If you’re looking at income-producing properties in Dallas, the capitalization rate—or cap rate for short—is one of the first metrics you need to get a handle on. It’s a foundational concept that tells you the potential return on a property.

Think of it like a financial speedometer for real estate. The cap rate shows how quickly a property’s income could theoretically pay back its purchase price, giving you a clean snapshot of its annual rate of return before factoring in any loans.

Demystifying The Cap Rate For Dallas Investors

For anyone serious about real estate investing in Dallas, mastering the cap rate isn’t just a good idea; it’s essential. Let’s say you’re weighing two different opportunities: a stock that pays a 5% annual dividend versus a rental property. The cap rate is the real estate world’s version of that dividend yield. It cuts through the noise and shows you the raw profitability of the asset itself.

This metric is incredibly helpful for comparing apples to apples across the sprawling Dallas-Fort Worth market. Whether you’re eyeing a sleek office tower in Uptown, a busy retail strip in Plano, or a massive industrial warehouse near DFW Airport, the cap rate gives you a standardized benchmark. It lets you quickly vet deals and see how the market is valuing different types of assets.

A solid grasp of cap rates also informs your financing strategy. As you explore different rental property financing options, knowing a property’s cap rate helps you project performance and structure a smarter deal.

The Core Formula

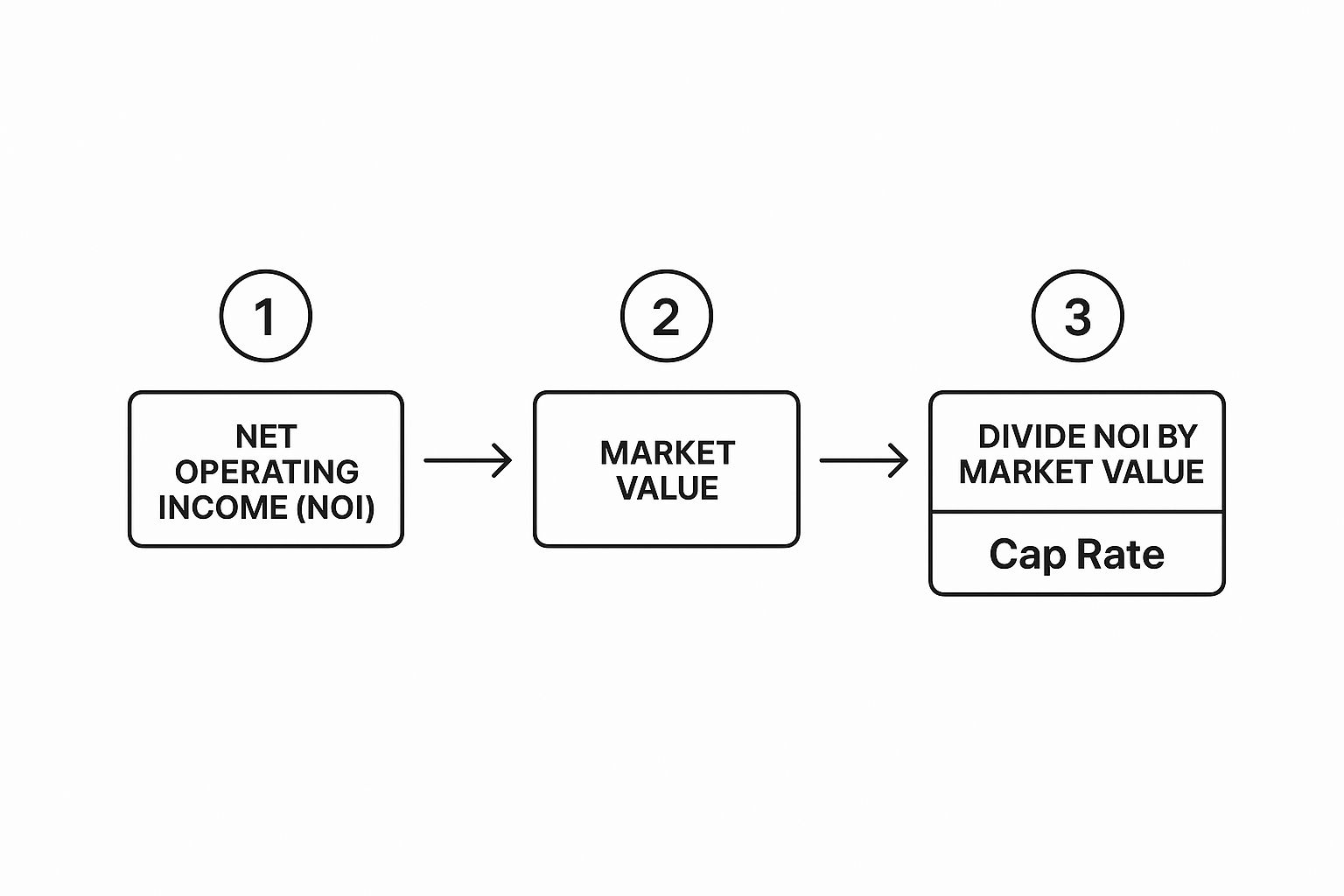

At its core, the cap rate formula is surprisingly simple. It’s all about the relationship between a property’s income and its market value.

This infographic lays out the three key steps to finding it.

As you can see, you figure out the income, divide it by the property’s value, and you get your cap rate. Put formally, the capitalization rate is the ratio of a property’s Net Operating Income (NOI) to its Current Market Value.

For example, if a commercial building in Dallas generates $100,000 in NOI and the market says it’s worth $1,000,000, its cap rate is 10%. Simple as that.

To make it even clearer, here’s a quick breakdown of how these pieces fit together.

Cap Rate At a Glance

| Component | Description | Example (Dallas Property) |

|---|---|---|

| Gross Rental Income | The total rent collected from all tenants over one year before any expenses. | $160,000 annually from a multi-tenant retail space. |

| Operating Expenses | The costs to run the property (taxes, insurance, maintenance, management fees). Does not include mortgage payments. | $60,000 for property taxes, insurance, and upkeep. |

| Net Operating Income (NOI) | Gross Rental Income minus Operating Expenses. This is the property’s pure profit before debt. | $100,000 ($160,000 – $60,000). |

| Current Market Value | The price the property would likely sell for in the current Dallas market. | $1,000,000. |

