When you’re trying to decide between a conventional loan and an FHA loan in Dallas, it really comes down to a classic trade-off: flexibility versus cost.

Think of it this way: an FHA loan is often the better route for buyers with lower credit scores or a smaller down payment saved up. A conventional loan, on the other hand, typically rewards those with stronger credit and more cash on hand, often leading to lower costs over the long haul. Making the right call here is a huge deal, especially in Dallas’s fast-paced real estate market.

Choosing Your Path to Dallas Homeownership

Navigating the Dallas real estate scene means making smart financial moves from day one. Your mortgage is arguably the biggest of them all, and for most people looking to buy a home in Dallas, the choice narrows down to either a conventional or an FHA loan. These two loans serve different buyers, and you need to get the core distinctions straight before you start touring homes in Bishop Arts or looking at suburbs like Plano.

An FHA loan, which is backed by the Federal Housing Administration, was specifically created to open the doors of homeownership to more people. It comes with more forgiving credit score requirements—sometimes as low as 580—making it a real possibility if your credit history has a few bumps. That flexibility also applies to the down payment, which can be as little as 3.5%.

Conventional loans, however, are a different animal. They aren’t insured by the government, so lenders are a bit stricter. They’re typically looking for a credit score of at least 620. And while it’s possible to get a conventional loan with just 3% down, borrowers with a solid financial footing are the ones who usually get the best terms and lowest costs with this option.

Here’s a piece of insider advice: the loan you choose can seriously impact how a seller sees your offer. In a hot Dallas market, an offer backed by a conventional loan often looks stronger and less risky to a seller, which could give you the upper hand in a bidding war.

So, let’s take a quick look at how these two popular loans stack up for anyone buying a home in Dallas.

Quick Look Conventional vs FHA Loans in Dallas

Here’s a simple, at-a-glance comparison to help you see the main differences between these two loan options for Dallas homebuyers.

| Feature | Conventional Loan | FHA Loan |

|---|---|---|

| Best For | Buyers with strong credit and savings | Buyers with lower credit or smaller down payments |

| Minimum Down Payment | As low as 3% | 3.5% |

| Credit Score Minimum | Typically 620+ | Typically 580+ |

| Mortgage Insurance | PMI, often cancelable with 20% equity | MIP, often for the life of the loan |

| Seller Perception | Generally viewed more favorably | Can be seen as having more potential hurdles |

This table gives you the highlights, but there’s a lot more to it. This guide will walk you through every critical detail—from the nuances of mortgage insurance to property standards—so you can make the absolute best choice for your Dallas home purchase.

Credit Score and Down Payment Requirements

When you’re weighing a conventional loan against an FHA loan, the conversation almost always starts with two things: your credit score and your down payment. For any Dallas homebuyer, these aren’t just numbers on a form; they dictate whether you get approved and shape the financial DNA of your mortgage for decades. Lenders here in Dallas have their own way of looking at these factors for each loan, and it goes beyond the national minimums you might see online.

An FHA loan is often the lifeline for buyers who need a bit more breathing room. The FHA gives the green light for credit scores as low as 580 with just a 3.5% down payment. This can be a total game-changer if you’re financially solid but your credit history isn’t quite perfect.

That said, a better score always helps, even with FHA. Dallas lenders are more likely to offer you a better interest rate if your FHA application shows a score north of 620. It’s always a good idea to polish up your credit profile before you apply. To get into the weeds on this, check out our detailed guide on FHA loan requirements in Texas.

How Credit Scores Impact Conventional Loans

Conventional loans are a different beast entirely. They operate on a tiered system where a stronger credit profile directly unlocks better financial terms. The absolute floor is typically a 620 credit score, but the real magic starts happening as your score climbs. A buyer with a 740 score is going to see a much lower interest rate and more affordable Private Mortgage Insurance (PMI) than someone just clearing the bar at 640.

This difference isn’t just academic; it translates to real purchasing power in hot Dallas neighborhoods.

