Every smart real estate investment in Dallas starts with the end goal clearly in sight. Your exit strategy isn’t just the final step; it’s the game plan that dictates your moves from day one. Think of it as your investment’s GPS—knowing the destination helps you navigate the entire journey.

A real estate investment exit strategy is simply how you plan to sell a property or cash out your equity to lock in your profits. For Dallas investors, the most common paths are a traditional sale, a fix-and-flip, or a strategic refinance. Each one is built to take advantage of different market conditions and financial goals.

Without a solid exit plan, you’re just reacting to market swings instead of controlling your asset’s future. The key is to match your strategy with your financial targets, the property itself, and the unique economic pulse of North Texas.

Your Blueprint for Profitable Dallas Real Estate Exits

For investors in the Dallas-Fort Worth area, it really boils down to a few core options. Each serves a different purpose and fits different timelines and risk appetites.

Key Exit Pathways for DFW Investors

- Traditional Sale: This is the classic approach of selling a property on the open market to capture its appreciation. It’s the perfect play for long-term holds in appreciating Dallas neighborhoods where time is on your side.

- Fix-and-Flip: This is a much faster-paced strategy. You buy an undervalued property, pour in some sweat equity and capital to boost its value through renovations, and then sell it quickly for a profit.

- Refinance and Hold: This strategy lets you pull equity out of a property without selling it. It frees up capital to reinvest in other deals while your original asset keeps generating rental income and appreciating.

