be surprised to find they’re willing to accept less than the full amount.

Once you pay it off, the account will be updated to “paid in collection.” While not perfect, this looks infinitely better to an underwriter than an open, unpaid collection.

Your entire credit improvement journey relies on consistent, timely payments. According to recent data from Equifax, staying current on all your accounts is still the most critical thing you can do for your score. You can learn more about the global insights shaping credit health on Equifax.com.

In the end, it all comes down to building good habits and smart systems. By automating your finances and cleaning up any past mistakes, you’re showing Dallas lenders that you’re a responsible borrower who can be trusted with a mortgage.

The 30 Percent Credit Utilization Rule

Once you’ve got your payment history locked down, the next biggest piece of the credit score puzzle is your credit utilization. This one factor makes up about 30% of your entire score, so it’s a big deal.

It sounds complicated, but it’s really just the percentage of your available credit that you’re currently using. A Dallas mortgage lender looks at this number closely. High utilization, even with perfect payments, can look like a red flag, signaling that you might be financially stretched thin.

Let’s say you have two credit cards, each with a $5,000 limit. That gives you a total credit line of $10,000. If you’re carrying a combined balance of $5,000 on those cards, your credit utilization is at a whopping 50%. Lenders see that and start to wonder if you’re relying too heavily on credit to get by.

The standard advice is to keep your utilization below 30%. But if you’re serious about getting the best possible mortgage rate in Dallas, the real magic happens under 10%. Getting your balances that low is one of the quickest ways to see a meaningful bump in your score.

Smart Strategies to Lower Your Utilization

Getting your utilization down isn’t always about slashing your budget. Sometimes, it’s just about being smarter with the timing of your payments and understanding the billing cycle.

Here are a few proven tactics that work:

- Pay Before Your Statement Closes: Most of us wait for the bill to come in the mail or our inbox. The problem is, your card issuer reports the balance from that statement to the credit bureaus. If you make a significant payment before the statement date, a much smaller balance gets reported. Simple as that.

- Try Multiple Payments a Month: Instead of one big payment, get in the habit of making a few smaller ones throughout the month. Just charged $300 for groceries? Hop online a few days later and pay it off. This keeps your running balance low at all times.

- Ask for a Higher Credit Limit: If you’ve been a responsible customer, give your card issuer a call and request a credit limit increase. If they approve it, your utilization ratio instantly drops, as long as your spending stays the same. The key here is not to see that new credit as an excuse to spend more.

Pro Tip: Mastering your credit utilization is like finding a cheat code for your credit score. It’s a direct signal to Dallas lenders that you’re a pro at managing debt, which is exactly what they want to see when underwriting a home loan.

