Knowing how to negotiate a house price in a competitive market like Dallas involves more than just picking a number—it’s about strategic preparation and deep local market intelligence. A winning negotiation is built on a solid foundation of current Dallas-specific data, presenting yourself as a strong buyer, and knowing which levers to pull beyond just the price.

Understanding The Dallas Market Before You Negotiate

Thinking you can negotiate a house price in Dallas without doing your homework is like trying to navigate the High Five interchange blindfolded. Success begins long before you submit an offer. It starts with a deep, analytical dive into the specific Dallas neighborhood you’re targeting.

Every micro-market has its own rhythm, whether it’s a historic home in the M Streets or a newer build in a suburb like Richardson.

Your first move is to become an expert on comparable properties, or “comps.” These aren’t just any recently sold houses. They are homes that closely match your target property in size, age, condition, and location. Analyzing comps gives you a powerful, data-backed foundation for your offer, turning your negotiation from a wild guess into an informed business decision.

Key Dallas Market Indicators To Watch

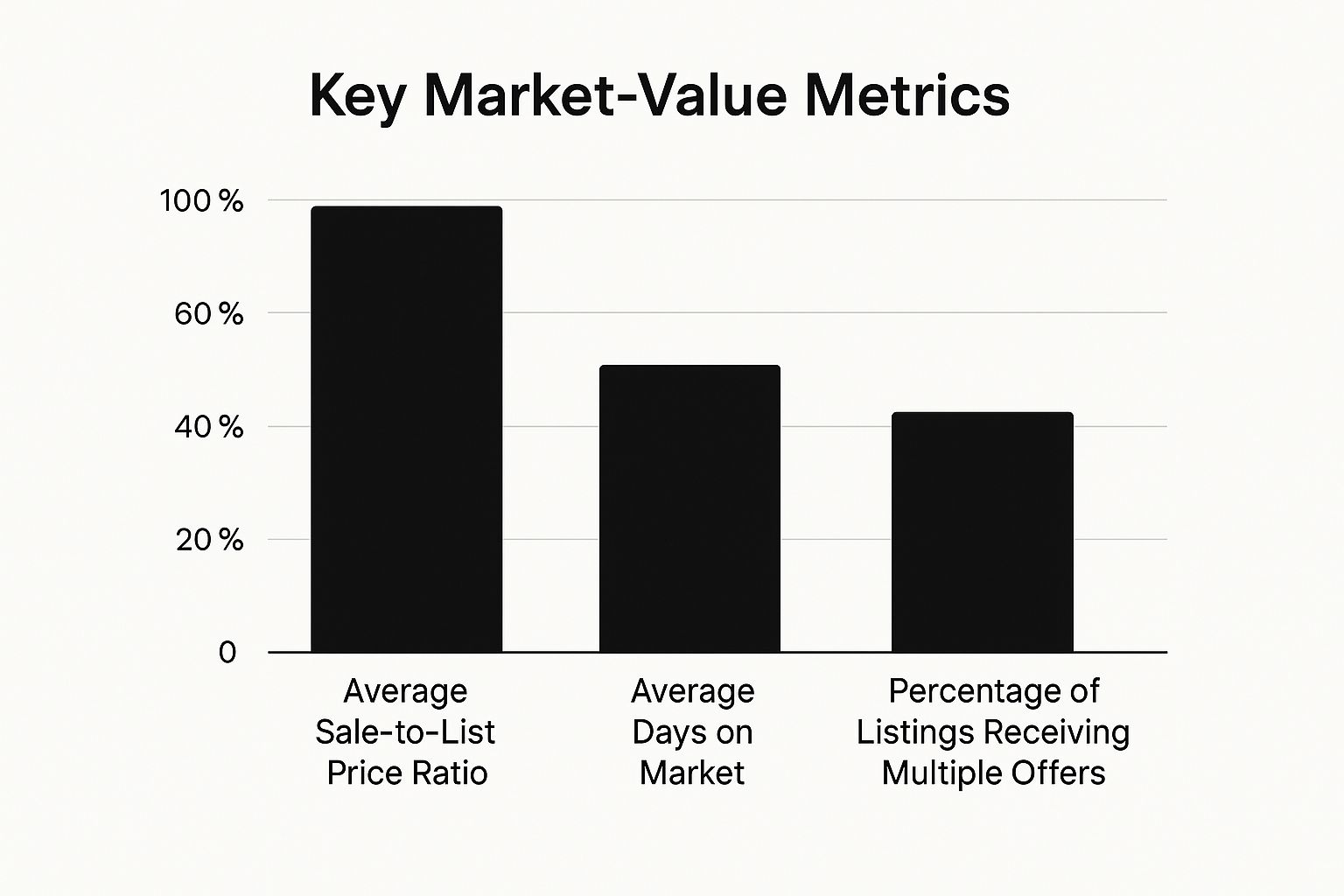

Beyond individual property sales, you have to get a feel for the broader market dynamics. A few key metrics will tell you whether you’re in a buyer’s or seller’s market, which directly impacts how much negotiating power you really have.

Here are the big three:

- Days on Market (DOM): This is the average time a property stays on the market before going under contract. A low DOM (like under 30 days) in a hot area like Lower Greenville suggests fierce demand and very little room for negotiation. A higher DOM might mean a listing is overpriced or has issues, giving you more leverage.

- Sale-to-List Price Ratio: This percentage shows how close sellers are getting to their initial asking price. A ratio at or above 100% means homes are selling for asking price or even more—a clear sign of intense competition. A ratio below 98% suggests sellers are more willing to make a deal.

- Inventory Levels: The amount of available housing inventory dictates the balance of power. Low inventory creates scarcity and favors sellers. Rising inventory gives buyers more choices and, you guessed it, more room to negotiate.

This data gives you a snapshot of what you’re up against.

