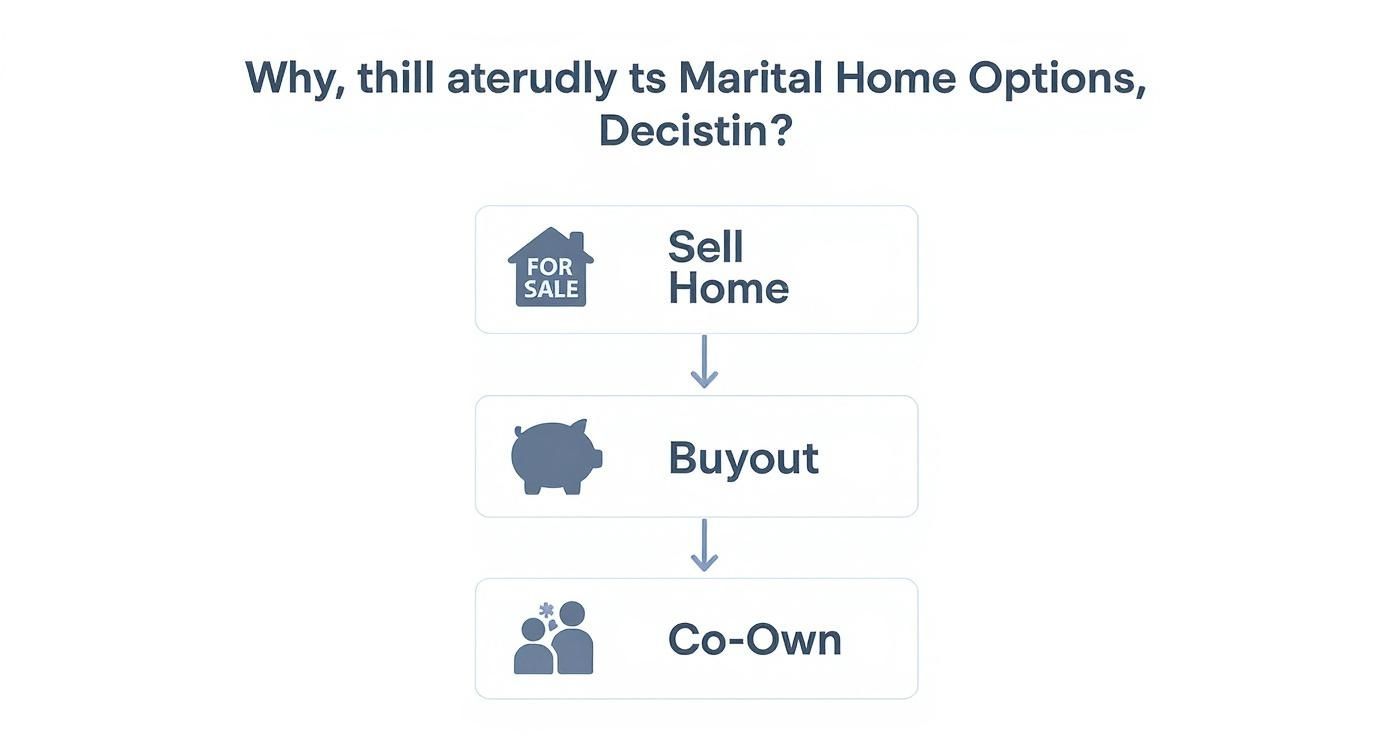

When you’re going through a divorce in Dallas, figuring out what to do with the house is often the biggest financial and emotional hurdle. It’s usually your largest shared asset, and untangling it requires a clear-headed strategy. Essentially, you have three paths: sell the house and split the profit, have one spouse buy out the other, or continue to co-own the property for a while. Making this decision is the first real step toward your new, separate financial life.

Your Options for the Marital Home in a Dallas Divorce

The moment a divorce is on the table, the question of the house looms large. It’s not just a building; it’s a home filled with memories, which makes every decision feel heavy. In Texas, we have community property laws, which means most assets you bought or paid for during the marriage—including your home—are typically considered to belong to both of you equally. That’s our starting line.

