Embarking on the journey to purchase a home in Dallas can feel like navigating a complex maze, from the bustling streets of Uptown to the quieter enclaves of Lakewood. The Dallas market presents unique dynamics that require a strategic and informed approach, whether you are a first-time buyer or seeking a luxury property. This guide moves beyond generic advice, offering a detailed, Dallas-centric home buying process checklist designed specifically for the discerning buyer in this competitive landscape.

This is your blueprint for making a confident purchase. We will break down each critical phase, providing actionable insights tailored to the Dallas-Fort Worth area. You will learn the specifics of securing financing with local lenders, selecting an agent who understands neighborhoods like Preston Hollow or the M Streets, and conducting thorough due diligence that accounts for local regulations and property values.

Forget vague tips; this comprehensive 10-step plan provides the practical framework needed to successfully acquire a property. It’s designed to equip you with the essential knowledge to turn your homeownership goals into a reality in one of Texas’s most dynamic real estate markets. Let’s begin the process.

1. Step 1: Financial Readiness & Pre-Qualification in Dallas

Before you start dreaming of a condo in Victory Park or a house in Lakewood, the critical first step in any Dallas home buying process checklist is to assess your financial health. This foundational stage goes beyond a quick glance at your bank account; it involves a thorough analysis of your credit, debt, and savings to determine a realistic budget suited for the competitive Dallas real estate market.

Establishing Your Buying Power

Getting pre-qualified by a lender familiar with the North Texas landscape provides a clear estimate of your purchasing power. This isn’t just a suggestion; it’s a strategic move. For instance, a self-employed individual looking in Preston Hollow will need to prepare two years of tax returns, while a couple with a combined $120,000 income might learn they can realistically target homes up to $550,000 in certain Dallas suburbs. Knowing these figures upfront prevents wasted time and positions you as a credible buyer.

