When you’re buying a home in Dallas, you’ll quickly hear the term “earnest money.” Think of it as a financial handshake—it’s your way of signaling to the seller that your offer is serious and you’re committed to seeing the deal through.

This deposit isn’t paid directly to the seller. Instead, it’s held safely by a neutral third party, like a title company in Dallas. Ultimately, your earnest money will take one of three paths: it gets applied to your closing costs, returned to you if you cancel under a protected contingency, or forfeited to the seller if you break the contract without a valid reason.

Your Earnest Money Deposit in a Dallas Home Purchase

Making an offer on a Dallas property is more than just naming a price. You need to show the seller you have “skin in the game,” and that’s precisely what earnest money does. It’s a good-faith deposit that gives sellers confidence you’re not just window shopping, but are a serious, qualified buyer ready to move forward.

This initial financial step is absolutely crucial, especially when you’re up against other buyers in competitive Dallas neighborhoods. A strong earnest money deposit can make your offer stand out. For example, in a sought-after area like the Lakewood Dallas suburban oasis, it tells the seller you mean business.

As you move through the home-buying process in Dallas, submitting your earnest money is one of the first major milestones. It’s soon followed by other key steps, like finalizing your financing and completing the transaction with professional loan signing services.

The Role of Your Deposit

This deposit is a standard part of the home-buying process in Texas, governed by the Texas Real Estate Commission (TREC) purchase contract. It’s important to remember that this isn’t the same as your down payment, which you’ll pay at the closing table. Earnest money is submitted shortly after your offer is officially accepted by the seller.

