The Dallas real estate market is going through a major gear shift. After years of a white-hot seller’s market, things are finally starting to settle down, moving toward a more balanced playing field for everyone. The most telling Dallas real estate market trends point to a slight dip in home sales, while the number of available homes—the inventory—has climbed.

This change is good news for buyers, giving them more choices and a bit more breathing room. For sellers, it simply means it’s time to be more strategic.

Navigating The Dallas Real Estate Market Today

Think of the Dallas market like a highway that’s been jammed with one-way traffic for years. That traffic, flowing entirely in the seller’s favor with fierce bidding wars and skyrocketing prices, is finally starting to even out. This isn’t a crash; it’s a healthy correction. We’re moving into a more predictable and sustainable environment.

This guide will break down exactly what this new landscape means for you. We’ll start with a clear picture of what’s happening right now, looking at how moderating price growth and more homes on the market are opening up new doors. For buyers, this translates to more negotiating power. For sellers, it calls for a smarter approach to pricing and getting their home show-ready.

Key Dynamics At Play

A few key factors are steering the market in Dallas right now. Getting a handle on these will help you make a smart move, whether you’re buying, selling, or just watching from the sidelines.

- Buyer Affordability vs. Seller Expectations: We’re seeing a classic tug-of-war. On one side, buyers are constrained by current mortgage rates. On the other, sellers remember the peak of the market and have high expectations. Finding the middle ground is the name of the game in Dallas.

- Rising Inventory Levels: The increase in the number of homes for sale is a game-changer. More supply directly impacts competition and pricing, giving buyers an advantage they haven’t had in years.

- Neighborhood-Specific Trends: Dallas isn’t a monolith. Some neighborhoods are still seeing strong demand and quick sales, while others are cooling off more noticeably. Location is more critical than ever.

To give you a clearer picture, here’s a quick rundown of the major market forces at work in Dallas.

Dallas Real Estate At A Glance

| Market Indicator | Current Direction | What It Means For You |

|---|---|---|

| Median Home Price | Stabilizing | Buyers: Less dramatic price jumps. Sellers: Aggressive pricing is less effective. |

| Housing Inventory | Increasing | Buyers: More options to choose from. Sellers: More competition in the market. |

| Days On Market | Slowly Increasing | Buyers: More time for decisions. Sellers: Homes may take a bit longer to sell. |

| Mortgage Rates | Fluctuating | Buyers: Impacts purchasing power. Sellers: Affects the pool of qualified buyers. |

This table shows we’re in a period of adjustment. The Dallas market isn’t slamming on the brakes, but it is certainly tapping them.

The Dallas market is moving towards a more balanced state. It’s no longer the extreme seller’s market we saw a couple of years ago. Buyers certainly have more leverage than they did before.

This shift creates a much more nuanced playing field. The days when any Dallas property, in any condition, would sell in a weekend for way over the asking price are behind us. Success now hinges on having a deep, practical understanding of local conditions.

For a deeper dive, check out our complete guide on the Dallas housing market in 2024, where we unpack even more insights into these trends. Think of this as your roadmap to making the most of the opportunities in Dallas real estate right now.

Breaking Down Dallas Home Prices and Valuations

To really get a feel for the Dallas real estate market, you have to look past the flashy headline numbers. Sure, the median home price is a decent starting point, but it doesn’t even begin to tell the whole story. It’s like judging a car by its top speed alone—you’re completely missing the details on acceleration, handling, and what it’s actually like to drive.

The real story of what’s happening with Dallas home values is in the details. We’re talking price per square foot, subtle differences between how various sources report data, and the on-the-ground reality. Things like interest rates and the constant stream of corporate relocations are putting some complex pressures on both housing demand and prices all across the city.

Interpreting Recent Price Adjustments

When people see prices dip, their first thought is often “downturn.” But what’s happening in Dallas right now is much more of a market correction. Think of it like a marathon runner who’s been sprinting for miles. They can’t keep up that breakneck pace forever. Eventually, they have to slow to a steady, sustainable jog to avoid burning out completely. That’s our real estate market—it’s shifting from an impossible sprint to a healthier, more manageable pace.

A few key things are driving these adjustments in Dallas:

- Interest Rate Impact: Higher mortgage rates hit buyers directly in the wallet, squeezing their purchasing power. This naturally puts some downward pressure on prices as affordability takes center stage.

- Corporate Relocations: Big companies are still moving to the Dallas area, which keeps feeding demand for housing. The difference now is that these newcomers are a lot more price-sensitive than they were at the peak of the market frenzy.

