Ever found your dream home in Dallas but your money is all tied up in the house you currently own? It’s a classic real estate catch-22. A bridge loan is a short-term financing solution designed to solve exactly this problem. It gives you the cash you need to buy a new property before you’ve managed to sell your old one, letting you jump on an opportunity in a hot market without delay.

Crossing The Gap In Dallas Real Estate

In a real estate market as fast as Dallas, timing can make or break a deal. You might find the perfect place in a sought-after neighborhood like Oak Cliff or the Park Cities, but your capital is locked up in your current home. This is a frustratingly common roadblock that can force you to either pass on a great house or submit a weak offer that’s contingent on your sale.

This is exactly where a bridge loan comes in. Think of it quite literally as a temporary financial bridge that helps you get from your old property to your new one without falling into the gap. It gives you the power to make a strong, non-contingent offer, which is a massive advantage when you’re up against multiple bids, a frequent reality across Dallas.

The Strategic Advantage In A Seller’s Market

When homes in areas like Lakewood or Uptown are getting multiple offers within days of listing, any offer with a financing contingency automatically goes to the bottom of the pile. Sellers almost always prefer a clean, certain offer that isn’t going to collapse because the buyer’s own home sale hits a snag.

That’s the power of a bridge loan—it lets you present your offer as if you were paying with cash. This kind of financing is a game-changer for buyers who need to act fast and with confidence.

Here’s what it really does for you:

- Securing Your Next Property: You can lock down your new Dallas home without the immense stress of trying to perfectly time the sale of your current one.

- Avoiding a Double Move: By closing on the new place first, you can move straight from your old house to the new one. No need for storage units or temporary living situations.

- Strengthening Your Offer: It lets you drop the dreaded home sale contingency, making your bid far more attractive to sellers.

A bridge loan isn’t just about borrowing money; it’s about gaining a serious competitive edge. It essentially turns your home equity into immediate buying power, allowing you to go head-to-head with other buyers and win.

How Bridge Loans Work For Dallas Property Buyers

So, how does this actually work? At its core, a bridge loan is pretty simple: it lets you tap into the equity you’ve built up in your current Dallas home to buy your next one. Think of all the value locked up in your property—a bridge loan temporarily unlocks it, turning that value into cash you can use right now.

This is especially critical in a fast-moving market like Dallas, where “we’ll get back to you” means the property is already gone. Bridge loans are built for speed. Unlike a traditional mortgage that can take a month or more, a bridge loan focuses almost entirely on your current home’s equity. This is what lets lenders move so quickly, often closing in a couple of weeks.

