For savvy buyers and investors, the market for foreclosures in Dallas Texas is a whole different ballgame. It’s a unique corner of the real estate world where you can often find properties for less than their market value, but it operates on its own timeline with a distinct set of rules. To really succeed here, you have to understand the journey a property in Dallas takes from being a standard home to a foreclosure listing.

Your Guide to the Dallas Foreclosure Landscape

Jumping into Dallas foreclosures can feel like trying to navigate a foreign country without a map. But once you break it down, it’s really just a structured process that kicks off when a Dallas property owner falls behind on their mortgage payments.

For a potential buyer, this isn’t just a single event. It’s a series of distinct phases, and each one offers a different way to buy the property. Knowing these stages is your first step. Think of it as learning the different entry points into a complex—but potentially very profitable—Dallas market.

The Three Core Stages of Foreclosure

The entire foreclosure process in Dallas can be boiled down into three main parts. Each stage comes with its own level of risk, potential for a great deal, and complexity in purchasing.

- Pre-Foreclosure: This is the starting line. It begins after a property owner has missed several mortgage payments, but before the bank has officially taken the property back. The owner is still in control and often highly motivated to sell fast to dodge a foreclosure on their credit report. This is your chance to negotiate directly with them.

- The Public Auction: If the property owner can’t catch up on their payments, the property heads to a public auction. In Dallas County, these are famously held on the first Tuesday of every month on the courthouse steps. It’s where investors often hunt for the steepest discounts, but it’s a high-stakes game. You’ll need cash ready to go, and you’re buying the property “as-is,” usually without a chance to inspect it first.

- Bank-Owned (REO): If a property doesn’t sell at the auction, the lender takes possession, and it becomes a Real Estate Owned (REO) property. From there, it’s usually listed on the open market with a real estate agent. The discounts might not be as deep as at the auction, but the buying process feels much more familiar. You can typically get inspections, and securing financing is much more straightforward.

A foreclosure is not a single event but a process. By understanding the timeline—from pre-foreclosure to auction to REO—buyers can strategically decide when and how to engage, turning a complex legal procedure into a tangible investment opportunity in the Dallas market.

To give you a clearer picture, here’s a quick breakdown of how these stages compare.

Dallas Foreclosure Stages at a Glance

| Stage | Property Status | Buyer Opportunity | Key Challenge |

|---|---|---|---|

| Pre-Foreclosure | Owner still holds the title but is in default. | Negotiate directly with a motivated seller. | Finding these properties and navigating sensitive property owner situations. |

| Public Auction | Sold to the highest bidder by a trustee. | Potential for the deepest discounts. | Requires cash, involves high risk, and offers no inspection period. |

| Bank-Owned (REO) | Owned by the lender after failing to sell at auction. | A more traditional buying process with financing options. | Less room for negotiation; discounts may be smaller. |

This table helps illustrate the trade-offs at each step of the process in Dallas.

Why This Matters for Dallas Buyers

Getting a solid grip on these concepts is non-negotiable for anyone serious about investing in foreclosures in Dallas Texas. Each stage demands a totally different playbook, from your sharpest negotiation skills in a pre-foreclosure deal to having a pile of cash ready for the auction.

Local market conditions, driven by economic shifts and housing supply in Dallas, also heavily influence how many properties you’ll find in each category. You can get a better feel for the current climate in our guide to the Dallas housing market trends and insights. When you know the landscape, you can put yourself in the perfect position to move fast when the right deal comes along.

How the Texas Foreclosure Process Works

If you’re serious about buying foreclosures in Dallas Texas, you first need to get a handle on the state’s specific rulebook. Texas is what’s known as a non-judicial foreclosure state. What does that mean? Put simply, the lender doesn’t need a judge’s permission to sell the property, which makes the whole timeline much faster and more direct for everyone involved.

This speed is a double-edged sword. For Dallas buyers, it means opportunities can pop up quickly. But it also means you have to stay on your toes and be ready to act fast. Knowing each step in the process is the key to timing your move just right.

The Initial Default and Notice Period

It all starts when a property owner falls behind on their mortgage. A single missed payment isn’t going to trigger a foreclosure, but a consistent pattern of delinquency will. Federal law actually requires lenders to wait until a loan is more than 120 days delinquent before they can officially kick off the foreclosure process.