This isn’t just a financial transaction; it’s deeply personal. But the numbers don’t lie. Data shows that 65–70% of divorces involve some kind of disagreement over the home, and for many individuals, that house makes up 60–70% of their total net worth. It’s the biggest piece of the pie.

This decision tree gives you a bird’s-eye view of the three main routes you can take.

Each of these paths—selling, a buyout, or co-owning—leads to a very different outcome, both financially and personally. It pays to think them through carefully.

The Three Core Paths

The most common and often cleanest choice is to sell the house and divide the money. It’s straightforward. This route gives both of you a clean financial break, freeing up the equity tied up in the home so you can both start fresh. It completely severs the financial ties to that property—no more shared mortgage payments, property taxes, or arguments over who will pay for a new water heater.

Another popular option is a spousal buyout. This is where one of you “buys” the other’s share of the house. To do this, the person staying usually has to refinance the mortgage into their name alone and pay the other spouse their cut of the equity. It’s a great solution if one person is emotionally attached to the home. The biggest roadblock? Qualifying for that new, larger mortgage on a single income, which can be tough in the competitive Dallas real estate market. This transfer of ownership is finalized with a legal document, and it’s important to understand what is a quitclaim deed because it’s often part of this process.

The goal is to transform an emotional asset into a liquid one with as little conflict as possible. Choosing the right path depends entirely on your financial circumstances and your ability to cooperate.

A less common but sometimes necessary option is deferred co-ownership. Here, you both stay on the title and mortgage for a set amount of time. This might be done to wait for a better real estate market. If you go this route, your divorce decree must spell out every single detail: who lives there, who pays for what (mortgage, repairs, utilities), and exactly when and how the house will eventually be sold. Getting this in writing prevents a world of headaches later. For a deeper dive, there’s some excellent legal guidance on selling your home during a divorce in Texas that covers these very issues.

To help you visualize which path might be right for your situation, I’ve put together a simple decision matrix. Think of it as a cheat sheet for weighing the pros and cons of each option against your personal circumstances.

Decision Matrix for Your Dallas Home During Divorce

| Option | Best For… | Key Challenge | Dallas Market Consideration |

|---|---|---|---|

| Sell & Split | Individuals seeking a clean financial break and wanting to move on independently. | Agreeing on a list price, agent, and offer acceptance can cause friction. | A hot Dallas seller’s market can mean a quick sale and potentially higher profits to divide. |

| Spousal Buyout | One spouse has a strong emotional or practical reason to stay and can financially qualify. | Qualifying for a new mortgage on a single income is the biggest hurdle. | Rising home values in Dallas mean the equity payout to the exiting spouse will be larger. |

| Co-Ownership | Individuals who can cooperate and have a specific reason to delay the sale, like waiting for the market to improve. | High potential for future disagreements over expenses, maintenance, and the eventual sale process. | Can allow you to wait for a more favorable market, but you’re also exposed to market downturns. |

Ultimately, there’s no single “best” answer—only the one that works for the two of you. A good Dallas divorce attorney and a real estate agent experienced in these situations can help you navigate the complexities and arrive at the best possible outcome.

Navigating the Legal Side of a Dallas Property Sale

When you’re selling a home during a divorce in Dallas, you’re not just dealing with the real estate market. You’re navigating a legal process first and foremost. Every decision is shaped by court orders, not just neighborhood comps.

Trying to sidestep the legal framework laid out by the Dallas County courts is a surefire way to create more conflict and expensive delays. Think of it this way: the entire process, from putting up the “For Sale” sign to handing over the keys, has to be in perfect alignment with what a judge has ordered.

It usually starts with what are called temporary orders. These are critical, setting the ground rules while the divorce is still in progress. They provide clear answers to pressing questions like, who gets to live in the house? And, just as importantly, who is on the hook for the mortgage, property taxes, and insurance?