Key Financial Benchmarks

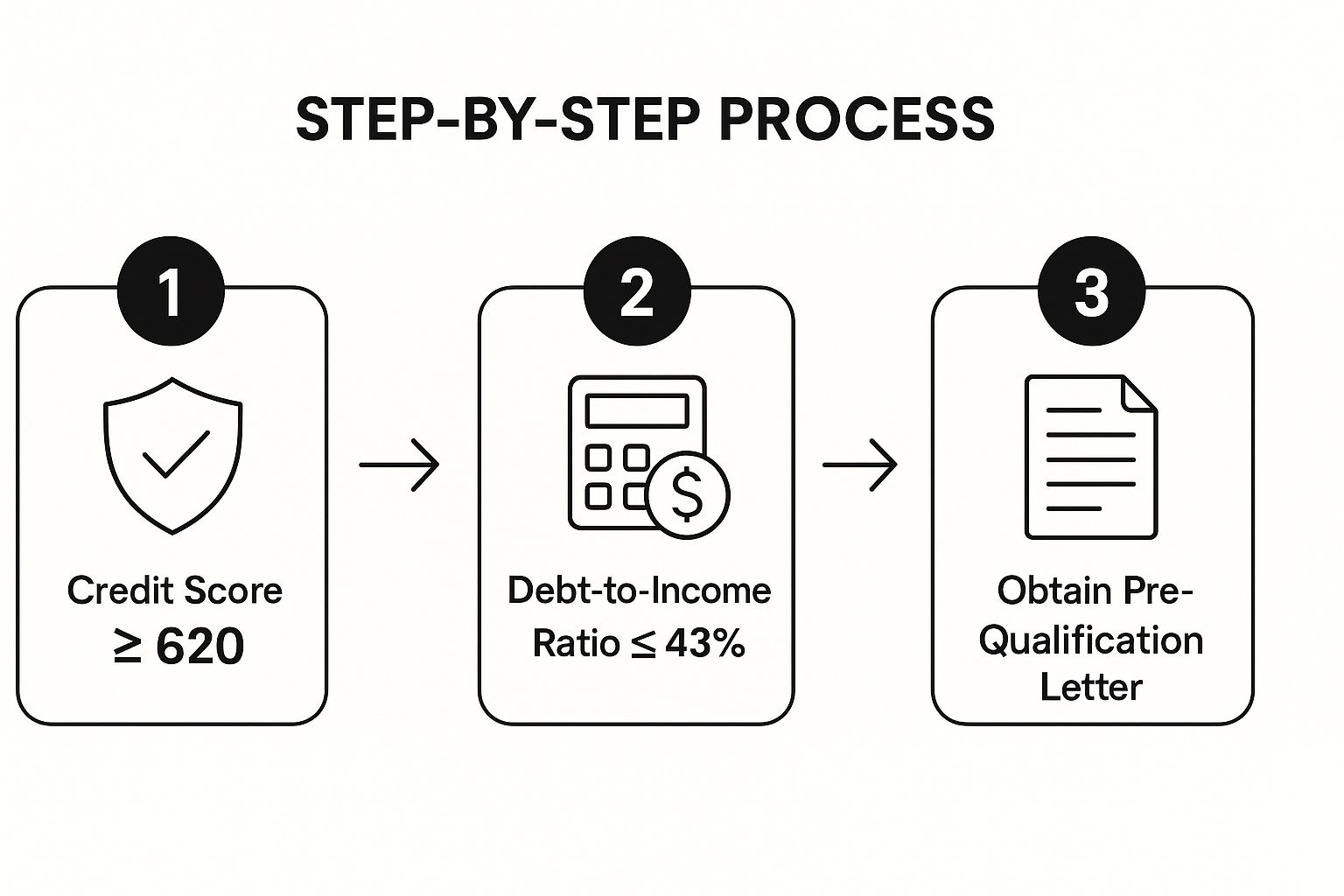

To ensure a smooth pre-qualification, focus on these critical metrics:

- Credit Score: Review your credit reports from all three bureaus (Equifax, Experian, TransUnion) 6 to 12 months before you plan to buy. Many conventional loans in Dallas require a minimum score of 620.

- Debt-to-Income (DTI) Ratio: Lenders typically look for a DTI ratio of 43% or lower. Actively pay down high-interest credit cards or personal loans to improve this figure.

- Cash Reserves: Aim to have at least 3 to 6 months of projected mortgage payments saved in addition to your down payment and closing costs.

The following infographic illustrates the core financial milestones required to get pre-qualified in Dallas.

Successfully meeting these three sequential benchmarks demonstrates to Dallas lenders that you are a low-risk, well-prepared applicant.

2. Step 2: Securing a Mortgage Pre-Approval in Dallas

After pre-qualification, the next crucial step in your Dallas home buying process checklist is securing a formal mortgage pre-approval. This is a much more rigorous financial review where lenders verify your income, assets, and credit by examining actual documentation. Unlike a pre-qualification, a pre-approval provides a conditional commitment for a specific loan amount, making you a highly competitive buyer in fast-moving Dallas neighborhoods like the M-Streets or Bishop Arts.

Demonstrating Your Financial Strength

A pre-approval letter signals to Dallas sellers that your financing is solid, often giving your offer an edge in multiple-bid situations. For example, a tech worker in Plano might get pre-approved for $750,000 by having their vested stock options properly documented and counted as income. Similarly, a military member relocating to be near the Dallas Naval Air Station can use a VA loan pre-approval to compete effectively, even with a zero-down payment offer. This document proves you have already passed a lender’s underwriting scrutiny.

Key Pre-Approval Strategies

To navigate the pre-approval process efficiently, consider these essential actions:

- Organize Documents: Before applying, gather key paperwork, including two years of tax returns, recent pay stubs, W-2s, and bank statements.

- Maintain Financial Stability: Avoid making any large purchases, opening new credit lines, or changing jobs while your loan is in underwriting.

- Compare Lenders: Seek pre-approvals from different lenders, such as a large institution like Wells Fargo Home Mortgage and a local Dallas credit union, to compare interest rates and terms.

- Monitor Expiration: Pre-approval letters are typically valid for 60 to 90 days. If your search for a home in Frisco or Southlake takes longer, be prepared to update your documentation.

3. Step 3: Real Estate Agent Selection and Buyer Representation Agreement

Navigating the competitive Dallas real estate market requires professional guidance, making the selection of a qualified real estate agent a pivotal part of any home buying process checklist. This step involves researching, interviewing, and choosing an agent who will act as your fiduciary, advocating for your best interests. This relationship is formalized by signing a Buyer Representation Agreement, which outlines the agent’s duties and the terms of your partnership.

