Think of an earnest money deposit as a financial handshake. It’s the best way to show a seller in Dallas that you’re serious about buying their property and not just kicking tires.

This deposit is your way of putting some skin in the game, proving you’re a committed buyer ready to move forward with a Dallas real estate purchase.

Understanding Your Good Faith Deposit in Dallas

Once your offer on a Dallas home gets the green light, you’ll be asked to submit this “good faith” payment. It’s important to remember this isn’t an extra fee—it’s actually a portion of the purchase price that you pay upfront.

This gesture is incredibly meaningful, especially in competitive Dallas neighborhoods like Uptown or the M Streets. It tells the seller you’re serious and gives them the confidence to take their home off the market.

Now, you don’t just hand a check over to the seller. Instead, the funds are held safely in an escrow account managed by a neutral third party, like a local Dallas title company. This setup protects your money while all the closing details are sorted out.

The real purpose of an earnest money deposit is to secure the property. It reserves the home for you, giving you the breathing room to get inspections done and lock in your financing without worrying about the seller entertaining other offers.

When you finally get to the closing table, this money comes right back to you. It’s typically applied to your down payment or closing costs, so you’ll have less to pay on the final day. Think of it as the very first financial step toward making that Dallas house your own.

For a quick overview, here’s how earnest money works in a typical Dallas-area transaction.

Dallas Earnest Money Deposit at a Glance

| Characteristic | Brief Explanation |

|---|---|

| What It Is | A “good faith” payment from a buyer to a seller in a Dallas real estate deal. |

| Typical Amount | Usually 1% to 2% of the home’s purchase price in the DFW market. |

| Who Holds It | A neutral third party, like a Dallas title company, in an escrow account. |

| Purpose | Shows the seller you’re a serious, committed buyer ready to close. |

| End Result | The funds are credited back to you at closing (applied to your down payment or costs). |

This deposit is a standard, crucial part of the Dallas home-buying process that provides security for both you and the seller.

How Earnest Money Works in a Dallas Property Deal

Think of an earnest money deposit as the ultimate proof of commitment in a Dallas real estate transaction. It’s more than just a procedural step; it’s a financial promise that protects both you and the seller, creating a necessary safety net while the deal moves forward.

For a Dallas seller, accepting your offer isn’t a small decision. They have to take their property completely off the market, potentially missing out on other great offers while they wait for your deal to close. Your deposit gives them the confidence that you’re a serious buyer and provides compensation if you back out for a reason not allowed in the contract.

What Your Deposit Does for You

For you, the buyer, that deposit is your ticket to securing the property. It essentially “reserves” the home, giving you an exclusive window to handle all the critical steps without worrying that the seller will accept another offer.

This buys you the time you need to:

- Schedule a detailed home inspection in the Dallas area.

- Get the property professionally appraised to verify its market value.

- Work with your lender to finalize your mortgage for the Dallas home.

In a hot market like North Texas, a strong deposit can make your offer stand out from the crowd. Agents who understand how to navigate these competitive situations often use tools and techniques like real estate marketing automation strategies to manage complex deals and client communications effectively.

Putting money down shows you’re not just kicking tires—you’re a committed buyer ready to see the deal through. To a Dallas seller juggling multiple offers, that signal can be the deciding factor.

At the end of the day, your earnest money isn’t just a formality. It’s a strategic move that locks in your claim to the property and ensures both sides are invested in getting to the closing table in Dallas.

Calculating Your Earnest Money Deposit in Dallas

Figuring out the right amount for your earnest money deposit is one of the most strategic moves you’ll make when you put an offer on a Dallas home. The old rule of thumb was pretty simple: 1% of the purchase price. But in the real world of the competitive DFW market, that’s often just the starting point.

These days, especially in sought-after neighborhoods from Preston Hollow to Lakewood, it’s not uncommon to see deposits in the 2% to 3% range. Putting down a larger amount like this does more than just check a box; it sends a clear, powerful message to the seller that you’re a serious buyer with the financial stability to close the deal.

Key Factors Influencing Your Deposit Amount

So, how do you land on the perfect number? It’s less about a strict formula and more about reading the room—or in this case, the Dallas market. The right amount is a blend of strategy and an understanding of the current conditions.

