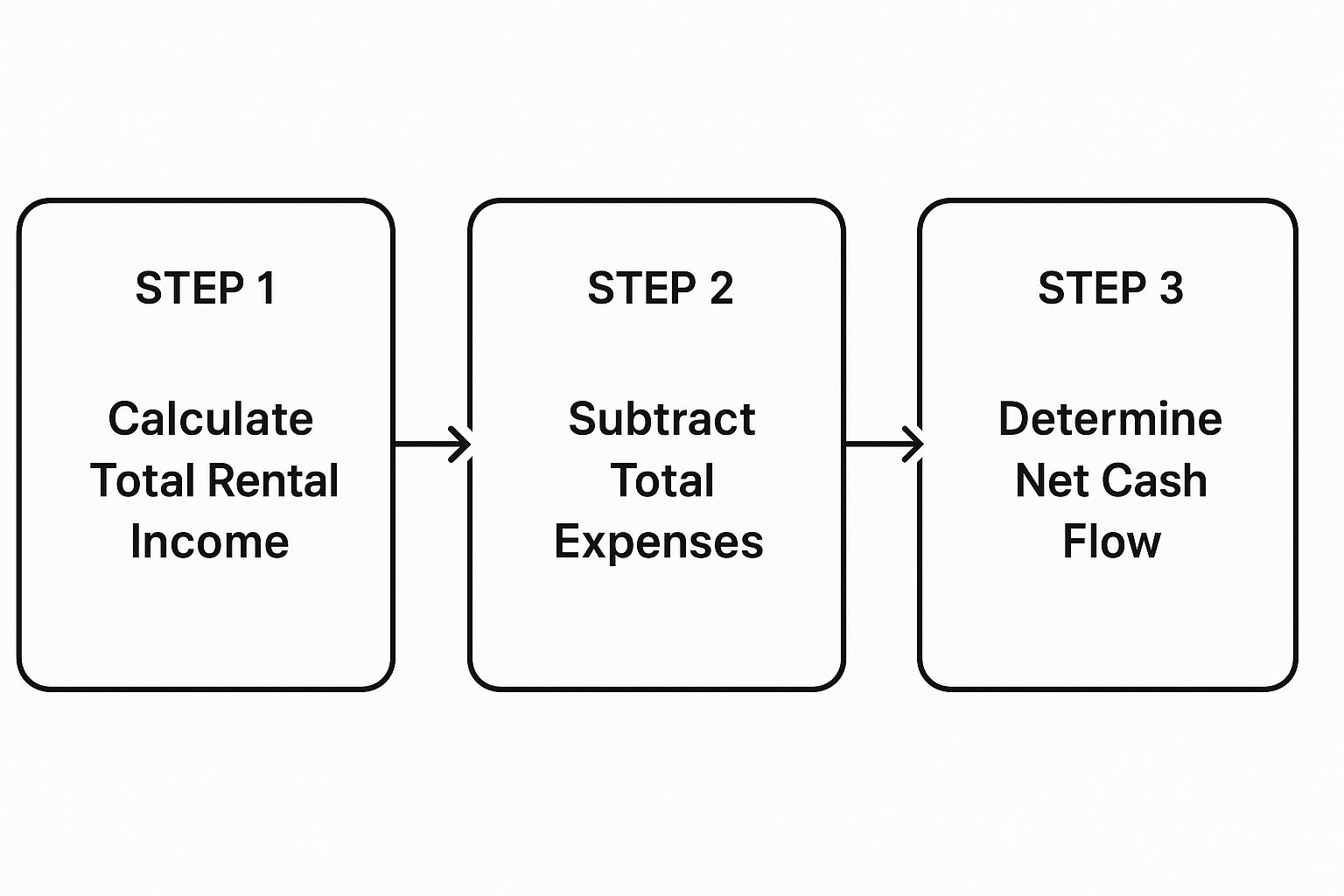

Calculating the cash flow for a rental property boils down to a pretty straightforward formula: Total Income – Total Expenses = Net Cash Flow. Simple, right? But the real trick, especially for a Dallas investment, is in the details. Getting an accurate result means you have to dig past the simple estimates and capture every single dollar coming in and going out.

Why This Calculation Is So Important

Look, a precise cash flow analysis does way more than just tell you if you’re in the black each month. It’s a powerful tool that helps you:

- Compare Investment Opportunities: It gives you an apples-to-apples way to evaluate different properties, whether you’re looking in Richardson, Plano, or right here in Dallas proper.

