For any homeowner in Dallas, getting a handle on property taxes isn’t just a good idea—it’s essential. These taxes are the financial engine that powers our local community, funding everything from schools and roads to the emergency services we rely on. Your total tax bill isn’t just one single number; it’s a mix of rates from several different local players, like Dallas County, the City of Dallas, and your local school district. It all boils down to a simple formula: your property’s value multiplied by these combined rates.

Your Guide to Dallas Property Taxes

Owning a home in Dallas makes you a key contributor to the city’s financial well-being. The property tax system is what keeps our public services running, but it can feel a bit confusing because the bill you get isn’t from a single source.

Think of your annual tax bill like a consolidated invoice from a few different organizations. Each one has its own budget and the power to levy a tax to fund its operations. That’s why understanding property taxes in Dallas, Texas, means looking at all the individual pieces that make up the whole.

The Key Players in Your Tax Bill

Several distinct entities have a hand in your final property tax obligation. Each one plays a specific part, whether it’s figuring out what your home is worth or setting the tax rates you’ll pay.

- The Dallas Central Appraisal District (DCAD): This is where it all starts. DCAD is an independent agency tasked with appraising the market value of every single property in Dallas County. Their valuation becomes the foundational number that all the other taxing bodies use for their calculations.

- Local Taxing Units: These are the government groups that provide the services you use every day. For most Dallas residents, this list includes the City of Dallas, Dallas County, Dallas Independent School District (ISD), and often a community college or hospital district. Each year, they set their own tax rate based on what they need to operate.

Your total tax rate isn’t just one number; it’s the sum of all the individual rates from the taxing units covering your property’s location. This combined rate is then applied to your home’s taxable value to figure out your final bill.

Of course, property taxes don’t just pop up once a year. If you’re buying a home, they’re a big part of your initial expenses. For anyone new to this, a good guide on first-time home buyer closing costs can shed some light on what to expect. This guide is here to give you the confidence to manage your property taxes, starting with the basics of how the system works.

How Your Dallas Property Tax Bill Is Calculated

Trying to figure out your Dallas property tax bill can feel like you’re staring at a complex puzzle. But once you know the pieces, it’s actually pretty straightforward. The whole calculation boils down to just two core components: the appraised value of your property and the combined tax rates from a handful of local entities.

Think of it like a simple recipe. The main ingredient is your home’s value, which is determined each year by the Dallas Central Appraisal District (DCAD). This isn’t just a number plucked from thin air; it’s DCAD’s official estimate of what your property could sell for on the open market.

The Two Key Ingredients of Your Tax Bill

Once DCAD has set your property’s appraised value, the next ingredient comes from the various “taxing units” that serve your address. Each of these government bodies figures out its own tax rate based on the budget it needs to fund public services for the year.

You’ll see several of these on your bill, including:

- The City of Dallas: This funds everything from police and fire protection to fixing the streets.

- Dallas County: This covers county-level services like the courts and public health programs.

- Dallas ISD (or your local school district): This is usually the biggest slice of the pie, funding our local public schools.

- Other Special Districts: Depending on where you live, this might include Dallas College or Parkland Hospital.

Each one sets its own rate, typically expressed as an amount for every $100 of property value. Your total tax rate is simply all these individual rates added together.

