To figure out a property’s fair market value, you’ve got to dig into recent comparable sales, make smart adjustments for the differences between properties, and get a real feel for the current Dallas market trends. It’s all about finding that realistic price a knowledgeable buyer and a willing seller would shake hands on without being under pressure. This process is crucial for a valuation that actually reflects what’s happening on the ground today in Dallas.

What Fair Market Value Means for Dallas Property

Before we start crunching numbers, it’s really important to understand what “fair market value” (FMV) actually means in a fast-moving real estate market like Dallas. This isn’t just some abstract number; it’s the gold standard for figuring out what a property is truly worth.

Think of it as the most likely price a property would fetch if it were put up for sale on the open market today. This whole concept hinges on a hypothetical deal between a buyer who’s done their homework and a seller who isn’t desperate to sell, with neither side being forced into the transaction. It’s the sweet spot where supply and demand meet for that specific property, in that specific Dallas neighborhood.

Distinguishing FMV from Other Valuations

It’s super easy to get fair market value mixed up with other numbers you’ll see thrown around. Knowing the difference is key to getting an accurate picture of a property’s worth.

- Tax Assessed Value: This is the number the Dallas Central Appraisal District (DCAD) uses to figure out your property taxes. It’s almost always lower than the true market value and is rarely a good indicator of what a buyer would actually pay.

- Online Estimates: Those instant “Zestimates” and other online valuations are generated by algorithms called Automated Valuation Models (AVMs). They can be useful for a quick ballpark idea, but they often miss the subtle details of local Dallas market conditions and the unique features of a property.

- List Price: This is simply the asking price a seller puts on their property. It’s the starting line for negotiations, not the finish line.

A property’s true fair market value is fluid. It’s influenced by hyper-local factors that can vary dramatically from one Dallas neighborhood to the next.

For instance, the market forces driving up prices for a new build in a hot area like Frisco are completely different from what’s happening with a historic home in the Bishop Arts District. Things like school district ratings, how close you are to the Dallas North Tollway, or if you can walk to local shops all make a huge difference.

In the end, a properly researched FMV gives you a realistic, evidence-based price that’s grounded in the current Dallas market—not just an algorithm or a tax bill.

To give you a clearer picture, here’s a quick look at the main ways professionals determine a property’s value in Dallas.

Core Property Valuation Methods for Dallas

This table breaks down the three primary approaches used to determine a property’s value in the Dallas market. Each one has its place, but the Sales Comparison Approach is the most common for residential properties.

| Valuation Method | Best For | Key Metric |

|---|---|---|

| Sales Comparison Approach | Single-unit residences, condos | Recent sales of similar nearby properties (comps) |

| Cost Approach | New construction, unique properties | Cost to rebuild the property from scratch, minus depreciation |

| Income Approach | Investment/rental properties | Potential rental income the property can generate (Gross Rent Multiplier, Cap Rate) |

Understanding these methods helps you see how an appraiser or a savvy real estate agent arrives at a number that reflects the true pulse of the Dallas market.