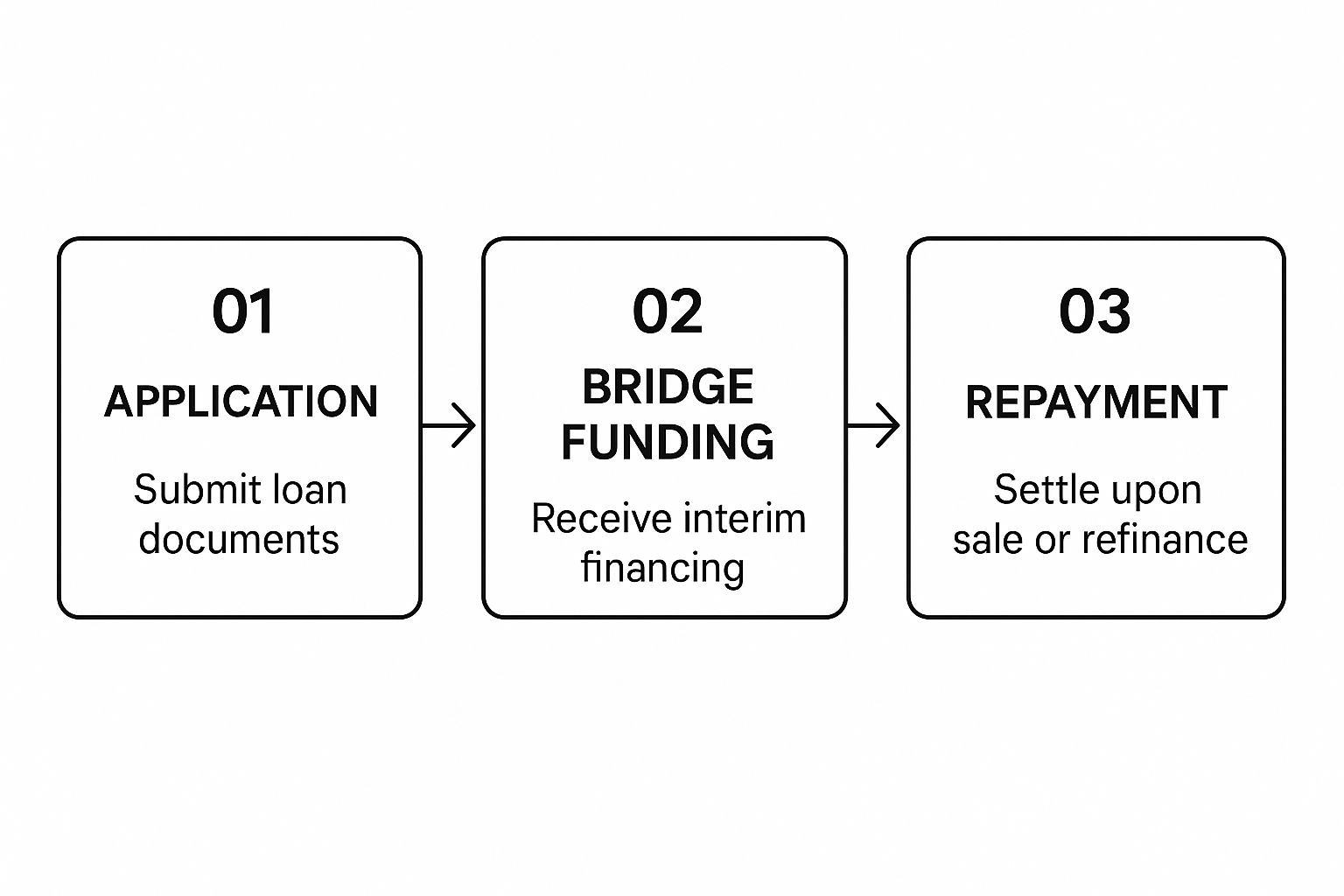

This visual breaks down the simple, three-step journey from getting the loan to paying it back.

As you can see, the mechanics are designed to be straightforward. You access your home’s value when you need it most and then settle the loan once that property sells.

A Dallas Investor Example

Let’s put this into a real-world Dallas context. Say an investor owns a rental property over in Bishop Arts that’s worth $600,000. They still owe $250,000 on it, which means they’re sitting on $350,000 in home equity.

Suddenly, a fantastic multi-unit building pops up for sale in Uptown for $950,000. The seller wants a quick, clean deal—no home sale contingencies. The investor needs to come up with a 20% down payment ($190,000), but their cash is tied up in the Bishop Arts property.

This is where a bridge loan saves the day:

- The Loan: A lender quickly approves a $190,000 bridge loan, using the Bishop Arts property as collateral.

- The Purchase: The investor takes that cash and makes a strong down payment on the Uptown property, closing the deal without a hitch.

- The Sale: They then list and sell their Bishop Arts rental over the next few months.

- The Repayment: Once the sale closes, they use the proceeds to pay back the $190,000 bridge loan, plus any interest and fees.

Without that bridge, the investor would have missed out completely. It was the key to unlocking the opportunity.

Two Combined Loans Or Standalone Financing

When you get a bridge loan in Dallas, it’s not always a one-size-fits-all product. Lenders typically structure them in one of two ways, depending on your needs.

One popular approach is to roll everything into a single, larger loan. The lender pays off your current mortgage and gives you the extra cash you need for the new home. You then have just one monthly payment to worry about until your old house sells.

The other option is to get a smaller, separate loan that functions like a second mortgage on your current home. This just covers the down payment for the new place, leaving your original mortgage as-is. In this case, you’d have two payments to juggle—your old mortgage and the new bridge loan—until you sell.