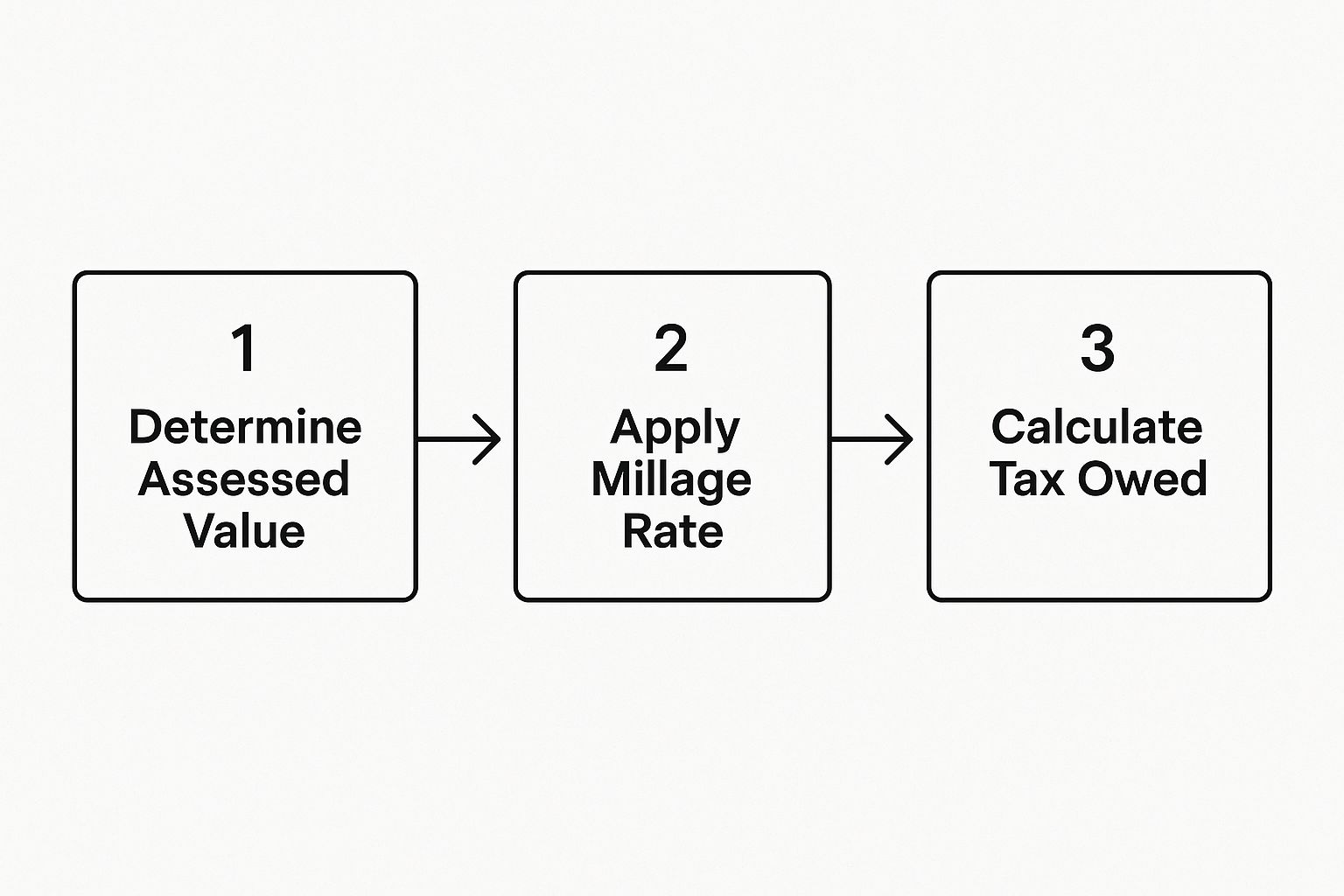

The image below gives you a clear, three-step look at how this process flows from the initial appraisal to your final tax bill.

As you can see, it all starts with the valuation. From there, the tax rates are applied, which leads directly to the final amount you owe.

A Step-by-Step Calculation Example

Let’s walk through a real-world example to see exactly how these moving parts fit together. Imagine you own a home in Dallas with a taxable value of $400,000. Keep in mind, this is the value after any discounts, like a homestead exemption, have been subtracted.

Now, let’s plug in some sample tax rates from the different entities that would be taxing this home.

Sample Dallas Property Tax Calculation Breakdown

Here’s a table showing how the different tax rates come together to create a total property tax bill for our hypothetical $400,000 Dallas home.

| Taxing Entity | Sample Tax Rate (per $100 value) | Tax Amount on a $400,000 Home |

|---|---|---|

| City of Dallas | $0.77 | $3,080 |

| Dallas County | $0.22 | $880 |

| Dallas ISD | $1.15 | $4,600 |

| Dallas College | $0.08 | $320 |

| Total Combined Rate | $2.22 | $8,880 |

To get the tax for each entity, you just divide your home’s taxable value by 100 and then multiply it by the rate. So for the City of Dallas, the math is ($400,000 / 100) x 0.77 = $3,080.

When you add up the tax amounts from all the different taxing units, you get the grand total: $8,880 for the year. This kind of breakdown makes it crystal clear exactly where your money is going. For a more detailed walkthrough, check out our guide on how to calculate property taxes.

