Seller financing is a creative way to buy a property where the owner basically becomes the bank. Instead of jumping through hoops with a traditional mortgage lender, the buyer makes their payments directly to the person selling the house, based on terms you both agree on. This approach can be a game-changer for getting into hot Dallas neighborhoods, from Oak Cliff to Plano, when a bank loan isn’t an option.

Your Guide to Seller Financing in Dallas

Let’s say you’ve found the perfect place in the Dallas market, but getting a conventional loan is proving to be a nightmare. Seller financing, sometimes called owner financing, opens up another door. The property owner, not a big financial institution, is the one who extends you the credit to buy their home.

This setup completely changes the dynamic of the sale. You, the buyer, make your monthly payments straight to the seller, who gets to earn interest on the loan. It’s a direct deal between two people, which often means more flexibility than you’d ever get from a Dallas bank with its rigid rules and endless paperwork.

The Core Components of the Agreement

At its heart, a Dallas seller-financed deal is built on two critical legal documents that a Texas real estate attorney must draft. Understanding these is essential for both buyers and sellers considering this route.

- The Promissory Note: Think of this as the official “IOU.” It’s a legally binding contract that spells out all the key details: the loan amount, interest rate, payment schedule, and what happens if you, the buyer, miss a payment.

- The Deed of Trust: This is the document that secures the loan. It gives the seller the legal right to foreclose on the property if the buyer defaults on the promissory note. It’s the seller’s safety net.

In essence, seller financing transforms a property owner into a private lender for their own asset. This allows them to create a steady income stream while opening the door for buyers who might not fit the narrow criteria of traditional banks, a common scenario in Dallas’s diverse economic landscape.

This financing method has gained traction not just for residential properties but across the Dallas real estate spectrum. As traditional lending standards have tightened, more investors and business owners are turning to this strategy. Seller financing accounted for 1.9% of all commercial property lending in the first half of 2023—a significant jump from just 0.5% during the same period in 2022. You can learn more about the advantages of seller financing by reading the latest industry insights.

To make sure everyone is on the same page, it’s crucial to understand who is responsible for what.

Key Roles in a Dallas Seller Financing Agreement

This table breaks down the main responsibilities for both the buyer and seller in a typical owner-financed deal here in Dallas.

| Role | Primary Responsibility | Key Document |

|---|---|---|

| Buyer | Makes timely monthly payments as agreed upon. | Promissory Note |

| Seller | Holds the property title until the loan is paid off. | Deed of Trust |

| Buyer | Maintains the property and pays taxes/insurance. | Deed of Trust |

| Seller | Can initiate foreclosure if the buyer defaults. | Deed of Trust |

Having these roles clearly defined from the start helps prevent misunderstandings down the road, ensuring a smoother transaction for everyone involved.

Why It Works in the Dallas Market

In highly competitive Dallas neighborhoods like Uptown or Preston Hollow, seller financing can give both parties a strategic edge. For sellers, it opens up the property to a much wider pool of potential buyers and often leads to a faster sale, since you’re not waiting around for a bank’s slow-moving approval process.

For buyers, it’s a direct path to securing a property, especially if your financial situation—maybe you’re self-employed or have a non-traditional income stream—doesn’t neatly fit into a conventional lender’s box. It’s a powerful tool for navigating one of the most active and exciting real estate markets in Texas.

How a Seller Financed Deal Unfolds in Texas

Knowing the definition of seller financing is one thing, but seeing how it actually comes together in the Dallas real estate market is where it gets interesting. A seller-financed deal moves to a different rhythm than a traditional bank-funded purchase, often with more flexibility and a faster pace.

Let’s walk through what this looks like in practice, from the initial handshake to the day you get the keys.

It all starts with a conversation, not a loan application. The first hurdle is finding a Dallas property where the owner is willing to act as the bank. Usually, this means they own the home free and clear, without a mortgage of their own. This simple fact sidesteps a whole lot of complexity right from the get-go.

Once you’ve found a willing seller, you move into the negotiation stage. This is where seller financing really stands apart. Instead of conforming to a bank’s rigid, one-size-fits-all underwriting box, the buyer and seller can craft a deal that works for both of them.

