Negotiating a house offer is about so much more than just throwing out a number. It’s a delicate dance of strategic preparation, truly understanding the local market, and, frankly, presenting yourself as the kind of serious, capable buyer a seller wants to work with. In a market as competitive as Dallas, your success is often decided long before you ever sign on the dotted line of an offer.

Laying the Groundwork for a Winning Negotiation

To successfully negotiate for a home here, you have to get a feel for the unique rhythm of the Dallas market. It’s a place where a property in Uptown can have a completely different negotiation playbook than one in Oak Cliff, even on the very same day. Your first move? Step away from the generic, nationwide real estate websites.

Your real advantage comes from digging into the hyper-local data. I’m talking about analyzing comparable sales—the “comps”—on the exact same street or within a few blocks, not just the same ZIP code. How long are homes sitting on the market in that specific corner of Plano or Lakewood? Is inventory bone-dry, sparking bidding wars, or do you have a few more options to play with? Answering these questions builds the entire foundation of your strategy.

Partnering with a Local Dallas Expert

This is precisely where a savvy Dallas real estate agent becomes your most valuable player. Their job isn’t just to unlock doors; it’s to interpret the raw data and give you the kind of on-the-ground context an algorithm could never provide. A great agent can often uncover the single most important piece of information: the seller’s motivation.

Key Insight: Understanding why someone is selling is just as critical as knowing their asking price. A seller who needs a quick close for a job relocation in Houston has entirely different pressure points than an investor who’s in no particular hurry. This insight is pure gold in a negotiation.

Your agent helps you read between the lines. They might have a working relationship with the listing agent, opening up a clearer channel for communication and getting a better feel for what the seller really wants. This partnership elevates your offer from a simple transaction to a well-informed, strategic move. It’s also smart to understand their side of the finances; you can get the full breakdown in our guide on who pays Realtor fees in Texas.

The Power of a Strong Pre-Approval

Before you even start daydreaming about your negotiation tactics, you have to prove you can actually close the deal. A mortgage pre-approval from a respected, local Dallas-area lender isn’t just a suggestion—it’s non-negotiable. It’s the most powerful signal you can send that you’re a serious contender.

A solid pre-approval letter accomplishes a few crucial things:

- Shows Financial Muscle: It’s concrete proof that a lender has vetted your finances and is ready to back you for a specific amount.

- Strengthens Your Offer: In a multiple-offer situation, an offer without a strong pre-approval is often the first to hit the discard pile.

- Sets a Faster Pace: With your financing already squared away, you can promise a quicker closing, which is a huge carrot to dangle in front of many sellers.

The recent economic climate has made this step more critical than ever. We’ve all seen how market dynamics can shift. After the boom of 2021, U.S. home sales dropped off as mortgage rates climbed and incomes struggled to keep pace. By 2023, those higher rates led to stricter lending standards, making it tougher for many to get a loan. You can see the broader trends on sites like Statista.com. Showing up with your financing already secured proves you’ve cleared that major hurdle, making your offer far more resilient and attractive.

To really craft a compelling offer, you need to know which levers you can pull beyond just the price. These “soft terms” can often be the deciding factor in a competitive Dallas market.

Key Negotiation Leverage Points in Dallas

| Leverage Point | Description & Dallas-Specific Example | Impact on Negotiation |

|---|---|---|

| Option Period & Fee | The time you have to conduct inspections. Offering a shorter option period (e.g., 5-7 days instead of 10) with a higher option fee ($300-$500) shows confidence. | High. This signals you’re serious and won’t waste the seller’s time. A shorter period is very attractive to sellers anxious to finalize the deal. |

| Closing Date Flexibility | Can you close quickly, or can you offer the seller a leaseback if they need more time to move? A seller in Frisco might need a 60-day leaseback to align with a job start or new home construction timeline. | High. Matching the seller’s timeline can be more valuable than a few thousand dollars on the offer price. It solves a major problem for them. |

| Earnest Money Deposit | The “good faith” deposit. Offering a higher earnest money amount (e.g., 2% of the sale price instead of 1%) demonstrates your commitment. | Medium. It shows you have skin in the game and are less likely to back out, which gives the seller peace of mind. |

| Financing Type | A Conventional loan is often viewed more favorably than an FHA or VA loan, which can have stricter appraisal requirements. Cash is king, but a strong conventional loan is next best. | Medium-High. In a bidding war in a hot area like Bishop Arts, a conventional loan can give you an edge over government-backed loans. |

| Contingencies | Can you waive any contingencies? Waiving the financing contingency is risky, but waiving the “sale of other property” contingency is a must in a competitive market. | High. The fewer hurdles the seller has to jump through, the cleaner and more appealing your offer becomes. |

Balancing these elements is the art of the deal. A slightly lower price might be happily accepted if it comes with a quick, clean close and a leaseback that saves the seller a major headache. It’s all about finding out what matters most to them and tailoring your offer to meet that need.