Without these orders in place, both of you remain legally tied to the mortgage. A single missed payment can wreck both of your credit scores, no matter who is actually living there.

Establishing Clear Rules of Engagement

In a divorce home sale, ambiguity is your worst enemy. The goal is to get everything you’ve discussed out of the verbal stage and into a legally binding agreement. A classic sticking point is simply choosing a real estate agent. If you and your spouse can’t agree, a Dallas judge won’t hesitate to appoint a neutral agent, effectively taking the control right out of your hands.

The best way to prevent this is by making your settlement agreement incredibly specific. It needs to be a detailed roadmap for the entire sale.

- Listing Price Agreement: Settle on the initial asking price for your Dallas home. Just as crucial, spell out a plan for how and when you’ll agree to price drops if the house sits on the market.

- Offer Acceptance Protocol: Define the lowest offer you’re both willing to accept. This simple step can stop one person from torpedoing a good offer out of spite or because they have unrealistic expectations.

- Repair and Staging Costs: Decide exactly how you’ll handle the cost of necessary repairs or professional staging. Will it be a clean 50/50 split? Or will one person front the money and get reimbursed at closing? Get it in writing.

A well-crafted legal agreement sees the potential roadblocks before you hit them. It’s not about a lack of trust; it’s about creating a solid business plan for a shared asset. This ensures things keep moving, even when communication between you has broken down.

Proactively Addressing Potential Legal Hurdles

A little foresight with your Dallas divorce attorney can save you from massive headaches later. For instance, what happens if your ex-spouse has a last-minute change of heart and decides they don’t want to sell? One of the biggest legal hurdles I see is a spouse simply refusing to sign the closing documents.

This single act can derail the entire sale, putting you in breach of contract with your buyer. A smartly written divorce decree can anticipate this, including language that gives one person the power to sign for the other if they refuse to cooperate. In more difficult situations, your attorney can file a motion with the court to force the sale, and a judge might even appoint a “special master” to sign the paperwork and get the deal done.

Another key piece of the puzzle is the real estate contract itself. Knowing what’s inside is crucial for both of you. You can get a clear breakdown of what is a real estate contract in our guide to better understand the legal documents you’ll be signing. This knowledge ensures everyone is on the same page about their obligations to the buyer.

Ultimately, a sale grounded in solid legal planning protects everyone involved. By working with a sharp Dallas divorce attorney to draft detailed, enforceable orders, you pull the emotion out of the process. You can then treat the home sale for what it truly is: a major financial transaction that demands precision and clear thinking.

The Financial Reality of Dividing Home Equity

When selling a house during a divorce, the number one question is always the same: how does the money actually get split? It’s about more than just the sale price. To keep things fair and avoid any nasty surprises at the closing table, you have to get a firm grip on the real financial picture. Especially here in Dallas, where home values can be significant, knowing your true net proceeds is absolutely essential.

Your home’s equity isn’t just the sale price minus what you owe on the mortgage. The real number—the cash you’ll actually walk away with and divide—is what’s left after every single selling cost has been paid. It’s a crucial distinction that, in my experience, often gets lost in the emotional shuffle of a divorce.

Calculating Your True Net Proceeds

To get a clear-eyed view of the funds you’ll be splitting, you have to subtract several key expenses from that final sale price. Think of it as peeling back the layers to get to the financial core.

These deductions almost always include:

- Remaining Mortgage Balance: This is the big one. It’s the total amount you still owe the bank, and it gets paid off first thing at closing.

- Real Estate Agent Commissions: In the Dallas market, this typically runs 5-6% of the sale price. That fee is then split between your agent and the buyer’s agent.

- Title Insurance and Escrow Fees: These are standard costs in any Texas real estate deal that cover the legal transfer of the property.

- Seller Concessions: If you agreed to help the buyer with their closing costs to make the deal happen, that amount comes directly out of your pocket.

- Repair Costs: Did the buyer’s inspection turn up a few issues? Any money you agreed to spend on repairs gets deducted from the proceeds.