As you can see, these factors are all interconnected and paint a clear picture of your leverage in a negotiation.

To make this even clearer, here’s a breakdown of the metrics you should be tracking to gauge your negotiation power in Dallas.

Key Dallas Real Estate Negotiation Indicators

| Indicator | What It Tells You | Favorable for Buyer Negotiation |

|---|---|---|

| Days on Market (DOM) | Average time homes are listed before selling. | High or Increasing DOM: Suggests lower demand, giving buyers more power. |

| Sale-to-List Price Ratio | The final sale price as a percentage of the listing price. | Below 100%: Indicates sellers are accepting offers below their asking price. |

| Months of Supply/Inventory | How long it would take to sell all current listings. | High or Increasing Inventory: More choices for buyers and less competition. |

| Number of Price Reductions | The frequency of sellers lowering their asking price. | Increasing Number of Reductions: Signals that initial prices may be too high. |

Analyzing these indicators together gives you a much sharper, more realistic view of the market than just looking at asking prices alone.

Local Developments And Their Impact

Never underestimate the power of local news. Is a new DART line being extended closer to the neighborhood? Did a local school just get a top rating, or is rezoning on the horizon?

These local developments can significantly sway property values and should be part of your negotiation strategy. Knowing about a future project the seller might not be aware of can provide crucial leverage. This whole process is a fundamental part of the home-buying journey, which you can learn more about in our guide on how to buy a house in Texas.

Expert Tip: A skilled real estate agent won’t just hand you market data; they’ll help you interpret it. They can tell you if a property’s high DOM is due to a slowing market in a Dallas suburb or if it’s an outlier that presents a unique opportunity.

While Dallas has its own unique market pulse, broader trends offer valuable context. National forecasts can be useful, but the real story is written in local Dallas data. For instance, while national inventory levels might show a slight easing, high-demand areas within Dallas-Fort Worth can defy these trends, maintaining a strong seller’s advantage. This is where local expertise becomes critical, helping you find pockets of opportunity even when the overall market feels tight.

