When you’re buying a home in Dallas, one of the biggest questions I get is, “How much should I really budget for closing costs?”

A solid rule of thumb is to set aside 2% to 5% of your home’s purchase price. So, if you’re looking at a typical $400,000 home in Dallas, you should be prepared for anywhere from $8,000 to $20,000 in closing costs. This money covers all the crucial services needed to finalize your mortgage and officially transfer the property title into your name.

Decoding Closing Costs in the Dallas Market

Navigating the Dallas real estate market is about more than just finding the perfect house; it’s about understanding all the financial pieces that come after the down payment. Closing costs are simply the collection of fees you pay to complete the purchase. Think of them as the administrative and legal expenses that turn a signed contract into official homeownership.

These costs aren’t just one big bill. Instead, they’re a bundle of separate charges from different companies involved in the transaction. Gaining a solid grasp of where this money goes is the first step toward accurately forecasting your budget and avoiding any surprises.

The Main Expense Categories

Understanding what you’re paying for demystifies the whole process. It puts you in control, so when you get your official loan documents, you can review them with confidence. Your closing costs will generally fall into three main buckets:

- Lender Fees: These are the charges from your mortgage company for creating and processing your loan. This includes things like the loan origination fee and underwriting.

- Third-Party Fees: These fees go to independent providers for required services. This covers the home appraisal, your credit report, and all the work done by the title company.

- Prepaids and Escrow Items: These aren’t really fees but are upfront payments for future expenses. You’ll prepay for things like your first year of homeowner’s insurance and a few months of property taxes.

For anyone just starting their homeownership journey, getting a handle on these expenses is a critical piece of the puzzle. You can find more great information in a comprehensive first-time homebuyer guide.

Why Costs Vary Across Dallas

That 2% to 5% range is a helpful starting point, but your final number will depend on your specific deal. The purchase price is the biggest driver—it’s no surprise that a luxury home in Preston Hollow will have higher closing costs than a starter home in East Dallas.

The type of loan you get also plays a big role. Conventional, FHA, and VA loans all have slightly different fee structures. Even the time of year you close can shift your costs, especially when it comes to prorated property taxes, which are a major part of your prepaid expenses.

Key takeaway for Dallas buyers: While some fees are fixed, many are negotiable. This is a real opportunity to lower your out-of-pocket expenses at the closing table.

Quick Estimate of Closing Costs on a Dallas Home

To give you a clearer picture, let’s look at how that 2-5% range translates to real numbers for typical home prices in the Dallas market. This table should help you quickly ballpark what to expect.

| Dallas Home Price | Estimated Closing Costs (2%) | Estimated Closing Costs (5%) |

|---|---|---|

| $350,000 | $7,000 | $17,500 |

| $450,000 | $9,000 | $22,500 |

| $600,000 | $12,000 | $30,000 |

| $800,000 | $16,000 | $40,000 |

Remember, these are estimates. Your specific loan, lender, and negotiations will determine your final costs, but this gives you a practical baseline for your budget planning.

A Detailed Breakdown of Lender and Third-Party Fees

When you get your Loan Estimate, the list of charges can look a little intimidating at first. Think of this document as the itemized receipt for your home purchase—every single fee that adds up to your final closing cost figure is listed right there.

Knowing what each line item means is the secret to accurately estimating your costs and, more importantly, making sure you’re not overpaying. Let’s break down the two main buckets of fees you’ll see when buying a home in Dallas: lender fees and third-party fees.

Lender fees are what your mortgage company charges to create, approve, and fund your loan. They get paid directly to your lender. On the other hand, third-party fees are for services from other companies that are required to get the deal done. Your lender just passes these costs along to you.

Unpacking Your Lender Fees

Your lender’s charges cover all the behind-the-scenes work they do to get your mortgage across the finish line. While most of these are standard, it’s always a good idea to review them with a fine-tooth comb.

