The Loan to Value (LTV) ratio is a straightforward but powerful number. It’s simply the percentage of your mortgage loan compared to the property’s appraised value. For any lender in Dallas, this ratio is one of the first things they look at to gauge the risk of your loan.

Unpacking The Loan To Value Ratio In Dallas

Think of LTV like a seesaw. The amount you’re borrowing is on one side, and the property’s actual value is on the other. Your down payment is the fulcrum that brings it all into balance. A bigger down payment means a smaller loan, which pushes your LTV down—and that’s exactly what Dallas lenders love to see.

Whether you’re eyeing a sleek condo in Uptown or a sprawling property in Plano, this single number will shape your entire homebuying experience. It has a direct say in your interest rate, your loan terms, and even the kinds of mortgages you’ll qualify for in the Dallas market.

Core Components Of LTV

At its heart, the loan-to-value ratio shows how much of the property’s value is being financed. Let’s make it real: say you’re buying a Dallas home appraised at $500,000 and you take out a $400,000 mortgage. Your LTV is 80%. It’s that simple. Getting a handle on this calculation is your first step toward understanding what equity is and how you start building it over time.

To give you a clearer picture, here’s a quick breakdown of what goes into the LTV ratio using our Dallas property example.

LTV Ratio At A Glance

| Component | Description | Example (Dallas Property) |

|---|---|---|

| Loan Amount | The total amount of money you borrow from the lender. | $400,000 |

| Appraised Value | The property’s current market value, as determined by a professional Dallas appraiser. | $500,000 |

| Down Payment | The cash you pay upfront. It’s the difference between the value and the loan. | $100,000 |

| LTV Ratio | (Loan Amount / Appraised Value) x 100 | 80% |

As you can see, these components are all interconnected. A change in one, like a larger down payment, directly impacts the final LTV percentage.

For a deeper dive, this guide on key facts about the Loan to Value Ratio is a great resource. It really breaks down how lenders see this number when they’re reviewing your application, giving you a valuable peek behind the curtain.

How to Calculate LTV for Your Dallas Property

Figuring out your LTV is actually more straightforward than you’d think. It’s the key to seeing your mortgage application through a Dallas lender’s eyes, and it all comes down to one simple formula.

The magic formula is: Loan Amount ÷ Appraised Value = LTV.

You take the amount you need to borrow, divide it by the home’s official value, and you get your LTV, which is always shown as a percentage. This little number tells the Dallas-based lender exactly how much of the property’s value they’re being asked to finance.

Now, here’s a crucial detail: lenders work off the official appraised value, not the listing price. The appraisal is an unbiased, professional opinion of what the Dallas property is truly worth, and in the world of mortgages, that’s the number that counts. Especially in a competitive market like Dallas, it pays to understand how this works. Getting a handle on how to determine fair market value can give you a real leg up.

The LTV Formula in Action

Let’s walk through a couple of real-world Dallas examples. You’ll see pretty quickly how your down payment is the main lever you can pull to change your LTV.

Scenario 1: A Townhome in Bishop Arts

- Appraised Value: $450,000

- Down Payment (15%): $67,500

- Loan Amount: $382,500

The math looks like this: $382,500 ÷ $450,000 = 0.85. Pop that into a percentage, and you’ve got an LTV of 85%.

Scenario 2: A House in Frisco

- Appraised Value: $600,000

- Down Payment (25%): $150,000

- Loan Amount: $450,000

Here, the calculation is: $450,000 ÷ $600,000 = 0.75. That gives you a much healthier LTV of 75%.

See the difference? That larger down payment on the Frisco house drops the LTV significantly. A lower ratio like that instantly makes you a less risky, more attractive borrower in a Dallas lender’s eyes, which often translates to better interest rates and terms.

Why Your LTV Ratio Is a Big Deal for Dallas Mortgages

Think of the Loan-to-Value ratio as the first thing a Dallas lender looks at to size up your loan application. It’s not just financial alphabet soup; it’s a quick snapshot of their risk. A low LTV tells them you have more “skin in the game” because you’ve put more of your own money down.

