Getting the right financing for a multi-unit property in Dallas is more than just finding a loan. It’s about learning to navigate a very distinct and fast-paced market.

The truth is, a one-size-fits-all approach just won’t cut it in the Dallas-Fort Worth metroplex. Local dynamics have a huge impact on lender decisions, and your success really comes down to matching your specific project to the right type of loan, whether that’s from a conventional bank or a government-backed program.

Your Guide to Dallas Multi-Unit Financing

To successfully finance a multi-unit deal in Dallas, you have to get a solid grip on the local lending scene. This isn’t just about chasing the lowest interest rate; it’s about understanding which properties catch a lender’s eye and, more importantly, why. The Dallas real estate game has its own set of rules and opportunities that you won’t find in other big cities.

For example, a lender will view a property in a high-growth pocket like Uptown or a booming suburb in Collin County very differently than one in a more established, slower-growth neighborhood. Lenders are dialed into local economic stats, job growth, and population shifts across the DFW metroplex. This hyper-local focus means your financing strategy needs to be just as specific.

Understanding the DFW Market Dynamics

The Dallas-Fort Worth market has shown incredible resilience, with rental housing demand that just doesn’t quit. This is fueled by strong demographic trends, a notoriously tight for-sale housing supply, and a steady stream of new residents moving to the area. For real estate investors, this robust demand creates a pretty favorable environment for securing a loan.

Of course, the national economic climate always plays a part. After a stretch of high interest rates in 2023 and 2024, the outlook for 2025 is showing real signs of a comeback.

Nationally, the multifamily origination volume is projected to reach between $370 billion and $380 billion in 2025. This rebound is being driven by deals that were put on hold re-entering the market and a growing need for refinancing as older loans come due.

This forecast points to a more active lending environment, which is great news for investors here in Dallas. Things like stabilizing property prices and cap rates are also supporting this positive trend. While supply has been an issue, it’s expected to ease up, which should only strengthen the market further. You can dive deeper into these trends in the 2025 Multifamily Outlook from Freddie Mac.

To help you get a quick overview of what’s out there, here’s a look at some of the common loan types for Dallas multi-unit properties.

Dallas Multi-Unit Loan Options at a Glance

This table breaks down the main financing paths for multi-unit deals in Dallas, highlighting what they’re best for and what to expect.

| Loan Type | Best For | Typical Loan-to-Value (LTV) | Key Consideration |

|---|---|---|---|

| Conventional Bank Loans | Stabilized properties; borrowers with strong financials and existing bank relationships. | Up to 75-80% | Terms can be more flexible, but often require a strong local track record. |

| Fannie Mae & Freddie Mac | Larger, stabilized properties (5+ units); long-term, fixed-rate financing. | Up to 80% | Standardized process, but can be complex and requires pristine property financials. |

| FHA/HUD Loans | Value-add projects, new construction, and affordable housing; high-leverage financing. | Up to 85-90% | Longer closing times and more red tape, but offer very attractive, non-recourse terms. |

| Bridge Loans | Quick acquisitions, repositioning a property, or when conventional financing isn’t an option. | Up to 70-75% | Short-term (1-3 years) with higher interest rates; used to “bridge” to permanent financing. |

| Local Credit Unions | Smaller multi-unit properties (2-10 units); investors looking for a personal touch. | Varies, often up to 80% | Tend to be relationship-focused and may offer more creative or flexible solutions. |

Think of this table as your starting point. Each option has its own set of hoops to jump through, but knowing the landscape is the first step toward picking the right one for your deal.

Why a Local Focus is Critical

To win at financing a multi-unit property in Dallas, you have to start thinking like a local lender. That means digging into the details:

- Submarket Nuances: Lenders don’t just see “Dallas.” They see Frisco, Plano, Bishop Arts, and Richardson, and they scrutinize each one based on its specific growth trajectory and tenant demand.

- Asset Type Preference: Some lenders are all about stabilized, cash-flowing assets. Others might be more willing to take a chance on a value-add project in a transitioning neighborhood like East Dallas.

- Relationship Banking: This is Texas, after all. Many local and regional banks prioritize relationships, often giving more flexible terms and a smoother process to borrowers they know and trust.

