Picture this: you've finally found the perfect home in a hot Dallas neighborhood like Bishop Arts or Preston Hollow, but there's a catch—you're up against multiple offers. This is exactly the scenario where an escalation clause can become your secret weapon.

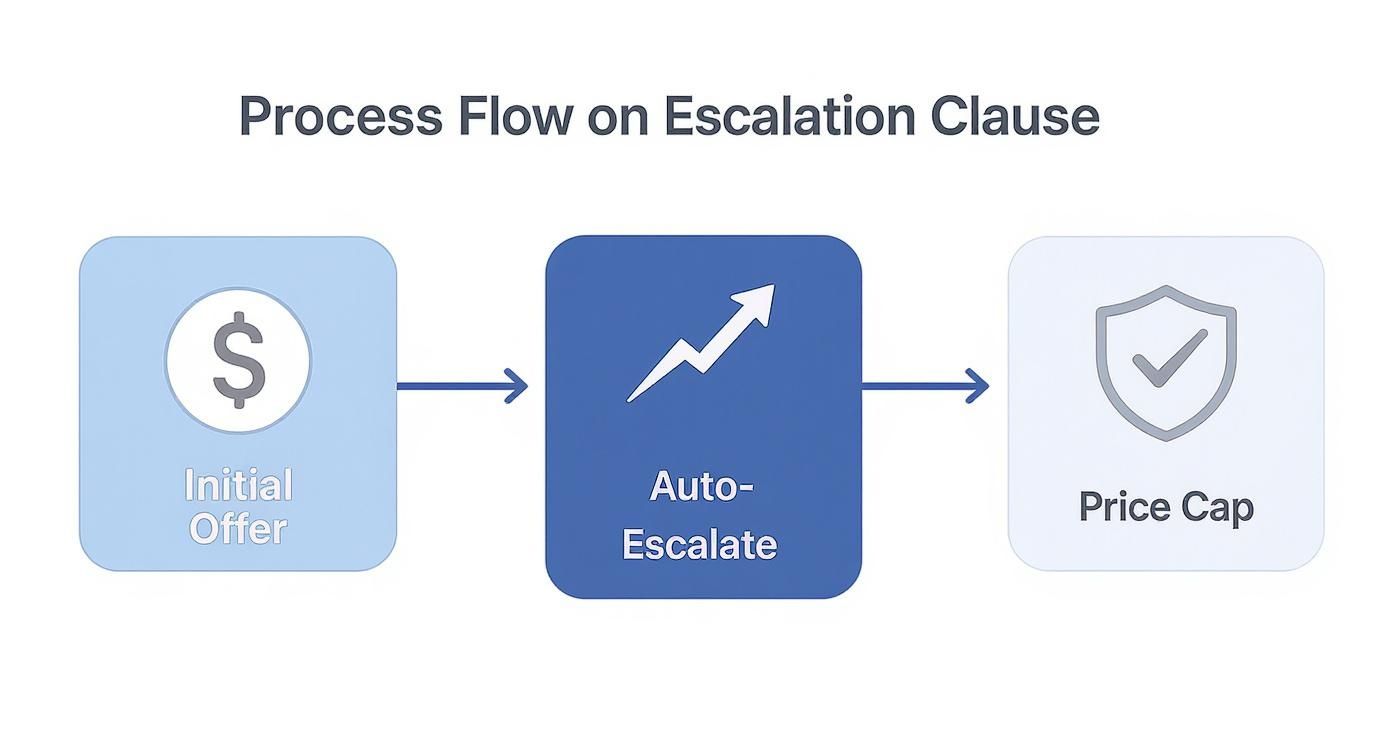

In simple terms, an escalation clause is an addendum you add to your purchase offer that automatically increases your bid to beat out competitors, up to a maximum price you set ahead of time.