- Buyer Psychology: After years of crazy bidding wars, Dallas buyers are just more cautious now. They’re not as willing to overpay, and that’s forcing sellers to get more realistic with their expectations.

Looking at the hard numbers, the average home value in Dallas is sitting around $315,056, which is a drop of about 4.6% over the last year. This dip shows home values are softening a bit, even though the market is still active. On average, homes are going under contract in about 27 days, which tells us things are still moving, just not at the chaotic speed we saw before.

A Tale of Two Property Types

Not all real estate is created equal, and that’s especially true in Dallas at the moment. Single-unit homes, townhomes, and condos are all playing by different rules. While single-unit homes are seeing a pretty moderate adjustment, the condo and townhome markets are feeling a more significant shift.

For example, sales for single-unit homes have only dipped slightly, but condo sales have dropped off quite a bit. This split suggests that buyers are leaning toward properties with more space or maybe just trying to avoid shared amenities and the HOA fees that come with them. For investors, understanding apartment building valuation methods is more important than ever, as many of those principles apply directly to condos and multi-unit properties in Dallas.

A healthy market correction is not a crash. It is the market’s natural way of finding a new equilibrium after a period of rapid, unsustainable growth. This phase allows fundamentals like income levels and economic stability to catch up with property values.

This distinction is critical whether you’re buying or selling in Dallas. If you’re selling a single-unit home, strategic pricing is everything. If you’re looking to buy a condo, you might find yourself in a buyer’s market with more room to negotiate. Knowing the nuances of these different segments is essential to making a smart move.

It also helps to see how Dallas stacks up against other big southern cities. For anyone weighing their options, our real estate market comparison of Atlanta vs. Dallas offers some great context on how different economic drivers are shaping each city’s property landscape. This bigger picture really helps clarify the unique forces at play right here in DFW.

Understanding The Shift In Housing Inventory

One of the most significant Dallas real estate market trends we’re seeing right now is a noticeable loosening of housing inventory. For years, listings felt like they were vanishing the second they appeared. Now, more properties are hitting the market, and—more importantly—they’re sticking around a little longer.

This isn’t a red flag. Think of it as the Dallas market finally taking a much-needed breath after an exhausting, multi-year sprint. We’re shifting away from the frantic seller’s market we all got used to and heading toward a more balanced, sustainable environment. For anyone trying to buy or sell in Dallas, grasping this inventory shift is the key to making smart moves.

What Is Months Of Supply

If you want to get a real feel for the market’s tempo, you need to understand the metric “months of supply.” It’s a simple but powerful concept: if no new homes were listed for sale, how long would it take to sell every single home currently on the market?

A low number, usually anything under four months, screams seller’s market. That means high competition and bidding wars. A high number, like six months or more, signals a buyer’s market where shoppers have more options and less pressure.

In Dallas, that number has been climbing. And that’s a game-changer. It impacts everything from asking prices to negotiation leverage. It’s the single biggest reason why the days of chaotic bidding wars are fading.

Let’s look at the numbers. The median home price recently climbed to about $460,611, a 4.5% increase from last year. But here’s the twist: the number of homes sold in that same timeframe plummeted from 940 to just 562. At the same time, the total number of homes for sale shot up 12.3% to 5,805 units.

This combination of fewer sales and more listings caused the months of supply to more than double, jumping from 4.32 to a hefty 8.37 months. That’s a crystal-clear signal that the market is tilting in favor of buyers. You can find more insights about these Dallas market dynamics and see how they are reshaping the current landscape.

Why Inventory Is Growing

So, where are all these extra houses coming from? It’s a mix of a few factors. For one, stubbornly high interest rates have cooled buyer demand. The intense urgency has faded, so homes naturally take longer to sell. We’ve seen the median days on market creep up from around 25 to over 32 days.

At the same time, homeowners who put off selling during the peak chaos are now deciding it’s time to make their move. This one-two punch of slower sales and a steady flow of new listings is what’s causing our local inventory to build.

The shift toward a balanced market is one of the most significant Dallas real estate market trends we’ve seen in years. It requires a complete adjustment in strategy for both buyers and sellers, moving away from reactive decisions toward proactive, data-driven planning.

This new reality has very practical consequences. Buyers finally have the luxury of time. They can schedule proper inspections and think through an offer without the pressure of waiving every contingency.