Finding Accurate Comps in Your Dallas Neighborhood

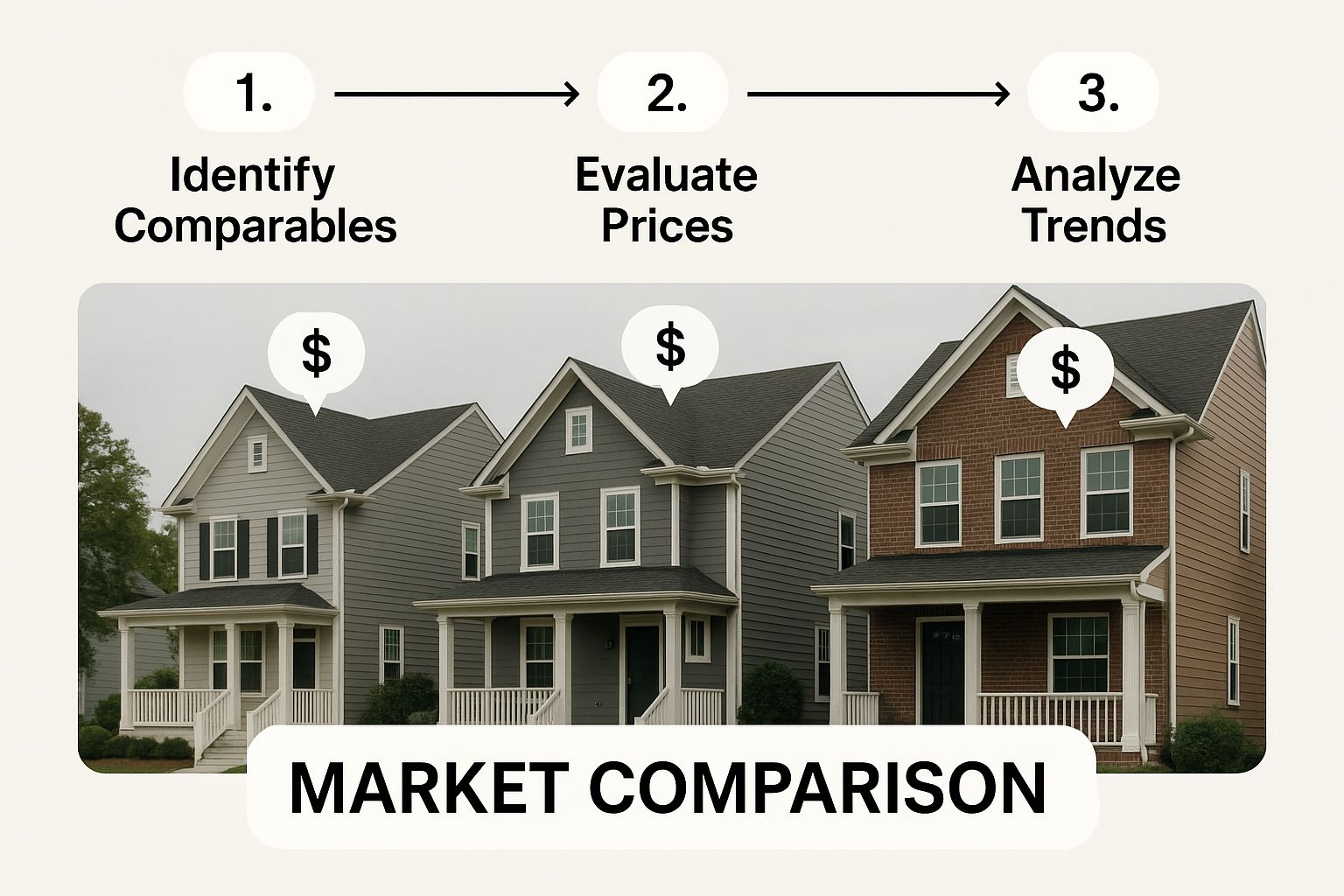

To nail down a property’s fair market value, you have to start with what’s recently sold nearby. This isn’t about guesswork or looking at pie-in-the-sky list prices; it’s about digging into the hard data of what real buyers have actually paid for similar properties in Dallas. This process of analyzing comparable properties—or “comps,” as we call them in the business—is the bedrock of any solid valuation.

Your goal is to build a convincing, evidence-based case for your property’s worth, grounded in real-world Dallas transactions. Let’s get into the nitty-gritty of what makes a property a true comparable.

Pinpointing Truly Similar Properties

Not all sales are created equal. A three-bedroom property in Lakewood Heights is a world away from a three-bedroom near White Rock Lake, even if they’re just a mile apart. Finding the best comps means filtering your search with the same critical eye a buyer would.

You need to focus on properties that are a close match to yours in a few key areas:

- Location: Stick to a tight radius. We’re talking within the same subdivision or just a few blocks away. In Dallas, micro-neighborhoods are everything.

- Square Footage: Look for properties within a 10-15% range of your property’s size. Anything more, and you’re comparing apples to oranges.

- Age and Condition: A completely renovated 1940s Tudor in the M Streets is not comparable to an original-condition home from the same decade. Condition is a massive value driver in Dallas.

- Key Features: Always compare the basics: number of bedrooms, bathrooms, and garage spaces.

This method is known professionally as the Sales Comparison Approach. It’s the gold standard because it reflects what willing buyers and sellers have actually agreed upon in the open market, not just what someone hopes to get.

Where to Find Reliable Dallas Sales Data

Knowing where to pull your data from is half the battle. Public records are a decent starting point if you’re tackling this on your own.