Winning Bidding Wars in Dallas Real Estate

Think of it as setting up an automated, smart bidding plan for a house you really want. Instead of getting caught in a stressful cycle of phone calls and counteroffers, you pre-authorize your bid to climb above other offers. It’s a powerful way to show the seller you're serious and ready to compete from the get-go.

In the fast-moving Dallas market, it's not uncommon for homes in prime locations to go under contract in just a few days. This kind of competitive heat makes an escalation clause an incredibly useful tool. The whole point is to make your offer stand out and adapt in a bidding war, helping you win the house without accidentally overpaying in the heat of the moment.

An escalation clause in real estate is a contractual provision that allows a buyer to automatically increase their offer by a certain increment above competing bids, up to a set maximum cap.

This setup gives sellers confidence that you're committed to closing at a competitive price, which is a huge plus in a busy Dallas market where they might be juggling several strong bids at once.

Why This Matters in Dallas

This strategy is especially powerful in what we call a seller's market—a common situation in many popular Dallas-Fort Worth neighborhoods. When there are more buyers than available homes, sellers have the upper hand, making a strong, well-crafted offer absolutely critical.

Knowing how and when to deploy an escalation clause can mean the difference between getting the keys to your dream Dallas home and watching it go to someone else. It's also wise to stay informed about the bigger picture. Keeping an eye on the current real estate market trends can help you decide if now is the right time to use this strategy.

To make it even clearer, let's break down the three core parts of a typical escalation clause.

Escalation Clause At a Glance

The table below gives a quick summary of the essential components.

| Component | Description | Dallas Example |

|---|---|---|

| Initial Offer Price | The starting price of your bid. This is the base amount you are offering for the property. | You offer $500,000 for a home in Lakewood. |

| Escalation Amount | The amount your offer will increase above a competing offer. This is often called the "escalation increment." | You agree to pay $2,000 more than any other bona fide offer. |

| Price Cap | The absolute maximum price you are willing to pay for the home. Your offer will not exceed this limit. | Your maximum price is capped at $525,000. |

With these three pieces in place, you create a dynamic offer that can automatically adjust to the competition, all while keeping you safely within your budget.

How an Escalation Clause Actually Works

So, how does this all play out in the real world here in Dallas? Let's get past the theory and into the nitty-gritty. An escalation clause isn't some complex legal sorcery; it’s actually a straightforward tool built around three key numbers that define your offer's power and its limits.

Think of it as setting up an "if-then" rule for your bid. You’re essentially telling the seller, "I'll pay X, but if you get a higher offer, I'm willing to beat it by Y, all the way up to my absolute maximum of Z." This lets your offer compete automatically in a heated Dallas bidding war without you having to frantically submit a new bid every few hours.

The Three Pillars of Your Offer

For an escalation clause to be effective, it needs to be crystal clear. That means spelling out three specific numbers that leave no room for guesswork. Each one has a critical job to do.

- Initial Bid: This is your starting point. It’s the price you’ll pay for the home if, by some miracle, no one else makes an offer.

- Escalation Amount: This is your secret weapon—the amount you’re willing to jump above the next highest offer. A common increment is $2,000, but it can be whatever you and your agent decide makes sense.

- Price Cap: This is your walk-away number. It's the absolute highest price you will go, no matter how much you love the house. Your offer cannot and will not exceed this ceiling.

These three components work in tandem to create a dynamic, competitive offer.

As you can see, the clause creates an automated bidding path, allowing your initial offer to climb just enough to beat the competition until it hits that non-negotiable price cap.

A Frisco Bidding War Scenario

Let's put this into practice with a classic Dallas-area example. Imagine a hot property hits the market in Frisco, listed at $500,000. You know it's going to be a popular one, so you and your agent decide to go in strong with an escalation clause.

Here’s what your offer looks like:

- Initial Bid: You start with a solid $500,000 offer.

- Escalation Amount: You agree to beat any competing offer by $2,000.

- Price Cap: Your absolute maximum is $530,000.