This buffer gives the property owner a chance to get things back on track. If they can’t, the lender sends out a Notice of Default and Intent to Accelerate. This is a formal letter that basically says, “you’ve broken the terms of your loan, and you have a certain amount of time—usually 20 to 30 days—to pay what’s overdue.”

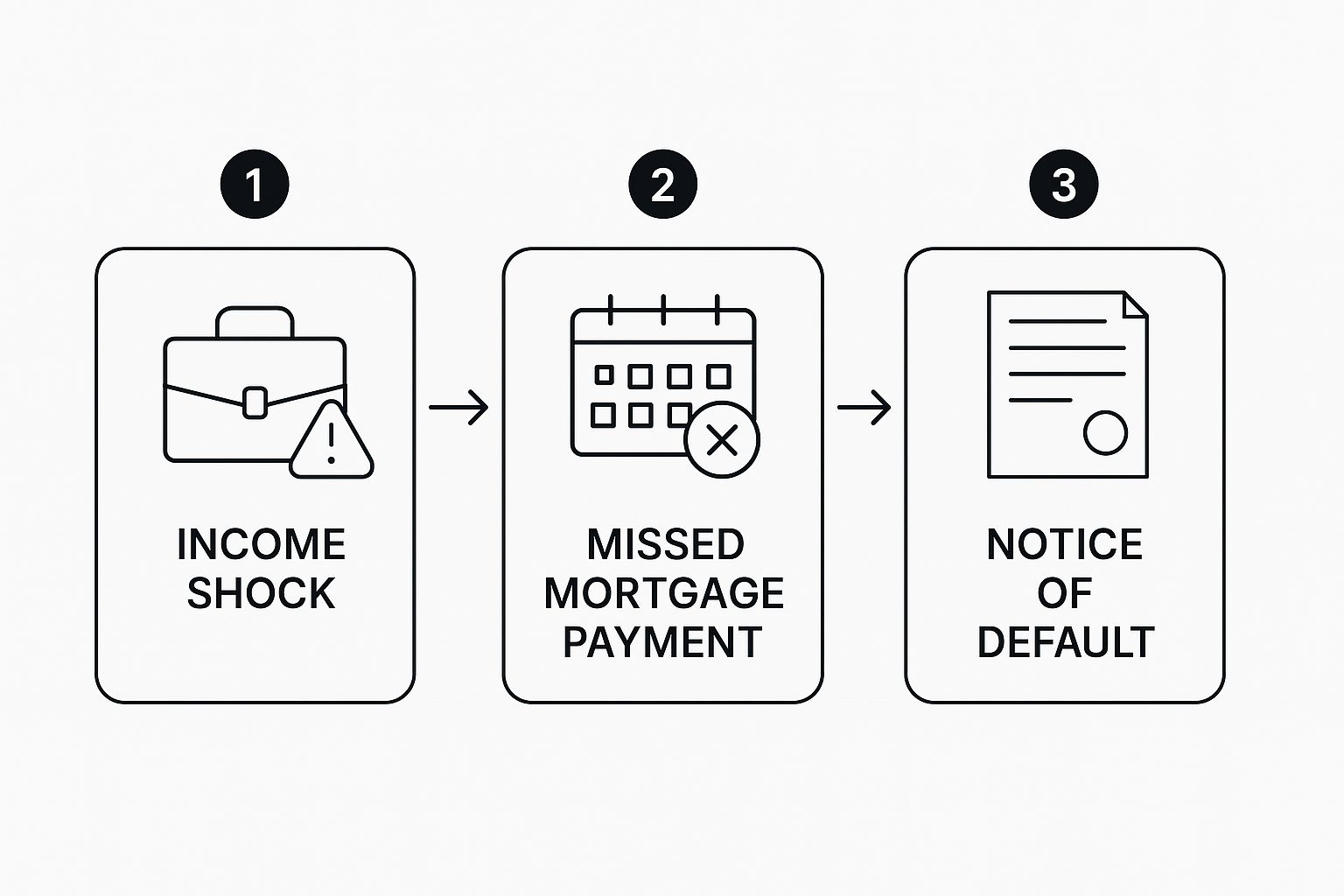

This infographic maps out the typical chain of events that pushes a property into foreclosure here in Dallas.

As you can see, the journey usually begins with some sort of financial hiccup that leads to missed payments and, eventually, that first official legal notice.

The Critical 21-Day Posting

When the property owner can’t cure the default in time, the process moves into its next critical phase. The lender’s representative, called a trustee, will officially schedule the property for a public auction.