For instance, a buyer trying to get into a sought-after area like Plano or the Bishop Arts District with a 740 score might qualify for a larger loan at a lower monthly payment. In a bidding war, that could be the exact edge they need to land their dream home.

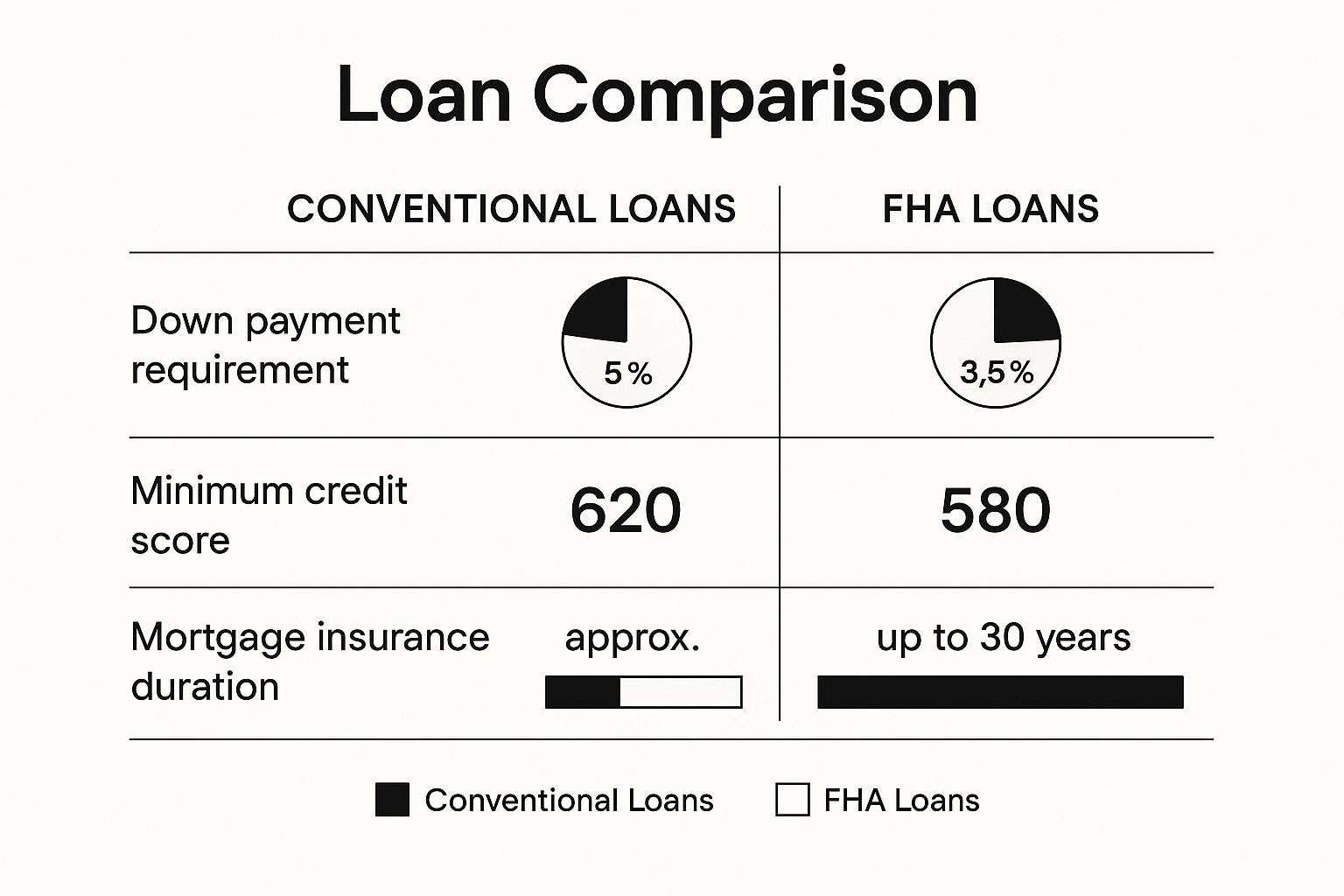

This infographic really puts the core differences side-by-side.