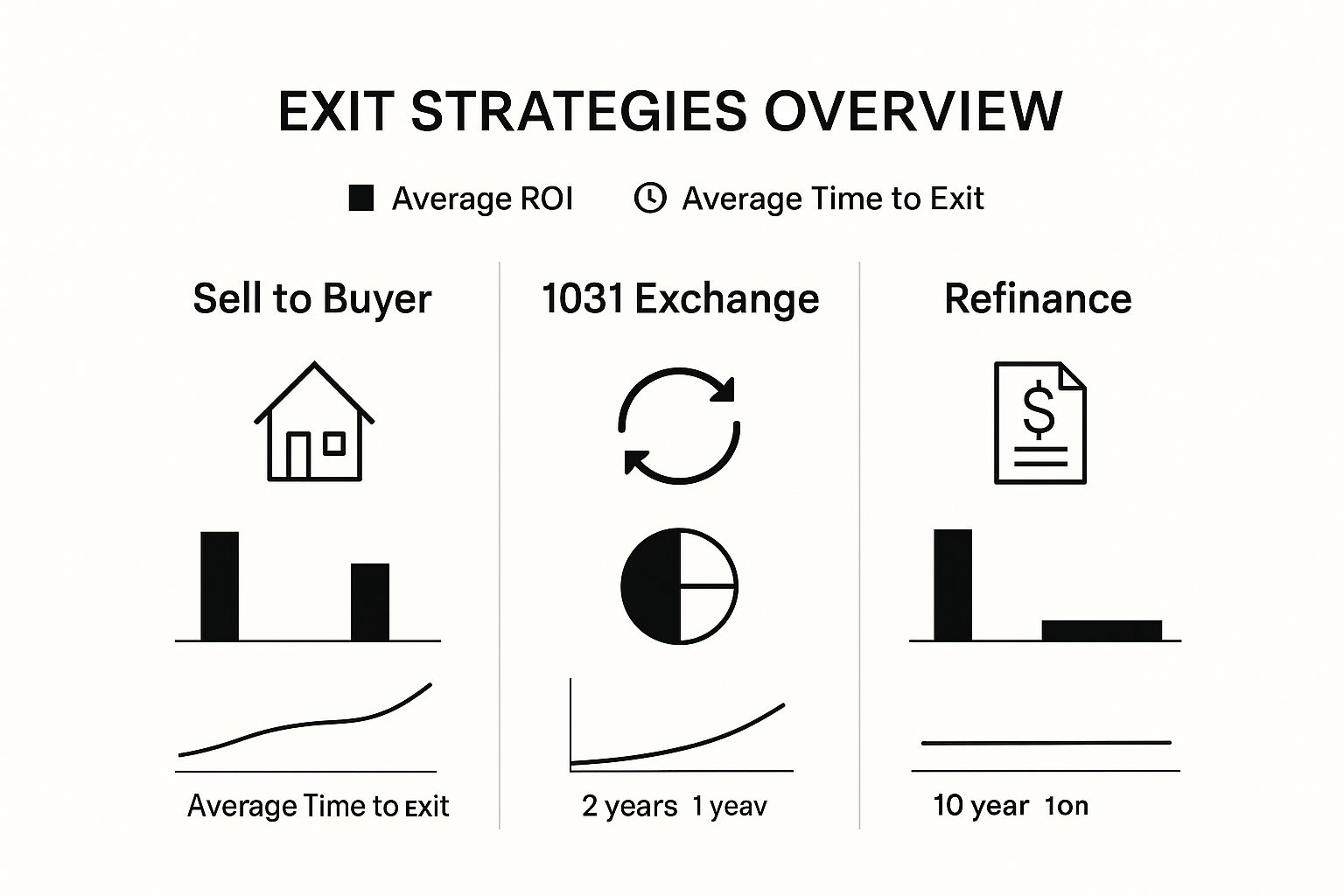

This visual gives a great snapshot of the typical returns and timelines you can expect from some of these popular exit strategies.

As you can see, there’s a clear trade-off between how fast you want to exit and the potential return on your investment. The right choice really hinges on whether you’re chasing immediate cash or building long-term wealth.

To make things even clearer, here’s a quick comparison of the main exit strategies tailored for the Dallas market.

Comparing Key Dallas Real Estate Exit Strategies

| Strategy | Primary Goal | Typical Timeframe | Best Dallas Market Condition |

|---|---|---|---|

| Traditional Sale | Maximize appreciation | 1-10+ years | Stable or rising market with strong buyer demand. |

| Fix-and-Flip | Quick profit from renovation | 3-12 months | Market with high demand for move-in ready homes. |

| Refinance & Hold | Access equity, build wealth | Long-term (5+ years) | Rising property values and favorable lending terms. |

This table helps put it all into perspective. Your choice will depend heavily on market dynamics, but having a clear goal and timeline is the first step toward a successful exit.

Mastering the Traditional Sale in the DFW Market

The traditional sale is the most familiar path for any Dallas real estate investor. You buy a property, you hold it, and you sell it on the open market. But mastering this in Dallas takes more than just putting up a sign. Think of it like a farmer timing a harvest; the goal is to sell your asset when it’s ripe, capturing the maximum appreciation.

This strategy is a perfect fit for investors who have held a property long enough for the Dallas market to do the heavy lifting. In a place like Dallas, with its relentless job growth and constant influx of new residents, that market magic can happen sooner than you think. A traditional sale lets you cash in on that growth in a direct, straightforward way.

Strategic Timing in the Dallas Market

When it comes to a successful sale, timing isn’t just important—it’s everything. Selling during a hot seller’s market, where demand is high and inventory is tight, can drastically boost your final price. In Dallas, this often lines up with the spring and early summer months when buyers are out in full force.

But seasoned Dallas investors know that seasonal trends are only one piece of the puzzle. You have to keep your finger on the pulse of the DFW metroplex’s economic health.

- Local Job Growth: Pay attention to the news in Dallas. When a big company relocates or expands here, a wave of new buyers isn’t far behind. Selling into that demand can be incredibly profitable.

- Inventory Levels: Keep an eye on the “months of supply” metric in Dallas. When inventory drops below four months, it signals a seller’s market, giving you serious leverage at the negotiating table.

- Interest Rate Climate: While you can’t control the Fed, selling when rates are relatively low opens up your Dallas property to a much wider pool of qualified buyers.

Preparing Your Property to Command a Premium

Once you’ve decided the time is right, the real work begins. Getting your property ready for the Dallas market isn’t just about a deep clean; it’s about strategically positioning your investment to outshine the competition. Visible marketing tools, like professionally designed and effective yard signs, are a must to capture that crucial local attention.

The final sale price is often determined before the first buyer ever walks through the door. Smart, targeted preparations—from minor cosmetic updates to professional staging—can yield a return far greater than their initial cost by creating a powerful first impression for potential Dallas purchasers.

