Pricing your Dallas home isn’t about picking a number you want—it’s about finding the number the market will bear. This is probably the single most important decision you’ll make in the entire selling process. Get it right, and you’ll have buyers flocking to your door. Get it wrong, and you’ll be hearing crickets.

A smart pricing strategy is what attracts that initial flood of buyer interest, sparks competitive offers, and dramatically shortens the time your home spends on the market. Let’s be honest, that’s the goal for every seller.

Setting the Right Price for Your Dallas Home

When you’re trying to figure out how to price your home, think of the list price as your most powerful marketing tool. It’s the very first thing buyers see, and it instantly shapes their perception of your property’s value.

Even in a hot Dallas neighborhood like Uptown or Highland Park, an overpriced home is a red flag. Today’s buyers have access to a ton of information, and their agents are arming them with data. If your home is listed for significantly more than similar, recently sold properties, it’s just not going to make their shortlist.

The Impact of an Initial List Price

Those first two weeks on the market are everything. This is your home’s grand debut, when it gets maximum exposure on all the major real estate platforms that Dallas buyers are glued to. A home priced correctly from the start seizes this momentum, drawing in a wave of showings and, you guessed it, strong offers.

On the flip side, starting too high with the intention of dropping the price later often backfires. Price reductions can make buyers suspicious. They start to wonder, “What’s wrong with it?” or “Are they getting desperate?” It weakens your negotiating power right out of the gate.

A data-driven approach is non-negotiable. Nailing the price from the start is far more powerful than making adjustments later, as it builds momentum and strengthens your negotiating position.

This guide will walk you through the real-world process of setting an effective price for the unique Dallas market. We’ll cover how to:

- Analyze market conditions: Get a real feel for what’s happening today in neighborhoods from Preston Hollow to Lakewood.

- Evaluate comparable properties: Learn how to find and accurately assess “comps”—similar homes that have sold nearby.

- Choose a pricing strategy: Figure out if you should price at, just below, or slightly above the current market value.

Here’s a quick look at the core factors that go into a smart pricing decision here in Dallas.

Quick Guide to Pricing Your Dallas Home

This table breaks down the essential elements that determine your home’s market value. Use it as a checklist to ensure you’re considering everything.

| Pricing Factor | Why It Matters in Dallas | Your Next Action |

|---|---|---|

| Location & Neighborhood | A home in the M-Streets commands a different price than one in Oak Cliff. Schools, amenities, and commute times are huge drivers. | Pinpoint your specific neighborhood and school district. Identify the key attractions that draw buyers to your area. |

| Recent Comparable Sales | This is the bedrock of pricing. What have similar homes actually sold for in the last 3-6 months? | Work with an agent to pull a CMA (Comparative Market Analysis) for homes with similar square footage, age, and features. |

| Current Market Conditions | Is it a buyer’s or seller’s market? Inventory levels and average days on market in DFW directly impact your strategy. | Research the latest Dallas-Fort Worth real estate market reports to understand current trends. |

| Home Condition & Upgrades | A recently renovated kitchen or a new roof adds real value. Dated features or needed repairs will detract from it. | Make a detailed list of all your home’s upgrades and any necessary repairs. Get quotes for major issues. |

| Size and Layout | Square footage is a primary metric, but the functionality of the floor plan (e.g., open concept, number of bedrooms on the first floor) also matters. | Know your home’s exact square footage and be prepared to highlight the most desirable aspects of its layout. |

By carefully weighing each of these factors, you move from guesswork to a well-supported, strategic list price that will set you up for a successful sale.

Reading the Dallas Real Estate Market

Before you can put a number on your home, you have to get a feel for the local Dallas real estate scene. The first thing to understand is that there isn’t one single “Dallas market.” It’s really a patchwork of tiny, distinct markets. What’s happening in the Bishop Arts District can be a completely different world from a suburb like Plano.

Learning to read these local signals is how you move from guessing to making an educated pricing decision. It means digging past the national headlines and into the hard data that shows what buyers are actually doing right here in your corner of the city.

Key Dallas Market Indicators

A few key metrics can paint a surprisingly clear picture of the market’s health, and they directly impact how much pricing power you have. Keeping a close eye on these numbers will keep your strategy grounded in reality, not just wishful thinking.