The financial fallout from selling a house in a divorce can be massive. For many individuals, their home represents 60–70% of their entire net worth, so how it’s divided is a huge financial event. When disagreements pop up, they can drag out legal fights for years and rack up serious costs. You can find more data on the financial side of divorce in this in-depth family law report.

A Realistic Dallas Home Sale Example

Let’s walk through a typical scenario for the Dallas area to see how this all shakes out in the real world. Say two individuals are selling their home in Lakewood for $700,000.

Here’s the breakdown:

- Final Sale Price: $700,000

- Remaining Mortgage: -$250,000

- Agent Commissions (6%): -$42,000

- Title Policy & Fees: -$6,000

- Agreed Repairs: -$2,000

- Buyer Closing Cost Concession: -$5,000

After all those costs are subtracted, the total net proceeds ready for division come to $395,000. That’s the number that truly matters—not the flashy $700,000 sale price.

Understanding the nuances of pricing is critical, especially when you need to achieve a fast sale to finalize divorce proceedings. Setting the right price from the start prevents costly delays and ensures you capture the home’s full market value. You can learn more about how to price a home for sale effectively to avoid common pitfalls.

Addressing Complex Financial Situations

Of course, not every divorce involves a simple 50/50 split of the proceeds. Texas is a community property state, but there’s room for complexity, especially when “separate property” enters the mix.

For instance, what if one spouse used a large inheritance (which is legally considered separate property) for the down payment on the Dallas house? In that case, they may have a right to be paid back for that specific contribution before the rest of the equity—the community property portion—is divided.

This is what’s known as a reimbursement claim. It’s not automatic. You have to be able to prove it with clear financial records, and it absolutely must be written into your final divorce decree to be enforced at closing. If it’s not legally documented, the title company will simply split the proceeds according to the court order, which usually means an equal division.

By doing these calculations upfront, both you and your spouse can move forward with a realistic view of what your financial futures look like. This kind of transparency takes the mystery out of the process, turning what could be an explosive emotional fight into a much more manageable business transaction.

How to Find the Right Dallas Real Estate Agent

When you’re selling a house during a divorce, let me be blunt: not just any real estate agent will cut it. This isn’t a normal sale. It’s a situation loaded with potential landmines—both legal and emotional—that most agents simply aren’t equipped to handle.

You don’t just need a top seller who knows the Dallas market. You need a skilled diplomat, a project manager, and a neutral third party all rolled into one. Choosing this person is one of the most critical decisions you’ll make in this entire process.

Why a Specialist Matters

Think about it. A typical agent is used to working with individuals who are on the same team, moving toward a common goal. But in a divorce, you’re dealing with two separate clients who may have conflicting interests and are likely communicating through lawyers. The agent’s ability to act as a calm, impartial buffer is everything.

A specialist in divorce sales acts as that neutral party. Their job is to provide objective, data-driven advice on pricing and negotiations without ever showing favoritism. They become the voice of reason when emotions inevitably run high.

They also understand the legal side of things here in Dallas. An agent experienced with divorce cases knows how to operate within the constraints of a court order and can work seamlessly with both of your attorneys. This specialized knowledge is what keeps the sale from getting derailed.

The goal here is simple: protect the asset. Your home’s equity can easily be eaten away by arguments and delays. An agent who specializes in divorce is trained to de-escalate conflict and keep everyone focused on getting the house sold for the best possible price.

Key Questions to Ask Potential Agents

When you start interviewing agents in the Dallas area, you have to dig deeper than their sales stats. You need to vet them specifically for their experience with divorce.

Here are the questions I’d be asking:

- “Have you sold homes for divorcing clients before?” Don’t just take a “yes.” Ask for a few (confidential, of course) examples of challenges they’ve navigated. What went wrong, and how did they fix it?

- “What’s your communication plan for two separate clients?” A pro will have a system. They should immediately talk about things like group emails or a shared portal to keep everything transparent and ensure both of you get the same information at the same time.

- “How do you handle disagreements on big decisions, like the list price or accepting an offer?” Their answer should be all about the data. They should talk about market analysis and facilitating compromise, not picking a side.

