So, you’re thinking about buying a house in Dallas. Fantastic choice. This isn’t just another generic article; think of it as your personal playbook for navigating the Dallas real estate scene and turning that dream of homeownership into a reality.

Starting Your Dallas Home Buying Journey

This guide is designed to cut through the noise. We’re giving you clear, actionable advice that speaks directly to the unique quirks and opportunities of the Dallas housing landscape. We’ll walk through everything from getting your finances in order to understanding the local mortgage market and, most importantly, putting together a team of Dallas pros who will have your back.

You’ll get a real sense of the current market shifts and learn how to zero in on neighborhoods that actually fit your life and your budget.

Here’s a sneak peek at what we’ll cover:

- Reading the Market: We’ll break down what recent shifts in prices and inventory actually mean for you as a buyer in Dallas.

- Financial Footwork: It’s more than just a down payment. We’ll talk about securing that all-important pre-approval and budgeting for Dallas-specific costs, like our notorious property taxes.

- Neighborhood Deep Dives: From the historic charm of Lakewood to the up-and-coming vibes in areas like Vickery, we’ll help you find your perfect corner of Dallas.

- Making a Winning Offer: I’ll share my best strategies for crafting a competitive offer that stands out in the Dallas market and how to handle the negotiation dance that follows.

Ultimately, this process is all about making smart, informed decisions. By getting a handle on the local nuances of buying a house right here in Dallas, you can move forward with total confidence. It doesn’t matter if you’re a first-time buyer or have done this a dozen times—let’s get you ready.

Getting a Handle on the Dallas Housing Market

The Dallas real estate scene is never static. To get the best deal, you need to understand the rhythm of the market right now. It’s about more than just slapping a “buyer’s” or “seller’s” market label on it; it’s about reading between the lines to get a real advantage. This knowledge is what helps you decide when to jump in, how to write an offer that gets noticed, and ultimately, how to avoid overpaying.

Think about it this way: the median price is a great starting point, but the real story is often in the details, like the price per square foot. A house might look pricey on the surface, but if it’s much larger than its neighbors and priced lower per square foot, you could be looking at a fantastic deal.

Key Numbers to Watch in the Dallas Market

To get a true feel for what’s happening, you have to look beyond the listing prices. A few key metrics paint a much richer picture of the Dallas market’s health, and these numbers will directly influence your negotiating power and how fast you’ll need to act.

Here’s what you should be keeping an eye on:

- Median Sale Price: This is the middle-of-the-road price for all homes sold. It’s your baseline for what homes are actually selling for.

- Inventory Levels: The total count of homes for sale. When inventory is high, you have more options and sellers might be more willing to negotiate.

- Days on Market (DOM): The average time a house sits on the market before going under contract. A longer DOM is a great sign for buyers—it means the frenzy is cooling off.

- Price Per Square Foot: This lets you make an apples-to-apples comparison between homes of different sizes, helping you spot true value.

Lately, we’ve seen some interesting movements in the Dallas market. The median sale price recently hit about $444,543, which is an 11.4% jump from last year. But here’s the twist: the price per square foot actually dipped by 1.4% to around $240.42. This is exactly why you need to look at the whole picture. For a deeper dive, you can check out more detailed Dallas market trends.

What This Data Means for Your Home Search

So, what do these stats actually mean for you as a buyer? That recent spike in available homes, coupled with houses staying on the market longer, is a game-changer.

The total number of homes for sale shot up by 10.2% to roughly 5,605 listings. More inventory means less of that frantic, buyer-eat-buyer pressure. You won’t feel like you’re being thrown into a bidding war for every halfway decent property that hits the market.

The median time a home stayed on the market stretched to about 39.3 days, and the months of supply nearly doubled. This signals a shift toward a more balanced market, giving buyers more leverage than they’ve had in a long, long time.

This change gives you something incredibly valuable: breathing room. You can take your time, get a proper inspection, and really think through your options without that nagging fear that the house will be gone by morning.

The Best Time to Buy in Dallas

Dallas is always going to be a competitive market—our economy is strong and people want to live here. That said, certain seasons definitely give buyers an edge. Knowing the cyclical nature of the market can help you time your move perfectly.