- Secure Financing: When you walk into a bank, lenders want to see that your investment is financially sound. A solid cash flow projection proves your property can cover its own debt and then some.

- Plan for the Future: A clear picture of your cash flow is your roadmap. It lets you build up reserves for those inevitable big-ticket repairs and plan for long-term growth.

The whole process is about subtracting all your property-related expenses from the rental income you collect. The good news is that rental income in the Dallas area has often outpaced inflation, which can seriously boost your cash flow if you keep a tight rein on expenses.

I’ve seen it time and time again: a new investor gets laser-focused on just the mortgage payment and completely overlooks other major costs. A reliable cash flow analysis must include everything—Dallas County property taxes, insurance, maintenance, and even potential vacancies. If it doesn’t, you’re just guessing.

Getting the Numbers Right for Dallas

Understanding your property’s financial health doesn’t need to be a headache. At its core, the goal is simple: figure out if your Dallas rental is bringing in more cash than it costs to own and operate every month.

The formula might be basic, but the accuracy of your final number depends entirely on the details you plug in. This is especially true in a dynamic market like Dallas, where things like property taxes and maintenance costs can be worlds apart from national averages.

For instance, identifying all your income streams beyond just the monthly rent and accounting for every specific North Texas expense is what separates a profitable Dallas investment from a nasty surprise down the road. This is how you master those critical details and make informed decisions.

Once you’ve got a handle on your current numbers, you can start looking into proven strategies to improve cash flow and really maximize your returns. And if you want to dive deeper into what’s happening locally, be sure to check out our detailed guide on Dallas real estate trends and price analysis.

Dallas Rental Cash Flow Formula At a Glance

To bring it all together, here’s a quick summary of the key pieces you’ll need for an accurate cash flow calculation for a Dallas-area property. Think of this as your cheat sheet for getting the numbers right.

| Component | Description | Dallas-Specific Example |

|---|---|---|

| Gross Rental Income | Total potential rent collected if the property is 100% occupied. | A duplex in Bishop Arts renting for $1,800/month per unit. |

| Additional Income | Extra revenue from sources like pet fees, laundry, or parking. | $50/month pet fee and $75/month for a reserved parking spot. |

| Vacancy Rate | A percentage of gross income set aside for when the property is empty. | A 5% vacancy rate, reflecting the average for the Dallas market. |

| Operating Expenses | All costs to run the property, excluding the mortgage principal. | Dallas property taxes, insurance, HOA fees, property management, repairs. |

| Net Operating Income (NOI) | Your income before accounting for your mortgage payment. | Gross Income (minus vacancy) – All Operating Expenses. |

| Debt Service | The total mortgage payment, including both principal and interest. | Your monthly P&I payment on the loan for the property. |

| Net Cash Flow | The final profit or loss after all income and expenses are tallied. | NOI – Debt Service = Your actual cash in pocket (or out). |

This table lays out the roadmap. By meticulously filling in each component with real, Dallas-specific figures, you move from a rough estimate to a reliable financial forecast for your investment property.

Totalling the Income for Your Dallas Rental

When you first start to calculate cash flow on a rental property, your mind naturally goes to the rent check. But if you want to get your numbers right, you have to think like a seasoned Dallas investor. That means accounting for every single dollar your property can bring in, not just the obvious ones.

The foundation of your income calculation is, of course, the Gross Potential Rent (GPR). This is the absolute maximum you could earn if your property was rented out 100% of the time. Nailing this number is critical, and it requires you to dig into the comps for the specific Dallas neighborhood you’re considering.

A modern two-bedroom in Uptown, for instance, is going to have a very different rent potential than a similar unit in the Bishop Arts District or a single-unit rental out in Richardson. You have to put in the work, research current listings, and see what properties have actually rented for recently. This is the only way to set a rate that’s both competitive and profitable.

Beyond the Monthly Rent

Once you’ve locked down your base rent, it’s time to brainstorm all the other ways the property can make money. These extra income streams, often called ancillary revenue, are frequently overlooked by new investors, but they can make a huge difference to your bottom line in Dallas.

For a Dallas property, here are a few common examples I see all the time:

- Pet Fees and Rent: Dallas is a very pet-friendly city, and most landlords capitalize on this. A non-refundable pet fee upfront and a small monthly “pet rent” of $25-$50 per pet is pretty standard.