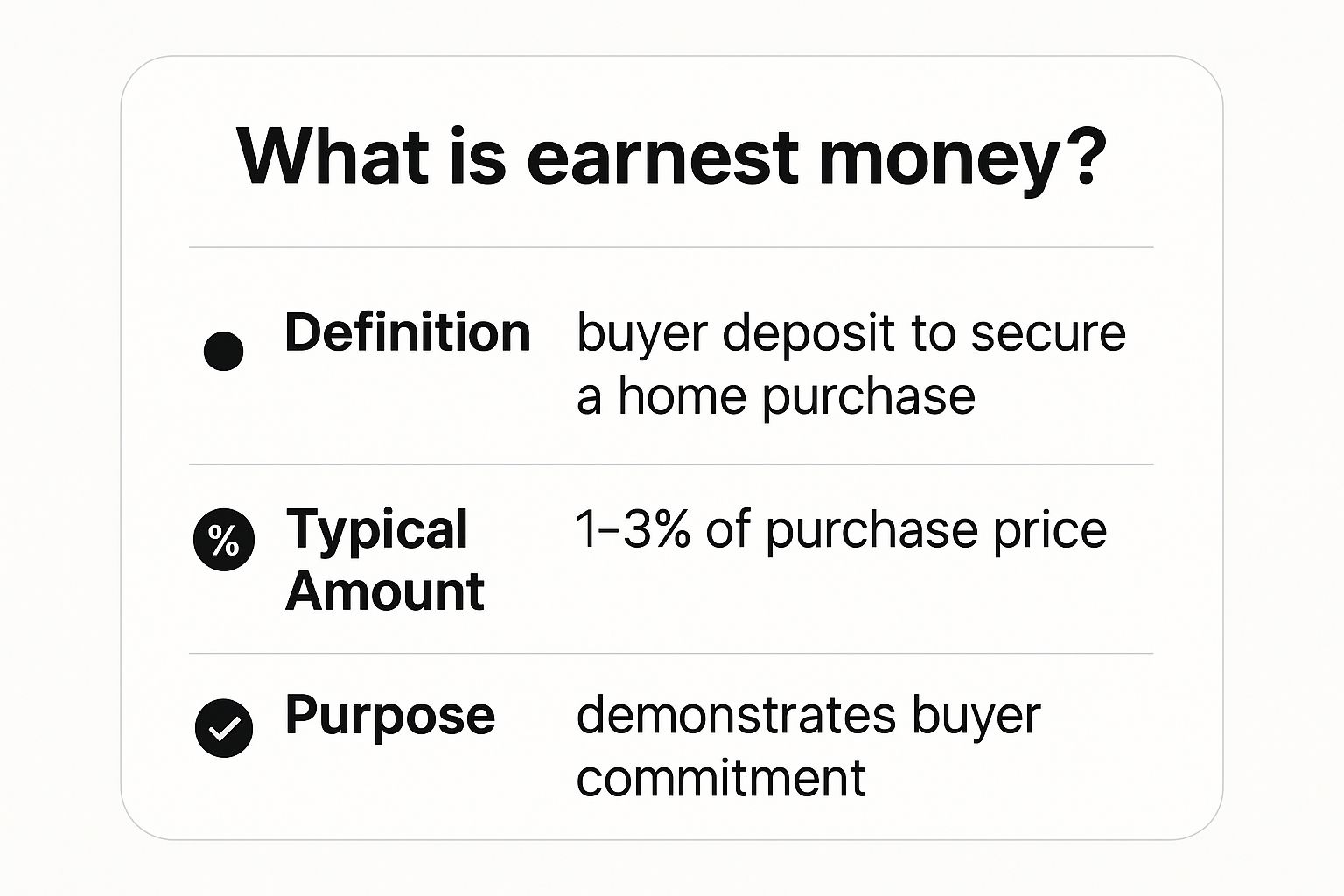

This visual breaks down how the deposit works as a commitment tool.

As you can see, the deposit solidifies your offer and is typically a small percentage of the total purchase price.

How Much Is Standard in Dallas?

So, how much should you expect to put down? While there’s no rigid rule, the amount in Dallas typically falls between 1% to 3% of the home’s purchase price.

The final amount can depend on a few things, like how hot the Dallas market is and what the seller is looking for. In a bidding war for a Dallas home, for instance, a larger earnest money deposit can give your offer a powerful edge over the competition.

Your earnest money isn’t an extra fee. If the deal goes through as planned, the full amount is credited back to you at closing. Most buyers choose to apply it directly toward their down payment or other closing costs.

Your earnest money is a key part of the Dallas homebuying puzzle. To make it even clearer, here’s a quick breakdown of where your deposit could end up.

The Three Paths for Your Earnest Money in Dallas

This table summarizes the three most common outcomes for your earnest money deposit during a Dallas property purchase.

| Scenario | What Happens to Your Deposit |

|---|---|

| Successful Closing | The money is credited back to you and applied toward your down payment or closing costs. |

| Protected Cancellation | You get a full refund if you back out for a reason covered by a contingency in your contract. |

| Contract Breach | The seller may be entitled to keep your deposit if you back out for an unprotected reason. |

Understanding these possibilities from the start helps you navigate the contract with confidence, knowing exactly how your funds are protected and what’s at stake in the Dallas market.

How Contract Contingencies Protect Your Deposit

Think of contract contingencies as your “get-out-of-deal-free” cards in a Dallas real estate transaction. These pre-negotiated “what if” clauses are built right into the standard Texas Real Estate Commission (TREC) contract, giving you a legal and penalty-free way to back out and get your earnest money back if things go south.

These aren’t shady loopholes. They are your safety net, ensuring you don’t get stuck buying a Dallas home with a cracked foundation or one you can’t get a loan for. Without these protections, your earnest money would be on the line the second the ink dries on the contract.

The Power of the Option Period

In Dallas, your single most powerful protection is the option period. This is a specific number of days—usually 7-10—that you literally buy from the seller for a small, non-refundable fee. This fee is your ticket to perform all your due diligence on the Dallas property.

During this window, you hold all the cards. You have the unrestricted right to terminate the contract for any reason. Found major foundation issues, a common headache with North Texas’s shifting soil? You can walk. Simply get cold feet and decide the house isn’t “the one”? You can walk then, too.

As long as you give the seller written notice before 5 p.m. on the last day of your option period, you get your entire earnest money deposit back. The only thing you lose is that small option fee you paid for the privilege.

The handling of earnest money deposits reflects important financial protections and customs across major real estate markets. Earnest money is usually refundable if the buyer decides not to proceed during a due diligence period, a designated window to conduct inspections, secure financing, and verify property details. Discover more about how this system balances buyer and seller interests on cellbunq.com.

Other Key Contingencies

Even after your option period expires, other specific protections for your deposit remain in place. Two of the most important in a Dallas transaction are:

- The Financing Contingency: What happens if your lender pulls the plug on your loan at the last minute? This contingency has your back. It protects your deposit if, through no fault of your own, your mortgage financing falls through.