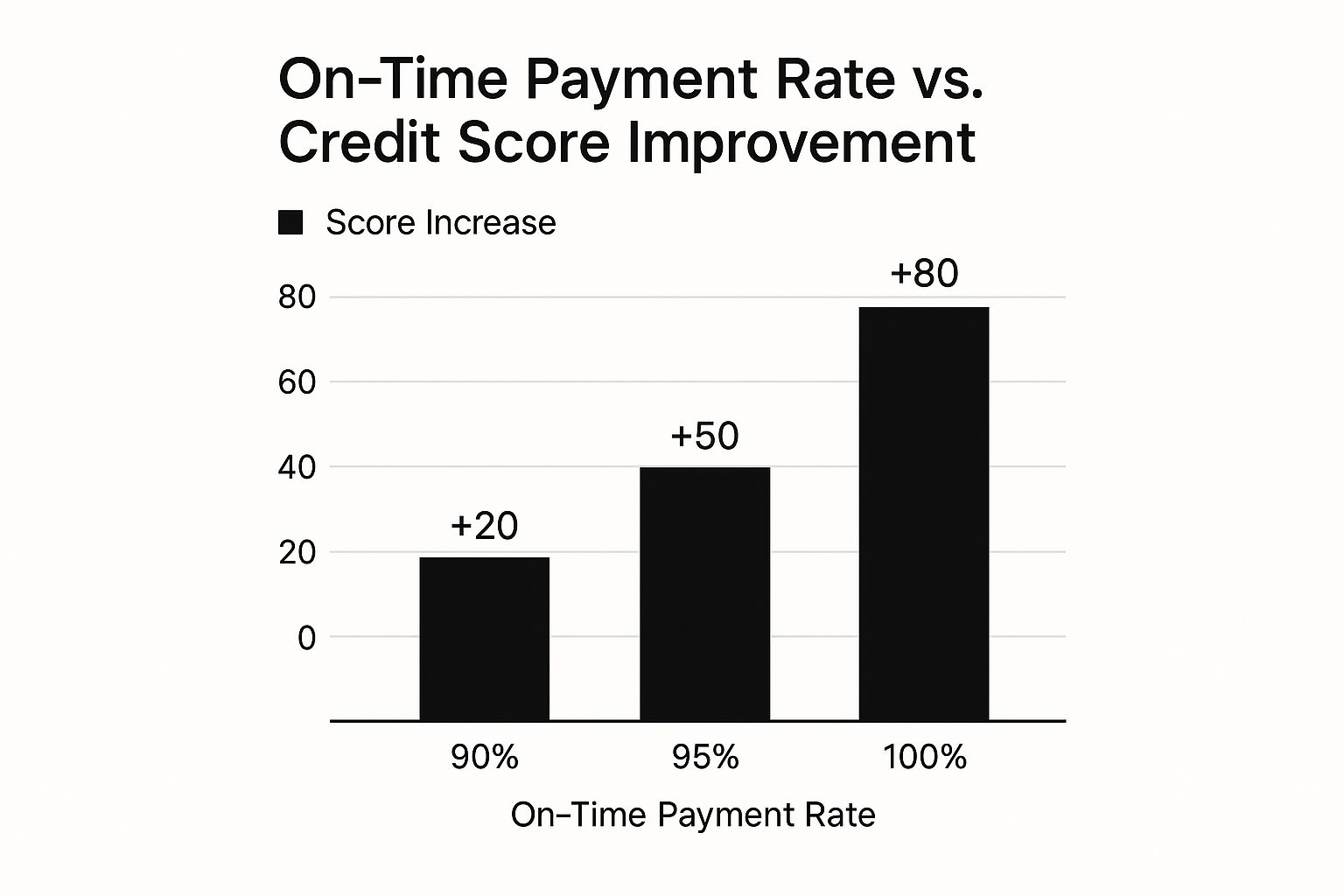

The infographic below highlights just how much of an impact these good habits can have. It all works together.

As you can see, a flawless payment history combined with low utilization can really move the needle on your score—we’re talking a potential jump of up to 80 points.

Your credit utilization ratio sends a clear message to lenders about your financial health. A lower ratio suggests you’re a responsible borrower, while a high one can be a major red flag. Let’s break down how different levels of utilization can be perceived.

Credit Utilization Impact on Your Score

| Utilization Ratio | Potential Impact on Score | Lender Perception |

|---|---|---|

| 0% – 9% | Very Positive | Excellent. You manage debt responsibly and don’t rely on credit. |

| 10% – 29% | Positive | Good. You’re using credit, but keeping it well under control. |

| 30% – 49% | Negative | Concerning. This is the zone where scores often begin to drop. |

| 50% – 74% | Very Negative | High risk. Lenders may see you as overextended. |

| 75%+ | Extremely Negative | Significant risk. This can severely drag down your score. |

Ultimately, aiming for single-digit utilization is the best strategy when you’re preparing for a mortgage application. It gives you the biggest score boost and makes the strongest impression.

How Utilization Impacts a Dallas Home Loan

Let’s bring this home with a real-world Dallas example. Imagine you’re getting your finances ready to buy a house. You have a credit card with a $10,000 limit and a $4,000 balance, putting you at 40% utilization. Even if you’ve never missed a payment, that ratio alone could be suppressing your score by 20-40 points.

Now, if you aggressively pay that balance down to under $1,000 (that’s below 10% utilization), you could see your score shoot up in just one or two months. That jump could be the difference between a good mortgage rate and a great one, saving you hundreds each month and tens of thousands over the life of your loan.

When you’re trying to land a home in a competitive Dallas neighborhood like Lakewood or Preston Hollow, those savings—and the power of a stronger application—can make all the difference.

Playing the Long Game with Strategic Credit Management

Building a strong credit profile isn’t about quick fixes. It’s a marathon, not a sprint, requiring smart, forward-thinking habits. Dallas mortgage lenders, in particular, want to see consistency and stability in your financial history. This means we need to look beyond the basics and focus on the strategic elements that create a resilient score.

It’s not enough to just pay your bills on time. Lenders dig deeper, looking at the maturity and diversity of your credit profile. This is where often-overlooked details, like the age of your credit history and the variety of accounts you manage, become incredibly important. These factors are your proof that you have real, long-term experience handling debt responsibly.

Protect Your Credit History Age

I see this all the time: people close old, unused credit cards thinking they’re being tidy with their finances. It feels like the right move, but it can actually backfire and drag your score down. Your length of credit history is a surprisingly hefty chunk of your score—about 15%—and that old card is a valuable asset.