Consider this your foundational briefing on these market dynamics. Once you understand how the big-picture trends and the specific Dallas-area factors play together, you’ll be in a much stronger position to build a financing strategy that turns your investment goals into a reality.

Unpacking the Top Loan Products for Dallas Investors

When you’re ready to finance a multi-unit property in Dallas, your success hinges on matching the right loan product to your specific deal. This isn’t just about textbook definitions; it’s about understanding how these loans actually perform in the real world—whether for a stabilized asset in Plano or a value-add project over in Fort Worth.

Choosing the wrong product can bring your deal to a screeching halt. Even worse, it can saddle you with bad terms that slowly bleed your returns dry. Think of your financing as a strategic tool, every bit as important as the property itself.

Conventional Commercial Loans

For many investors, conventional commercial loans are the natural first thought when it comes to financing multi family property. These are the workhorse products you’ll find at local Texas banks, regional institutions, and even the big national players.

The biggest plus here is the potential for better interest rates and more flexible terms, especially if you already have a relationship with the bank. But don’t expect a cakewalk. Dallas lenders will put your financials, your track record, and the property’s performance under a microscope. They want to see a solid history and a crystal-clear plan for the asset.

If you’re looking at a stabilized property in a great Dallas submarket with high occupancy and strong cash flow, a conventional loan is often the most direct and cost-effective path forward. They simply love proven assets and experienced operators.

Government-Backed Agency Loans

Once you start looking at larger properties (typically five units and up), the game changes. This is where Government-Sponsored Enterprise (GSE) loans from Fannie Mae and Freddie Mac become incredibly powerful options. These are famous for offering very attractive, long-term, fixed-rate financing that gives you incredible stability and predictability.

Now, the process is highly standardized, but that also means it can be more complex and take longer than getting a conventional loan. The property has to be in excellent shape with a strong, documented operating history. Lenders using these programs are sticklers for detail, so your paperwork has to be absolutely perfect.

A huge priority for these agencies in the Dallas market is supporting workforce housing. This public policy alignment can unlock major opportunities if your property serves this demographic.

The Federal Housing Finance Agency (FHFA) really put its money where its mouth is on this. For 2025, they’ve set the multifamily loan purchase caps for Fannie Mae and Freddie Mac at a whopping $73 billion each. That creates a $146 billion liquidity pool. And here’s the kicker: at least 50% of those loans must be “mission-driven,” with specific carve-outs for workforce housing loans. This is a direct capital pipeline for properties that fit the bill in major markets like Dallas. You can see how the 2025 multifamily loan caps are structured for yourself.

This makes agency debt a brilliant strategic move for investors buying or refinancing properties that house moderate-income renters right here in the DFW area.

Short-Term and Specialty Financing Options

Of course, not every deal is a perfect fit for a conventional or agency loan. Sometimes you need more speed or creativity, and that’s where bridge and hard money loans enter the picture.

- Bridge Loans: Let’s say you find a fantastic value-add opportunity in a neighborhood that’s turning around, like parts of East Dallas. The property needs a major facelift before it can qualify for permanent financing. A bridge loan gives you the short-term cash (usually for 1-3 years) to buy and fix up the property, “bridging” that gap until you stabilize it and can refinance into a long-term loan.

- Hard Money Loans: These are all about the asset. Lenders focus almost entirely on the property’s value instead of your personal credit score. They’re fast, but they are expensive. A hard money loan can be your ace in the hole for a quick-close situation where you have to move in days—not weeks—to beat competing offers. The plan is always to secure the deal, then quickly refinance into a more traditional, cheaper loan.

For these kinds of plays, knowing the local market is everything. Taking the time to explore a guide to Dallas’s top neighborhoods can give you the ground-level intel you need to spot where these value-add projects make the most sense.

Here’s a quick breakdown of where these specialty loans shine:

| Loan Type | Primary Use Case | Key Feature | Ideal Dallas Scenario |

|---|---|---|---|

| Bridge Loan | Renovating and repositioning a property | Short-term financing (1-3 years) to prepare an asset for permanent debt. | Buying a dated apartment complex in Oak Cliff to modernize and increase rents. |

| Hard Money Loan | A rapid, competitive acquisition | Extremely fast closing time, based on the property’s after-repair value (ARV). | Securing a highly sought-after duplex in a hot market before another buyer can. |

At the end of the day, the “best” loan is simply the one that clicks perfectly with your investment strategy, the property’s current state, and what you hope to achieve in the dynamic Dallas market.