Here are the most common lender fees you’ll run into on a Dallas home loan:

- Loan Origination Fee: This is the main fee lenders charge for processing your loan application. It covers all the administrative work, from taking your application to prepping your final documents. In the Dallas area, this fee typically runs between 0.5% and 1% of your total loan amount.

- Underwriting Fee: Underwriting is the deep-dive process where the lender verifies all your financial info and assesses the risk of giving you the loan. This fee covers the cost of the underwriter’s time and analysis. Expect this to be a flat fee, usually between $500 and $1,000.

- Discount Points: This one is completely optional. You can choose to pay “points” upfront, which essentially pre-pays some interest to secure a lower interest rate for the entire life of your loan. One point costs 1% of the loan amount. Deciding to pay for points is a long-term financial calculation.

These fees are a core part of the mortgage process. For brokers, being able to clearly explain these charges is a must, and you can find more great insights in this guide with essential mortgage broker tips.

Real-World Insight: While the underwriting fee is almost never negotiable, the loan origination fee sometimes is. If you have a strong credit profile and a straightforward application, it never hurts to ask your loan officer if there’s any wiggle room.

Navigating Essential Third-Party Services

Third-party fees are for mandatory services performed by independent companies. Your lender lines these services up on your behalf, and you settle the bill for them at closing. These costs can vary quite a bit depending on the vendor and the specifics of your Dallas property.

Here’s a look at the typical third-party charges:

- Appraisal Fee: A licensed appraiser has to evaluate the home’s value to make sure it’s worth at least what you’re borrowing. In Dallas-Fort Worth, an appraisal typically costs between $450 and $700. It can be higher for larger or more unique properties.

- Credit Report Fee: The lender needs to pull your credit history from the big three bureaus (Experian, Equifax, TransUnion). This is a pretty small fee, usually just $30 to $60.

- Flood Certification Fee: This fee pays a third party to officially determine if the property sits in a designated flood zone. If it does, you’ll be required to buy separate flood insurance. The certification itself is a minor cost, generally $15 to $25.

- Survey Fee: A survey is what legally confirms the property’s boundaries and identifies any easements or encroachments. While lenders don’t always require one for existing homes in established Dallas neighborhoods, it’s something I highly recommend. A survey can run anywhere from $400 to $900, depending on the lot’s size and complexity.

By getting familiar with these specific charges, you can turn that confusing closing statement into a clear and simple roadmap. This knowledge gives you the power to ask smart questions, spot any potential overcharges, and head to the closing table with total financial confidence.

Figuring Out Title Insurance and Escrow Costs in Dallas

When you start adding up your closing costs, the fees from the title company are going to be one of the biggest line items. In any Dallas real estate deal, the title company plays two critical roles: providing title insurance and managing the entire closing process through an escrow officer. Getting a handle on how these costs are calculated is crucial for creating an accurate homebuying budget.

Unlike some other closing costs that can vary wildly between providers, title insurance premiums in Texas are actually regulated by the state. This is good news—it means you won’t find a cheaper rate by shopping around different title companies, which brings a welcome level of predictability to the process. Your focus, then, should be on understanding the policies you need and the other smaller service fees the title company charges.

What Do Title and Escrow Actually Do in a Dallas Closing?

At its core, a title company’s main job is to make sure the property you’re buying has a “clean” title. This means they verify the seller has the undisputed legal right to sell it and that there are no surprise liens or claims hanging over it.

The escrow officer is the neutral third party who holds all the money and documents until every single condition of the sales contract has been met. They are the ringmaster of the closing circus.

Here’s a quick look at their key functions:

- Title Search: They dig through public records to find any potential snags in the property’s title history.

- Title Insurance: They issue insurance policies that protect both you and your lender from any future title disputes that might pop up.

- Escrow Services: The escrow officer coordinates with your lender, handles all the paperwork, and disburses every dollar at closing.

- Settlement Services: They prepare the final closing statements and walk you through signing the mountain of documents.

Owner’s vs. Lender’s Title Insurance Policies

In Texas, you’ll run into two different kinds of title insurance. It’s absolutely vital to know the difference, because one is required by your lender and the other is just plain smart to have.