A Look at the Seasons

| Season | Market Pace | Buyer Advantage | Key Consideration |

|---|---|---|---|

| Winter | Slower | Less competition, more motivated sellers. | Inventory is at its lowest. |

| Spring | Busiest | Peak inventory, tons of options. | Intense competition and higher prices. |

| Summer | Busy | Great selection, sellers become flexible. | Prices tend to stay high. |

| Fall | Balanced | Competition drops off, price cuts appear. | Often the “sweet spot” with serious sellers. |

If you’re hunting for a deal, fall and winter are often your best bet. There are fewer buyers out there, and sellers who listed back in the spring or summer might be getting anxious to close before the holidays. On the flip side, spring offers the most choices, but you’ll be up against the most competition. By combining current data with these seasonal patterns, you can make a smart, confident move in the Dallas market.

How to Secure Financing for Your Dallas Home

Before you start dreaming of that Bishop Arts bungalow or a sleek Uptown condo, we need to talk about the most critical first step: getting your finances in order. Securing financing is the engine that drives this whole home-buying journey in Dallas. Getting it right from the start will save you a world of stress and instantly make you a buyer that sellers take seriously.

This isn’t just about getting a loan. It’s about truly understanding what it costs to own a home in Dallas. You need a lender who gets the local DFW market—someone who understands our fluctuating property taxes and the unique insurance needs we have here in North Texas. Your first power move? Getting pre-approved.

Getting Pre-Approved with a Dallas Lender

Think of a pre-approval letter as your golden ticket. It’s more than just a piece of paper; it tells sellers and their agents that you’re not just window shopping. It shows you’ve done the work and have a lender ready to back your offer.

Here in Dallas, I’ve seen firsthand how working with a local lender gives buyers a leg up. They have insider knowledge of our appraisal values and typical closing timelines, which can make your offer look much stronger.

To get the ball rolling on pre-approval, you’ll need to pull together some key financial documents:

- Proof of Income: This is usually your last two years of W-2s and your most recent pay stubs.

- Asset Verification: Lenders want to see bank and investment account statements to confirm you have the cash for a down payment and closing costs.

- Credit History: They’ll pull your credit report to see how you manage debt. You’ll generally need a score above 620, but the higher, the better.

A strong pre-approval letter from a reputable Dallas lender tells a seller that your offer isn’t just a number, but a firm commitment. In a competitive situation, it can be the single thing that makes your offer stand out from the rest.

Building a Realistic Dallas Home Budget

Your budget is so much more than the monthly mortgage payment. Here in Dallas, several local costs can sneak up on you and seriously impact your monthly expenses if you’re not prepared. Overlooking them can stretch your budget way too thin.

Key Dallas-Specific Costs to Factor In:

| Cost Category | Dallas-Specific Consideration | Estimated Impact |

|---|---|---|

| Property Taxes | Rates vary wildly across Dallas County. A home in one school district can have a much higher tax bill than a similar house just a few miles away. | Can easily add hundreds of dollars to your monthly payment. |

| Homeowners Insurance | North Texas is no stranger to hail and tornadoes. That severe weather risk drives our insurance premiums up compared to other parts of the country. | Expect to pay higher-than-average rates. It pays to get multiple quotes. |

| HOA Fees | Many of the newer communities and condos in Dallas come with Homeowners Associations, and they have monthly or annual fees. | These can run anywhere from $50 to over $500 per month. |

These aren’t optional expenses; they’re a fundamental part of owning a home here. Any good lender will help you calculate your total PITI (Principal, Interest, Taxes, and Insurance) to give you a true picture of your monthly bottom line. It’s also a great time to learn more about the differences between a conventional loan vs. an FHA loan to see which one fits your financial picture.

Down Payments and Assistance Programs in Texas

Saving up for a down payment is often the biggest hurdle for buyers. While putting 20% down is the classic way to avoid Private Mortgage Insurance (PMI), it’s not the only way. Many loan programs today allow for much smaller down payments, some as low as 3%.

Luckily, Texas has some fantastic down payment assistance programs designed to make homeownership more achievable. Programs like My First Texas Home (MFTH) and My Choice Texas Home offer grants or low-interest loans that can help qualified buyers cover their down payment and closing costs. These are game-changing resources for anyone buying a house in Dallas.

It’s also worth noting that the Dallas-Fort Worth housing market has cooled off a bit recently. Home values in Dallas saw a decline of about 2.8% over the past year, and some projections show that trend continuing. This shift is creating more affordability and opening up opportunities for buyers. We saw this in action when a new home south of downtown Dallas was reduced from $445,000 to $375,000. This cooling market, paired with the available assistance programs, might just make your financial goals more attainable than you think.

Finding Your Ideal Dallas Neighborhood

Dallas isn’t a monolith. It’s a sprawling mosaic of truly unique neighborhoods, each with its own distinct flavor, lifestyle, and price tag. Picking the right one isn’t just about finding a dot on a map; it’s about discovering the community where your life—both personal and financial—can truly click.

