If you’re looking into buying a home in Dallas, Texas, you’ve probably heard about FHA loans. Generally, you’ll need a minimum credit score of 580 for a 3.5% down payment, proof of steady income, and the house itself has to meet HUD safety standards. These government-insured mortgages are a game-changer, specifically designed to make homeownership more accessible for buyers in competitive markets like Dallas.

Your Path to Dallas Homeownership with an FHA Loan

Securing an FHA loan is one of the clearest routes to owning a home in Texas, especially when you’re navigating the Dallas real estate scene. These government-backed mortgages open doors for buyers who might not quite fit the strict mold for conventional financing.

It helps to think of the Federal Housing Administration (FHA) not as your bank, but as an insurance provider for your lender. This insurance gives Dallas lenders the confidence to offer mortgages with more flexible credit score requirements and much lower down payments. For a hopeful Dallas homebuyer, this can be the exact key needed to unlock the door to a new property.

FHA Loan Requirements in Dallas At a Glance

The FHA process is actually pretty straightforward once you understand what Dallas lenders are looking for. Here in Dallas, they’ll focus on a few key areas of your application to make sure you’re set up for success.

Here’s a quick summary of the main criteria:

| Requirement | Guideline | Key Takeaway for Dallas Buyers |

|---|---|---|

| Minimum Credit Score | 580+ for 3.5% down | A higher score means less money out of pocket. |

| Minimum Down Payment | 3.5% | This is significantly lower than many conventional loans. |

| Debt-to-Income (DTI) Ratio | Ideally under 43% | Shows lenders you can comfortably manage monthly payments. |

| Property Standards | Must meet HUD safety standards | The Dallas home has to be safe, sound, and secure. |

| Occupancy | Primary residence only | You must actually live in the Dallas home you buy. |

This table gives you the bird’s-eye view, and now we’ll dig into the details of what each of these FHA loan requirements means for you here in Dallas. We’ll cover everything from credit scores to property standards.

And if you’re exploring specific areas, whether you’re drawn to neighborhoods with historic charm or more modern living, our 75206 home buying guide offers deeper insights into some fantastic Dallas communities. With this knowledge in hand, you can navigate your home purchase with total confidence.