Right away, that signals you’re a serious, lower-risk borrower. For lenders, less risk often means better deals for you. A solid LTV can be your ticket to a lower interest rate, which could save you a small fortune over the life of your mortgage in Dallas.

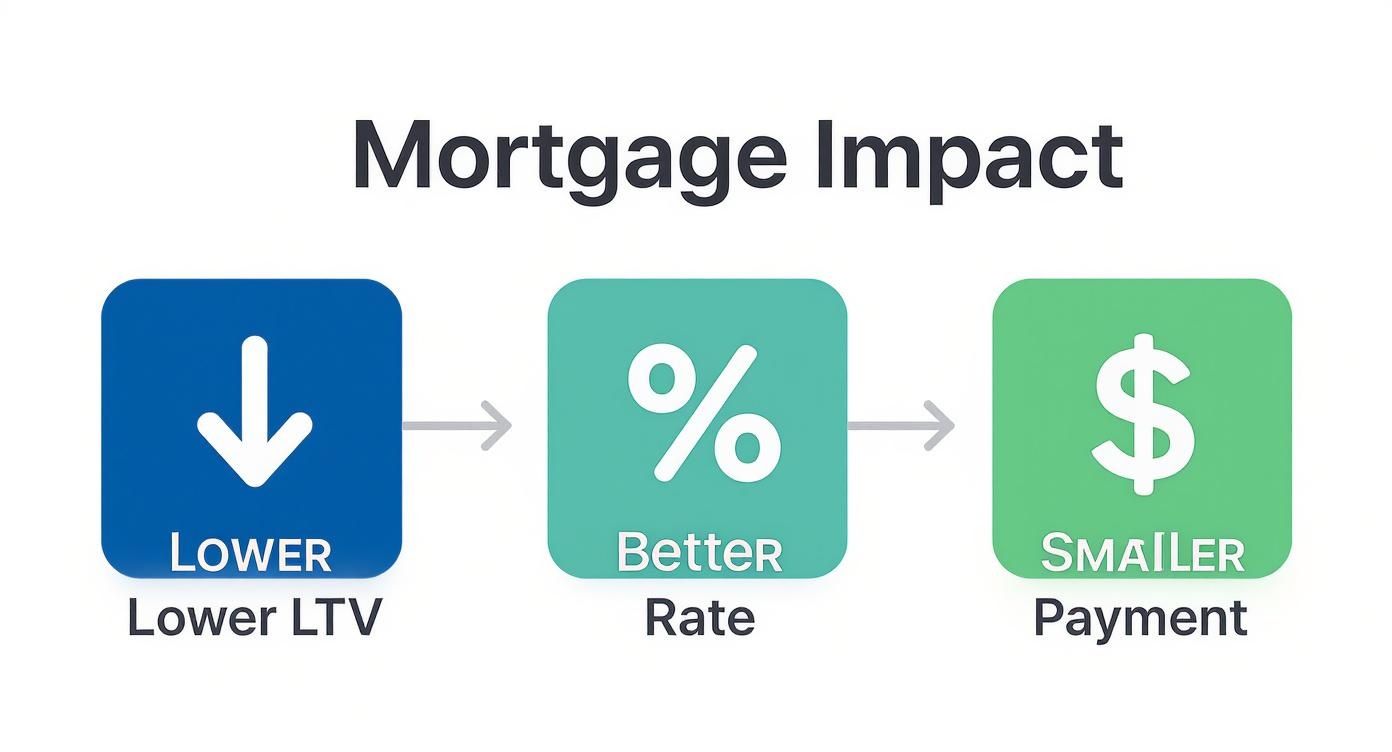

How Your LTV Hits Your Wallet

For anyone buying a property in Dallas, getting a handle on your LTV is crucial. It directly shapes three key financial parts of your mortgage:

- Your Monthly Payment: A lower LTV means you’re borrowing less money. A smaller loan always translates to a smaller monthly payment. Simple as that.

