If you’re getting ready to sell your home in Dallas, one of the first and most critical pieces of paperwork you’ll encounter is the Seller’s Disclosure Notice. This isn’t just another form to check off your list. It’s a foundational document that provides a complete, honest history of your property’s condition for potential buyers.

Think of it as your home’s official “résumé.” It’s your chance to lay everything on the table, build trust, and kick off a smooth, transparent transaction.

What Every Dallas Seller Needs to Know

Selling a home in Dallas goes far beyond beautiful staging and slick marketing. It means meeting specific legal requirements designed to protect everyone involved—and the Seller’s Disclosure Notice is at the heart of it all.

In the fast-paced Dallas real estate market, a thoroughly completed disclosure is more than just a formality. It’s a powerful tool for building buyer confidence. It gives them a clear-eyed view of what they’re really buying, from the state of the air conditioning system that’s braved countless Texas summers to any known foundation issues—a common concern given North Texas’s expansive clay soil.

The Legal Foundation in Texas

Let’s be clear: this notice isn’t optional. It’s a state mandate. Texas law is very specific about a seller’s duty to be upfront about their property’s condition. This legal framework exists to prevent the nightmare scenario where a buyer moves in and discovers a huge, undisclosed problem, which almost always leads to stressful and expensive legal battles.

The Seller’s Disclosure Notice is your first line of defense against future litigation. Honesty and thoroughness are not just ethical; they are your legal shield.

The rules are formally laid out in state law. Under Section 5.008 of the Texas Property Code, sellers of single-unit residential properties are required to provide this written notice. It must detail the property’s condition and any known defects, covering everything from the structure and plumbing to electrical systems and environmental hazards.

To give you a clearer picture, here’s a quick breakdown of what this legal requirement entails for a Dallas seller.

Core Components of the Texas Seller’s Disclosure

| Requirement | Description | Legal Basis |

|---|---|---|

| Written Notice | Sellers must provide a formal, written document detailing the property’s condition. | Texas Property Code § 5.008 |

| Comprehensive Scope | The notice covers all major systems, structural components, and potential hazards. | Texas Property Code § 5.008 |

| Known Defects | Sellers are obligated to disclose any defects or malfunctions they are aware of. | Texas Property Code § 5.008 |

| Mandatory Delivery | The notice must be delivered to the buyer on or before the effective date of the contract. | Texas Property Code § 5.008 |

This table highlights the non-negotiable aspects of the disclosure. It’s a serious legal document with real consequences if not handled correctly.

Why It Matters for Your Dallas Sale

For a Dallas seller, a complete and accurate disclosure does a few very important things. First, it shows you’re operating in good faith, which can make buyers feel much more confident about their offers. Second, it helps manage expectations from the get-go, so the buyer knows exactly what they’re getting into before signing on the dotted line.

Most importantly, it fulfills your legal duty and dramatically reduces your risk of being sued after the sale. This proactive transparency, paired with professional guidance, is a cornerstone of a successful closing. For a closer look at getting your property ready for a top-dollar sale, you might want to review our guide on maximizing your home’s value with expert agent services. Combining a solid disclosure with smart sales strategy is how you win in the Dallas market.

When Is a Seller’s Disclosure Not Required in Dallas?