- “Are you comfortable working under the direction of a court order?” Their familiarity with legal documents and collaborating with attorneys is a huge tell. You want someone who sees this as standard procedure, not a complication.

Finding the right person is a huge first step, and it’s worth taking the time to understand how to choose a real estate agent who truly gets what you’re going through.

Red Flags to Watch Out For

Just as important as knowing what to look for is spotting the warning signs. You need to be on high alert for an agent who isn’t right for this unique job.

Pay close attention to these red flags:

- Taking Sides: If an agent says anything like, “Don’t worry, I’ll make sure you get what you’re owed,” run. Their job is to be 100% neutral.

- No Clear Process: Ask them to walk you through their process for managing communication and disputes. If they can’t give you a clear, specific plan, they don’t have one.

- Pressure to Settle: An agent pushing you to take a lowball offer just to “get it over with” is not protecting your financial interests. Their priority should be maximizing the sale price, period.

By being deliberate and choosing a Dallas real estate agent with proven experience in divorce sales, you’re not just hiring a salesperson. You’re bringing in a neutral professional whose sole focus is getting the best financial outcome for both of you. This single decision can be the difference between a messy, expensive ordeal and a smooth sale that lets everyone move on.

Getting Your Dallas Home Ready for the Market

Selling a home is never easy. But when you’re doing it in the middle of a divorce, the stress can feel overwhelming. The key is to shift your mindset and approach the entire process like a business transaction.

Your shared goal is to get the best possible price for your Dallas home. To do that, you need to present a united front to potential buyers, making calculated decisions on everything from the list price to who pays for professional staging. This isn’t about winning an argument; it’s about successfully closing a major financial deal.

Setting a Fair and Defensible Price

The listing price is often the first major hurdle. It’s common for one person to want a fast sale, suggesting a lower price, while the other believes the home is worth more and wants to hold out. This is where emotion needs to take a back seat to hard data.

Instead of both of you getting separate market analyses from different agents—which can lead to more conflict—I always recommend a more neutral path. The best way to get a number you can both agree on is to jointly hire a certified third-party appraiser. An appraiser has no skin in the game; they provide an unbiased, professional valuation based on strict industry standards.

That appraisal becomes your benchmark. It removes the guesswork and gives you a solid, fact-based starting point for your listing price. A home priced correctly from the start attracts more serious buyers and spends less time on the market, which is a win for everyone involved.

Depersonalizing Your Shared Space

This part can be tough, I won’t lie. Walking through a home and packing away years of memories is an emotional task. But it’s absolutely critical for a successful sale. A potential buyer can’t picture their future in the living room if it’s covered in photos from your past.

It’s time to transform “our home” into a market-ready “house.” Here’s what that looks like in practice:

- Tackle the clutter: Systematically go through every closet, cabinet, and storage space. Make a plan together for what gets sold, stored, donated, or tossed.

- Remove the personal touches: All personal photos and memorabilia need to be packed away. The goal is to create a clean, neutral canvas.

- Stage for success: Professional staging can make a world of difference. Even simple changes, like rearranging furniture to create a better flow or bringing in a few modern pieces, can dramatically boost a home’s appeal.

A mindset shift is essential here. You’re no longer decorating a home for yourself. You’re preparing an asset for its next owner. Thinking this way makes the difficult decisions about what to pack up much more straightforward.

Creating a Financial and Logistical Game Plan

When it comes to the logistics of selling, ambiguity is your worst enemy. To head off arguments before they start, you need to put a simple, clear agreement in writing. Think of it as a playbook for the sale.

This document should spell out everyone’s responsibilities and cover all the practical details.

Here’s what your agreement should include:

- Who pays for what? Decide how you’ll handle the costs for repairs, professional cleaning, landscaping, and staging. Will you split it 50/50? Or will one person cover the costs upfront and get reimbursed at closing? Get it in writing.