Closing an old account hurts you in two ways:

- It shrinks your average credit age. A longer history of responsible borrowing is always better in a lender’s eyes.

- It cuts your total available credit. This instantly spikes your credit utilization ratio, which can do significant damage to your score.

My advice? If that old card doesn’t have an annual fee, keep it open. A simple trick is to use it for a small, recurring purchase, like a Netflix subscription, and then set up autopay to pay it off in full each month. This keeps the account active and working in your favor without you having to think about it.

Cultivate a Healthy Credit Mix

Lenders also want to see that you can juggle different kinds of debt. This is what we call your credit mix, and it accounts for roughly 10% of your score. A healthy mix shows you’re a versatile borrower who can handle different financial responsibilities.

Credit generally falls into two buckets:

- Revolving Credit: Think credit cards and lines of credit, where your balance and payments can change month to month.

- Installment Loans: These are loans with fixed payments over a set period, like a car loan, student loan, or, eventually, a mortgage.

Having a bit of both on your report is the sweet spot. If your credit history is all credit cards, for example, getting a small personal loan and paying it off diligently can help diversify your profile. Just remember, never take on debt just to build your mix. Only do it if it aligns with your actual financial needs and goals.

A diverse credit profile signals financial maturity to a Dallas mortgage lender. It suggests you can handle the responsibility of a large installment loan—like a mortgage—because you’ve already proven you can juggle different payment structures.

Minimize New Credit Applications

Every single time you apply for new credit, the lender pulls your report, creating what’s called a hard inquiry. Each one can cause a small, temporary dip in your score. One or two isn’t a disaster, but a flurry of applications in a short time frame looks risky to a lender.

This becomes especially critical in the months leading up to your mortgage application. From a lender’s perspective, multiple inquiries look like a sign of financial trouble—as if you’re scrambling for credit, which is a massive red flag. The bottom line: only apply for new credit when you absolutely need it.

A huge part of this long game is effective debt management. Using a strategy like the debt snowball method can help you knock down balances systematically, which improves both your payment history and your credit utilization. You can find some great online debt snowball calculator tools to help map this out. This also has a direct, positive impact on another key metric lenders scrutinize: your debt-to-income ratio. We break that down completely in our guide explaining what the debt-to-income ratio is.

Protecting Your Score from Economic Shifts

Your personal finances don’t operate in a bubble. Big-picture economic trends can easily send shockwaves through your credit profile, creating instability right when you’re trying to make a major move like buying a home in Dallas.

To build a truly resilient credit score, you need financial habits that can weather the storm—whether that storm is a personal job loss or a full-blown recession. It’s all about being proactive so your path to a Dallas mortgage stays clear, no matter what the economy is doing.

The Illusion of Temporary Support

We saw this play out perfectly during the pandemic. Government programs like stimulus checks, paused student loan payments, and mortgage forbearance offered a temporary safety net for millions. It created a strange situation where, on average, credit scores actually went up between 2020 and early 2022, especially for individuals who started with lower scores.

But that created a false sense of security. As soon as those programs ended, the reality check hit hard. Deferred payments came due, and many people saw their scores drop as they struggled to keep up. You can dig into more of the data on how these post-pandemic shifts impacted credit volatility on Resolvepay.com.

This whole experience taught a crucial lesson for anyone serious about their credit.

Relying on temporary, external support isn’t a real credit strategy. Lasting financial health comes from building your own buffer to handle economic curveballs without wrecking your long-term goals.

Think of this buffer as your personal financial shock absorber. It’s what protects your credit score from the damage of missed payments when life gets unpredictable.

Building Your Financial Buffer

Creating this personal safety net is one of the most powerful things you can do for your credit health. It’s more than just stashing cash; it’s about building a system that ensures your critical bills get paid even if your income takes a hit. It’s essentially an insurance policy for your credit score.

Here’s how you can start building that buffer today:

- Create a Dedicated Emergency Fund: Your target should be 3 to 6 months of essential living expenses. This isn’t your “fun money” fund. It’s strictly for covering housing, utilities, and debt if your regular income disappears.

- Know Your “Bare-Bones” Number: Do the math. What is the absolute minimum you need to cover your non-negotiable monthly bills? This includes your rent or mortgage, car payment, Dallas utilities, and minimum payments on all debts. This number is your monthly survival target.

- Automate Your Savings: The easiest way to save is to make it automatic. Treat your emergency fund contribution like any other bill. Set up a recurring transfer from your checking to a separate high-yield savings account that happens right after you get paid.