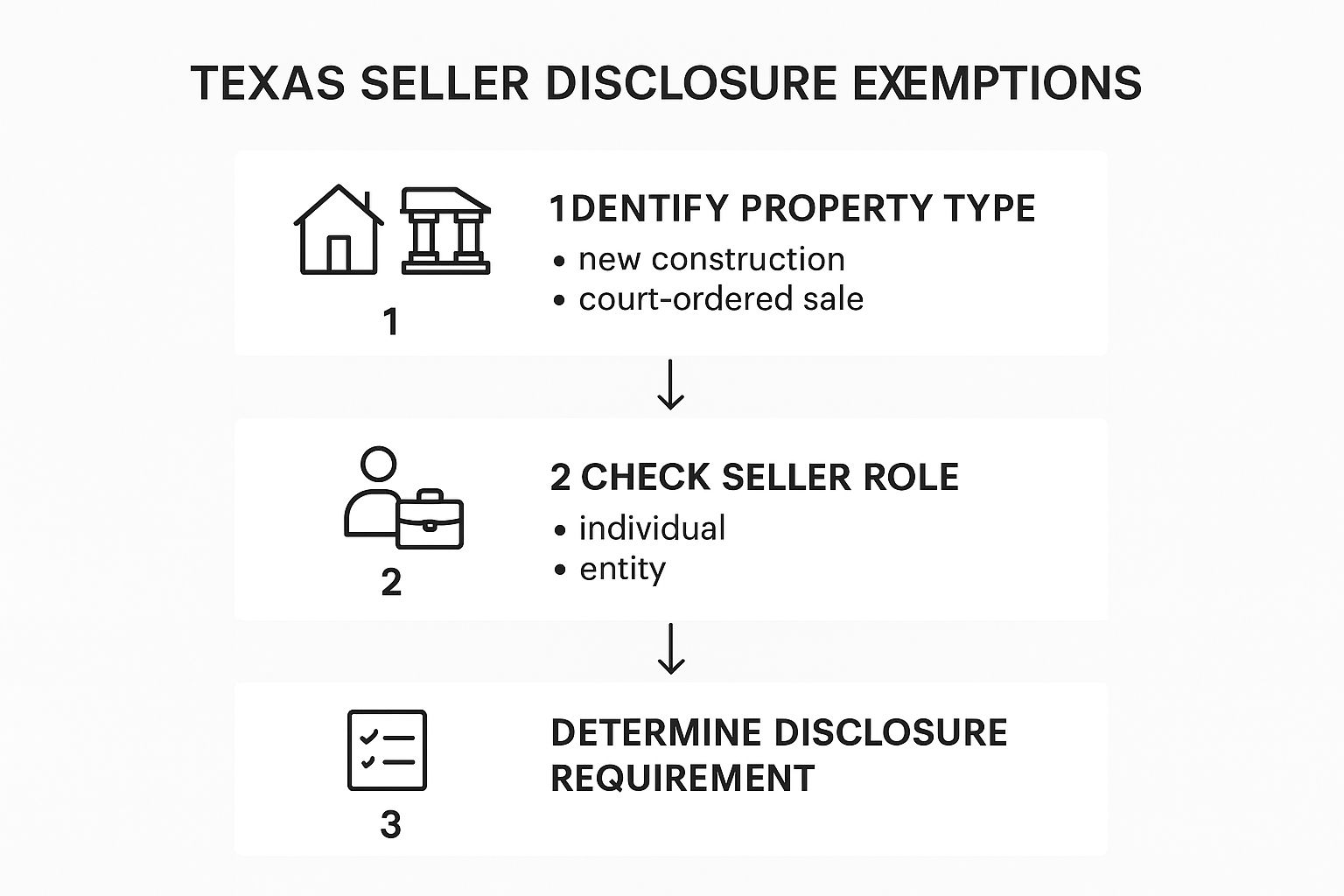

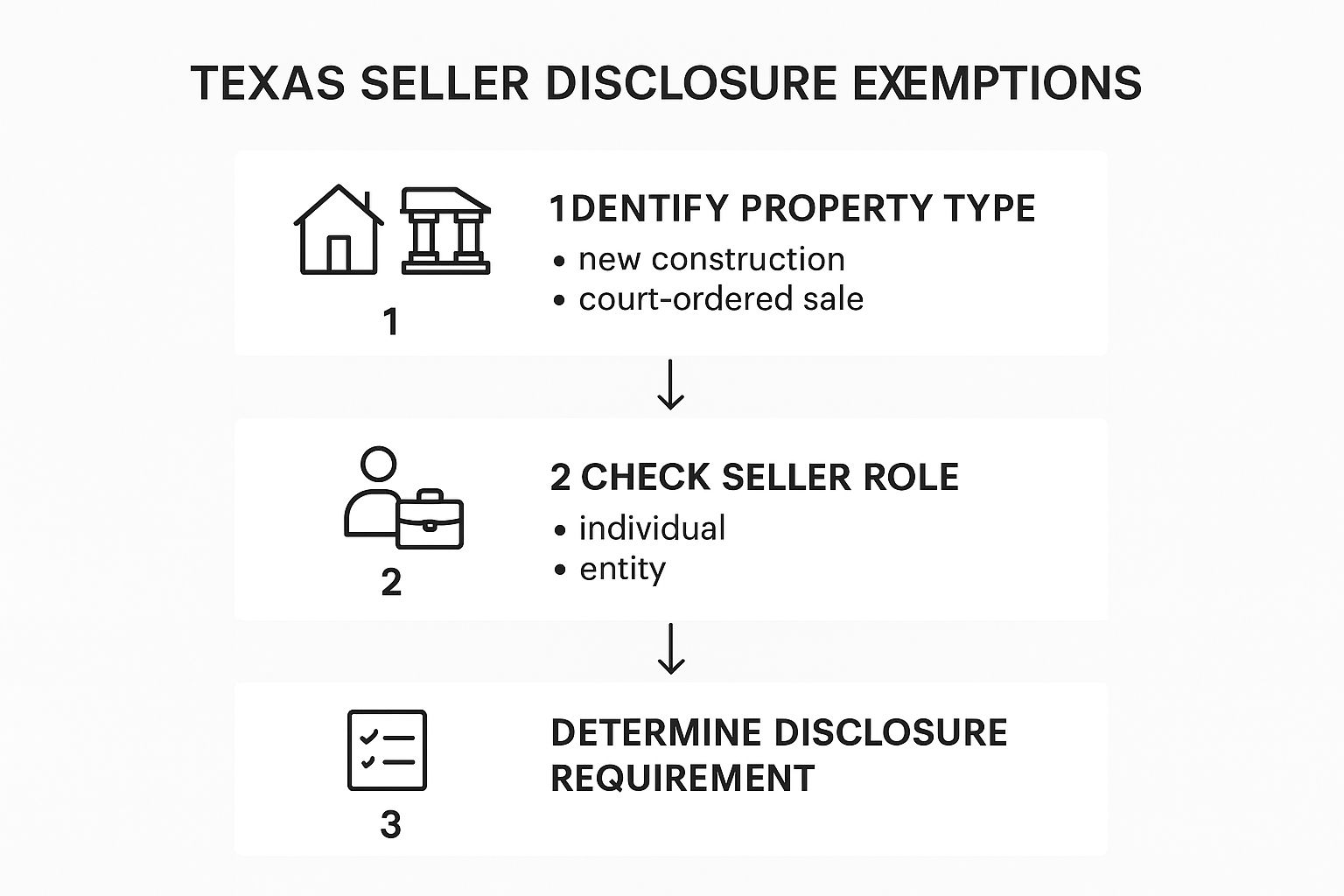

While the Seller’s Disclosure Notice is a staple in most Dallas real estate deals, it’s not an ironclad rule for every single sale. Texas law wisely carves out specific exemptions, and understanding them is key to knowing your legal duties when selling certain properties.

Think of it this way: the law recognizes that some sellers simply wouldn’t have the personal history with a home to provide a meaningful disclosure. For example, a bank that has foreclosed on a property in the M Streets has never lived there. They can’t honestly tell you if the dishwasher has a quirky rattle or if the back porch floods during a heavy Dallas rainstorm.

Key Exemptions Under Texas Law

Several common situations release a Dallas seller from the obligation to provide the notice. These aren’t just convenient loopholes; they are specific exceptions laid out in the Texas Property Code. It’s crucial to know if your sale falls into one of these categories before you put your home on the market.

Here are some of the most common exemptions you might run into in the Dallas area:

- Foreclosure or Bankruptcy Sales: When a lender sells a property after a foreclosure or a trustee sells it as part of a bankruptcy, a disclosure isn’t required.

- Court-Ordered Sales: If a sale is mandated by a court—think probate or divorce proceedings—it’s also exempt.

- Transfers Involving the Government: Selling your property to a government agency? You don’t need to provide a disclosure.

- Sales of New Homes: Builders selling a brand-new, never-occupied residence are not required to provide the standard notice.