Building Your Strategic Negotiation Toolkit

Knowing the Dallas market data is a great start, but it’s only one piece of the puzzle. To really negotiate a house price effectively, you have to prove you’re a serious contender. This means putting together a personal negotiation toolkit built on solid financial readiness and smart leverage. Your goal is simple: show the seller you’re not just kicking tires, but a credible buyer who can actually close the deal.

The absolute cornerstone of this toolkit is a full mortgage pre-approval, and I can’t stress this enough—not a pre-qualification. A pre-qualification is little more than a rough estimate based on information you provide. A pre-approval, on the other hand, means a lender has dug in, verified your income, checked your assets, and reviewed your credit. They’ve committed to lending you a specific amount.

When you submit an offer with a pre-approval letter from a reputable Dallas lender, it’s a powerful signal of your financial strength. It dramatically boosts your credibility, and sellers love it because it means there’s a much lower risk of the deal collapsing over financing. Having a solid grasp of different financing options is a critical part of this prep; it’s worth exploring resources dedicated to understanding mortgages to get up to speed.

Turning The Home Inspection Into Leverage

Beyond your financials, the professional home inspection is easily your most powerful negotiation tool. In a market like Dallas, with everything from historic homes in Oak Cliff to brand-new builds, an inspection can uncover serious issues that are completely invisible to the untrained eye. This isn’t about finding a few cosmetic flaws to nitpick. It’s about identifying legitimate problems that impact the home’s value and safety.

Once you get that inspection report, the key is to separate the major concerns from the minor wear-and-tear.

- Major Issues: These are your real negotiation points. Think foundation problems—a common concern here in Dallas thanks to our expansive clay soil—or an old roof, outdated electrical systems, or a dying HVAC unit. These are big-ticket items the seller can’t just brush off.

- Minor Issues: Things like a dripping faucet, scuffed-up baseboards, or a loose cabinet handle are generally seen as routine maintenance. Bringing these up can make you look petty, potentially souring the seller and weakening your position on the issues that actually matter.

Key Takeaway: Your inspection report isn’t a weapon to beat down the price over every little thing. It’s a professional, fact-based document you use to build a compelling case for why a price adjustment or seller credit is fair and justified.

Framing Your Request Professionally

How you present your requests after the inspection is just as important as what you’re asking for. Instead of firing off a long list of demands, a good agent will frame the conversation around finding solutions.

Let’s walk through a common Dallas scenario. Say the inspection on a great home in Lake Highlands reveals the air conditioning unit is 20 years old and on its last legs. Dallas summers are no joke, and a full replacement is going to cost around $8,000.

Instead of just demanding the seller replace it, your agent might propose a couple of options:

- A Price Reduction: Ask for an $8,000 reduction on the final sales price. The seller’s net proceeds are the same, and you get to manage the replacement with your own contractor after you close.

- A Seller Credit: Request an $8,000 credit toward your closing costs. Buyers often prefer this because it reduces the amount of cash you need to bring to the table, freeing up funds you can use for the repair right away.

This approach is collaborative, not confrontational. It respectfully points out the issue and offers a reasonable financial solution, which makes it far more likely the seller will play ball. Mismanaging this step is one of the most frequent stumbles I see; you can read more about common buyer mistakes in Dallas real estate to make sure you’re fully prepared. By focusing on significant, costly repairs and presenting flexible solutions, you maintain goodwill and keep the deal moving forward.

Crafting A Compelling Initial Offer

Your initial offer is so much more than just a number—it’s the opening line in a strategic conversation with the seller. It really sets the tone for the entire negotiation. In a market as competitive as Dallas, a well-thought-out offer that goes beyond just the price tag can make you stand out and get a seller’s serious attention.

While the price is obviously the headline, the other terms of your offer can be just as powerful. These are the details that speak to a seller’s specific needs, often making your proposal more attractive than a competing one, even if that other offer has a slightly higher price.