- Parking Fees: If your property is in a dense, popular area like Deep Ellum or Lower Greenville, a guaranteed parking spot is gold. Charging $50-$100 per month for an assigned space is completely reasonable.

- Laundry Facilities: For multi-unit properties, installing coin-operated or card-based laundry machines can create a nice, steady, and passive income stream.

- Late Fees: Your lease should always have a clearly defined penalty for late rent payments. When you enforce it, it becomes part of your income.

Factoring in the Reality of Vacancy

Here’s a hard truth: no property stays occupied forever. Tenants move out, and it always takes some time to turn the unit over—cleaning, making small repairs, marketing, and finding the next great tenant. That gap is called vacancy loss, and you absolutely must budget for it.

By accounting for vacancy, you adjust your optimistic Gross Potential Rent down to a much more realistic figure: the Effective Gross Income (EGI).

An overly optimistic income projection is the fastest way to misjudge a deal. I always advise my clients in Dallas to budget for vacancy, even in a strong market like ours. Assuming 100% occupancy is a rookie error that can quickly erase your projected cash flow.

So, what’s a reasonable vacancy rate for a Dallas rental? I typically advise clients to use a conservative estimate between 5% and 8%, depending on the neighborhood and property type.

Let’s say your property’s GPR is $24,000 for the year. Applying a 5% vacancy rate means you subtract $1,200 to cover potential empty periods. This brings your Effective Gross Income down to $22,800. Now, add in your other income sources, and you have a total income figure you can actually count on. This is the true starting point for a reliable cash flow analysis.

Uncovering Every Dallas Property Expense

While watching the income roll in is the fun part, the real work—and where most Dallas deals fall apart—is on the expense side of the ledger. For anyone investing in Dallas, missing just one or two of our unique local costs can completely sink your numbers. This is where you separate a truly profitable investment from a future money pit.

A real-world expense list goes way beyond the simple mortgage payment. You have to factor in everything from Texas’s notoriously high property taxes to the non-negotiable cost of keeping an AC unit humming through a brutal Dallas summer.

Fixed Monthly and Annual Costs

Some expenses are thankfully predictable, which makes them much easier to budget for. These are your fixed costs, the bills that show up like clockwork, whether you have a tenant in place or not.

Your mortgage payment, which covers Principal & Interest, is the most obvious one. But several others are just as critical for a Dallas-area property:

- Property Taxes: Let’s be blunt: Texas has some of the highest property tax rates in the country. It’s absolutely crucial to look up the exact rates for Dallas County, or neighboring counties like Collin or Denton. Never, ever use a national average; this single line item can kill an otherwise great deal in Dallas.

- Homeowners Insurance: A landlord policy is not the same as a standard homeowner policy. It’s essential for protecting your asset, and rates in North Texas are often influenced by weather events like hailstorms.

- HOA Fees: If your rental is in a planned community in a suburb like Plano or Frisco, you can’t ignore mandatory HOA fees. These can run anywhere from $50 to several hundred dollars a month and must be baked into your calculations.

Variable and Unpredictable Expenses

This is the category that trips up so many new Dallas investors. Variable expenses change from month to month, and you absolutely have to set aside funds for them. Underestimating these costs is the most common way cash flow gets silently eroded over time.

Think of it as building a financial safety net specifically for the property. When a $500 repair bill pops up, you’ll have the reserves ready to go without having to pull from your personal savings.

A realistic analysis means budgeting for what will go wrong, not just what you hope goes right. In Dallas, that means planning for AC repairs in August and knowing an older home might have plumbing issues. Proactive budgeting is your single best defense against surprise costs.

Here are the key variable expenses you need to forecast:

- Repairs and Maintenance: A solid rule of thumb is to budget 5-10% of your monthly rent for this bucket. This covers everything from a leaky faucet to a busted garbage disposal.

- Capital Expenditures (CapEx): These are the big-ticket replacements that you know are coming eventually—a new roof, a water heater, or a full HVAC system. Set aside another 5-8% of the rent specifically for these future bombshells.

- Property Management Fees: If you hire a pro to handle the day-to-day (and I highly recommend it), expect to pay 8-10% of the collected monthly rent. This fee buys you freedom from late-night tenant calls and logistical headaches.

Beyond these operational costs, don’t forget about the financial advantages. Many less-obvious but equally important property investment tax deductions can lower your taxable income and boost your net cash flow. By meticulously tracking every single expense, you build an honest, complete picture of what it truly costs to run your Dallas rental. This discipline is what allows you to calculate cash flow on your rental property with confidence.