The Dallas Central Appraisal District (DCAD) website is a great public resource for property details, but the Multiple Listing Service (MLS) is the undisputed king for actual sales prices. While you need a license to access the MLS directly, its data is what powers the major real estate websites you’re already familiar with.

As you sift through the data, be ruthless about tossing out outliers. Distressed sales like foreclosures, short sales, or any deal that wasn’t an “arm’s-length” transaction between unrelated parties will only skew your numbers. For investors zoning in on particular areas, our Northeast Dallas real estate investment guide provides much deeper insight into local market nuances. Careful filtering is what ensures your final valuation is built on solid ground.

Making Adjustments for Features and Dallas Market Dynamics

Once you have a solid list of comparable properties, the real analysis begins. This is where the science of data meets the art of valuation. No two properties are exactly alike, so understanding how to make financial adjustments for those differences is how you get to a realistic fair market value in Dallas.

Think about it this way: a freshly remodeled kitchen in a Preston Hollow property adds tangible value compared to a similar house with dated appliances and countertops. An extra bedroom in a hot area like University Park? That demands a significant upward adjustment. Even something like a swimming pool becomes a huge value-driver during a scorching Dallas summer.

Making Defensible Adjustments

The trick is to assign a realistic dollar value to these differences. This isn’t just guesswork; it’s a process rooted in Dallas market data.

- Size Matters: If your property is larger than a comparable, you’ll add value. If it’s smaller, you’ll subtract it. A good starting point is to use the average price per square foot from your comps.

- Upgrades and Condition: Take a hard look at the level of finish-out. A brand-new roof, an updated HVAC system, or high-end flooring can easily justify a 5-10% value bump over a comp that’s still in its original condition.

- Unique Amenities: What makes a property stand out? A three-car garage in a neighborhood with tight parking or a prime corner lot placement definitely warrants a positive adjustment.

Here’s a great visual that shows how appraisers and agents often lay this out to compare properties side-by-side.

As you can see, the visual comparison markers highlight how each feature—from square footage to recent upgrades—creates a unique value proposition. Beyond just figuring out a property’s current worth, many owners are looking for smart ways to boost their investment’s appeal. Exploring strategies to raise property value can give you some fantastic ideas on which renovations actually deliver the best return in the Dallas market.

Your valuation is only as good as your understanding of today’s Dallas market, not last year’s. A hot seller’s market in Uptown can cool off in a matter of months, while a once-overlooked neighborhood like Oak Cliff can suddenly see a surge in demand.

To stay current, you have to track key local indicators. Keep an eye on the average days on market, the sale-to-list price ratio, and the current inventory levels for your specific Dallas submarket. These numbers tell the real-time story of what buyers and sellers are doing right now.

Valuing Dallas Investment Properties With the Income Approach

When you’re eyeing a duplex in Deep Ellum or a small apartment building over in Lower Greenville, you have to think differently. The real value isn’t just in the bricks and mortar—it’s in the income that property can generate. This is exactly where the Income Approach comes into play.

Think of it as putting on your investor hat. This method treats the property like a business, focusing purely on its financial performance and cash flow potential. For Dallas investors, it cuts through the fluff and answers the most important question: what’s my return going to look like?

The Core of the Income Approach

At its heart, the Income Approach zeroes in on a property’s Net Operating Income (NOI). It’s a straightforward calculation: just take your total rental income and subtract all the operating expenses—things like property taxes, insurance, and maintenance.

Once you have that NOI number, you can use a couple of common methods to figure out the property’s value.

- Capitalization Rate (Cap Rate): This is your quick-and-dirty valuation tool. You simply divide the property’s NOI by the going cap rate for similar properties in that Dallas submarket. For example, if a property brings in $50,000 in NOI and the market cap rate is 6%, you’re looking at a value of roughly $833,333.

- Discounted Cash Flow (DCF): This one is more involved. The DCF method projects a property’s income and expenses out over several years and then discounts all that future cash flow back to what it’s worth today. It’s a much more granular way to see the long-term picture.

The Income Approach, especially DCF, is a globally recognized technique for valuing assets based on their future earnings. However, its accuracy depends heavily on the assumptions made about future rental growth and expenses, making careful local Dallas research vital. Discover more insights about this valuation method on corpinvest.com.