Your Credit Score and Down Payment

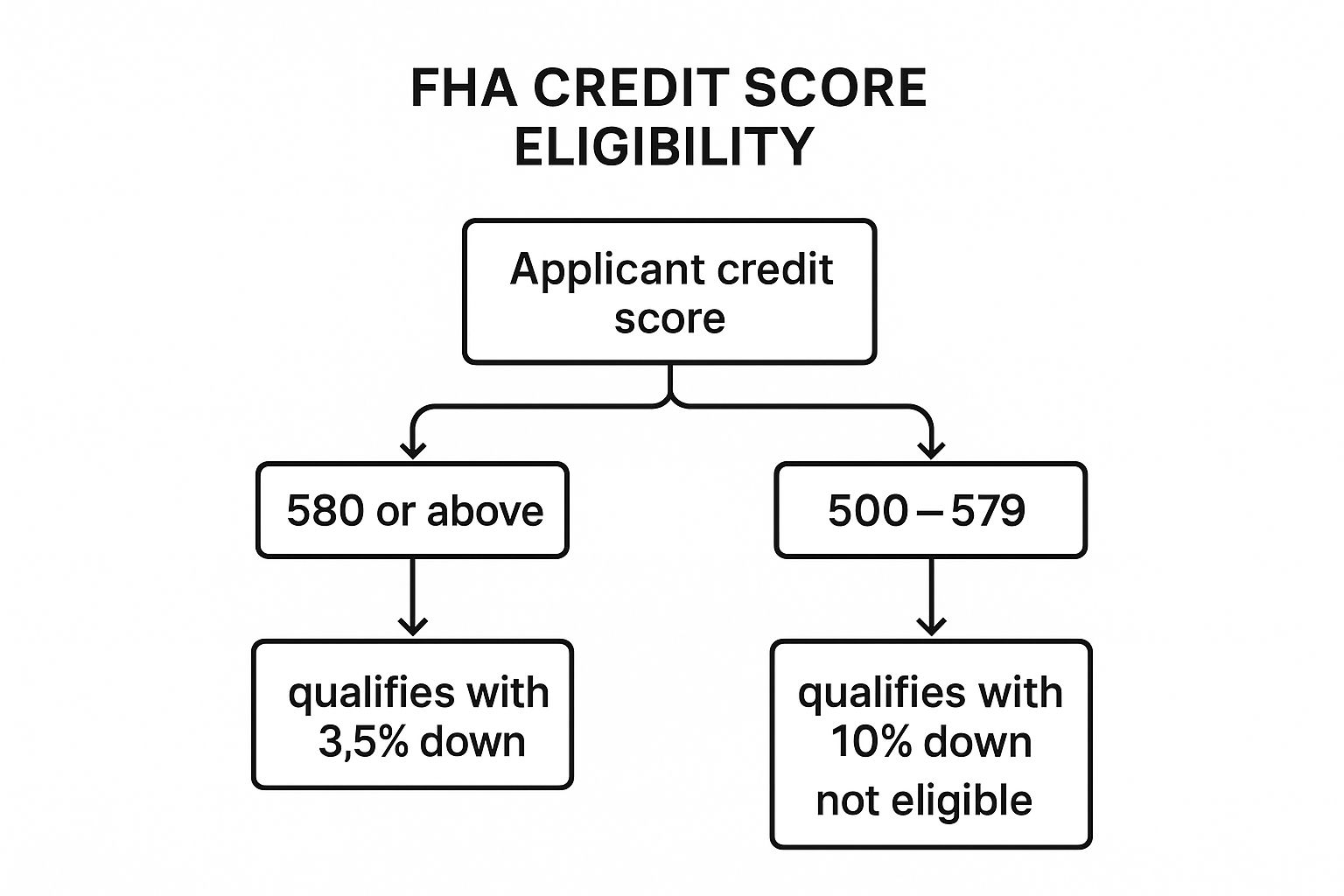

When you’re looking at an FHA loan in Dallas, your credit score and down payment are two sides of the same coin. They’re completely intertwined. The FHA sets up a straightforward system that links your credit score directly to how much you need to put down, which is a huge deal when you’re figuring out your upfront costs for a home in Dallas.

The biggest draw of the FHA program is, without a doubt, its low down payment option. If you have a credit score of 580 or higher, you unlock the program’s most powerful feature: a low 3.5% down payment. For many aspiring Dallas buyers, that single benefit is what makes breaking into the competitive Dallas housing market a real possibility.

How Credit Tiers Affect Your Down Payment

The FHA loan requirements in Texas lay out a clear path based on your credit history. The Federal Housing Administration is willing to work with scores as low as 500, but there’s a trade-off. Borrowers with a credit score between 500 and 579 can still get approved, but it comes with a higher price of admission—a 10% down payment. You can see how these rules stack up against other loan types in our guide on mortgage pre-approval requirements.

It’s important to know that individual lenders in Dallas can set their own, slightly higher credit score minimums. These are called ‘lender overlays,’ which are just extra rules lenders add to protect themselves from risk.

The decision tree below gives you a quick visual of how your score will determine your down payment.

As you can see, hitting that 580 mark is the magic number for unlocking the lowest possible down payment. Getting a handle on this relationship is the first step toward setting realistic financial goals for your home search right here in the Dallas area.

Getting to Know FHA Loan Limits in Dallas

An FHA loan isn’t a blank check—it comes with a cap on how much you can borrow, known as a loan limit. Think of it like a guardrail on the highway; it’s there to keep the program focused on helping everyday homebuyers and to prevent borrowing that outpaces local Dallas home values.

These limits aren’t set in stone. They’re actually updated every year to keep pace with the real estate market here in Texas. This is especially important in a fast-moving city like Dallas, which the FHA has officially designated as a high-cost area.

