Navigating the Dallas real estate market to secure the right financing can feel overwhelming, whether you are a first-time homebuyer or a seasoned investor. This resource is designed to simplify that process by providing a detailed guide to the top providers of home loans in Dallas, Texas. We cut through the marketing clutter to offer a straightforward comparison of lenders, from large national banks to local mortgage specialists.

Each entry in this listicle provides a clear, concise overview, including screenshots and direct links to the lender’s website. We analyze key features, specific loan products like FHA or jumbo loans, and typical eligibility requirements. Our goal is to equip you with the practical information needed to compare your options effectively and identify the best fit for your unique financial situation and property goals in the Dallas area.

Before you begin your search, it is crucial to understand your financial standing, especially your credit score. A strong credit history is fundamental to securing favorable loan terms. To get a better grasp on this critical component, it’s helpful to understand how the three credit bureaus work and compile your credit reports. This foundational knowledge will empower you as you engage with the lenders detailed below.

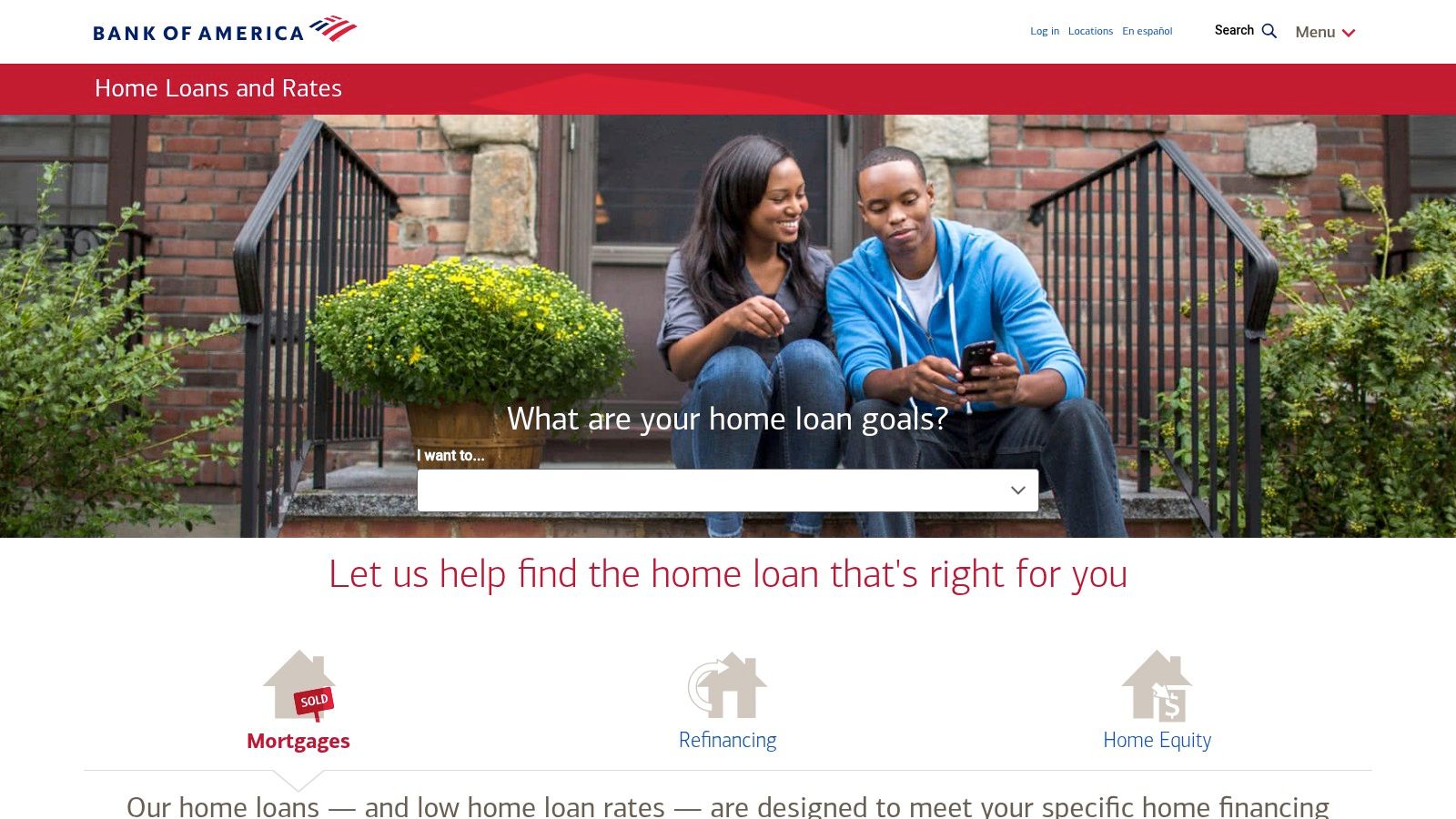

1. Bank of America – Home Loans

For Dallas homebuyers who prefer the security and extensive resources of a major national bank, Bank of America provides a robust platform for securing a mortgage. Their website is a comprehensive hub where you can explore a variety of loan products, including conventional fixed-rate and adjustable-rate mortgages (ARMs), jumbo loans for high-value Dallas properties, and government-backed options like FHA and VA loans.

The platform’s strength lies in its digital-first approach combined with a physical presence. You can get a prequalification letter entirely online, a crucial first step for making a serious offer in competitive Dallas neighborhoods like Uptown or the M-Streets. However, if you need personalized guidance, you can visit one of their many local Dallas-area branches to speak with a lending specialist.

Standout Features & Considerations

- Digital Prequalification: The online prequalification tool is fast and user-friendly, providing a clear picture of your borrowing power.

- Local Presence: With numerous financial centers across Dallas, you have the option for in-person consultations, a significant advantage over online-only lenders.

- Potential Costs: While rates are competitive, be aware that closing costs and origination fees may be higher than those offered by smaller, local credit unions. It’s wise to compare the Loan Estimate carefully.

This blend of powerful online tools and local, on-the-ground support makes Bank of America a solid choice for those seeking home loans in Dallas, Texas, especially for existing BofA customers who may qualify for relationship-based discounts.