Here are the three big ones I always focus on:

- Inventory Levels: This is classic supply and demand. When inventory is low—meaning there are fewer homes for sale than active buyers—you’re in a seller’s market. This is common in many sought-after Dallas neighborhoods and gives you more room to be ambitious with your price. High inventory, on the other hand, creates a buyer’s market, and you’ll need to be much more competitive.

- Days on Market (DOM): This number tells you exactly how fast homes are moving in your area. If homes down the street are selling in under 30 days, things are hot. But if they’re sitting for 60-90 days or more, it’s a clear sign the market is cooling off, and a more cautious price is in order.

- Sale-to-List Price Ratio: This little percentage reveals how close sellers are actually getting to their asking price. A ratio at or above 100% tells you bidding wars are likely happening. Anything below 98% suggests buyers have the upper hand and are successfully negotiating prices down.

Spotting What Kind of Market You’re In

Once you know these indicators, you can confidently identify the type of market you’re facing. Getting this right is absolutely crucial for setting a price that works.

A seller’s market, with its low inventory and quick sales, gives you the green light for more aggressive pricing. A buyer’s market, however, means you have to price sharply to even get noticed among all the other options.

Then there’s a balanced market, where prices are more stable and homes sell at a steady, predictable pace. In this scenario, pricing your home right at its true, defensible value is the only strategy that makes sense. Honestly, misreading these conditions is one of the costliest mistakes a Dallas seller can make.

How Local Economic Shifts Affect Your Home’s Value

It’s not just about real estate data, either. The Dallas-Fort Worth area is always changing, and those big economic shifts can ripple through the housing market fast. Think about what happens when a major company announces a new headquarters in Frisco, or a project like the Klyde Warren Park expansion gets underway. These things create jobs, bring people to the area, and can seriously boost demand—and home values—in the surrounding neighborhoods.

Staying aware of these broader trends is a big piece of the puzzle. According to recent housing market research from J.P. Morgan, the national market is seeing slower growth. However, Dallas often bucks national trends due to strong local job growth and corporate relocations. With the number of existing homes for sale in DFW still tight, this scarcity means sellers have to be incredibly precise with their pricing to avoid sitting on the market.

Mastering the Comparative Market Analysis

If you’re trying to figure out how to price your home for sale in Dallas, the single most important tool in your arsenal is the Comparative Market Analysis, or CMA. This isn’t just a simple estimate; it’s a deep dive into what’s actually selling around you. A solid CMA looks at similar properties and how they’ve performed, giving you a data-driven price range that makes sense for the current market.

Think of it as piecing together a puzzle. We’re connecting the dots between location, size, condition, and timing to pinpoint a realistic list price for your home.

The first move is to gather your “comps”—the comparable properties. You’ll want to find 3–5 homes that have sold within the last 3 months right in your specific Dallas micro-market. If you’re in Kessler Park, you’re looking at Kessler Park sales, not homes across town in Lake Highlands. This keeps your analysis grounded in reality.

Here’s the basic criteria I use when pulling initial comps:

- Location: Stick to a 1-mile radius of your property, if possible.

- Square Footage: Look for homes within about 200 sq ft of your own.

- Condition: This is crucial. Try to match the level of renovation, from flooring and kitchens to the roof.

- Time Frame: Only use sales that have closed in the last 90 days. Anything older is stale data.

Evaluating Comps in Your Dallas Neighborhood

Once you have your handful of comps, it’s time to dig into the nitty-gritty. For instance, a beautifully renovated Tudor in Kessler Park might have recently sold for $475,000, while a newer construction home over by White Rock Lake fetched $510,000. This immediately shows you how the age of the home, its style, and specific upgrades can dramatically impact value.

You’ll also need to account for differences in size. Let’s say that Tudor was 2,000 sq ft and the new build was 2,200 sq ft. To compare them apples-to-apples, we calculate the price per square foot for each. This helps normalize the data and gives you a much clearer picture of what buyers are willing to pay for space in your area.

I always tell my clients that focusing on the price-per-square-foot metric often uncovers hidden trends and nuances within specific Dallas neighborhoods.

Insights From Active and Expired Listings

Sold properties are only part of the story. You also need to look at what’s currently for sale (active listings) and what failed to sell (expired listings).

Active listings are your direct competition. They tell you what buyers are seeing right now and can hint at pricing struggles. I pay close attention to homes that have been sitting on the market for more than 60 days—it’s almost always a sign they were priced too high from the start.