Meeting Lender Qualification Standards in DFW

Getting a “yes” from a multi-unit lender in the Dallas-Fort Worth market isn’t just about having a good deal on paper. It’s about presenting a complete borrower profile that shows you’re the right person for them to back right now. They’re not just underwriting a property; they’re investing in your ability to execute a business plan in the DFW arena.

To successfully finance a multi family property, you need to pull back the curtain on their underwriting process. This means getting a firm grasp on the key metrics they live by and positioning your deal to meet their strict criteria. It’s a three-pronged approach: the property’s performance, your personal financial strength, and your track record.

The All-Important Debt Service Coverage Ratio

The first metric any Dallas lender will drill down on is the Debt Service Coverage Ratio (DSCR). It’s a straightforward calculation—the property’s annual Net Operating Income (NOI) divided by its total annual mortgage payments—but it’s the number one sign of a property’s ability to pay its own bills.

A DSCR of 1.0x means the property is breaking even, with zero room for error. Lenders hate that. They need to see a cushion, which is why most DFW lenders will require a DSCR of at least 1.20x to 1.25x.

But this isn’t a static number. A lender might be willing to accept a slightly lower DSCR on a pristine, Class A property in a hot Dallas suburb with proven rent growth. On the flip side, they’ll likely demand a higher ratio, maybe 1.30x or more, for an older, value-add property in a less established area. It’s all about balancing risk.

Understanding this ratio is non-negotiable for investors. If your property’s NOI is $100,000 and your total annual mortgage payments are $80,000, your DSCR is 1.25x ($100,000 / $80,000). This simple math is the foundation of your loan application’s strength.

To get ahead, it’s incredibly valuable to see your deal through the lender’s eyes. A great way to do that is to learn the ins and outs of their process, and this guide to commercial real estate underwriting is an excellent starting point.

Liquidity and Net Worth Requirements

Beyond the property itself, lenders need to know you are financially solid. They will look closely at your personal liquidity (cash and easily accessible assets) and your total net worth. These goalposts are directly tied to the size and risk of the loan you’re asking for.

Here’s what to expect in the Dallas market:

- Post-Close Liquidity: Lenders want to see you have enough cash left after closing to cover several months of mortgage payments. A common requirement is having 6-12 months of principal and interest payments sitting in reserve.

- Net Worth: Many lenders require your personal net worth to be equal to or greater than the total loan amount. So, for a $2 million loan on a property in Richardson, the lender will likely expect the sponsorship team to have a collective net worth of at least $2 million.

This isn’t just a box-checking exercise. It’s their assurance that if the property hits a rough patch—like unexpected vacancies or a major capital expense—you have the financial runway to keep the loan current and protect their investment.

Building Credibility with Your Track Record

Your experience as a real estate investor is a massive piece of the puzzle. If you have a portfolio of successfully managed properties, you’re already speaking their language. But what if you’re just starting out?

Don’t panic. Lenders will still consider new investors, but you have to be proactive about building credibility.

- Start Small: Successfully managing a duplex or a four-plex is the best way to build a real-world resume that a lender can look up and verify.

- Assemble a Strong Team: If you lack direct experience, partner with people who have it. Bringing on a highly-regarded Dallas property management company or partnering with a seasoned investor can dramatically strengthen your loan application.

- Create a Detailed Business Plan: Your loan proposal needs to tell a compelling story. Show the lender you’ve done your homework on the specific Dallas submarket, understand the local tenant base, and have a clear, data-backed plan to operate the property successfully.

Ultimately, Dallas lenders are looking for sponsors who are organized, financially prepared, and deeply knowledgeable about the local market. By focusing on your DSCR, shoring up your financials, and thoughtfully presenting your experience, you can build the kind of borrower profile they are eager to fund.