The logic behind these exemptions is pretty practical. They mostly apply when the seller is an entity or person who hasn’t lived in the home and, therefore, can’t truthfully vouch for its condition from firsthand experience.

This distinction is fundamental to understanding the spirit behind the seller’s disclosure Texas requirements.

Specific Property and Transaction Types

Beyond those broad categories, Texas law gets a bit more granular with other exemptions that are especially relevant in a diverse market like Dallas. For instance, certain sales are exempt based on the relationship between the buyer and seller or the nature of the property itself.

This includes transfers between co-owners or when you transfer a property into a living trust. Another key exemption applies if the value of the home itself is 5% or less of the property’s total value. You might see this scenario in the Dallas area with sales involving large, valuable tracts of land where the house is just a minor part of the deal.

Figuring out if you need to provide a disclosure is a critical first step for any seller. And if you’re a buyer trying to understand how these exemptions shape the market, our guide to Dallas 2024 housing insights can offer a clearer picture. Knowing these rules helps everyone involved move forward with confidence and clarity.

What Does “To The Best of Your Knowledge” Really Mean?

As you work through the seller’s disclosure Texas notice, you’ll see a specific phrase pop up again and again: “to the best of your knowledge” or simply “as far as you know.” This isn’t just some throwaway legal jargon. It’s the absolute core of your responsibility as a seller.

A lot of Dallas sellers get this wrong. They think it means they need to become a private investigator, poring over every inch of their home’s history or trying to guess what a home inspector might find. That couldn’t be further from the truth. The standard is much more personal—it’s all about your actual, present knowledge. What are you personally aware of, right here, right now?

Think of it like being a witness on the stand. You’re only asked to testify to the facts you know firsthand. You’re not expected to be a detective, a structural engineer, or a fortune teller. Your job is simply to be honest about the information you have.

Actual Knowledge vs. What You Should Know

This standard draws a clear line in the sand. It separates what you actually know from what you think you should know or could have known. You aren’t required to hire an army of experts to inspect your own home before filling out the form. You just need to answer based on your own experience residing there.

For instance, if you know for a fact that the A/C unit needed a massive, expensive repair last summer after buckling under a Dallas heatwave, that’s something you must disclose. But what about a slow, hidden plumbing leak inside a wall that has never left a water spot or given you any trouble? If you don’t know it exists, you can’t be held responsible for not disclosing it. Simple as that.

This legal distinction is huge for both buyers and sellers. The fact that disclosures are based on the seller’s “belief and knowledge” is a cornerstone of Texas property law. This subjective standard means sellers are only on the hook for issues they genuinely know about. Of course, this can sometimes make things tricky for a buyer who discovers a problem after closing, only to have the seller claim they had no idea. You can dive deeper into how Texas courts view these disclosure duties on lonestarlandlaw.com.

The Golden Rule of Disclosure: Tell them what you know, and be upfront about what you don’t. Never, ever guess or speculate on the form. If you’re not sure, checking the “Unknown” box is a perfectly acceptable and legally sound answer.

Practical Tips for Nailing Your Disclosure

So how do you handle this in the real world? It all comes down to being precise and honest. When a question on the form brings up an old repair or a potential issue you’re a bit fuzzy on, just stick to the facts.

Here’s how to tackle a couple of common situations:

- On Old Repairs: Maybe the person you bought the house from mentioned foundation work, but you have no paperwork. No problem. You can simply state that: “Previous owner stated the foundation was repaired around 2012. Seller has no documents or further information.”

- On Iffy Conditions: What if you suspect something isn’t quite right but aren’t sure of the cause? Just describe what you’ve observed. For example: “Window in the back bedroom is sometimes stiff and difficult to open. The cause is unknown.”

This approach fulfills your legal duty completely without putting you on the line for information you simply don’t have. It’s the safest, most transparent way to complete your seller’s disclosure Texas notice and protect yourself from headaches down the road.

How to Complete the Disclosure Form Section by Section

At first glance, the official Texas Seller’s Disclosure Notice can look pretty intimidating. It’s a multi-page beast, packed with checkboxes, legal jargon, and what feels like a million questions. But here’s a better way to think about it: it’s not a test. It’s more like a structured interview about your home’s life story.