Crafting an Offer That Actually Gets a “Yes”

Your initial offer is so much more than just a number on a page. Think of it as your opening move in a high-stakes chess match. The way you put it together sets the tone for everything that follows. In a market as fast-paced as Dallas, a thoughtfully crafted offer can instantly put you in the seller’s good graces, while a sloppy one will get your offer tossed in the “no” pile without a second thought.

Forget the old-school advice about “lowballing” just for the sake of it. A truly strategic offer is the natural result of all that homework you’ve already done. It has to reflect the property’s real condition, its specific pocket of Dallas—a 45-day-old listing in Richardson is a completely different ballgame than a brand-new listing in the super-competitive Bishop Arts District—and, critically, how long it’s been sitting on the market.

Finding That Perfect Opening Number

Landing on that first number is part science, part gut instinct. While every deal is different, a good rule of thumb is to start slightly below asking. Industry data often points to initial offers landing 5%-10% below list price, but in Dallas, that can change in a heartbeat depending on how hot the market is.

In a more balanced Dallas market, you might find that 20%-30% of offers below asking price eventually lead to a signed contract after some negotiation. But when inventory is tight and competition is fierce—a frequent state of affairs in DFW—offers at or even above asking price become the norm to even get a foot in the door. You can dig into more of these trends and stats over at the National Association of REALTORS®.

The real secret is to back up your number with cold, hard logic. Is your offer lower because the comparable sales support it? Or is it because the inspection revealed the house needs a new roof and has leaky, original windows? When you present your offer as a well-reasoned valuation instead of just a random number, you command respect. It invites a serious counteroffer, not an outright rejection.

The Overlooked Power of a Personal Letter

Imagine a seller is looking at three offers, all financially similar. What makes them pick yours? Sometimes, it’s a simple human connection. This is where a personal letter can be your secret weapon.

An offer letter transforms a dry, transactional document into a personal story. It can be the one thing that makes a seller root for you, especially if they have a deep emotional tie to the home they’re leaving behind.

Don’t just gush about how much you want the house. Get specific. Did you fall in love with the huge oak tree in the front yard? Did you notice the thoughtful, high-end updates they made to the kitchen? Mentioning these details proves you see their property as a future home, not just an asset. That personal touch can be an incredibly powerful tie-breaker.

Building Your Offer with the Official TREC Contract

In Texas, your offer is built on the foundation of the One to Four Residential Contract (Resale), the standard form from the Texas Real Estate Commission (TREC). Knowing your way around this document is non-negotiable; it’s how you protect yourself and structure a winning deal.

Here are the critical pieces you and your agent will put together:

- Price and Financing: This is the headline. State your offer price clearly and always attach your lender’s pre-approval letter to show you’re ready to go.

- Seller Concessions: Are you asking the seller to chip in for your closing costs? This can be a smart move to reduce the cash you need to bring to the table.

- Earnest and Option Money: A healthy earnest money deposit (typically 1-2% of the price) and a fair option fee (think $200-$500) for a 7-10 day option period signals you’re a serious, committed buyer.

- Closing Date: This is a surprisingly valuable bargaining chip. If you can offer a closing date that lines up perfectly with the seller’s timeline, you gain a massive advantage without spending an extra dime.

By carefully dialing in each of these elements, you’re not just throwing a price at the wall. You’re presenting a complete, compelling package designed to be the obvious choice for any Dallas seller.

Mastering the Art of Counteroffers and Concessions

A counteroffer from a Dallas seller isn’t a rejection—it’s an invitation to the real negotiation. This is where the deal truly begins to take shape. To navigate this back-and-forth successfully, you have to read between the lines, stay calm, and get creative. Your goal is to figure out what the seller truly wants and find a path forward that works for both of you.

That initial counteroffer is a goldmine of information. Did they only adjust the price, or did they touch other terms like the closing date or your repair requests? A seller who only budges on price is signaling that their bottom line is the main event. But if they accept your price while ignoring your requested closing date, they’re telling you their timeline is the priority.