Assembling Your Winning Loan Package

A well-crafted loan package is much more than a folder of documents; it’s your deal’s first impression. In a competitive market like Dallas, a weak or incomplete package gets shoved to the bottom of the stack. A professional, compelling one? That can put you miles ahead of other investors.

This isn’t just about checking boxes. It’s about telling a convincing story that gives lenders unshakable confidence in you and your project. Think of it as the ultimate sales pitch for your deal. You’re not just asking for money—you’re proving you’re a low-risk, high-potential partner. This is especially true when financing a multi family property in DFW, where lenders have seen it all and can spot an unprepared borrower from a mile away.

Crafting a Compelling Executive Summary

The executive summary is, without a doubt, the most critical part of your loan package. It’s the very first thing an underwriter reads, and it sets the tone for your entire request. A dry, fact-only summary will get skimmed. A well-written narrative that connects the dots will grab their attention and make them want to learn more.

Your summary has to tell a story. It should concisely explain the investment opportunity, your strategy for the property, and why you are the right person to pull it off. This is your chance to link your project to the specific, real-time dynamics of the Dallas market.

For instance, don’t just state the property’s address. Explain why that specific location is a brilliant investment. You could point to recent job growth announcements in Frisco, new corporate HQs moving near Richardson, or infrastructure projects that will directly benefit your chosen submarket. This shows deep local knowledge and backs up your financial projections with real-world data.

Essential Documents and Pro-Level Tips

While the summary is the star, your supporting documents provide the proof. Your package has to be organized, complete, and dead simple for the lender to review. Missing information is a huge red flag that just screams disorganization.

Here are the core components every winning loan package needs:

- Personal Financial Statement (PFS): This document gives the lender a clean snapshot of your assets, liabilities, and net worth. Be thorough and completely honest.

- Real Estate Schedule: A detailed list of all properties you currently own. This needs to include purchase price, current value, debt, and cash flow for each.

- Property Proforma: This is your detailed financial forecast for the property. It must include projected income (rents, other fees) and all operating expenses (taxes, insurance, maintenance, management). Always use conservative numbers backed by market data—lenders will absolutely stress-test your assumptions.

- Property-Specific Information: This includes the current rent roll, historical operating statements (if you can get them), and professional photos of the asset.

A crucial part of assembling your loan package is conducting thorough due diligence before you even submit it. To ensure your package is comprehensive, gaining a deep understanding of what this entails is essential. Reviewing a complete guide to the due diligence process will help you anticipate lender questions and prepare bulletproof documentation.

Justifying Your Projections with Dallas Market Data

Your proforma is where you prove the deal makes solid financial sense. Lenders will pick apart your rent growth and vacancy assumptions, so you have to justify these numbers with hard data from the specific Dallas submarket where your property is located.

Forget generic assumptions. Cite specific, comparable properties. For example, if you’re projecting a 5% rent increase on a property in Plano, you should include a list of nearby properties that have recently achieved similar or even higher rents for comparable units.

While securing financing for a multi-unit investment is a different beast than buying a personal residence, understanding the local market fundamentals is a common thread. You can get a feel for some of these foundational concepts in our guide on what you need to know about buying in Dallas to build a more well-rounded perspective. This level of detail shows you’ve done your homework and aren’t just guessing. It transforms your request from a hopeful ask into a well-researched, undeniable business proposal.

Choosing the Right Lender for Your Dallas Deal

In the Dallas-Fort Worth market, picking a lender for your multi-unit property is so much more than just a transaction. Think of your lender as a strategic partner. The right one can unlock opportunities you didn’t even see, while the wrong one can stall your project before it even gets off the ground. This choice directly impacts your entire investment plan, making it one of the most critical decisions you’ll make when financing multi family property.

The lending scene in Dallas is incredibly diverse. You’ve got everything from massive national banks to relationship-focused Texas regional players. Each has its own appetite for risk, preferred deal size, and familiarity with DFW’s unique submarkets. The real key is finding a partner whose lending philosophy aligns with your specific goals, whether you’re buying a stabilized asset in a prime suburb or tackling a gutsy value-add project.