A Lender’s Title Insurance Policy is mandatory if you’re getting a mortgage. It protects your lender’s financial stake in the property up to the loan amount. As the buyer, this one’s on you to pay for.

An Owner’s Title Insurance Policy is all about protecting you. It shields your equity from any hidden title defects that could surface long after you’ve moved in. While it’s technically optional, I strongly advise every single Dallas homebuyer to get it. In a typical North Texas deal, the seller pays for the owner’s policy, but remember, this is always a point of negotiation in the contract.

Expert Tip: The cost for an owner’s policy in Texas is a one-time fee paid at closing, and it protects you for as long as you own the home. Considering the financial nightmare a title claim can become, it’s one of the smartest investments you can make in your purchase.

Calculating the Premium on a Dallas Home

Since the Texas Department of Insurance (TDI) sets the rates, the math is refreshingly straightforward. The premium is based on a tiered structure that’s tied directly to the home’s sale price.

Let’s walk through an example for a $450,000 home in Dallas:

- The first $100,000 of the home’s value costs $875.

- The remaining value up to $1 million costs $5.40 per thousand dollars.

For our $450,000 home, the calculation would put the standard owner’s policy premium at $2,765. The good news is that when you purchase the lender’s policy at the same time, you usually just pay a small simultaneous issuance fee—around $100—instead of a whole separate premium.

Keep in mind that other related fees, like the settlement or escrow fee, are charged separately. These usually run between $350 and $600 and cover the title company’s administrative work for managing the closing. For complex deals, a tool like a real estate title document reviewer can help double-check documents for accuracy.

Estimating Your Prepaid Expenses and Property Taxes

Of all the numbers on a closing statement, the “prepaids” often cause the most confusion. It’s an odd term, but it’s simpler than it sounds. Unlike fees you pay for services like an appraisal or title search, prepaids are your own money being set aside to cover future bills.

Think of it as giving yourself a head start on the regular costs of homeownership. If you can get a handle on these numbers, you’ll be much closer to an accurate “cash-to-close” figure. In Dallas, this bucket of costs almost always breaks down into three key items: property taxes, homeowner’s insurance, and a little thing called daily mortgage interest.

Calculating Prepaid Homeowner’s Insurance

Lenders won’t release a dime for your loan until they know the house is insured. It makes sense—they’re protecting their investment, and you’re protecting your new home. To make this happen, they require you to pay for your first full year of homeowner’s insurance right at the closing table.

In Dallas, you can expect the annual premium for a standard policy to run anywhere from $2,500 to over $4,500. This number can swing quite a bit based on the home’s value, its age, and even its specific location (like if it’s near a flood plain).

Here’s how to nail this number down:

- Get quotes from several insurance companies well before you’re scheduled to close.

- Pick a policy that satisfies your lender’s rules and gives you the coverage you’re comfortable with.

- That full 12-month premium is what you’ll pay at closing. So, if your policy is $3,600 for the year, that’s the exact amount you’ll see on your settlement statement for this line item.

Understanding Prepaid Mortgage Interest

Mortgage payments are almost always due on the first of the month, but they pay for the interest from the month before. This backward-looking payment schedule creates an awkward gap when you close on, say, the 20th of the month.

To solve this, your lender will charge you per diem (or daily) interest. You’ll pay for each day from your closing date through the end of that month.

Let’s walk through a real-world Dallas scenario. Say you’re getting a $400,000 loan with a 6.5% interest rate and your closing is on May 20th.

- First, find the annual interest: $400,000 x 0.065 = $26,000.

- Next, calculate the daily interest: $26,000 / 365 days = $71.23 per day.

- Then, count the days you’ll owe. For a May 20th closing, you’ll pay for 12 days (May 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, and 31).

- Finally, do the math: $71.23 x 12 days = $854.76.