Negotiating the Terms

This negotiation is the heart of the entire arrangement. It’s where you hammer out the financial DNA of the sale. The main points on the table will be:

- Purchase Price: This will be based on the home’s market value, but the seller might be more flexible given the creative financing structure.

- Down Payment: Sellers will almost always require a down payment. The good news? It can be far more negotiable than the strict 20% minimum many Dallas banks demand.

- Interest Rate: You can expect the rate to be a bit higher than a conventional mortgage. This is how the seller is compensated for taking on the risk a bank normally would.

- Loan Term: You’ll agree on the repayment timeline. This could be anything from a short-term loan with a large “balloon” payment due in a few years to a more traditional, long-term loan that pays off completely over time.

Once you’ve agreed on these points, you need to get them down on paper. A solid grasp of what is a real estate contract is absolutely essential here to make sure everyone’s interests are protected. The beauty of this process is that it allows for creative solutions that fit the unique situations of both the buyer and the seller.

The Legal Framework and Closing Process

With the terms set, it’s time to bring in the pros. Getting Texas legal and title experts involved isn’t optional—it’s the only way to protect everyone and ensure the deal is airtight. A Dallas real estate attorney will draft the two most important documents you’ll sign.

The Promissory Note and the Deed of Trust are the legal pillars of a Texas seller-financed deal. The note is the buyer’s promise to pay, and the deed of trust secures that promise with the property itself, giving the seller recourse in case of default.

At the same time, a local Dallas title company will step in. Their job is to run a deep dive on the property’s history to confirm it has a “clean” title, meaning no hidden liens or ownership claims can pop up later. They’ll also manage the escrow, holding onto all the funds and documents until every last condition of the sale has been met.

The final step is the closing. You’ll sign the last of the paperwork, the deed officially transfers into the buyer’s name, and the deed of trust is recorded with the county. Just like that, the buyer is the new homeowner. The seller now puts on their “lender” hat, ready to start collecting the monthly payments you both agreed upon. This streamlined path, free from the red tape of big banks, is exactly why seller financing remains such a powerful tool in the Dallas market.

The Strategic Advantages for Buyers and Sellers

When it comes to Dallas real estate, seller financing isn’t just a Plan B. For the right buyer and seller, it’s a savvy strategy that can open doors that traditional banks keep firmly shut. This flexible approach creates a unique set of advantages for both sides of the table, especially in a competitive market like ours.

For a buyer, the biggest win is often speed. Imagine finding the perfect spot in a hot Dallas neighborhood like the Design District. Instead of waiting weeks or even months for a bank to go through its slow-motion underwriting, you can close a deal directly with the seller in a fraction of the time. That kind of agility is a game-changer.

On top of that, buyers usually get a break on closing costs. You can say goodbye to bank origination fees, appraisal charges, and all the other administrative costs that financial institutions pile on. This means less cash out-of-pocket, which is capital you can put toward renovations or other investments right away.

Key Benefits for Buyers in Dallas

If you don’t fit into the neat little box that conventional lenders require, the benefits become even clearer.

- Easier Access: Are you an entrepreneur, a freelancer, or someone with a non-traditional income source? Seller financing can be your ticket to property ownership without having to produce years of cookie-cutter W-2s.

- Negotiable Terms: The down payment, interest rate, and even the length of the loan are all on the table. This allows for creative deal structures that you’d never get from a big bank.

- Less Red Tape: With fewer people involved and a lot less paperwork, the whole process is more direct and far less of a headache.