This is where a great partnership pays off. Teaming up with a Dallas real estate agent who truly gets the investor mindset is key. They’ll pull a detailed comparative market analysis (CMA) to help you set a price that’s both aggressive and realistic. More importantly, a savvy agent will handle the negotiations and navigate the complexities of closing, making sure your Dallas exit is as smooth and profitable as possible.

Executing a Profitable Dallas Fix-and-Flip

The fix-and-flip is the quintessential high-stakes, high-reward exit strategy, and it’s a perfect fit for a fast-moving market like Dallas. Unlike a long-term hold where time is on your side, this approach is all about speed and precision. The game is simple: buy an undervalued Dallas property, add serious value through renovations, and sell it quickly for a profit.

Success here is all about spotting the right opportunities in North Texas. You’re looking for the diamonds in the rough, often in evolving Dallas neighborhoods like Oak Cliff or parts of East Dallas where older homes are just waiting for a modern touch. A deep, almost intuitive, understanding of local Dallas market trends isn’t just helpful—it’s your most critical tool.

Assembling Your Renovation Game Plan

Once you’ve got the keys to your Dallas property, your budget becomes your bible. An accurate, down-to-the-studs renovation budget is non-negotiable. It has to cover everything from materials and labor to pulling Dallas city permits and—crucially—those unexpected overages that always seem to pop up. The number one mistake new Dallas flippers make is underestimating the true cost of repairs, which can vaporize your profits in a heartbeat.

This is where your local network proves its worth. Having a trusted team of Dallas-based contractors, plumbers, and electricians on speed dial is what keeps a project on schedule and on budget. For investors trying to figure out where to spend their money, identifying profitable renovations is the key to maximizing that final sale price in the Dallas market.

A successful Dallas fix-and-flip isn’t just about making a property look new; it’s about making smart, market-driven improvements that directly translate to a higher After Repair Value (ARV). The profit is made in the planning, not just the sale.

This strategy isn’t without its risks, from surprise foundation issues to a sudden cooling in the Dallas market. That’s why a contingency fund of at least 10-15% of your total renovation budget is an absolute must. Think of it as your safety net against the unknown in North Texas real estate.

Adding Value That Resonates with Dallas Buyers

Flipping houses in Dallas is nothing new, but standing out from the crowd means knowing exactly what today’s buyers want. Sustainability and smart home features are no longer niche interests; they’re creating real opportunities to add value in the DFW area. Things like energy-efficient windows, smart thermostats, and quality insulation can seriously boost a property’s appeal and its immediate resale value.

To pull off a truly profitable flip in Dallas, you have to focus on the upgrades that deliver the best bang for your buck.

- Kitchen and Bathroom Remodels: These are, and always have been, the highest-impact renovations in Dallas. Think modern fixtures, quality countertops, and fresh, updated appliances.

- Curb Appeal: First impressions are everything for a Dallas property. You can add thousands to the perceived value with simple things like fresh landscaping, a new front door, or a crisp coat of exterior paint.

- Smart Home Technology: Integrating features like smart thermostats, security systems, and lighting controls speaks directly to the tech-savvy buyers dominating the Dallas market.

By zeroing in on these strategic enhancements, you’re not just creating a more attractive home—you’re engineering a more lucrative exit from your Dallas investment.

Using Refinancing to Unlock Dallas Property Equity

Who says a profitable exit has to involve a sale? For savvy Dallas investors, the “refinance and hold” strategy is a powerful way to pull capital out of a property without actually letting go of a high-performing asset.

Think of it like this: you’ve built up a vault of equity inside your Dallas property. A refinance lets you open that vault, take out cash, and put it to work elsewhere—all while your original investment keeps appreciating and making you money.

This move is typically done through a cash-out refinance. It’s pretty straightforward: you replace your current mortgage with a new, larger one. The difference between the two loans comes back to you as tax-free cash. You can then use that liquidity as a down payment on your next Dallas property, letting one successful investment fund the next.

When Does Refinancing Make Sense in Dallas?

Now, this isn’t a strategy you can just use anytime. Its success really depends on the right market conditions and your property’s specific performance. In Dallas, you want to see a few key factors line up before you even consider it.

