If you’re trying to get a real feel for the Dallas real estate market, there’s one number that tells you more than almost any other: the absorption rate. This isn’t just industry jargon; it’s a powerful metric that shows you exactly how quickly properties are selling in any given area.

Think of it as the market’s pulse. It tells you whether properties in a neighborhood are getting snapped up the moment they’re listed or if they’re sitting on the market for a while.

Taking the Pulse of the Dallas Real Estate Market

Before you even think about buying or selling in Dallas, you need to understand the local rhythm. Let’s use an analogy. Imagine the total number of homes for sale in a popular area like the M-Streets or Lakewood is a full bathtub. The absorption rate is how fast that water is draining.

If the water is draining rapidly, you’re looking at a hot seller’s market. Demand is intense, and homes are selling fast. But if it’s draining slowly, it’s a cooler market that favors buyers, offering them more choices and better leverage for negotiation. This single number paints a much clearer picture than just looking at listing prices alone.

Why This Number is a Game-Changer

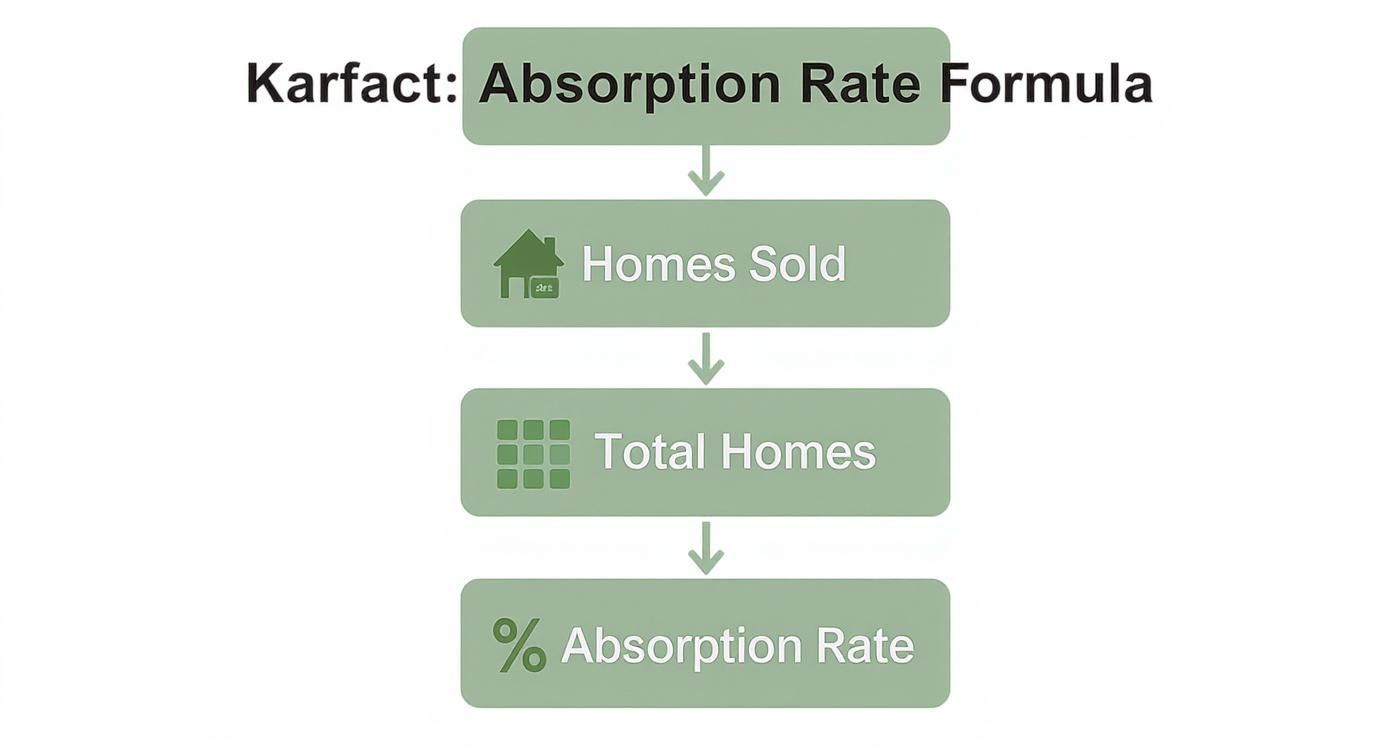

So, what makes this metric so important? It’s a direct reflection of market health. We calculate it by taking the number of homes sold in a specific timeframe and dividing that by the total number of homes currently for sale. The result gives you an instant snapshot of supply and demand. You can find more details about how to calculate this key real estate term on re-leased.com.