Texas law is very strict about the notification timeline here.

- A Notice of Trustee’s Sale has to be filed with the Dallas County Clerk’s office.

- The same notice must be physically posted at the Dallas County courthouse door.

- A copy of that notice must be sent to the property owner via certified mail.

All three of these things must happen at least 21 days before the auction is scheduled to take place. This 21-day posting period is a non-negotiable legal requirement and serves as the official public announcement of the sale.

For investors and buyers in Dallas, this 21-day window is your signal to get moving. It’s when you can start tracking specific properties, digging into your due diligence, and getting your financing in order for the auction. It’s the official green light that a property is heading to the courthouse steps.

The Auction on the First Tuesday

Everything culminates at the foreclosure auction in Dallas County. By law, these sales must happen on the first Tuesday of the month, even if it’s a holiday. The sale takes place at a designated spot at the county courthouse between 10 a.m. and 4 p.m.

The trustee runs the auction and sells the property to the highest bidder who can pay with certified funds right then and there. While the number of foreclosures changes with the Dallas market, this process has been a constant fixture for years. For example, in the year ending May 2014, the Dallas area saw 6,728 home foreclosures, placing it among the top ten cities in the nation for foreclosure volume at that time. You can dig into more of this kind of historical data on the Texas A&M Real Estate Research Center’s website.

This legally defined timeline is the playbook for buying foreclosures in Dallas Texas. Once you understand these milestones—from the 120-day delinquency rule to the 21-day posting and the final auction—you can spot opportunities and move with the confidence that comes from knowing the rules of the game.

Finding and Vetting Foreclosure Deals in Dallas

Successfully buying foreclosures in Dallas Texas starts with one simple rule: you have to know where to look. The best opportunities aren’t just sitting on Zillow waiting for you. Landing a great deal requires a proactive strategy to find properties at every stage of the foreclosure process.

To get a real edge, you have to dig deeper than the average buyer. This means tapping into a mix of public records, specialized online services, and your local real estate network. By combining these sources, you get a much clearer picture of the entire inventory, from properties quietly entering pre-foreclosure to those already owned by a bank in Dallas.

Where to Uncover Dallas Foreclosure Properties

The first step is building a reliable pipeline of potential deals. The key is using multiple channels, because each one gives you a unique peek into the Dallas market. Some are free but demand more of your time, while others serve up curated lists for a fee.

A solid search strategy should always include:

- Dallas County Public Records: This is ground zero. The Dallas County Clerk’s office is the official source for all foreclosure filings. If you want to know exactly what’s heading to the auction block, monitor the Notice of Trustee’s Sale filings here.

- Specialized Online Platforms: Services like RealtyTrac or Foreclosure.com are designed for this. They pull data from countless sources and put pre-foreclosures, auction schedules, and REO listings all in one place, saving you a ton of legwork.

- Local Real Estate Agents: Find an agent in Dallas who lives and breathes distressed properties. These pros often get wind of bank-owned (REO) listings before they hit the open market and can offer local insights you just can’t get anywhere else.

- Bank Websites: Don’t forget to go straight to the source. Most lenders have a section on their website dedicated to their REO inventory. Checking the sites of big national banks and smaller Dallas-area community banks can turn up hidden gems.

The Due Diligence Framework for Dallas Deals

Finding a property is just the start—vetting it properly is how you protect your investment. Every foreclosure comes with its own set of risks, and having a systematic due diligence process is absolutely non-negotiable. This is how you separate the true diamonds in the rough from the money pits in Dallas.

Your first move is figuring out the property’s realistic market value. This involves running a comparative market analysis (CMA), which is just a fancy way of saying you need to look at what similar, updated properties have recently sold for in that same Dallas neighborhood. These “comps” are your anchor; they tell you what the property could be worth and help you figure out your maximum bid.

Next, you have to get a handle on the property’s physical condition, which can be tricky. You rarely get to do a full inspection before an auction, so it often comes down to a drive-by assessment. Look for obvious red flags like a crumbling roof, major cracks in the foundation, or boarded-up windows. For bank-owned properties, however, a full professional inspection is a must.

Vetting a foreclosure isn’t just about finding a discount; it’s about accurately pricing the risk. A thorough analysis of comps, repair costs, and title status transforms an unknown variable into a calculated investment decision.