Website: https://www.bankofamerica.com/mortgage/

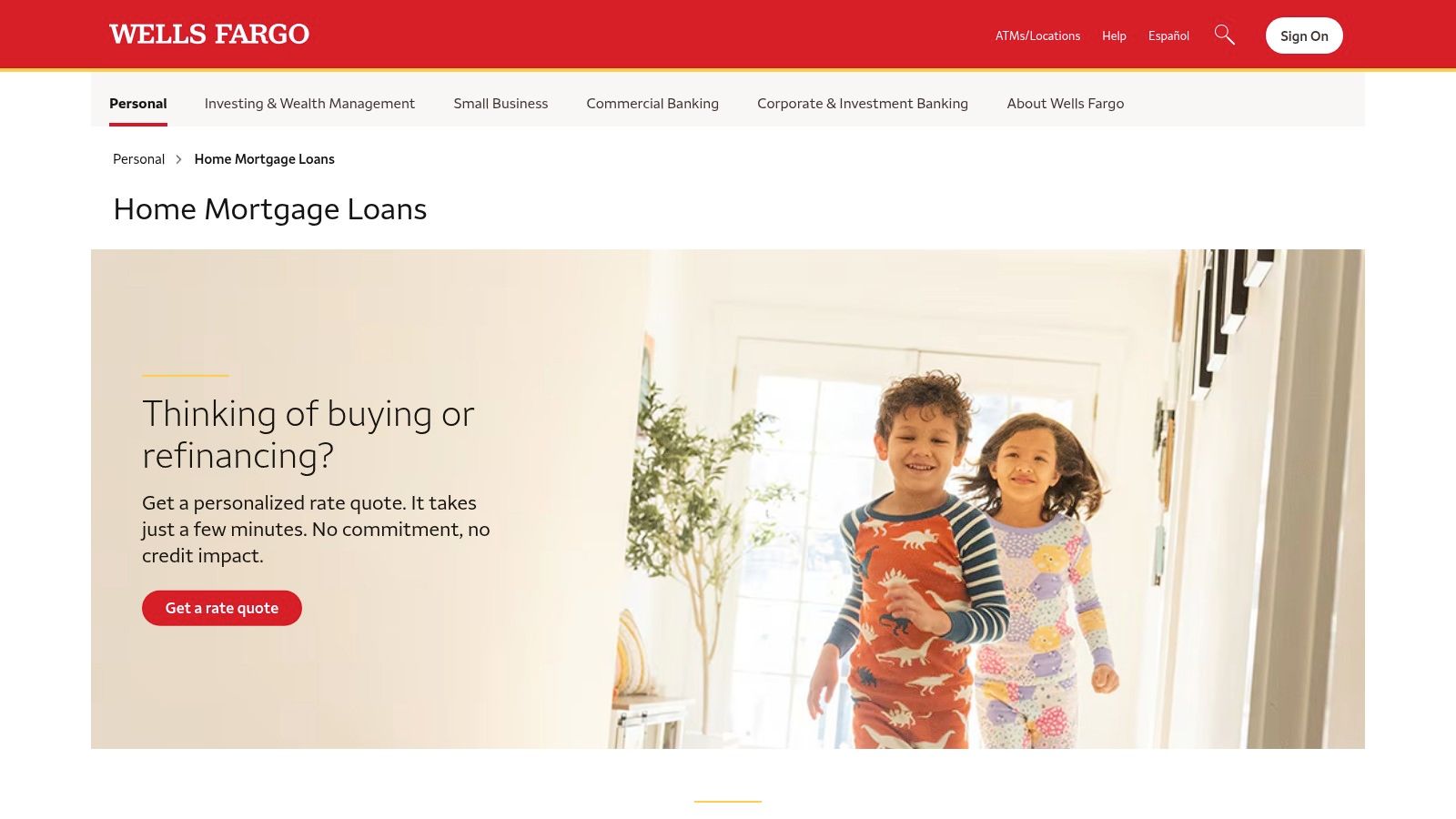

2. Wells Fargo – Mortgage Loans

As another major player in the mortgage industry, Wells Fargo offers a dependable and structured path for Dallas homebuyers seeking financing. Their platform is well-suited for those who appreciate extensive educational resources alongside a wide array of loan products. You can find everything from conventional and jumbo loans, ideal for properties in affluent Dallas neighborhoods like Preston Hollow, to government-backed FHA and VA loans.

The website excels at guiding users through the homebuying process with its user-friendly online tools and clear application portal. You can easily track your loan’s progress from application to closing. Like other national banks, Wells Fargo maintains a significant physical footprint in the Dallas-Fort Worth area, providing the option to discuss complex financing scenarios with a home mortgage consultant in person.

Standout Features & Considerations

- Homebuyer Education: The site offers robust educational content, which is particularly helpful for first-time buyers navigating the competitive Dallas market.

- Extensive Branch Network: With numerous local branches, you can get face-to-face support, a key benefit when making a significant financial decision.

- Potential for Delays: Some customers report longer processing times compared to smaller, local lenders. It’s wise to start your application early, especially if you have a tight closing deadline on a Dallas property.

For individuals looking for strong digital tools backed by the security of an established institution, Wells Fargo presents a reliable choice for securing home loans in Dallas, Texas.