Understanding the absorption rate helps you:

- Gauge the Market’s Temperature: Quickly see if a specific Dallas neighborhood is hot, cold, or balanced.

- Spot Emerging Trends: Track whether demand is heating up or cooling down in areas from North Dallas to the Bishop Arts District.

- Make Smarter Decisions: Know if it’s the right time to sell for top dollar or the perfect moment to buy with an advantage.

This one number is the key to understanding who holds the power in the market. To dive deeper, check out our guide on how to tell if it’s a buyer’s or seller’s market.

In short, the absorption rate cuts through all the noise. It translates complicated market activity into one clear, easy-to-understand figure that shows the real relationship between how many homes are for sale and how fast buyers are actually closing on them.

To make it even clearer, let’s break down the components used in the calculation.

Absorption Rate at a Glance

This table simplifies the key elements that go into calculating the absorption rate, giving you a quick reference for understanding the market dynamics in Dallas.

| Component | What It Represents | Example in Dallas |

|---|---|---|

| Homes Sold | The total number of properties that successfully closed within a set period (e.g., the last 30 days). | In May, 150 homes were sold in the Lakewood area. |

| Active Listings | The total number of properties currently available for sale on the market at the end of that period. | At the end of May, there were 300 homes for sale in Lakewood. |

| Time Period | The specific window of time used for the calculation, typically one month. | The calculation is based on market activity from May 1st to May 31st. |

Looking at these pieces together gives you a powerful, data-driven view of what’s really happening on the ground.

How to Calculate the Absorption Rate for Any Dallas Property

So, how do you actually use this concept? You don’t need a math degree to figure it out. Calculating the absorption rate for a specific Dallas neighborhood—whether it’s the trendy Knox-Henderson area or the eclectic Bishop Arts District—boils down to a simple formula and two key numbers.

Think of it as a snapshot of market momentum. You’re essentially just dividing the number of properties sold in a certain timeframe by the total number of properties currently on the market. That simple division reveals the raw relationship between supply and demand.

The Basic Formula

Here’s the formula you’ll use. It’s clean, simple, and powerful.

(Number of Homes Sold ÷ Total Number of Available Homes) x 100 = Absorption Rate (%)

This calculation tells you what percentage of the available housing supply was “absorbed” by buyers during that period. If you want to get comfortable with this and other key metrics, it’s worth brushing up on the essential real estate math formulas that underpin smart investing.

Let’s run the numbers with a real-world Dallas example. Say we’re looking at the townhome market in Knox-Henderson, a consistently hot area.

A Knox-Henderson Case Study

First things first, you need solid data. Your best source is always the Multiple Listing Service (MLS), as it provides the most accurate, up-to-the-minute information. You also need to pick a consistent timeframe—most real estate pros stick to a 30-day period to get a current, relevant picture of the market.

Let’s imagine this is what the MLS data for Knox-Henderson townhomes looks like:

- Homes Sold in the Last 30 Days: 25

- Total Available Townhomes: 100

Now, let’s plug those numbers into the formula:

- Divide sold homes by available homes: 25 ÷ 100 = 0.25

- Convert to a percentage: 0.25 x 100 = 25%

Just like that, we see the absorption rate for Knox-Henderson townhomes is 25%. This isn’t just a random number; it’s a powerful piece of market intelligence. It tells us that a full quarter of all available townhomes in the area were snapped up by buyers in the last month alone. That’s a fast-moving market.

Turning Numbers Into Dallas Market Intelligence

So, you’ve got the calculation down, but what does that number really tell you about the Dallas real estate scene? This is where the magic happens—where raw data turns into powerful, actionable insight. An absorption rate isn’t just a percentage; it’s a vital sign for the market, telling you who holds the cards: buyers or sellers.

Think of it as taking the temperature of a specific Dallas neighborhood. A high rate in a hot area means properties are flying off the market. A low rate suggests things are moving a bit slower, opening the door for negotiation.