Forget the generic tourist descriptions. To successfully buy a house here, you have to think beyond the front door and get real about your daily grind. What’s your commute to major job centers like the Downtown Business District or Legacy West in Plano really going to look like? Could easy access to a DART rail line change your whole day? Which parks, coffee shops, and restaurants can you actually see yourself hitting up on a regular basis?

Matching Lifestyle with Location

Every corner of Dallas has its own personality. You’ve got the historic charm of Lakewood, with its huge, mature trees and unbeatable proximity to White Rock Lake, which offers a completely different world than the high-energy, high-rise living you’ll find in Uptown. Your first big task is figuring out which vibe feels like you.

Are you hunting for a walkable area packed with more dining and entertainment options than you could ever get through? Or is a quieter, more residential feel with plenty of green space at the top of your list? Answering these questions honestly will help you filter the entire metroplex down to just a handful of promising areas. In a market as massive as Dallas, that focus is everything.

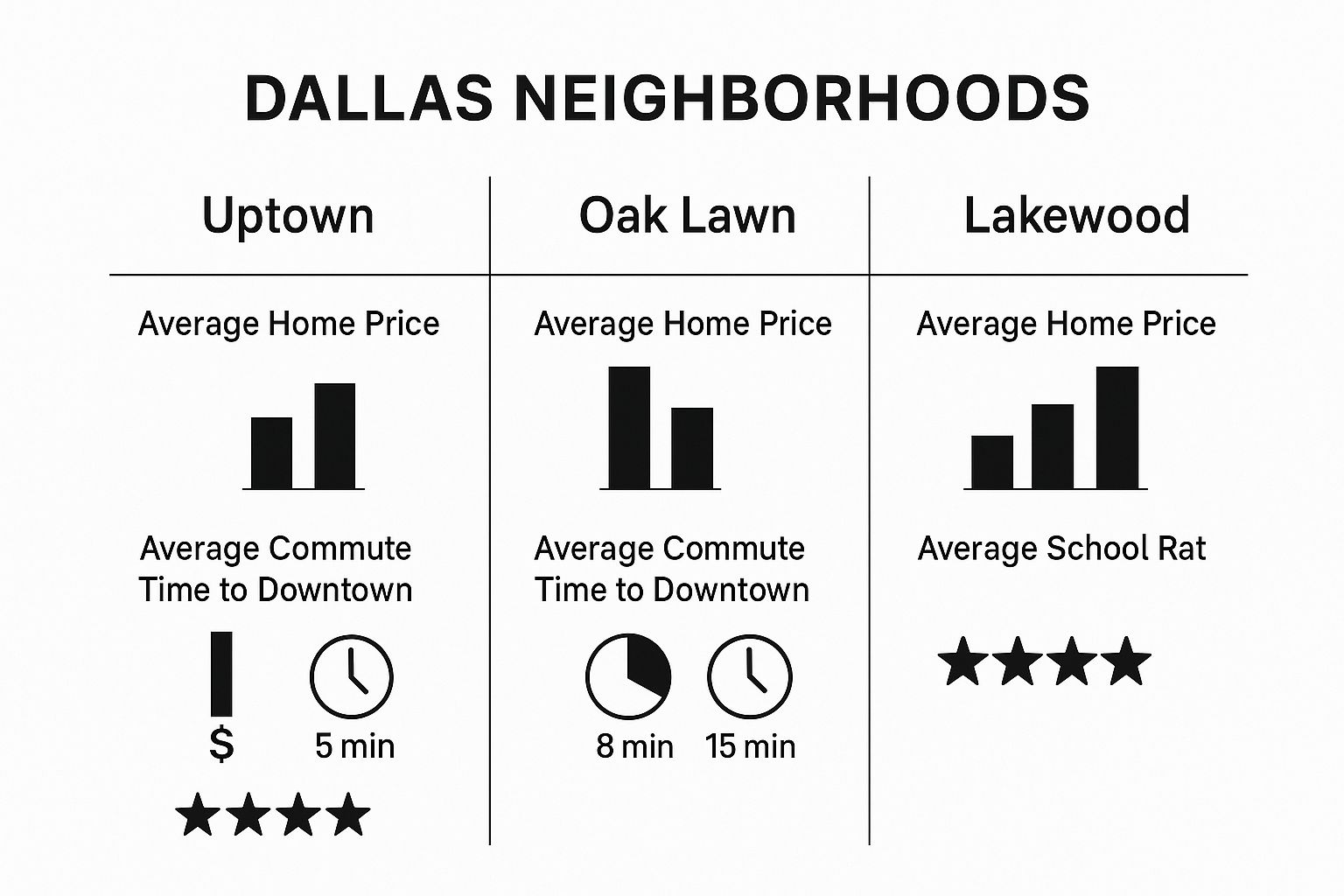

This kind of snapshot quickly shows you the trade-offs. For example, Uptown’s sky-high price tag buys you unparalleled access to downtown, while a neighborhood like Lakewood offers a more laid-back pace for a similar investment.