- Total Interest Paid: When you snag a better interest rate because of a good LTV, the amount of interest you pay over the long haul drops significantly.

- Avoiding PMI: This is a huge one. Dallas lenders almost always require Private Mortgage Insurance (PMI) on conventional loans when your LTV is higher than 80%.

PMI is an extra insurance policy you pay for monthly, but it protects the lender—not you—in case you can’t make your payments. By getting your LTV down to 80% or lower, you can dodge this extra cost entirely. You can get the full scoop on our guide that explains what Private Mortgage Insurance is and why it matters.

Keeping Up with Dallas Lending Standards

Lending rules aren’t set in stone; they move with the economy. For a while, with Dallas home values climbing and rates staying low, lenders were a bit more relaxed about LTV requirements. That all started to change around 2022 when economic jitters made them tighten up their lending criteria. This just goes to show how central the LTV ratio is for managing risk, especially in a major market like Dallas. You can discover more insights about these lending trends to see the bigger picture.

The LTV ratio is a powerful lever in your mortgage application. A lower percentage doesn’t just reduce the lender’s risk—it puts you in a much stronger position to negotiate the best possible terms for your new Dallas home.

To really see why LTV is such a game-changer, it helps to understand all the pieces of the puzzle. LTV is just one part of how to qualify for a mortgage, but it’s a very important one.

Real World LTV Scenarios for Dallas Buyers

Knowing the LTV formula is helpful, but seeing how it actually plays out for buyers right here in the Dallas market makes everything click. The loan-to-value ratio you bring to the table has a direct, tangible impact on the mortgage you qualify for, the interest rate you’ll pay, and ultimately, your total monthly housing cost.

Let’s walk through a few scenarios to see how different LTVs can shape the homeownership journey for buyers in various Dallas neighborhoods.

This simple visual really drives the point home: a lower LTV is a win for your wallet.

It all comes down to risk. When you put more of your own money down, the lender’s risk goes down. They reward you for that with better terms. It’s a straightforward trade-off that gives you more control over your finances in the Dallas real estate scene.

Dallas Buyer Scenarios Based on LTV Ratio

To make this concept concrete, let’s compare three different buyers looking for homes across Dallas County. A first-time buyer in Richardson with a small down payment is going to have a completely different financial experience than someone with a large down payment looking in Highland Park.

The table below breaks down exactly how the LTV ratio changes the game for each of them.

| Buyer Profile | LTV Ratio | Likely Loan Type | PMI Required? | Interest Rate Impact |

|---|---|---|---|---|

| Richardson Buyer | 97% | FHA or Conventional 97 | Yes, absolutely. | Higher rate due to the increased lender risk. |

| Lakewood Buyer | 85% | Conventional | Yes, until equity hits 20%. | Standard, competitive Dallas market rates. |

| Highland Park Buyer | 75% | Conventional or Jumbo | No. | Excellent; qualifies for the best rates available. |

You can see the pattern immediately. A lower LTV unlocks better opportunities. The Highland Park buyer with a 75% LTV not only gets to skip PMI entirely but also snags the best interest rates on the market, which will save them thousands over the life of the loan.

On the other end, the Richardson buyer’s 97% LTV is a fantastic way to get into a home with very little cash up front. However, that comes with the trade-off of paying for PMI and a slightly higher interest rate to compensate the Dallas lender for taking on more risk.

Actionable Strategies to Lower Your LTV in Dallas

If your loan-to-value ratio is a bit higher than you’d like, don’t sweat it. You’re in the driver’s seat. The single most effective way to lower your LTV is to increase your down payment, which directly shrinks the amount of money you need to borrow.

Think of it this way: every extra dollar you put down upfront is a dollar you don’t have to finance. This not only chips away at your loan amount but also makes you a much stronger buyer in the competitive Dallas market, signaling to lenders that you’re a lower-risk borrower.