Putting It All Together: A Dallas Case Study

Theory and checklists are great, but nothing makes the concepts click quite like seeing the numbers in action. Let’s walk through a realistic scenario to show you exactly how to calculate cash flow on a rental property using figures you’d actually see in the Dallas market. This is where the rubber meets the road, and you’ll see the real-world impact of every single line item we’ve discussed.

For our example, we’ll analyze a hypothetical single-story, 1,600 sq. ft. house in Richardson. It’s a popular suburb just north of Dallas, well-known for its strong job market and great community feel. Let’s say you bought this property for $350,000 with a 20% down payment.

As you can see, figuring out your net cash flow is really a process of subtraction. You start with all your potential income and then carefully deduct every single expense associated with owning and operating the property in Dallas.

Richardson Rental Income Breakdown

First things first, let’s figure out the income side of the equation. After doing some quick research on comparable rentals in the 75080 zip code, you’ve landed on a fair market rent of $2,400 per month. You’ve also decided to allow pets, charging a pretty standard $50 per month in pet rent.

Here’s how that breaks down:

- Gross Potential Rent (GPR): $2,400/month

- Ancillary Income (Pet Rent): +$50/month

- Total Potential Monthly Income: $2,450

But we know that no property stays occupied 100% of the time. We have to account for vacancy. For a desirable Dallas area like this, a conservative 5% vacancy rate is a smart bet.

- Gross Scheduled Income: $2,450 x 12 = $29,400

- Vacancy Loss (5%): -$1,470

- Effective Gross Income (EGI): $27,930 per year (or $2,327.50 per month)

This EGI is our true starting point—it’s the realistic, top-line income we can expect for the year.

Meticulous Expense Calculation

Now for the other side of the ledger: the expenses. This is where being meticulous with your research into Dallas-specific costs really pays off.

| Expense Category | Monthly Cost | Annual Cost | Notes |

|---|---|---|---|

| Property Taxes | $555 | $6,660 | Based on a typical 2.15% tax rate in Dallas County. |

| Insurance | $150 | $1,800 | Landlord policy for a property of this value in North Texas. |

| Repairs & Maintenance | $120 | $1,440 | Budgeting 5% of GPR for routine upkeep. |

| Capital Expenditures | $192 | $2,304 | Setting aside 8% of GPR for future big-ticket items. |

| Property Management | $216 | $2,592 | A standard 9% fee on collected rent. |

| Total Operating Expenses | $1,233 | $14,796 |

With our expenses tallied up, we can finally calculate our Net Operating Income (NOI).

NOI = Effective Gross Income – Total Operating Expenses

$13,134 = $27,930 – $14,796

The Bottom Line: Financing and Final Cash Flow

The last major piece of the puzzle is your financing. Remember, you purchased the property for $350,000 with 20% down ($70,000), which means your loan amount is $280,000. If we assume a 30-year fixed loan at a 6.5% interest rate, your monthly principal and interest (P&I) payment comes out to about $1,770.

This debt service is what we subtract from our NOI to find our final cash flow. Now for the moment of truth:

- Annual NOI: $13,134

- Annual Debt Service: $1,770 x 12 = $21,240

- Annual Cash Flow: $13,134 – $21,240 = -$8,106

- Monthly Cash Flow: -$675.50

This case study reveals a negative cash flow, a pretty common scenario for investors in high-property-tax states like Texas, especially when using significant financing. This doesn’t automatically make it a bad investment—appreciation could still deliver strong long-term returns—but it highlights the absolute necessity of running the numbers yourself on any Dallas-area deal.

To make this whole process easier when you’re analyzing your own deals, it helps to use a tool designed to keep all these numbers organized. You can get a head start with this free rental property analysis spreadsheet I put together for investors.

Common Cash Flow Mistakes in the Dallas Market

Even seasoned investors can get tripped up when they calculate cash flow on a rental property, especially in a unique market like Dallas. One simple miscalculation is all it takes to turn a promising deal into a financial sinkhole. Making sure your projections are grounded in Dallas reality means knowing which common mistakes to sidestep.

One of the biggest and most costly errors I see is underestimating Texas property taxes. These aren’t just a small line item on your spreadsheet; with some of the highest rates in the nation, property taxes can completely torpedo your Dallas cash flow. Using a national average or a generic percentage is a recipe for disaster.

