So, you’ve found your dream home in Dallas and are ready to make it yours. Before you get the keys, there’s one last financial step: closing costs. Think of them as the final set of fees required to officially seal the deal on your property.

These costs cover all the behind-the-scenes work, from appraisals and title insurance to legal services and property taxes. They typically add up to 2-5% of the home’s total purchase price, which can be a significant amount of cash to bring to the table. The good news? Closing cost assistance programs in Dallas exist specifically to help you manage these upfront expenses and make homeownership more accessible.

What Are Closing Costs in a Dallas Home Purchase?

When you buy a home in Dallas, the sticker price isn’t the final number. Closing costs are a bundle of separate fees paid to different parties who help finalize the sale. They cover all the administrative and legal tasks needed to transfer the property ownership from the seller to you, the buyer.

It’s a lot like buying a car. You don’t just pay the price on the window sticker; you also have to cover taxes, title transfer, and registration fees. Closing costs are the Dallas real estate version of that, making sure the entire transaction is above board and financially secure for everyone.

Key Types of Closing Costs

It might seem like a long, confusing list of charges, but most closing costs fall into just a few main buckets. Getting a handle on these categories is the first step to feeling in control of your Dallas home purchase.

- Lender Fees: These are the charges from your mortgage lender for creating, underwriting, and processing your loan. This includes things like loan origination fees, application fees, and the cost of pulling your credit report.

- Third-Party Fees: This is usually the biggest chunk of your closing costs. It covers services provided by independent professionals, such as the home appraisal, property survey, and title search.

- Prepaid Expenses: These are costs you pay in advance at the closing table for items that will recur over time. This includes your first year of homeowners insurance and funds to set up an escrow account for future property tax payments.

These aren’t just arbitrary fees; each one serves a critical purpose in protecting your investment. For example, title insurance is your safeguard, confirming that the seller legally owns the property and has the right to sell it to you. It protects you from any future ownership claims or legal headaches down the road.

For a more detailed breakdown, you can check out our guide on how to calculate closing costs for a Dallas property. Since the down payment and closing costs are the two biggest cash hurdles, it’s also smart to calculate your down payment on a house so you have a complete picture of your upfront expenses.

Now, let’s explore the assistance programs designed to make these costs much more manageable.

How Do Closing Cost Assistance Programs Actually Work?

Think of closing cost assistance as a financial co-pilot helping you land your new home in Dallas. It’s a tool designed to bridge the gap between what you’ve saved and the final amount you need to bring to the closing table.

These programs aren’t just one-size-fits-all. They come in a few different flavors, but they all share the same goal: to lower the amount of cash you need to pay upfront. This lets you keep more of your hard-earned money for things like moving trucks, new furniture, or just a healthy emergency fund.

The Three Main Ways You Can Get Help

When you start looking at assistance in the Dallas area, you’ll find most programs fit into one of three main buckets. Knowing how each one works is the key to picking the right one for you.

- Grants: This is the best-case scenario. A grant is basically free money—a gift you never have to pay back. It’s like a scholarship for buying a house, providing direct cash without adding to your future debt.

- Forgivable Loans: Picture a loan that slowly disappears over time. With a forgivable loan, you get the money for your closing costs, and as long as you live in the home, a portion of that loan is forgiven each year. After a certain period, usually around five years, the entire loan is wiped clean.

- Deferred Payment Loans: This type of loan covers your costs now, but you don’t have to start paying it back right away. In fact, you typically won’t make any monthly payments. The full amount only becomes due when you sell the house, refinance your mortgage, or finally pay it off.

At the end of the day, these programs are all about breaking down the biggest barrier for many would-be homeowners: the upfront cash requirement. By helping cover those hefty closing costs, they make buying a home in Dallas a real possibility.

More Help is Becoming Available

The good news is that these kinds of programs are becoming more common. There’s a growing movement to support homebuyers, and Texas is right at the heart of it.

Nationwide, the number of down payment assistance (DPA) programs saw an 11% jump between mid-2023 and mid-2024, now totaling 2,415. A whopping 73% of these programs are aimed at helping with down payments or closing costs.

And Texas? It’s one of the top five states with the most programs available. You can explore more details on this homebuyer assistance trend to see just how much support is out there for prospective Dallas homeowners.

Who Qualifies for Assistance in Dallas

Figuring out if you’re eligible for closing cost assistance is your very first move. Think of the requirements like a checklist for getting into an exclusive club—you want to make sure you tick all the boxes before you get your heart set on buying a home.

While every program in the Dallas area has its own specific rules, they all tend to look at the same handful of things. Once you get a handle on these common criteria, you’ll have a much better idea of where you stand.