Understanding the Price Spectrum Across Dallas

The financial landscape of Dallas real estate is incredibly diverse. The city is home to 128 distinct neighborhoods, and the median listing price can vary wildly from one to the next. This is exactly why getting granular with your research is so critical before you start touring homes.

For instance, the beautiful, established neighborhood of Lakewood recently saw a median listing price hovering near $1.9 million (that’s about $491/sq ft), cementing its status as one of the priciest spots in the city.

Flip the script, and you’ll find up-and-coming areas like Vickery, which offered a much more accessible median listing price of around $168,500 ($165/sq ft). These numbers prove that homeownership in Dallas is within reach for many budgets—as long as you know where to aim your search.

The key takeaway here is that the overall Dallas median listing price of $430,000 doesn’t tell you much. Your budget is the single most important filter that will guide you toward certain neighborhoods and away from others. Localized research is your most powerful tool.

To help put this into perspective, let’s look at how a few popular neighborhoods stack up against each other.

Comparing Popular Dallas Neighborhoods

This table gives a quick snapshot of what you can expect in terms of cost and lifestyle across different parts of the city.

| Neighborhood | Median Price Range | Known For | Ideal For Individuals Seeking |

|---|---|---|---|

| Uptown | $500k – $2M+ | High-rise condos, walkability, vibrant nightlife | Young professionals and urbanites |

| Lakewood | $800k – $2.5M+ | Historic homes, White Rock Lake, community-focused | Established households and outdoor enthusiasts |

| Bishop Arts | $400k – $900k | Indie boutiques, art galleries, unique restaurants | Creatives and those who love a strong local culture |

| Preston Hollow | $1M – $10M+ | Large estates, privacy, prestigious schools | Affluent buyers seeking luxury and exclusivity |

| Lake Highlands | $450k – $1M | Good schools, community feel, access to parks | Buyers looking for value and a suburban vibe |

As you can see, the “right” neighborhood is entirely subjective. It all comes down to what you value most.

Key Factors to Consider in Your Neighborhood Search

Beyond the price and the general vibe, a few practical realities should weigh heavily on your final decision. A stunning house in the wrong location can lose its shine fast if the daily logistics are a nightmare.

As you start exploring different parts of Dallas, keep these crucial elements on your checklist:

- Commute and Transportation: Don’t just look at a map—actually clock your potential commute during rush hour. A seemingly short drive can turn into a long haul on the Central Expressway. If you’re a public transit user, check the proximity and frequency of DART bus and rail service.

- Local Amenities: What do you need nearby? Think grocery stores, your favorite gym, coffee shops, and parks. The simple convenience of having your essentials just a short drive or walk away can make a massive difference in your quality of life.

- Future Development: Do a little digging into what’s planned for the area. New commercial projects, big infrastructure upgrades, or park improvements can have a huge positive impact on property values and your long-term enjoyment of the neighborhood.

- Property Taxes: This is a big one people often overlook. Property tax rates can vary significantly, even between adjacent suburbs or neighborhoods. A lower home price in an area with a sky-high tax rate might not actually save you as much as you think in the long run.

For a deeper dive into even more communities, you might want to check out our guide on the best neighborhoods in Dallas. By carefully weighing all these factors, you can move forward with confidence and find a Dallas neighborhood that truly feels like home from the moment you move in.

Crafting a Winning Offer in Dallas

Alright, you’ve got your financing lined up and you’ve narrowed down the Dallas neighborhoods you love. Now for the exciting part: the hunt. This is where the spreadsheets and planning turn into real-world action—finding that perfect house and making an offer that actually gets accepted.

In a market like Dallas, especially for hot properties in places like the M-Streets or Lower Greenville, this whole process is a mix of speed, smart strategy, and solid local knowledge.