Practical Impacts Of Increased Supply

This growing inventory is fundamentally changing how deals get done in Dallas. Sellers can no longer just name their price; they have to compete for a buyer’s attention. That means smart pricing and top-notch presentation are absolutely essential.

- For Buyers: The biggest win is negotiating power. With more houses to choose from, you’re in a much stronger position to negotiate the price, ask for repairs, or even get the seller to contribute to your closing costs.

- For Sellers: The market is demanding a dose of realism. Overpricing your home is the fastest way to get overlooked. Properties that sit on the market too long often end up selling for less than if they were priced correctly from day one.

Ultimately, what we’re seeing is a return to normalcy. It’s a market that rewards careful planning over impulsive decisions, creating a much healthier and more predictable path for anyone looking to achieve their real estate goals in Dallas.

A Closer Look At The Dallas Condo Market

While the broader Dallas housing market is settling into a new normal, the city’s condo scene is dancing to a completely different beat. It’s a perfect example of why you can’t paint all Dallas real estate market trends with the same brush. The condo segment has become its own distinct micro-market, and the story here is all about dramatic shifts.

Think of the single-unit home market as a busy highway where traffic is finally slowing to a more manageable speed. The condo market, on the other hand, is like an intersection where several lanes just closed, causing a major pile-up of available properties. For sellers, that means navigating some serious congestion. For buyers, the road ahead is wide open.

A Buyer’s Market Emerges

The data paints a vivid picture: this part of the Dallas market is tilting heavily in favor of buyers. Unlike the subtle adjustments we’re seeing in single-unit homes, the condo market has gone through a much sharper correction. This isn’t just a minor cool-down; it’s a fundamental shift in supply and demand.

The numbers don’t lie. In May 2025, Dallas condo sales took a steep 32.29% nosedive year-over-year, with only 216 units changing hands. This drop echoed in the total dollar volume, which fell nearly 29% to around $101.3 million. At the same time, the median closing price for condos slipped 7.1% to $265,000, a clear signal of softening in this niche. You can learn more about the factors behind these Dallas market changes and how they’re hitting different property types.

The glut of condos on the Dallas market has created a rare window of opportunity for buyers. With way more listings than active shoppers, the negotiating power has shifted decisively, opening the door for better terms and prices.

This environment is a direct result of inventory piling up faster than it can sell. While new condo listings ticked up by 7%, active listings exploded by a massive 50.6%. All this pushed the inventory level up by over 66% to 8.2 months of supply, cementing its status as a true buyer’s market.

Forces Driving The Condo Market Shift

So, what’s causing this unique trend in Dallas condos? It’s not just one thing, but a handful of factors creating a growing gap between supply and demand. If you’re looking to jump into this specific corner of the market, you need to know what’s driving the change.

Here are a few of the forces at play:

- Changing Buyer Preferences: The recent focus on personal space has pushed many buyers toward properties with yards and dedicated home offices—features that are much easier to find in a single-unit house.

- The Impact of HOA Fees: Rising Homeowners Association fees, which cover building maintenance and amenities, can add a hefty sum to the monthly cost of ownership, making some condos look less attractive financially.

- Influx of New Construction: Dallas has seen a steady stream of new multi-unit developments come online, adding fresh inventory to a market just as demand started to cool.

When you put these pieces together, you get a highly competitive landscape for sellers and an incredible opportunity for buyers. It’s a classic case of supply outpacing demand, and that always leads to price adjustments and more bargaining power for those ready to make a deal.

Strategies For Buyers And Sellers

If you’re active in the Dallas condo market right now, a one-size-fits-all strategy just won’t cut it. Your approach has to be tailored to the specific conditions of this buyer-friendly environment.

For Condo Buyers:

Your negotiating power is at an all-time high. Don’t be afraid to come in with a competitive offer below the asking price. With so many comparable listings available, you have plenty of data to justify your offer. Be ready to ask for concessions, too, like having the seller contribute to closing costs or provide a credit for updates.

For Condo Sellers:

Your two biggest priorities are pricing and presentation. In a crowded field, your listing absolutely must stand out. Price your condo competitively from day one to grab immediate attention. You should also invest in professional staging and photography to make a killer first impression. Being flexible on terms can also make your property much more appealing than the one down the hall.

Exploring Dallas Neighborhood Hotspots

While city-wide statistics give you a good bird’s-eye view, the real action in the Dallas real estate market trends is happening on the ground, neighborhood by neighborhood. Dallas isn’t one monolithic market; it’s a vibrant patchwork of smaller micro-markets, each with its own vibe, price tag, and future. Digging into these local differences is the key to making a smart move.