Securing Expert Representation

Choosing the right agent is a strategic decision that directly impacts your success. For example, a first-time buyer targeting the Bishop Arts District should partner with an agent who has a deep, proven sales history in that specific neighborhood. Likewise, an executive relocating to a high-rise in Uptown Dallas would benefit from an agent specializing in luxury condos and corporate moves. The goal is to find representation aligned with your unique purchasing goals.

Key Agent Selection Criteria

To ensure you secure the best possible representation in Dallas, focus on these critical actions:

- Interview Multiple Agents: Schedule consultations with at least three agents to compare their expertise, communication styles, and strategies for the Dallas market.

- Verify Credentials and History: Check for an active Texas Real Estate Commission (TREC) license and review their recent sales history and client testimonials. Learn more about how to choose a top North Dallas real estate agent.

- Understand the Agreement: Before signing, carefully review the Buyer Representation Agreement. Clarify the commission structure, the agreement’s duration, and the agent’s specific duties to ensure there are no surprises.

Successfully vetting and selecting a dedicated agent provides you with an invaluable ally, equipped with the market knowledge and negotiation skills needed to secure your ideal Dallas property.

4. Step 4: House Hunting and Property Research in Dallas

With your pre-approval letter in hand, you can now begin the exciting phase of the home buying process checklist: the search. This systematic hunt involves scouring Dallas listings, attending open houses in areas like the M-Streets or Bishop Arts, and scheduling private tours. It’s the stage where your wish list confronts the realities of the DFW market, forcing a strategic balance between desires and budget.

Defining Your Ideal Dallas Property

Success in this phase comes from translating your lifestyle into tangible property features. For instance, a young professional might prioritize a condo in Uptown for its walkability and proximity to the Katy Trail. In contrast, someone seeking a quieter retreat may focus their search on single-story homes in established North Dallas neighborhoods. Creating a spreadsheet to rank potential homes by commute time, price, and desired amenities is a highly effective strategy.

Key Research Strategies

To make an informed decision, your research must go beyond curb appeal. Employ these tactics:

- Prioritize Wants vs. Needs: Create a clear list distinguishing your must-have features (e.g., a home office, specific school district) from your nice-to-haves (e.g., a swimming pool).

- Neighborhood Vetting: Visit potential neighborhoods at different times, including rush hour and weekends, to understand traffic patterns and community atmosphere.

- Leverage Digital Tools: Utilize platforms like Zillow and Realtor.com for listings, while tools like GreatSchools.org and local crime maps provide deeper insights into Dallas neighborhoods.

- Document Showings: Take detailed notes and photos during each visit. After seeing several homes, specifics can start to blur together.

Systematically evaluating properties and their surrounding communities ensures you find a home that fits your lifestyle now and holds its value for the future.

5. Making an Offer and Negotiation Strategy

Once you’ve identified a home in a neighborhood like the Bishop Arts District or Frisco, the next crucial step in your home buying process checklist is to craft and negotiate a compelling offer. This phase is more than just naming a price; it’s a strategic communication that outlines your proposed terms, contingencies, and timeline to the seller. In a dynamic market like Dallas, a well-structured offer is what separates you from the competition.

Crafting a Competitive Offer

Your offer is a comprehensive package. In a competitive scenario for a sought-after M-Streets property, this might mean offering over the asking price and shortening the option period. Conversely, a buyer targeting a home that has been on the market for 60 days in Plano might offer at or below asking price while requesting the seller cover closing costs. A strong offer, guided by your agent, balances aggressiveness with self-protection.

Key Offer Components

A successful negotiation hinges on more than just the price. Focus on these elements to strengthen your position:

- Price and Earnest Money: Research recent comparable sales (comps) in the specific Dallas neighborhood to justify your offer price. A larger earnest money deposit can signal your seriousness.

- Contingencies: Key protections like financing, appraisal, and inspection contingencies are standard. In a multiple-offer situation, you might consider shortening these periods, but waiving them entirely carries significant risk.

- Closing Timeline: Flexibility can be a powerful negotiating tool. Offering a quick close for a seller who has already relocated or a longer rent-back period for one who needs more time can make your offer more attractive than a higher-priced one.

Understanding how to strategically leverage these components is vital to securing your desired Dallas property.

6. Purchase Contract Execution and Contingency Management

Once your offer on a Dallas property is accepted, the “home buying process checklist” shifts into a legally binding phase: executing the purchase contract. This crucial step transforms negotiations into a formal agreement, kicking off a series of time-sensitive deadlines known as contingencies. Effectively managing this period, from contract signing to deadline tracking, is essential to keep your deal moving forward in the fast-paced Dallas market.