Soon enough, another buyer swoops in with an offer of $510,000. Your escalation clause immediately kicks in. Your offer automatically bumps up to $512,000 ($510,000 + your $2,000 increment), and just like that, you're back in the lead.

Now, what if a third buyer offers $525,000? Same deal. Your offer automatically escalates to $527,000. But here's where your cap comes in. If a fourth buyer submits a bid for $529,000, your clause would try to beat it, but it would stop at your $530,000 ceiling. In this case, the other buyer would win.

But hold on—how do you know the seller isn't just making up other offers? This is where a crucial piece of the puzzle comes in: verification. The seller must provide you with a copy of the actual, bona fide competing offer that triggered your clause.

This isn't just a courtesy; it's your protection. This proof ensures you’re not being tricked into paying your maximum price and guarantees the entire process is transparent. A well-written escalation clause always includes this non-negotiable requirement.

Gaining a Strategic Edge in the Dallas Market

In the red-hot Dallas real estate market, an escalation clause is one of the sharpest tools in a buyer's toolbox. It gives you a serious competitive advantage without forcing you to lay all your cards on the table from the start. Think of it as a safety net that protects you from immediately overpaying.

Let's say a gorgeous home pops up in a coveted neighborhood like Uptown or Lakewood. You know it's going to get multiple offers. Instead of getting locked into a stressful, drawn-out bidding war, your offer can automatically adjust, keeping you in the game. It’s a clean, efficient way to make your offer stand out.

Why It Makes Your Offer Stand Out

Simply put, an escalation clause tells the seller you mean business. It shows you’re a serious, committed buyer who has done their homework, figured out their finances, and is ready to compete for the property. When Dallas homes are going under contract in a matter of days, this proactive stance can save you from the gut-wrenching feeling of being outbid by a hair.

This isn't just a Dallas phenomenon. In fast-paced markets like ours where inventory is tight, buyers are using creative contract strategies like this to stay competitive. It’s a smart way to handle the pressure.

The real beauty of it is this: you stay in the running as other bids push the price up, but only to a ceiling you've already decided you're comfortable with. Your offer does the heavy lifting, keeping you a top contender without the emotional drain of a back-and-forth bidding war.

Beyond Just the Price

An escalation clause becomes even more powerful when you pair it with other strong components. Imagine presenting a Dallas seller with an offer that’s not just financially competitive but also has a solid financing pre-approval and flexible closing dates. That's an almost irresistible package. Honing your real estate negotiation strategies is key to crafting an offer that truly shines.

For those who want to take it a step further, think about the bigger picture. When you leverage predictive analytics for smarter investments, you can set a much more strategic cap on your escalation clause. Having that data-backed insight into where a Dallas neighborhood's home values are headed gives you confidence in your numbers.

Navigating the Risks and Common Pitfalls

An escalation clause can be your secret weapon in a Dallas bidding war, but it’s not a magic wand. Wielding it without a clear strategy can leave you with a serious case of buyer's remorse and a much lighter wallet. Before you even think about adding one to your offer, you need to understand the potential traps and how to sidestep them.

The single biggest danger? Overpaying. It's easy to get swept up in the heat of the moment and throw out a big number. But your price cap shouldn't be based on emotion; it needs to be grounded in a solid analysis of what similar homes in that specific Dallas neighborhood have recently sold for. Without that data, you're just guessing, and you could end up pushing your final price far beyond the home's actual market value.

The Appraisal Gap Problem

This risk of overpaying leads directly to a very real and expensive problem: the "appraisal gap." This happens when your winning bid, pushed higher by your escalation clause, comes in above the home's official appraised value. Lenders won’t finance a dollar more than what the appraiser says the home is worth, leaving you to cover the difference in cash.

Let's say your offer escalates to $550,000 for a Dallas home, but the appraisal comes back at only $530,000. That creates a $20,000 gap that you have to pay out of pocket on top of your down payment and closing costs. If you don't have those liquid funds ready to go, the entire deal could fall apart.