Finally, a preliminary title search is crucial. You absolutely must know if there are other liens on the property, like unpaid property taxes or money owed to a contractor. Some of these debts can survive the foreclosure auction and become your problem, instantly wiping out your potential profit.

Comparing Dallas Foreclosure Property Types

Not all foreclosures are created equal. Different stages of the process offer wildly different levels of risk and reward. Understanding these trade-offs is the key to matching your strategy with your budget and how much risk you’re willing to take on.

Here’s a simple breakdown of what to expect with the main types of foreclosures in Dallas Texas.

| Property Type | Typical Risk Level | Potential for Discount | Acquisition Complexity |

|---|---|---|---|

| Pre-Foreclosure | Moderate | Good | High (Requires negotiation) |

| Auction | Very High | Highest | Moderate (Requires cash) |

| REO (Bank-Owned) | Low | Moderate | Low (Traditional sale) |

This table really spells it out. The courthouse auction offers the biggest potential discount, but it also carries the highest risk since you’re buying “as-is” with no inspection and usually need all cash. On the flip side, an REO property is a much safer, more traditional purchase, though the discount probably won’t be as deep. A sharp vetting process will give you the confidence to navigate any of these paths and make a smart move.

Mastering the Dallas County Foreclosure Auction

The foreclosure auction on the steps of the Dallas County courthouse is an iconic, almost legendary event in local real estate. Held like clockwork on the first Tuesday of every month, the scene can feel chaotic and frankly, a bit intimidating if you’re new to it all. But with the right homework and a disciplined mindset, it’s one of the most direct ways to buy foreclosures in Dallas Texas, often at a steep discount.

Success here has absolutely nothing to do with luck. It’s all about meticulous preparation. The environment is fast-paced and hyper-competitive, leaving zero room for hesitation or trying to figure things out on the fly. You have to do all the heavy lifting beforehand, from lining up your money to digging into property details. Think of it as studying for a huge final exam—your performance on auction day is a direct result of the work you put in beforehand.

The number one, non-negotiable rule of the Dallas auction is that cash is king. You can’t just show up with a pre-approval letter from your lender. Winning bidders must hand over certified funds, like a cashier’s check, for the full purchase price right then and there. This is a hard-and-fast rule that instantly weeds out a lot of people and underscores why serious preparation is so critical.

Your Pre-Auction Checklist

Before you even dream of raising a hand to bid, there are several crucial due diligence steps you absolutely must take. Skipping even one of these can turn a great opportunity into a financial nightmare. A methodical approach is your best defense against buying a Dallas property riddled with expensive, hidden problems.

Your pre-auction game plan should always include these steps:

- Securing Certified Funds: Figure out your absolute maximum budget and get those cashier’s checks ready. Seasoned investors often bring multiple checks in different amounts to cover various potential winning bids without showing their hand.

- Conducting a Title Search: This is a big one. Hire a title company or an attorney to run a preliminary title search on any property you’re serious about. This is how you uncover nasty surprises like tax liens or second mortgages that won’t be wiped out by the auction.

- Performing a Drive-By Inspection: You won’t be able to get inside the property, so a detailed drive-by is the next best thing. Look for obvious red flags like major foundation cracks, a roof that’s seen better days, or signs of fire damage. Get out of the car and walk around if you can.

- Setting a Maximum Bid: Based on your research of comparable sold properties (comps) and your best guess on repair costs, you need to set a hard maximum bid. This number is your lifeline on auction day—don’t go over it. Period.

Navigating Auction Day Dynamics

When you get to the Dallas County courthouse on auction day, you’ll walk into a whirlwind of activity. Trustees will be announcing property details, and bidders will be clustered in small groups. The trustee is the auctioneer, reading the legal notice for each property before opening the floor for bids. The whole process is incredibly fast, often lasting just a few minutes per property.

The single biggest mistake you can make at a foreclosure auction is emotional bidding. Getting caught up in the heat of the moment and blowing past your max bid is the quickest way to turn a potential asset into a huge liability. Discipline is everything.

To come out ahead, you have to stick to your numbers. The adrenaline and competitive energy make it easy to get dragged into a bidding war where the only goal is to “win.” That’s a trap that catches way too many rookies. Your goal isn’t just to buy a property; it’s to make a smart investment. Let someone else get emotional and overpay. You wait for the right deal that fits within your carefully calculated plan. If you master your prep and stay disciplined, you can confidently navigate the chaos and find great deals on foreclosures in Dallas Texas at the auction.