| Capitalization Rate | The final percentage calculated by dividing NOI by the Market Value. | 10% ($100,000 / $1,000,000). |

This table illustrates how the final cap rate is a direct reflection of a property’s income-generating power relative to its price tag in the local Dallas market.

How to Calculate the Cap Rate Formula

A capitalization rate is only as good as the numbers you plug into it. For investors looking at the Dallas market, getting a firm handle on the two key parts of the formula—Net Operating Income (NOI) and Current Market Value—is absolutely critical for making a smart buy.

Think of the cap rate formula as a simple equation: NOI / Market Value = Cap Rate. The math itself isn’t complex, but the accuracy of your inputs will make or break your entire analysis. Getting these figures right gives you a clean, honest look at a property’s performance before you ever sign on the dotted line.

Calculating Net Operating Income in Dallas

Net Operating Income, or NOI, is the pure, unleveraged profit a property kicks off in a single year. It’s what’s left in the pot after you’ve paid all the necessary bills to keep the lights on and the building running. To figure it out, you take the property’s total potential income and subtract all its operating expenses.

Let’s walk through a quick, hypothetical example using a small apartment complex over in Dallas’s Bishop Arts District.

1. Start with Gross Rental Income

This is the absolute maximum rent you could possibly collect if every single unit was occupied 100% of the time. For our example, let’s say the complex has the potential to bring in $250,000 a year.

2. Subtract Vacancy and Credit Loss

Realistically, no property in Dallas—or anywhere—stays full all year. You have to account for empty units and tenants who don’t pay. A common practice is to subtract a percentage, typically around 5-10% in a stable market like Dallas. If we assume a 5% vacancy rate ($12,500), our effective gross income drops to $237,500.

3. Deduct All Operating Expenses

These are the non-negotiable costs of owning and maintaining the property. They almost always include:

- Property Taxes: A significant expense here in Dallas County.

- Property Insurance: Protecting your asset from the unexpected.

- Maintenance and Repairs: The budget for routine upkeep and fixing what breaks.

- Management Fees: Costs paid to a third party to handle the day-to-day operations.

A classic rookie mistake is throwing mortgage payments (debt service) or major capital improvements, like a brand-new roof, into this calculation. NOI is designed to measure the property’s profitability on its own, completely separate from your financing. Always leave those costs out.

Once you’ve subtracted these expenses, you have your NOI. It’s the single most important number for judging a property’s financial health and is a cornerstone when you calculate return on investment property.