Website: https://www.wellsfargo.com/mortgage/

3. Chase – Home Lending

For Dallas homebuyers, particularly those already integrated into the Chase banking ecosystem, the Chase Home Lending platform offers a streamlined and potentially cost-effective mortgage experience. Their website provides a full suite of tools, from initial rate exploration for conventional, FHA, and VA loans to a robust online application portal. This makes it a strong contender for those seeking home loans in Dallas, Texas, who value digital convenience.

The primary advantage is the seamless integration for existing Chase customers. You can manage your mortgage alongside your checking and savings accounts, and often qualify for relationship-based discounts on closing costs or rates. Whether you’re financing a property in Bishop Arts or a high-rise in Victory Park, the platform’s educational resources and direct access to mortgage advisors offer valuable support throughout the process.

Standout Features & Considerations

- Existing Customer Benefits: Chase Private Client or Sapphire Banking customers may be eligible for significant rate discounts or closing cost credits, which can be a major financial advantage.

- Integrated Digital Experience: The ability to prequalify, apply, and track your loan status entirely online is a key feature, backed by strong customer support.

- Fee Structure: While competitive, it’s important to compare their Loan Estimate against local lenders, as some origination or administrative fees may be higher.

Chase combines the digital prowess of a national institution with tangible benefits for its current customers, making it an excellent option for Dallas residents looking for an efficient, all-in-one financial home for their mortgage.