Beyond The Price Tag: Uncovering Seller Motivation

One of the most powerful tools in your negotiation playbook is simply understanding why the seller is moving. Is the seller relocating for a new job in Plano and needs a fast, drama-free closing? Or are they waiting for their new construction home in Prosper to be finished and would absolutely love a longer, more flexible closing date?

This information is gold. A good agent can often uncover these critical details just by talking with the listing agent. Knowing the seller’s main goal—whether it’s speed, certainty, or simply the highest price—lets you tailor your offer to solve their problem.

Pro Tip: An offer that directly solves a seller’s biggest problem can easily beat a higher-priced offer that doesn’t. A quick, clean close for a seller on a tight timeline is often worth thousands of dollars to them.

For instance, if you learn a seller needs to move quickly, offering a fast closing period of 21-30 days can be a massive advantage. This shows you’re organized, have your financing locked down, and are ready to go without delay.

The Strategic Value of Other Offer Terms

Let’s break down the other key parts of your offer and how to use them as strategic levers in your negotiation. Each piece communicates something about you as a buyer.

- Earnest Money Deposit: This is your “skin in the game.” A larger earnest money deposit (1-3% of the purchase price is standard in Dallas) shows you are a serious, committed buyer. It screams confidence in your ability to close and lowers the seller’s perceived risk.

- Contingencies: These clauses are your safety net, allowing you to back out of the deal if something goes wrong (like a bad inspection or financing falling through). In a hot Dallas market, minimizing contingencies can make your offer much stronger. But be very careful about waiving critical protections like the inspection contingency.

- Closing Date: As we’ve mentioned, a flexible closing date can be a huge bargaining chip. Aligning your timeline with what the seller needs shows goodwill and can make them more willing to work with you on other requests.

It’s also smart to think about the home’s future potential when crafting your offer. Understanding the potential return on investment from kitchen renovations can help you frame a fair price, especially if you know you’ll be making improvements down the line.

Structuring Your Offer: The Full Picture

Think of your offer as a complete package. Sometimes, a slightly higher price combined with fewer contingencies is far more attractive to a seller than a lower, all-cash offer that asks for a long inspection period. It’s all about balancing risk and reward for both you and the seller.

Your agent’s experience is invaluable here. They can help you structure an offer that is aggressive enough to get noticed but reasonable enough to be accepted—navigating that delicate balance is what defines a successful Dallas real estate negotiation.

Mastering The Art Of The Counteroffer

When a seller in Dallas sends back a counteroffer, don’t take it as a rejection. It’s actually the opposite—it’s an invitation to keep the conversation going. Think of it as a positive sign. The seller is engaged and clearly wants to find a way to make a deal work. Your job is to dissect their response and figure out how to keep the momentum on your side.

The first move is to sit down with your real estate agent and break down their counteroffer. Look past just the price. What terms did they change, and which ones did they accept? This is where you’ll find clues about what the seller truly values, giving you the playbook for how to negotiate the house price from here.

Decoding The Seller’s Priorities

A seller’s counteroffer is practically a roadmap to their motivations. Did they only bump up the price, or did they get creative with other terms? Understanding their focus is key to crafting your next move.

- Purely Price-Focused: If the only edit is the price, you know their bottom line is the main event. This happens a lot in hot Dallas neighborhoods where sellers are confident they can hit their target number.

- Timeline Adjustments: Did they agree to your price but ask to push back the closing date? This is a huge signal that timing is their primary pressure point. They might be trying to line up the sale with their own move to a new home in a place like Frisco or McKinney.

- Contingency Changes: A seller trying to remove a contingency or shorten your inspection window is all about certainty. They want a low-risk deal that’s less likely to fall apart.

For example, say you offer $550,000 on a University Park home. The seller counters at $565,000 but keeps all your other terms as-is. Their focus is crystal clear: sale price. That tells you the path forward is finding a price compromise, not fiddling with other contract details.