Expired listings are even more telling. They reveal the price points that the market completely rejected. I saw several listings in Oak Cliff priced above $350,000 expire last quarter, which was a clear signal to sellers in that pocket to be more conservative. This kind of insight helps you avoid making the same mistake.

When looking at active and expireds, I specifically track:

- Homes with days on market (DOM) over 45 days.

- Any price reductions and the story behind them.

- The gap between the original list price and the final sale price on comparable homes.

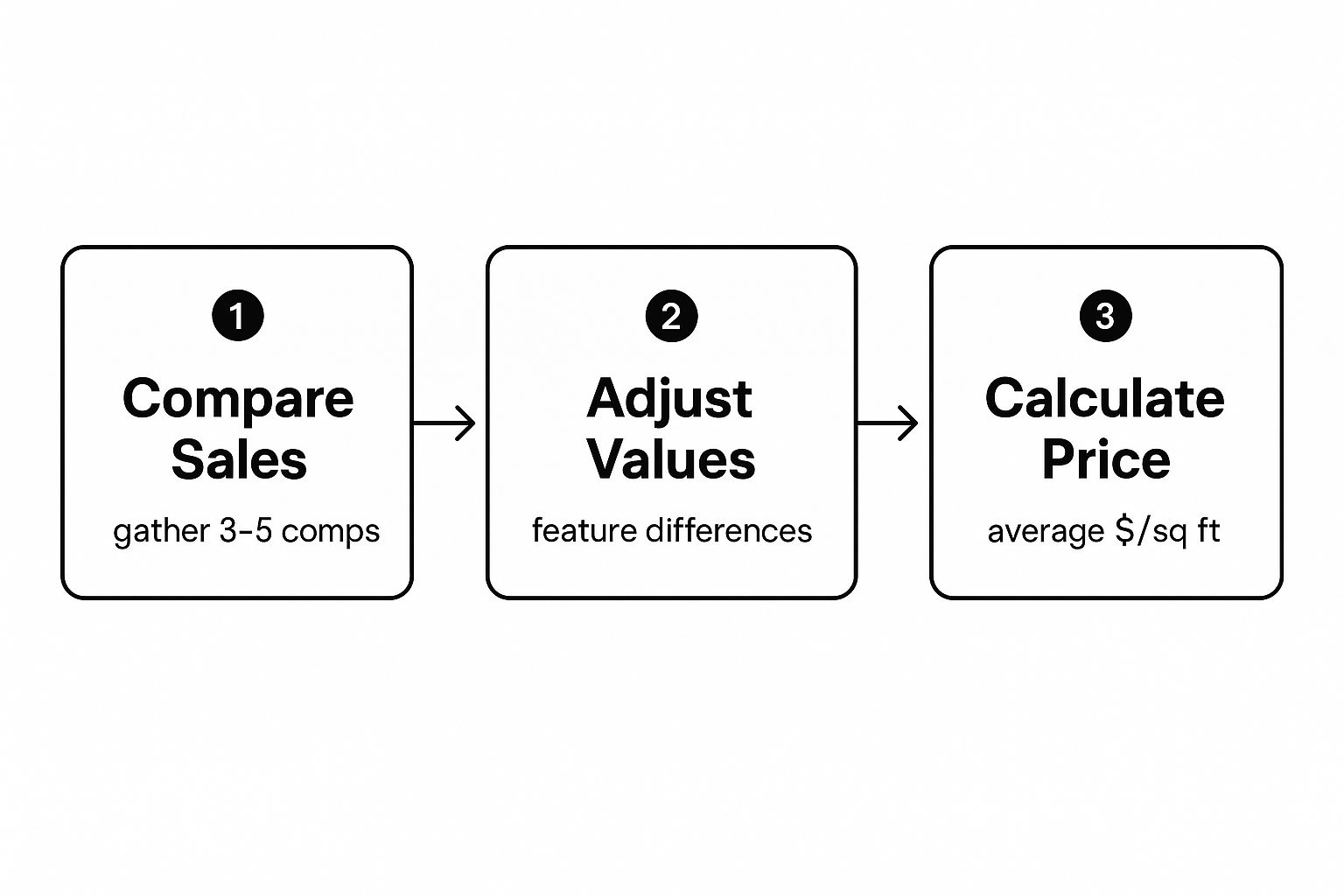

The process of pulling comps, adjusting for differences, and averaging the data is what ultimately gets you to your target price.