The true story of Dallas real estate is written block by block. You’ll find that certain pockets of the city are consistently lapping the city-wide average. Why? It’s usually a cocktail of unique drivers creating intense demand—think new corporate campuses popping up, major infrastructure projects making commutes easier, or the kind of lifestyle amenities that pull in a specific crowd of buyers.

Identifying High-Growth Areas

Across Dallas, several key areas are flashing green lights for growth and investment. These are often the neighborhoods that masterfully blend the charm of an established community with the excitement of new development, creating a magnetic environment for both new residents and investors.

What’s the secret sauce? Look for areas with high walkability, great access to green spaces like the Katy Trail, and a buzzing local business scene. These neighborhoods tend to hold their value like a champ. Likewise, districts getting a boost from city-led revitalization projects or new DART lines often see a direct, positive bump in property values. If you’re curious about what this looks like up close, this in-depth 75206 Dallas real estate guide gives you a granular look at one of East Dallas’s most sought-after zip codes.

Factors Fueling Neighborhood Demand

So, what flips the switch and turns a quiet neighborhood into a real estate hotspot? It’s almost always a mix of economic energy and lifestyle appeal.

- Corporate Relocations: When a giant like Nasdaq sets up a major office, it’s like dropping a boulder in a pond. A wave of professionals floods in looking for homes nearby, which can light a fire under local demand almost overnight.

- Infrastructure and Transit: Game-changing projects like the DART Silver Line expansion are huge. They make suburbs feel closer to the city core, opening them up to a whole new group of commuters.

- Lifestyle and Amenities: Never underestimate the power of a “live-work-play” environment. Neighborhoods like Uptown, Lower Greenville, and the Bishop Arts District are thriving because they put incredible dining, shopping, and fun right at your doorstep.

The neighborhoods in Dallas that prove most resilient are the ones selling more than just four walls and a roof. They’re offering a complete lifestyle. This blend of modern convenience and genuine community spirit acts as a powerful buffer against whatever the broader market is doing.