A good Dallas agent will walk you through three critical factors:

- The Price of the Home: It’s simple math—more expensive Dallas homes naturally require a larger deposit.

- The Current Dallas Market Climate: Is it a seller’s market with homes flying off the shelf? You’ll need a higher deposit to stand out. If it’s a buyer’s market, 1% might be perfectly fine.

- How Much Competition You Have: If you know you’re walking into a multiple-offer situation in Dallas, a beefier deposit can be the ace up your sleeve that makes your offer shine.

Let’s put it into perspective. On a $600,000 house in a hot Dallas neighborhood, an offer with a $12,000 to $18,000 (2-3%) deposit is going to look a lot stronger than one with the standard $6,000 (1%). It just screams commitment and financial readiness.

You can see this play out in local market data. There’s a direct link between how competitive a local Dallas market is and the average size of the earnest money deposit. In the most heated Dallas markets, deposits easily hit 3% or more, while things cool down closer to the 1% baseline in less frantic areas. The National Association of REALTORS® offers insights on how market trends impact the home-buying process, which can be applied to local conditions.

At the end of the day, think of your earnest money deposit as more than just a formality. It’s a powerful piece of your negotiation strategy in the Dallas market. A well-calculated, generous deposit can be the single detail that convinces a seller to pick your offer and hand you the keys to your new Dallas home.

The Earnest Money Process From Offer to Closing in Dallas

So, your offer on a Dallas home was accepted—congratulations! Now the real work begins, and one of the very first things you’ll need to do is handle the earnest money deposit. This part of the process moves fast, so it’s important to understand the steps involved to make sure your funds are handled correctly from day one.

Typically, your Texas purchase agreement will give you a pretty tight deadline, often just a few days, to get the money where it needs to go. You don’t just write a check to the seller. Instead, the funds are sent to a neutral third party, which in most Dallas real estate deals is a title company. They’ll hold your deposit safely in a protected escrow account.

Depositing and Tracking Your Funds in Dallas

Think of this escrow account as a secure holding area. The Dallas title company acts like a referee, keeping the money safe until everyone has fulfilled their end of the bargain. This step is a crucial way for you, the buyer, to show the seller you’re serious about the purchase. The money sits in this account until closing day, at which point it gets applied toward your purchase price or closing costs.