You have to look up the most recent tax rates for the specific property address in Dallas, Collin, or Denton County. Don’t guess. This information is public, and it’s the only number you should trust in your analysis.

Overlooking Big-Ticket Capital Expenditures

Another classic blunder is forgetting to budget for capital expenditures, or CapEx. These are the big, infrequent, but absolutely inevitable replacement costs—think a new roof, an HVAC system, or a water heater. Too many investors only budget for routine maintenance, leaving them completely blindsided by a $10,000 bill five years down the road.

A savvy Dallas investor knows that a roof doesn’t last forever and an AC unit will eventually fail in the Texas heat. Setting aside a separate fund for these big-ticket items—typically 5-8% of the gross rent—is non-negotiable for long-term financial health.

This isn’t just about saving for a rainy day; it’s a calculated business expense. Factoring in CapEx from the get-go ensures your property stays a viable, cash-flowing asset, not a ticking time bomb of deferred costs.

Inaccurate Vacancy and Management Assumptions

Being overly optimistic about occupancy is another trap. Sure, the Dallas rental market is strong, but assuming your property will be occupied 100% of the time is just not realistic. You have to account for the time between tenants for cleaning, marketing, and making repairs. A conservative 5-8% vacancy rate will protect your cash flow from those unavoidable gaps.

A major hit to cash flow can also come from poor tenant placement, leading to missed rent payments. This is why incorporating thorough credit checks into your vetting process is non-negotiable for securing reliable income.

Finally, a lot of new investors really misjudge the true cost of property management. They either try to do it all themselves without accounting for their own time and effort (which has value!) or they forget to budget the standard 8-10% fee for a professional service.

The decision to rent or buy in Dallas involves a lot of personal and financial factors, and understanding every associated cost is absolutely critical. You can learn more by exploring our detailed comparison of renting versus buying in Dallas to see which path aligns with your goals. Ultimately, whether you pay a pro or pay yourself, management is a real cost that has to be in your cash flow calculation.

Common Questions from Dallas Investors

When you start running the numbers on a Dallas rental, you’ll quickly find that our market has its own quirks. It’s totally normal to have questions about what’s “good” and how local factors, especially our infamous property taxes, play into the equation. Let’s tackle some of the most common questions I hear from investors.

What’s a Good Cash Flow for a Rental Property in Dallas?

There’s no single magic number, but most seasoned Dallas investors I know look for a net cash flow of $200 to $400 per month, per door. That’s the real money left over after every single bill is paid.

Of course, your personal strategy dictates what “good” means to you. For example, you might gladly accept a slimmer cash flow on a property in a rapidly appreciating area like North Dallas. There, the long-term equity growth is the real prize. On the other hand, if you’re buying in a steady, reliable suburb like Garland or Mesquite, your focus will likely be on maximizing that monthly income right from the start.

How Do Texas Property Taxes Wreck My Cash Flow Calculations?

I don’t mean to be dramatic, but Texas property taxes can absolutely destroy an otherwise great-looking Dallas deal. They are, without a doubt, the most critical expense to get right in your analysis. Using a generic national average is one of the fastest ways to turn a “can’t-miss” investment into a money pit once the tax bill arrives.

You have to dig up the actual, combined tax rates for the specific county (like Dallas, Collin, or Denton) and the city. Don’t guess. For any property you’re serious about, pull up the tax history directly from the county appraisal district’s official website. It’s a non-negotiable step.

Appreciation is a fantastic part of your overall return, but it’s not cash flow. Cash flow is the money you can actually spend—the funds hitting your bank account from the property’s operations. Keep these two completely separate in your analysis to get a true picture of your investment’s health.

Should I Factor Appreciation into My Cash Flow?

Nope. Never. Think of it this way: cash flow is the immediate, liquid profit your rental generates. It’s the tangible money in your pocket at the end of the month.

Appreciation, while a huge part of building wealth through real estate, is just paper profit. It’s “unrealized” gain until the day you sell the property or do a cash-out refinance. Blurring the lines between cash flow and appreciation will only confuse your numbers and give you a dangerously inaccurate view of how your Dallas property is performing month-to-month.

Getting a handle on the Dallas real estate market takes local knowledge and a steady hand. For personalized advice on finding and analyzing investment properties that truly fit your financial goals, trust the experts at Dustin Pitts REALTOR Dallas Real Estate Agent. Let us help you make your next move a success. Learn more at dustinpitts.com.