Determining Current Market Value

The other half of our equation is the property’s current market value. This isn’t just the seller’s asking price; it’s what the building is genuinely worth in today’s Dallas market. This value is a moving target, constantly influenced by demand in neighborhoods from Plano all the way down to Oak Cliff.

There are three main ways to pin down this number:

- Comparable Sales Analysis: This is the go-to method in Dallas. You look at recently sold properties that are similar in size, age, condition, and location. It tells you what the market has been willing to pay.

- Professional Appraisal: A licensed appraiser will give you an official valuation based on a deep dive into the property and Dallas market data. If you’re getting a loan, your lender will absolutely require this.

- Market Sentiment: This one is less about numbers and more about the “vibe” of a Dallas neighborhood. Are investors bullish on the area? Is there a lot of new development happening nearby? These factors directly influence what a buyer will pay.

What a Good Cap Rate Looks Like in Dallas

Ask ten real estate investors what a “good” cap rate is in Dallas, and you’ll likely get ten different answers. That’s because there’s no single magic number. A cap rate is entirely relative; think of it as a financial snapshot that tells a story about a property’s risk and potential return. What looks like a fantastic deal to one investor might be a hard pass for another, all depending on their strategy.

A lower cap rate is basically the Dallas market putting a premium price tag on a stable, proven asset. It signals that other investors are lining up to buy, the tenants are reliable, and the location is top-notch. This means the perceived risk is low, but you can also expect a lower immediate cash-on-cash return for your money.

On the flip side, a higher cap rate is often the market’s way of compensating you for taking on more risk. Maybe the property is in an up-and-coming Dallas neighborhood, has tenants with shorter leases, or needs a serious facelift. The higher potential return is the carrot dangling in front of an investor who’s willing to roll up their sleeves and tackle those challenges.

Decoding Cap Rate Tiers in the Dallas Market

To really get a feel for what a cap rate is telling you, it helps to look at how they vary across different property types in the Dallas-Fort Worth metroplex. The number itself is a direct reflection of how confident investors are in that specific asset class and location.

Let’s take a sleek, modern Class A office building in the Dallas Arts District, fully leased with long-term corporate tenants. That property might trade at a pretty low cap rate, maybe in the 5% to 6% range. Investors are happy to pay top dollar for the stability and prestige that comes with an asset like that.

Now, picture an older retail strip center in a developing part of Dallas. That property will almost certainly have a much higher cap rate, possibly 8% or more. That higher number is a clear signal of the risks involved—things like potential tenant turnover or the need for major capital improvements—and it’s there to reward the investor for taking that gamble.

Cap rates aren’t just numbers on a spreadsheet; they are indicators of market sentiment and investment strategy in Dallas. A low cap rate suggests stability and high investor confidence, while a higher rate points to greater risk but also potentially greater reward.

From Frisco Multifamily to Industrial Parks

The sheer diversity of the Dallas real estate market provides a perfect real-world classroom for these dynamics. Multifamily apartment buildings in a booming suburb like Frisco—known for its strong corporate presence—often sell at lower cap rates simply because the demand to own there is so intense.

In contrast, an industrial warehouse in a legacy area like the Great Southwest Industrial Park might have a higher cap rate. While the industrial sector is incredibly strong in Dallas right now, factors like the building’s age, specific location, and tenant quality will ultimately shape its risk profile and, by extension, its cap rate.

Cap rates also tell a story over time, shifting with the broader economy. For instance, low interest rates can push cap rates in prime Dallas markets down, while economic uncertainty can cause them to climb. You can learn more about how capitalization rates reflect market cycles and economic conditions in greater detail.

What Really Drives Dallas Cap Rates?

Cap rates in Dallas aren’t just static numbers on a spreadsheet. They’re alive, constantly shifting in response to what’s happening with the property itself, the local DFW market, and the economy at large. To really get a feel for a deal’s potential, you have to understand what makes these rates tick.

Think of it like this: a cap rate tells a story about risk and reward. The property’s own features are the main characters, the Dallas market is the setting, and the national economy is the plot. Each part plays a crucial role in how the story unfolds.

Let’s break it down.

Property-Specific Characteristics

First, you have to look at the building itself. These are the details that are unique to the asset and give you the clearest picture of its stability and risk.

Here are the big three:

- Location, Location, Location: It’s a cliché for a reason. A retail spot on a busy corner in Uptown Dallas is going to have a much lower cap rate (meaning a higher price tag) than a similar building in a more remote area. Easy access to jobs, highways, and amenities means higher tenant demand and lower risk for you, the investor.