How to Fund Your Dallas Foreclosure Purchase

Trying to secure funds for foreclosures in Dallas Texas is a completely different ballgame than getting a standard mortgage. Your financing strategy is dictated entirely by the type of foreclosure you’re targeting—whether it’s a property on the courthouse steps or a home already owned by the bank. A one-size-fits-all approach just won’t cut it here.

In the fast-paced world of the Dallas County auction, traditional financing is completely off the table. Lenders need weeks to handle underwriting and appraisals, but at the auction, you’re expected to pay in full the second the trustee says “sold.” This reality means investors have to get creative and lean on faster, alternative funding sources built for speed.

Funding Options for Auction Purchases

When you’re buying at the Dallas County auction, your financing might as well be cash. The lenders who thrive in this high-stakes environment are the ones who specialize in speed and asset-based lending. They are your best friends here.

Some of these specialized funding methods include:

- Hard Money Loans: These are short-term loans from private companies or individuals. Forget your credit score; these lenders are far more interested in the property’s after-repair value (ARV). They can get a deal funded in a matter of days, not weeks, which is exactly what you need for an auction buy.

- Private Capital: This is all about borrowing from your network of individuals or private investment groups. If you’ve got a solid track record, you can often negotiate more flexible terms than even a hard money lender might offer.

- Portfolio Lines of Credit: For seasoned investors with a portfolio of rental properties, a line of credit secured by existing assets is a powerful tool. It gives you a ready source of cash that can be deployed instantly to snap up an auction deal.

In the world of Dallas foreclosure auctions, your ability to fund a deal instantly is your ticket to entry. Traditional loan pre-approvals are useless; only certified funds or pre-arranged private capital will secure a winning bid.

Financing Bank-Owned REO Properties

Once a property becomes bank-owned (REO) and hits the open market, the financing landscape changes completely. The frantic pace of the auction is gone, and the process starts to look a lot more like a typical real estate transaction. This shift opens the door to a much wider array of funding options.

For REO properties, buyers can generally use conventional mortgages from banks and credit unions, which is especially helpful for those looking to occupy the property themselves. Even better, for properties that need a lot of TLC, specialized renovation loans are a fantastic tool.

A popular choice for many is the FHA 203(k) loan. This loan cleverly bundles the purchase price and the estimated repair costs into a single mortgage. It lets you finance the whole project without juggling separate loans for the acquisition and the construction. Our detailed Dallas home buying guide has more insights into different loan types that work for various buying situations.

Aligning Your Strategy with Your Capital

Choosing the right financing is all about matching your capital source to the specific opportunity in front of you. While the foreclosure rate in the Dallas area remains relatively low—clocking in at just 1.17 percent in December 2023, well below the national average—the competition for good deals is still intense. You can read more about Dallas’s declining foreclosure rates to get a better feel for the market dynamics.

Ultimately, your success in buying foreclosures in Dallas Texas hinges on having your financing locked down before you even start looking. Whether that means lining up a hard money lender for the auction or getting pre-approved for a renovation loan for an REO, being prepared is your greatest advantage.

Navigating Legal Risks and Title Issues

While the allure of foreclosures in Dallas Texas is undeniable, every potential deal carries its own set of legal tripwires. Getting this right is about more than just finding a property; it’s about making sure your investment is protected from hidden liabilities that can pop up and drain your finances long after you’ve closed.

The single most critical piece of the puzzle is securing a clean title. Think of the title as the property’s official biography. A “clean” or “clear” title means no one else has a claim on it, giving you indisputable ownership.

The problem is, many foreclosed properties in Dallas come with what’s known as a clouded title, a situation that can lead to some serious financial headaches if you’re not prepared.

Understanding Title Defects and Liens

When you buy a foreclosure, particularly straight from the courthouse steps at an auction, you’re often buying it “as-is”—and that includes any existing debts tied to the property. Not every lien gets automatically erased by the foreclosure sale, and any that survive become your problem to solve.

Here are a few common title issues to keep on your radar in Dallas:

- Property Tax Liens: Unpaid property taxes owed to Dallas County or local school districts are always first in line. If these aren’t paid, you could find the county foreclosing on you.

- Mechanic’s Liens: Did a contractor do a bunch of work on the property but never get paid? They might have filed a lien against the property, and that claim can stick to the title like glue.