- Rapid Appreciation: Your Dallas property needs to have jumped in value. If you’re in a hot Dallas submarket like Bishop Arts or the M-Streets where values have surged, you’ve likely got a nice chunk of equity ready to be tapped.

- Favorable Interest Rates: The goal is to lock in a new loan at a rate that doesn’t torpedo your monthly cash flow. Lower rates make this strategy much more appealing and, frankly, profitable for Dallas properties.

- Strong Rental Income: Your property’s cash flow absolutely must be able to support the new, higher mortgage payment. No exceptions.

A cash-out refinance is a strategic tool for scaling your portfolio, not just a piggy bank for quick cash. It only works if your Dallas property’s Net Operating Income (NOI) can easily cover the new debt service. That’s what proves to lenders that your asset is financially healthy.

The Critical Role of Net Operating Income

Let’s talk about the single most important number lenders will zero in on: your Dallas property’s Net Operating Income (NOI). This is your total revenue minus all operating expenses.

A high NOI screams that your Dallas investment is well-managed and profitable, which directly impacts the kind of refinancing terms you’ll get. Better property management leads to a healthier NOI, which in turn unlocks more favorable loan conditions. It’s a simple, powerful connection.

This link between on-the-ground operational skill and financial opportunity is becoming more important than ever. Refinancing has always been a key exit strategy, giving you a partial cash-out without a full sale. As borrowing costs shift, your ability to run a tight ship is what boosts the NOI that makes a successful refinance possible for your Dallas asset.

In fact, investors with strong operational chops managed 37% of all real estate assets under management in 2023. You can find more details on this trend in McKinsey’s Global Private Markets Report. The takeaway is clear: by actively improving your Dallas property’s day-to-day performance, you are directly paving the way for a much more successful refinance.

Advanced Exit Strategies for Seasoned Dallas Investors

Once you start operating at scale, managing a portfolio of Dallas properties demands a different playbook. Standard exit strategies just don’t cut it anymore. When your holdings grow, selling off Dallas properties one by one becomes a massive time sink and an administrative nightmare. This is where the heavy hitters come in—advanced, large-scale exit strategies built for maximum efficiency in the North Texas market.

For a serious portfolio holder in Dallas, one of the most powerful moves is the portfolio sale. Instead of listing a dozen properties individually, you bundle them up and sell them in a single, clean transaction to one large buyer. This buyer is almost always an institutional fund or a private equity group looking to deploy a ton of capital into the hot North Texas market.

Weighing a Portfolio Sale

A portfolio sale in Dallas is all about trade-offs. The huge plus is efficiency. You’ve got one negotiation, one closing, and one point of contact. This massively cuts down on the time and paperwork required to liquidate your Dallas assets.

But that convenience usually comes at a cost. Big-time buyers expect a discount for taking on so many Dallas properties at once. This often means you’ll get a lower price per door than you would on the open market. The real question is whether the speed and simplicity are worth more to you than the potential hit on your total proceeds. You can dive deeper into figuring out the right approach in this detailed Dallas real estate investment guide.

The Rise of Real Estate M&A

An even more sophisticated play is to treat your entire Dallas real estate holding company like any other business you’d sell. This is essentially a Mergers and Acquisitions (M&A) deal, where the buyer acquires your whole operation—the properties, the management structure, the brand, everything. From a tax standpoint, this can be a much savvier move and helps you sidestep the headache of transferring individual property titles.

While traditional property sales are still the norm, M&A is becoming a much bigger piece of the strategic exit puzzle. After a global dip in 2023, commercial real estate M&A came roaring back by mid-2024, with North America seeing a 50% jump in activity. What’s really telling is that 68% of investors surveyed plan to ramp up their M&A activity, showing a clear shift toward acquisitions as a go-to strategy. You can read more about this trend in Deloitte’s commercial real estate outlook.

For Dallas investors, this is great news. It means there’s a growing pool of institutional money actively hunting for entire portfolios, especially in red-hot Dallas sectors like multifamily and industrial logistics.

Choosing Your Ideal Dallas Exit Strategy

Picking the right real estate exit strategy isn’t about finding some magic formula that works for every Dallas investor. Far from it. The perfect exit for a high-rise in Uptown will look completely different from the best move for an undervalued fixer-upper in a rapidly changing Dallas neighborhood.