Bridge Loan vs. Traditional Mortgage Timeline in Dallas

In a competitive market like Dallas, timing is everything. A bridge loan’s main advantage is its speed, which can be the deciding factor in getting your offer accepted.

Here’s a side-by-side comparison of the closing process for a bridge loan versus a traditional mortgage.

| Stage | Bridge Loan | Traditional Mortgage |

|---|---|---|

| Application & Initial Review | 1-2 Days | 3-7 Days |

| Property Valuation | 3-5 Days (Often a BPO or AVM) | 7-14 Days (Full Appraisal Required) |

| Underwriting & Approval | 3-7 Days | 14-21 Days |

| Closing & Funding | 1-2 Days | 3-5 Days |

| Total Estimated Timeline | ~2 Weeks | ~4-6 Weeks |

As the table shows, a bridge loan can cut the closing timeline by more than half. That speed gives you the power to make a non-contingent offer that looks almost as good as cash to a seller.

Weighing the Pros and Cons for Your Dallas Purchase

A bridge loan can be a game-changer in the fast-paced Dallas real estate market, but it’s a specialized tool, not a one-size-fits-all fix. Think of it like a secret weapon in your home-buying arsenal. It gives you some serious firepower, but you have to know when and how to use it.

This kind of financing has some huge advantages that can give you a real edge, but it also comes with costs and risks you need to look at with eyes wide open. You have to weigh both sides carefully to see if it truly lines up with your financial reality and what you’re trying to accomplish.

The single biggest plus? The power to make a clean, non-contingent offer. In hot Dallas neighborhoods like Lakewood or Preston Hollow, sellers often get swamped with bids. An offer that isn’t tied to you selling your current house first immediately jumps to the top of the pile. It lets you go head-to-head with cash buyers and gives you a much better shot at landing your dream home.

The Key Advantages for Dallas Buyers

Beyond just making your offer stronger, a bridge loan brings some very practical perks that smooth out the chaotic process of moving. It gives you the freedom to buy and settle into your new place on your own schedule, taking the pressure off to sell your current home in a hurry.

Here are the main upsides:

- Win Competitive Bids: When you drop the home sale contingency, your offer looks incredibly attractive to sellers. They want certainty and a quick close, and you’re giving them exactly that.

- Avoid a Double Move: You can go straight from your old house to the new one. No need to deal with the headache and expense of finding temporary housing or putting all your stuff in storage.

- Act with Speed: When that perfect home hits the market, a bridge loan lets you pounce on it immediately instead of watching from the sidelines while you wait for your place to sell.

The core value of a bridge loan in Dallas is leverage. It transforms your home equity into immediate financial power, allowing you to negotiate from a position of strength in a market where every advantage counts.

Potential Drawbacks and Financial Risks

Now for the other side of the coin: the costs and the risks. Bridge loans are designed for the short term, and that convenience comes at a price. You can almost always expect to see higher interest rates and origination fees compared to a standard, long-term mortgage.

The biggest risk, without a doubt, is the financial strain of carrying two housing payments at once. If your current Dallas home sits on the market longer than you planned, you could find yourself on the hook for two mortgages. That can put a serious dent in your budget.

This is something you have to think long and hard about, especially as the lending world changes. The U.S. bridge financing market is expected to balloon from $31.3 billion in 2024 to $69.62 billion by 2031—a compound annual growth rate of 14.26%. While new tech is driving this growth, the basic risks haven’t gone away. You can discover more insights about the future of bridge loans and key lending trends to see where things are headed.

Before you jump in, you absolutely must have a solid, realistic plan to sell your existing property within the loan’s term, which is usually somewhere between six and twelve months.

Qualifying for a Bridge Loan in Dallas

So, what does it take to actually get a bridge loan in Dallas? It’s not quite the same as applying for a standard 30-year mortgage. Lenders are taking on a different kind of risk with these short-term loans, so they focus intensely on a few specific things. The process is built for speed, but that also means the requirements are pretty black-and-white.

The absolute number one factor is equity. How much of your current Dallas home do you actually own? This isn’t just a detail; it’s the collateral that backs the entire loan. Lenders need to see a lot of it, typically requiring that your existing mortgage balance is no more than 70% of your home’s current value (a loan-to-value ratio of 70% or less).