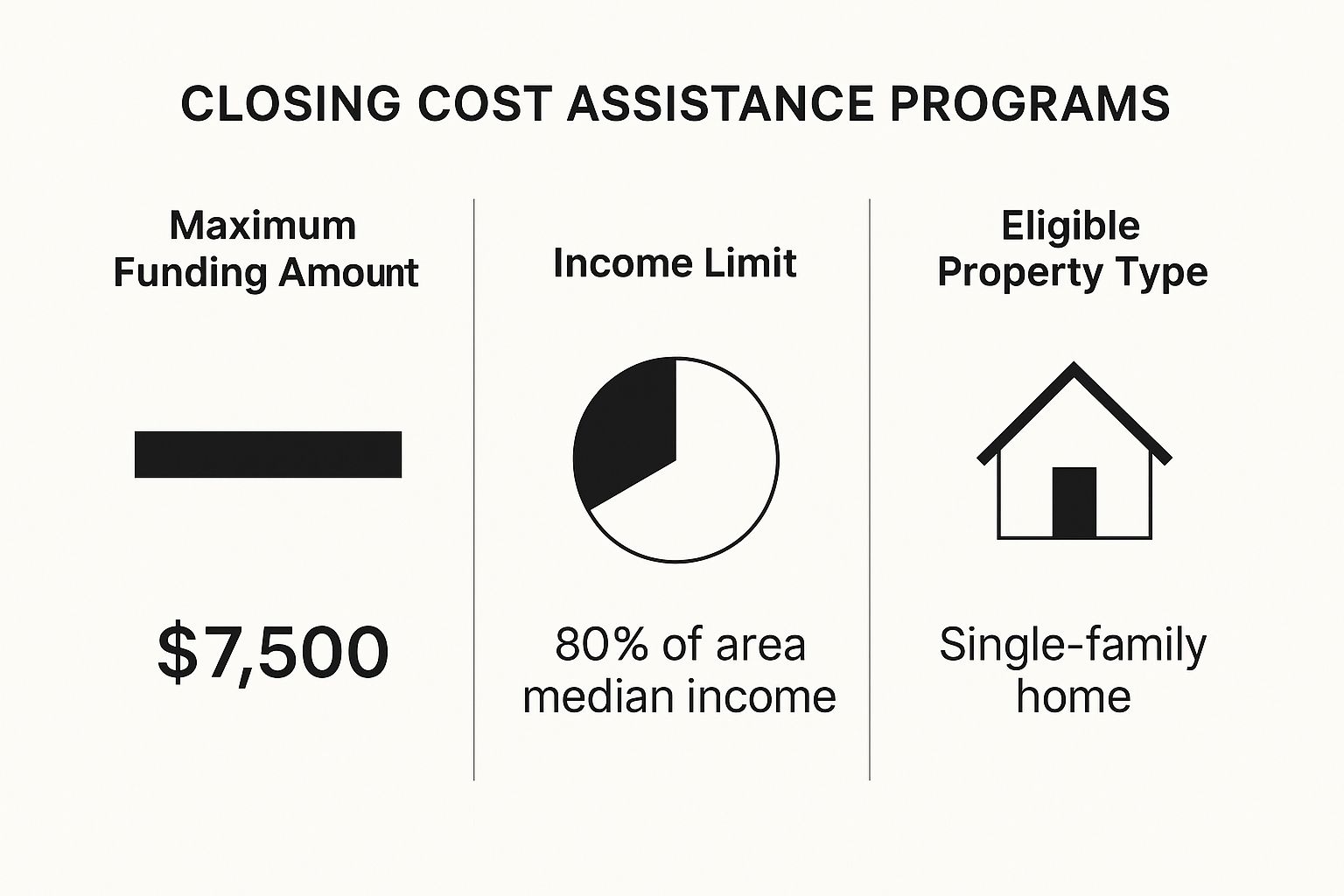

Your Income and Financial Health

First and foremost, these programs look at your household income. They use a benchmark called the Dallas Area Median Income (AMI) to see who qualifies. Your income usually needs to be at or below a certain percentage of that number—often 80% or 120%, depending on the program. It’s their way of making sure the help goes to the people who need it most.

Your credit score also plays a big role. You don’t need a perfect score, but lenders and assistance programs want to see that you’re a reliable borrower. Most programs set a minimum score, typically somewhere around 620 or 640, to show you’re ready to take on a mortgage.

The point of these programs isn’t to find homebuyers with flawless finances. It’s about helping moderate-income individuals in our Dallas community achieve the dream of sustainable homeownership.

Requirements Beyond the Numbers

Income and credit are just part of the picture. A few other standard requirements are in place to ensure you’re truly prepared for what comes with owning a home.

- Homebuyer Education: You can bet that almost any assistance program will require you to complete a homebuyer education course. These classes, which are often online, are incredibly helpful. They walk you through everything from creating a budget to understanding what happens at the closing table.