Website: https://www.chase.com/personal/mortgage

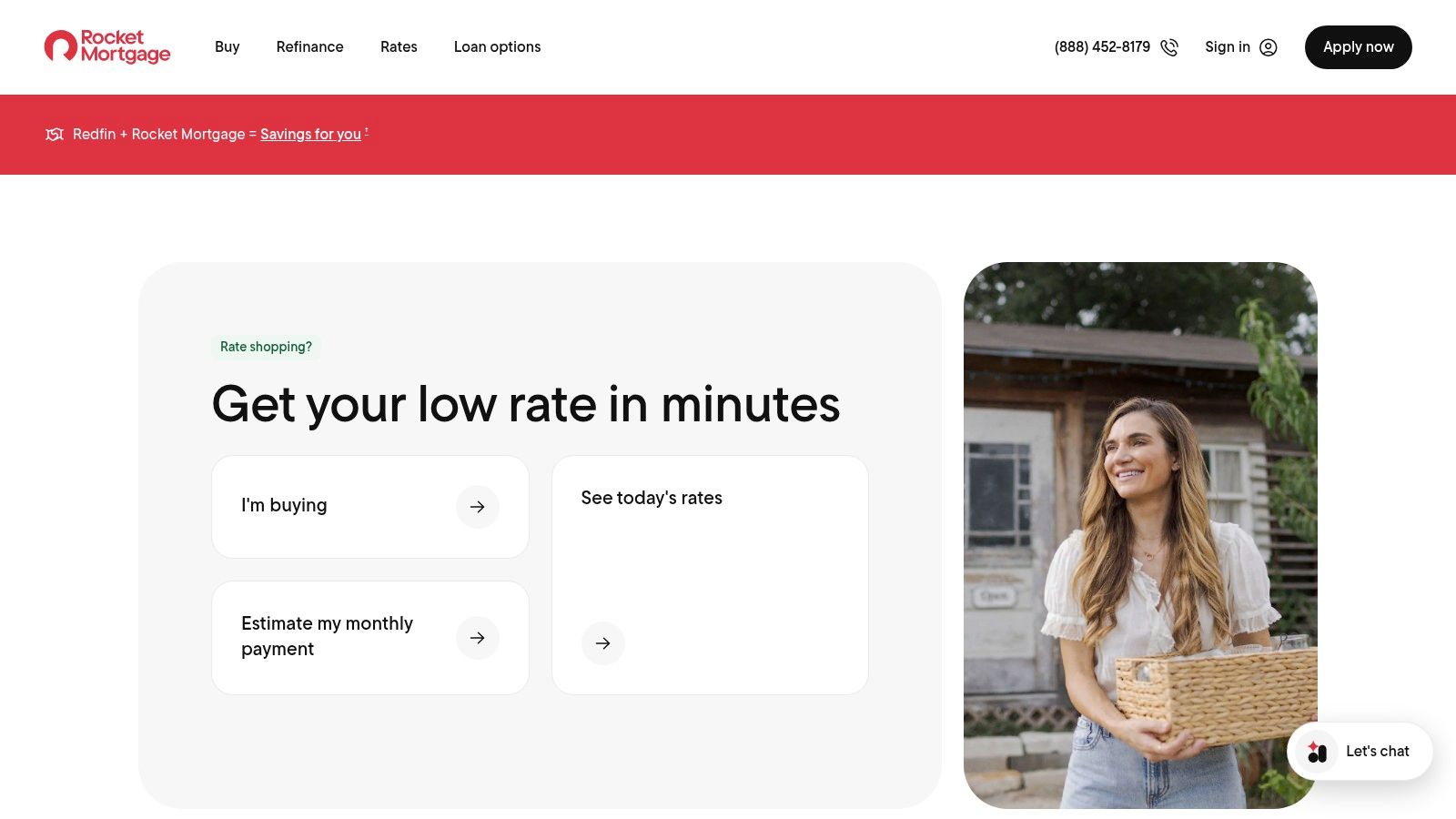

4. Quicken Loans (Rocket Mortgage)

For the tech-savvy Dallas homebuyer who prioritizes speed and convenience, Rocket Mortgage by Quicken Loans offers a fully digital mortgage experience. Their platform is engineered for efficiency, allowing you to navigate the entire loan process from your computer or smartphone, a significant advantage when acting quickly on a new listing in a fast-moving market like Bishop Arts or North Oak Cliff. The website provides access to a wide array of mortgage products, including conventional, FHA, VA, and jumbo loans.

The primary appeal of Rocket Mortgage is its streamlined, online application that can deliver a verified approval in minutes. This allows prospective buyers to make competitive, documented offers almost immediately. While the platform is celebrated for its user-friendly interface and transparent fee structure, it is best suited for those comfortable with a self-directed process.