That $854.76 gets added to your closing costs. The upside? Your first mortgage payment won’t be due until July 1st, which covers all of June’s interest. You get a nice little break before that first big payment hits.

Prorating Dallas Property Taxes

This is where things can get a little tricky. Property tax prorations are probably the most complex part of the prepaid puzzle because you’re essentially splitting the annual bill with the seller. In Texas, we pay property taxes in arrears—meaning the bill you get toward the end of the year is for that entire calendar year.

The title company does all the math, but here’s how it works: The seller pays for the taxes from January 1st up to the day before closing. You take over from the day of closing through December 31st.

Here’s a Dallas Property Tax Scenario:

- Home Purchase Price: $450,000

- Estimated Annual Taxes: $9,000 (a 2% combined rate is a good estimate for Dallas County)

- Closing Date: September 15th

The Calculation Breakdown:

- Figure out the daily tax rate: $9,000 / 365 days = $24.66 per day.

- Calculate the seller’s share: From January 1st to September 14th, there are 257 days. So, the seller’s portion is $6,338.82 (257 days x $24.66).

- The Proration: At closing, the seller doesn’t write a check to the tax office. Instead, they give you a credit for $6,338.82. You then become responsible for paying the entire tax bill when it arrives later in the year.

Important Note on Escrow: It doesn’t stop with the seller’s credit. Your lender will also require you to put money into an escrow account to build up a cushion for next year’s taxes and insurance. They’ll typically collect a prorated amount plus an extra two months of payments to get the account started on solid ground.

Getting a firm grip on these tax dynamics is a game-changer for budgeting. For a deeper dive into what drives property values and taxes in the area, take a look at this Dallas housing market overview.

A Practical Dallas Homebuyer Calculation Example

Alright, let’s get down to brass tacks. Theory is one thing, but seeing the numbers come together for a real-world scenario makes all the difference. To really show you how to calculate closing costs, we’re going to walk through a hypothetical purchase in a popular Dallas neighborhood like Bishop Arts.

This isn’t just a math problem. It’s a hands-on exercise that will turn abstract line items into a concrete budget you can actually use. Think of it as a crucial step toward feeling financially ready and confident about your home purchase.

Setting the Scene: A Bishop Arts Purchase

To ground our calculation, we need a realistic scenario. We’ll use round numbers to keep the math straightforward, but these figures are absolutely typical for what you might see in the Dallas market today.

Here’s our setup:

- Purchase Price: $450,000

- Down Payment: 10% ($45,000)

- Loan Amount: $405,000 (Conventional Loan)

- Interest Rate: 6.5%

- Closing Date: October 15th

- Negotiated Seller Credit: $5,000 toward your closing costs

With these details locked in, we can start building out a sample closing cost worksheet, one fee at a time.

Sample Closing Cost Calculation for a $450,000 Dallas Home

This table breaks down all the estimated costs into the main categories we’ve been discussing. I’ve seen thousands of these settlement statements, and this is a very standard layout. Remember, some fees are fixed, while others are estimates that can shift slightly before closing day.

| Fee Category | Itemized Fee | Estimated Cost |

|---|---|---|

| Lender Fees | Loan Origination Fee (1%) | $4,050 |

| Underwriting Fee | $800 | |

| Credit Report Fee | $50 | |

| Third-Party Fees | Appraisal Fee | $550 |

| Survey Fee | $500 | |

| Flood Certification | $20 | |

| Title & Escrow Fees | Lender’s Title Policy | $100 |

| Settlement/Escrow Fee | $450 | |

| Prepaids & Escrow | 1-Year Homeowner’s Insurance | $3,800 |

| Prepaid Interest (17 days) | $1,254.25 | |

| Initial Escrow Deposit (Taxes) | $1,500 | |

| Initial Escrow Deposit (Insurance) | $633.34 | |

| Total Estimated Costs | $13,707.59 |

This total shows the gross amount you’d need before any credits are applied. It’s a perfect illustration of how quickly all those smaller charges can add up to a pretty significant number.