- Property Type and Location: The assistance is for your primary residence—the home you will actually live in. So, no investment properties allowed. Some programs also have geographic boundaries, meaning the aid is only for homes within Dallas city limits or specific neighborhoods they’re trying to revitalize.

- Minimum Contribution: Many programs want to see that you have some of your own money in the deal. You might be asked to contribute a small amount, often around $1,000, to show you’re personally invested in the purchase.

For anyone new to this process, getting familiar with the specific challenges and opportunities for a Dallas first-time home buyer can give you an even bigger advantage. Meeting these qualifications is your direct ticket to unlocking thousands of dollars in assistance and making your homeownership goal a reality.

Finding the Right Program in the Dallas Area

Alright, now that you have a handle on the general qualifications, let’s zero in on the specific closing cost assistance programs available right here in Dallas. It’s a great time to be looking. The world of homebuyer aid is bigger than ever, with a record 2,554 active programs nationwide as of the second quarter of 2025.

What’s really interesting is that 38% of these programs now welcome repeat buyers, not just first-timers. This shift is opening doors for more people to get back into homeownership. Dallas is no exception, with some fantastic local and state-level options to help slash those upfront costs.

Key Dallas-Area Assistance Programs

For homebuyers in our area, assistance typically comes from two main sources: the City of Dallas itself and the Texas Department of Housing and Community Affairs (TDHCA). Each one has programs built for different buyers and financial situations.

The Dallas Homebuyer Assistance Program (DHAP) is probably the best-known local option. It’s a city-run program that gives direct financial help to qualified buyers purchasing a home within Dallas city limits. If your income falls within their guidelines, DHAP is often the first place to look for some serious help with closing costs.

At the state level, the TDHCA has some heavy hitters. The My First Texas Home program is a fan favorite, bundling a mortgage loan with down payment and closing cost assistance. It’s an excellent all-in-one solution for Texans ready to buy their first place. For a deeper dive into these options, you can check out our guide on Texas home buyer grants.

To help you see how these programs stack up, here’s a quick comparison of some popular options you’ll find in the Dallas area.

Comparison of Dallas Area Closing Cost Assistance Programs

This table breaks down the key features of popular assistance programs available to homebuyers in Dallas.

| Program Name | Provider | Assistance Type | Maximum Assistance | Key Requirement |

|---|---|---|---|---|

| Dallas Homebuyer Assistance Program (DHAP) | City of Dallas | Forgivable Loan/Grant | Varies (often up to $60,000) | Property within Dallas city limits; Income limits |

| My First Texas Home | TDHCA | 30-year, fixed-rate mortgage with assistance | Up to 5% of the loan amount | First-time homebuyer; Credit/income requirements |

| My Choice Texas Home | TDHCA | 30-year, fixed-rate mortgage with assistance | Up to 5% of the loan amount | Open to all homebuyers (not just first-time) |

| SETH 5 Star Texas Advantage Program | SETH | Grant or Forgivable 2nd Lien | Up to 5% of the loan amount | Varies by location and buyer profile |

This table shows that while local programs like DHAP can offer substantial funding, they come with specific geographic and income rules. Statewide options, on the other hand, often provide more flexibility for buyers across Texas.

Choosing Your Best Fit

So, which program is right for you? That’s a personal decision that comes down to your financial picture and what you’re looking for in a home. The best thing you can do is line up the details of each program side-by-side and see how they match your situation.

Your ideal program is the one that aligns perfectly with your circumstances. Consider the assistance amount, whether the aid is a grant or a forgivable loan, and if you meet the specific income and credit score requirements.

Don’t just stop at the first one you find. The assistance landscape is full of opportunities, and things can change quickly. For more great insights into the market and other resources that might help your search, check out this excellent real estate blog. A little extra research now can save you thousands of dollars at the closing table.

Your Step-By-Step Application Guide

Navigating the world of closing cost assistance programs in Dallas can feel a little intimidating at first, but it really just boils down to a few key steps. Once you see the process laid out, you can tackle it one piece at a time and avoid the common hiccups that trip up many prospective buyers.

Think of it like getting ready for a big trip. You wouldn’t just jump in the car and go; you’d get your route planned, your car checked out, and your documents in order. Applying for assistance is no different. The journey starts with finding the right guide.

Find An Approved Lender First

This is, without a doubt, the most important first move you can make. You can’t just walk into any bank or call any mortgage company. You absolutely must partner with a lender who has been officially approved by the specific assistance program you’re interested in.

Whether it’s a Dallas city program or a statewide option from the Texas Department of Housing and Community Affairs (TDHCA), these approved lenders are the experts. They know the rules inside and out, understand the paperwork, and can prevent you from spinning your wheels on an application that’s going nowhere. Starting with them saves a massive amount of time and frustration.