Navigating Contract Contingencies

The executed contract outlines specific conditions that must be met for the sale to proceed. These contingencies protect you as the buyer. For instance, if an inspection on a Bishop Arts District duplex reveals significant foundation problems, the inspection contingency allows you to renegotiate repairs, seek a price reduction, or terminate the contract without losing your earnest money. Similarly, if an appraisal on a downtown high-rise comes in below the agreed-upon price, the appraisal contingency gives you leverage to renegotiate or walk away.

Key Management Milestones

Successfully navigating this phase requires meticulous organization and communication:

- Calendar Critical Dates: Immediately create a calendar marking all contingency deadlines for inspection, financing, and appraisal. Missing a deadline can mean forfeiting your rights.

- Constant Communication: Maintain regular contact with your agent, lender, and title company. For example, if your lender needs an extra document for final loan approval, prompt action is critical to meet the financing contingency deadline.

- Review Amendments: Carefully review any contract amendments or addenda before signing. A seller’s proposed repair amendment for a home in Richardson might not fully address the issues found during inspection.

This video provides an overview of the key elements found within a typical Texas real estate purchase contract.

Mastering these sequential management steps ensures you protect your interests and navigate toward a successful closing on your new Dallas home.

7. Professional Home Inspection and Due Diligence

Once your offer is accepted, the next critical phase in your Dallas home buying process checklist is conducting thorough due diligence, centered around a professional home inspection. This step, typically completed within a 7 to 10-day “option period,” involves hiring a licensed inspector to evaluate the property’s condition from its foundation to its roof. This evaluation is not a pass/fail test; it’s an in-depth report on the home’s structural, mechanical, electrical, and safety systems, uncovering potential issues and future repair needs.

Uncovering Potential Liabilities

The inspection report provides the leverage needed for negotiation. For example, an inspection on a University Park home might reveal its $15,000 HVAC system is nearing the end of its life, allowing you to negotiate a credit from the seller. Similarly, discovering an active termite infestation in a Lakewood property means you can require the seller to pay for treatment before closing. These findings protect your investment by identifying costly problems upfront.

Key Inspection Considerations

To maximize the value of your inspection, follow these guidelines:

- Hire an Expert: Select a licensed, insured inspector with extensive experience in Dallas-area homes. Vet their credentials through organizations like ASHI or InterNACHI.

- Attend the Inspection: Being present allows you to ask questions directly and gain a firsthand understanding of the findings beyond the written report.

- Prioritize Repairs: Focus negotiations on significant safety or structural issues, such as outdated electrical panels or foundation concerns, rather than minor cosmetic flaws.

- Consider Specialists: For older homes in areas like the M-Streets or properties with pools, consider specialized inspections for elements like hydrostatic plumbing or wood-destroying insects. A knowledgeable Dallas agent can recommend the right inspection services for your specific needs.

8. Final Mortgage Approval and Underwriting

Once your offer is accepted and inspections are complete, the next critical phase in the Dallas home buying process checklist is securing final mortgage approval. This isn’t a mere formality; it’s a deep-dive underwriting process where the lender verifies every single detail of your application and the property itself. From a Frisco starter home to an estate in Highland Park, the lender’s goal is to ensure the loan meets strict investor and regulatory standards.

Navigating the Underwriting Gauntlet

Underwriting involves a comprehensive review of your financial stability and the home’s value. An underwriter will re-verify your employment, re-pull your credit, and scrutinize your bank statements. For example, a self-employed individual purchasing a loft in the Design District may need to provide updated profit-and-loss statements, while an underwriter might question a large, undocumented cash deposit into your account, potentially delaying the closing.

Key Actions for a Smooth Approval

To prevent last-minute complications that could jeopardize your purchase, focus on these critical actions:

- Maintain Financial Status Quo: Avoid making any large purchases, changing jobs, opening new credit lines, or co-signing for other loans. Any significant change can trigger a full re-evaluation.

- Respond Immediately: Underwriters often request additional documentation on tight deadlines. Promptly providing whatever they ask for, such as a letter explaining a recent credit inquiry, keeps the process moving.

- Document Everything: Ensure every non-payroll deposit into your bank accounts has a clear paper trail. Gifts for a down payment, for instance, require a formal gift letter from the donor.