Differentiating Dallas Lender Types

Your first move is to get a lay of the land and understand who’s providing capital in Dallas. You’ll generally run into four main categories: large national banks, Texas regional banks, local credit unions, and specialized mortgage brokers. Each brings something different to the table, with its own set of pros and cons for an investor like you.

Before you start making calls, it helps to know the players. Here’s a quick breakdown of the lender types you’ll encounter and what to expect from each.

Comparing Lender Types for Dallas Multi-Unit Deals

This table gives you a snapshot of the different lender categories, helping you decide which type of institution might be the best fit for your specific financing needs in Dallas.

| Lender Type | Strengths | Potential Drawbacks | Best Suited For |

|---|---|---|---|

| Large National Banks | Highly competitive rates, wide array of loan products, established processes. | Rigid underwriting, can be slow, may not understand local submarket nuances. | Stabilized properties, large loan amounts, borrowers with strong financials. |

| Texas Regional Banks | Deep local market knowledge, relationship-focused, more flexible terms. | May have slightly higher rates, smaller lending capacity than national banks. | Value-add projects, investors with a local track record, relationship-driven borrowers. |

| DFW Credit Unions | Personal touch, potential for creative financing, strong community focus. | Typically limited to smaller deals (e.g., 2-10 units), may have fewer product options. | Smaller multi-unit properties, investors who are members, community-focused projects. |

| Mortgage Brokers | Access to a vast network of lenders, saves you time, expert deal matching. | Quality varies greatly, potential for added fees. | Investors who want to see multiple options, complex deals, or need to find a niche lender. |

Ultimately, the “best” lender is the one whose strengths perfectly match the requirements of your deal and your long-term investment strategy.

Selecting a lender isn’t just about comparing interest rates on a spreadsheet. It’s about finding an institution that understands the long-term potential of your investment in the specific Dallas submarket you’ve targeted.

Questions to Vet Your Potential Lender

Once you’ve got a shortlist, it’s time to interview potential lenders to see if they really know their stuff. Their answers will tell you a lot about their genuine knowledge of the Dallas multi-unit scene and how serious they are about deals like yours.

Come to the conversation prepared with pointed questions:

- What’s your recent lending experience with properties in this specific Dallas submarket (e.g., Bishop Arts, Plano, Richardson)?

- What’s your typical loan size, and does my project fit comfortably in your wheelhouse?

- Based on my project, what Debt Service Coverage Ratio (DSCR) and reserve requirements should I expect?

- Can you walk me through your underwriting and closing timeline for a DFW deal like this?

Their responses will tell you everything. You’ll quickly figure out if they have the experience and if they’re the right fit for your team.

Analyzing the Term Sheet Beyond the Rate

Getting that first term sheet is an exciting moment, but the interest rate is only one piece of the puzzle. A savvy investor knows to analyze the entire document, hunting for details that can seriously impact your profitability over the life of the loan.

Here are the key items you need to scrutinize:

- Prepayment Penalties: Are there hefty fees for paying off the loan early? This can kill your flexibility if you plan to sell or refinance.

- Reserve Requirements: How much cash will the lender force you to keep in reserve for taxes, insurance, and capital expenditures? This affects your liquidity.

- Recourse vs. Non-Recourse: Are you personally on the hook for the loan (recourse), or is the property the only collateral (non-recourse)? This is a huge one.

- Fees: Dig into all the origination, underwriting, and processing fees. They can add up fast.

This careful review ensures there are no nasty surprises down the road and that the loan terms truly support your investment strategy.