As you can see, adjusting for specific features and then averaging the price per square foot is the most direct path to landing on a competitive price.

Making Fair Value Adjustments

No two homes are identical, which is where adjustments come in. Features like a swimming pool, a true chef’s kitchen in a neighborhood like Preston Hollow, or a killer outdoor living space all add value, and you need to account for them.

I start by listing out all the major upgrades (or lack thereof) that differentiate your home from the comps. From there, it’s a matter of assigning a realistic value. Here’s a simplified approach:

- Calculate a baseline price per square foot from your best comps.

- Add or subtract a reasonable amount—say, $5–$15 per sq ft—for major differences in condition or high-end upgrades.

- Factor in unique elements like a larger lot, a better view, or a premium for a top-tier school district.

- Average these adjusted figures to arrive at your final price range.

Pro Tip: Don’t forget to check for things like local HOA fees or special assessments. These can impact a buyer’s overall budget and, indirectly, what they’re willing to pay for your home.

Let’s put it into practice. Imagine the average price per square foot in Lakewood is $240. If your home is 1,800 sq ft, your starting point is around $432,000. But if you just put in a $20,000 chef’s kitchen or have a professionally landscaped, fenced-in yard that your comps lack, you layer that value on top. This is how you fine-tune the numbers to reflect your home’s true worth.

To get a more detailed look at the methodology, check out our article explaining what a comparative market analysis is.

By following this process, you’ll develop a list price that truly resonates with today’s Dallas buyers and reflects the real-time conditions of your neighborhood. It’s how you price your home for sale with total confidence.

Choosing Your Dallas Home Pricing Strategy

Alright, you’ve done the hard work of pulling comps and analyzing the market. Now comes the moment of truth: picking the right pricing strategy. This isn’t a one-size-fits-all decision. The best approach really hinges on your personal goals and what’s happening right now in your specific Dallas neighborhood.

Are you looking for a quick, straightforward sale, or are you prepared to hold out for the absolute highest dollar amount? Your answer will shape the entire sales process, from the first showing to the closing table.

Price At Market Value for Broad Appeal

In my experience, pricing your home right at its fair market value is almost always the smartest play. It’s the most direct and effective strategy. This tells buyers you’re serious, you’ve done your research, and you aren’t playing games.

What does this do? It immediately attracts the largest group of qualified buyers out there—the ones who are actively searching for a reasonably priced home. This approach works well in just about any Dallas market, whether it’s a stable, established area in East Dallas or a more competitive, fast-moving spot. It’s clean, simple, and avoids the risk of your home sitting on the market and going stale.

When a home hits the market priced correctly from day one, it builds instant credibility. Buyers and their agents see the value, which translates into more showings and, ultimately, strong offers that are close to what you’re asking.

Price Below Market to Create a Bidding War

Now, in a red-hot seller’s market—like what we often see for charming, updated homes in the M-Streets or Lakewood—you can get a little more creative. Pricing your home just below its market value can be an incredibly powerful move. This isn’t about giving your home away; it’s a strategic play to create a frenzy.

A slightly under-market price can trigger a flood of interest right out of the gate, leading to a weekend packed with showings and multiple offers. This competitive environment often pushes the final sales price well above your initial ask. I’ve seen it happen where the home sells for more than it would have if it were listed at market value from the start.

This strategy is a calculated risk. It requires a deep understanding of local demand and the confidence that your home has the features buyers in that specific area are fighting for.

The Dangers of Pricing Too High

Starting with a price that’s too high is easily one of the most common and costly mistakes a seller can make. It’s tempting to “test the market,” but it almost always backfires. Savvy Dallas buyers and their agents will simply scroll past your listing, immediately labeling it as overpriced.

While your home sits, the “days on market” counter keeps ticking up, which creates a negative perception. Eventually, you’ll have to make a price cut. By then, however, you’ve lost that critical initial excitement. Buyers start to wonder, “What’s wrong with it?” and that’s when the lowball offers start to roll in.

Pricing your home correctly from the very beginning has a massive impact. Homes initially listed within 2-3% of their final sale price tend to sell much faster in the Dallas market. On the flip side, those overpriced by more than 5% often languish and end up selling for a significant discount. You can find more details in these real estate statistics and trends.