Decoding the Seller’s Next Move

When you get a counteroffer, take a breath. Don’t just react. The first thing you and your agent should do is analyze it. What are they giving up, and what are they holding onto for dear life? This breakdown is crucial for crafting a smart response that keeps the deal moving forward.

Let’s say you’re buying an older home in a historic part of Dallas, like the M-Streets. You offered a fair price but asked for a credit to replace the original, inefficient windows. If the seller counters by rejecting the credit but lowering the price by a smaller amount, what does that tell you? It shows they don’t want the headache of repairs but are willing to bend on price. That’s your cue: negotiating for a price reduction or credit is a much better path than asking them to manage the work themselves.

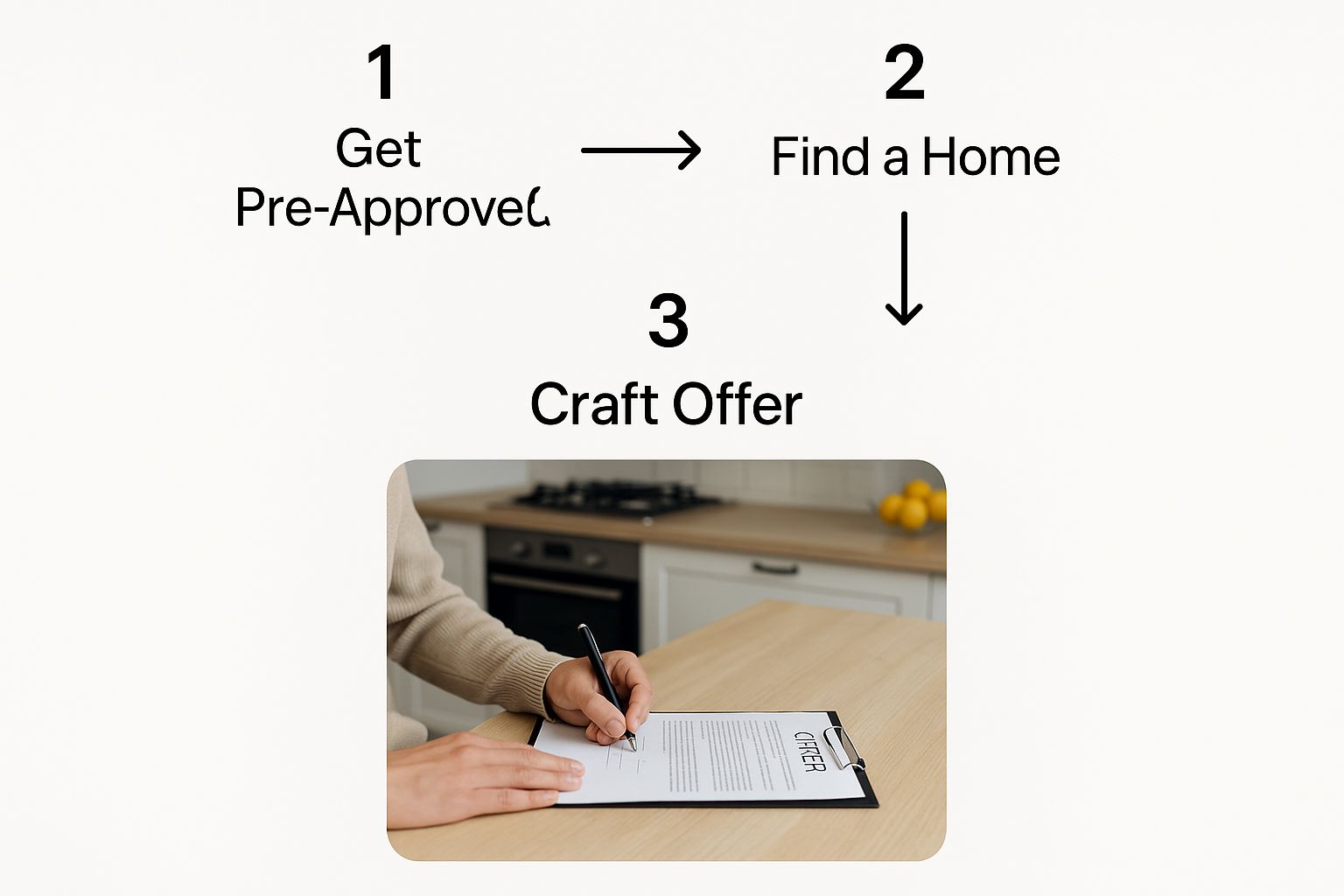

This is a key part of the dance: you craft an offer, send it over, and then get ready for the counteroffer dialogue.