This simple infographic neatly sums up the core concept.

It boils down to the relationship between how many homes are selling versus how many are available. That’s the engine driving market speed.

Decoding the Dallas Market: What the Percentages Mean

Different absorption rates paint very different pictures across Dallas-Fort Worth. Generally, the market falls into one of three categories, each with its own playbook for buyers and sellers.

A rate climbing above 20% in a sought-after suburb like Frisco or Plano signals a red-hot seller’s market. In these areas, homes are practically selling the moment a “For Sale” sign hits the yard.

On the flip side, a rate dipping below 15% might point to a buyer’s market, maybe for a niche condo market downtown. In this scenario, buyers have more inventory to choose from and a lot more room to negotiate. The sweet spot—a balanced market where neither side has a clear edge—hovers between 15% and 20%. These benchmarks are essential for understanding the latest Dallas real estate market trends.

To make this crystal clear, let’s break down how these rates define the market for you.

Dallas Market Scenarios by Absorption Rate

| Absorption Rate | Market Type | What It Means for a Dallas Buyer | What It Means for a Dallas Seller |

|---|---|---|---|

| Below 15% | Buyer’s Market | You have the advantage. Expect more choices, less competition, and greater negotiating power on price and terms. | Patience is key. Your property may be on the market longer, and you’ll likely need to be more flexible on pricing. |

| 15% – 20% | Balanced Market | The market is stable. You’ll find a reasonable number of homes, but well-priced properties will still move quickly. | Expect fair offers. Pricing your home correctly is critical to attract serious buyers without leaving money on the table. |

| Above 20% | Seller’s Market | Be prepared to act fast. Bidding wars are common, and you may need to make a strong, clean offer to stand out. | You’re in the driver’s seat. Expect strong interest, quick sales, and potentially multiple offers above the asking price. |

By learning to read these numbers, you can go from just looking at data to truly understanding the pulse of the Dallas market.

Using Absorption Rates for Strategic Dallas Investments

This is where the rubber really meets the road. Grasping what is absorption rate gives you a serious competitive advantage in the Dallas real estate market.

Whether you’re selling a property in Lakewood or scouting investment properties in Las Colinas, this number cuts through the noise. It helps you shift from simply guessing what the market will do to building a real strategy based on hard data.

For sellers, it’s all about timing and pricing. If you see a high absorption rate in your specific neighborhood, you’re in the driver’s seat. It signals you can likely price more aggressively and expect a quick sale. On the flip side, a lower rate might be a sign to price more conservatively to attract buyers and avoid having your home sit on the market for months.

Spotting Opportunities for Investors

For investors, this is where the real magic happens. By tracking absorption rates over time, you can spot trends and find opportunities before they hit the mainstream.

- Identifying Emerging Hotspots: Let’s say you notice a steadily climbing absorption rate in an area like Old East Dallas. That’s a clear signal that demand is heating up, making it a prime spot for future appreciation. Getting in early is how you maximize your returns.

- Assessing Development Risk: If you’re thinking about a new build or a major renovation project, a declining rate should give you pause. It could mean the market is becoming oversupplied, serving as a warning to either proceed with caution or rethink the project entirely.

By analyzing absorption rate trends, you can effectively forecast market shifts, identifying undervalued areas poised for growth while avoiding those that are becoming oversaturated.

This metric becomes even more powerful when you combine it with others. For example, you can learn how to evaluate a property’s profitability by understanding its capitalization rate in our detailed guide.

Ultimately, knowing how to use the absorption rate allows you to make data-backed choices, turning market intelligence into tangible investment success right here in Dallas.

Gauging Market Temperature with Months of Supply

While the absorption rate gives you a percentage, its close cousin—Months of Supply—paints a much clearer picture by putting that data on a timeline. It’s a fantastic metric because it answers one simple, powerful question:

If no new homes hit the market, how long would it take to sell every single property currently for sale?

https://www.youtube.com/embed/BXFLQltEZN8

Think of it this way: instead of a percentage, you get a tangible timeframe. This makes it incredibly easy to wrap your head around the real supply and demand dynamics in any Dallas-Fort Worth neighborhood.

How to Calculate Months of Supply

The math here is refreshingly simple. All you do is take the total number of homes currently for sale and divide it by the number of homes that sold in the last month.