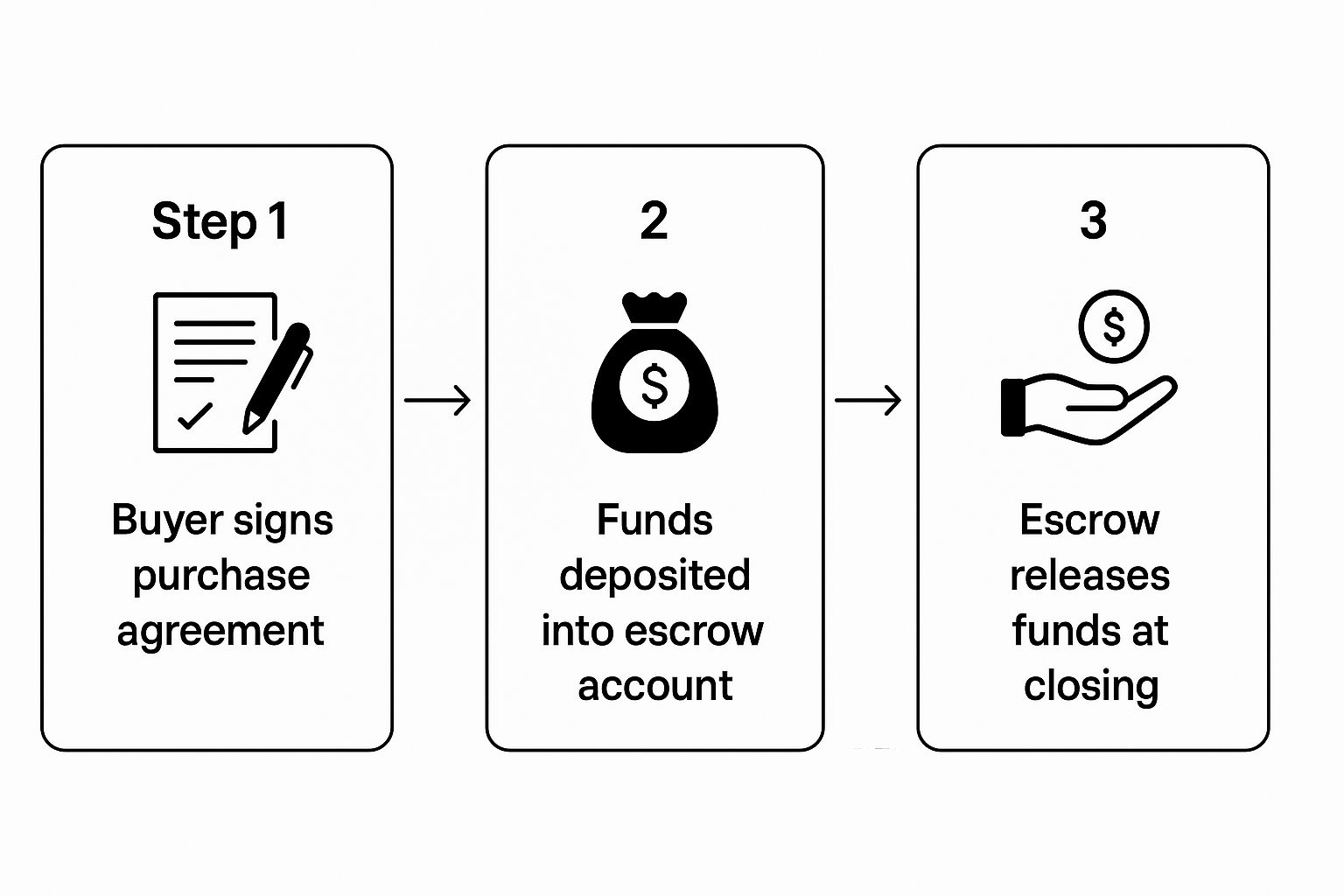

This infographic breaks down the simple journey your earnest money takes in a Dallas transaction.

As you can see, once the contract is signed, your deposit is locked away, completely independent of both you and the seller, until it’s time to close the deal.

Reaching the Finish Line at a Dallas Closing

When you finally make it to the closing table, your earnest money deposit plays its final part. The amount you put down will be credited back to you on the final settlement statement.

Essentially, that deposit reduces the total amount of cash you need to bring to the table to finalize the sale. It’s one of many moving parts, which is why staying organized is so important. Using a comprehensive checklist for buying a new house can make all the difference in keeping everything, including your earnest money payment, right on track for your Dallas purchase.

Safeguarding Your Deposit with Texas Contract Contingencies

Putting down a chunk of cash for your earnest money deposit is a big step, but it doesn’t have to be a nail-biting gamble. The secret to keeping that money safe is hiding in plain sight within your Texas purchase contract: contingencies.

Think of them as your legal safety net. They’re specific conditions written into the deal that let you walk away—with your deposit in hand—if something doesn’t go as planned.

In the fast-paced Dallas real estate market, these clauses are your best friend. They essentially make your deposit refundable if a major roadblock pops up, protecting you from losing thousands over something you couldn’t have seen coming. For an even deeper dive into this, FreedomMortgage.com has some great insights.

It’s crucial to get a handle on how these protections work before you ever put a pen to paper. If you’re new to the process, we break it all down in our guide on what is a real estate contract.

Key Contingencies for Dallas Buyers

There are all sorts of contingencies you can write into an offer, but for anyone buying a home in the Dallas area, a few are non-negotiable. You have to make sure they’re explicitly included in your offer for them to count.

Here are the big three that every Dallas buyer should have:

- Financing Contingency: This is the most common one for a reason. If, for whatever reason, your mortgage application falls through and you can’t secure the loan, this clause lets you back out and get your earnest money back. You just have to make sure you follow the timeline laid out in the contract.