- The Appraisal Contingency: If the Dallas home appraises for less than what you agreed to pay, this clause kicks in. It gives you the power to go back to the seller and renegotiate the price or to terminate the contract and walk away with your earnest money intact.

Keeping a close eye on these dates is absolutely critical. Once all your contingency periods have passed, your earnest money becomes “hard.” At that point, it’s generally non-refundable if you decide to back out of the deal.

When Your Earnest Money Is Refunded in a Dallas Deal

It’s the question every Dallas home buyer has on their mind: “How do I get my earnest money back if the deal falls apart?” Thankfully, the standard Texas real estate contract isn’t a one-way street. It comes with several built-in protections that clearly spell out when your deposit is safely returned.

Think of these clauses as your contractual exit ramps. They give you a legal and penalty-free way to terminate the agreement when specific conditions aren’t met. But these protections aren’t automatic. You have to act decisively within the strict timelines laid out in your Dallas contract, which means providing formal written notice to the seller before the clock runs out on that contingency period.

Common Refund Scenarios in Dallas

Let’s walk through a few real-world examples you’re likely to encounter in the Dallas market where you’d get your earnest money back.

- During the Option Period: You hire an inspector who finds significant foundation shifting—a classic issue in North Texas thanks to our expansive clay soil. The potential repair bill is just too high. If you terminate the contract during your 7-10 day option period, your earnest money is fully refunded.

- When Financing Fails: You were pre-approved, but your lender suddenly denies the final loan because of a last-minute shift in their underwriting rules. As long as you have a Third Party Financing Addendum in place and you meet its deadlines for notification, your deposit is protected.

- If the Appraisal is Low: The home appraises for $25,000 less than your offer, and the Dallas seller isn’t willing to negotiate down to the new value. The appraisal contingency in your contract gives you the power to walk away and have your earnest money returned.

In each of these situations, the earnest money is protected because the buyer is exercising a right specifically granted to them in the purchase agreement. The refund process is initiated once both parties sign a release of earnest money form, instructing the Dallas title company to return the funds.

Common Ways Dallas Buyers Forfeit Earnest Money

Losing your deposit is a buyer’s worst nightmare. It’s crucial to understand what happens to your earnest money when a deal goes sideways. While contract contingencies offer powerful protection, a few common missteps can put your deposit squarely at risk in a Dallas real estate transaction.

The most frequent mistake is a simple case of cold feet after the option period has expired. This crucial window is your time for due diligence and second thoughts. Once it closes, your earnest money is considered “hard,” meaning it’s fully committed to the deal. If you back out after this point for a reason not covered by another contingency, you’ll almost certainly forfeit the money.

Another frequent pitfall involves finances. A buyer might have a solid loan pre-approval, but then they go out and make a large purchase—like a new car—before closing day. This can torpedo their debt-to-income ratio, causing the lender to pull the loan approval. When that happens, the buyer is left in breach of contract and the seller has a claim to the deposit.

Missing Critical Deadlines

The Texas purchase contract is a calendar of strict, non-negotiable timelines. Missing a termination deadline, even by a single day, can be an incredibly expensive mistake.

For instance, your financing contingency will have a specific date by which you must notify the seller if your loan is denied. If you fail to send that notice on time, you lose that protection. Even if your loan is ultimately denied a few days later, the Dallas seller can keep your earnest money because you missed the contractual window to terminate.

The purchase agreement is a legally binding document. Dallas sellers are entitled to compensation if you fail to hold up your end of the deal without a valid, contractual reason. This is why paying close attention to dates and obligations is non-negotiable.

Ultimately, these scenarios all come down to discipline throughout the buying process. Strong preparation, which includes a solid grasp of how to negotiate house price and all contract terms, is your best defense against losing your deposit.

Navigating Earnest Money Disputes in Texas

So, what happens when a Dallas home deal collapses and both you and the seller believe you’re entitled to the earnest money? It’s a messy situation that can quickly turn a straightforward transaction into a complex, frustrating standoff.

In Texas, the title company plays a crucial but very specific role. Think of them as a neutral third party, simply holding the funds in escrow. A Dallas title company cannot release the earnest money to either party without getting identical, written instructions from both the buyer and the seller. The only other way the funds get released is with a formal court order. They won’t—and can’t—play judge or take sides.