To really nail this approach, you need a solid grasp of fundamental concepts, like what rental yield is and how it impacts investment returns. Understanding these mechanics is crucial for accurately projecting a property’s profitability and, ultimately, its true market value in the competitive Dallas investment scene.

When You Need a Professional Dallas Appraiser

While a well-researched DIY valuation is a fantastic starting point, there are times when the stakes are just too high to go it alone. Some situations absolutely demand the unbiased, legally defensible opinion that only a licensed Dallas appraiser can deliver.

Knowing when to bring in a professional is key. Their detailed report provides a credible opinion of value that no Zestimate or personal calculation can match. Ultimately, it can save you a ton of money and legal headaches down the road.

High-Stakes Scenarios Requiring an Expert

Certain situations are non-negotiable—you need a formal appraisal. This is when calling in a pro to determine fair market value with pinpoint accuracy is the only smart move.

Here are a few examples:

- Complex or Unique Properties: Trying to value a one-of-a-kind custom property in Highland Park? An expert’s eye is needed to properly assess its unique architectural features against what’s happening in the Dallas market.

- Estate Settlements: When settling an estate, an official appraisal is essential. It establishes a clear and impartial value for all property assets, making sure the distribution is equitable for everyone involved.

- Divorce Proceedings: An appraisal provides a neutral, third-party valuation that is critical for dividing marital assets fairly. In many cases, it’s required by the court.

- Challenging Property Taxes: If you’re convinced your DCAD property tax assessment is way off, a formal appraisal report is the strongest piece of evidence you can bring to an appeal.

A professional appraiser’s work is grounded in established methodologies like the Market Approach, which relies on real transaction data from comparable properties. This method is crucial for reconciling a property’s intrinsic worth with observed market prices. Learn more about the strength of market-comparative valuation from Growthequityinterviewguide.com.

For properties with tricky layouts or hard-to-reach areas, an appraiser might even use specialized drone inspection services to get an accurate read on the condition of things like the roof. This commitment to detail is what sets a professional appraisal apart.

For a broader look at the market conditions influencing these valuations, check out our insights into the Dallas-Fort Worth housing market trends.

Common Dallas Property Valuation Questions

When you’re trying to pin down a property’s value in Dallas, a few questions always seem to pop up. Getting straight answers is the key to feeling confident about the number you land on.

One of the first things people ask about are those online valuation tools. They’re quick, easy, and give you a number in seconds. But think of them as a very rough starting point, not the finish line. These algorithms often miss the hyper-local details that truly drive value here—like the premium a property gets for being zoned to a top-tier school in Lakewood, or the very real bump in price from a brand-new kitchen in an older M Streets home. They give you a ballpark, but they can’t see the nuance from a satellite.

New Construction and Existing Home Values

Another big question is how all the new development affects the value of existing homes in Dallas. In neighborhoods seeing a ton of growth, like Trinity Groves or The Cedars, new construction can feel like a double-edged sword.

At first, a wave of new builds can introduce more competition, sometimes putting a little downward pressure on older properties that haven’t been updated. But hang on, because the long-term effect is usually a net positive. All that new investment brings better infrastructure, cool new amenities, and higher price points that tend to lift the entire neighborhood’s value over time. The trick is to see if the new properties are truly comparable in quality and style to the existing ones.

The core difference between a professional appraisal and your own fair market value research is weight and purpose. An appraisal is a formal, legally defensible opinion of value required for official transactions, while your analysis is a tool for personal decision-making.

Appraisal vs. Fair Market Value

Finally, it’s easy to get “appraisal” and “fair market value” mixed up. They sound similar, but they serve very different roles.

A formal appraisal is a legally binding opinion of value created by a licensed professional. Lenders, courts, and attorneys rely on this unbiased report for official transactions. Your own FMV research, on the other hand, is your personal tool. It’s an educated, well-researched estimate you create to guide your own strategy, whether you’re making an offer or setting a listing price. Both are aiming for accuracy, but one is for official business, and the other is for your playbook.

For a deeper look into what makes these Dallas neighborhoods tick, check out our Dallas real estate guide to top neighborhoods for some invaluable local context.

Navigating these questions is much easier with an expert by your side. At Dustin Pitts REALTOR Dallas Real Estate Agent, we provide the in-depth market analysis and professional guidance you need to make informed decisions. https://dustinpitts.com