Gather Your Essential Documents

With an approved lender on your team, it’s time to pull together your financial paperwork. This is how the program confirms that you meet the income and credit requirements. No surprises here—it’s the standard stuff needed for any home loan.

Your lender will give you a specific checklist, but you can get a head start by tracking down these common items:

- Proof of Income: Grab your most recent pay stubs covering a 30-day period.

- Tax Records: You’ll need your federal tax returns from the last two years.

- Bank Statements: Pull up the latest statements from your checking and savings accounts.

- Identification: A government-issued photo ID, like your driver’s license, is a must.

Having all of this organized and ready to hand over shows you’re a serious, prepared buyer. It makes life easier for everyone involved and can seriously speed up your timeline to the closing table.

Complete Your Homebuyer Education

Just about every single closing cost assistance program in Dallas will require you to complete a homebuyer education course. Don’t look at this as just another hoop to jump through—it’s genuinely designed to set you up for success as a homeowner.

These courses, many of which you can do online, cover everything from creating a household budget to understanding the fine print in your mortgage documents. The certificate of completion is a mandatory part of your application, so knocking this out early is a smart move. Plus, the knowledge you pick up will be valuable long after you get the keys to your new home.

Got Questions About Dallas Closing Cost Assistance? We’ve Got Answers.

When you’re navigating the Dallas home financing maze, it’s natural for questions to pop up—especially around something as specific as closing cost assistance. Dallas homebuyers often run into the same hurdles, and getting straight answers is the only way to move forward with real confidence.

Think of this section as your personal cheat sheet. We’re tackling the most common questions head-on to clear up any confusion and give you a better feel for how these programs can fit into your homebuying plans.

Do I Have to Be a First-Time Homebuyer in Dallas to Qualify?

Not at all. This is probably the biggest myth we hear about closing cost assistance. While many programs are certainly geared toward helping people buy their first home, plenty of options in Dallas are wide open to repeat buyers.

In fact, some programs get creative with the definition of a “first-time homebuyer.” You might be considered one if you simply haven’t owned a home in the last three years. That means even if you’ve been a homeowner before, you could still be eligible. Beyond that, other programs have no first-time buyer requirement whatsoever, particularly those designed to support specific Dallas neighborhoods or professions.

The bottom line? Never count yourself out. Always dig into the specific rules for any program that catches your eye, because they’re designed to help a much broader group of buyers than you might think.

Will I Have to Pay This Money Back?

This is a fantastic question, and the answer really depends on which program you choose. The assistance is usually structured in one of three ways, and each has its own rules about repayment.

It’s crucial to understand these differences, so let’s break them down:

- Grants: This is the gold standard of assistance. It’s essentially a gift that you never have to repay.

- Forgivable Loans: Think of this as a loan with an expiration date. It’s typically forgiven over a set period, often five years, as long as you live in the home and it remains your primary residence.

- Deferred Payment Loans: These are often zero-interest loans that you don’t have to worry about until later. Repayment is only required when you sell the home, refinance, or pay off your mortgage.

It is absolutely essential to talk through these terms with your lender. Understanding your financial obligations down the road is key to picking the Dallas closing cost assistance program that truly fits your long-term goals.

Can I Just Use My Own Bank or Any Lender I Want?

No, and this is a big one. You must work with a mortgage lender who is officially approved and certified to handle the specific assistance program you’re interested in. There’s no wiggle room on this requirement.

Both the City of Dallas and state-level agencies like the Texas Department of Housing and Community Affairs (TDHCA) keep updated lists of participating lenders right on their websites. These lenders are trained on all the program rules, paperwork, and application quirks. Honestly, starting your search with one of these approved lenders is one of the smartest moves you can make. Their experience will be a huge advantage in making sure your application sails through smoothly.

How Does Assistance Work With My Main Home Loan?

Closing cost assistance doesn’t replace your primary mortgage (like a conventional or FHA loan); it works right alongside it. The help usually comes in the form of a separate, much smaller loan or a grant that gets applied when you sign the final papers at closing.

Now, in some situations, pairing your main mortgage with an assistance program might mean you get a slightly higher interest rate on that primary loan. Lenders sometimes do this to balance the risk or cover the extra administrative work involved. But for the vast majority of Dallas homebuyers, this small trade-off is more than worth it. Receiving thousands of dollars in immediate cash assistance can completely remove the single biggest obstacle standing between you and your new home.

Finding your way through the Dallas real estate market is easier with an expert guide. At Dustin Pitts REALTOR Dallas Real Estate Agent, we specialize in connecting homebuyers with the resources they need to make their dreams a reality. Let our team help you explore all your options and find the perfect path to homeownership. Visit us online to get started.