Successfully navigating this meticulous review moves your loan from conditional approval to “clear to close,” the final green light for your Dallas home purchase.

9. Final Walk-Through and Pre-Closing Inspection in Dallas

The final walk-through is a crucial safeguard in the Dallas home buying process checklist, occurring within 24-48 hours of closing. This is not another home inspection; it’s a final verification to ensure the property’s condition has not changed since you signed the contract and that all agreed-upon terms have been met. This is your last chance to identify new issues before the keys to your new home in Highland Park or Kessler Park are officially yours.

Verifying Contractual Obligations

The primary goal of the walk-through is to confirm the home meets the exact specifications outlined in your sales contract. For example, if the sellers agreed to repair a faulty HVAC unit as a result of the inspection, you must verify the work was completed correctly. Similarly, if high-end appliances in a Bishop Arts District loft were included in the sale, you need to ensure they are still present and in working order. Discovering that custom window treatments were removed or a new leak has appeared under a sink at this stage is critical to address before closing.

Key Verification Checklist

To conduct a thorough and efficient final walk-through, bring your contract and inspection reports and systematically check these items:

- Agreed-Upon Repairs: Confirm all negotiated repairs have been completed to a satisfactory standard. Ask for receipts and warranties if available.

- Included Items (Conveyances): Verify that all items that were supposed to convey with the sale, like refrigerators, washers, and specific light fixtures, are still in place.

- System Functionality: Test all major systems one last time. This includes running the air conditioning, checking for hot water, flushing toilets, and turning on all lights.

- Property Condition: Look for any new damage that may have occurred since your last visit, such as scuffs on walls from moving furniture or a broken window.

A comprehensive walk-through ensures you are accepting the property in the condition you bargained for, preventing post-closing disputes.

10. Step 10: Closing Process and Property Transfer in Dallas

The final phase of your Dallas home buying process checklist is the closing, where the legal transfer of the

property officially occurs. This formal meeting, typically held at a Dallas title company, involves signing a stack of documents, transferring funds, and recording the deed. It’s the culmination of months of preparation, turning your contract into concrete ownership of a Dallas property.

Finalizing the Transaction

The closing day is the legally binding event that makes the home yours. For instance, a first-time buyer purchasing a $400,000 townhome in the Bishop Arts District will execute documents with the title company agent, transferring their down payment and closing costs. In return, the seller signs over the deed, and the title company ensures all funds are properly disbursed and the new ownership is legally recorded with Dallas County.

Key Closing Day Benchmarks

To ensure a seamless closing appointment, focus on these critical final steps:

- Review Closing Disclosure: The Consumer Financial Protection Bureau mandates you receive your final Closing Disclosure at least three business days before closing. Compare it meticulously with your Loan Estimate to check for discrepancies.

- Certified Funds: You must bring a cashier’s check or arrange a wire transfer for the exact amount of your closing costs and remaining down payment. Personal checks are not accepted.

- Proper Identification: Bring a valid, government-issued photo ID, such as a driver’s license or passport. Ensure your name on the ID perfectly matches your name on the loan documents.

Successfully navigating these final benchmarks ensures the keys to your new Dallas home are placed firmly in your hand without any last-minute delays.

Home Buying Process: 10-Step Comparison Guide

| Stage | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Pre-Qualification and Credit Assessment | Low – Basic financial review and estimates | Minimal – Credit reports, income info, simple forms | Preliminary budget, credit issues identified | Early stage buyers assessing affordability in Dallas | Sets realistic expectations, strengthens buyer position |

| Mortgage Pre-Approval Process | Medium – Detailed financial verification | High – Complete docs, appraisal, lender interaction | Conditional loan commitment, competitive offers | Serious buyers ready to make offers in Dallas | Definitive budget clarity, rate lock options |

| Real Estate Agent Selection and Buyer Representation Agreement | Medium – Research and legal agreement signing | Moderate – Time interviewing agents, verifying credentials | Professional Dallas representation secured | Buyers needing expert guidance and negotiation | Access to market, fiduciary protection |

| House Hunting and Property Research | Medium – Extensive property search and evaluation | Moderate – Online tools, showings, neighborhood info | Well-informed Dallas property choices | Buyers exploring Dallas options, balancing needs & wants | Comprehensive market understanding |