As you can see, getting your foot in the door is easier with an FHA loan, but the long-term cost of that mortgage insurance can really add up over time.

Down Payment Nuances in Dallas

Many people think you need 20% down for a conventional loan, and while that amount does let you skip PMI altogether, it’s far from a requirement. Plenty of Dallas buyers get approved with as little as 3-5% down. This makes conventional loans surprisingly accessible, especially for those with great credit who just haven’t had time to save up a massive lump sum.

On the other hand, the FHA’s 3.5% minimum down payment is refreshingly straightforward. As long as your credit score is 580 or higher, that’s the number. This predictability is huge for buyers who need to know exactly how much cash they’ll need at closing.

Ultimately, the right choice boils down to your personal financial snapshot. Your credit health and the cash you have on hand will naturally point you down the most logical path for your Dallas home purchase.

Decoding Mortgage Insurance in the DFW Market

Mortgage insurance is one of the most significant long-term costs that Dallas homebuyers need to wrap their heads around when comparing a conventional loan vs. an FHA loan. This isn’t just a minor fee; it’s a hefty monthly expense that works very differently depending on your loan, and it will directly impact your purchasing power in the DFW market.

FHA loans come with something called a Mortgage Insurance Premium (MIP), and it’s a two-part system. First off, there’s an upfront premium, which currently sits at 1.75% of your total loan amount. So, for a $350,000 home in a Dallas suburb, that’s an extra $6,125 you’ll need to pay at closing or roll into your loan.

But the upfront cost is only part of the story. You’ll also be paying a monthly MIP, and this is where the real financial catch of an FHA loan often lies. If you put down less than 10%, that monthly insurance payment is stuck with you for the entire life of the loan.

The Conventional Loan Alternative: Private Mortgage Insurance

Conventional loans handle this differently with Private Mortgage Insurance (PMI). Unlike the mandatory MIP on FHA loans, PMI is only required if your down payment is less than 20% of the home’s purchase price. The cost of PMI also varies quite a bit based on your credit score and how much you put down.

A Dallas buyer with a 740 credit score is going to pay a much lower PMI rate than a buyer with a 640 score. That flexibility is a huge perk for anyone with a strong financial history. But the biggest difference of all? PMI isn’t permanent.

The ability to cancel mortgage insurance is the single biggest long-term financial advantage of a conventional loan. Once you reach 20% equity in your Dallas home—either through payments or market appreciation—you can request to have PMI removed, permanently lowering your monthly housing cost.

This is a massive distinction with serious financial implications. Let’s break down how these two insurance types actually stack up for a typical home purchase right here in the Dallas area.

MIP vs. PMI: A Dallas Cost Comparison

Let’s say you’re buying a $400,000 house in North Dallas. Here’s a quick look at what the insurance costs might look like:

- FHA Loan Scenario: You’re on the hook for an upfront MIP of $7,000 (1.75% of the loan). Then you’ll have a monthly MIP payment that could follow you for 30 years, potentially costing you tens of thousands of extra dollars over the life of the mortgage.

- Conventional Loan Scenario: With a 5% down payment and good credit, you’ll have monthly PMI. But once your loan balance drops to $320,000 (hitting that 20% equity mark), you can cancel the insurance. In Dallas’s appreciating market, you might hit that target in just a few years.

For a long-term Dallas homeowner, the lifetime cost of FHA mortgage insurance can be a major financial drag. In contrast, the temporary nature of PMI on a conventional loan provides a clear path to a lower monthly payment down the road.

Navigating Loan Limits and Property Standards

The choice between a conventional and an FHA loan does more than just tweak your monthly payment—it can fundamentally shape where and what you can buy across the entire Dallas-Fort Worth metroplex. Both loan types have maximum borrowing amounts, known as loan limits, and very specific rules about the condition of the home you’re buying. From McKinney down to Fort Worth, these factors can either open up your home search or seriously narrow it down.