- Tenant Quality and Leases: Who is paying the rent, and for how long? A property with a 15-year lease locked in with a big national brand like CVS or Starbucks is a fortress. It’s safe, predictable, and will have a very low cap rate in the Dallas market. On the flip side, a building full of small tenants on month-to-month leases is a lot more uncertain, so you’ll see a higher cap rate to compensate for that risk.

- Age and Condition: An older building that needs a new roof and HVAC system is a headache waiting to happen. Those future costs are a real risk, so the cap rate will be higher. A brand-new or recently renovated property with no looming repair bills? That’s a much safer bet, and its lower cap rate will reflect that.

Dallas Market Dynamics

Stepping back from the specific property, the overall health of the Dallas-Fort Worth economy sets the stage. A booming local market tends to lift all properties, pushing cap rates down as more money flows into the area chasing deals.

Of course, smart financial management plays a role, too. Taking advantage of crucial tax deductions for real estate investors can boost your net operating income, which directly impacts the cap rate calculation for your specific property.

When an economy is firing on all cylinders with strong job and population growth—just like Dallas has seen for years—it attracts a flood of investment capital. All that competition for a limited number of deals naturally bids prices up and, in turn, pushes cap rates down.

Macroeconomic Conditions

Finally, the big picture stuff—national economic trends, especially interest rates—has a huge say in Dallas cap rates. When the Federal Reserve makes a move, it sends ripples through the entire real estate world.

The connection between interest rates and property values is a simple seesaw. When interest rates go up, loans get more expensive. This cools down buyer demand, which can lead to higher cap rates (and lower property prices) in Dallas. When rates fall, cheaper money fuels a buying frenzy, compressing cap rates. Dallas is not immune to these national trends, and local cap rates often reflect the broader cost of capital and investment sentiment.

Using Cap Rates To Compare Dallas Properties

Alright, now for the practical part. How does this all play out in the real world of Dallas real estate? One of the best ways to use the cap rate is as a quick screening tool. It’s your first pass, helping you compare different deals and get a feel for how the market is pricing them based on the income they produce.

Imagine you’ve got your eye on two totally different investment opportunities in the DFW metroplex. Before you spend weeks digging into the fine print, calculating and comparing their cap rates gives you an immediate gut check on their relative value, risk, and potential.

A Tale Of Two Dallas Assets

Let’s walk through a real-world scenario. To really see the cap rate in action, we’ll put two hypothetical properties side-by-side: a stable apartment building in a quiet Dallas suburb and a trendy retail spot in a bustling, high-energy neighborhood.

- Property A: The Richardson Multifamily Building. Think of a well-kept, fully leased apartment complex in a prime suburban location. It’s in a town known for a strong corporate base, so it generates a steady, predictable income with very little drama or tenant turnover.

- Property B: The Deep Ellum Retail Space. Now, picture a ground-floor retail unit in one of Dallas’s most vibrant, fast-changing areas. The potential income is higher, but it all hinges on the success of a single restaurant tenant who’s on a relatively short lease.

Let’s see how the numbers might look for these two properties.

Here’s a quick breakdown to show you how a savvy investor would line them up.

Hypothetical Dallas Property Comparison

| Metric | Property A (Richardson Multifamily) | Property B (Deep Ellum Retail) |

|---|---|---|

| Purchase Price | $5,000,000 | $2,000,000 |

| Net Operating Income (NOI) | $275,000 | $150,000 |

| Calculated Cap Rate | 5.5% | 7.5% |

Right away, the cap rate tells a story. The Richardson property has a lower cap rate (5.5%). This signals that investors see it as a safe, stable asset—lower risk, but also a lower initial return. The market is willing to pay a premium for that stability.

On the flip side, the Deep Ellum property’s higher cap rate (7.5%) is the market’s way of compensating an investor for taking on more risk. The income depends entirely on one trendy tenant in a location that could change on a dime. Neither property is automatically “better”; they just fit completely different investment appetites.

Understanding The Limitations

As powerful as the cap rate is, it’s not the be-all and end-all. Think of it as a snapshot, not the full movie. It’s your starting point for digging deeper.

The capitalization rate is an essential first-glance metric, but it only tells part of the story. It measures the property’s unleveraged return and does not account for the powerful effects of financing, future rent growth, or potential appreciation.

For instance, the cap rate calculation pretends you paid all cash. It completely ignores how a mortgage can change your returns. A much more detailed analysis would involve using a rental yield calculator to understand your actual cash-on-cash return after financing.