This system is designed to protect everyone involved, ensuring the deposit isn’t handed over improperly. This transparent handling is a fundamental part of the property buying process, safeguarding both buyer and seller interests. You can find out more about how this framework supports real estate transactions at poems.com.sg.

The Dispute Resolution Path

When a disagreement over the earnest money pops up in a Dallas deal, there’s a clear path to follow. The process generally moves through these stages:

- Agent Negotiation: The first line of defense is your Dallas real estate agent. They’ll talk to the seller’s agent, point to the specific terms in the contract, and try to work out a resolution.

- Mediation: If the agents hit a wall, the next step is usually mediation. A neutral third party comes in to help both sides talk through the issues and hopefully find a compromise everyone can live with.

- Legal Action: As a last resort, either you or the seller can file a lawsuit in a Dallas court. At that point, a judge will review the case and issue a binding order telling the title company exactly how to disburse the funds.

The key takeaway here is that the Texas system is built to strongly encourage compromise. A long, drawn-out dispute freezes the earnest money indefinitely, which is a major headache for everyone. The seller can’t easily re-list the Dallas property with a potential cloud on the title, and the buyer can’t get their deposit back to start a new home search.

Dallas Earnest Money Questions Answered

When you’re navigating the fast-paced Dallas real estate market, it’s completely normal to have questions, especially when it comes to the financial side of things. Let’s tackle some of the most common and practical questions Dallas buyers have about earnest money. My goal is to give you direct answers for clarity and confidence.

How Much Earnest Money Is Normal for a Dallas Home?

In the competitive Dallas market, the standard starting point for an earnest money deposit is 1% of the purchase price. So, for a $500,000 home in a great Dallas neighborhood like Richardson or Plano, you’d be looking at a $5,000 deposit.

But what happens when you’re trying to lock down a property in a red-hot area like Uptown or the Bishop Arts District? That’s when a stronger offer can make all the difference. In these bidding wars, it’s common to see buyers bump their earnest money up to 2% or more just to make their offer impossible for the seller to ignore. Ultimately, the exact amount is always a negotiation point within the purchase contract.

Is the Texas Option Fee Different from Earnest Money?

Yes, they are completely separate, and it’s crucial to understand how each one works in a Texas transaction. Think of it this way:

- The Option Fee: This is a smaller, non-refundable payment, usually just $100-$500, that you pay directly to the seller. It’s the price you pay to “buy” yourself an option period—a set number of days where you can walk away from the contract for any reason and still get your earnest money back.

- Earnest Money: This is the much larger, refundable deposit that gets held by a neutral third party (the title company). If you back out during your option period, you get this earnest money back. The seller, however, gets to keep your option fee as compensation for taking their home off the market for you.

Getting this distinction right is vital, especially for new buyers in Dallas. For a deeper look at the entire home-buying process, check out our Dallas first-time homebuyers guide for more must-know tips.

Who Actually Holds the Earnest Money in Dallas?

One thing to be very clear on: your earnest money is never handed directly to the seller in a Dallas deal. Instead, it’s deposited with a neutral third party, which is almost always the title company responsible for closing the transaction.

The title company holds these funds in a protected escrow account. They are legally bound by the contract and can only release the money under specific, agreed-upon conditions—either to be applied to your closing costs at closing, or with signed, written instructions from both you and the seller.

This system protects both parties and ensures the money is handled fairly according to the terms everyone agreed to.

What if the Seller Backs Out of the Contract?

While it’s rare, a seller backing out of a contract without a legally valid reason is a serious breach. If a Dallas seller terminates the contract improperly, you are absolutely entitled to a full refund of your earnest money deposit.

But it doesn’t stop there. The standard Texas (TREC) contract gives the buyer some powerful tools. Beyond just getting your money back, you may have the right to sue the seller for “specific performance” to force them to complete the sale, or you could seek financial damages you incurred because of their breach.

Navigating the complexities of an earnest money deposit in a Dallas real estate transaction requires expertise and local knowledge. Dustin Pitts REALTOR Dallas Real Estate Agent provides the guidance needed to protect your interests at every step. Contact us today to ensure your home buying journey is secure and successful. Visit https://dustinpitts.com to learn more.