Dallas County FHA Loan Ceilings

While many counties in Texas share a standard FHA limit, the Dallas area gets a higher ceiling. This is a crucial adjustment that reflects the higher property values here, giving Dallas buyers a fair shot at a wider range of homes without getting priced out of the market.

Knowing the current FHA loan limit for Dallas County is one of the first things you should figure out. It gives you a realistic budget right from the start, so you can focus your time and energy on properties you can actually afford.

For most of Texas, the single-unit FHA loan limit is $498,257. But in high-cost areas like Dallas, that number gets a boost. Here, the limit for a single-unit home jumps to $563,500, and it scales all the way up to $1,083,650 for a four-unit property. You can explore more of the statewide guidelines by checking out these Texas FHA loan requirements on trussfinancialgroup.com.

This tiered structure is fantastic because it means whether you’re hunting for a cozy single-unit house or a small multi-unit building to live in, the FHA loan can adapt to the unique market conditions right here in Dallas.

Understanding these numbers helps you and your real estate agent filter listings with precision. It turns your home search from a wide-net guessing game into a targeted strategy, ensuring you only look at homes that fit one of the most important FHA loan requirements in Texas.

Managing Your Debt-to-Income Ratio

Okay, so we’ve covered credit scores and down payments. But there’s another piece of the puzzle Dallas lenders look at very closely: your ability to actually handle the monthly mortgage payment on top of everything else you already owe.

This is where your Debt-to-Income (DTI) ratio enters the picture. Think of it as a quick financial health checkup. It’s a simple but powerful number that shows lenders what percentage of your gross monthly income is already spoken for by recurring debt payments. A lower number tells them you’ve got enough breathing room in your budget to comfortably take on a new mortgage.

How Your DTI Is Calculated

For FHA loans, the magic number lenders in Dallas generally look for is a DTI of 43% or less. This is what’s called the “back-end” ratio because it includes all your monthly debt obligations, plus the new house payment.

To figure this out, your lender will add up all your fixed monthly debts:

- Car loans

- Student loans

- Minimum payments on your credit cards

- And, of course, the estimated new mortgage payment (which includes principal, interest, taxes, and insurance)

They’ll take that total and divide it by your gross monthly income (your income before taxes). So, if your total monthly debts, including the new mortgage, add up to $2,500 and you make $6,000 a month, your DTI is sitting right around 41.6%.

Now, here’s where FHA loans offer a bit of wiggle room. In some cases, a Dallas lender might approve a loan even if your DTI is a little higher, provided you have strong ‘compensating factors.’ These are basically big gold stars on your financial report card that help reduce the lender’s risk.

So, what counts as a strong compensating factor? It could be a hefty savings account, putting down more than the minimum, or having a long and stable job history. These things signal to the lender that you’re a reliable borrower, even if your DTI is a touch over the line.

This flexibility can be a huge advantage, especially if you’re exploring the market for North Dallas luxury homes, where the loan amounts might push your DTI higher. Keeping a close eye on your DTI is one of the most critical steps you can take to set yourself up for a successful FHA loan approval here in Dallas.

Meeting FHA Property and Occupancy Rules

Getting an FHA loan isn’t just about your personal finances. The home you’re hoping to buy in Dallas has to meet some specific standards, too. Before any loan gets the final thumbs-up, the property must pass a mandatory FHA appraisal to ensure it meets the Department of Housing and Urban Development’s (HUD) minimum property standards.

Now, this isn’t the same as a standard home inspection. The FHA appraiser’s main job is twofold: first, to verify the home’s market value, and second, to check for anything that could impact its safety, security, or structural soundness. Think of it as a safety net that protects both you and the lender from getting tangled up in a Dallas property with major, hidden problems.

Key Property and Occupancy Standards

For a Dallas home to get the green light, an FHA appraiser will be looking for a few key things. This isn’t just a simple checklist; it’s a foundational part of the FHA loan requirements here in Texas.