Key Insight: Take a look at that list again. Notice how the prepaid homeowner’s insurance premium is one of the single biggest expenses? This is exactly why I tell my clients to get insurance quotes early. It’s a game-changer for accurate budgeting.

While these figures are specific to our Dallas example, the types of costs are universal in Texas. This localized focus is what matters; general national averages don’t account for specific Texas regulations like state-set title insurance rates or our unique property tax system. It really drives home why a local, personalized calculation is the only one that matters for a Dallas home purchase.

Calculating the Final Cash-to-Close

Now for the best part—subtracting the money you don’t have to pay! This is where your agent’s negotiation skills directly pad your bank account on closing day.

- Total Estimated Closing Costs: $13,707.59

- Less Seller Credit: –$5,000.00

- Net Closing Costs Due: $8,707.59

To figure out your final “cash-to-close,” you just add your down payment to this net closing cost figure.

$45,000 (Down Payment) + $8,707.59 (Net Closing Costs) = $53,707.59

That $53,707.59 is the magic number—the estimated amount you’ll need to wire or bring as a cashier’s check to the title company. For more insider tips, be sure to check out our complete Dallas home buying guide with insights and tips.

This is the kind of practical math every buyer should do.

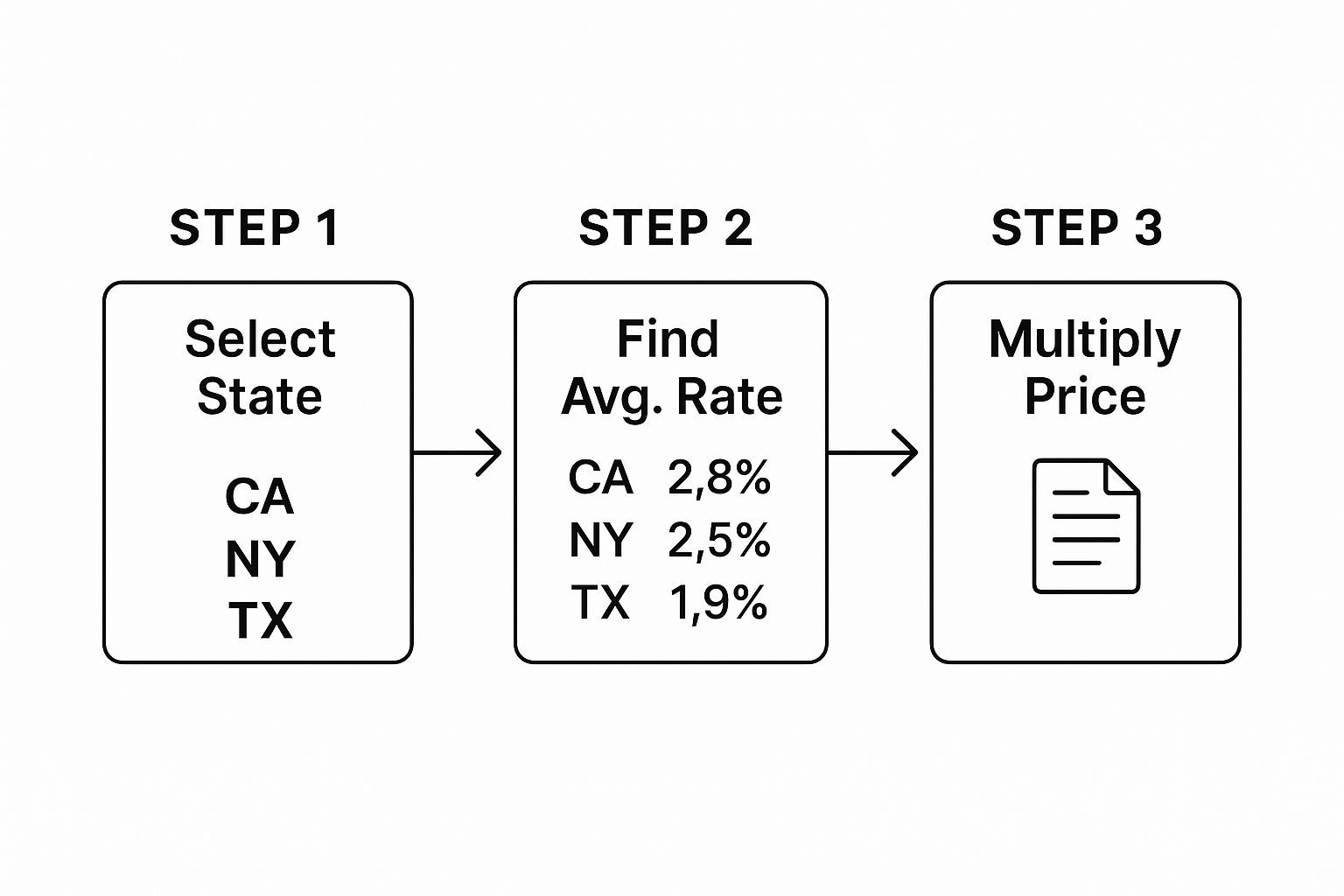

As you can see, the basic formula is always the same: multiply the home price by the average rate for your specific area. It reinforces that local knowledge is absolutely essential for getting your numbers right.

Common Questions About Dallas Closing Costs

Even after you’ve run the numbers and have a solid estimate, it’s natural to have a few questions about closing costs. It’s a complex part of the home-buying process, and getting clear, straightforward answers is key to feeling confident as you head to the closing table. Let’s break down some of the most common questions I hear from buyers in Dallas.

A big one is always about negotiation. Are these costs set in stone? While some fees, like state-regulated title insurance premiums, are what they are, many others are absolutely negotiable.

A key takeaway here is that you can—and should—question lender fees like the loan origination or underwriting fee. Even better, you and your agent can always negotiate for the seller to cover a portion of your closing costs. This is called a seller credit, and it directly reduces the cash you need to bring to closing.