The core issue with a poorly drafted escalation clause is the potential for an uncontrolled final price. It’s a strategic tool, but without built-in safeguards like a firm cap and necessary contingencies, it can quickly work against you.

Revealing Your Hand Too Soon

Another major pitfall is that an escalation clause immediately tells the seller the absolute most you're willing to pay. You've laid all your cards on the table.

An experienced seller's agent in Dallas might see your cap of $550,000 and just counter at that exact price, even if the next highest offer wasn't anywhere close. By showing your hand upfront, you give up all your negotiating leverage and lose any chance of getting the home for less than your maximum.

A poorly written clause can also open you up to serious legal and financial trouble. A clause without a firm price cap or essential contingencies for inspection and appraisal is a recipe for disaster. You could find yourself legally bound to a price you can't actually afford. You can read more about these potential traps for home buyers on hjlawfirm.com.

At the end of the day, a winning offer is about more than just the final number. To build a truly compelling and secure offer, it's vital to understand all the financial components, including knowing what is earnest money deposit and how it strengthens your position.

Here’s a rewrite of the section, crafted to sound like it was written by an experienced real estate professional.

How to Write an Escalation Clause That Actually Works

Writing a good escalation clause is where strategy meets psychology. It's not just about slapping a higher number on your offer; it's about crafting a bid that’s aggressive enough to win in a hot Dallas market but smart enough to protect your own wallet. A poorly worded clause can backfire spectacularly, either by failing to land you the house or, even worse, tricking you into a massive overpayment.

To get it right, your clause needs to be built on a foundation of solid research and crystal-clear language. This is where leaning on an experienced Dallas real estate agent pays off. They have the on-the-ground knowledge to help you structure an offer that will get a seller's attention for all the right reasons.

Your Checklist for a Bulletproof Clause

Before you sign that offer, run through this checklist. Each one of these elements works together to create a bid that’s not just competitive, but also secure and able to withstand the pressure of a Dallas bidding war.

-

Set a Data-Driven Price Cap: Your "max price" can't just be a number you feel good about. It has to be rooted in a Comparative Market Analysis (CMA) for that specific Dallas neighborhood. Using real data ensures your cap is high enough to be a contender without letting you get swept up and pay more than the home is actually worth.

-

Choose a Clever Escalation Increment: Don't just go with a round number like $2,000. Think outside the box. An increment of $2,100 might be just enough to squeak past a competing offer that has the exact same cap and increment as yours. It’s a tiny detail, but in a close race, it can be the difference-maker.

-

Demand Proof of a Competing Offer: This is non-negotiable. Your clause must clearly state that for your price to go up, the seller has to show you a complete, bona fide copy of the other offer. This is your safeguard against a seller (or their agent) trying to bluff you into a higher price.

A strong escalation clause isn’t just about the money; it's about setting the rules of the game. By demanding proof and setting a firm, data-backed limit, you stay in the driver's seat during even the most intense negotiations.

Don't Let Your Other Contingencies Get Lost in the Shuffle

Remember, an escalation clause is all about the price. You have to be careful that the addendum's language doesn't accidentally wipe out your other critical protections. Your offer should spell out that your inspection, financing, and appraisal contingencies are still in full effect, no matter what the final price ends up being.

This is what saves you from being legally bound to a home with a cracked foundation or one that doesn't appraise. Let's say your offer for a house in Preston Hollow escalates to $575,000, but the appraiser says it’s only worth $560,000. Your financing contingency gives you the power to renegotiate with the seller or walk away, keeping your earnest money safe. Without it, you'd be stuck trying to come up with that $15,000 difference in cash.

When done right, a solid escalation clause lets you make a bold play for the house you want without gambling with your financial future.

When to Use This Strategy and When to Pass

Knowing what an escalation clause is gets you in the game. Knowing when to use it—and when to leave it on the bench—is how you win.

This isn't a tool you pull out for every offer. Wielding it in the wrong situation can actually backfire, weakening your negotiating power or making your offer look less appealing to a Dallas seller who just wants a simple, clean deal.