Understanding Who Sets Your Tax Rates

Ever get your tax bill and wonder, “Who comes up with these numbers?” When it comes to property taxes in Dallas, Texas, the answer is closer to home than you might think. The power to set the rates you pay rests entirely with local elected officials—the very people you vote for to represent your community.

This isn’t some arbitrary decision made by a faceless agency in Austin or Washington D.C. Instead, groups like the Dallas City Council, the Dallas County Commissioners Court, and your local school board trustees are in the driver’s seat. They are directly accountable to you, the taxpayer.

Each of these “taxing units” holds public meetings to hash out their budget for the coming year. They figure out what they need to fund everything from police and fire departments to road repairs and new textbooks. Based on those needs, they vote to adopt a specific tax rate, which ultimately determines your final bill.

Transparency and Your Right to Weigh In

To keep tax bills from spiraling out of control, Texas law has some powerful checks and balances built right in. These rules are designed to make the whole process transparent and give you a real voice. Two of the most important concepts to get familiar with are the “No-New-Revenue” rate and the “Voter-Approval” rate.

Think of the No-New-Revenue (NNR) tax rate as the baseline. It’s the rate that would bring in the exact same amount of money from the same properties as the year before. If property values in Dallas shoot up, this rate automatically drops to keep the city’s total revenue the same. It’s a fantastic benchmark for understanding if a proposed rate is a true tax increase.

The Voter-Approval tax rate is essentially a ceiling. It’s the highest rate a taxing unit can set on its own without needing to get direct permission from you, the voter, in an election. This is a critical safeguard that forces local officials to justify any significant tax hikes to the public.

These ideas are the bedrock of the state’s “Truth in Taxation” laws, which are all about promoting accountability. The Dallas Central Appraisal District (DCAD) keeps detailed records of all this, but you can also find a ton of great info about the framework on the official page for Texas property tax transparency.

How Budgets and Rates Actually Get Decided

Every year, each taxing unit has to go through a public process to set its budget and tax rate. It’s not done behind closed doors—you have an open invitation to participate.

Here’s how it generally plays out:

- Proposing a Budget: The city council, school board, or county commissioners figure out a budget based on their projected expenses.

- Holding Public Hearings: They are required by law to hold public meetings to present the proposed budget and the tax rate needed to fund it. This is your chance to step up to the mic and have your say.

- Adopting the Rate: After listening to public feedback, the governing body takes a final vote. The rate they choose can’t go above the Voter-Approval rate unless they call an election.

Understanding this process changes the game. You stop being a passive taxpayer and become an informed homeowner who can engage directly with the officials making these critical decisions about your money.

The Dallas County “Truth in Taxation” website is a fantastic resource for keeping tabs on all of this. It gives you the details on proposed rates, meeting schedules, and how any changes might hit your wallet. Getting involved is the single best way to influence your local property taxes.

Finding Property Tax Exemptions in Dallas

Lowering your annual property tax bill in Dallas, Texas, is often simpler than you’d think. The secret lies in claiming exemptions. Think of them as special discounts that directly reduce your home’s taxable value, which is the magic number used to calculate what you owe. These aren’t loopholes; they’re provisions put in place to give homeowners some much-needed financial breathing room.

The most common and impactful one is the general residence homestead exemption. If your Dallas property is your primary residence, you’re in. This one exemption alone can slash tens of thousands off your home’s taxable value, translating into real savings year after year.

The best part? Applying is a one-time thing that pays off for as long as you live there. You just need to file the application with the Dallas Central Appraisal District (DCAD) once you’ve officially moved in and made it your home.

Key Exemptions for Dallas Homeowners

Beyond the general homestead exemption, several other valuable options are on the table for those who qualify. Each one is tailored to a specific group, and you can often “stack” them on top of each other for even bigger savings.

- Over-65 Exemption: The moment you turn 65, you can claim another significant reduction on your homestead’s taxable value for school district taxes. Most other taxing entities in Dallas County also offer a local over-65 exemption, sweetening the deal even more. The biggest perk here is that your school property taxes are frozen—they can’t go up as long as you own and live in the home.