The visual above really hammers it home: your first offer is just the opening move in a longer, more detailed negotiation. The counteroffer is where you start to really dial in the terms to fit your needs.

Knowing When to Stand Firm and When to Bend

Not every point is a hill to die on. Successful negotiation is all about give and take. You need to decide on your absolute non-negotiables before you even see a counteroffer. Is there a maximum price you simply cannot go beyond? Are you unwilling to close unless the seller addresses a known foundation issue—a common concern with the clay soil in the Dallas area?

Strategic Insight: Your willingness to be flexible on terms the seller cares about can give you leverage on the things you care about. If they need a 60-day leaseback after closing, offering it might make them much more agreeable to that repair credit you requested.

Try to think about concessions that create a win-win scenario. Maybe the seller is stuck on their price, but you could really use some help with closing costs. You could propose meeting their price in exchange for a seller credit. This gives them the sales price they want on paper, while you get the cash-to-close assistance you need. It’s a common and highly effective tactic right here in the Dallas market. For a deeper dive into these mechanics, check out our guide on how to negotiate house price.

The Art of the Seller Concession

Seller concessions are one of the most powerful tools in your entire negotiation toolkit. Simply put, these are closing costs the seller agrees to pay for you, which directly reduces the cash you need to bring to the table. This can cover a variety of expenses:

- Loan Origination Fees: The costs your lender charges to set up your mortgage.

- Title Insurance: Protects you and the lender from any old claims or issues with the property’s title.

- Appraisal and Inspection Fees: The upfront costs for verifying the home’s value and condition.

- Prepaid Property Taxes: Your initial payment into the escrow account that handles property taxes.

When you ask for concessions, frame it as a solution, not a demand. Instead of just asking for money, tie it directly to a need. For example: “To help with the costs of the necessary roof repairs we found during the inspection, we’re requesting a $5,000 seller credit toward our closing costs.” This is so much more effective than just dropping your offer by $5,000. It provides a clear reason and keeps the negotiation focused on solving a real problem.

Turning Contingencies Into Strategic Advantages

In any real estate transaction, contingencies are your safety nets. But when you’re negotiating a house offer in the Dallas market, they become much more than that—they’re powerful strategic tools. These clauses give you a legal path to walk away if certain conditions aren’t met, but their real power is in opening the door for more negotiation after the seller accepts your offer.

The trick is to use them wisely. In a competitive market like Dallas, an offer bogged down with too many contingencies can look weak and get tossed aside. On the other hand, waiving them all is a huge, often unnecessary, risk. You need to find the sweet spot: know which contingencies are non-negotiable for your protection and how to frame them as strengths.

The Inspection Contingency: Your Strongest Negotiation Tool

The inspection contingency, known in Texas as the option period, is easily your most valuable asset post-offer. This is a specific number of days where you have the unrestricted right to bring in inspectors and terminate the contract for any reason at all. But its true strength is as a negotiation lever.

Once your inspector hands over their report, you’ll have a much clearer picture of the home’s true condition. This isn’t about nitpicking cosmetic flaws. It’s about uncovering significant issues that are common in North Texas homes and could seriously impact the property’s value or your safety.

Common red flags we see in Dallas-area inspection reports include:

- Foundation Movement: That infamous expansive clay soil in DFW means foundation problems are a constant worry. Big cracks in the slab or brick are tell-tale signs you need a structural engineer to take a look.

- Roofing Damage: Hail is just a fact of life here. A thorough roof inspection can spot damage from past storms that isn’t obvious from the street, potentially saving you a massive replacement bill.

- HVAC Performance: A struggling air conditioner during a blistering Texas summer is a nightmare waiting to happen. An inspector can tell you if that AC unit is on its last legs.

- Outdated Electrical or Plumbing: In many of Dallas’s charming older neighborhoods, original systems can pose serious safety hazards and require expensive, complex updates.

Let’s say an inspection on a home in East Dallas reveals a $15,000 foundation repair is necessary. This is your moment. Instead of just walking away, you can reopen negotiations with a clear, data-backed reason for a price reduction or a seller credit at closing.