The cap rate also doesn’t see into the future. That riskier Deep Ellum property might offer incredible upside if that neighborhood continues to explode—a factor its current cap rate simply can’t capture. It’s a vital tool, but it’s just one tool in the Dallas investor’s belt.

Common Cap Rate Traps Dallas Investors Fall Into

In a fast-paced market like Dallas, it’s easy to get tripped up by the numbers, and the cap rate is a classic stumbling block. It’s a fantastic tool, no doubt, but if you don’t grasp its subtleties, you can make some serious miscalculations. I’ve seen it happen to both rookies and seasoned pros, so let’s break down the common mistakes to avoid.

Chasing a High Cap Rate

The biggest myth I see is investors thinking a higher cap rate automatically means a better deal. When you see a Dallas property with an unusually high cap rate, your first thought might be “jackpot,” but your second should be “what’s the catch?”

More often than not, that sky-high number is waving a big red flag. It could be pointing to a mountain of deferred maintenance, a building full of non-paying tenants, or a location with serious problems. Always dig deeper to figure out why the rate is so high before you even think about making an offer.

Confusing Cap Rate with Your Actual Return

Here’s another critical distinction: your cap rate is not your return on investment. It’s an unleveraged calculation, which is a fancy way of saying it pretends you bought the property with a briefcase full of cash. It completely ignores your mortgage.

Your real-world profit is measured by your cash-on-cash return. This metric looks at the cash you get back each year compared to the actual cash you put into the deal. In a market like Dallas, a smart financing strategy can make a property with a modest cap rate spit out an incredible cash-on-cash return. The two numbers tell very different stories.

Using a One-Size-Fits-All Cap Rate

Finally, you can’t just slap an “average Dallas cap rate” on a property and call it a day. That’s a recipe for disaster. Dallas isn’t one monolithic market; it’s a patchwork of dozens of unique submarkets, each with its own vibe, risks, and rewards.

Think about it: a sleek Class A office building in Uptown Dallas is going to trade at a completely different cap rate than an older industrial warehouse out in Arlington. Trying to value both with the same number is like comparing apples to oranges—it just doesn’t work.

To get an accurate picture, you have to get granular. Look for comparable sales of similar properties in that exact same neighborhood. This is the only way to make sure your analysis is grounded in reality and you don’t end up overpaying for a deal that looked good on paper.

Common Questions About Dallas Cap Rates Answered

If you’re digging into the Dallas market, you’ve probably got questions about cap rates. Let’s tackle a few of the most common ones that come up.

Where Can I Find Real-World Cap Rates for a Dallas Neighborhood?

A city-wide average for Dallas won’t cut it when you’re looking at a specific deal. To get an accurate cap rate for a neighborhood like Bishop Arts or Las Colinas, you have to go local.

Your best bet is to connect with commercial real estate brokers who live and breathe that specific submarket. Other solid sources include recent appraisal reports and paid data platforms that track verified sales comps. The goal is to find data on properties that are truly comparable to the one you’re analyzing.

Is the Cap Rate My All-In Return on Investment?

Not even close. Think of the cap rate as a snapshot of the property’s raw, unleveraged earning power. It’s a crucial starting point, but it completely ignores the effect of your loan, any future appreciation, or tax benefits.

A simple way to remember it: The cap rate measures the property’s performance, not your performance as an investor. Your actual return comes into focus when you analyze metrics like Cash-on-Cash Return, which accounts for your financing.

Why Do Two Similar-Looking Dallas Properties Have Different Cap Rates?

This is a great question because it gets to the heart of risk assessment. You could have two nearly identical buildings side-by-side in Dallas, yet one trades at a 5% cap and the other at a 6.5% cap. Why the huge difference?

It almost always comes down to the income stream and operational risks. Key factors include:

- Tenant Quality: Is the building leased to a blue-chip national company or a local startup?

- Lease Term: Are the tenants locked in for another ten years, or are leases expiring soon?

- Operating Expenses: Is one building run more efficiently than the other?

- Building Condition: Does one property need a new roof or HVAC system in the near future?

A property with a long-term lease guaranteed by a national brand is considered a safer bet, so investors are willing to pay more for it—which translates to a lower cap rate.

Navigating the Dallas real estate market requires expert guidance. At Dustin Pitts REALTOR Dallas Real Estate Agent, we provide the in-depth analysis and local knowledge you need to make informed investment decisions. Visit us online to explore Dallas properties and connect with an expert today.