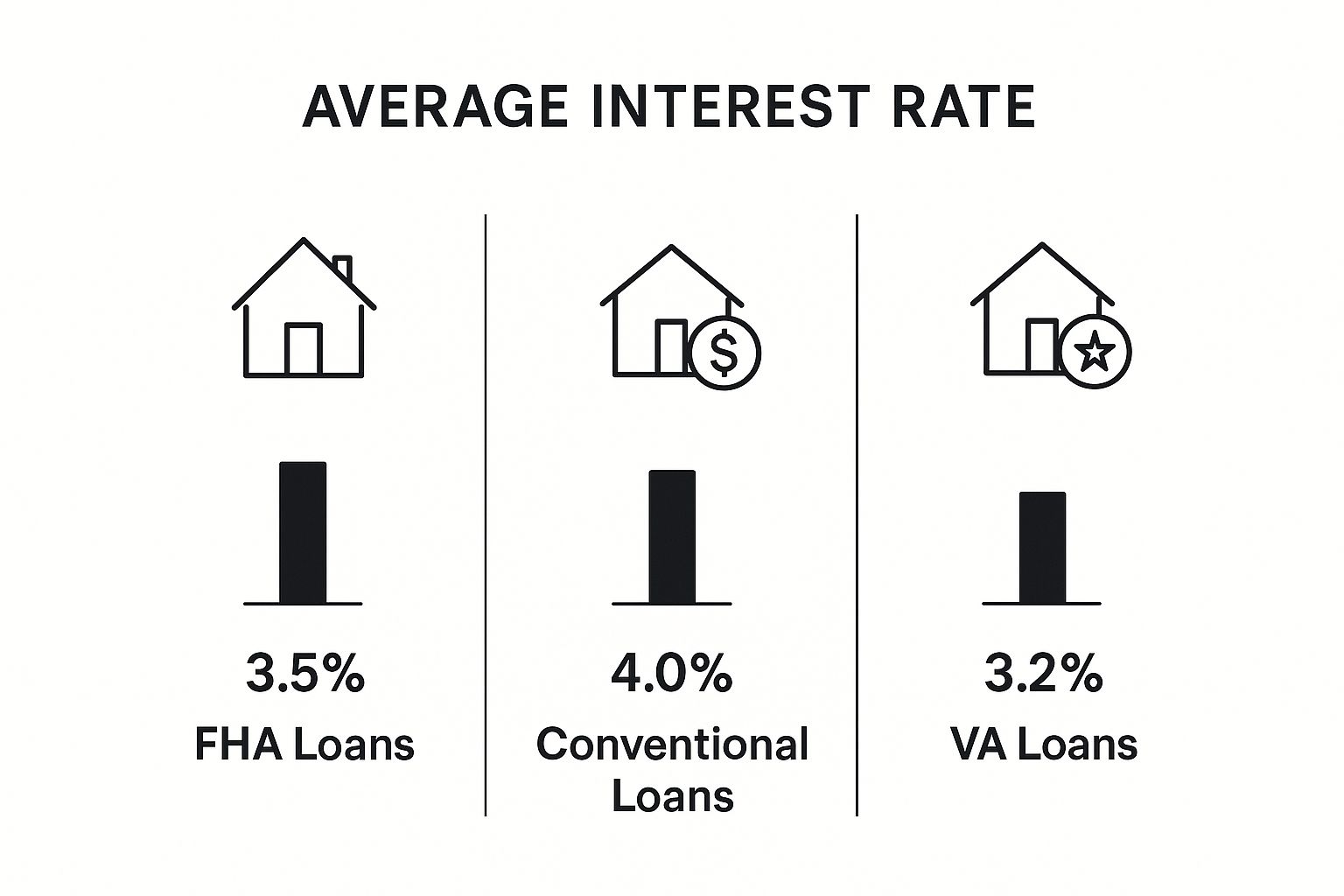

This visualization compares average rates for common loan types, offering a quick snapshot of the financing landscape.

As the image shows, government-backed loans can sometimes offer more competitive interest rates than conventional options, which is something to keep in mind as you shop around.

The market itself is showing some real signs of life. In the first quarter of 2025, commercial and multifamily mortgage originations jumped by an impressive 42% compared to the same time in 2024. This rebound, happening in what’s usually the slowest quarter, points to growing confidence from both borrowers and lenders.

This momentum suggests that even with market uncertainties, lenders are actively looking for solid deals in key markets like Dallas. You can discover more about these Q1 lending trends from the Mortgage Bankers Association. All this activity makes finding the right lending partner more important than ever if you want to capitalize on the opportunities out there.

Common Questions on Dallas Multi-Unit Financing

Stepping into the world of multi-unit financing in Dallas? You’ve got questions. Everyone does. The market is dynamic, and the rules of the game can feel like they’re constantly shifting. Getting straight answers to the most common sticking points is the only way to move forward with confidence and avoid leaving money on the table.