This is where a great real estate agent earns their keep. A top-tier Dallas agent does way more than just open doors with a lockbox key. They’re plugged into a network that often hears about off-market or “coming soon” listings you’ll never see on the public websites. This inside track is huge. It can give you a critical head start, letting you see—and sometimes even offer on—a home before the rest of the market even knows it exists.

Analyzing a Property’s True Value

Before you even dream of a number, you and your agent need to figure out what the home is really worth in today’s Dallas market. I’m not talking about the list price; that’s just a starting point. We need to find the true market value, and we do that by running a Comparative Market Analysis (CMA).

This means digging into the “comps”—comparable homes that have sold recently in the immediate area. A solid comp is a house that’s very similar in a few key ways:

- Location: Ideally within a half-mile radius, right there in the same neighborhood.

- Size: Similar square footage and the same number of bedrooms and bathrooms.

- Condition: This is a big one. An updated kitchen, a new roof, or a pristine backyard pool all factor in.

- Timeline: We only look at sales from the last 3-6 months. Anything older is stale data.

Let’s say you’re eyeing a three-bedroom house in Lakewood. Your agent isn’t just going to pull any old three-bedroom that sold nearby. They’ll zero in on homes of a similar size, in Lakewood, that sold within the last quarter, adjusting the value up or down for things like a beautifully renovated kitchen or an ancient AC unit. This detailed work is what keeps you from overpaying.

Structuring an Offer That Stands Out

A killer offer is about much more than just the price. In Dallas’s competitive pockets, sellers are looking at the whole package. The goal is to present an offer that’s not just strong on price but also signals that you’re a serious, low-hassle buyer who can get to the closing table without any drama.

So, what does a compelling offer look like?

- A Competitive Price: Based on that CMA, you’ll land on a price that’s both aggressive and fair. If you find yourself in a bidding war, this might mean going in at or even slightly above the asking price.

- A Strong Earnest Money Deposit: Think of this as your “good faith” deposit. Putting down a larger amount—typically 1% of the purchase price—shows the seller you have skin in the game.

- A Favorable Option Period: In Texas, the option period is your time to conduct inspections and back out for any reason. Offering a shorter period, like 7 days instead of the standard 10, can be a really attractive term for an anxious seller.

- Minimal Contingencies: Fewer “what ifs” make for a stronger offer. While you almost always want to keep your inspection and appraisal contingencies, avoiding odd or complicated requests can give you a real edge.

Your pre-approval letter is the bedrock of your entire offer. When you pair that with a solid price and clean terms, you’re sending a powerful message to the seller: “I’m qualified, I’m serious, and I’m ready to close this deal.”

Navigating Inspections in North Texas

Once your offer is accepted—congrats!—the option period kicks in. This is your window to bring in a professional inspector to give the house a thorough once-over. Here in North Texas, we have our own special set of common issues, and a good local inspector will know exactly what to hunt for.

Make sure your inspector pays close attention to these areas:

- Foundation: Our expansive clay soil is notorious for causing foundations to shift. An inspector will look for tell-tale signs like cracks in the brick or drywall, doors that don’t close properly, and uneven floors.

- Roof Condition: Hail is just a part of life here. A seasoned inspector can spot hail damage from a mile away, which is critical because it can massively affect your ability to get homeowners insurance.

- HVAC System: Dallas summers are no joke. You absolutely need to know that the air conditioning system is up to the task and has been well-maintained.

- Plumbing: In older Dallas homes, especially those built before the 1980s, old cast iron pipes under the foundation can be a ticking time bomb for expensive repairs.

The inspection report isn’t a simple pass/fail grade. It’s more of a comprehensive to-do list for the property. Armed with this report, you can go back to the seller and negotiate for repairs, a price drop, or seller credits to cover the cost of the work. This is the final, critical negotiation before the home is truly yours.

So, your offer was accepted. Congratulations! Take a moment to celebrate, but don’t kick back just yet. A whole new phase of the Dallas home-buying journey is about to begin.

This is what we call the “under contract” period. It’s the final stretch, but it’s packed with crucial steps. In Texas, we have a few unique processes designed to protect you, and it’s all about doing your due diligence before the keys are officially in your hand.

Your Safety Net: The Option Period and Inspections

The first thing you need to know about is the option period. This is a non-negotiable step for any savvy buyer. It’s a window of time, usually 7-10 days, that we negotiate into the contract. During this period, you have the unrestricted right to back out of the deal for any reason at all.

Why is this so important? Because this is your time to bring in the pros. You’ll hire a licensed inspector to go through the home with a fine-tooth comb. They’ll check everything—the foundation, the roof, the HVAC, the plumbing, all of it.