As you weigh offers, remember that a buyer’s commitment is also shown through things like the amount of earnest money in a real estate deal.

Using Pricing Psychology

Don’t forget the psychology of numbers. There’s a real reason agents price a home at $695,000 instead of $700,000. It’s not just about making it feel a little cheaper.

This simple adjustment ensures your home shows up in the online searches of every buyer who has set their maximum budget at that $700,000 mark. You’d be surprised how many people you’d miss by just one thousand dollars. It’s a small tweak that can seriously expand your pool of potential buyers.

What Is Your Home Really Worth? A Hard Look at Condition and Upgrades

The market data gives us a baseline, but the real story of your home’s value is told in its condition and upgrades. You can have two houses side-by-side in the same Dallas neighborhood, yet they can be worlds apart in price. Why? It all comes down to maintenance, improvements, and how the home feels to a buyer.

Pricing your home for sale means taking a step back and looking at your property with a critical, objective eye. This is the tough part. You have to remove the emotional attachment and see your house for what it is—a product. What features will make a buyer’s eyes light up, and what deferred maintenance will make them hesitate?

Dallas Upgrades That Actually Pay Off

Not all home improvements are smart investments, especially when you’re about to sell. In the Dallas market, some upgrades are practically expected, while others might not even recoup their cost. For example, a stunning chef’s kitchen remodel in a high-end neighborhood like Preston Hollow almost always adds serious value because it meets buyer expectations for that area.

On the flip side, sinking $80,000 into a custom swimming pool in a neighborhood where they aren’t common might be a misstep. Some buyers will just see it as a weekly maintenance bill, not a luxury perk.

So, where should you focus your money for the best return? Dallas buyers consistently respond to these improvements:

- Kitchen Remodels: This is the heart of the home, and it’s almost always a winning investment. Think modern appliances, quality countertops (quartz is a huge draw right now), and a functional, open layout.

- Bathroom Renovations: A dated primary bathroom can be a deal-breaker. Even a modest refresh with new fixtures, a modern vanity, and updated tile can completely change the feel of a home.

- Curb Appeal: Never underestimate a first impression. A new front door, fresh paint, and sharp, professional landscaping can boost perceived value before a buyer even steps inside.

Here’s the bottom line for Dallas sellers: focus on projects that improve both the look and the function of your home. Today’s buyers want move-in ready, and they will pay a premium to avoid the headache of a major renovation.

Factoring In the Fixes and Flaws

Just as a beautiful kitchen adds thousands to your price, a leaky roof will take it right back off—and then some. Deferred maintenance is a huge red flag for buyers. Things like an HVAC system on its last legs or hints of foundation issues will lead to one of two things: lowball offers or a laundry list of repair requests after the inspection.

You really have two ways to handle necessary repairs:

- Fix It Before You List It. This is usually the best route. By making the repairs upfront, you present a well-maintained, confident product. A pre-listing inspection is a great tool here; it lets you find and fix problems on your own terms, not under pressure from a buyer’s timeline.

- Price It Accordingly. If you can’t tackle the repairs due to time or budget, you have to price the home to reflect the work needed. Get a few professional quotes for the job so you can show buyers you’ve already factored that cost into your asking price. This transparency builds trust.

Remember, a home that looks cared for gives buyers peace of mind. Keeping detailed service records for your HVAC, roof, and other major systems is a fantastic selling point. For a complete guide on getting your property show-ready, check out our preparing your home for sale checklist.

Once you’ve taken an honest inventory of your home’s strengths and weaknesses, you can set a price that truly reflects its market worth.

Navigating a Professional Home Appraisal

Your Comparative Market Analysis (CMA) is an incredibly powerful tool for gauging a market-driven price. But it’s not the final word. That comes from a professional appraisal, which is an official, data-backed valuation from a licensed expert.

Think of it this way: a CMA is what we, as agents, use to recommend a smart list price. An appraiser’s report, on the other hand, is a legally recognized opinion of value that a buyer’s lender will almost always require. It’s a critical, non-negotiable step in the mortgage process.

A buyer’s loan is capped at the home’s appraised value—they can’t get a penny more from the bank. If the appraisal comes in lower than your agreed-upon sale price, you’ve got an “appraisal gap” on your hands, and that can put the whole deal at risk.