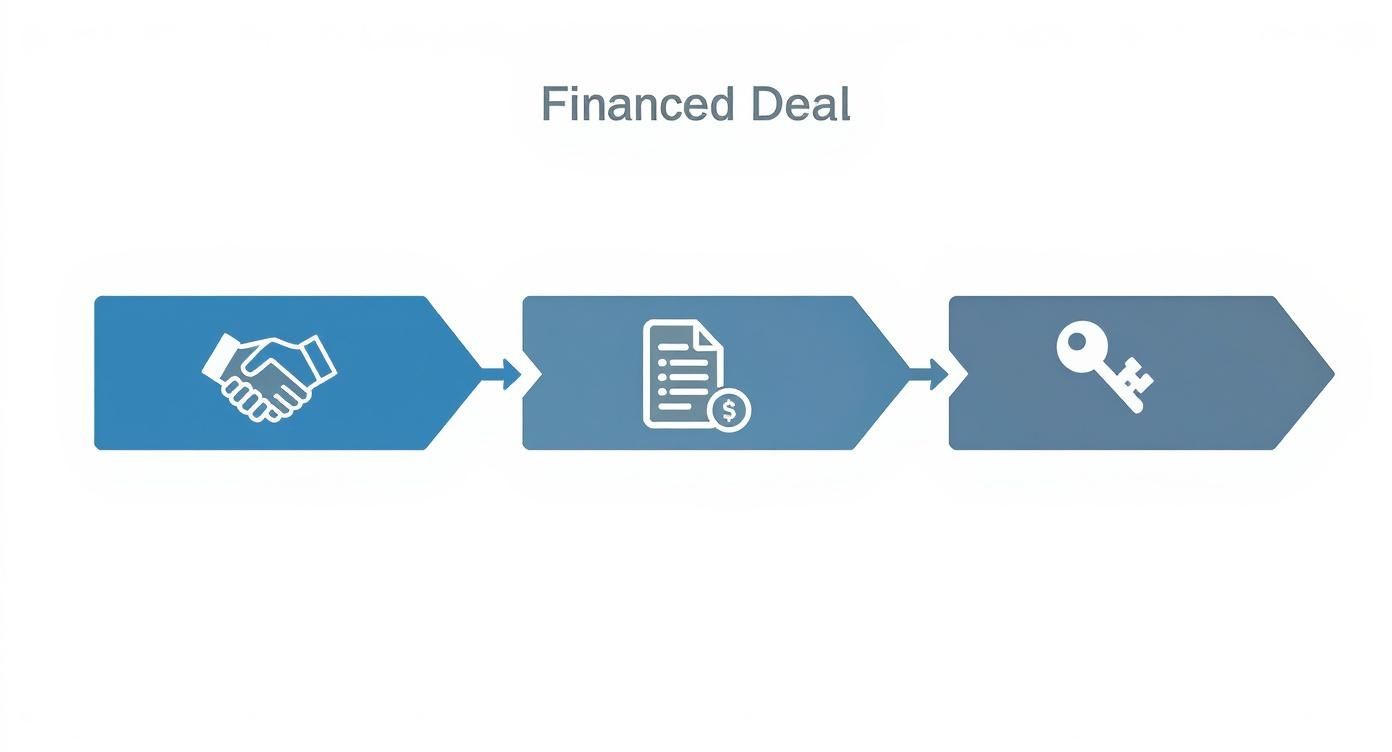

This infographic gives you a quick visual of how a seller-financed deal flows from start to finish.

As you can see, cutting out the institutional middleman is what really speeds up the timeline and simplifies the entire transaction.

Powerful Incentives for Dallas Sellers

Sellers have just as much to gain, especially in sought-after Dallas areas like Lakewood or Uptown. By offering to finance the deal yourself, you immediately broaden your audience to include a larger pool of serious, motivated buyers who might otherwise be on the sidelines. More competition often means you can secure a higher final sale price.

Seller financing isn’t just about selling a property; it’s about transforming an asset into a consistent, long-term income stream.

This is a huge point. By acting as the bank, you create a steady cash flow from the monthly interest payments. Your property’s equity is no longer just sitting there—it becomes a performing asset that generates revenue. To really grasp the power of this, it’s helpful to understand what is internal rate of return and how to calculate the yield on your investment.

This isn’t just a residential strategy, either. It’s a common and powerful tool in the Dallas business world. Data shows that for many mid-sized business sales, seller financing can account for 10% to 30% of the total purchase price. In fact, a massive 85% of buyers see it as a crucial part of making a deal happen. You can find more details on how seller financing impacts business acquisitions on morganandwestfield.com.

To put it all together, here’s a simple breakdown of how this arrangement benefits both parties in a Dallas transaction.