- Keep It Separate but Accessible: Your emergency fund needs to be liquid, meaning you can get to it fast without paying penalties. A high-yield savings account is ideal. It keeps the money out of sight (and out of mind) from your daily spending but is ready when you truly need it.

When you have this cushion in place, an unexpected layoff or a shaky economy doesn’t automatically become a credit catastrophe. You can keep your payment history clean and your credit utilization in check, which is exactly the kind of financial stability Dallas mortgage lenders want to see.

Common Credit Questions for Dallas Home Buyers

As you get closer to your goal of buying a home here in Dallas, the “what ifs” and “how to’s” naturally start to pile up. It’s one thing to understand the basics of credit, but it’s another to apply that knowledge to your specific situation.

This is where the rubber meets the road. Let’s tackle some of the most common questions I hear from aspiring Dallas homeowners, with clear, straightforward answers to get you across the finish line.

How Long Does It Take to Improve a Credit Score?

This is the big one, and the honest-to-goodness answer is: it really depends. The time it takes to see a real jump in your score is tied directly to what’s dragging it down. Some fixes are surprisingly fast, while others require a bit more patience.

For example, if your main issue is high credit card balances—say you’re using 70% of your available credit—you could see a significant score boost in as little as 30 to 45 days. All you have to do is pay down those balances. Once the new, lower balance is reported to the credit bureaus, the scoring algorithms react almost immediately. This is hands-down one of the quickest ways to give your score a lift.

On the other hand, if you’re dealing with more serious dings like late payments, accounts in collections, or a charge-off, the timeline stretches out. These negative marks can stick around for up to seven years. While their impact definitely fades over time, you can’t erase them overnight. Moving the needle here is all about building a fresh track record of consistent, on-time payments over several months.

My advice for Dallas buyers is to start focusing on your credit at least six months before you plan to get serious about house hunting. That buffer gives you enough breathing room to handle both the quick wins and the more stubborn issues.

Should I Hire a Credit Repair Company?

You’ve probably seen the ads promising to wipe your credit report clean and give you a massive score boost overnight. It sounds tempting, but you need to be careful. While there are legitimate credit repair organizations out there, the truth is that they can’t do anything for you that you can’t legally do for yourself, for free.

Here’s how they typically work: they dispute negative information on your report, regardless of whether it’s accurate. Sometimes, if a creditor doesn’t respond to the dispute within the required timeframe, the item gets temporarily removed. But if the debt is valid, it can—and often does—reappear later.

Before you spend your hard-earned money, think about this:

- The Cost: Credit repair services aren’t cheap. They often charge monthly fees that could be put to much better use, like actually paying down the debt that’s hurting your score.

- No Guarantees: They cannot legally remove accurate negative information from your report. It’s as simple as that.

- You’re in Control: You have the right to dispute any errors on your credit report yourself by contacting the credit bureaus directly. It just takes a bit of time and effort.

For most people getting ready for a Dallas mortgage, the best path forward is to stick with the tried-and-true methods: pay your bills on time, every time, and keep your credit card balances low. That’s how you build a genuinely strong credit profile that any mortgage underwriter will respect.

What Credit Score Do Dallas Lenders Really Want?

In a hot market like Dallas, lenders have their pick of applicants. You might technically be able to get certain loans with a score in the low 600s, but you’ll pay for it with a much higher interest rate and less attractive terms. From a lender’s perspective, a lower score simply means higher risk.

To put yourself in the running for the best homes—and more importantly, the best mortgage rates—you should really be aiming for these tiers:

| Credit Score Range | Lender Perception in Dallas | What It Means for You |

|---|---|---|

| 740+ | Exceptional | You’re a top-tier applicant. Lenders will roll out the red carpet with their lowest interest rates. |

| 700-739 | Very Good | You’re still a very strong borrower and will easily qualify for competitive rates. |

| 670-699 | Good | This is generally the minimum for a conventional loan. You’ll get approved, but your rate might be a tick higher. |

| Below 670 | Fair to Poor | You’ll likely be looking at government-backed loans (like FHA) and should brace for higher rates and fees. |

The difference between a “good” score and an “exceptional” one can easily save you tens of thousands of dollars over the life of your mortgage. A higher score doesn’t just improve your approval odds; it gives you leverage. Once you hit that 740+ benchmark, you’re in a fantastic position to move forward. Our guide on how to get pre-approved for a mortgage is the perfect resource for taking that next step with confidence.

At Dustin Pitts REALTOR Dallas Real Estate Agent, we believe an informed buyer is an empowered buyer. If you’re ready to put your strong credit score to work and find your perfect Dallas home, we’re here to help. Connect with us today at https://dustinpitts.com.