What Appraisers Look For in Dallas Homes

Appraisers are all about objective, verifiable facts. They aren’t swayed by the staging or trendy paint colors; they focus on the concrete data points that determine a property’s true worth. Their process is part physical inspection, part deep dive into the local market data.

Here’s what a Dallas appraiser will zero in on:

- Property Condition: They’re looking at the big picture—structural integrity, the age and condition of major systems like the roof and HVAC, and the overall quality of the construction.

- Square Footage and Layout: An appraiser will measure the home to verify its official gross living area and assess how functional the floor plan is. Awkward layouts can impact value.

- Upgrades and Features: Permanent fixtures and significant upgrades get documented. Think renovated kitchens, updated bathrooms, or high-end flooring—not your new sofa.

- Comparable Sales: Just like a CMA, they analyze 3-5 recent, nearby home sales to create a baseline. From there, they make precise, dollar-value adjustments for any differences between your home and the comps.

An appraiser’s final number is a direct reflection of your home’s tangible assets and its standing in the current Dallas market. It’s a reality check that holds significant weight in the transaction.

The Strategic Edge of a Pre-Listing Appraisal

Waiting around for the buyer’s appraisal can be a nail-biting experience. A much smarter, more proactive approach is to get your own pre-listing appraisal before your home even hits the market. This single move can give you a massive advantage and head off so many last-minute headaches.

When you invest in an appraisal upfront, you confirm your asking price with an unbiased, professional opinion. This gives you incredible confidence in your pricing strategy. It can also uncover potential red flags—like unpermitted work or a valuation that’s lower than you expected—giving you time to address them before a buyer ever steps through the door.

Plus, having a recent, professional appraisal in hand is a powerful negotiating tool. It shows potential buyers that your price isn’t just a number you picked out of thin air; it’s backed by solid, defensible data.

To get a better feel for everything involved, you can learn more about the complete real estate appraisal process and how it affects your sale. Ultimately, taking this step empowers you with knowledge, reduces risk, and sets you up for a much smoother, more predictable closing.

Common Questions About Pricing Your Home

Pricing a home isn’t an exact science, and it’s completely normal to have questions. In fact, most Dallas sellers I work with ask some version of the same things. Let’s tackle a few of the most common ones I hear.

Should I List My House a Little High to Have Negotiating Room?

This is probably the number one question I get, and I understand the logic behind it. But in my experience, it’s a strategy that often backfires.

Starting with too high a price tag can scare off the most serious buyers right out of the gate. They might not even see your home because it’s priced out of their search filter. A competitively priced home, on the other hand, creates excitement and attracts a flurry of initial interest. That activity is what builds a strong negotiating position—sometimes even sparking a bidding war.

How Much Value Will I Actually Get Back from My Renovations?

This is a tough one because “it depends” is the real answer. While kitchen and bathroom remodels are almost always a good bet in the Dallas market, the return on investment isn’t guaranteed.

The value you recoup really boils down to a couple of key things:

- The Quality of the Work: Was it a professional job with quality finishes, or a quick DIY fix? Buyers can tell the difference, and they’ll pay more for the former.

- Neighborhood Vibe: Putting a $100,000 chef’s kitchen into a home in a neighborhood where houses sell for $400,000 means you probably won’t get all your money back. The updates need to match what buyers expect to see in your area.

A good rule of thumb? Focus on updates that bring your home up to the standard of your specific neighborhood, whether that’s Lakewood or Preston Hollow. You want to meet buyer expectations, not necessarily exceed them by a mile.

What if the Bank’s Appraisal Is Lower Than Our Agreed-Upon Price?

When this happens, it’s called an “appraisal gap,” and it can definitely be a stressful moment. The buyer’s lender will only loan them money for the appraised value, not the higher price you both agreed to in the contract.

Don’t panic, though. You have a few ways to move forward:

- The buyer can make up the difference in cash.

- You can agree to lower the sale price to match the appraisal.

- You and the buyer can meet somewhere in the middle.

- If you can’t find a solution, the contract might have to be terminated.

Figuring out the Dallas real estate market takes more than just online research; it requires local knowledge and a strategy built on real-world experience. If you’re ready for an accurate, data-backed valuation for your home, get in touch with Dustin Pitts REALTOR Dallas Real Estate Agent. Let’s make sure your property is positioned for a successful and profitable sale. https://dustinpitts.com