Your job is to walk through it systematically, answering every question honestly based on what you personally know. This guide will break down the key sections, translating the official language into plain English and using real-world Dallas scenarios to show you exactly how to tackle it.

The Official TREC Form

First things first, let’s get familiar with the document itself. The Texas Real Estate Commission (TREC) provides the standard form that nearly every seller in the state uses. Just seeing it and understanding its layout is a great way to demystify the process.

Here’s a snapshot of what you’ll be working with.

See? When you break it down, it’s just a series of straightforward questions about your property’s components and history. Nothing to be scared of.

Structural and System Components

This is usually the longest part of the notice, and for good reason. It digs into the condition of everything from your roof and foundation to your plumbing and HVAC systems. Honesty is absolutely your best policy here.

For Dallas sellers, this section is especially critical. Think about our infamous expansive clay soil. When the form asks about the foundation, you must disclose any known previous repairs. It’s a common issue in North Texas, so if you had piers installed to level the house, you need to say so. If you have the paperwork, even better—get ready to provide it.

The same goes for your HVAC system. Let’s be real, our summers are brutal. If your unit struggled to keep up and needed a major repair last August, that’s a material fact a buyer needs to know. You’ll simply check “Yes” to having knowledge of a defect and then explain the issue and the repair in the space provided.

- Appliances and Fixtures: This part covers items like your oven, dishwasher, ceiling fans, and smoke detectors. You’ll note which items are present and whether you’re aware of any problems.

- Systems (Plumbing, Electrical, HVAC): Here, you’ll report any known issues with the core systems that make the house run. This includes everything from a chronically slow drain to a circuit breaker that trips every time you use the microwave.

The guiding principle is simple: if you know about it, you disclose it. This includes past problems that have already been fixed. The repair itself is part of the property’s history, and it’s something the new owner deserves to know.

Environmental and Property Conditions

This part of the seller’s disclosure Texas form shifts focus to the property itself, covering issues like flooding, termites, hazardous materials, deed restrictions, and any homeowners’ association (HOA) rules.

As you can see, the obligation to disclose depends on both the type of property and your role in the sale.

For instance, one question asks about “improper drainage.” If your backyard in a Dallas neighborhood like Lakewood turns into a small lake every time there’s a heavy downpour, that’s exactly the kind of thing you need to mention.

Likewise, if your property is part of a powerful HOA with very specific (and strict) rules about exterior paint colors or fence heights, that information is critical for a potential buyer. Filling out each section with care and complete honesty is the key to completing the form without stress and with total legal compliance.

Common Disclosure Mistakes Dallas Sellers Make

Think of the seller’s disclosure as your shield. An accurate, honest disclosure protects you from future trouble, but a sloppy or rushed one can leave you wide open to risk. It might seem like just another form, but getting the seller’s disclosure Texas requirements right is critical for a clean, successful sale in Dallas.

The most common mistake sellers make is simply rushing through it. It’s tempting, to be sure. You want to check the boxes and move on. But this isn’t just paperwork; it’s a legal document where every checkmark and every handwritten note matters. Taking your time to really think through each question is the single best thing you can do to protect yourself.

Guessing Instead of Disclosing the Unknown

Another major pitfall is guessing. If you aren’t 100% sure about the age of the roof or the exact details of a repair from five years ago, it’s far safer to mark “Unknown” than to invent an answer. Your legal duty is to disclose what you actually know, not what you think might be true.

Speculation can easily be twisted into misrepresentation. Let’s say you guess the roof is about 10 years old, but it’s really 20. If it fails right after the new owner moves in, they could have a strong case that you misled them. Being honest about what you don’t know is just as crucial as disclosing what you do.

Downplaying Known Issues

It can be tempting to soften the truth about a known problem. Don’t do it. Describing a recurring plumbing blockage as a “slow drain” or conveniently forgetting to mention that the A/C unit can’t keep up with a blistering Dallas August is a gamble you don’t want to take.

Buyers are smart, and their inspectors are thorough. They will find out the full story. If they feel you were intentionally deceptive, what could have been a simple negotiation point can escalate into a nasty dispute or even a lawsuit.