Core Financial Requirements

While equity is the star of the show, your personal finances still have to be in order. After all, the lender needs to know you can handle the payments, especially if you end up carrying two housing payments at once, even for a short time in a competitive market like DFW.

Lenders will zoom in on these three areas:

- Strong Credit Score: This is your financial report card. To feel confident, most Dallas lenders will want to see a credit score of 680 or higher.

- Verifiable Income: You’ll need to show a steady, reliable income that can comfortably cover your current bills and the new bridge loan payment.

- Debt-to-Income (DTI) Ratio: This ratio simply compares your monthly debt payments to your gross monthly income. Lenders need to see that you aren’t stretched too thin and can manage the temporary increase in debt.

If this sounds familiar, it’s because these are the same pillars of conventional home financing. In fact, many of the same principles from our guide on mortgage pre-approval requirements are at play here, which really underscores the need for a solid financial footing.

Eligible Properties in the DFW Area

One of the great things about bridge loans in the Dallas area is their flexibility. They aren’t just for that perfect single-owner home in Preston Hollow. Lenders are often open to financing different kinds of properties, as long as they are marketable and have a good chance of selling or being refinanced quickly.

A bridge loan is fundamentally a bet on the value of your current property. Lenders need to be confident that your existing Dallas home can sell quickly and for a price that covers the loan, making its location, condition, and marketability critical parts of the approval equation.

Getting a handle on the bigger picture of real estate financing is always a smart move. For a solid refresher, you might want to check out this article on how to qualify for a mortgage. Many of the core financial principles are the same, and understanding them gives you a clearer view of what any lender looks for when you’re borrowing against real estate.

How to Get a Bridge Loan From a Dallas Lender

Getting a bridge loan in Dallas might sound complicated, but it’s a pretty straightforward path when you break it down. The whole process is built for speed. Lenders focus on the equity in your current home to get you the cash you need, fast. When you know what to expect, it feels a lot less overwhelming.

Your first move is finding a solid Dallas lender who really knows their way around this kind of short-term financing. You want someone who gets the local market. For a handpicked list of the best pros in town, take a look at our guide to the best mortgage lenders in Dallas, Texas. Once you’ve picked a partner, it’s time to get your paperwork in order.

The Five Core Steps to Getting Your Funds

From the first application to getting the money in your account, the process follows a clear path. Each step is designed to confirm you’re a good candidate and secure the loan against your current Dallas home.

Here’s what that five-step journey usually looks like:

- Find a Lender and Apply: First things first, choose a local lender with bridge loan experience and fill out their application.

- Gather Your Documents: You’ll need to pull together key paperwork—think proof of income, bank statements, your current mortgage statement, and details on both the home you’re selling and the one you want to buy.

- Get a Property Valuation: The lender will arrange for an appraisal or a Broker Price Opinion (BPO) on your current home. This is to lock in its market value and figure out how much equity you can tap into.

- Go Through Underwriting for Approval: This is the review stage. The lender’s underwriting team will comb through all your financial documents and the property valuation to give the final green light.

- Close the Loan and Get Paid: Once you’re approved, you’ll sign the final documents. After that, the funds are released, and you’re ready to make a powerful, all-cash-style offer on your new home.

A Realistic Look at the Numbers

It’s really important to understand the costs. Bridge loans typically come with higher interest rates than traditional mortgages—that’s the trade-off for their short-term convenience and the lender’s risk.

Recent Dallas-area data shows the average interest rate for a bridge loan was recently hovering around 10.83%, with most rates landing somewhere between 9% and 12.99%. Keep in mind, these numbers can shift based on the Dallas market and your specific financial situation. To dive deeper into the data, you can read the full research about bridge loan activity and see what’s driving market trends.

Pro Tip: Get pre-approved for your long-term mortgage at the same time you’re applying for the bridge loan. This makes for a seamless switch once you sell your old house and are ready to pay off the short-term loan.