- IRS Tax Liens: The federal government doesn’t mess around. An IRS lien can be especially tricky and may even survive a foreclosure sale, giving them a claim on your new asset.

It’s a huge and costly mistake to assume a foreclosure sale magically wipes the slate clean. A thorough title search isn’t just an optional add-on; it’s the fundamental safeguard that stops you from inheriting someone else’s financial mess along with the house keys.

The Role of an Attorney and Title Company

With so much on the line, trying to navigate a Dallas foreclosure purchase without professional backup is a high-stakes gamble. You absolutely need a qualified real estate attorney in your corner to review all the paperwork and flag any potential legal exposure.

At the same time, a reputable title company acts as your private investigator. They dig deep into public records to uncover any liens, judgments, or ownership disputes attached to the property. This legwork is your best defense against nasty surprises after the sale. The complexity of these issues is a core reason why thorough due diligence is a cornerstone of any successful North Dallas real estate investment guide.

While foreclosure activity in the Dallas metro during the second quarter of 2024 stayed below historical norms, Texas continues to rank high for bank-owned (REO) properties. According to a mid-year 2024 foreclosure market report, Texas saw 1,197 foreclosures end in bank repossessions in the first half of the year alone. This data shows there’s a steady stream of distressed properties hitting the market, but each one demands a meticulous approach to legal and title verification to make sure it’s a secure investment.

Common Questions About Dallas Foreclosures

Diving into the world of foreclosures in Dallas Texas is exciting, but it naturally brings up a lot of questions. Even after you get the basics down, the specific details can feel a little fuzzy. This section is designed to clear things up, tackling the most common questions I hear from buyers and investors.

Think of this as your quick-reference guide. We’ll cover the practical, boots-on-the-ground concerns that pop up when you start getting serious about finding a great foreclosure deal in Dallas.

Where Are the Best Places to Find Foreclosure Listings in Dallas?

You’ll find the most reliable leads by combining public records with a few specialized platforms. The absolute first place to look is the Dallas County Clerk’s public records. This is the official source for upcoming auction lists, straight from the horse’s mouth.

From there, expand your search with these resources:

- Subscription Sites: Services like RealtyTrac and Foreclosure.com do the heavy lifting by pulling data from countless sources. They offer organized lists of pre-foreclosures, auction properties, and bank-owned homes.

- The Local MLS: For bank-owned (REO) properties, the Multiple Listing Service is your go-to. A real estate agent who specializes in distressed properties is your key to getting direct access here.

- Bank Websites: Lenders often post their REO properties directly on their corporate websites. It’s worth checking these periodically, as you can sometimes find properties that haven’t hit the wider market yet.

Do I Absolutely Need Cash to Buy a Foreclosure at the Dallas Auction?

For the courthouse step auctions, yes—you absolutely do. You’ll need certified funds (like a cashier’s check) ready to go for the full amount of your winning bid, right then and there. Traditional mortgages just don’t work with that kind of speed.

But the game changes completely for bank-owned (REO) properties that are sold after an auction doesn’t pan out. For those, you can typically use conventional financing, including FHA and VA loans, just like you would for any standard home purchase.

For anyone facing the difficult prospect of foreclosure themselves, a major worry is the impact on their credit. If you want to understand common reasons why credit scores drop, it can offer some helpful context on the financial fallout.

What Are the Biggest Risks of Buying a Dallas Foreclosure?

Every investment has its risks, but foreclosures come with their own unique set of challenges. When you’re buying foreclosures in Dallas Texas, the biggest hurdles are almost always the same.

The top risks are the unknown condition of the property, since pre-auction inspections are rare; undiscovered title issues, such as liens that aren’t wiped out by the sale; and intense competition from other investors at auction. There’s also a small risk that the auction could be canceled at the last minute if the owner resolves the debt.

The difference between a great investment and a money pit is how well you manage these risks. That means doing your homework—running preliminary title searches, driving by the property, and setting a firm budget that leaves plenty of room for unexpected repairs.

Navigating the Dallas real estate market requires expert guidance, especially when dealing with the complexities of foreclosures. Dustin Pitts REALTOR Dallas Real Estate Agent provides the local knowledge and strategic insight needed to identify and secure valuable opportunities. Whether you are an experienced investor or a first-time buyer, connect with a dedicated professional to guide your next move. Visit us online to learn more.