Techniques For A Productive Response

Once you’ve got a read on the seller’s priorities, you can build a response that moves the negotiation forward. Remember, the goal isn’t to “win” at all costs but to land on a deal that works for everyone. This usually means a bit of give and take.

Key Insight: The best negotiations are rarely about one person caving. They’re about a strategic trade. You might nudge your price up slightly in exchange for a seller credit towards your closing costs, which can save you a chunk of cash right at closing.

Think about what you can give that doesn’t cost the seller much but holds real value for you. Offering a quick close, for example, can be a massive incentive for a seller who’s already packed their bags and moved on.

Real-World Dallas Counteroffer Scenario

Let’s play out a common back-and-forth for a house in the Bishop Arts District, listed at $475,000.

You make an offer of $460,000 with a standard 30-day close and ask the seller to chip in $5,000 for closing costs. They counter at $472,000 and strike out the closing cost credit entirely. This tells you they care about both the sale price and their net proceeds.

Instead of just splitting the difference on price, you can get creative. Your agent might go back with a new, more strategic offer:

- Increased Price: You come up to $468,000.

- Seller Credit: You still ask for a credit, but a smaller one—say, $3,000.

- Valuable Concession: You also ask for the recently updated washer, dryer, and refrigerator to be included.

This is a smart play. You’ve met them partway on price, showing you’re serious. But by negotiating for the appliances and a partial credit, you’re adding tangible value for yourself that might feel more agreeable to the seller than just another price drop. This approach keeps everyone at the table and shows how to negotiate house price by looking at the whole package, not just one number.

Navigating Special Negotiation Scenarios In Dallas

Not every home purchase is a simple back-and-forth. The Dallas market, with its explosive growth and mix of housing, throws some unique curveballs at buyers. Knowing how to handle these special situations is what separates a good offer from a winning one.

A bidding war is a classic Dallas scenario, especially in sought-after neighborhoods. When a great house hits the market, offers can pour in, and it’s easy to get swept up and bid more than you should. One of the best tools in your arsenal here is an escalation clause.

Think of it as an automatic counteroffer. The clause bumps up your bid by a certain amount over any competing offer, but only up to a maximum price you set beforehand. It keeps you in the game without laying all your cards on the table at once.

Another tactic that can work wonders is a personal offer letter. While it’s not always the deciding factor, a genuine letter that connects with the seller on a human level can sometimes tip the scales, particularly when offers are neck and neck.

Negotiating With Home Builders

Head out to the Dallas suburbs like Frisco or McKinney, and you’ll find a different negotiation landscape: new construction. The builder’s sales rep might make the list price sound like it’s set in stone. And while they’re usually firm on the base price, there’s almost always wiggle room elsewhere.

Forget about haggling over the sticker price. Your leverage is in the extras. Builders are surprisingly flexible with things like:

- Upgrades: This is where you can score big. Ask for premium flooring, higher-end appliances, or that beautiful countertop package to be thrown in. These have a high retail value but cost the builder much less.

- Closing Cost Contributions: Getting the builder to cover some or all of your closing costs can save you thousands in cash at the closing table. It’s a huge win.

- Lot Premiums: Sometimes, you can even negotiate a discount on the “lot premium,” which is the extra charge for a prime spot in the development.

The builder’s main goal is to protect the appraised values across the neighborhood by keeping sale prices high. They are far more willing to give ground on other costs that don’t show up on the public sales record. A deep dive into the Dallas-Fort Worth housing market overview can show you what kind of concessions other buyers are getting from builders.

Competing Against All-Cash Offers

In Dallas, you will go up against all-cash offers, often from investors. Sellers love them because there’s no financing contingency—no risk of a loan falling through—and the deal can close much faster. So how does your financed offer stand a chance?

Simple: make your offer as close to cash as you possibly can. This is all about removing uncertainty for the seller.