For a conventional loan to be considered “conforming,” it has to stay within the limits set by the Federal Housing Finance Agency (FHFA). These limits are almost always much higher than what the FHA allows, giving you the keys to more expensive properties without veering into jumbo loan territory. For 2025, the FHFA set the conforming loan limit at a hefty $806,500 for most of the U.S., a direct reflection of climbing home prices.

Compare that to FHA loan limits, which are capped at $524,225 for a single-person residence in most Texas areas, including Dallas County. The difference is stark and clearly shows how a conventional loan can unlock higher-priced homes in some of Dallas’s most sought-after neighborhoods. For a deeper dive into these loan limit differences, check out the analysis on Bankrate.com.

This gap is a huge deal here in Dallas, where home prices can swing wildly from one neighborhood to the next. If you’ve got your eye on affluent areas like Preston Hollow or Highland Park, a conventional loan is pretty much your only option. An FHA loan, with its lower ceiling, is a much better fit for more moderately priced homes, like those in certain up-and-coming parts of East Dallas or the surrounding suburbs.

FHA Property Standards and Seller Perceptions

Beyond the dollar signs, property standards are a major dividing line, especially in a competitive market like DFW. FHA appraisals are known for being incredibly strict, and for good reason—they do more than just determine a home’s value. An FHA-approved appraiser is also required to confirm the property meets the government’s minimum standards for health and safety.

This means they’ll call out issues that a conventional appraiser might not even mention. Think things like:

- Peeling paint in homes built before 1978 (a lead-based paint hazard)

- An inadequate heating or electrical system

- Obvious safety issues, like missing handrails on a staircase

- Any evidence of a leaky roof or structural problems

These stringent requirements can be a real headache for sellers. If an FHA appraisal comes back with a list of required repairs, the seller has to fix them before the loan can close. That often means delays and unexpected costs they weren’t banking on.

This is exactly why sellers in hot Dallas neighborhoods almost always prefer offers backed by conventional financing. A conventional offer signals a smoother, faster closing with fewer hoops to jump through, giving you a serious competitive advantage when you’re in a bidding war.

At the end of the day, while an FHA loan is a fantastic tool that opens the door to homeownership for many, its stricter property standards can sometimes put you at a disadvantage. A conventional loan gives you more flexibility and is often seen as a much stronger negotiating tool when you finally find that perfect Dallas home.

How DTI Ratios and Seller Perceptions Can Make or Break Your Offer

Beyond the black-and-white numbers of credit scores and down payments, two other factors often become the real tiebreakers: your debt-to-income (DTI) ratio and how sellers in Dallas view your loan type. These elements can seriously impact not just your buying power, but your ability to compete in the fast-paced DFW market.

Your DTI ratio is simply a measure lenders use to see how well you can handle your monthly mortgage payment on top of your existing debts. FHA loans are famously more forgiving here, often greenlighting buyers with higher DTI ratios. This is a huge advantage for Dallas buyers juggling student loans or car payments. For a deeper dive, check out our guide on what the debt-to-income ratio means for your mortgage application.

But here’s the catch: what gets you approved with a lender might not win over a seller.

How Dallas Sellers Really View Your Loan Choice

In a hot market like Dallas, sellers and their agents are looking for the cleanest, most straightforward path to the closing table. An offer backed by a conventional loan often signals a financially solid buyer, which can immediately make your offer stand out from the pack.

A big reason for this comes down to the appraisal. FHA loans have much stricter appraisal standards because the appraiser has to confirm the home meets specific government-mandated safety and livability criteria. This can sometimes flag issues that delay or even kill a deal. Because of this, sellers in competitive situations often lean toward conventional loans, which come with a quicker, less intensive appraisal process.

When you’re in a multi-offer situation for a great Dallas home, an offer with a conventional loan is almost always seen as stronger and more reliable. This perception can give you a massive edge, even if your offer isn’t the highest number on the table.

This doesn’t mean an FHA loan is a bad move. Not at all. A well-qualified buyer with a solid pre-approval from a respected Dallas lender can absolutely submit a winning offer. The secret is understanding how your financing looks from the other side of the table and working with your real estate agent to frame your offer in the strongest possible light.