| Making an Offer and Negotiation Strategy | Medium – Strategic offer preparation and counteroffers | Low to Moderate – Market data and negotiation support | Competitive offers that protect buyer interests | Active buyers in the DFW market | Leverages contingencies, can secure better terms |

| Purchase Contract Execution and Contingency Management | High – Contract management and deadline tracking | High – Coordination with multiple professionals | Legal commitment, contingency management | Post-offer phase needing deadline and risk control | Legal protection, clear timelines |

| Professional Home Inspection and Due Diligence | Medium – Scheduling and attending inspections | Moderate – Inspection fees, specialized tests | Identification of defects, repair negotiation leverage | Dallas buyers prioritizing home condition assurance | Avoids costly surprises, informed maintenance |

| Final Mortgage Approval and Underwriting | High – Thorough lender review & verification | High – Doc re-submission, appraisal, title checks | Final loan approval with funding readiness | Buyers finalizing mortgage after offer acceptance | Ensures loan compliance and security |

| Final Walk-Through and Pre-Closing Inspection | Low – Last-minute property condition check | Minimal – Time and attention during walk-through | Confirmation property matches contract terms | Buyers before closing to ensure contract fulfillment | Identifies unresolved issues, reduces risks |

| Closing Process and Property Transfer | Medium – Legal document signing and funds transfer | Moderate – Coordination among parties and title company | Legal ownership transfer and recorded deed | Buyers completing Dallas purchase | Legal security, finalizes ownership |

You’ve Got the Keys: Your Dallas Homeownership Journey Begins

Congratulations! Holding the keys to your new Dallas property is a monumental achievement, the direct result of your meticulous planning and strategic execution. By systematically working through each stage of this home buying process checklist, you have transformed a complex and often intimidating endeavor into a manageable and successful journey. From the initial financial preparations of credit assessment and mortgage pre-approval to the critical due diligence of inspections and final walk-throughs, each step was a vital building block toward this moment.

Navigating the vibrant and competitive Dallas real estate landscape requires more than just a list; it demands informed action. You’ve learned that a successful purchase is not a single event but a series of well-managed phases, each with its own set of challenges and opportunities. This checklist was designed to empower you, providing a clear roadmap to follow and ensuring no crucial detail was overlooked.

From Checklist to Homeowner: Key Takeaways

The true value of this guide lies not just in checking off boxes but in understanding the why behind each action. Let’s recap the core principles that underpinned your success:

- Financial Readiness is Foundational: Securing mortgage pre-approval wasn’t just a formality. It was your most powerful negotiating tool, demonstrating your seriousness and capacity to a seller in a competitive market like North Dallas or the Park Cities.

- Expert Guidance is Non-Negotiable: Partnering with a skilled REALTOR® and signing a Buyer Representation Agreement provided you with dedicated advocacy, hyper-local market insights, and expert negotiation that you simply cannot replicate on your own.

- Diligence Protects Your Investment: The option period and professional home inspection were your safety nets. They provided the crucial opportunity to uncover potential issues, from foundation concerns common in Texas soil to aging HVAC systems, allowing you to negotiate repairs or even walk away, protecting your long-term financial well-being.

- The Contract is Your Rulebook: Understanding every line of the purchase contract, especially the contingency deadlines, was paramount. Managing these dates for financing, appraisals, and inspections ensured a smooth path to the closing table without risking your earnest money.

Beyond the Closing Table: Your Next Steps

While the purchase is complete, your journey as a Dallas homeowner is just beginning. Now is the time to transition from buyer to owner. Start by securely storing all your closing documents, both digitally and in hard copy. Begin the process of transferring utilities into your name, setting up mail forwarding, and changing your address with relevant institutions.

Most importantly, take a moment to celebrate this incredible milestone. You have successfully navigated one of life’s most significant transactions in one of the nation’s most dynamic cities. This comprehensive home buying process checklist has served its purpose, guiding you from aspiring buyer to a Dallas homeowner.

Ready to turn your Dallas real estate goals into reality? Whether you’re just starting your research or prepared to make a move, partnering with an expert is the most critical step. With unparalleled knowledge of Dallas’s diverse neighborhoods and a commitment to client success, Dustin Pitts REALTOR Dallas Real Estate Agent provides the strategic guidance necessary to navigate this checklist with confidence. Visit Dustin Pitts REALTOR Dallas Real Estate Agent to leverage premier expertise for your home buying journey.

Article created using Outrank