Standout Features & Considerations

- Completely Online Process: You can apply, upload documents, and track your loan status 24/7 without needing to visit an office.

- Fast Preapproval Decisions: The automated system provides rapid feedback on your borrowing capacity, giving you an edge in Dallas’s competitive housing market.

- Limited In-Person Interaction: This digital-first model means you won’t find a local Dallas branch for face-to-face guidance, which may be a drawback for those who prefer personal consultation.

Rocket Mortgage is an excellent choice for individuals seeking efficient home loans in Dallas, Texas, who value a powerful online platform and are confident in managing their mortgage application digitally.

Website: https://www.rocketmortgage.com/

5. Guild Mortgage Company

For Dallas homebuyers looking for a lender with a deep understanding of the local market, Guild Mortgage Company stands out. Their platform offers a comprehensive suite of loan products, including conventional, FHA, VA, and even USDA loans for properties on the outskirts of the Dallas-Fort Worth metroplex. The website provides a solid starting point for exploring these options and beginning the application process online.

Guild’s primary advantage is its emphasis on personalized, local service. While you can manage much of the process digitally, the company encourages connecting with a local Dallas-area loan officer who can provide tailored advice for navigating competitive bids in neighborhoods like Lakewood or Preston Hollow. This direct support is invaluable for first-time buyers or those with complex financial situations.

Standout Features & Considerations

- Local Market Expertise: Guild loan officers have significant experience in the Dallas market, offering insights that purely online lenders cannot match.

- Personalized Customer Service: The focus is on building a relationship with a dedicated officer, providing a single point of contact throughout the process.

- Service Model: While online tools are available, the experience is designed to be hybrid. Those seeking a fully digital, hands-off process might find the emphasis on personal contact less ideal.

This combination of accessible online resources and dedicated local support makes Guild Mortgage a strong contender for anyone seeking home loans in Dallas, Texas, especially for borrowers who value expert guidance.

Website: https://www.guildmortgage.com/

6. PrimeLending, A PlainsCapital Company

For homebuyers seeking a lender with deep roots and specialized knowledge of the Dallas-Fort Worth metroplex, PrimeLending offers a compelling combination of local expertise and extensive loan options. As a PlainsCapital Company, their website provides a direct gateway to a wide array of mortgage products, from conventional and jumbo loans ideal for properties in Preston Hollow or Southlake, to government-backed FHA and VA programs.

The platform successfully balances robust digital tools with personalized, local service. You can start the application process entirely online, uploading documents and tracking your loan’s progress through their digital portal. However, PrimeLending’s key differentiator is its network of dedicated local loan officers who understand the nuances of the competitive Dallas real estate market and are available for direct consultation.

Standout Features & Considerations

- Dallas Market Expertise: Loan officers possess an in-depth understanding of local market conditions, which can be invaluable when structuring a competitive offer.

- Extensive Loan Portfolio: The company offers a broad selection of loan types, catering to a diverse range of financial situations and property values.

- Potential for Varied Timelines: While customer service is a strong point, be aware that processing times can sometimes vary. It is wise to confirm expected closing timelines upfront, especially in a fast-moving market.

This focus on blending technology with local, on-the-ground insight makes PrimeLending a top contender for anyone looking for home loans in Dallas, Texas, who values expert guidance alongside digital convenience.

Website: https://www.primelending.com/

7. Supreme Lending

As a Dallas-headquartered mortgage lender, Supreme Lending offers a deep-rooted understanding of the local housing market, providing a significant advantage for prospective homebuyers. Their website serves as a direct portal to a wide array of loan options, including conventional, FHA, VA, and USDA loans, catering to a diverse range of financial situations and property types across Dallas County.

The platform emphasizes a streamlined digital application process while retaining a strong focus on personalized customer service. This approach is ideal for buyers in fast-paced Dallas markets like Bishop Arts or Plano who need both efficiency and expert guidance. Their local expertise means loan officers are well-versed in the specific challenges and opportunities within North Texas real estate.

Standout Features & Considerations

- Local Expertise: Being based in Dallas gives their team an edge in understanding neighborhood-specific appraisal values and market conditions.

- Personalized Service: Supreme Lending is known for its commitment to customer service and communication, aiming for a smooth journey from pre-approval to closing.