Your decision really boils down to a few core questions: What are your financial goals? How much risk are you comfortable with? What kind of Dallas property do you actually own? And what’s the current pulse of the DFW market? If you’re chasing a quick capital gain to roll into the next deal, that’s one path. If you’re playing the long game to build wealth through steady appreciation in Dallas, that’s another entirely.

Matching Your Strategy to Your Dallas Asset

Often, the Dallas property itself will tell you which exit makes the most sense.

Think about it: a stabilized, cash-flowing apartment complex in a prime Dallas area like Highland Park is a perfect candidate for a traditional sale or a 1031 exchange. You’ve already done the hard work of maximizing its value, so your exit is all about cashing in on that success and maybe rolling those gains into an even bigger Dallas asset.

On the flip side, let’s say you’re holding an older, single-tenant commercial building in a Dallas area where demand is starting to heat up. In that case, a fix-and-flip approach or a major renovation before selling is the obvious play. Here, your goal is to force appreciation through your own efforts, not just wait for the Dallas market to do the work for you.

The most effective real estate investment exit strategies are proactive, not reactive. When you truly understand your property’s potential and the local Dallas market dynamics, you can architect an exit that squeezes every last drop of value out of the deal instead of just reacting to whatever the market throws at you.

Making the Final Call

Ultimately, your choice demands a clear-eyed look at what’s happening on the ground in Dallas right now. Keeping up with local DFW economic indicators isn’t just good advice; it’s essential. For a fresh perspective, it’s always a smart move to review Dallas real estate insights and key 2024 trends to make sure your strategy lines up with today’s opportunities.

This isn’t just theory—it’s how you make smart, actionable decisions. By carefully weighing your goals, risk level, and property type against the vibrant Dallas market, you can confidently pick the exit strategy that best locks in your financial success.

Frequently Asked Questions

When it comes to real estate exit strategies in Dallas, a few key questions pop up again and again. Here are some straightforward answers to the most common queries I hear from investors navigating the DFW market.

When Is the Best Time to Sell an Investment Property in Dallas?

Timing the Dallas market is a blend of art and science. Sure, spring and early summer traditionally see a flurry of activity as more buyers come out to play, but the real secret lies in watching the broader economic cycles in North Texas.

To truly maximize your profit, you need to keep a close eye on key DFW metrics. Think big-picture stuff: major corporate relocations in Dallas, job growth numbers, and, of course, local housing inventory levels. Selling when inventory is tight and buyer demand is surging will almost always get you a better price, regardless of what the calendar says. For a deeper dive, you can learn more about Dallas real estate market trends and insights to help you pinpoint that perfect moment.

How Does a 1031 Exchange Work as an Exit Strategy in Texas?

Think of a 1031 exchange less as a final exit and more as a strategic pivot for a Dallas investor. It’s a powerful tool that allows an investor to sell a property and roll the entire profit into a new, similar investment, effectively kicking the capital gains tax can down the road.

In Texas, the timeline is non-negotiable and incredibly strict: you have just 45 days from your sale date to formally identify a replacement property. Then, you have to successfully close on that new property within 180 days. It’s a game-changer for Dallas investors looking to scale their portfolio without giving up a huge chunk of their gains to taxes.

What Are the Biggest Risks of Flipping Houses in DFW?

Flipping in a hot market like Dallas-Fort Worth comes with its own set of challenges. The biggest pitfalls I see are underestimating the cost of renovations and being overly optimistic about the property’s After Repair Value (ARV) in Dallas. Material and labor costs can swing wildly, and one unexpected issue—like a hidden foundation problem in a Dallas home—can absolutely demolish your profit margin.

A sudden market shift or an unexpected jump in interest rates can also leave you holding onto a Dallas property much longer than you budgeted for. The flippers who consistently succeed in Dallas do two things religiously: they build a hefty contingency fund into every budget and they perform obsessive due diligence on hyper-local Dallas property values before they even think about making an offer.

Are you planning your next real estate move in Dallas? Whether you’re buying, selling, or investing, having an expert by your side makes all the difference. Contact Dustin Pitts REALTOR Dallas Real Estate Agent to get personalized guidance from a team with deep knowledge of the DFW market. Visit us at https://dustinpitts.com to start the conversation.