An escalation clause is built for one specific environment: a red-hot, competitive market where a bidding war isn't just possible, it's practically guaranteed. Picture that perfectly staged home in a prime Dallas spot like the M-Streets or Bishop Arts that just hit the market. When you know offers are going to come flying in, the clause gives you an automated way to stay in the lead.

Ideal Scenarios for an Escalation Clause

This strategy is at its best when a few key ingredients are in the mix. If you can check all these boxes, you've got a prime opportunity to make a dynamic, competitive offer.

- A Trophy Property: The home is priced right, looks great, and sits in a Dallas neighborhood everyone wants. Competition is a given.

- A Classic Seller's Market: Simply put, there are way more buyers looking than homes for sale in that pocket of Dallas. This dynamic naturally creates bidding wars.

- Confirmed Competition: This is critical. Your agent has spoken to the listing agent and confirmed that multiple offers are already on the table or are expected any minute.

In these high-stakes situations, an escalation clause sends a clear signal: you're a serious buyer, and you came prepared to compete. It immediately makes your offer stand out.

When to Hold Back

On the flip side, deploying this clause can be a major tactical error. If a property has been sitting on the Dallas market for weeks, a fancy escalating offer is completely unnecessary. In fact, it gives away your entire hand when you should be negotiating from a position of strength.

You also have to read the room. Some Dallas listing agents and their sellers just don't like them. They can find the mechanics confusing or a hassle, preferring a straightforward, "highest and best" offer situation.

If the seller's agent asks everyone to submit their best shot, listen to them. Trying to get cute with an escalation clause will likely annoy them more than impress them. A strong, simple offer is the smarter play in that scenario.

Got Questions? Let's Talk Escalation Clauses

Even when you've got a great strategy mapped out, it's totally normal to have questions about how an escalation clause actually plays out in the fast-paced Dallas real estate market. This is a nuanced tool, and getting the details right is what makes it work. Let's break down some of the most common things buyers ask.

Can the Seller Just Jump Straight to My Max Price?

You bet they can. This is probably the biggest risk you take when using one. When you write in an escalation clause, you’re essentially laying all your cards on the table, including the absolute highest price you’re willing to pay.

A sharp seller in Dallas might see your cap and decide to just counter right at that number, skipping all the steps in between—even if no other offer was anywhere close. This is where leaning on your agent's gut feeling and local market knowledge is so important to figure out if you're dealing with that kind of situation.

What Happens if Another Buyer Also Has an Escalation Clause?

Now things get interesting. When two offers have escalation clauses, it triggers an automatic bidding war. The outcome almost always comes down to who has the higher cap.

Let’s walk through it:

- Your Max Offer (Cap): $550,000

- Other Buyer's Cap: $545,000

- Your Escalation Increment: $2,000

In this showdown, your offer would beat the other one by escalating $2,000 over their max. You'd likely win the house for $547,000. This scenario really drives home why setting a thoughtful, well-researched cap is the most critical part of the strategy.

Do All Sellers in Dallas Even Like These Things?

Nope, and that's a crucial piece of the puzzle. Some sellers and their listing agents here in the Dallas-Fort Worth area just want to keep things simple. They might ask everyone to submit their "highest and best" offer from the get-go, avoiding the headache of comparing multiple offers with complex, moving parts.

Your agent should be on the phone with the listing agent before you even start writing the offer. Finding out what the seller prefers is key. Trying to force a strategy on a seller who isn't open to it is a surefire way to get your offer pushed to the bottom of the pile.

Knowing the answers to these questions helps you and your agent make a smart call on whether an escalation clause is the right weapon for your arsenal on any given property.

Navigating the competitive Dallas real estate market requires more than just a pre-approval letter; it takes expert guidance. At Dustin Pitts REALTOR Dallas Real Estate Agent, we provide the strategic advice you need to craft a winning offer. Whether you're buying or selling, let us help you achieve your real estate goals.