A critical—and often overlooked—mistake is failing to update the disclosure. If a major Dallas hailstorm damages the roof or the water heater fails a week before closing, you are legally required to amend the notice to reflect the property’s new condition.

Failing to Update the Disclosure

Your Seller’s Disclosure Notice isn’t a “one and done” document. It has to be accurate all the way up to the closing table. If a new issue pops up—no matter how inconvenient the timing—you must disclose it in writing. This keeps the transaction transparent and prevents the buyer from being blindsided by a last-minute surprise.

Juggling all these obligations can feel overwhelming. That’s why having a clear roadmap, like our home selling Dallas checklist, is so valuable for making sure nothing falls through the cracks. Steer clear of these common mistakes, and you’ll safeguard your sale and ensure a much smoother transfer of ownership.

Your Seller’s Disclosure Questions Answered

Navigating the seller’s disclosure Texas requirements can feel like walking a tightrope. You’re trying to be honest and meet your legal duties, but you also don’t want to needlessly spook a great buyer. It’s a delicate balance.

To help clear things up, let’s tackle some of the most common and pressing questions we hear from Dallas sellers. These aren’t just hypotheticals; they are real-world situations that pop up all the time and knowing how to handle them is key to a smooth, legally sound sale.

What Happens if I Fail to Provide the Disclosure on Time?

In real estate, timing is everything, and that’s especially true with the disclosure notice. Texas law is crystal clear: you have to get the completed and signed form to the buyer on or before the day your purchase contract becomes effective.

If you miss that deadline, you hand the buyer a huge piece of leverage. The law gives them the right to terminate the contract for any reason at all, right up until the closing day. Think about that—it’s a powerful escape hatch that puts your entire Dallas home sale at risk.

Am I Required to Disclose a Death on the Property?

This is a really sensitive topic that causes a lot of confusion. The short answer is no, you are not legally required to disclose a death that happened at the property from natural causes, suicide, or an accident that had nothing to do with the home’s condition.

The key distinction, however, is how the person died. If a death was the direct result of a property defect—say, from faulty wiring or a structural collapse—you absolutely must disclose the underlying problem with the property. The focus is always on the physical condition of the house, not the personal events that occurred within it.

You are legally protected from having to disclose these personal events. Your focus should remain squarely on the physical state of the property and its systems.

Should I Disclose Repairs Made Years Ago by a Previous Owner?

This comes up a lot, especially with the beautiful, older homes you find all over Dallas, from the M Streets to Preston Hollow. The rule of thumb is this: if you have actual knowledge of a major repair, even one done by a prior owner, it’s always best to disclose it.

For instance, if the seller you bought the house from mentioned they had foundation work done in 2010 and even gave you the paperwork, that’s information you need to pass on. You can simply state the facts as you know them: “Seller was informed by previous owner that foundation repairs were performed. See attached documents.”

Even if the information is fuzzy, disclose what you know. An honest statement like, “Seller is aware of a prior foundation repair but has no specific details or paperwork,” is the safest route. It’s always better to share what you know, even if it’s incomplete.

Can a Buyer Sue Me After Closing for a New Problem?

Yes, a buyer can sue you after the sale closes, but whether they have a real shot at winning is a different story. It all comes down to what you knew and when you knew it, which is why the Seller’s Disclosure Notice is your best friend.

If a buyer uncovers an issue that you genuinely had no idea about, they will have a very tough time proving you committed fraud or intentionally misrepresented the property. The law judges you based on your actual knowledge when you filled out the form.

However, if they can produce evidence that you knew about a defect and deliberately hid it, you could be in for a serious legal battle and be on the hook for damages. This is exactly why being thorough and honest on your seller’s disclosure Texas form is so critical. It’s your documented proof that you acted in good faith.

Navigating the complexities of a Dallas home sale requires more than just filling out forms—it requires expert guidance. At Dustin Pitts REALTOR Dallas Real Estate Agent, we ensure our clients are fully prepared, protected, and positioned for a successful closing. If you’re ready to sell your Dallas property with confidence, visit us at https://dustinpitts.com.