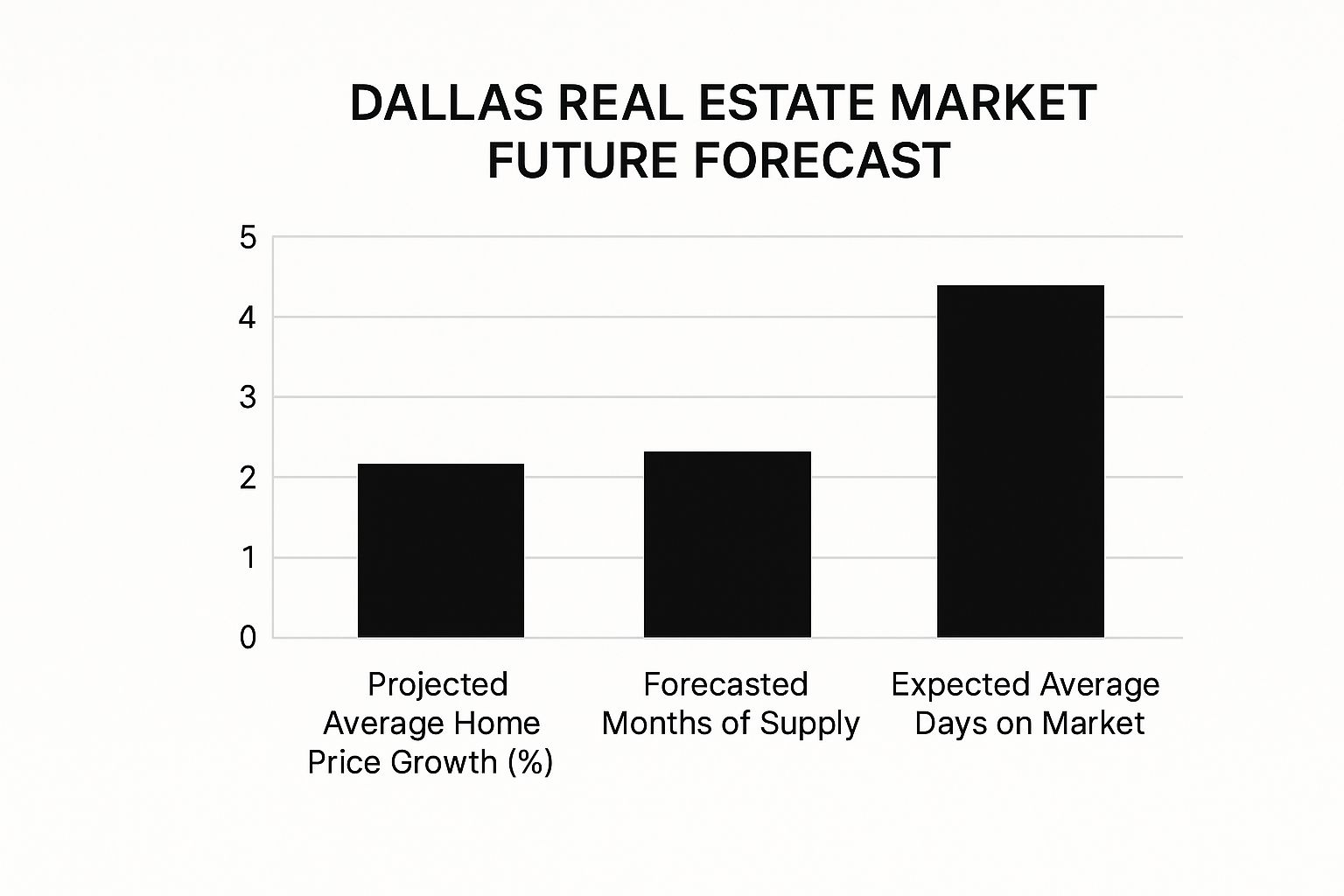

This image breaks down some of the key future forecasts for the Dallas market as a whole, touching on price growth, inventory, and how fast homes are selling.

What these numbers suggest is a market that’s settling into a more stable, predictable rhythm. We’re looking at moderate price gains and a pace that gives everyone a bit more room to breathe.

To give you a clearer picture of how different areas stack up, let’s compare some of the most talked-about neighborhoods in Dallas.

A Comparative Look At Key Dallas Neighborhoods

This table offers a side-by-side analysis, looking at everything from pricing and growth to the unique lifestyle each neighborhood offers.

| Neighborhood | Median Price Action | Key Amenities | Investment Outlook |

|---|---|---|---|

| Uptown | Consistently high; stable premium market. | Walkability, Katy Trail access, high-end dining, vibrant nightlife. | Strong & Stable: A blue-chip Dallas neighborhood. Limited new development keeps values high. |

| Bishop Arts District | Rapid appreciation over the last decade. | Independent boutiques, artisanal eateries, strong arts scene, historic charm. | High Growth: Still has room to grow as it gains popularity. Ideal for long-term holds. |

| Lakewood | Steady, strong growth; commands a premium. | White Rock Lake, Dallas Arboretum, historic homes, excellent schools. | High-Demand: Perennially desirable for its amenities, ensuring consistent demand and value. |

| Preston Hollow | Luxury market with significant price points. | Large estate lots, privacy, top-tier private schools, upscale shopping. | Luxury Tier: Insulated from minor market shifts. A top-tier investment for high-net-worth individuals. |

This comparison highlights that your “best” investment really depends on your goals—whether you’re after rapid growth, stable long-term value, or a specific lifestyle appeal.

An Investor’s Perspective on Dallas Neighborhoods

If you’re looking to invest, finding the next hotspot means learning to spot the early signs of a neighborhood on the rise. Often, the clues are there before prices take off: an uptick in commercial renovation permits, a string of new coffee shops and indie businesses opening, and city money being spent on sprucing up local parks.

Here’s a pro tip: keep an eye on the neighborhoods that border already-popular areas. As prices climb in the “it” districts, smart buyers and investors start looking just next door for better deals. This creates a ripple effect, spreading appreciation and development outward. By tracking these patterns, you can get a serious leg up in Dallas’s competitive real estate game.

Strategic Takeaways For Buyers And Sellers

Navigating the Dallas real estate market today requires a much more thoughtful game plan than it did just a few years ago. The days of putting a sign in the yard and watching bidding wars unfold on their own are behind us. Now, the market rewards smart, data-driven decisions.

For both buyers and sellers, knowing how to connect is key. Understanding things like effective real estate lead generation tactics can make a huge difference in this more balanced environment. The name of the game is adapting your strategy to what’s happening on the ground right now.

Guidance For Dallas Buyers

If you’re a buyer, you can finally take a breath. The increase in housing inventory across Dallas gives you something you haven’t had in a long time: choices. More choices mean more time to make a decision without the intense pressure of a market spiraling out of control.