Exploring Alternatives to a Bridge Loan in Dallas

A bridge loan can be a fantastic tool, but it’s not the right fit for every Dallas homebuyer. It’s smart to look at all your options to make sure you’re picking the financial strategy that truly works for your situation and risk tolerance. For many, a more traditional path might be the better way to go.

Your Current Home as a Source of Funds

One of the most popular alternatives is a Home Equity Line of Credit, or HELOC. Think of it like a credit card that uses your current home’s equity as the credit limit. This lets you draw out cash as you need it for the down payment on your new place. The good news? A HELOC usually has lower interest rates and fees compared to a bridge loan.

The big catch, especially in the lightning-fast Dallas market, is the timeline. Getting a HELOC approved and funded can take weeks. That kind of delay can mean losing out on a home in hot areas like Plano or Frisco, where bidding wars are common and properties can go under contract in just a few days.

Another way to tap into your equity is with a cash-out refinance. Here, you’d replace your existing mortgage with a new, larger one, and pocket the difference in cash. It’s a great way to get down payment money, often locking in a good long-term interest rate. But again, speed is the issue. The approval process is just like a regular mortgage—plan on 30 to 45 days—which often isn’t fast enough for a competitive offer. You can dive deeper into how different long-term loans stack up in our guide on a conventional loan vs FHA.

A Simpler, But Riskier, Approach

Finally, you could always make a contingent offer. This is the most straightforward route: your offer to buy the new house is only valid if you successfully sell your current one. While it’s the safest bet for your wallet, it puts you at a huge disadvantage. Most Dallas sellers will pass over a contingent offer in a heartbeat for one that offers a sure thing.

The demand for short-term property financing is exploding. Recent market data shows the total value of bridging loans has crossed the £10 billion mark for the first time ever, which is a massive 28.6% jump in just one quarter. If you’re curious about the bigger picture, you can learn more about these finance market trends.

A Few Common Questions About Dallas Bridge Loans

When you’re thinking about using a short-term loan to buy a home in Dallas, a lot of questions pop up. It’s smart to get straight answers before you jump in. Let’s tackle some of the most common things Dallas homebuyers ask about bridge loans.

How Fast Can I Really Get a Bridge Loan in Dallas?

Speed is the whole point of a bridge loan. A typical mortgage in the Dallas area can drag on for 30 to 60 days, which can feel like an eternity in a competitive market. A bridge loan, on the other hand, can often be funded in just two or three weeks.

How is that possible? It’s because the loan is secured by the equity you already have in your current home, which makes the lender’s approval process much simpler. The exact timeline can vary based on the lender and how fast an appraisal can be done, but it’s this quick turnaround that makes them so useful in Dallas’s fast-paced real estate market.

What If My Old House in Dallas Doesn’t Sell in Time?

This is the big one—the risk you absolutely have to plan for. Bridge loans are built for the short haul, usually with terms running from six to twelve months. If that deadline is getting close and your old place still hasn’t sold, you need to talk to your lender right away.

Some lenders might be willing to grant an extension, but it will almost certainly cost you extra in fees. In a true worst-case scenario, if the loan isn’t paid back when the term ends, the lender could start foreclosure on the property you used for collateral. That’s why you absolutely must have a realistic, conservative game plan for selling your current home before you even think about signing on the dotted line.

A bridge loan is a powerful tool for seizing opportunities, but it demands a solid exit strategy. The loan is a temporary solution, and its success hinges entirely on the timely sale of your original property.

Can I Use a Bridge Loan for a New Construction Home in a Dallas Suburb?

You bet. A bridge loan is a fantastic option if you’re buying a new build in one of the booming Dallas suburbs like Frisco, McKinney, or Prosper. As anyone who has built a home knows, construction schedules can be unpredictable, and delays can easily wreck your plans for selling your old home.

A bridge loan takes that stress out of the equation. It gives you the power to close on your new construction home as soon as it’s finished, without being handcuffed to the sale of your current one. You can lock down your brand-new home and then focus on selling your old one without the crushing pressure of a tight deadline.

Are you ready to make a winning offer on your next Dallas property? The expert team at Dustin Pitts REALTOR Dallas Real Estate Agent can connect you with trusted local lenders and guide you through every step of the process. Visit us at https://dustinpitts.com to create your strategy today.