Key Strategy: Don’t just get a pre-qualification. Get a fully underwritten pre-approval. This means a lender has already dug into your finances, verified everything, and is ready to fund the loan. It tells the seller your financing is a virtual lock.

You can also sweeten the pot with other seller-friendly terms. Offer a larger earnest money deposit, agree to a shorter inspection period, or offer flexibility on the closing date to fit their schedule.

This is where you also see global trends hitting home. International demand is a major player in the Dallas real estate market. While national stats show foreign buyers snapping up $56 billion in U.S. homes, Texas is a prime destination. The key takeaway for Dallas buyers is that a significant portion of these transactions (47%) are all-cash. You can discover more about these international buying trends on nar.realtor. Knowing this helps you prepare for the competition. By making your financed offer clean, certain, and strong, you can level the playing field and win.

Answering Your Top Dallas Negotiation Questions

Even with the best game plan, questions always come up when it’s time to negotiate. It’s only natural. Here are a few of the most common ones I hear from buyers trying to navigate the Dallas real estate scene.

How Much Below The Asking Price Can I Offer?

This is the big one, isn’t it? The honest answer is always: it depends entirely on the market data.

In a sizzling Dallas market, where a desirable home in a neighborhood like Lakewood might see a flood of offers in its first weekend, coming in below the list price is likely a non-starter. You might not even get a call back. In these situations, your negotiating power is found in the other terms of the offer, not the price itself.

But what if the data tells a different story? If a property has been sitting on the market for 60+ days and similar homes are selling for 3-5% under list, then a lower offer is completely justified. For a $500,000 house, presenting a data-backed offer of $480,000 isn’t a lowball—it’s a strategic opening move. The trick is to have your agent present it with the comps to show the seller why you landed on that number.

Real-World Insight: A low offer without data is just wishful thinking. A low offer with supporting data is a negotiation. You have to anchor your price to what the local Dallas market is actually doing.

Should I Include A Personal Letter With My Offer?

Ah, the “love letter to the seller.” It can be a surprisingly effective tool, but only in the right circumstances. If you find yourself in a bidding war where all the offers are pretty much identical, a genuine, heartfelt letter can create a personal connection that tips the scales in your favor. It works best when you can tell the seller has a real emotional connection to the home.

A word of caution, though. These letters can accidentally create Fair Housing risks by revealing personal details. It’s always best to keep the focus on your love for the home—the big backyard where you can already see your dog playing, or the fantastic kitchen layout for entertaining—rather than on personal characteristics. And if you’re dealing with an investor-owned property? A strong, clean offer will always carry more weight than a letter.

What Happens If The Appraisal Comes In Low?

An appraisal gap—when the home appraises for less than your offer—feels stressful, but it’s really just a new opportunity to negotiate. When this happens in Dallas, you generally have a few paths forward:

- You Cover the Difference: You can bring extra cash to closing to make up the difference between the appraised value and the sales price. Buyers in super competitive Dallas markets often plan for this possibility.

- The Seller Drops the Price: You can go back to the seller and ask them to reduce the price to the appraised value. To keep the deal alive, they just might agree.

- Meet in the Middle: This is often where things land. If you offered $500,000 on a Dallas home and the appraisal comes in at $490,000, you might offer to bring an extra $5,000 if the seller will drop the price by $5,000.

- Walk Away: As long as your contract has an appraisal contingency, you have the right to terminate the deal and get your earnest money back.

This is exactly the kind of situation where having a seasoned agent in your corner is priceless. They know how to present these options to the seller’s agent and negotiate the best possible outcome for you based on the current Dallas market pulse.

Navigating the Dallas real estate market requires local expertise and a proven negotiation strategy. At Dustin Pitts REALTOR Dallas Real Estate Agent, we provide the data-driven guidance and skilled representation you need to secure your ideal property at the best possible price. Start your Dallas home search with us today.