Seller Financing Benefits Buyer vs Seller in Dallas

| Benefit | For the Buyer | For the Seller |

|---|---|---|

| Speed & Agility | Faster closing process gives a competitive edge. | Attracts serious buyers ready to move quickly. |

| Financial Flexibility | Lower upfront closing costs and negotiable loan terms. | Can command a higher sale price due to increased demand. |

| Accessibility | Opens doors for those with non-traditional income. | Creates a wider pool of potential, qualified buyers. |

| Investment Angle | Path to ownership without rigid bank requirements. | Converts property equity into a steady, interest-bearing income stream. |

| Simplicity | Less paperwork and fewer bureaucratic hurdles. | More control over the terms and structure of the sale. |

Ultimately, seller financing is about creating a true win-win. It empowers both buyers and sellers to achieve their goals with a level of creativity and efficiency that the traditional lending market simply can’t match.

Navigating the Potential Risks and Downsides

https://www.youtube.com/embed/rbKccmIW57c

While seller financing can open doors in the Dallas real estate market that would otherwise be closed, it’s not a risk-free path. For both buyers and sellers, it’s crucial to walk into this arrangement with your eyes wide open. Understanding the potential hazards is the first and most important step to protecting yourself and making the deal a success.

For any seller in Dallas, the biggest worry is simple: buyer default. What happens if the buyer just stops paying? Suddenly, you’re not just missing out on income; you’re facing the headache of reclaiming your property through the Texas foreclosure process. It’s a legal maze that can be slow, stressful, and surprisingly expensive—a far cry from the clean break of a traditional sale.

This is why the upfront vetting process is everything. When you offer seller financing, you’re not just a seller anymore. You’re the bank. And you need to think like one, carefully evaluating the buyer’s financial footing.

Risks for the Buyer

Buyers aren’t immune to the risks, either. The convenience of seller financing often comes at a cost, and that usually starts with a higher interest rate. Sellers are taking a gamble that banks won’t, and they’ll price that risk into the loan. You can expect to pay more than you would with a conventional mortgage in Dallas.

Another common catch is the balloon payment. This is a classic feature of short-term seller financing deals. You might have manageable monthly payments for three or five years, but then the entire remaining balance comes due in one massive, lump-sum payment.

A balloon payment isn’t just a final bill—it’s a deadline. You either have to sell the property or get a traditional bank loan to pay off the seller. If you can’t manage either, you could default and lose the home, along with every dollar of equity you’ve built.

This is a make-or-break term in the negotiation. As a buyer, you need to have a rock-solid plan for how you’ll handle that balloon payment when it looms.

The Importance of Due Diligence

Ultimately, the best defense against these risks is a good offense. Both parties have to commit to hammering out an ironclad agreement where every detail is understood. From the interest rate to the consequences of a late payment, nothing can be left ambiguous. This is where you absolutely must conduct thorough due diligence to make sure every angle is covered.

Here’s what to focus on:

- Financial Vetting: Sellers, do your homework. Pull credit reports, verify income, and get a clear picture of the buyer’s financial stability.

- Contract Scrutiny: Buyers, this is not the time for skimming. Get a Dallas real estate attorney to review every word of the promissory note and deed of trust.

- Exit Strategy: Buyers need a realistic plan for that balloon payment from day one. Is refinancing a viable option? What’s your backup plan?

By tackling these potential problems head-on, buyers and sellers in Dallas can craft a seller financing deal that truly works for everyone involved.

Essential Texas Legal and Financial Frameworks

A seller financing agreement in Dallas is far more than a simple handshake deal. It’s a formal, legally-binding transaction that has to play by specific Texas and federal rules. Getting a handle on this legal framework isn’t just a good idea—it’s absolutely essential for protecting both the buyer and seller from expensive headaches down the road.

Federal laws like the SAFE Act and the Dodd-Frank Act lay down the ground rules for how these deals can be put together. Here in Texas, these regulations often dictate whether a seller needs to bring in a licensed Residential Mortgage Loan Originator (RMLO) to prepare the loan documents. The general rule of thumb? If you’re a seller financing more than one property in a single year, you’ll almost certainly need to use an RMLO.

Core Legal Documents in a Dallas Deal

At the heart of any seller-financed transaction, you’ll find a trio of crucial legal documents. Each one has a specific job to do, and all three must be drafted by a qualified Dallas real estate attorney to make sure they hold up in court.