How to Handle the Appraisal Contingency

In a hot market, it’s easy for bidding wars to push offer prices beyond what a bank appraiser thinks the home is actually worth. This is precisely where the appraisal contingency protects you from overpaying. If the appraisal comes in low, this clause lets you renegotiate or back out without losing your earnest money.

Imagine you offer $550,000 for a house in a sought-after Plano neighborhood. The bank’s appraiser, however, values it at $535,000. The lender will only finance a loan based on that lower number. Your appraisal contingency gives you a few ways to play this:

- Renegotiate: Go back to the seller and ask them to drop the price to the appraised value of $535,000.

- Meet in the Middle: Perhaps the seller will lower the price a bit if you agree to bring extra cash to the table to cover the remaining difference.

- Walk Away: If the seller refuses to budge on price, you can terminate the contract and get your earnest money back.

Without this contingency, you’d be on the hook for that entire $15,000 gap out-of-pocket or risk forfeiting your deposit.

The Financing Contingency: A Delicate Balance

The financing contingency is straightforward: it protects your earnest money if your home loan unexpectedly falls through. It’s a standard safety net, but in a multiple-offer frenzy—which is common in suburbs like Frisco—sellers might lean toward offers without it.

Waiving this is extremely risky, and I almost never advise it. But you can make an offer with this contingency look much stronger. The key is to show the seller your financing is a done deal. Get a full underwriting pre-approval from a reputable Dallas lender, not just a basic pre-qualification. This signals to the seller that a bank has already vetted your finances and the loan is virtually guaranteed, making them much more comfortable accepting your offer.

Finalizing The Deal And Getting To The Closing Table

After all the back-and-forth negotiations, reaching a final agreement feels like a massive victory. But hold on—the deal isn’t quite done yet. There’s a critical stretch between having an executed contract and actually getting the keys to your new Dallas home. Staying sharp during this final phase is crucial to avoid any last-minute, costly surprises.

This last leg of the journey is all about verification and keeping the lines of communication wide open. Your main job is to make sure every single detail you agreed upon in the contract is handled exactly as promised. It’s time to shift from negotiating to executing, ensuring nothing slips through the cracks before you sit down to sign the final papers.

The All-Important Final Walk-Through

Think of the final walk-through as your last chance to inspect the property before it officially becomes yours. This usually happens 24-48 hours before closing. It’s not another home inspection to hunt for new problems; it’s a verification step. You’re there to confirm two things: the home is in the same condition as when you agreed to buy it, and all the repairs you negotiated have been completed.

Bring your contract and any repair amendments with you—this is your checklist. You’ll want to systematically go through each item to make sure the work was done and done right.

Here’s what to zero in on during your Dallas walk-through:

- Verify Repairs: If the seller promised to fix that leaky faucet or replace a cracked window, now’s the time to check their work. Don’t be shy; turn on the faucet and inspect the window closely.

- Check for New Damage: Look for any new issues that might have popped up since you were last there. Dings in the walls from moving furniture or other accidental damage can happen.

- Confirm Inclusions: Make sure everything the seller agreed to leave is still there. This includes appliances, specific window treatments, or light fixtures. Test them to ensure they’re in working order.

- Test Major Systems: Do a quick check of the essentials. Turn on the heat or A/C, run the hot water, and flip some light switches to confirm everything is functioning as it should.

If you spot an issue, like a repair that wasn’t finished or new damage, you need to tell your real estate agent immediately. It is so much easier to get these things resolved before closing than it is after the papers are signed.

Understanding Your Closing Disclosure

Roughly three business days before your closing date, you’ll receive a critical document from your lender: the Closing Disclosure (CD). This five-page form lays out all the final, official details of your mortgage loan. It includes your loan terms, projected monthly payments, and a complete breakdown of your closing costs.

Do not rush through reviewing your CD. Pull out the Loan Estimate you received at the beginning of the process and compare them side-by-side. Some minor figures might have shifted slightly, but the big numbers should match. Scrutinize every single line item, from the loan amount and interest rate to the fees charged by your lender and the Dallas title company. If you need a refresher on the broader home-buying journey, our detailed guide on how to buy a house in Texas can provide more context.

The title company is a key player here. They act as a neutral third party, managing the escrow account, making sure the property’s title is free of any liens, and handling the final transfer of funds and ownership. If you find any discrepancy on your CD—no matter how small—bring it to your lender and agent’s attention right away.

Proactive Communication Is Key To A Smooth Closing

The final days leading up to closing can feel a bit chaotic. You’ve got your agent, your lender, and the title officer all working to bring the deal across the finish line. The absolute best way to sidestep any last-minute drama is with clear, proactive communication.