- Appraisal Contingency: Banks won’t lend you more money than a house is actually worth. If the official appraisal comes in below the price you offered, this contingency gives you options. You can try to renegotiate a lower price with the seller, or you can walk away from the deal with your deposit intact.

- The Texas Option Period: This one is a game-changer unique to Texas. The “option period” gives you a set number of days—usually 7 to 10—to do all your homework. This is your window to get a professional home inspection. If the inspector finds something you’re not comfortable with, you can terminate the contract for any reason during this period and get your earnest money refunded.

A word of caution: Contingencies aren’t automatic. They have to be carefully negotiated and written into the purchase agreement. Each one comes with its own strict deadlines, which is why it’s so important to have a sharp Dallas agent in your corner to keep everything on track and protect your investment.

When a Seller Can Keep Your Earnest Money in Texas

While your contract contingencies are a great safety net, they don’t cover everything. There are specific circumstances where a Dallas seller can legally keep your earnest money deposit, and it almost always boils down to one thing: breach of contract.

Think of your earnest money as your promise to uphold your end of the deal. If you break that promise by violating the terms of the purchase agreement, you put those funds at risk.

The Most Common Contract Breaches in Dallas Real Estate

The most straightforward example is simply getting cold feet. If you decide to back out of the purchase for a reason that isn’t covered by one of your contingencies—especially after your option period has expired—the Dallas seller is almost always entitled to keep your deposit.

Missing critical deadlines is another big one. A Texas real estate contract is packed with important dates and timelines. Dropping the ball on any of them can put you in default.

For instance, let’s say your contract states you must apply for your mortgage within five days. If you just don’t get around to it in time, you could be in breach. The seller might then have the right to terminate the contract and keep your earnest money as compensation for their trouble and for taking their home off the market.

This really highlights how binding that purchase agreement is. For a deeper look into the specifics, you can learn more about what happens to earnest money when a deal falls through. Ultimately, staying on top of your responsibilities as a buyer in Dallas is the single best way to protect your deposit.

Dallas Earnest Money: Your Questions Answered

If you’re buying a home in Dallas, you’ve probably heard the term “earnest money” thrown around. It’s a crucial part of the process, but it can be confusing. Let’s clear up some of the most common questions Dallas buyers have.

Is Earnest Money Just Another Name for a Down Payment?

That’s a great question, and the simple answer is no—but they are connected.

Think of earnest money as the “engagement ring” of the Dallas real estate world. It’s the good-faith deposit you put down when you make an offer, showing the seller you’re serious about buying their property. Your down payment, on the other hand, is the much larger chunk of cash you bring to the closing table, which goes directly toward the purchase price.

The good news? Your earnest money almost always gets credited toward your down payment at closing.

What if I Change My Mind? Can I Get My Earnest Money Back?

It really depends on when you change your mind in a Texas transaction.

In Texas, our contracts have what’s called an “option period.” During this short window (usually 7-10 days), you have the unrestricted right to back out for any reason at all and get your earnest money back. This is your time to do inspections and really think things over.

Once that period ends, you can only get your deposit back if a specific contingency in the contract isn’t met. For example, if your financing falls through and you have a financing contingency, you’re protected. But if you just get cold feet after the option period, you’ll likely lose that money.

Who Actually Holds Onto the Money in a Dallas Deal?

Your earnest money doesn’t go directly to the seller. Instead, it’s held by a neutral third party—almost always the title company here in Dallas.

They keep the funds safe and sound in a special escrow account. The money doesn’t move until both you and the seller sign off on releasing it, either at closing or if the contract is terminated.

How Do I Pay the Earnest Money?

While a personal check is sometimes still accepted, it’s becoming less common in Dallas. For speed and security, most Dallas title companies now prefer a cashier’s check or a wire transfer. Your agent will give you specific instructions from the title company once your offer is accepted.

Navigating the details of an earnest money deposit in a fast-paced market like Dallas requires an expert in your corner. At Dustin Pitts REALTOR Dallas Real Estate Agent, we make sure our clients are protected and positioned for success from day one. Visit us at https://dustinpitts.com to see how we can help you with your Dallas home purchase.