- Processing Speed: Their reputation is built on closing loans quickly and efficiently, a crucial factor when dealing with tight closing dates in a competitive market.

For those who value a lender with a strong local reputation and a commitment to timely closings, Supreme Lending is a premier choice for securing home loans in Dallas, Texas, combining modern tech with a personal touch.

Website: https://www.supremelending.com/

8. TexasLending.com

For borrowers who value deep local knowledge, TexasLending.com stands out as a Dallas-based mortgage company dedicated to serving the Texas market. Their platform is designed to be straightforward, offering a comprehensive suite of loan products such as conventional, FHA, VA, and USDA loans. The company prides itself on educating homebuyers, making it a strong option for first-time buyers navigating the competitive Dallas real estate landscape.

The website facilitates a smooth online application process, allowing prospective homeowners in areas like Plano or Frisco to manage their mortgage journey digitally. Their focus on customer support provides a valuable resource for anyone needing clear communication and guidance. This hyper-local approach ensures their loan officers have an intimate understanding of the DFW housing market.

Standout Features & Considerations

- Local Expertise: As a Texas-centric lender, their team possesses specialized knowledge of Dallas-area market conditions, which can be invaluable during the appraisal and underwriting process.

- Educational Focus: The site offers resources aimed at demystifying the mortgage process, empowering borrowers to make informed decisions.

- Variable Processing Times: While known for strong support, be aware that processing times can fluctuate depending on loan volume, so it’s wise to discuss timelines upfront.

With its blend of competitive rates and a commitment to customer education, TexasLending.com is a compelling choice for those seeking home loans in Dallas, Texas, especially for buyers who appreciate a lender with a true local pulse.

Website: https://www.texaslending.com/

9. Herring Bank – FHA Loans in Dallas

For Dallas homebuyers, particularly first-time buyers, who might find conventional loan requirements challenging, Herring Bank offers a specialized focus on FHA loans. Their platform is geared toward individuals who can benefit from more flexible credit standards and lower down payment requirements, making homeownership accessible in diverse Dallas neighborhoods from Oak Cliff to Richardson.

The bank’s website provides clear, straightforward information about the FHA loan process, helping demystify a government-backed mortgage. Unlike larger, impersonal institutions, Herring Bank emphasizes personalized service, guiding applicants through each step and exploring potential down payment assistance programs. This hands-on approach can be invaluable when navigating the competitive Dallas real estate market for the first time.

Standout Features & Considerations

- FHA Loan Specialization: The bank’s core strength is its deep expertise in FHA lending, which is ideal for borrowers with less-than-perfect credit or limited funds for a down payment.

- Personalized Service: As a regional bank with a local Dallas presence, they offer a more personalized experience compared to national mortgage factories.

- Limited Product Scope: If you are seeking a jumbo loan for a property in Highland Park or a specialized ARM product, you may find their offerings too narrow. Their primary focus remains on government-backed loans.

Herring Bank is a strong contender for anyone specifically seeking FHA home loans in Dallas, Texas, valuing direct guidance and flexible qualification criteria over a broad portfolio of mortgage products.

Website: https://www.herringbank.com/mortgage/fha-loan/dallas/

10. New American Funding – Dallas First-Time Homebuyer Guide

New American Funding excels at guiding first-time homebuyers through the often-intimidating Dallas market. Their platform is specifically tailored to educate and empower new buyers, offering a wealth of resources alongside a diverse suite of loan products such as FHA, VA, and conventional options. This educational focus makes it a standout choice for individuals purchasing their first property in competitive Dallas neighborhoods.

The website provides a comprehensive guide that breaks down the process, from understanding credit scores to navigating closing day. Its digital-first approach allows for a streamlined online application, making it convenient for those ready to take the next step. While they are a national lender, their resources are specifically framed for the challenges and opportunities within the Dallas-Fort Worth metroplex. This makes their platform an excellent starting point for anyone seeking home loans in Dallas, Texas, for the very first time.

Standout Features & Considerations

- First-Time Buyer Focus: The entire platform is built around the needs of new buyers, offering clear, step-by-step guidance.

- Educational Resources: Unlike many lenders, they provide robust guides and articles that demystify the mortgage process, a key benefit for those unfamiliar with real estate transactions in Dallas.

- Potential for Slower Processing: As a large national lender with a strong online presence, processing times can sometimes vary, which is a crucial consideration in Dallas’s fast-moving housing market.