Here are the big-ticket items they focus on:

- Structural Soundness: The home needs a solid foundation and a roof that keeps moisture out. No major leaks or cracks allowed.

- System Safety: All the essential systems—electrical, plumbing, and heating—must be working properly and safely.

- Health and Safety: The appraiser will look for obvious hazards like peeling lead-based paint in older homes or significant mold issues.

Beyond the home’s physical condition, there’s also a very strict rule about who gets to live there. The FHA loan program is designed exclusively for owner-occupants.

What does that mean for you? You must intend to move into the Dallas home within 60 days of closing and live in it as your primary residence for at least one full year. This rule ensures the program helps actual homebuyers find a place to live, not investors looking to flip or rent out properties in the competitive Dallas market.

Ultimately, these rules are in place to promote stable homeownership and make sure government-backed loans are used for safe, sound housing. Understanding these requirements from the get-go will help you focus your search on Dallas homes that are likely to qualify, saving you time and potential heartache down the road.

Common FHA Loan Questions for Dallas Buyers

Let’s be honest, navigating the FHA loan process can feel like a maze, especially when you’re trying to land a home in the fast-paced Dallas market. Getting clear, straightforward answers to your questions is the best way to move forward with confidence. Here are a few of the most common ones we hear from Dallas homebuyers.

Can I Use an FHA Loan for an Investment Property in Dallas?

That’s a common question, but the short answer is no. FHA loans are built from the ground up to help people buy a home they are actually going to live in.

The rules are pretty strict: you have to move into the property within 60 days of closing the deal and make it your primary residence for at least one full year. While you can use an FHA loan to buy a small multi-unit property in Dallas (up to four units), you’re still required to live in one of them yourself. The program is all about promoting homeownership, not funding real estate portfolios.

Do I Have to Pay Mortgage Insurance for the Whole Loan Term?

This is a great question, and the answer comes down to your down payment. If you’re able to put down 10% or more on a Dallas property, the FHA only requires you to pay the annual Mortgage Insurance Premium (MIP) for 11 years.

However, most Dallas buyers go with the very popular 3.5% down payment option. If that’s your plan, the rules in Texas state you’ll be paying MIP for the entire life of the loan. The only way out is to eventually sell the home or refinance into a different mortgage, like a conventional loan, once you’ve built up enough equity.

What if a Dallas Home I Want Fails the FHA Appraisal?

It happens more often than you’d think, especially with some of the beautiful older homes around Dallas. An FHA appraisal can flag issues that don’t meet HUD’s minimum property standards. If it does, those repairs absolutely have to be completed before the loan can close.

When this happens, you have a few ways you can go:

- Talk to the seller: Your first move is usually to negotiate and ask the seller to handle the repairs.

- Pay for them yourself: This is an option, but it’s risky. If the deal falls through for some other reason, you could lose the money you spent.

- Walk away: If the repairs are just too much or you can’t reach an agreement with the seller, you always have the option to cancel the contract.

Your real estate agent is your best friend in this scenario. They’ve been through this before and can give you expert advice on how to negotiate with the seller and protect your own interests in a Dallas transaction.

Can Gift Funds Be Used for My FHA Down Payment in Texas?

Absolutely! This is one of the biggest perks of the FHA program for many Dallas buyers. The guidelines are very flexible here, allowing you to use gift funds from an approved source to cover your entire down payment and even your closing costs.

Approved sources include a relative, your employer, or even certain charitable organizations. The key is documenting everything correctly. The money must come with a formal gift letter that makes it crystal clear it’s a gift, not a loan that you have to pay back. This ensures the funds don’t negatively impact your debt-to-income ratio.

Working through the FHA loan requirements in Texas can feel a little overwhelming, but you don’t have to figure it all out on your own. With an expert in your corner, you can navigate the Dallas market with confidence. For personalized support from a team that knows this area inside and out, contact Dustin Pitts REALTOR Dallas Real Estate Agent. Let’s work together to make your Dallas homeownership dream a reality. Visit us at https://dustinpitts.com.