Months of Supply = Total Available Homes ÷ Number of Homes Sold Per Month

This is essentially the inverse of the absorption rate. Rather than seeing what percentage of homes sold, you’re calculating how long the current inventory would last based on the recent pace of sales.

Let’s ground this with a real-world Dallas example. Say we’re analyzing the market for single-story homes in Richardson.

- Total Available Homes: 200

- Homes Sold in the Last 30 Days: 50

Now, let’s plug those into the formula: 200 ÷ 50 = 4 Months of Supply.

What does that 4 really tell us? It means that at the current sales velocity, it would take exactly four months to sell out every single-story home currently listed in Richardson. That one number instantly tells a story about market pressure. A low number suggests a hot market with lots of competition, while a high number points to a slower-paced environment that favors buyers.

Here is the rewritten section, designed to sound like an experienced human expert.

How to Not Get Duped by the Numbers

The absorption rate is an incredibly useful tool, but like any tool, you have to know how to use it right. It’s easy to look at the number and jump to the wrong conclusion, leading to some pretty bad decisions. I’ve seen it happen time and again.

If you want to get a real feel for the Dallas market, you need to steer clear of a few common mistakes that can completely throw off your analysis.

Don’t Fall for the City-Wide Average

This is the biggest mistake I see people make. They pull one absorption rate for all of Dallas and think they have the full picture. Nothing could be further from the truth. Dallas isn’t just one market; it’s a patchwork of dozens of smaller, unique markets, each with its own rhythm.

Think about it: the market for a sleek high-rise condo in Victory Park has almost nothing in common with the market for a classic ranch-style home out in Richardson. A city-wide average might look perfectly balanced, but it could be hiding the fact that one neighborhood is a red-hot seller’s market while another is a sleepy buyer’s market.

A broad analysis can hide critical opportunities or risks. Always calculate the rate for the specific neighborhood and property type you’re interested in—that’s where the true story is.

Remember that Real Estate Has Seasons

Another easy trap to fall into is forgetting about the calendar. Even in a powerhouse market like Dallas, real estate ebbs and flows with the seasons. Spring and summer are almost always busier, with more sales driving the absorption rate up. Come the holidays, things tend to quiet down.

Comparing a rate from May to one from December without accounting for this natural cycle is like comparing apples to oranges. It’ll give you a skewed view of what’s actually happening with market trends.

Use Fresh Data or Don’t Bother

Finally, in a market that moves as quickly as Dallas, old data is basically useless. A market report from just three months ago might as well be ancient history. The ground can shift under your feet that fast.

To get an accurate read on what is absorption rate telling you today, you absolutely must use the most current data you can get your hands on, straight from the MLS. Using fresh numbers means your strategy is built on what’s happening now, not what was happening last quarter.

Got Questions About Dallas Absorption Rates? We Have Answers.

Once you start digging into absorption rates, a few common questions always pop up. Let’s tackle them head-on so you can feel confident whether you’re buying, selling, or just keeping a close eye on the Dallas-Fort Worth market.

What’s a Good Absorption Rate in Dallas?

That really depends on which side of the closing table you’re on.

A “good” rate is all about perspective. If you’re selling a property, an absorption rate soaring above 20% is fantastic news. It means you’re in a hot seller’s market where properties are flying off the shelves.

But for a buyer, a rate that dips below 15% is the sweet spot. This signals that inventory is building up, giving you more options to choose from and a bit more wiggle room for negotiation. A balanced, healthy market usually hovers somewhere in that 15-20% range.

How Often Should I Check the Rate?

If you’re an active player in the market—buying or selling right now—checking the absorption rate monthly is a must. The Dallas real estate market doesn’t stand still; it can shift surprisingly fast.

Relying on last quarter’s data is like using an old map. A quick monthly check-in ensures your strategy is grounded in what’s happening today, not what was happening months ago.

Does the Rate Change for Condos vs. Houses?

Yes, and this is a crucial point. You can’t paint the entire market with one broad brush. It’s essential to look at the specific property type you’re interested in.

The demand for a luxury high-rise condo in Uptown can be completely different from a single-story home out in Plano. Always segment your analysis. A good decision for one isn’t always a good decision for the other.

For anyone looking to get a better handle on how different market metrics work together, this guide on understanding Key Performance Indicators (KPIs) provides some great context.