This strategy is used all the time in the Dallas market. It’s a powerful tool to make a deal work for everyone and is a standard part of the back-and-forth that gets a contract signed.

Can I Roll Closing Costs into My Loan?

This is another huge, and very important, question. The short answer is generally no; you can’t just add your closing costs on top of your mortgage for a purchase. The loan amount is based on the home’s value and your down payment, not all the extra fees.

But don’t worry, there are a couple of smart workarounds we use all the time:

- Lender Credits: You can sometimes choose a slightly higher interest rate on your loan. In exchange, the lender gives you a “credit” to cover some or all of your closing costs. This means less cash out of pocket upfront, but your monthly payment will be a bit higher.

- Negotiated Seller Credits: As we just talked about, this is the most common way to finance your closing costs without paying for them directly. The seller agrees to pay a certain amount towards your costs, which is then handled at closing.

For anyone just starting their home search, figuring out these options can feel overwhelming. Our team specializes in walking buyers through this, and you can get a great overview in our guide for the first-time home buyer in Dallas, TX.

What’s the Difference Between the Loan Estimate and Closing Disclosure?

You’ll get two critical documents that outline all your costs, and it’s vital to know what they are. First, the Loan Estimate shows up within three days of your loan application. It’s exactly what it sounds like—an estimate.

The second document is the Closing Disclosure (CD). This is the final, official breakdown of your costs. You will receive it at least three business days before your scheduled closing day, giving you time to review it.

Your job is to compare these two documents side-by-side. The numbers on the CD should be very close to what was on your Loan Estimate. By law, some fees can’t change at all, while others have a small tolerance. Carefully reviewing the CD is your last, best chance to catch any mistakes before you sign on the dotted line.

Navigating the details of closing costs is a lot less stressful when you have an expert in your corner. Here at Dustin Pitts Dallas Real Estate Agent, we make sure our clients understand every single line item and feel completely prepared for closing day. If you’re getting ready to buy a home in Dallas, visit us online to see how we can help you reach your goals with total confidence.