Don’t just sit back and wait for someone to call you. Check in with your team regularly. Confirm they have all the paperwork they need from you and ask if there are any outstanding items. A simple question like, “Is there anything you need from my end to keep us on track for closing?” can prevent a small hiccup from snowballing into a major delay.

This kind of constant contact keeps everyone on the same page, all working toward the same goal: getting you the keys to your new Dallas home, smoothly and without a hitch.

Dallas Home Negotiation FAQ

Got questions? You’re not alone. Navigating the back-and-forth of a real estate deal in Dallas can feel like a high-stakes game. Let’s break down some of the most common questions I hear from buyers so you can feel confident and ready to make your move.

How Much Below Asking Price Should I Offer In Dallas?

This is the million-dollar question, and the honest answer is: it completely depends. There’s no magic formula or a set percentage that works across the board. The right offer is all about the specific house and what’s happening in that exact corner of the market right now.

For example, in a red-hot Dallas neighborhood like Lakewood or Highland Park, a fantastic home priced correctly can spark a bidding war over a single weekend. In that scenario, just to get your foot in the door, you might need to offer at or even slightly above the asking price. It feels aggressive, but it’s often the reality of competing in those sought-after areas.

On the flip side, what if you find a home that’s been sitting on the market for over 30 days? Or maybe it’s in a part of town that isn’t seeing quite as much frenzy. Here, you have more room to negotiate. Starting with an offer that’s 3-5% below the list price could be a perfectly reasonable opening move. The best compass you have is your agent’s deep dive into recent, comparable sales—that data is your guide.

Is It A Good Idea To Write A Letter To The Seller In Dallas?

Absolutely, it can be. When a seller is staring at two or three offers that are all financially similar, that personal letter can be the one thing that tips the scales in your favor. It’s your chance to connect on a human level and make your offer more than just numbers on a page.

The real key to a powerful letter is to focus on your genuine appreciation for the home. Forget a long, drawn-out story about your life. Instead, point out the specific things you fell in love with. Did the backyard feel perfect for summer barbecues? Did you admire the way they updated the kitchen?

Mentioning these details shows the sellers that you truly see and value the care they’ve poured into their property. That can resonate deeply and build a connection that other offers just can’t match.

Pro Tip: Keep it heartfelt and to the point. A short, sincere note about why you love their home is much more effective than a generic plea. You’re showing them you see it as a future home, not just another asset.

What Happens If The Appraisal Comes In Lower Than My Offer Price?

This is exactly why the appraisal contingency is one of the most important clauses in your contract. If the bank’s appraiser determines the home is worth less than what you’ve agreed to pay, it doesn’t automatically kill the deal. You have options.

Your first move is usually to go back to the negotiating table. Armed with the official appraisal report, your agent can ask the seller to lower the sale price to match the new, appraised value. This is the most common and often successful approach.

If the seller won’t come down the full amount, you might negotiate to meet in the middle, with you bringing a little extra cash to closing to cover part of the gap. Or, if you have the funds, you could choose to pay the entire difference yourself. But if you can’t find a solution that works, your appraisal contingency gives you the protected right to walk away from the deal and—crucially—get your earnest money back. This is a delicate conversation where an experienced agent is invaluable.

Should I Waive The Inspection Contingency To Make My Offer Stronger?

In a word: no. Waiving your right to an inspection is an incredibly risky gamble that I almost never recommend, especially here in North Texas. The potential to uncover huge, budget-busting problems is just too high to ignore.

Think about our specific regional issues. We have expansive clay soil that can cause serious foundation movement. We have a history of intense hail storms that can leave behind hidden roof damage. Your professional inspection is your one and only line of defense against buying a property with these kinds of massive, underlying problems.

There’s a much smarter way to make your offer more competitive. You can shorten your inspection window, which in Texas is called the option period. Instead of asking for a typical 10-day period, offering a 5-7 day option period tells the seller you’re serious and won’t drag your feet. This simple change makes your offer much more attractive while keeping the critical protection of a full inspection intact.

Navigating the complexities of the Dallas real estate market requires local expertise and a strategic approach. At Dustin Pitts REALTOR Dallas Real Estate Agent, we provide the in-depth market knowledge and negotiation skills needed to secure your ideal home. Whether you’re buying or selling, we’re here to guide you every step of the way. Start your Dallas home search with us today.