- Limited Physical Presence: Buyers who prefer in-person meetings may find the limited number of physical branches in the Dallas area to be a drawback compared to local banks.

Website: https://www.hshservicing.com/learning-center/guides/dallas-first-time-homebuyer-guide/

11. The Tuttle Group – Guide to Dallas Home Loans for First-Time Home Buyers

For first-time buyers navigating the complex Dallas housing market, The Tuttle Group offers a specialized and supportive approach. Their website serves as an educational resource, breaking down the steps and loan options available to those new to the process. They provide access to conventional, FHA, VA, and even jumbo loans, ensuring a variety of products to fit different financial situations for individuals and professionals purchasing their first property in the Dallas area.

The platform is designed to demystify the mortgage journey, moving beyond a simple application portal. It focuses on personalized service and local expertise, which can be invaluable when trying to secure financing in competitive neighborhoods. Their guidance is particularly useful for understanding the nuances of the home loans Dallas Texas landscape, from initial pre-approval to closing day. To better understand the entire journey, new buyers can explore a comprehensive Dallas home buying process checklist to complement the lender’s resources.

Standout Features & Considerations

- First-Time Buyer Focus: The entire experience is tailored to educate and assist new homebuyers, reducing the intimidation factor of securing a mortgage.

- Local Dallas Expertise: As a local lender, they possess a deep understanding of the Dallas market, which can be a significant advantage over large, national institutions.

- Limited Digital Tools: The website is more informational than transactional. Those seeking a fully-online, self-service application process may find the tools less robust than those of larger fintech lenders.

The Tuttle Group is an excellent choice for first-time buyers who prioritize personalized guidance and local market knowledge over a high-tech, automated platform.

Website: https://thetuttlegroup.com/guide-to-dallas-home-loans-for-first-time-home-buyers/

12. Texas State Affordable Housing Corporation (TSAHC)

For many aspiring Dallas homebuyers, the biggest hurdle isn’t the monthly payment but the initial down payment. The Texas State Affordable Housing Corporation (TSAHC) directly addresses this challenge. Its website is not a direct lender, but a critical resource hub connecting eligible individuals with programs that offer down payment assistance grants and mortgage credit certificates, which can significantly reduce the upfront cost and long-term tax burden of owning a home in Dallas County.

The platform allows you to find participating lenders in the Dallas area and determine if you meet the income and purchase price limits for its programs. It is an essential first stop for first-time buyers or moderate-income purchasers who may think a home in a neighborhood like Oak Cliff or Richardson is out of reach. The required homebuyer education courses also equip you with crucial knowledge for sustainable homeownership.

Standout Features & Considerations

- Down Payment Assistance: TSAHC provides grants (which do not require repayment) that can cover up to 5% of the loan amount, a game-changer for many buyers.

- Mortgage Credit Certificates (MCCs): Eligible homebuyers can receive a special tax credit, saving them up to $2,000 every year on their federal income taxes.

- Strict Eligibility: Be aware that these valuable programs have firm income and home purchase price restrictions that vary by county. You must also work with a TSAHC-approved lender.

By bridging the affordability gap, TSAHC provides one of the most powerful tools available for those seeking home loans in Dallas, Texas, making homeownership a reality for a wider range of residents.

Website: https://www.tsahc.org/

Home Loan Options Comparison – Dallas, TX

| Mortgage Provider | Core Features / Loan Options | User Experience & Support | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Bank of America – Home Loans | Diverse mortgage options | ★★★★ Online tools, local branches | Competitive rates, nationwide 🏆 | General buyers & sellers | Online prequalification, education resources ✨ |

| Wells Fargo – Mortgage Loans | Conventional, FHA, VA loans | ★★★★ Branch network, buyer programs | Special programs for first-time 💰 | First-time buyers, veterans | Homebuyer education, loan tracking ✨ |

| Chase – Home Lending | Variety of loan products | ★★★★ Strong support, Chase integration | Offers & specials for customers 💰 | Existing Chase customers | Mortgage advisors, online management ✨ |

| Quicken Loans (Rocket Mortgage) | Fully online process, fast preapprovals | ★★★★ 24/7 support, efficient | Transparent fees, convenience 💰 | Tech-savvy, busy professionals | Completely online, quick approvals ✨ |

| Guild Mortgage Company | Conventional, FHA, VA, USDA loans | ★★★★ Personalized local service | Flexible terms, local expertise 💰 | Local Dallas residents | Strong Texas presence, branch support ✨ |