Let’s cut through the noise and tackle those questions head-on. Here’s what you really need to know about getting a deal funded in the DFW metroplex.

What Is a Typical Down Payment for a Multi-Unit Property in Dallas?

This is usually the first question on every investor’s mind. While there’s no universal number, most conventional multi-unit loans in Dallas require a down payment somewhere in the 25% to 35% range.

Of course, that number isn’t set in stone. It can swing based on a few critical factors.

Government-backed programs, like certain FHA loans, can sometimes open the door to lower down payments. But be aware, these often come with their own set of strings, like mandatory mortgage insurance premiums (MIP) and much stricter property standards. Dallas lenders are all about managing risk, so they’ll look hard at your property’s cash flow, its specific location, and your personal track record as an investor. All of these will play a role in the final down payment they land on.

For example, a newer, stabilized Class A property in a booming suburb like Frisco is much more likely to secure a loan with a lower down payment than an older, value-add building that naturally carries more perceived risk.

Can I Get Financing with No Prior Multi-Unit Investing Experience?

Yes, you can, but you need to be prepared for a steeper climb. Lenders are, by nature, a risk-averse group. A borrower without a proven history in multi-unit properties is a big question mark. To get comfortable with that unknown, they’ll want to see strength in other areas of your profile.

Here’s what Dallas lenders will typically look for to balance the scales:

- A Higher Down Payment: They’ll want you to have more skin in the game. Don’t be surprised if they ask for 35% or even 40% down.

- Stronger Financials: Your personal liquidity and net worth will be under a microscope. They need to know you have the cash reserves to handle any unexpected bumps in the road.

- Partnerships: This can be a game-changer. Bringing an experienced operator or a well-regarded Dallas property manager onto your team can give lenders the confidence they need to say yes.

For many new investors, a fantastic way to break into the market is by using an FHA loan to buy a small 2-4 unit property and living in one of the units. This “house hacking” strategy dramatically lowers the barrier to entry and is a well-worn path for those just getting their start.

This approach is worlds away from buying a single-unit residence. If you’re still weighing your options, our guide for the Dallas first-time home buyer can offer some great foundational knowledge on the local market, even though the financing rules are completely different.

How Important Is the Property’s Location Within DFW to Lenders?

Location isn’t just important—it’s everything. Experienced Dallas lenders are masters of the DFW metroplex’s submarkets. They don’t see Dallas as one big blob; they see a collection of unique neighborhoods, each with its own story. A deal in Uptown is a completely different animal than one in Arlington or McKinney.

Lenders do their own deep-dive analysis on the local economic picture. They’re looking at things like:

- Local job growth and announcements from major employers.

- Population shifts and demographic trends in that specific zip code.

- New infrastructure projects or commercial developments planned nearby.

A building sitting in a high-growth corridor will almost always get more favorable loan terms than an identical property in an area with flat or declining economic indicators. Your job is to make sure your loan application tells a powerful story about why your chosen location is positioned for growth and stable returns.

Are Interest Rates Higher for Dallas Investment Properties?

In short, yes. The interest rates on commercial loans for investment properties are almost always higher than what you’d get for a mortgage on your own home. It all comes down to risk. Lenders know that if a borrower hits a financial rough patch, they are far more likely to stop paying the loan on an investment property before they default on the mortgage for the house they live in.

The final rate you’re offered will be a blend of several key ingredients:

- The loan type you’re using (e.g., conventional, agency, bridge).

- Your strength as a borrower (credit, net worth, experience).

- The property’s performance, especially its Debt Service Coverage Ratio (DSCR).

- The broader economic climate when you apply.

Because rates can swing pretty wildly between lenders, you absolutely have to shop around. Getting term sheets from several different Dallas-based lenders is the only way to know for sure that you’re getting the best deal. And remember, financing is just one piece of the puzzle. A deep understanding of rental property tax deductions is another crucial tool that can seriously boost your investment’s bottom line.

Ready to navigate the Dallas real estate market with an expert by your side? The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the deep local knowledge and financing expertise to guide you through every step of your multi-unit property investment. From identifying prime opportunities to connecting you with the right lenders, we’re here to help you achieve your goals. Visit us online at https://dustinpitts.com to get started.