- Disability Exemption: If you meet the federal definition of disabled, you’re eligible for an exemption that works much like the over-65 benefit. This also includes that valuable school tax ceiling, putting a freeze on that portion of your taxes. Just keep in mind, you can’t claim both the over-65 and disability exemptions; you have to pick one.

- Disabled Veteran Exemption: Texas provides a substantial exemption for veterans who have a disability rating from the U.S. Department of Veterans Affairs. The amount is tiered based on your disability percentage, and a 100% disabled veteran could end up paying zero property taxes on their homestead.

The combined effect of these exemptions can be a game-changer. For example, a Dallas homeowner who is over 65 could stack their general homestead exemption with the over-65 exemption, dramatically cutting their annual tax obligation.

To give you a clearer picture, here’s a quick breakdown of the most common exemptions available to Dallas County homeowners.

Common Dallas County Property Tax Exemptions

| Exemption Type | Primary Benefit | Who Is Generally Eligible |

|---|---|---|

| General Homestead | Reduces the taxable value of a primary residence for all taxing units. | Any homeowner whose property is their principal residence. |

| Over-65 | Provides an additional reduction in taxable value and freezes school taxes. | Homeowners who are 65 years of age or older. |

| Disability | Offers a similar benefit to the Over-65 exemption, including a school tax freeze. | Homeowners who meet the Social Security definition of disabled. |

| Disabled Veteran | Provides a partial or full exemption based on the VA disability rating. | Veterans with a service-connected disability rating. |

Taking the time to see which of these you qualify for is one of the smartest financial moves a homeowner can make.

The Application Process and Deadlines

Applying for these exemptions is pretty straightforward, but you do need to pay attention to the details. You’ll submit the right form to DCAD along with any required proof, like a driver’s license showing the property’s address or documentation of your age or disability.

Deadlines are key. The general deadline to file for most exemptions is April 30. However, for the over-65 or disability exemptions, you can file anytime after you qualify, and the benefits will be prorated for that tax year. For anyone buying a new home, getting a handle on all the financial pieces is crucial. In our guide on FHA loan requirements in Texas, we walk through many of the essentials new buyers should be aware of.

Maximizing Your Savings: A Practical Example

Let’s put this into real-world terms. Imagine a Dallas homeowner whose property has an appraised value of $450,000. With no exemptions, their tax bill is based on that full amount. Ouch.

But let’s say they qualify for and apply for both the general homestead and the over-65 exemptions. The state mandates a $100,000 school tax homestead exemption, and the over-65 exemption tacks on another $10,000 reduction for school taxes. Just like that, their taxable value for school taxes plummets from $450,000 down to $340,000. Their taxes for other local entities would also drop. A few minutes spent on paperwork can easily save thousands of dollars every single year.

How to Protest Your Dallas Property Appraisal

It happens every year. The Notice of Appraised Value from the Dallas Central Appraisal District (DCAD) lands in your mailbox, and the number you see for your home seems… high. Way too high. If you think your property’s value has been inflated, you have the legal right to challenge it.

Don’t worry, this isn’t some adversarial fight. Protesting your appraisal is a standard procedure for countless Dallas homeowners. Think of it as opening a conversation with the appraisal district, armed with solid evidence, to make sure your home’s value is fair and accurate. A successful protest directly lowers your home’s taxable value, which means a smaller property tax bill in your future.

Let’s walk through how to navigate the protest process and build a winning case, step by step.

Stage 1: Receiving Your Notice and Filing the Protest

It all starts the moment you open your Notice of Appraised Value, which usually arrives in April or May. This document is the starting gun. It shows your property’s proposed value and—most importantly—the deadline to file your protest.

In most cases, this deadline is May 15 or 30 days after the notice was mailed, whichever is later. Mark your calendar immediately because missing this date means you lose your chance to protest for the entire year.

Filing the protest is your first critical move. You can typically do this online through the DCAD portal, by mail, or in person. The form will ask for your reason for protesting. Common grounds include the value being too high compared to similar homes or being unequal to other appraisals in your area.

Stage 2: Gathering Your Evidence

Once you’ve filed, it’s time to build your case. Your opinion alone won’t get you very far; you need to assemble a logical, fact-based argument showing the appraisal district why their number is off the mark.

Here’s the kind of evidence that makes a difference:

- Comparable Sales Data: This is your bread and butter. Find recent sales of homes in your neighborhood that are similar in size, age, and condition but sold for less than your appraised value. Focus on sales that happened close to January 1st of the tax year.