| PrimeLending, A PlainsCapital Company | Extensive loan offerings | ★★★★ Local officers, strong support | Competitive rates, Dallas focus 💰 | Dallas buyers & investors | Deep local market knowledge ✨ |

| Supreme Lending | Diverse loan programs | ★★★★ Quick processing, local service | Strong reputation in Dallas 💰 | Dallas area buyers & sellers | Personalized service, timely closings ✨ |

| TexasLending.com | Wide loan range, educational resources | ★★★★ Competitive rates and support | Local expertise, competitive rates 💰 | Budget-conscious and informed buyers | Focus on education & tools ✨ |

| Herring Bank – FHA Loans in Dallas | Low down payment, flexible credit | ★★★★ Personalized local service | FHA specialization, payment assistance 💰 | First-time homebuyers | FHA-focused loans, down payment help ✨ |

| New American Funding – Dallas First-Time Homebuyer Guide | Variety of loan products, buyer resources | ★★★★ Educational focus | Competitive rates for first-time 💰 | First-time buyers | Comprehensive first-time buyer support ✨ |

| The Tuttle Group – Guide to Dallas Home Loans | Conventional, FHA, VA, jumbo loans | ★★★★ Strong customer support | Local expert guidance 💰 | First-time buyers, local market | Personalized service, local expertise ✨ |

| Texas State Affordable Housing Corporation (TSAHC) | Down payment assistance, mortgage credits | ★★★ Homebuyer education courses | Assistance for low/mod income 💰 | Low-to-moderate income buyers | Statewide programs, nonprofit benefits ✨ |

Final Thoughts

Navigating the complex landscape of home loans in Dallas, Texas, can feel like a monumental undertaking, but armed with the right resources, you can approach the process with confidence and clarity. Throughout this guide, we’ve explored a diverse range of lending options, from national banking giants like Chase and Bank of America to locally-focused powerhouses such as PrimeLending and Supreme Lending. The key takeaway is that there is no single “best” lender for everyone; the ideal choice depends entirely on your specific financial situation, property goals, and personal preferences.

For instance, a first-time homebuyer might find invaluable support and specialized programs through resources like the Texas State Affordable Housing Corporation (TSAHC) or dedicated guides from New American Funding. Conversely, a seasoned investor or individual pursuing a luxury property in a neighborhood like Preston Hollow or the Park Cities may prioritize the bespoke services and jumbo loan expertise offered by a private banking division or a specialized lender known for handling complex financial profiles.

Making Your Decision: A Strategic Approach

The journey to securing your Dallas home loan doesn’t end with this list. Your next steps are crucial for transforming information into action. The most important part of this process is self-assessment. Before you even submit an application, you must define your non-negotiables.

- Analyze Your Financials: What is your credit score, debt-to-income ratio, and down payment capacity? Be realistic. This will immediately narrow down which lenders and loan products are viable options for you.

- Define Your Priorities: Is the absolute lowest interest rate your primary goal, or do you value a highly responsive, communicative loan officer who can guide you through Dallas’s competitive market? Are you looking for digital convenience like Rocket Mortgage, or do you prefer the in-person consultation offered by a local branch?

- Compare Pre-Approvals: Do not commit to the first offer you receive. We strongly recommend getting pre-approved by at least three different lenders from the list above. This not only gives you a clear picture of what you can afford but also provides significant negotiating power. You can leverage competing offers to secure better rates or lower closing costs.

Remember, securing financing is one of the most significant steps in acquiring property in Dallas. The lender you choose becomes a critical partner in your transaction. They will work hand-in-hand with your real estate agent to ensure a smooth process from offer to closing. A proactive, experienced loan officer who understands the nuances of the Dallas market can be the deciding factor in a multiple-offer situation. By carefully vetting these options and aligning them with your unique needs, you position yourself for a successful and less stressful home-buying experience.

Finding the right home loan is just one piece of the puzzle. To navigate the competitive Dallas real estate market effectively, you need an expert agent who understands both the properties and the financial intricacies of securing them. Partner with Dustin Pitts REALTOR Dallas Real Estate Agent to gain a strategic advantage in your property search. Dustin Pitts REALTOR Dallas Real Estate Agent provides unparalleled market knowledge and works seamlessly with top lenders to ensure your entire home-buying journey is a success.