Given the notorious clay soil in North Texas, foundation issues can be a real concern. If the inspection uncovers something major, this is our chance to go back to the seller and negotiate for repairs or a credit toward your closing costs. For older Dallas homes, it’s also wise to consider asbestos testing during your home inspection to ensure there are no hidden safety hazards.

The Title Company and Appraisal Get to Work

While you’re busy with inspections, another key player enters the scene: the title company. Their job is to dive deep into the property’s history to make sure it has a “clear title.” This means confirming there are no outstanding liens, ownership disputes, or other claims against it.

Once they’ve verified everything, they’ll issue a title insurance policy. This protects both you and your lender from any future ownership disputes. It’s an essential safeguard you absolutely don’t want to skip.

Think of the option period and title search as your safety net. This is your chance to verify that the home is in the condition you expect and that you will be the sole, rightful owner upon closing.

Around the same time, your lender will order an appraisal. An independent, licensed appraiser will evaluate the property to determine its fair market value. They need to make sure the home is worth at least what you’ve agreed to pay for it. If the appraisal comes in low, don’t panic. We have a few options, like renegotiating the price or exploring other financing solutions.

The Final Steps to the Closing Table

Once the appraisal is in and your lender gives the final “clear to close,” you’re officially in the home stretch.

Just before the big day, typically 24-48 hours before closing, we’ll do a final walkthrough. This is a quick visit to the property to make sure it’s in the same condition as when you made your offer. We’ll also verify that the seller has moved out and that any repairs they agreed to have been completed properly.

Then comes closing day. You’ll head to the title company’s office to sign a whole stack of documents. Make sure you bring your photo ID and a cashier’s check for the down payment and closing costs. If you need a refresher, our guide on how to calculate closing costs can help you prepare.

After all the papers are signed and the money is officially transferred, the deal is done. You’ll get the keys, and the house is finally yours

Your Top Dallas Home Buying Questions Answered

When you’re thinking about buying a home in Dallas, a ton of questions probably come to mind. It’s completely normal. Let’s tackle some of the most common ones I hear from clients to give you a clearer picture of the road ahead.

How Much Do I Really Need for a Down Payment in Dallas?

Everyone’s heard the 20% rule, and while that’s a great goal to avoid Private Mortgage Insurance (PMI), it’s definitely not a deal-breaker. The reality is, many of my clients get into their homes with much less.

Most conventional loans today only require 3-5% down. On top of that, Texas has some fantastic down payment assistance programs that can offer grants or low-interest loans to help you bridge the gap. These can seriously reduce the amount of cash you need to have ready on closing day.

What Is the Best Time of Year to Buy a House in Dallas?

Figuring out the right time to buy can give you a real edge in the Dallas market. Spring is when you’ll see the most “For Sale” signs pop up, but it’s also when you’ll face the most intense competition and bidding wars.

If you’re looking for a bit more breathing room and negotiation power, I always tell my clients to look at the fall and winter. The market cools off, and sellers who listed during the peak season might be getting anxious. They’re often more motivated to cut a deal before the holidays, which can mean better prices for you.

Are Property Taxes Really That High in Dallas?

I won’t sugarcoat it: yes, property taxes in Texas are higher than in most states, and Dallas is no different. The exact rate you’ll pay is a mix of city, county, and school district taxes, so it can vary quite a bit from one neighborhood to the next.

This isn’t a minor detail—it’s a significant part of your monthly payment, often adding several hundred dollars or more. Before you get your heart set on a home, we absolutely need to pull the current tax records so you know exactly what you’re getting into.

How Long Does It Take to Close on a House Here?

Once you get that exciting call that your offer was accepted, you can generally expect the closing process to take about 30 to 45 days. This timeline is pretty standard and gives everyone enough time to get their ducks in a row without being frantic.

During this period, a lot happens behind the scenes:

- The Option Period: This is your 7-10 day window to get inspections done and really kick the tires.

- The Appraisal: Your lender will order this to make sure the home is worth what you’re paying for it.

- Final Loan Approval: The lender’s underwriters will do a final review of all your paperwork.

- Title Search: A title company makes sure there are no hidden claims or liens against the property.

It’s a structured process designed to protect you and ensure everything is buttoned up before you get the keys.

Navigating the Dallas real estate market is much easier with an expert on your side. For personalized guidance and local market insights, contact Dustin Pitts REALTOR Dallas Real Estate Agent today. Let’s find your perfect Dallas home together. Visit us at https://dustinpitts.com.