- How will you handle showings? Figure out the logistics. Will all requests go through your agent? Who is responsible for making sure the house is clean and ready on short notice? Set clear expectations.

- What’s the process for offers? Before you get your first offer, agree on your protocol. Decide on a minimum price you’ll consider and a timeframe for responding to buyers.

By laying out a clear roadmap, you take the emotion out of the day-to-day decisions. It allows your agent to do their job effectively and helps you both navigate the sale efficiently, so you can close this chapter and move on to the next.

Common Questions About Selling a Home in a Dallas Divorce

When you’re selling a house during a divorce in Dallas, the questions come fast and furious. It’s an emotional time, and Texas law adds its own layer of legal and financial complexity to an already stressful situation. Getting straight answers to these common questions can give you the clarity you need to move forward.

I’ve been in this business a long time, and these are the questions I hear most often from clients who are right where you are now.

Can My Spouse Force the Sale of Our House in a Dallas Divorce?

In a word, yes. A Texas court judge absolutely has the power to order the sale of your marital home. In our state, the standard for dividing property is what’s considered a “just and right” division. Selling the house and splitting the proceeds is often the cleanest way to achieve that.

If you and your spouse are at an impasse—you can’t agree on a buyout, and neither of you can afford to keep the home alone—a court-ordered sale becomes a likely outcome. The judge will look at the whole financial picture. Can one of you realistically maintain the mortgage, taxes, and upkeep while also buying out the other’s equity? If not, selling is usually the court’s go-to solution for an equitable split.

What Happens if My Spouse Refuses to Cooperate With the Sale?

This is a frustrating, but fixable, problem. Once the sale is ordered by a judge and written into your divorce decree, non-cooperation stops being a marital dispute and becomes a legal violation. A spouse who intentionally blocks the sale—by refusing to sign listing agreements, denying access for showings, or turning down perfectly good offers—can be held in contempt of court.

Your Dallas divorce attorney can file a motion to enforce the decree, which essentially asks the judge to force your ex-spouse to comply. If that doesn’t work, the court has another tool. A judge can appoint a receiver or a special master, which is a neutral third party who is given the authority to manage the entire sale. They can sign the documents on behalf of the uncooperative spouse and get the deal done.

The bottom line is the legal system has built-in ways to prevent one person from holding the process hostage. These measures are there to protect your shared asset and ensure the judge’s orders are followed.

How Are Home Sale Profits Taxed During a Divorce?

This is a big one, and you don’t want to get it wrong. The IRS capital gains tax exclusion is a huge financial benefit. Normally, if you’ve owned your home and lived in it as your main residence for at least two of the last five years, you can exclude a massive chunk of profit from taxes.

Here’s how it works:

- An individual can exclude up to $250,000 of profit.

- A married couple filing a joint tax return can exclude up to $500,000.

What’s really important here is that after the divorce, you can often each claim the $250,000 individual exclusion on your share of the profits. This is true as long as you both met the residency requirement before you split. This is not something to guess on, so make sure you talk to a Dallas-based tax professional to see how this applies to your specific numbers.

Who Pays the Mortgage While the House Is on the Market?

This needs to be spelled out, in writing, in a temporary court order or your final settlement agreement. A handshake deal or a verbal promise is a recipe for a credit score disaster.

You have a few options for handling this:

- The spouse who remains in the home makes the payments.

- You both agree to contribute a certain percentage or dollar amount each month.

- The payments are made from a specific joint account set aside for this purpose.

Without a formal, court-ordered plan, remember this: the lender doesn’t care about your divorce agreement. If both your names are on the mortgage, you are both legally on the hook. One missed payment dings both of your credit reports. Get it in writing to protect yourself.

Selling a home during a divorce is more than just a real estate transaction—it’s a major life transition. At Dustin Pitts REALTOR Dallas Real Estate Agent, we have the experience and sensitivity to guide you through it, focusing on the best financial outcome with the least amount of stress. If you’re facing this challenge in the Dallas area, reach out today to see how we can help you start your next chapter. Find your path forward at https://dustinpitts.com.