- Promissory Note: Think of this as the IOU. It’s the buyer’s official, written promise to pay back the loan. This document spells out everything: the loan amount, the interest rate, the payment schedule, and what happens if the buyer defaults.

- Deed of Trust: This is the seller’s security blanket. The Deed of Trust secures the loan by using the property itself as collateral. If the buyer stops making payments, this document gives the seller the legal right to foreclose. We cover this in detail in our guide on what is a Deed of Trust.

- Warranty Deed: This is the final piece of the puzzle that officially transfers ownership of the property from the seller to the buyer. To ensure the transfer is clean and legally sound, it’s vital to understand the common Texas property deeds and their implications.

Hiring an experienced Dallas real estate attorney isn’t just an optional expense; it’s the single most important step you can take. They’re the ones who ensure your agreement is compliant, your rights are protected, and the whole deal is structured to avoid future legal battles.

The Scale of Seller Financing

This isn’t some niche strategy; seller financing has a massive footprint. Over the last five years, the total value of owner-financed notes hit an incredible $131.9 billion. What’s really interesting is that 86% of these deals came from sellers who only created one note within a 12-month period. This shows just how popular this approach is for individual property owners in Dallas, not just big-time investors.

For anyone in Dallas thinking about going this route, the takeaway is simple: don’t try to navigate this complex legal maze on your own. The upfront cost of getting professional legal advice is tiny compared to the potential financial and legal disasters that can come from a poorly written agreement.

Got Questions About Seller Financing in Dallas? Let’s Talk Specifics.

Even when you’ve got the basics down, seller financing in Dallas can bring up some very practical questions. It’s a different animal than a typical bank loan, and that’s why it’s smart to dig into the details. Getting clear answers to these common questions can give you the confidence to decide if it’s the right move for you.

Here are some of the most common things both buyers and sellers ask when putting together a seller-financed deal in the Dallas-Fort Worth area.

What Kind of Interest Rate Should I Expect in a Dallas Seller-Financed Deal?

This is usually the first question on everyone’s mind, and for good reason. In a seller-financed arrangement, the interest rate is completely negotiable. There’s no bank setting the terms.

That said, a good rule of thumb is to expect a rate that’s 1% to 4% higher than what you’d see from a conventional mortgage lender in Dallas at that moment. This extra percentage is the seller’s compensation for taking on the risk a bank would normally handle. The final number will come down to things like the buyer’s creditworthiness, how much they’re putting down, and the general vibe of the Dallas real estate market.

Can I Use This for Any Property in the DFW Area?

Pretty much, yes! Seller financing is incredibly versatile and can work for almost any type of property you can imagine across the DFW metroplex. We’re talking about everything from a single-person dwelling in East Dallas to a commercial storefront in the Arts District or even a vacant lot in a booming suburb.

Where it really comes in handy is for properties that are a little… different. Think unique homes that are tough for a Dallas bank to appraise or land deals, which are notoriously difficult to get traditional financing for. The key isn’t the property itself; it’s whether the seller is open to the idea. It works best when they own the property free and clear, with no mortgage of their own.

Seller financing shines brightest where traditional lending falls short. It provides a practical solution for properties that don’t fit into a conventional lender’s rigid approval box, unlocking opportunities for both buyers and sellers across Dallas.

What Happens if the Buyer Defaults on the Loan Here in Texas?

This is the big one, especially for any Dallas property owner thinking about offering these terms. If a buyer stops making payments, the seller doesn’t just get to take the keys back. They have to initiate the formal Texas foreclosure process to legally reclaim the property.

Make no mistake, this is a serious legal procedure. It can be expensive and drag on for a while. This is precisely why it’s non-negotiable for a seller to have an ironclad deed of trust and a professionally drafted promissory note. These documents, prepared by a Texas real estate attorney, are the seller’s armor—they clearly lay out the right to foreclose and take back the property if the buyer doesn’t hold up their end of the bargain.

Navigating the complexities of the Dallas real estate market requires local expertise. For personalized guidance on buying or selling, connect with Dustin Pitts REALTOR Dallas Real Estate Agent at https://dustinpitts.com.