- Photos and Repair Estimates: Is your foundation cracked? Does the roof need replacing? Document any major issues that drag down your property’s value. Get professional estimates for the repair costs to back it up.

- A Professional Appraisal: Yes, it costs money, but a recent appraisal from a certified professional can be incredibly persuasive. To get a better feel for what this entails, you can learn more about the official real estate appraisal process.

- Unequal Appraisal Evidence: Take a look at the appraised values of comparable homes on your street. If their values are consistently lower than yours, you can make a strong case that your appraisal is unequal and unfair.

The strength of your protest really comes down to the quality of your evidence. A well-organized file with clear, relevant data gives you the best possible shot at getting a fair outcome.

Stage 3: The Informal Settlement and Formal Hearing

After DCAD reviews your protest, you’ll likely get a chance for an informal settlement discussion. This is usually a phone call or meeting with a DCAD appraiser to go over your evidence. A huge number of protests are actually resolved right at this stage. Come prepared, stay calm, and walk them through your evidence point by point.

If you can’t reach an agreement, your case moves on to a formal hearing before the Appraisal Review Board (ARB). The ARB is an independent panel of local citizens who hear disputes between property owners and the appraisal district.

At the hearing, both you and a DCAD representative will present your cases. The ARB listens to both sides and then makes a final call on your property’s value. It’s a more structured process, but it gives you another opportunity to have your evidence reviewed by an impartial group. Getting through these steps can lead to some serious savings on your Dallas property taxes.

Frequently Asked Questions About Dallas Property Taxes

Let’s face it, digging into property taxes in Dallas, Texas, can feel like opening a can of worms. You’ve got questions, and you need clear, practical answers. This section is designed to tackle some of the most common things homeowners ask, giving you the confidence to manage your tax obligations.

When Are Property Taxes Due in Dallas County?

Mark your calendars. In Dallas County, property tax statements usually land in your mailbox in October. The most important date to circle, highlight, and set a reminder for is January 31 of the next year. That’s your final day to pay up without getting hit with penalties.

If that deadline slips by, payments made on or after February 1 start racking up penalties and interest—and they can add up fast. Remember, it’s your responsibility to make sure your taxes are paid, even if you claim the bill never showed up.

Can I Pay My Dallas Property Taxes Online?

Absolutely. The Dallas County Tax Office makes it pretty convenient to pay online through their official website. You’ll find a secure payment portal with a couple of different ways to settle your bill.

You can use an e-check directly from your bank account, which is usually free. Another option is to use a major credit or debit card, but keep in mind a third-party vendor handles these, and they’ll tack on a processing fee for the convenience.

At the end of the day, you’re the property owner, and the legal responsibility to pay that tax bill on time falls squarely on your shoulders. A quick visit to the Dallas County Tax Office website to check your account status can save you a world of headaches later on.

What If a Mortgage Company Pays My Property Taxes?

If you have an escrow account with your mortgage lender, they’re the ones cutting the check to the county. Throughout the year, a portion of your monthly mortgage payment goes into this escrow account, and your lender uses those funds to pay the tax bill on your behalf.

Your lender typically gets the tax info straight from the county, so don’t be surprised if a physical bill never makes it to your door. Still, it’s always a good idea to double-check that the payment was actually made before the January 31 deadline. A quick call or a look at your online mortgage statement can confirm it.

What Is the Difference Between Appraised and Taxable Value?

This is a big one, and it’s where a lot of confusion comes in. The two values sound similar but mean very different things for your wallet.

The appraised value is what the Dallas Central Appraisal District (DCAD) determines your property is worth on the open market. Think of it as the full sticker price.

Your taxable value, on the other hand, is the appraised value after subtracting any exemptions you’re eligible for, like the homestead or over-65 exemption. This is the number that actually matters because your tax bill is calculated from this lower, discounted value. That’s exactly why applying for every exemption you qualify for is one of the smartest moves a homeowner can make.

Thinking about buying or selling a home in the Dallas area? The local market is complex, and understanding details like property taxes is crucial. Dustin Pitts REALTOR Dallas Real Estate Agent brings the local expertise you need to make smart, confident decisions. Visit https://dustinpitts.com to get started with an expert by your side.