Which Loan Is Right for Your Dallas Home Purchase

Choosing between a conventional loan and an FHA loan really just comes down to your unique financial situation and what you’re trying to accomplish in the Dallas market. There’s no magic bullet or one-size-fits-all answer here. The best way forward is to match the loan’s biggest strengths to your personal profile.

To get a clearer picture, let’s walk through a couple of common scenarios Dallas buyers find themselves in. Each profile shows how one loan can give a homebuyer a real advantage over the other.

Buyer Profiles for the Dallas Market

Profile 1: The Uptown Professional with Student Debt

Imagine a young professional making great money but also carrying significant student loan debt. They’ve found the perfect condo in Uptown, but their debt-to-income ratio is a little too high for most conventional lenders.

- Best Choice: An FHA loan. Its more forgiving DTI requirements can make qualifying much easier, opening a path to homeownership that might otherwise be closed due to their existing financial obligations.

Profile 2: The Frisco Buyer with Strong Credit

Now, picture someone with a 760 credit score and a 10% down payment saved up for a home in a competitive suburb like Frisco. Their main goals are long-term savings and building equity as fast as possible.

- Best Choice: A conventional loan. This is a no-brainer. They can completely sidestep FHA’s lifetime mortgage insurance. With their strong credit, their PMI will be affordable and—most importantly—it can be canceled once they hit 20% equity, saving them thousands over the life of the loan.

The right mortgage is the one that aligns with both your immediate purchasing power and your long-term financial health. The upfront flexibility of an FHA loan is perfect for some, while the long-term cost savings of a conventional loan better suit others.

Making this decision is a critical step in your journey. For a detailed look at what comes next, check out our comprehensive home buying process checklist, which guides you through the entire journey. By carefully weighing the conventional vs. FHA differences against your specific goals in Dallas, you can confidently pick the financing that sets you up for success.

Frequently Asked Questions

Even after comparing conventional and FHA loans side-by-side, Dallas homebuyers often have a few specific questions that pop up. This section is all about getting you quick, clear answers to help you lock in your final decision.

Can I Use Gift Funds For My Down Payment in Dallas?

Yes, you absolutely can. Both FHA and conventional loans allow you to use gift funds for a down payment in Texas, but they play by slightly different rules. FHA is generally more flexible, letting you accept gifts from a wider circle, including close friends, employers, or charitable organizations.

Conventional loans, on the other hand, usually require the gift funds to come from a relative. No matter which loan you choose, the lender will ask for a formal gift letter confirming the money isn’t a loan and never has to be repaid.

Is One Loan Type Faster to Close in the DFW Market?

In a hot market like Dallas, speed is everything. In that race, conventional loans often close faster than FHA loans. The main reason comes down to the FHA’s stricter property appraisal standards, which can sometimes flag required repairs and create delays.

A conventional appraisal is more straightforward, focusing primarily on the home’s market value. This efficiency is a big reason why Dallas sellers often smile a little brighter at offers backed by conventional financing.

For a Dallas buyer, a faster closing can be a powerful negotiating tool. While an FHA loan might take 30-45 days, a smooth conventional closing can sometimes be wrapped up in under 30 days, making your offer much more attractive to a motivated seller.

What Are My Refinancing Options Later On?

Your options for refinancing really hinge on the loan you pick from the start. If you go with an FHA loan, a popular move for Dallas homeowners is to refinance into a conventional loan once you’ve built up at least 20% equity. This is a fantastic strategy to finally ditch that pesky monthly MIP.

On the flip side, if you start with a conventional loan, you can always refinance into another conventional loan to snag a lower interest rate or adjust your loan term. And if you already have an FHA loan, you could look into an FHA Streamline Refinance to lower your rate with a lot less paperwork. Each path offers a strategic way to manage your mortgage as your finances and the Dallas market change over time.

Figuring out the maze of conventional and FHA loans is much easier with an expert in your corner. Connect with Dustin Pitts, REALTOR® Dallas Real Estate Agent, to get personalized advice for your Dallas home purchase at https://dustinpitts.com.