This shift directly translates to more negotiating power for you. With more homes to choose from, you can be more selective. This is your chance to negotiate on price, ask for seller concessions to cover repairs, or even request contributions toward your closing costs. Your most powerful tool? A solid financing pre-approval, which shows sellers you’re a serious, reliable buyer.

The current Dallas market isn’t about waiting for a crash—it’s about recognizing the opportunity in a correction. Buyers who are prepared and patient can find excellent value without the frenzy of the past few years.

Advice For Dallas Sellers

For sellers, the game has completely changed. Simply being on the market isn’t enough anymore; you have to stand out in a more crowded field. In today’s market, a successful sale boils down to two things: realistic pricing and impeccable property presentation.

Overpricing your home is the fastest way to get ignored. A property priced correctly from day one generates immediate interest and is far more likely to sell quickly and for a better price than one that sits on the market through multiple price cuts.

And don’t skimp on presentation. Investing in professional staging and high-quality photography isn’t just an option anymore. It’s a critical step to making a powerful first impression that attracts serious, motivated buyers.

Your Top Questions About The Dallas Market, Answered

If you’re trying to keep up with the Dallas real estate scene, you’re not alone. It can feel like things are changing by the minute. Here are some straightforward answers to the questions we hear most often from buyers, sellers, and investors trying to get a handle on what’s happening right now.

Is It A Good Time To Buy A House In Dallas?

For buyers, this market is a breath of fresh air. We’re finally seeing a healthy increase in the number of homes for sale, which means you have more to choose from and less of that frantic, “buy-it-now-or-it’s-gone” pressure from the last few years.

With homes sitting on the market a little longer, the ball is back in the buyer’s court. You actually have time to think and negotiate. We’re seeing more deals where buyers can successfully negotiate on the price, ask for repairs, or even get the seller to chip in for closing costs. Mortgage rates are still a key part of the equation, but the chance to buy a home without getting into a wild bidding war makes this a fantastic window of opportunity for anyone ready to make a move.

Are Home Prices In Dallas Dropping?

Let’s be clear: prices aren’t crashing. What we’re seeing is a slight, and frankly, much-needed correction. Depending on who you ask, the average home value in Dallas has dipped somewhere between 2.8% and 4.6% over the last year. It’s not a dramatic freefall, but more of a market sigh of relief after a period of unsustainable growth.

This cooling-off period is actually a good thing. It’s bringing home prices back in line with what makes sense for local incomes and the broader economy. It’s a sign that the market is finding its balance again, with sellers setting more realistic asking prices right from the start.

What Is The Forecast For The Dallas Housing Market?

Most experts are calling for a period of stability. Don’t expect any massive swings in either direction. The general consensus for the next year is a potential slight, gradual decline in home values, maybe in the ballpark of -2.2%. This continued adjustment is viewed as a positive, keeping the market from getting overheated again.

The real story here is the strength of the Dallas economy. With major companies still moving here and job growth staying strong, our housing market has a solid foundation. These economic drivers should prevent any serious downturn and support steady, long-term property values.

At the end of the day, the forecast points to a market that’s more predictable and less volatile than what we’ve gotten used to.

What Are The Hottest Neighborhoods In Dallas Right Now?

Even as the broader market finds its footing, demand in certain Dallas neighborhoods is as strong as ever. Each of these areas has its own unique draw and continues to be a smart place to invest.

- Uptown: Always a top contender. Its walkability, upscale restaurants and shops, and energetic vibe keep it a premium, stable market.

- Bishop Arts District: The creative, independent spirit of this neighborhood is a huge magnet. It’s known for its unique character, and home values here continue to appreciate nicely.

- Lakewood: With beautiful homes, great schools, and easy access to White Rock Lake, Lakewood is in constant demand. That keeps property values incredibly resilient.

- Preston Hollow: This is Dallas’ premier luxury market. The massive estates and privacy attract high-net-worth buyers, making it largely immune to smaller market fluctuations.

These neighborhoods consistently do well because they offer more than just a house—they offer a distinct lifestyle. It’s why they remain key drivers in the Dallas real estate market trends.

Making the right move in a market like this takes more than just data; it takes deep local knowledge. The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the on-the-ground expertise to help you navigate the nuances and achieve your goals. Whether you’re looking to buy, sell, or relocate, we’re here to help you find your perfect place in Dallas. https://dustinpitts.com