Boosting Your Down Payment

So, how do you beef up that down payment? It comes down to a mix of smart saving and knowing where to look for help. Texas actually has some great programs designed to give homebuyers a leg up.

- Texas Down Payment Assistance: It’s worth exploring what the Texas Department of Housing and Community Affairs (TDHCA) offers. They have programs that can provide grants or low-interest loans to help cover your down payment and closing costs.

- Strategic Savings: Get serious about saving specifically for your Dallas home. Set up a dedicated high-yield savings account and automate your transfers. You’d be surprised how quickly it can grow when you’re not tempted to touch it.

Combining your own disciplined savings with state-level assistance is the fastest route to a larger down payment and, ultimately, a much more attractive LTV ratio in the Dallas market.

Navigating Appraisals and Refinancing

Beyond your down payment, a little strategy goes a long way. When you make an offer on a Dallas home, make sure it’s backed by solid comparable sales in the area. This helps ensure the property appraises for what you’re paying (or even more), keeping your LTV right where you want it.

If you already own a home in Dallas, refinancing is a powerful tool in your belt. As you pay down your mortgage or as your Dallas property’s value appreciates, you can refinance to get a new loan with a lower LTV. This could be your ticket to ditching PMI and even snagging a lower monthly payment.

It’s a good reminder that LTV isn’t a “one-and-done” number set in stone at closing. It’s dynamic and can change with the market. For example, between 2016 and 2018, average LTVs across the euro area fluctuated from as low as 53% to as high as 87%, showing just how much these ratios can shift with economic trends. You can discover more about how LTVs interact with economic trends to see the bigger picture.

Your Dallas LTV Questions, Answered

Navigating the Dallas real estate market means getting comfortable with terms like Loan-to-Value. To help you feel more confident, I’ve put together some straightforward answers to the questions I hear most often from Dallas-area buyers.

What’s Considered a Good LTV Ratio in Dallas?

The short answer? The lower, the better.

If you can hit an LTV of 80% or lower, you’ve reached the gold standard in Dallas. That’s the magic number that lets you sidestep Private Mortgage Insurance (PMI) and usually unlocks the best interest rates lenders have to offer.

But let’s be realistic—not everyone can put down 20%. Plenty of people in Dallas buy homes with higher LTV ratios. Loan programs from the FHA, and even some conventional options, can go as high as 97% LTV, which makes getting into a home much more achievable for those with less cash saved up. An LTV above 80% is extremely common for Dallas buyers and nothing to worry about.

Can I Really Get a Dallas Mortgage with a 95% LTV?

Yes, you absolutely can. Getting a mortgage with a 95% LTV (which is just another way of saying a 5% down payment) is a well-trodden path for buyers in Dallas. Many conventional and government-backed loan programs are built specifically for this situation.

The main thing to know is that a 95% LTV almost always comes with PMI. It’s an extra monthly fee tacked onto your mortgage payment, but it’s not forever. Once you’ve built up enough equity in your Dallas property, you can have it removed.

A higher LTV makes homeownership more accessible with less cash upfront, but it often comes with the added cost of PMI. It’s a balance between upfront savings and long-term monthly expenses.

How Does a Low Appraisal Wreck My LTV?

A low appraisal can definitely throw a wrench in the works for a Dallas home purchase. Lenders are conservative—they calculate your LTV based on the purchase price or the appraised value, whichever is lower.

Let’s play this out. Say you agree to buy a place in Knox-Henderson for $500,000, but the appraiser says it’s only worth $480,000. The Dallas-based lender will now only consider the property’s value to be $480,000.

Suddenly, your numbers are all off. To get the same loan, you’ll need to come up with a much larger down payment to cover that $20,000 gap. Your only other options are to try and renegotiate a lower price with the seller or, if the financing just doesn’t work anymore, walk away from the deal.

Working through the details of LTV in the fast-paced Dallas market is much easier with an expert in your corner. If you want personalized advice for your home-buying journey, connect with Dustin Pitts REALTOR Dallas Real Estate Agent at https://dustinpitts.com.